Market Snapshot

| Indices | Week | YTD |

|---|

At the beginning of 2019, a contagious view had gone viral which was that America was in a decline, the U.S. Government was led by a maniac who relished in chaos, the trade war with China coupled with the Fed raising rates was going to push the Global economy into a recession, artificial intelligence was going to replace jobs at an accelerated rate, and man-made climate change was going to destroy the Earth. The net result is that our children were going to be worse off than us for the first time in the World’s history… if they existed at all.

Not a cheerful way to go into the New Year.

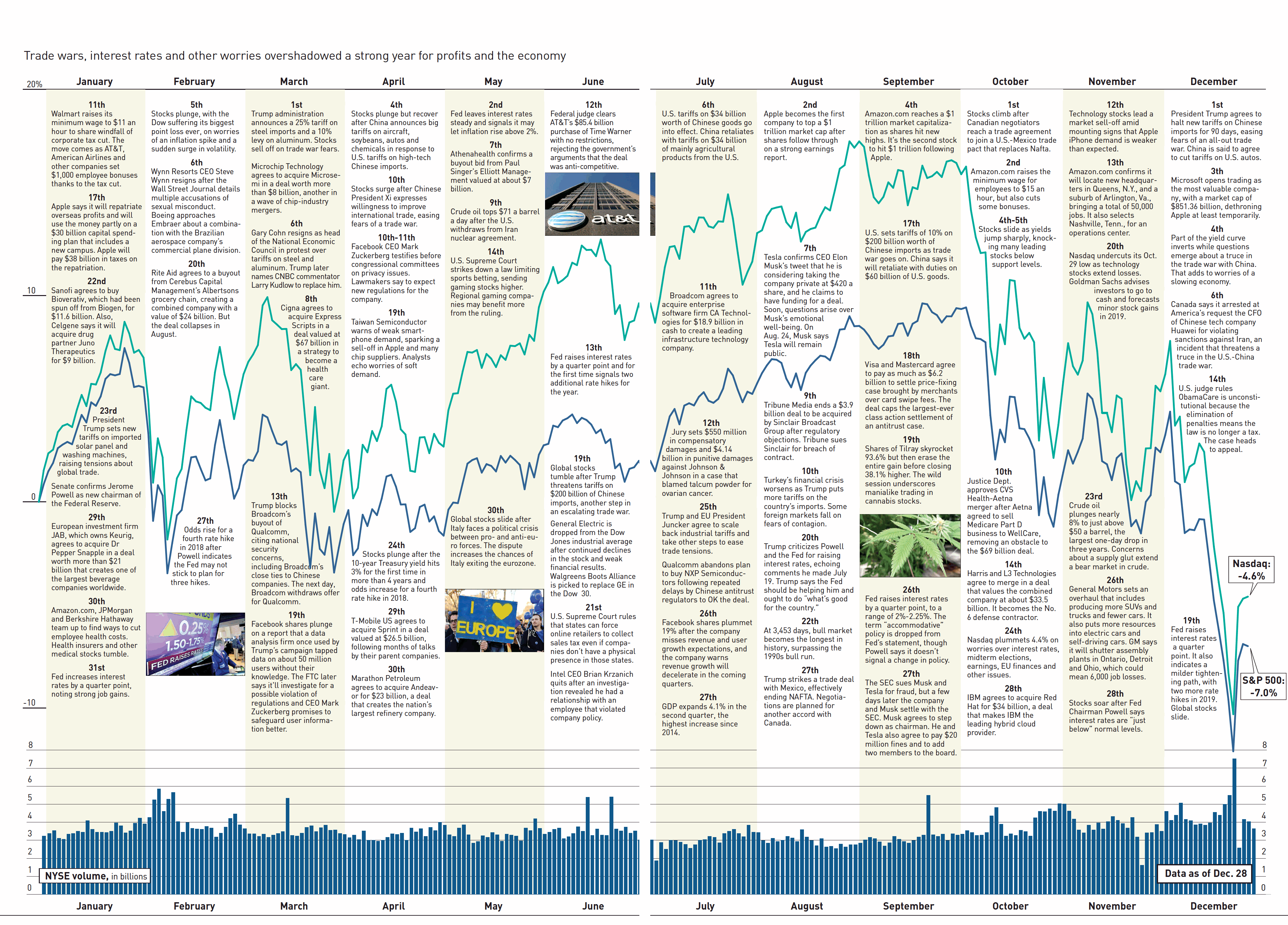

Stocks, working like a voting machine reflecting the mood of the masses in real time, had dropped like rocks in the fourth quarter. Public markets in December logged the worst equity performance since the Great Depression. Leading technology stocks were “deFAANGed” and were off 30% as group since August. On Christmas Eve, the 1000 point drop in the Dow put stocks officially in a “Bear Market,” with stocks having fallen more than 20%. Merry Christmas!

As bad as it felt in the United States with the S&P 500 down 6% for the year, around the World it was much worse. The Shanghai Exchange was off 25% and the tech heavy Shenzhen Market was down 35%. France’s CAC fell 11%, Germany’s DAX was down 18% and Japan’s Nikko was off 12%. Only Brazil and India had positive returns for 2018, performing up 15% and 6%, respectively.

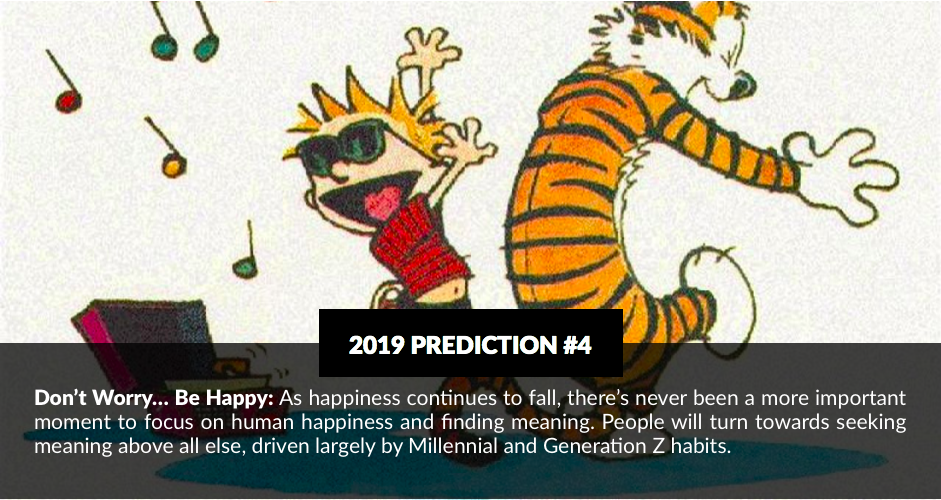

To make matters worse, even with remarkable advancements in medicine and essentially the highest standard of living in the World, life expectancy in the United States actually fell. The main culprit was the combination of suicides rising 30% in the past 20 years and the opioid epidemic that was responsible for the 72,000 overdose deaths in 2017. Despite relative comfort and success, people weren’t feeling like their lives had meaning. In fact, the most popular class at both Yale and Harvard was the “happiness class”. (See Prediction #4 for more)

Given this backdrop, it was a surprise to most people that 2019 was a BOOM year.

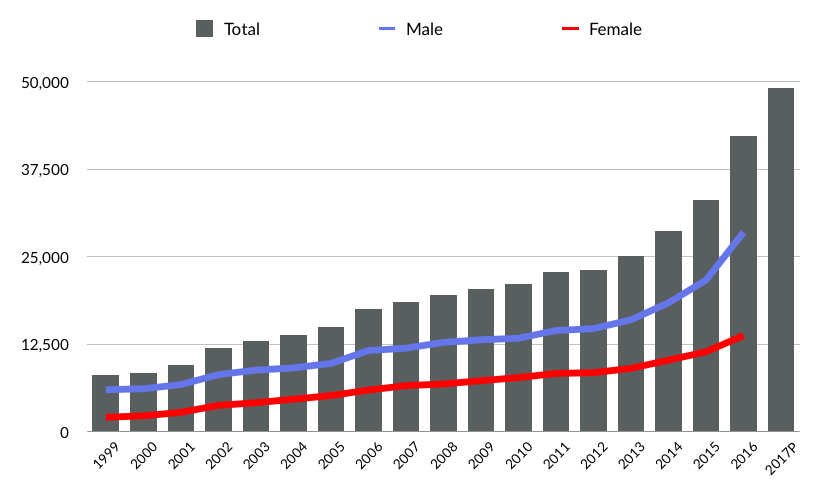

The trade war between the U.S. and China was a primary worry, with the two largest economies trading jabs back and forth. President Xi put tariffs on “Trump Country,” while President Trump used the leverage that the U.S. imports 3x more goods from China (in comparison to Chinese imports to the U.S.) to level the playing field.

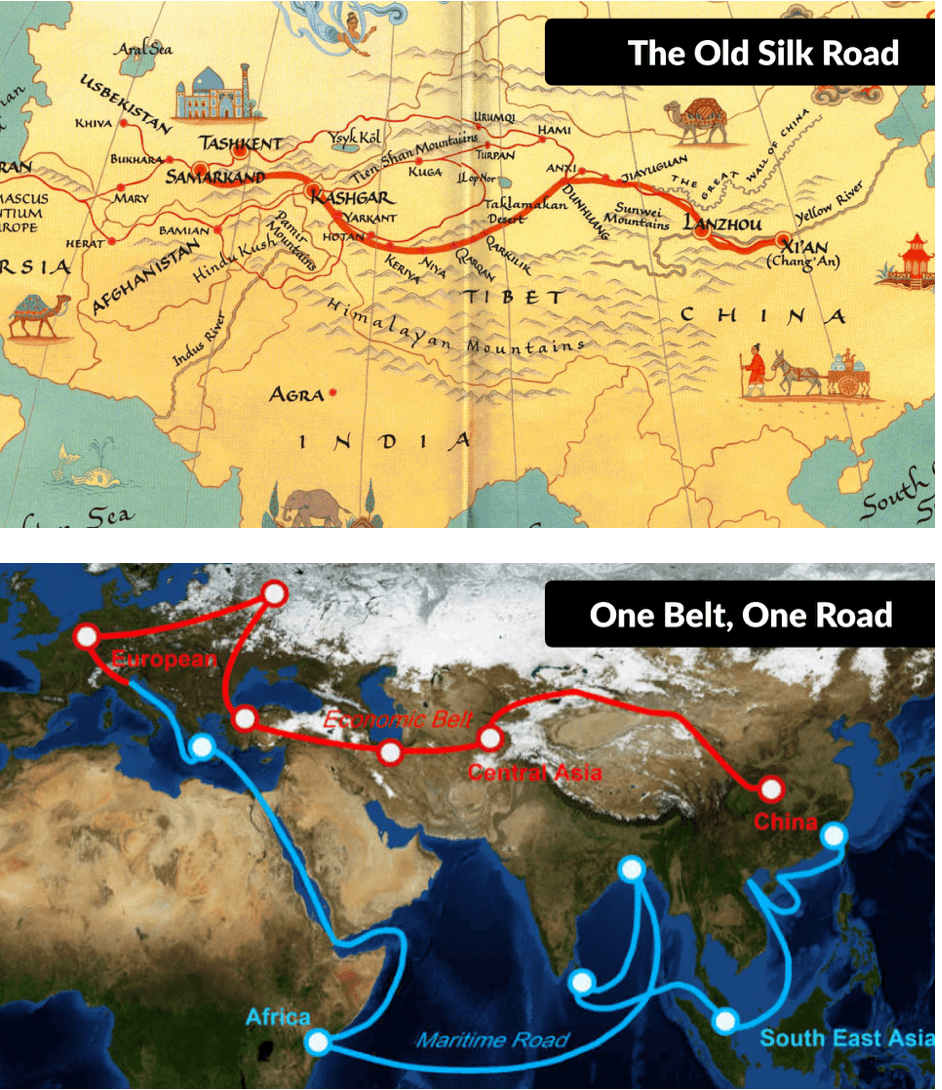

The CUSA Trade Pact (China/USA) in February was a major catalyst to a resurgence in equity prices. Additionally, the “New NAFTA” between the U.S., Mexico, and Canada approved by Congress in mid-2019 also provided fuel to stocks surging positively, affecting $1.3 trillion in trade between the three countries. “One America”, the region from Canada to Chile, proved to be a powerful economic trade zone, competing against China’s “One Belt, One Road”.

Experts had also predicted even more volatility in China given that 2019 was the 100th anniversary of the creation of the Communist Party and the 30th anniversary of the Tiananmen Square Massacre and the expected restriction on access to information.

In fact, the opposite happened.

