Market Snapshot

| Indices | Week | YTD |

|---|

I don’t have a vision of the future. I have a vision of now.

— King Gillette, Founder, Gillette Safety Razor Company

King Gillette was a frustrated traveling salesman working for Crown Cork & Seal selling bottle caps when he had an idea. What if instead of having to shave with an expensive, dangerous and high maintenance “straight edge” razor, you could have a cheap metal razor you could throw away after using a few times?

Having almost killed himself shaving on a train from Chicago to Milwaukee on the way to a meeting and constantly being frustrated by the cost of a new razor or the need to continually sharpen what he had, Gillette thought there had to be a better way to stay clean shaven.

So excited was Gillette by his brainstorm, he went to Massachusetts Institute of Technology (MIT) to see if they could help design his invention. The engineers at MIT told Gillette that what he wanted to manufacture was “impossible”. Gillette was so convinced of the power of his concept that he didn’t let the cynics stop him from pursuing his idea. Ironically, Gillette found his partner in MIT educated William Emery Nickerson who together after five years, were able to produce the inexpensive sharp edge razor he had imagined.

Gillette applied for a patent in 1901 and founded the Gillette Safety Razor Company to launch his new product. A razor plus one blade was priced at $5, and 20 blades — each in a decorative wrapper bearing King’s portrait — cost $1. Production began in 1903 and the company sold a grand total of 51 razors and 168 blades, less than $1,000 in revenue.

By 1904, Gillette had invented the disposable double edge razor, as well as the business model of selling the razor below manufacturing cost and making all the profit on the recurring sale of blades. Hence the “Razor-Razor Blade” model was born, with numerous enterprises benefitting from this business model innovation. A little over 100 years after King hatched his idea, the Gillette Safety Razor Company was sold in 2005 to Proctor & Gamble for $57 billion while it was making $2.5 billion of profit.

The Razor-Razor Blade playbook has created phenomenal business opportunities across a range of industries, with everybody from Hewlett Packard selling inexpensive printers to generate ongoing high-margin printer ink sales, to Microsoft selling X Box consoles at low margin to spark lucrative game purchases.

Source: GSV Asset Management

Disclosure: GSV owns shares in Dropbox and Spotify

In recent years, entrepreneurs have taken King Gillette’s vision a step further, with “Free” and “Freemium” models that seem to monetize by magic. Facebook, valued at over $390 billion, is the World’s center of communication and collaboration but the platform is free to over 1.7 billion users.

Spotify has transformed the music industry by hooking 100+ million users on a free streaming music platform — and then converting an astonishing 50 million into subscribers paying $9.99 per month for a premium experience. (Disclosure: GSV owns shares in Spotify)

But in recent years, Dropbox has gone a step further. It is defying gravity with a “Free” product that first caught fire with consumers and now counts a majority of Fortune 500 companies as customers. It’s Razor-Razor Blade meets Software-as-a-Service.

DROPBOX: RAZOR-RAZOR BLADE MEETS SAAS

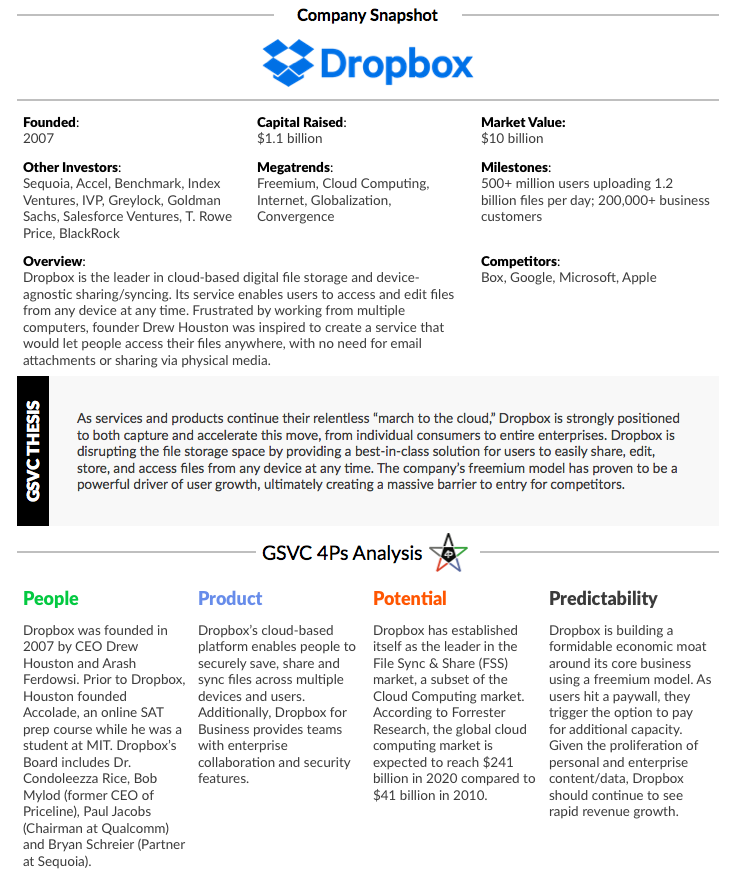

In 2007, when most of the World thought that the cloud was condensed water in the sky, Dropbox founder Drew Houston created a free service that enabled people to store and retrieve digital files from any device at any time.

It all started in a Boston bus station when Houston, then a software engineer, opened his laptop, eager to get some work done on the ride to New York City. But when he reached for a thumb drive in his back pocket that was loaded with the files he needed, no dice. As Houston recalls, “ I sulked for about 10 or 15 minutes and then wrote some code that I thought would solve the problem.”

Shortly after his bus station epiphany, Houston met co-founder Arash Ferdowsi through a mutual friend at MIT. Arash liked the idea of a file storage platform in the cloud — he dropped out of school with a semester left, and Dropbox was born.

Just two years later, with strong early traction, Dropbox received a call that both validated the business and became a mantra for the naysayers. Steve Jobs, whose iCloud file storage service was still nearly two years from launch, pitched the co-founders on an acquisition. He argued that the best chance for success was in the Apple family because Dropbox was a, “feature, not a product.”

95023.jpeg)

Fast forward to 2017 and Dropbox has emerged as a leading collaboration platform with well over 500 million users and more than 200,000 business customers. Everyone, it turned out, had files to store and Dropbox’s freemium model gave new customers ample space to do so. But inevitably, people needed more. As we’ve observed about companies like Snap, we love businesses that are addictive but don’t cause cancer. (Disclosure: GSV owns shares in Snap)