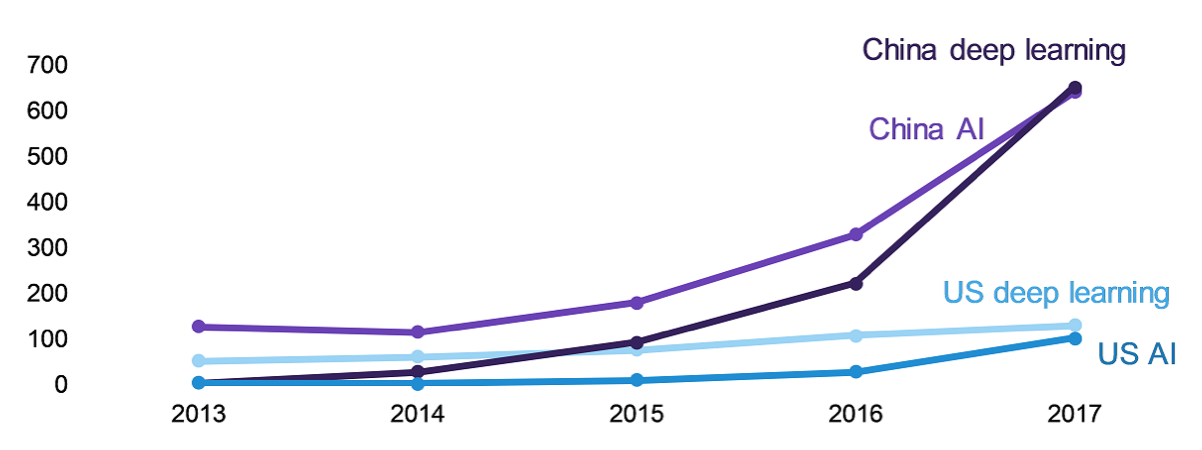

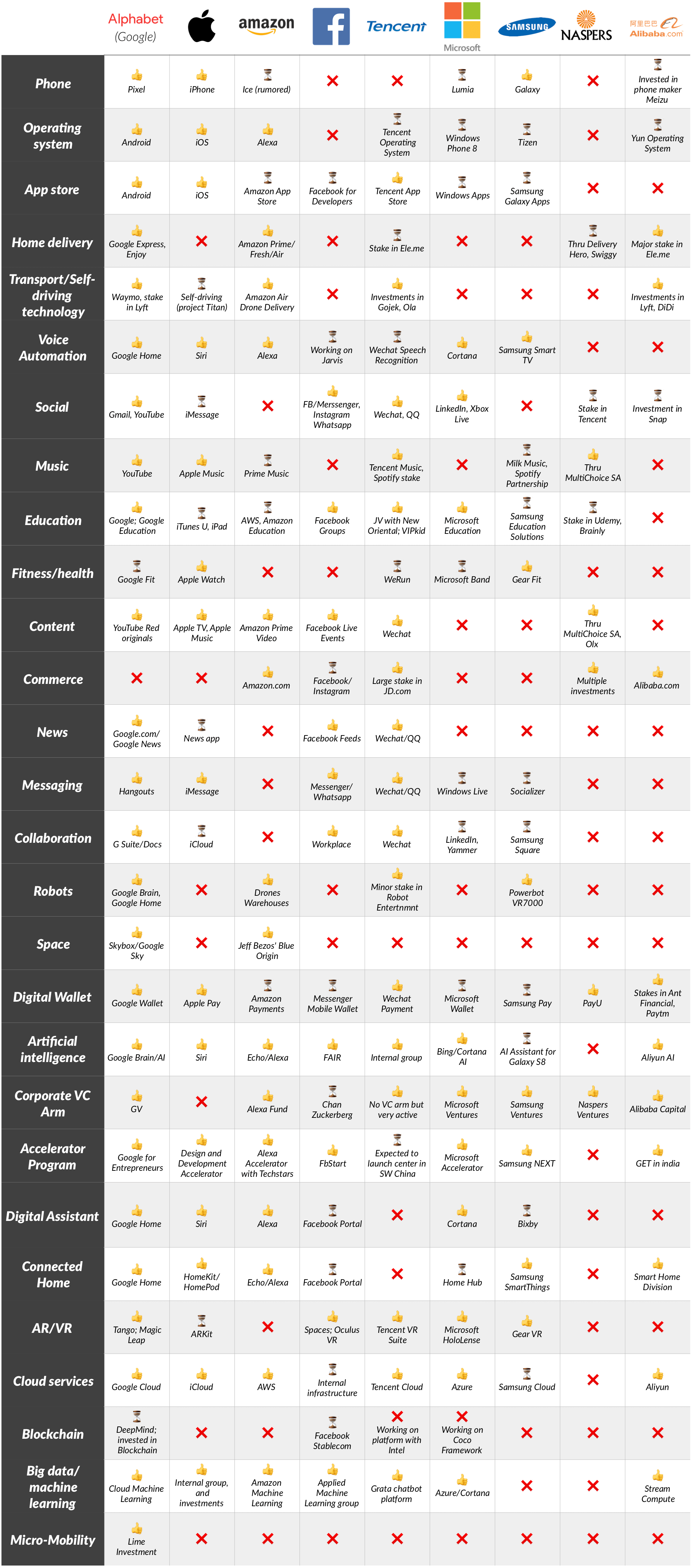

The Chinese got rid of the forbidden “4T’s” you weren’t allowed to speak about (Taiwan, Tibet, Tiananmen Square, and Trump) and embraced a more open society. The “all in” bets China had made in being the leader in artificial intelligence, education, and sustainable energy were paying off in spades. China has now surpassed the U.S. in A.I. patents by 6 to 1, has the two largest education companies in the World, and is rapidly creating alternative energy sources, including electric cars. It’s now said that if “data is the new oil, China is the new Saudi Arabia”.

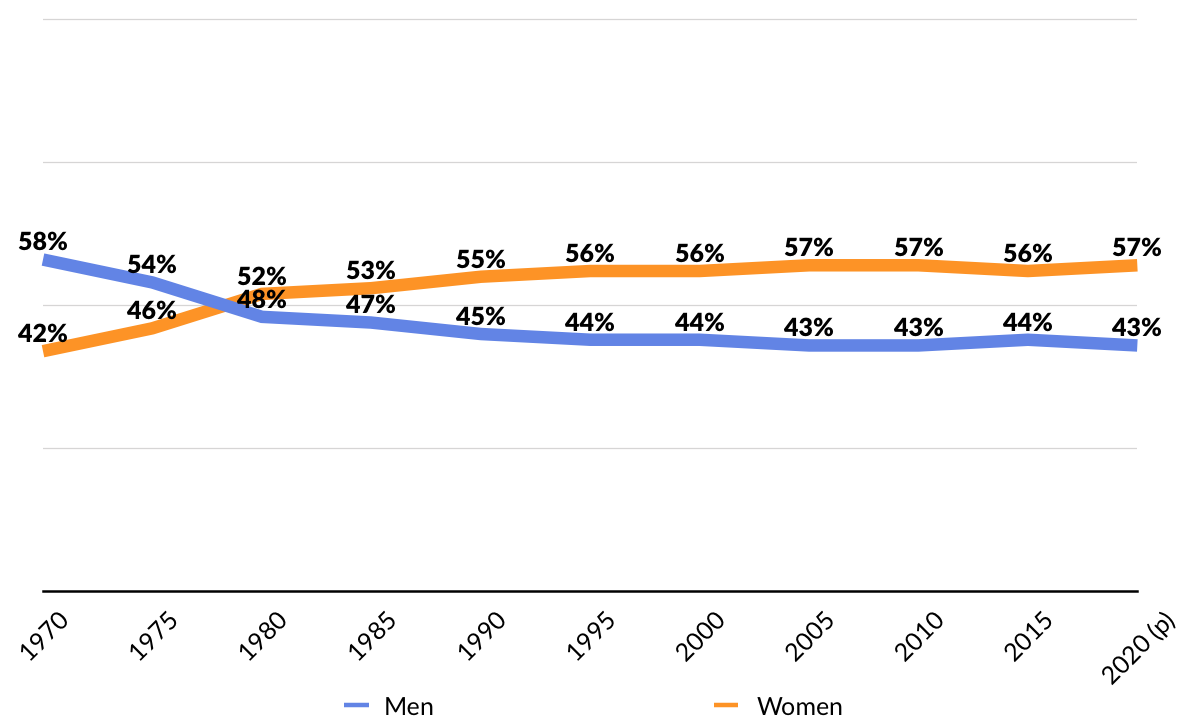

Woman Power and its sister the #MeToo movement continued in full force in 2019. The 126 female members of Congress is the most in history. The U.K.’s Parliament is nearly 25% female — the highest in its history as well. Along with 25 female CEOs of the Fortune 500, this signaled evidence of the rising wave. The greatest sign of future strength in the knowledge economy was the fact that nearly 60% of college and graduate students were women. A #MenToo movement was attempted, trying to bring attention to the plight of uneducated white males who were increasingly unemployable, but this never got any traction.

Silicon Valley has replaced Wall Street and the Dallas Cowboys as the group that people love to hate. Part of the reason is because people like to root against somebody who has been too successful, but a lot of it is a result of the Valley’s arrogance and greed. Privacy issues and who owns your data finally made its way into social consciousness, and progressive tech companies are starting to pay people for data that they were historically getting for free.

Facebook views itself as not just “America’s Team” but as “the World’s Team.” But “fake metrics,” “fake news,” and “fake contrition” have contributed to Facebook having fewer and fewer “friends”. In fact, nearly 40% of college students now don’t use Facebook. Network Effects result in the magic that has created exponential growth and enterprise value for many Internet leaders including Facebook. 2019 is when we saw Reverse Network Effects, resulting in a huge decline in value for FB shares.

2019 was also the year that Bytedance, the largest private company in the World that nobody had heard of, becomes a household name. Based in Beijing and valued at $75 billion, Bytedance is a mobile first company that is powered by machine learning. Toutiao is Bytedance’s headline news service that doesn’t employ any reporters and only uses A.I. to deliver personalized news. TikTok is Bytedance’s video sharing service, which has more downloads than any Internet property anywhere.

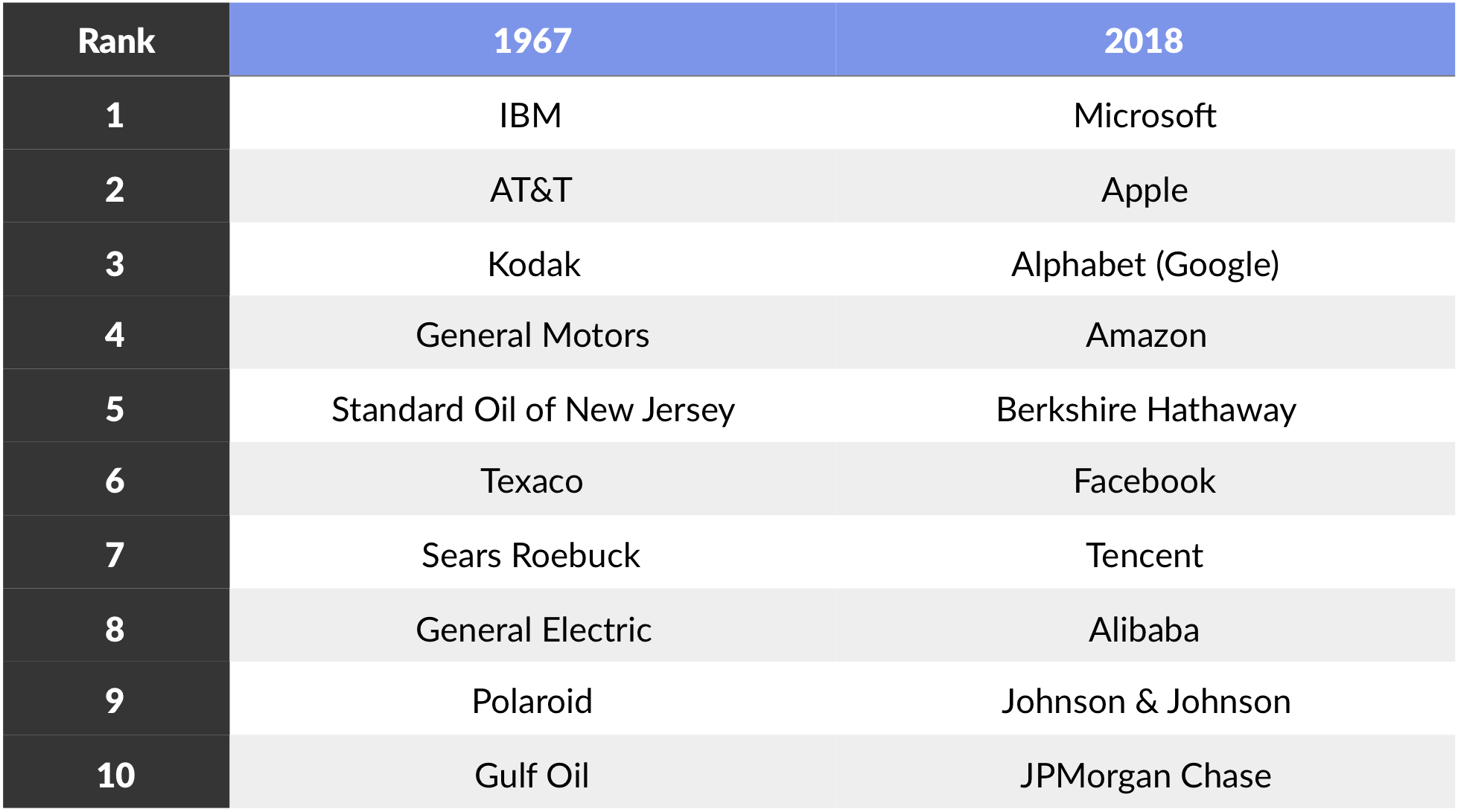

The consolidation wave that has been thundering through TechLand continued as tech “platforms” continued to fill out their product stacks. Of particular interest was, of course, A.I., Voice Operating Systems, AR/VR, delivery services, and blockchain.

The autonomous future became very visible in 2019. Studies showed that autonomous cars could reduce 90% of the 1.3 million annual automobile deaths. As such, the World accelerated the adoption of the new technology. China, with 265,000 automobile accidents a year, was once again leading the charge. In the United States, the trucking industry, which employs 10% of the U.S. workforce, was shocked at how fast autonomous technology was disrupting its business. Doctors, lawyers, and teachers started to grasp that robots were either going to be their friend or be their foe.