From Insanely Great Product to Network Effects Business

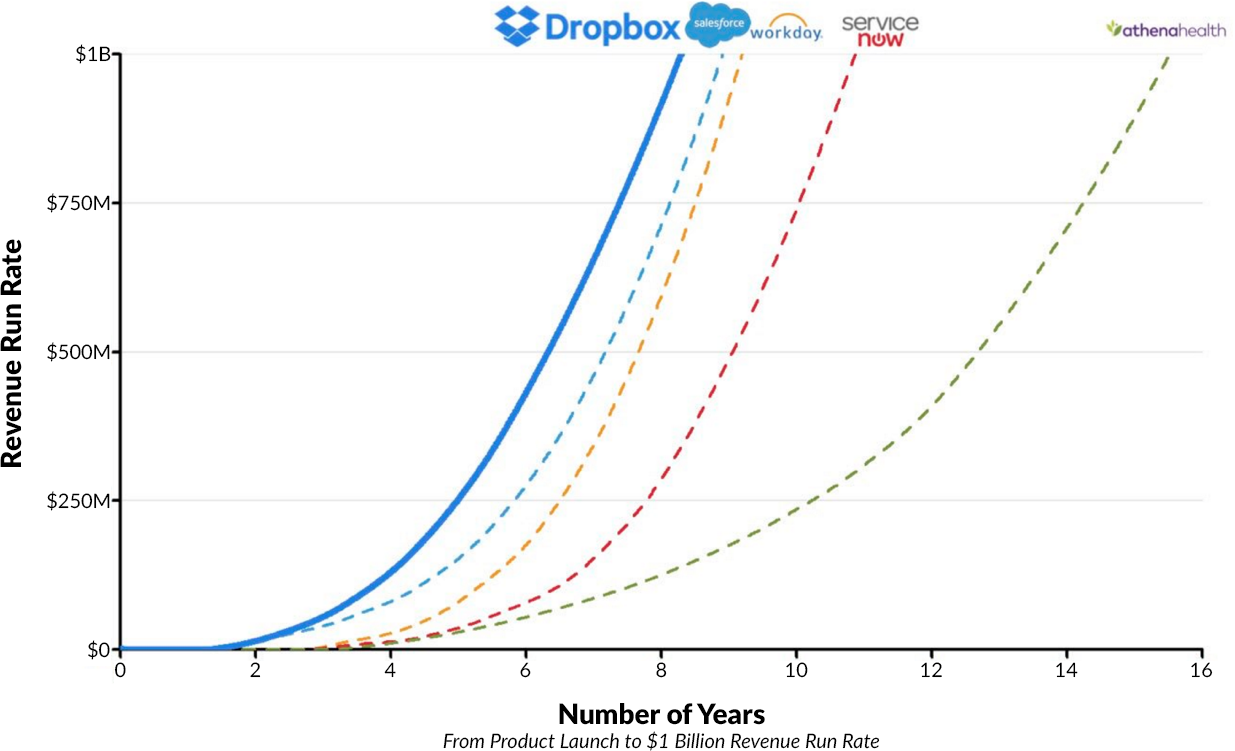

In January, Dropbox became the fastest Software-as-a-Service business to reach the $1 billion revenue run-rate milestone. It took just eight years, ahead of SaaS all-stars like Salesforce and Workday.

By focusing on creating the best file storage and collaboration platform, Dropbox has become a global service with strong penetration in developed markets. Over 100 million users hail from North America and over half of the United Kingdom is on the Dropbox platform.

The foundation is a freemium model that grants users platform access at no cost for their first 2GB of storage, with an option to earn up to 5GB of free storage by referring friends. Upgrading to Dropbox Pro costs $10 per month and increases the storage capacity to 1TB. To date, the company has consistently demonstrated strong retention rates, with each new user cohort generating more revenue over time.

While the vast majority of Dropbox’s 500+ million users are still using the platform for free, the conversion rate is increasing, driven by a strong push into businesses. The Dropbox for Business plan has several pricing structures dependent on size. The “Standard” plan is $12.50 per user per month and the “Advanced” plan is $20. Enterprise-wide sales — think large deployments — have an elastic pricing structure. The net result is that average revenue per user is growing.

Dropbox’s competitive advantage in the enterprise is like Apple’s. Employees want to use the technology they use at home. It is a network effects business and the network effects at Dropbox are disruptive and growing. The 500+ million installed user base presents a large opportunity for the expansion into larger enterprises. Today Dropbox serves a majority of Fortune 500 companies, as well as emerging private companies like Spotify. (Disclosure: GSV owns shares in Spotify)

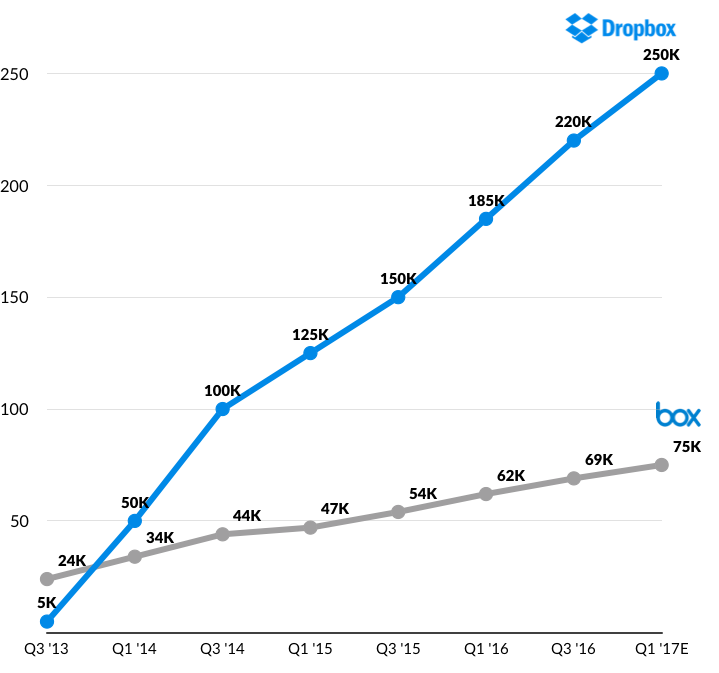

The power of a networks effects business in the enterprise cannot be understated. Consider Dropbox’s competitor Box, which started as a business-oriented service from the get-go. When Box filed for its IPO in 2014, it reported 32 million users and 44,000 paying customers. At that point, it had been focused on enterprise sales for years.

By contrast, Dropbox announced the launch of its business offering in April 2013, and by September 2014 it already had 100,000 business customers. By November 2015, that number jumped to 150,000, and today it is well over 200,000. Today, Box has just 75,000 paying customers.

Source: Company reports for Box, GSV estimates based on company reports for Dropbox

The potent mix of a dynamic freemium engine that is feeding a lucrative enterprise business creates powerful advantages for Dropbox. Well over 90% of the company’s current revenue is inbound and organic — meaning it is not driven by marketing spend.

On the contrary, Box gets less than 10% of its revenue on an organic basis, and nearly all of its revenue is driven by a salesforce. Similarly, SaaS peers Atlassian and Workday also derive the majority of their revenue through their salesforce. This is an enormous differentiator, and it is why Dropbox reported that it has been free cash flow positive for the past year.

Source: Company Filings, Yahoo Finance

*For Dropbox public comps, Market Cap is as of 2/24/17; Dropbox Market Value is as of last financing round

**Dropbox ARR is based on recent company reports

Looking at the efficiency per employee, we also see a clear advantage for Dropbox. With approximately 2,210 employees, according to its LinkedIn profile, Dropbox generates $452,000 in annual revenue (on a run-rate basis) per employee. This is well ahead of all competitors in the SaaS space, and Salesforce is only a distant second with $375,000 in ARR per employee.

Source: Company Reports & Filings,

*Employees numbers are taken from the companies LinkedIn profiles

Another key lever for Dropbox’s long-term profitability prospects is its data storage infrastructure. For the first eight years of its existence, Dropbox resided atop Amazon AWS, effectively “dropping off” files into Amazon machines.

But over the last year, Dropbox has migrated away from Amazon, creating its own “cloud” to custom fit the company’s specific needs and scale more cost effectively over time. We expect that this feat of engineering will have a very positive impact on Dropbox’s long-term operating margins, driving those to 30-35% levels over the next 3-4 years.

COMPETITIVE DYNAMICS

Storage

As Dropbox continues to demonstrate powerful growth and network effects into the enterprise, the market for cloud storage services is becoming increasingly competitive. Beyond Box, Dropbox is competing against two technology titans — Alphabet (Google) and Microsoft.

This week Alphabet announced that Google Drive, its file sharing and collaboration platform, had 800 million active users. In 2015, the company reported that Google Drive had one million business customers.

As part of its announcement, Alphabet previewed a variety of new features that emphasize making Google Drive a more valuable resource for teams, which signals a renewed focus on the enterprise. Among recent improvements is an expansion of a framework called “Quick Access,” which applies Google’s artificial intelligence horsepower to analyze a user’s habits and signals to proactively serve up the files they need when they need them.

Communication & Collaboration

Another pole of the competitive landscape that is beginning to converge with Dropbox is communication and collaboration for teams.

Atlassian, which is focused squarely on this space, serves nearly 70,000 business customers with a product suite that includes resources to support product management (Jira), collaboration and chat (Trello and Hipchat), and developer tools (Bitbucket, SourceTree, Bamboo).

With the appropriate stock ticker “TEAM,” Atlassian is valued at $6.4B. In posted $457 million in revenue for 2016, representing 43% year over year growth. The company had free cash flow of $95 million.