It was becoming harder and harder for many — especially technologists — to imagine a future where humans could compete with A.I. and robots to have productive jobs. The answer was to dust off the old and failed concept of Universal Basic Income (UBI), a model where the government would essentially give everybody an allowance.

The flawed logic with UBI is that the government doesn’t make money… it takes money. And if it doesn’t have enough people to take money from, the concept falls flat on its face. Failed experiments in places such as Finland put the nail in the UBI coffin. This, coupled with the fact that for the first time in modern history there were more open jobs than unemployed people, made the real answer obvious. We needed to provide people with skills and knowledge they needed to participate in the future.

Interestingly, one answer to how to compete with technology was to use technology to allow people to obtain the knowledge and education they need in a cost-effective and time-efficient manner. Rapidly scaling education technology companies called “Weapons of Mass Instruction” became wildly popular with companies such as Coursera and Course Hero becoming core apps that people used on a daily basis. (Disclosure: GSV owns shares in Coursera and Course Hero)

While coding jobs were still in high demand, it became obvious that pretty soon, technology was going to replace the technologist. What people needed to know to participate in the future had to be reconceptualized. The Three R’s of Reading, Writing and Arithmetic were being augmented by the Seven C’s: Communication, Critical Thinking, Collaboration, Civic Engagement, Cultural Fluency, Character, and Creativity. Learning to learn was foundational and the University of California San Diego’s “Learning How to Learn” class becoming the most popular in the World. Learning English became an even larger megatrend, especially in Asia where English has become the language of business.

Politics cast a very dark shadow over society with Populists gaining power as a direct response to a World that seemed out of control. Conventional wisdom was that the newly elected Democratic-controlled House was going to spend 2019 prosecuting President Trump for all of his alleged misdeeds with impeachment being inevitable. Actually, Congress was persuaded by the greater good to focus on solving existing problems as opposed to creating new ones.

The 2020 Presidential Race, which began during the Kavanaugh hearings, was in full swing in 2019 when Elizabeth Warren announced her candidacy on New Years Eve, with Michael Bloomberg soon following. Others rapidly jumped in alongside them. If elected, Bloomberg would be almost 79 at his inauguration. Age wasn’t a liability in the field where leading contenders such as Bernie Sanders and Joe Biden would be 79 and 78, respectively, at inauguration.

The freshest blood in the field was Beto O’Rourke who, at an age 30 years younger than his competitors, showed his prowess in raising money. While it was expected that other Republicans would challenge President Trump, nobody emerged as 2019 came to an end. But strong rumors surrounded Utah’s Senator Mitt Romney, who people remembered was the only person who called Russia right.

Geopolitics went well beyond the main show featuring China versus the United States. Brexit reminded observers of the “dog that caught the fire truck”… now what do you do? The Middle East remained predictably unpredictable. India, the largest democracy in the World was able to reelect Narendra Modi despite his sinking popularity. Those watching India were relieved as progress under Modi’s leadership became noticeable, as evidenced by the brand new and impressive Mumbai International Airport.

All in all, 2019 was a year where the World advanced, met many of the challenges it faced with progressive solutions, and continued to become more integrated.

Here’s to an even better 2020!

Now let’s reverse the clock back to December 31, 2018…

FIVE TO WATCH FOR 2019

Despite a strong start to the year in 2018, public markets plummeted as investors around the world became more and more spooked by global events. For the year, the S&P 500 was down 6.2%, NASDAQ was off 3.9%, and the Dow Jones was down 5.6%. The GSV 300, an index of the World’s 300 fastest growing public companies and a barometer for the broader Global growth economy, fell 17.2%.

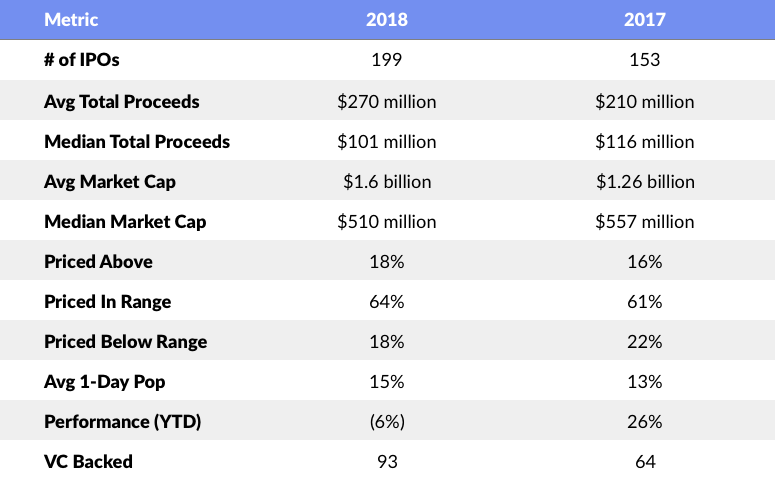

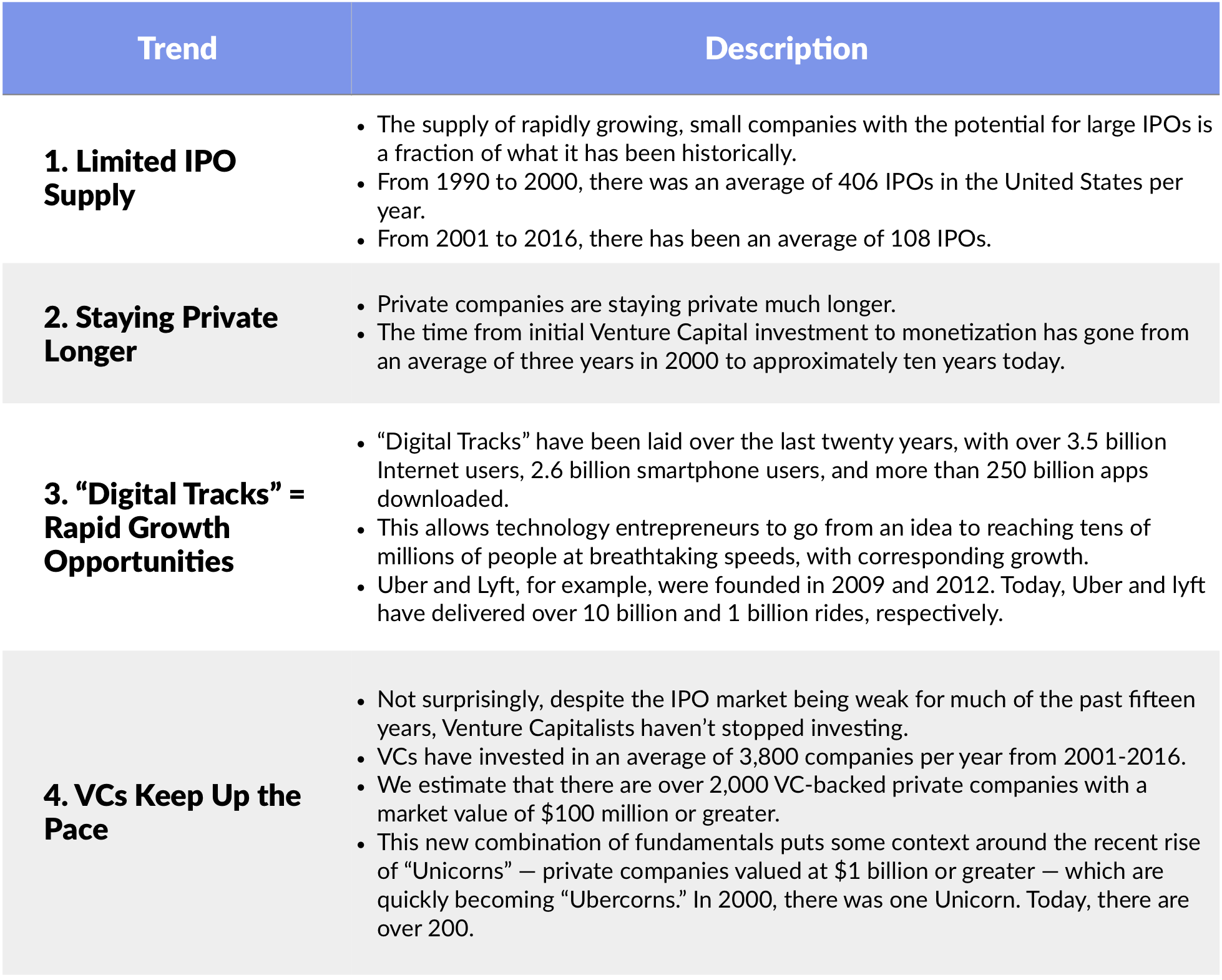

Historically, when you have corrections in the Market, what’s changed investor sentiment were hot technology IPOs. Netscape (1995 IPO), eBay (1998 IPO), and Facebook (2012 IPO) were prime examples of this dynamic.

The Stock Market reflects the confidence investors have in the future, and the IPO market is an even more acute indicator. If investors are pessimistic, new issues shut down. If investors are optimistic, they treat IPOs like fresh oxygen that they can’t get enough of.

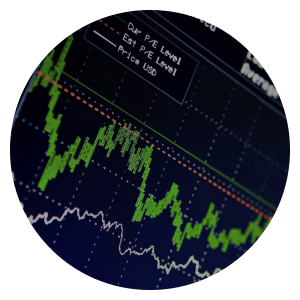

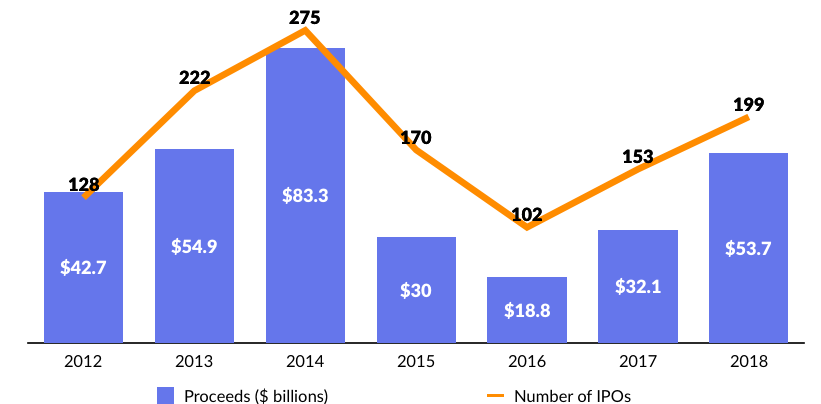

Following a strong 2017, the IPO market continued thriving in 2018, with 199 companies going public raising a combined $53.7 billion in proceeds. Compare that to 2016, where only 102 companies listed and IPO proceeds were a paltry $18.8 billion. In the past 15 years, there has been an average of 108 IPOs annually, down from the decade of the 90s, which had an average of 406 IPOs annually.

While we were pleased to see improving IPO activity in 2018, the recent trend points to a broader opportunity for the best names to break through an IPO backlog that has been building over the last fifteen years.

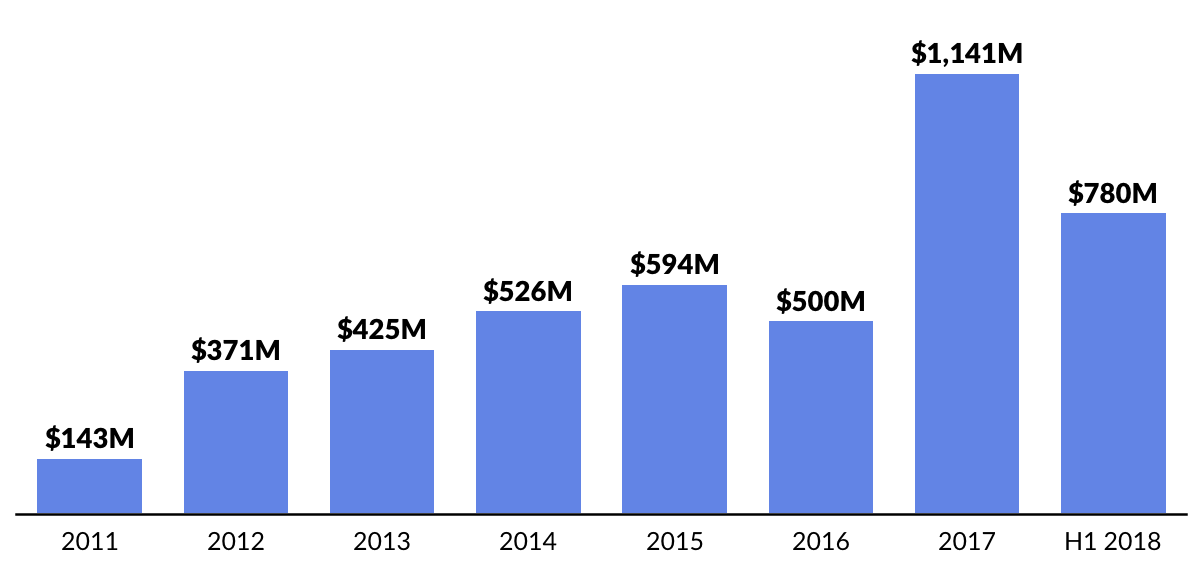

Source: GSV Asset Management

Disclosure: GSV owns shares in Lyft

This March, Dropbox made its public debut, pricing above the range and popping 36%. Dropbox is the fastest Software-as-a-Service business to reach a $1 billion revenue run-rate according to IDC. 2017 revenues were $1.1 billion, up from $845 million in 2016 and $604 million in 2015 – a 35% CAGR for the period. A few weeks later, all eyes — and ears — were on Spotify as the Stockholm-based music streaming platform made its anticipated public debut via a direct listing. The company priced well above the price of most recent private transactions. (Disclosure: GSV owns shares in Dropbox and Spotify)

Hong Kong was the top IPO market in the World in 2018, with 125 companies raising a total of $36.5 billion (up 175% year-over-year). This is well ahead of the second-place New York Stock Exchange, which had 64 companies raise a combined $28.9 billion. Hong Kong hosted three of Asia’s top five IPOs, including smartphone maker Xiaomi, telecommunications operator China Tower, and on-demand food delivery platform Meituan-Dianping.