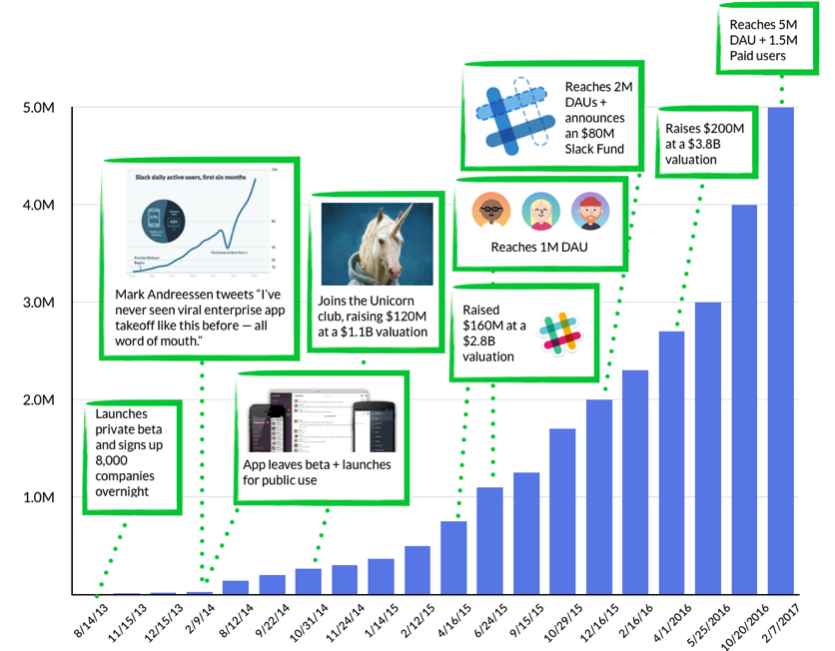

The recent poster child for the emerging opportunity in team communication and collaboration has been Slack. It’s core is a highly intuitive messaging platform that is used by a range of organizations, from NASA the Wall Street Journal and Harvard University. Today, Slack has over five million daily active users and 1.5 million paying customers. It was valued at $3.8 billion in a 2016 financing led by Thrive Capital. Current investors include Accel, Andreessen Horowitz, Google Ventures, IVP, KPCB, and others.

Slack isn’t simply creating a better messaging tool, as we wrote about in SLACK ATTACK. It is developing an ecosystem of high-value productivity applications to streamline how people access and process information. Slack’s “App Directory” — which is equivalent the iTunes App Store — offers more than 280 services that can be seamlessly integrated on demand.

Slack has also developed a “BotKit,” an open-source framework for building automated services that users can access through conversational interfaces. The aim is for Slack “bots” to increasingly automate the most tedious business interactions, from setting up meetings to expense reporting and recapping basic information to colleagues.

Birdly, for example, a bot armed with advanced natural language processing capabilities, can automatically call up timely customer data directly within Slack from relationship management platforms like Salesforce and Zendesk.

The next frontier is the creation of SlackBots powered by Artificial Intelligence, particularly Machine Learning. Applications that observe and learn from patterns of communication and collaboration will be game-changers. They will escalate information that matters, when it matters. They will anticipate questions and problems and tee up answers and solutions.

Not surprisingly, beyond Slack and Atlassian, Alphabet and Microsoft have complemented their cloud storage offering with various integrated communication and collaboration tools. “Google for Work” integrates email (Gmail), chat (Gchat), video conferencing (Hangouts), file storage/sharing (Google Drive), and document editing (Google Docs). A host of new features will be familiar to Slack users.

And this week, Microsoft will officially launch its direct Slack competitor “Microsoft Teams,” which will integrate with its OneDrive and Office offerings.

WHAT’S NEXT

Dropbox Platform

Dropbox has continued its relentless focus on creating a superior product in cloud storage, recently launching “Smart Sync,” a feature that helps people save more space on their devices. With Smart Sync, Dropbox users can choose which files are saved on a device, and which ones are available in “online-only” mode (which means you still see the file icon and description, but the actual file is stored in the cloud). The net result is that without wasting any device space, users can still access all their files with a single click.

But as evidenced by activity from Atlassian, Slack, Google, and Microsoft, Dropbox’s emphasis will increasingly move to a productivity platform. To this end, last month the company released a collaboration suite called Paper. It is a document editing platform that enables teams to work simultaneously on the same document and the work flow is seamless — a capability that Dropbox had previously lacked vis-a-vis Google Docs.

The recent product additions are further evidence that Dropbox has evolved to a platform business, and that it is pulling further ahead of its competitors.

In the longer term, we believe Alphabet will be Dropbox’s leading competitor. However, the differentiator will be focus. Dropbox’s sole business focus is on building a superior platform for file sharing, storage, collaboration, and creation. Alphabet’s focus is in tens of different directions. A good comparison to that is the music space, where Spotify continues to dominate its competitors Apple, Amazon, and Google Play.

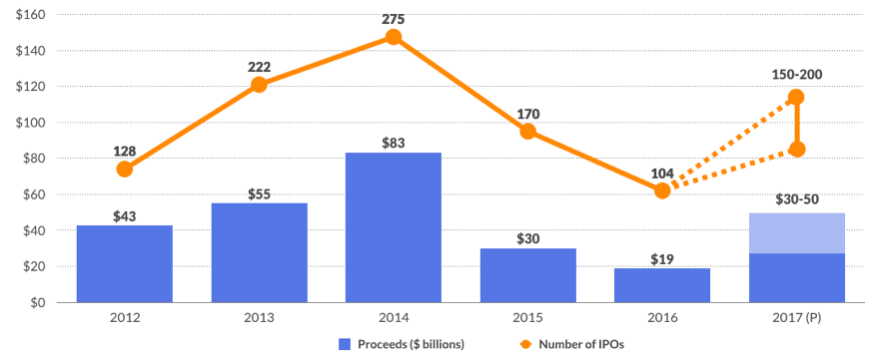

Improving IPO Landscape

There were a paltry 102 U.S. IPOs in 2016 — just 40 were venture backed — but we are starting to see some bullish signs from the Market for the best names to break through a backlog that has been building over the last fifteen years. Snap (Snapchat) could be a starting gun in 2017. (Disclosure: GSV owns shares in Snap)

Last summer, Vice Media CEO indicated that he was in discussions with major banks about taking his $4 billion company public. At the Wall Street Journal’s 2016 Global Technology Conference, Palantir CEO Alex Karp indicated that the company had prepared itself, should it decide to IPO in 2017. (Disclosure: GSV owns shares in Palantir)

The streaming music leader Spotify has also signaled its intent to go public. A 2016 $1 billion convertible note with aggressive IPO convert terms has become a countdown clock of sorts and CEO Daniel Ek has stepped in for co-founder Martin Lorentzon as Chairman of the business — another sign of a likely listing. (Disclosure: GSV owns shares in Spotify)

Accordingly, we see a tremendous opportunity for Dropbox given its growth, scale and leadership position.

We expect Dropbox to trade at a premium to other SaaS businesses. With a $1 billion revenue run-rate growing at a strong clip, and with very low customer acquisition cost and free cash flow profitability, there is significant leverage in the operating model. We anticipate strong growth and market share gains as Dropbox transitions from a niche cloud storage service to a full-fledged collaboration platform.

—

Stocks took a pause last week, with the Dow falling 0.5%, and NASDAQ and the S&P 500 each dropping 0.4%. With many stocks up smartly since the election — especially technology stocks — taking a “breather” is both natural and healthy.

Confidence continues to rise with a Trump agenda that is focused on creating jobs, reducing regulations, and spending on modern infrastructure. Underscoring rising business optimism, 235,000 new jobs were created last month, with unemployment dropping to 4.7%. Oil prices plunged nearly 10% to under $50 on predictions that oil peak demand will be reached in the next ten years.

New public company Snap was banged around last week, dropping on numerous analyst SELL ratings and intense pressure from Facebook. Facebook reached an all-time high as it continued to roll-out features mimicking Snap. Chinese social app platform Momo reported monster results, with EPS up 633% and revenues up 524% off the strength of its paid video sharing platform.

We continue to view the environment for equities favorably, despite the recent Fed Rate rise and all but certain further rise on March 15th. The reasons for our BULLISHNESS include strong fundamentals for many of our favorite growth businesses and attractive relative valuations.