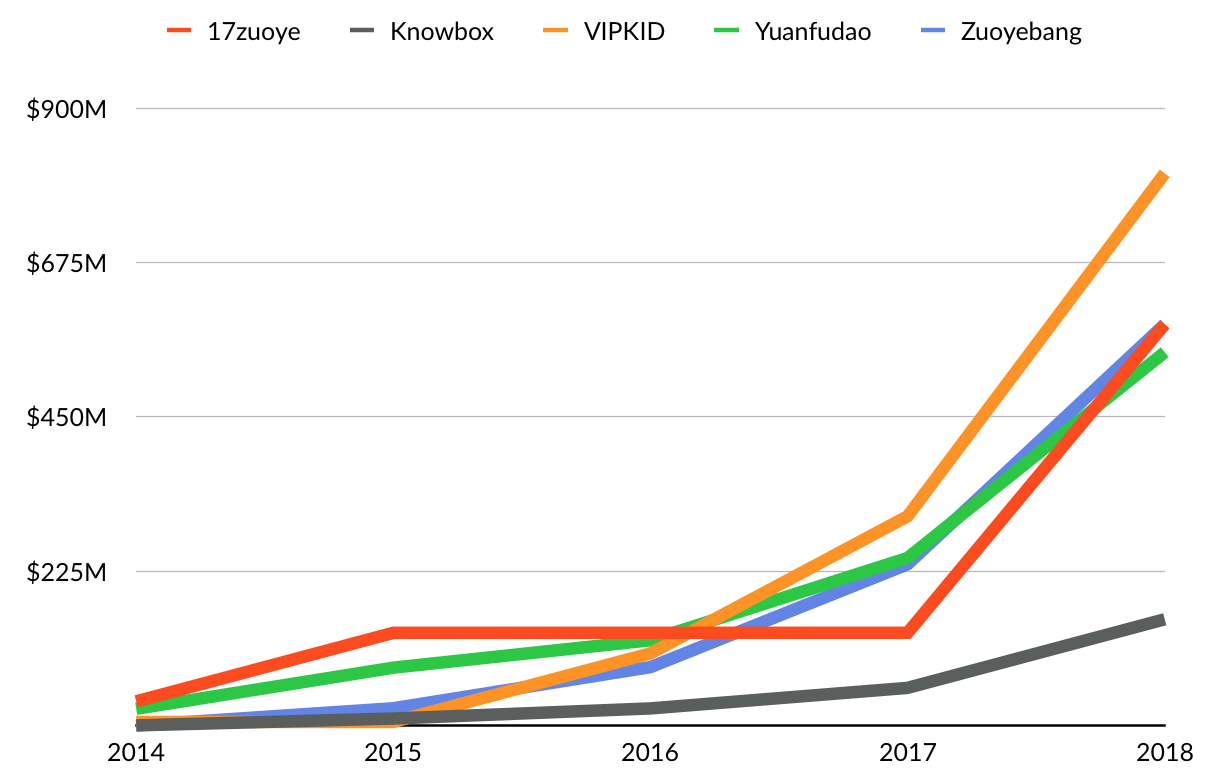

All in all, across Asia companies raised a total of $109 billion in public offerings, up 27% from 2017, with the Middle Kingdom accounting for almost one-third of issues. Notable Chinese IPOs include bulk-discount commerce platform Pinduoduo and Chinese music platform Tencent Music Group. For the year, 15 Chinese education companies went public. More notably, Chinese education technology companies continue to thrive in the private markets, raising a significant amount of capital in the past few years.

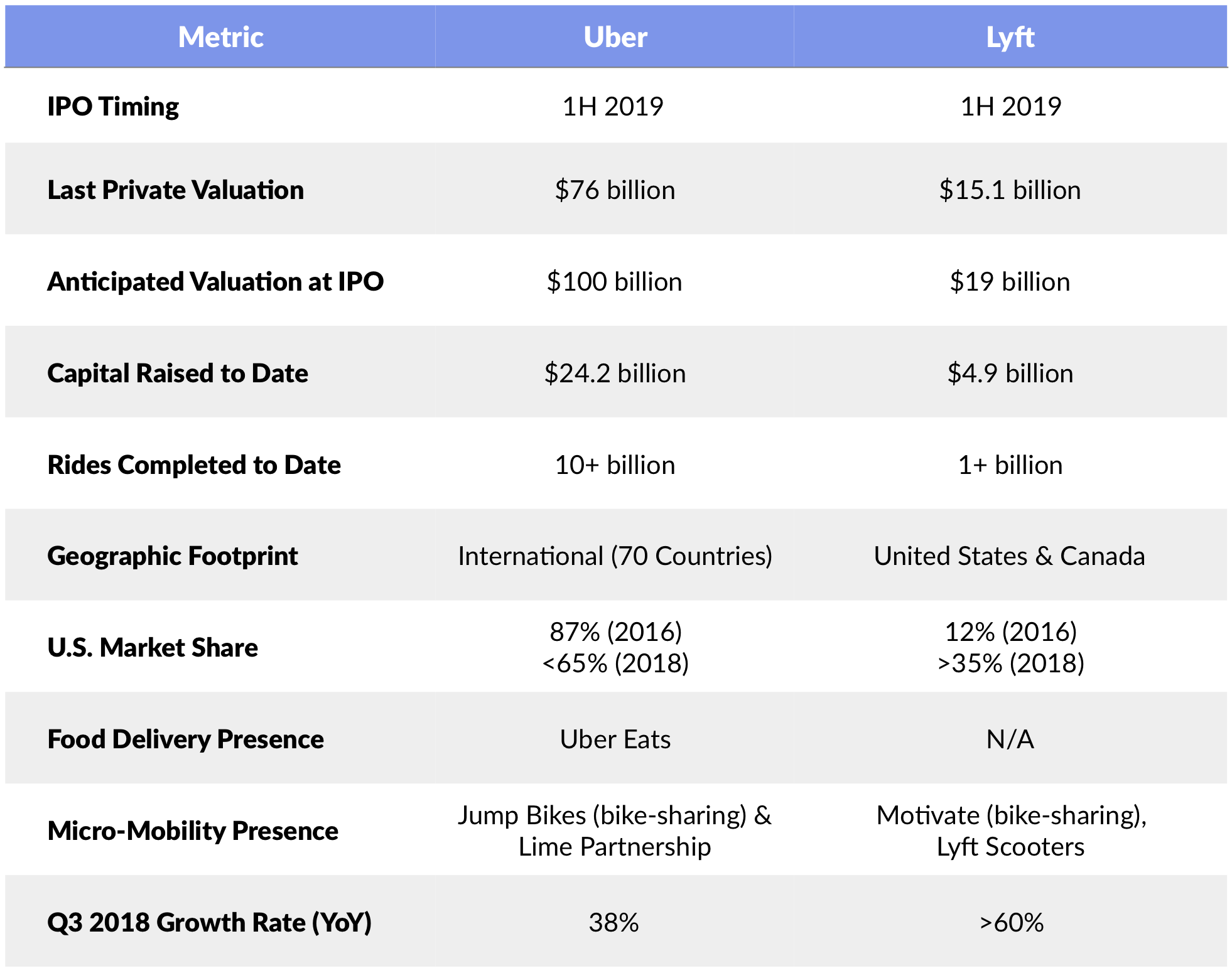

Entering into 2019, all eyes will be on the anticipated public debuts of Lyft and Uber, who both confidentially filed within a week of each other to go public. The rivals’ competition now extends beyond domestic ride-sharing, to a race to be first to market. The anticipated IPOs place both Uber and Lyft’s offering ahead of schedule, especially for Uber who had previously indicated plans to go public the second half of 2019. (Disclosure: GSV owns shares in Lyft)

The success of Uber Eats could be a driver in Uber’s upcoming public offering. But its core ride-share business creates a challenge for the company to justify an anticipated $100B valuation with $10.5 billion in net revenue over the last twelve months. In the third quarter, Uber’s overall gross revenue grew +34%, but its ride share business decelerated to +23%, down from 33% in Q2 and 50% in Q1 2018.

A major cause of Uber’s ride share deceleration in the U.S. has been Lyft’s ongoing success in attracting both drivers and Millennial riders. Lyft’s market share has grown from 12% in 2012 to over 35% today. Meanwhile, Uber’s has shrunk from 89% to less than 65% today.

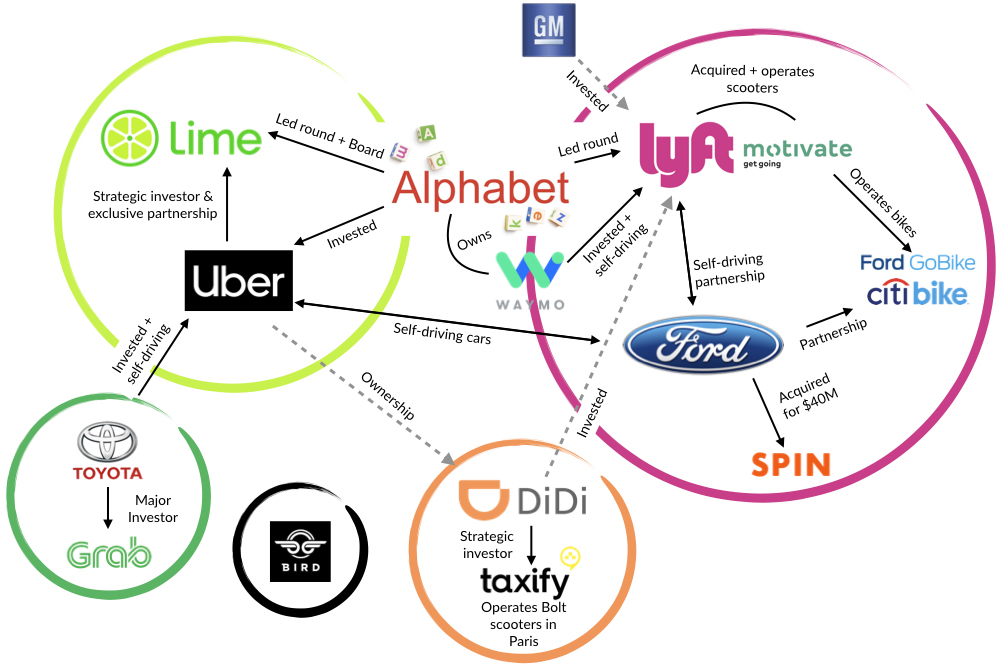

Lyft has become a competitor in the micro-mobility space and is the largest bike-sharing service operator in North America, following its acquisition of Motivate this Summer. Aside from a partnership and investment in Lime and ownership of Jump Bikes, Uber’s plans in the micro-mobility space are still unclear.

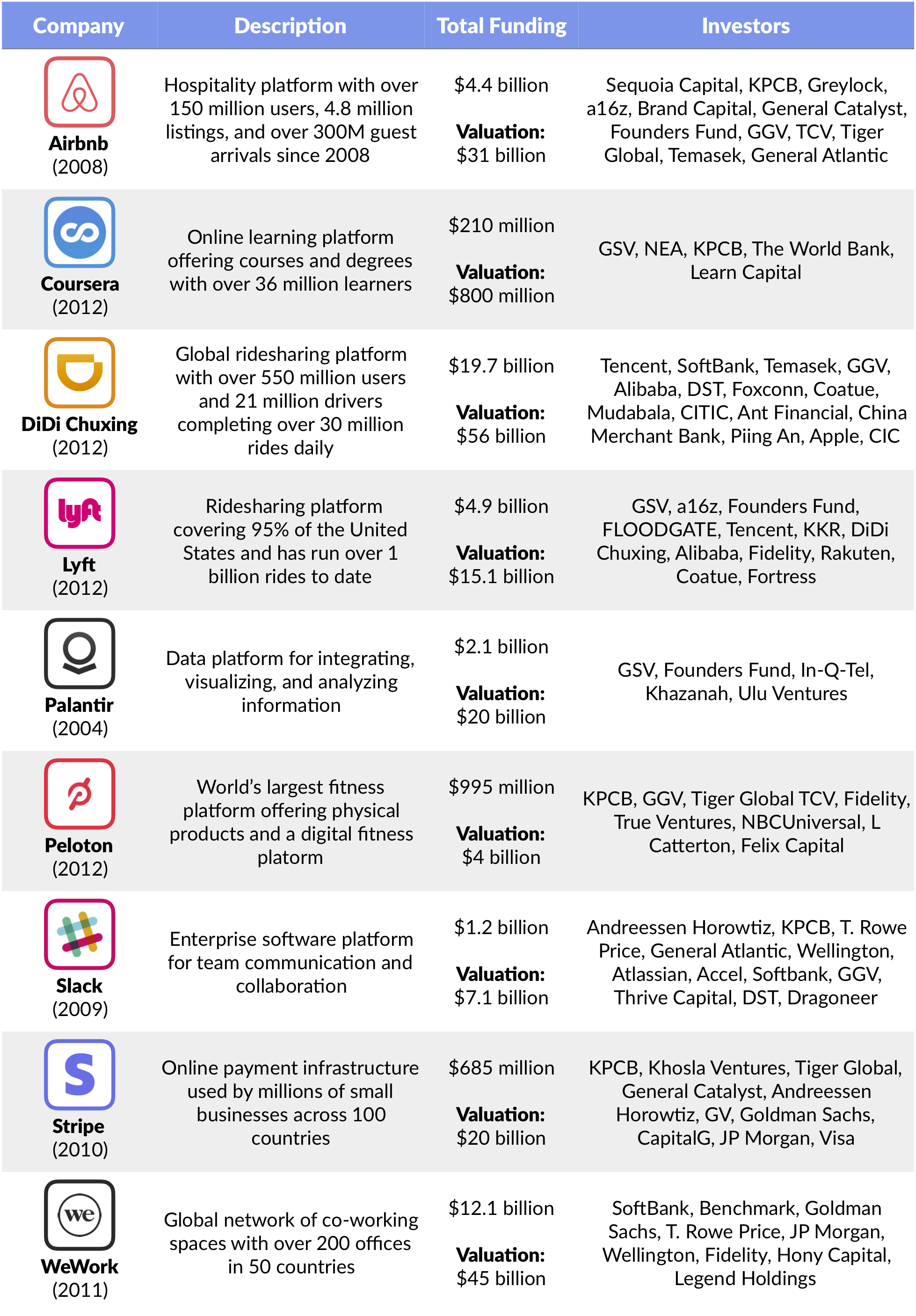

Aside from Uber and Lyft, the list of IPO candidates goes on.

Source: GSV Asset Management, Crunchbase, Wall Street Journal

Disclosure: GSV owns shares in Coursera, Lyft, Palantir

The Fall of the Berlin Wall in 1989 opened the flood gates for global connectivity, partnerships, and democracy. In 1900, only 12% of the world lived in a democracy, compared to 56% today. Airline travel has boomed, with the number of international travelers going from 1 billion in 1990 to 4 billion today. By 2036, there is expected to be 8 billion airline travelers.

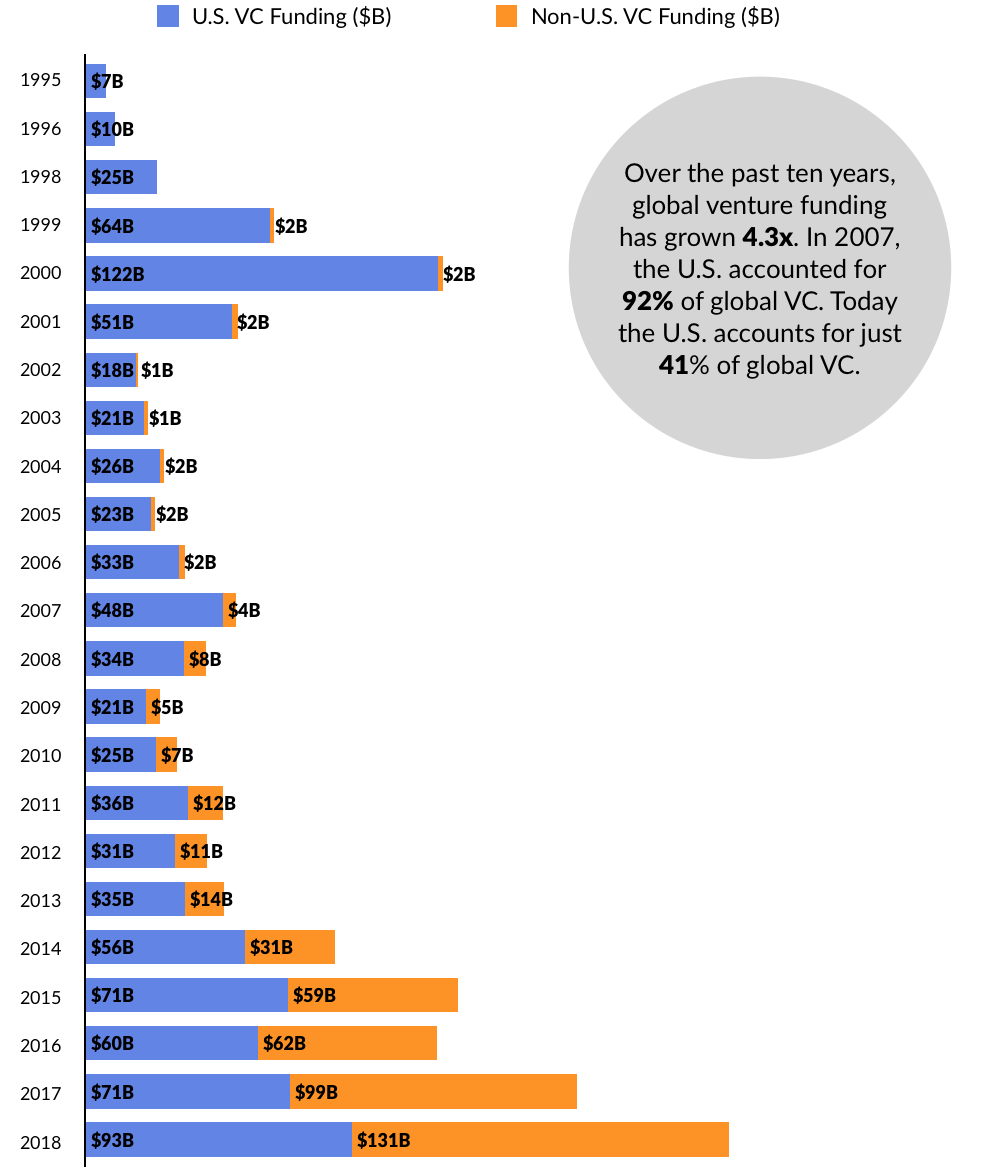

When looking at global financial markets, in 1990 only 15% of S&P 500 revenue came from outside the United States. Today, that number has risen to 43%. Over the past ten years, global venture funding has grown 4.3x. In 2007, the U.S. accounted for 92% of global VC. Today the U.S. accounts for just 41% of global VC.

To us, the magic of Silicon Valley and what has made the sixty miles between San Francisco and San Jose special is not about bits, bytes, and chips. The entrepreneurial mindset is alive and thriving. And what excites us the most is that the magic of Silicon Valley has gone Global and it’s gone viral. From Austin to Boston, Chicago to Sao Paulo, Shanghai to Mumbai to Dubai… a Global Silicon Valley has emerged.

In 2019, look for the continued surge in innovation coming from Global markets, especially from the VChIIPs (Vietnam, China, India, Indonesia, Philippines), Europe, and Latin America.

VChIIPs

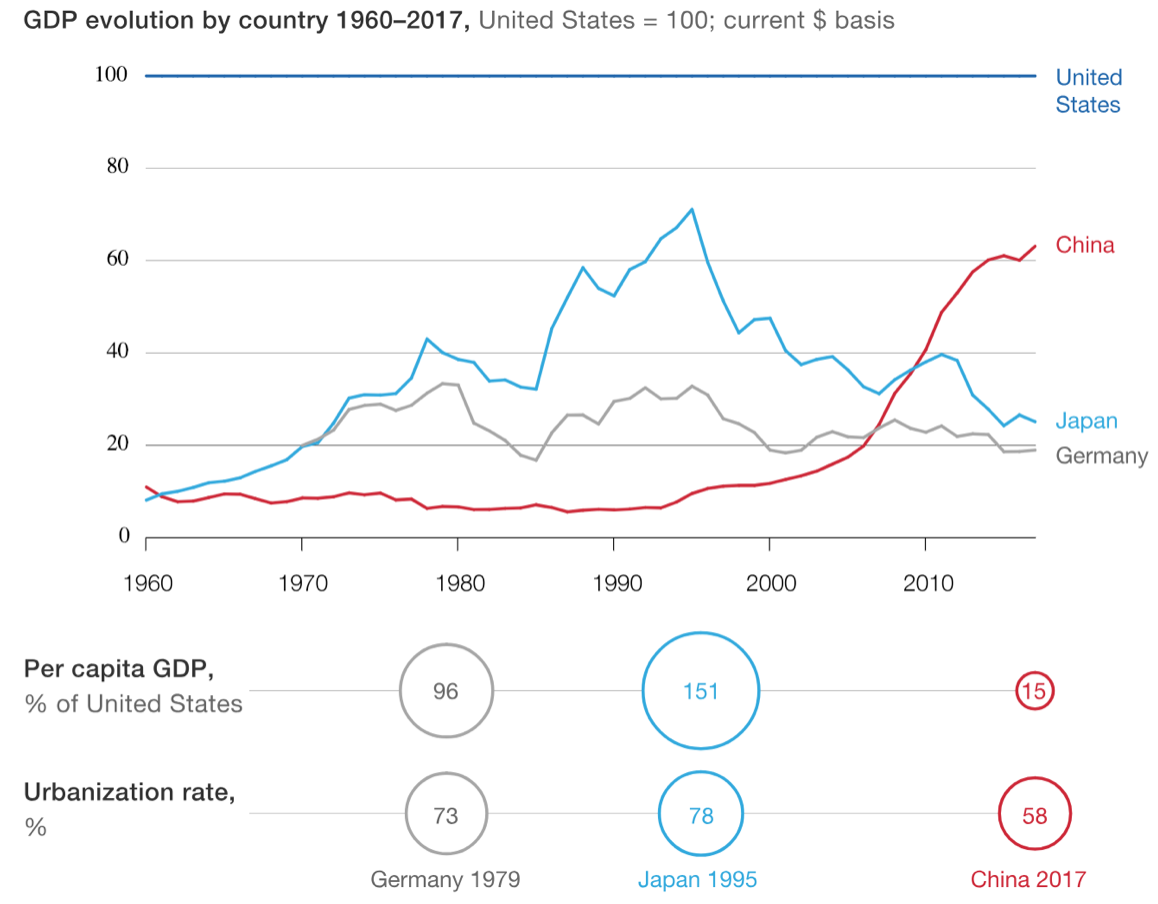

Looking in the rearview mirror, the world’s economic engine for the last 100 years was the United States, Europe, Japan, and Canada.

In 2000, with just 9% of the global population, these countries contributed nearly 75% of global GDP. But over the last 15 years, GDP growth in these countries has been flat-to-negative. Today they contribute just 53% of Global GDP. A key driver behind this change has been aging populations. Over 26% of these populations are over the age of 60 while just 16% are under the age of 15. In Japan last year, there are more adult diapers sold than baby diapers.

These dynamics are not changing anytime soon. The average (weighted) fertility rate in Canada, the United States, Europe, and Japan is 1.6. At a fertility rate under two, you’re essentially dying.

Where is the growth and opportunity as we look ahead? We call it the VChIIPs — Vietnam, China, India, Indonesia, and the Philippines.

These countries are home to over 41% of the global population and command 20% of global GDP, growing at 10.8%. If you look at the demographics, they are effectively the mirror opposite of what you see in the developed countries. Just 12% the VChIIP population is older than 60, 23% is younger than 15, and the fertility rate is 2.1, driving organic growth.

Source: The World Bank, GSV Asset Management

Surprisingly, conventional wisdom holds that the China growth story is yesterday’s news. But if you look at the Middle Kingdom’s profound technological innovations in recent years, coupled with a relentless pace of infrastructure investment, President Xi’s “Chinese Dream” is becoming a Chinese Reality. This growth story is just beginning.

A key catalyst is massive urbanization that is pervasive around the World but explosive in China. Take Shenzhen as an example.

In the 1970s, Shenzhen was a small fishing village. But in 1980, it became China’s first “Special Economic Zone,” which sparked breakneck growth for the next two decades. In less than a generation, Shenzhen has gone from being a backwater to the financial backbone of southern China. It is home to the Shenzhen Stock Exchange, as well as the headquarters of Ping An Insurance, Huawei, and Tencent. It has one of the busiest ports in the World.

If you look at the United States, there are 10 cities with a population of one million or more. In China, there are 160. Importantly, Chinese urban behemoths are clusters of young people who are embracing technology, brands, and digital commerce. These are young people who are getting ready to change the World. Accordingly, we’re seeing innovation abound. Transformative businesses are being created. Venture investment activity is accelerating. In 2017, startups in Beijing and Shanghai raised more venture funding than startups in Silicon Valley.

Europe

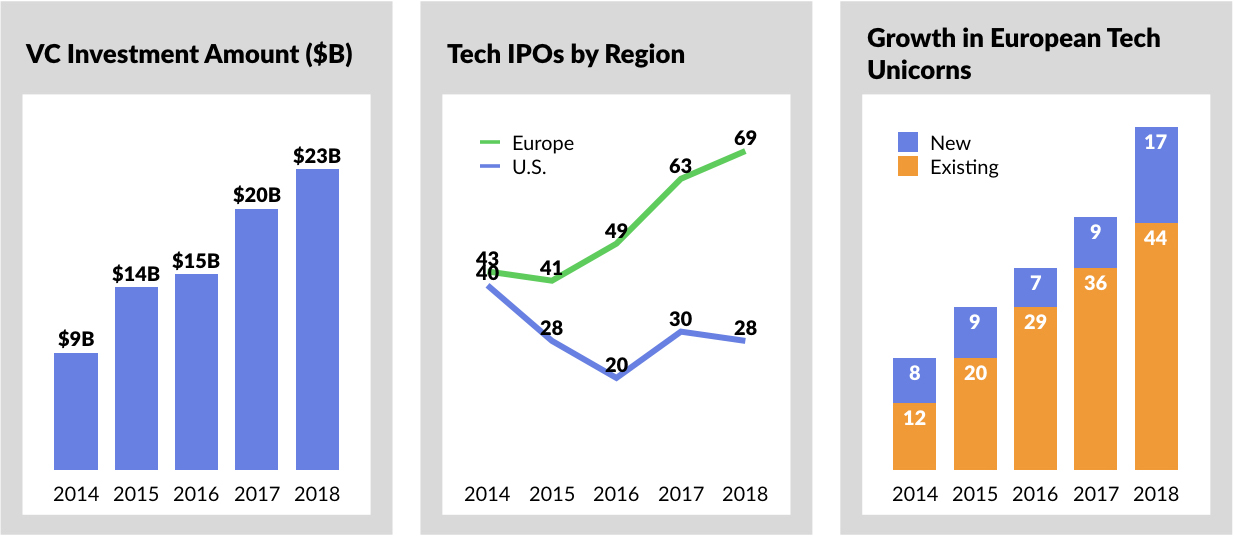

Several key catalysts have been fueling the European innovation ecosystem in recent years. Governments have been shifting heightened attention towards developing technology and artificial intelligence and have changed tax and immigration laws to incentivize tech talent.

Already, Europe has more tech developers than the U.S. — 5.7 million compared to 4.4. million. And most importantly, that talent wants to stay in Europe. In Atomico’s recent survey of European entrepreneurs and startups, 83% of entrepreneurs state that they would choose to stay in Europe to build their startup. In comparison, only six percent stated that they wanted to move to Silicon Valley. Not surprisingly, Europe’s tech industry is currently growing five times faster than the overall EU economy.

Accordingly, there has been a strong inflow of venture capital investments, which is expected to hit $23 billion this year. In comparison, European venture investments in 2014 was only $9 billion. In parallel, the number of tech IPOs and unicorns coming out of Europe has been growing steadily every year.

Already, notable success stories are showing up across Europe. Spotify’s public listing this Spring was a major landmark for the continent. The Stockholm-based streaming leader has been fending off competitors in Apple, Amazon, and Google for years, and continues to grow at a solid pace. Spotify currently counts 87 million paid users, which is up 40% year-over-year.

This summer, online payment provider iZettle was acquired for $2.2 billion by PayPal. Prior to its acquisition, iZettle was planning to list first in Stockholm at a $750 million valuation and then in the United States at a $1 billion valuation. In the Netherlands, payment processing platform Adyen went public, bursting into Europe’s tech scene when its market value doubled to $14 billion following its IPO. As one of the World’s leading payment platforms, Adyen counts companies such as Netflix, Facebook, Uber and Spotify as users. The company was one of the 2018’s top IPOs performing up 98%.

Romania’s capital Bucharest may not be the first place to associate with innovation, but that notion is changing quickly. Romania’s UiPath is an emerging leader in the robotics process automation (RPA) industry. UiPath creates AI-based robots that handle the flow and integration of back office applications. The software uses computer vision to understand and to automate repetitive tasks, freeing up employee’s time to focus on more complex work. Founded in 2012 and currently valued at $3 billion, UiPath has raised $448 million to date from blue-chip investors including Kleiner Perkins, Accel, and CapitalG.

Looking ahead, we’re focused on the growing list of disruptive companies coming from across the pond.

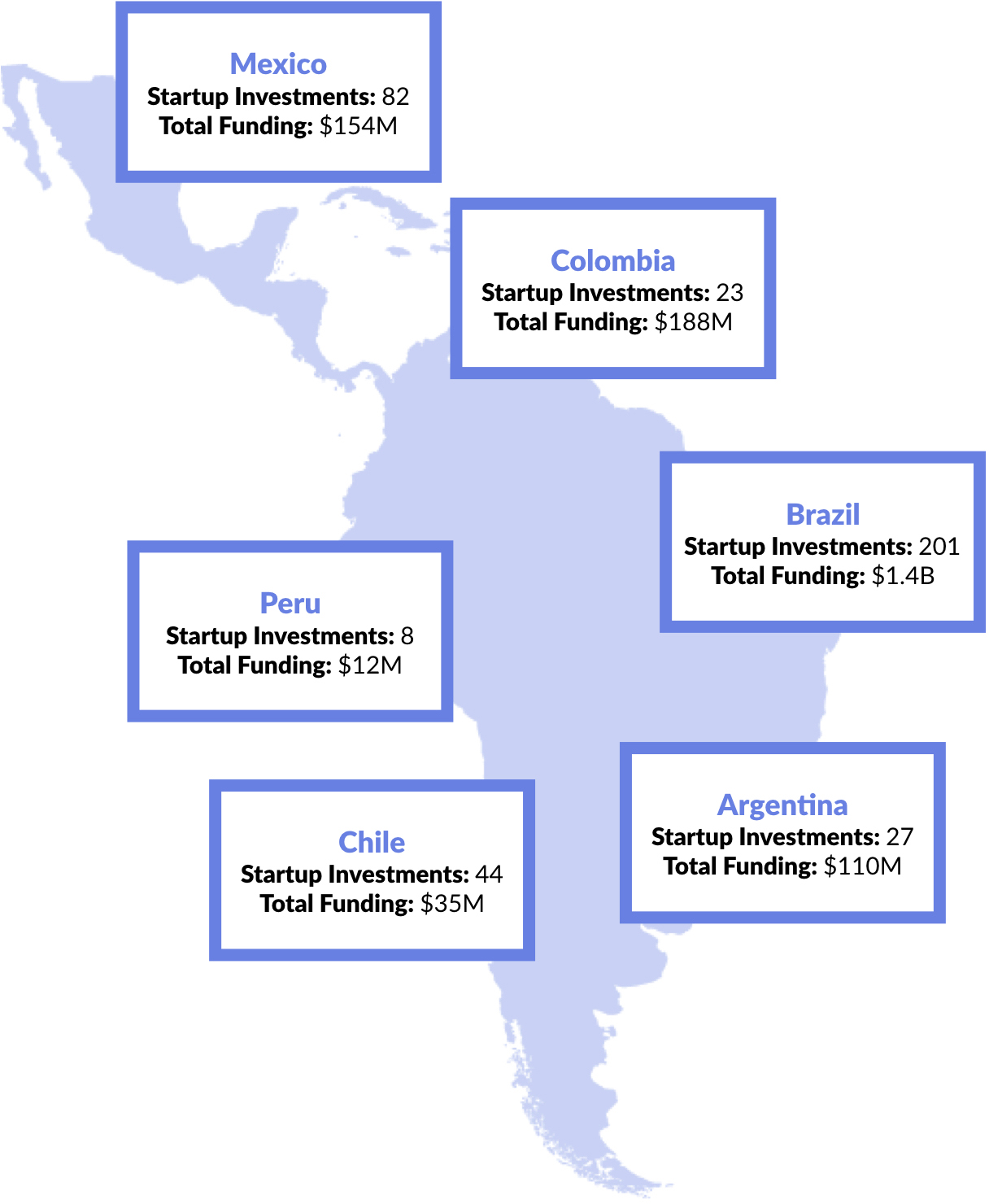

Latin America

The historic Silk Road which connected Central Asia, India, and China was as much about an exchange an ideas than of physical goods. The trade route was catalyst for cultural development across China, India, Persia, Europe, and the African continent. It catapulted China to economic and geo political dominance. President Xi’s “One Belt, One Road Initiative” aims to create the modern Silk Road, focused on creating connectivity and cooperation between Eurasia and China.

All in all, the “One Belt, One Road” network connects two-thirds of the World’s population and 31% of the World’s GDP. A corresponding global network that we are focused on is “One America,” which connects North America and South America… bringing together 14% of the World’s population and 31% of global GDP.

Brazil was once the darling of the emerging market, with investors clamoring for a spot in the economy, but it has quickly fallen from good graces. While the middle class is still expanding and the economy may still boom, the optimism in the country has fallen and political corruption is a serious problem.

But despite all this, the tricky labor laws, and hefty taxes, the hype began for a reason. São Paulo and Brazil have never stopped growing, the startup infrastructure is worlds ahead of where it used to be, and no one can complain about the energetic Brazilian culture, the World Cup in 2014, and the Olympics in 2016. The potential in Brazil has yet to be tapped, and Brazils remains as Latin America’s epicenter for innovation.

But all throughout the region, from Mexico to Peru and Chile, and Colombia to Argentina, innovation hotspots are emerging as the next generation of entrepreneurs tackle the continent’s most pressing issues. Chile has been dubbed “Chilecon Valley” for the number of foreign entrepreneurs the country has attracted with its robust offerings for startups.

The first half of 2018, Latin American startups raised a record amount of venture funding, with Fintech, Marketplaces, and AgTech being the hottest sectors.

In the past two years, a number of Latin American startups have raised megarounds or matured to Unicorn status.

Colombian on-demand delivery startup Rappi raised $130 million this January and $200 million this August from a syndicate of investors including DST, Delivery Hero, Sequoia Capital, Andreessen Horowitz, and Redpoint Ventures. Founded in 2015, the company reached Unicorn status, joining the elite club alongside Brazil’s Nubank.

Founded in 2014, Nubank has democratized access to banking solutions for people that traditionally could not or did not have access to physical banks. Since its launch, the company has launched a series of products ranging from low-interest rate credit cards to high-yield savings accounts, while making the process simpler for everybody to have access to a financial provider. This October, Nubank raised $180 million from Tencent at a $4 billion valuation. In total, Nubank has raised $707 million from investors including DST, Founders Fund, Sequoia Capital, Fortress, Goldman Sachs, and Tiger Global.

Movement is in our DNA. Until about 10,000 years ago — or 99% of human history — there were few, if any homes or villages. People were nomadic, chasing food and gentler climates.

While we couldn’t change the weather, we learned how to domesticate plants and animals in what is now called the Neolithic Revolution. And when the food stopped moving, so did we.

In the next 10,000 years, historians might look back and name our era the “Metropolis Revolution.”

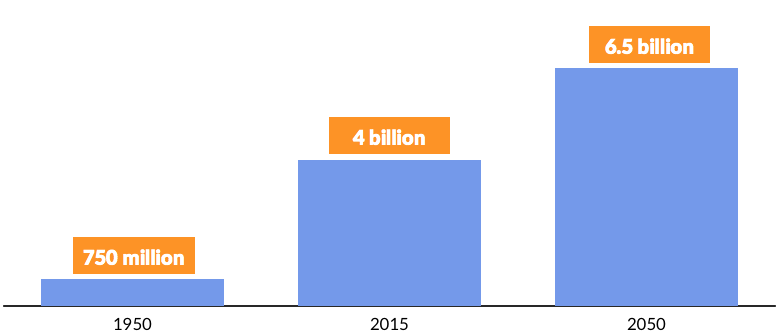

Today, the United Nations estimates that four billion people, or 54% of the World’s population, live in cities. In the next 15 years, the Economist projects that urbanization will increase average city density by 30%. By 2050, the ranks of urban dwellers will swell by 2.5 billion to nearly two-thirds of Global population.

Around 80 million people annually move from rural to urban areas and the number of megacities — cities with a population 10 million or greater — has doubled in the past two decades, from 14 in 1995 to 31 in 2017. It’s estimated that by 2100, over 80 cities across the World will have a population over 10 million.

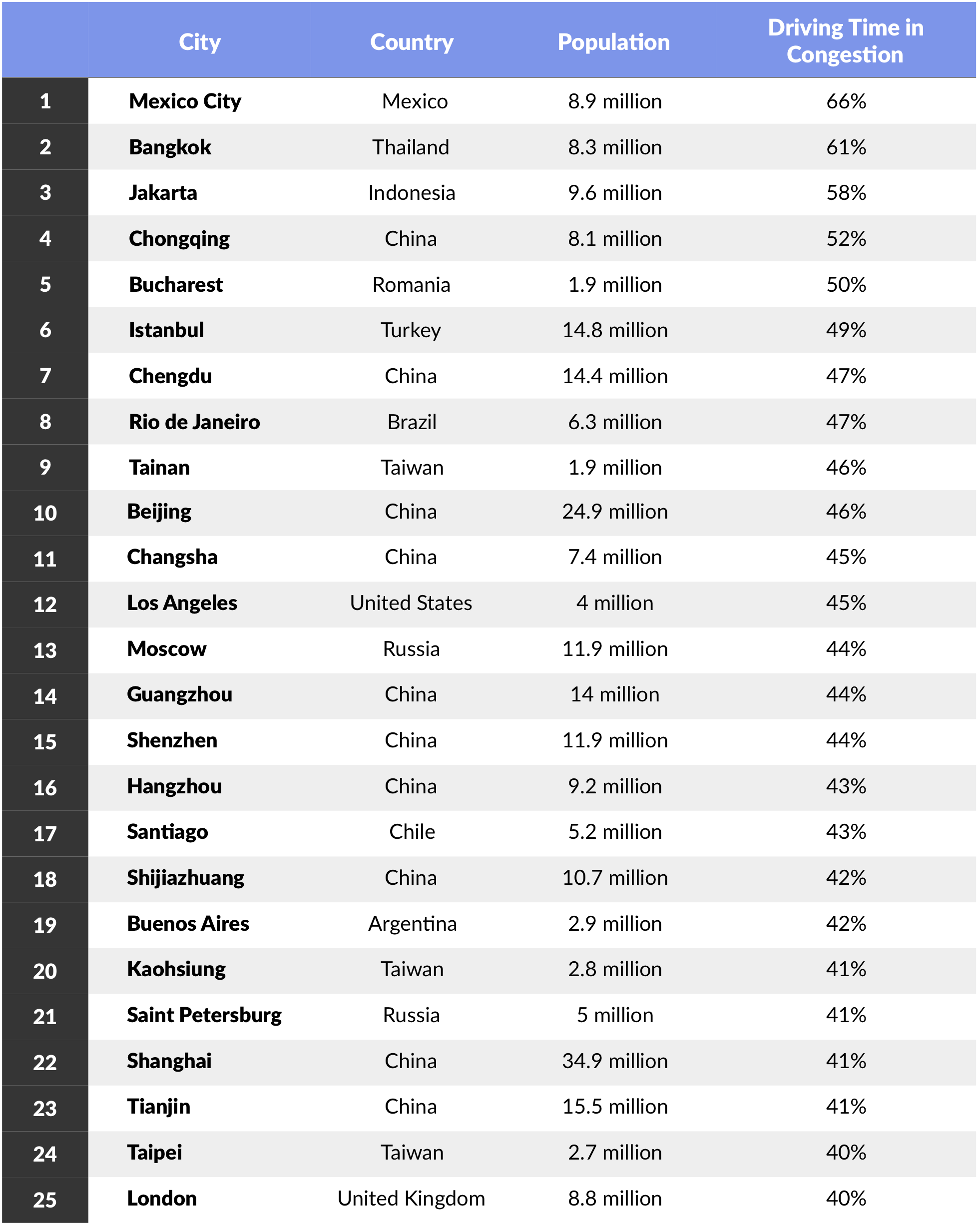

The rise of Global urbanization, coupled with a corresponding increase in the number of vehicles on the road, has pushed city traffic to the limit. In Mexico City, for example, the city with the most traffic congestion in the World, drivers spend two-thirds of their time in the car in gridlock. And with a population of eight million, Mexico City isn’t even considered to be a “megacity” (10+ million population).

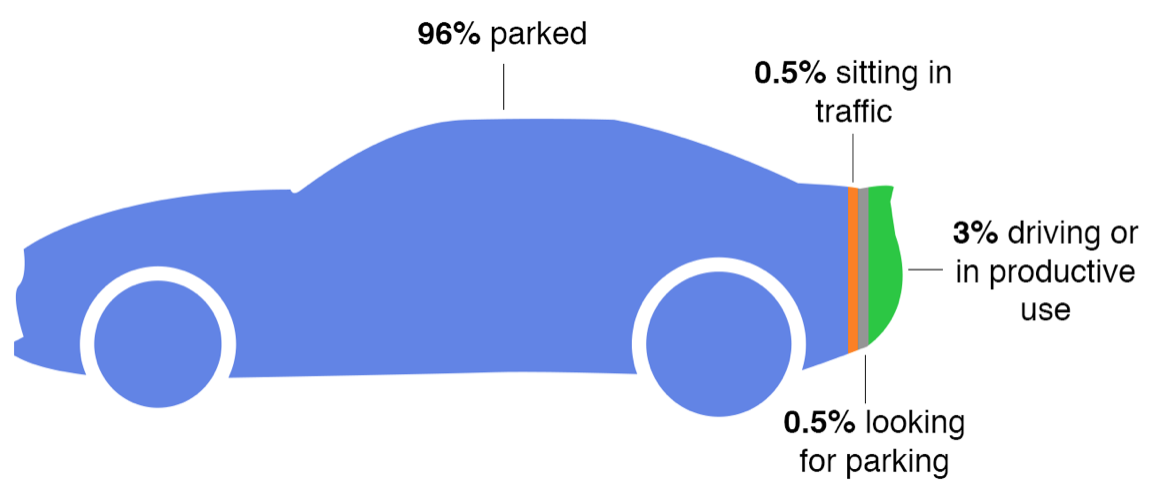

Americans spend over $2 trillion per year on car ownership — more than what we shell out for food. But shockingly, the 250 million cars in the United States spend 96% of the day parked. In other words, there are 240 million cars parked at all times. As Lyft co-founder John Zimmer has observed, BMW doesn’t make the “Ultimate Driving Machine” — it makes the “Ultimate Parking Machine”.

As is often the case, the greatest problems create the greatest opportunities — the bigger the problem, the bigger the opportunity.

And thats where the “Fast Mile” comes in. Arising at the intersection of several megatrends — the sharing economy, smartphones, urbanization, sustainability, and on-demand services — the Fast Mile encompasses solutions that will add efficiency to the problem of last mile transportation in congested cities.

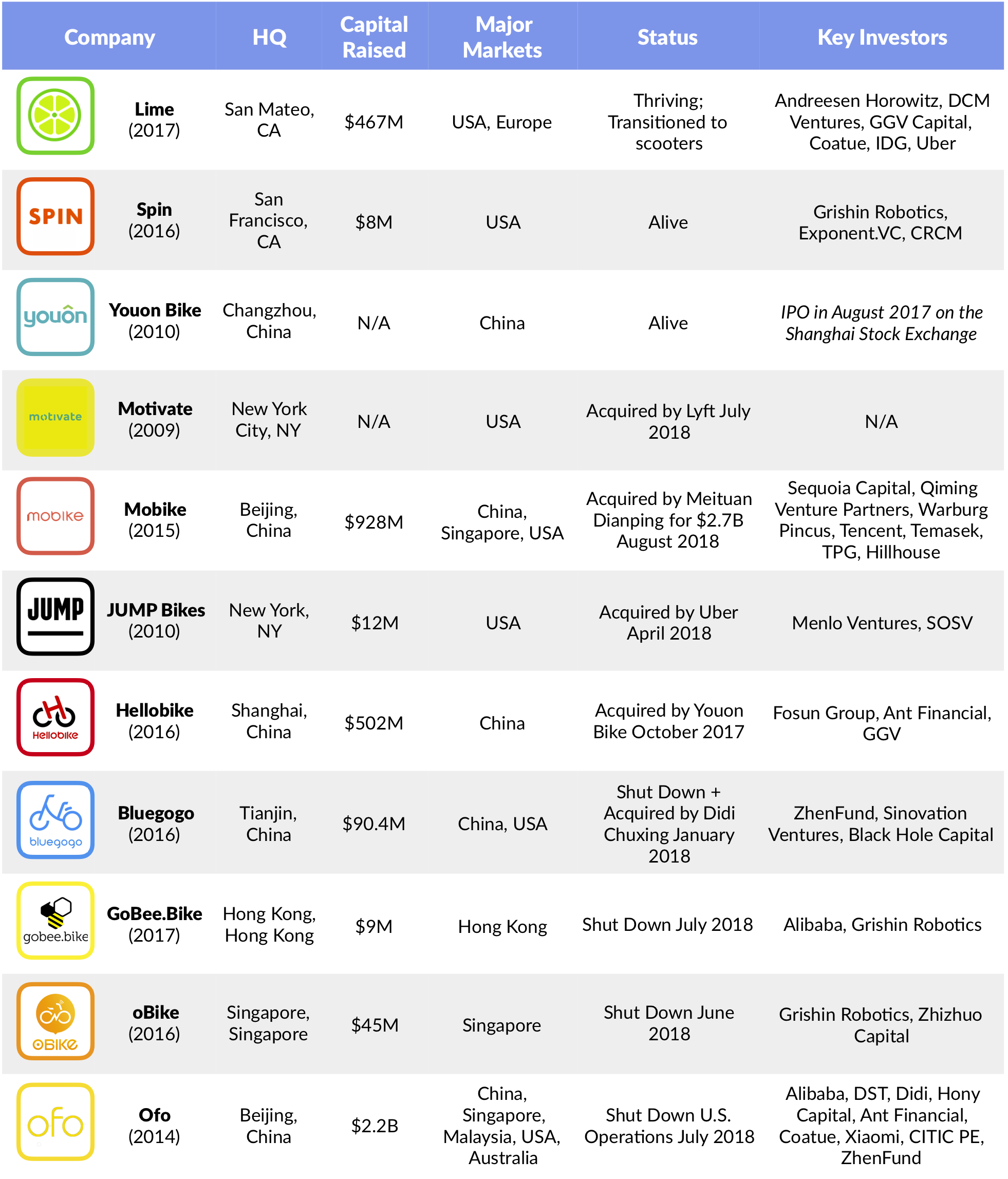

In a few short years, bike-sharing emerged as the fastest growing sector of the on-demand “Sharing Economy.” Venture funding for bike-sharing startups exploded in 2017, largely driven by the mega-rounds raised by Chinese early-movers Ofo and Mobike ($1.9 billion in combined 2017 financings).

In even shorter time, bike-sharing suddenly became the fastest dying sector… Ofo is struggling to maintain payroll, Mobike sold to Meituan and was discontinued in most locations, Jump (under Uber) has been underperforming, and Lime transitioned from bikes to scooters.

What happened?

In China, which is home to over 20 million shared bikes, over-saturation, vandalism and theft (often at the behest of competitors), as well as general disregard on behalf of consumers, led to the proliferation of bike graveyards. Wukong reportedly lost 90% of its bikes the first six months after it launched in January 2017. Additionally, the global launch of scooters and their surging popularity worldwide quickly wiped out demand for bike-sharing services.

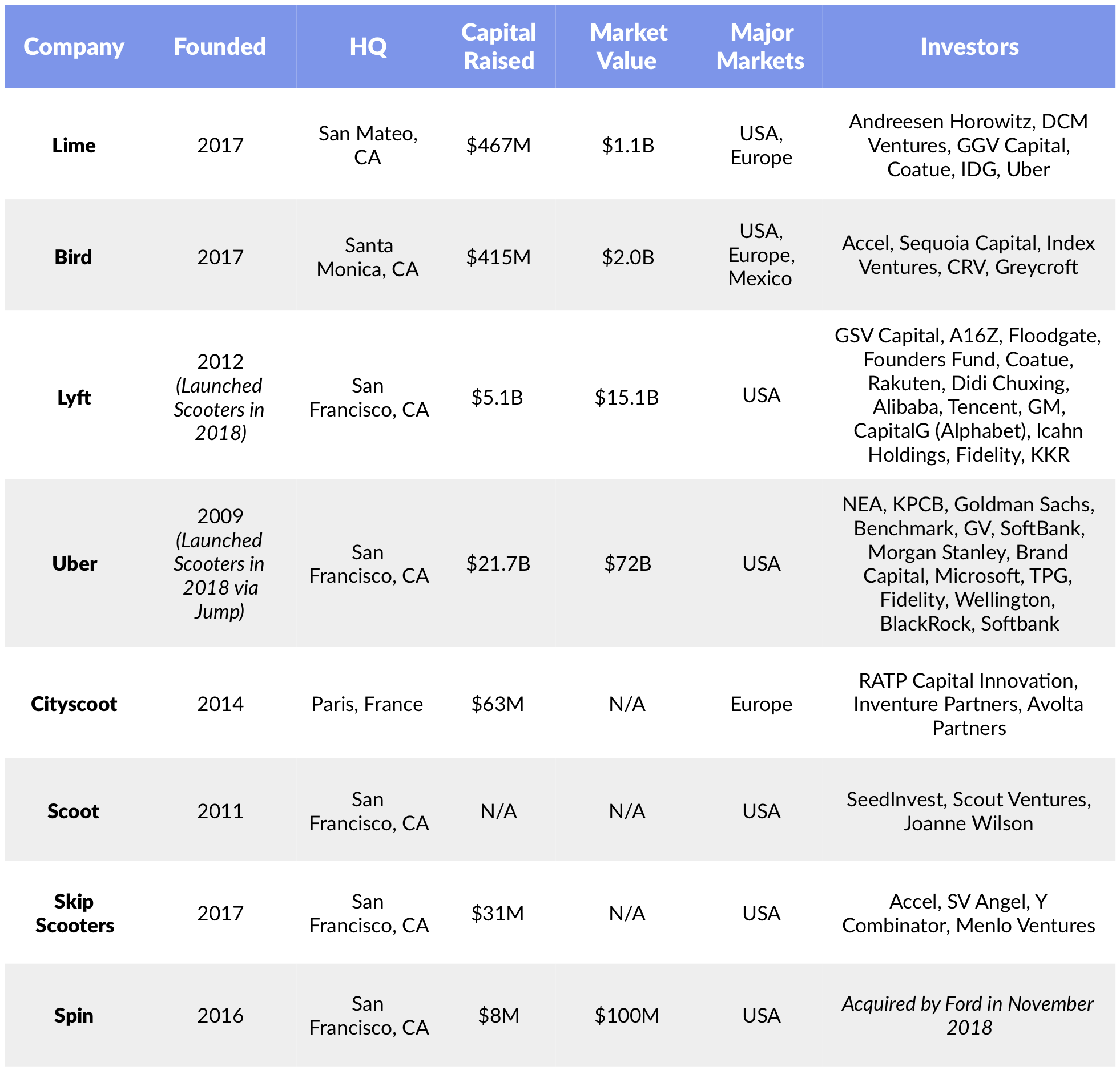

The scooter feeding frenzy began in Spring 2018 when Bird and Lime started dropping motorized scooters with top speeds of 15 mph all over cities, unannounced. Scooters have quickly gone from fad to fixture, with people from all walks of life using them to get from A to B on workdays and weekends alike.

Scooters have quickly become the new — and perhaps most popular — disruptor in urban transportation. They are grabbing market share from bike-sharing and even ride sharing services. Even Uber and Lyft have hopped onto the scooter band wagon, launching their own scooter services this Fall. This July, Uber also invested in Lime’s Series C alongside Google Ventures.

In an environment where many bike and scooter-sharing services have struggled to maintain momentum, Lime stands out.

The California-based company (formerly LimeBike) was founded in 2017 and launched as a dockless bike-sharing service, painting the streets of the United States with fleets of bright green bikes. It quickly followed with electric scooters, sensing an opportunity to develop a portfolio of last mile services. It currently operates in over 120 cities globally and recently surpassed 26 million scooter and bike rides delivered since inception.

The short-term impact on Fast Mile mobility services has been significant. Micro-mobility services like Bird and Lime have replaced walking, public transportation and car trips (owned, ride-sharing, or taxi) approximately one-third of the time each.

In Lime’s case, the company is significantly helping reduce the reliance of personal cars. Approximately 20% of Lime riders globally use the service to connect to or from public transit. Additionally, Lime successfully helps connect riders to local businesses, with 32% of urban riders using Lime to travel to or from a dining or entertainment. 40% of riders in major urban networks rely on Lime to travel to or from work, school or appointments.

The City of Lights has become the largest market for scooters in the World and is Lime and BIrd’s largest market. As Paris continues its focus on limiting car traffic — which is a growing epidemic worldwide — the city is turning towards scooters and other micro-mobility services to help pedestrians commute.

With early consumer feedback being extremely positive and coupled with strong momentum, look for major metropolitans globally to continue their embrace of micro-mobility services. The dawn of the Fast Mile is upon us and urban transportation is in for an overhaul.

500 years ago, people were born, grew up and died within a five mile radius. Effectively, your parent’s past was your future.

Then came a wave of innovation which connected people around the world in many different ways, starting with the Gutenberg Press in 1439. Other inventions such as the steam engine (1756), locomotive (1804), telephone (1876), automobile (1888), and airplane (1903) brought the world closer together one step at a time.

Moore’s Law, which was postulated in 1965, changed the pace of innovation and paved the way for massive adoption of technological improvements.

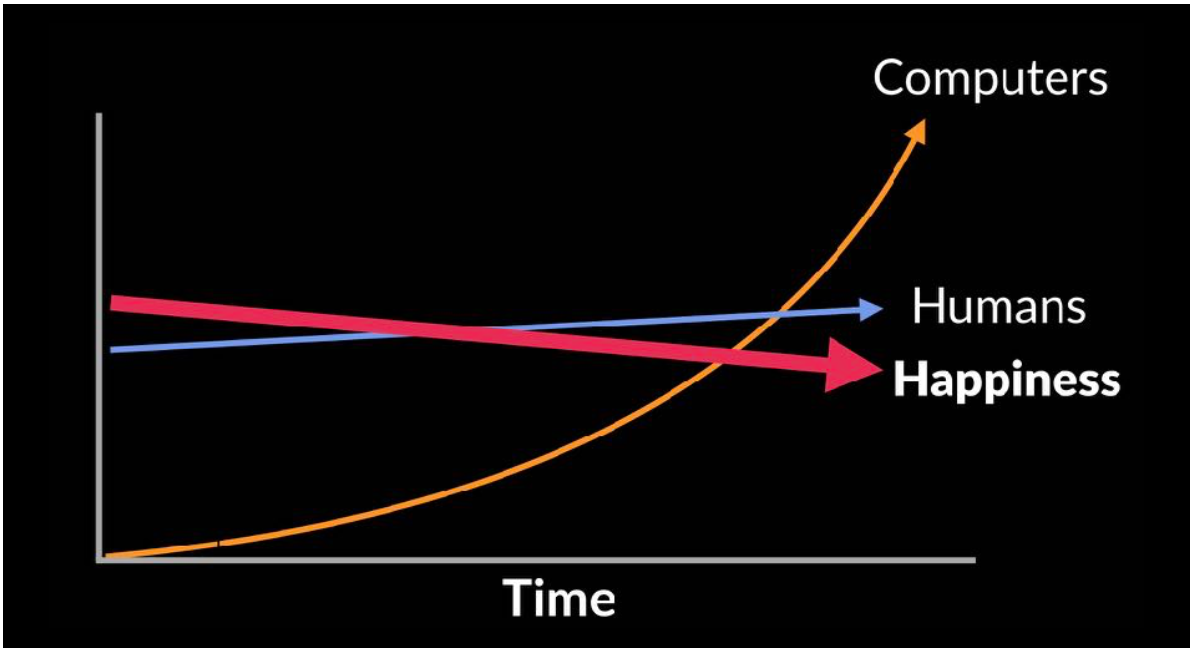

And while technology has been on a technology upgrade cycle — the original iPhone is virtually unrecognizable now — human capabilities and happiness have stalled. Despite the incredible advancements in technology and unfathomable improvements through technology upgrades, people’s lives aren’t keeping pace and in fact, people’s happiness is falling.

A major cause of unhappiness and stress is from the anxiety tied to always being connected to our mobile device. Hyperconnectivity as a result of technology has been attributed to increased levels of anxiety, depression, and stress.

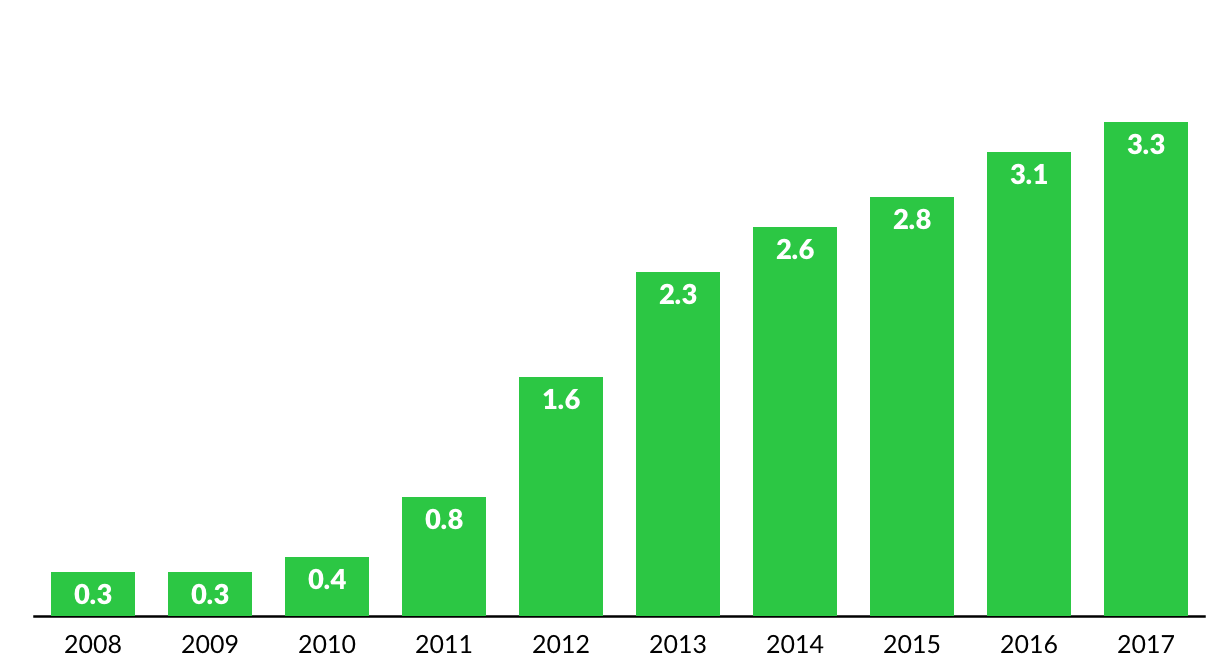

Time spent on mobile devices has gone from 20 minutes in 2008 to over three hours today. This is starting to have such a negative impact on society, that even kids are beginning to take notice. When a class of third graders from an elementary school in Boston was asked to design the perfect playground, their number one rule was “no cell phones.”

In the United States, suicide rates are up 30% over the past twenty years. Opioid deaths increased 45% to 75,000 casualties last year alone. That’s more than the number of people who died in traffic accidents. Add it up, and life expectancy for U.S. citizens actually fell last year.

As a direct reaction to this, the #1 class at both Harvard and Yale is on how to find happiness. It’s stunning that the best and brightest students are searching for more than how to become a “Captain of Industry” and actually want to find meaning to their lives.

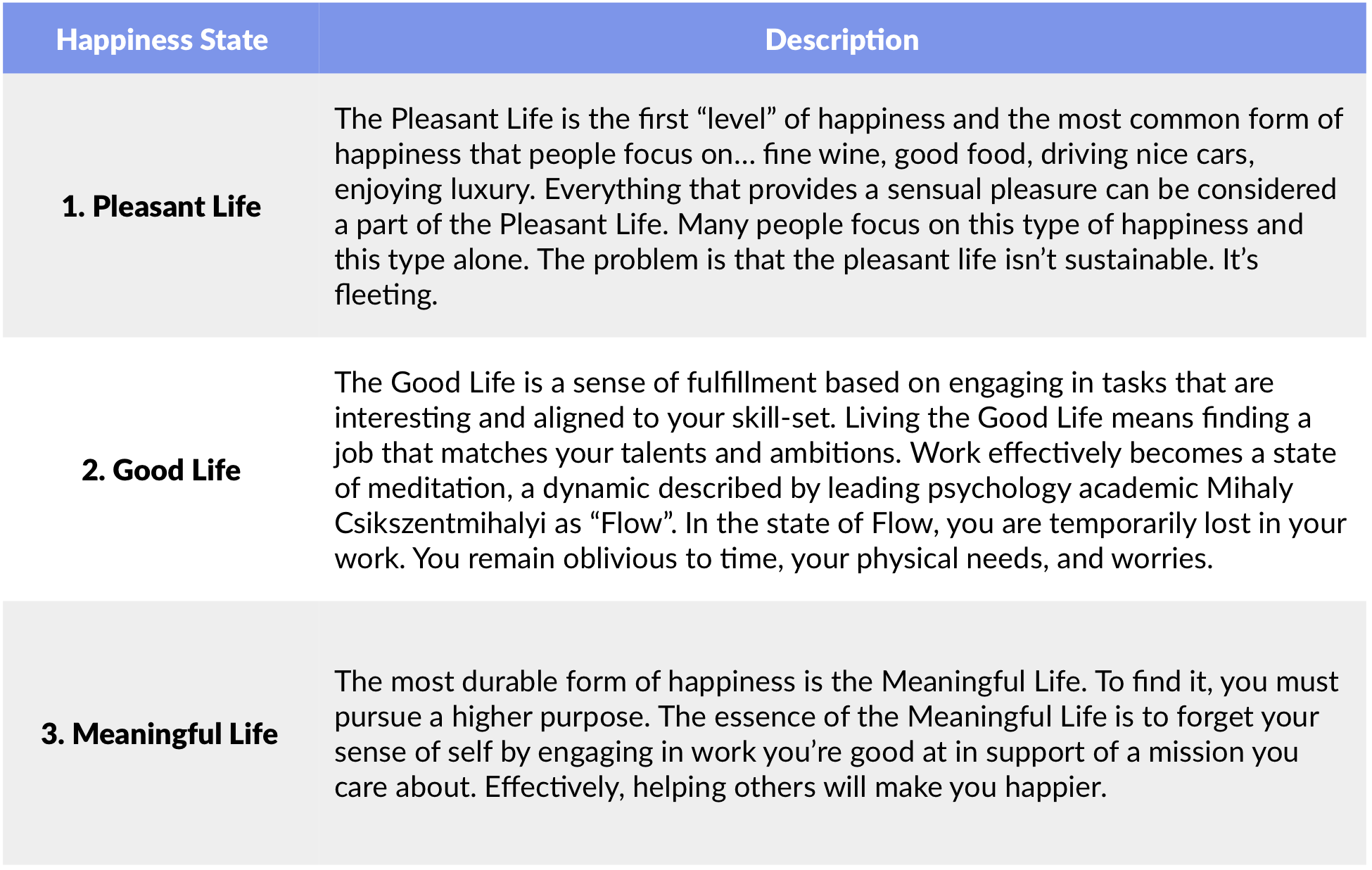

But what is the path to happiness? Find ways out of this “default mode” where we’re consumed with identifying risks and the implications of mistakes we’ve made in the past. In other words, live in the moment.

In an ever-changing and uncertain world, the important of a purposeful and meaningful life will be increasingly important. At the core of a happy life is a finding meaningful purpose. To echo the simple wisdom Steve Jobs shared in a ten minute commencement address to Stanford University students in 2005:

“Sometimes life hits you in the head with a brick. Don’t lose faith. I’m convinced that the only thing that kept me going was that I loved what I did. You’ve got to find what you love. And that is as true for your work as it is for your lovers. Your work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the only way to do great work is to love what you do. If you haven’t found it yet, keep looking. Don’t settle. As with all matters of the heart, you’ll know when you find it. And, like any great relationship, it just gets better and better as the years roll on. So keep looking until you find it.”

A megatrend creating huge opportunities is a phenomenon we call “Mind, Body, Soul” — businesses with a value proposition and customer experience at the intersection of healthy living and mental and spiritual well-being… allowing people to live happier, healthier, and more fulfilled lives.

Today, the ancient practices of yoga and meditation are the most popular alternative health approaches in the United States, each used by around 35 million adults. Since 2012, the number of Americans who meditate has tripled and the number of Americans who do yoga is up 55%.

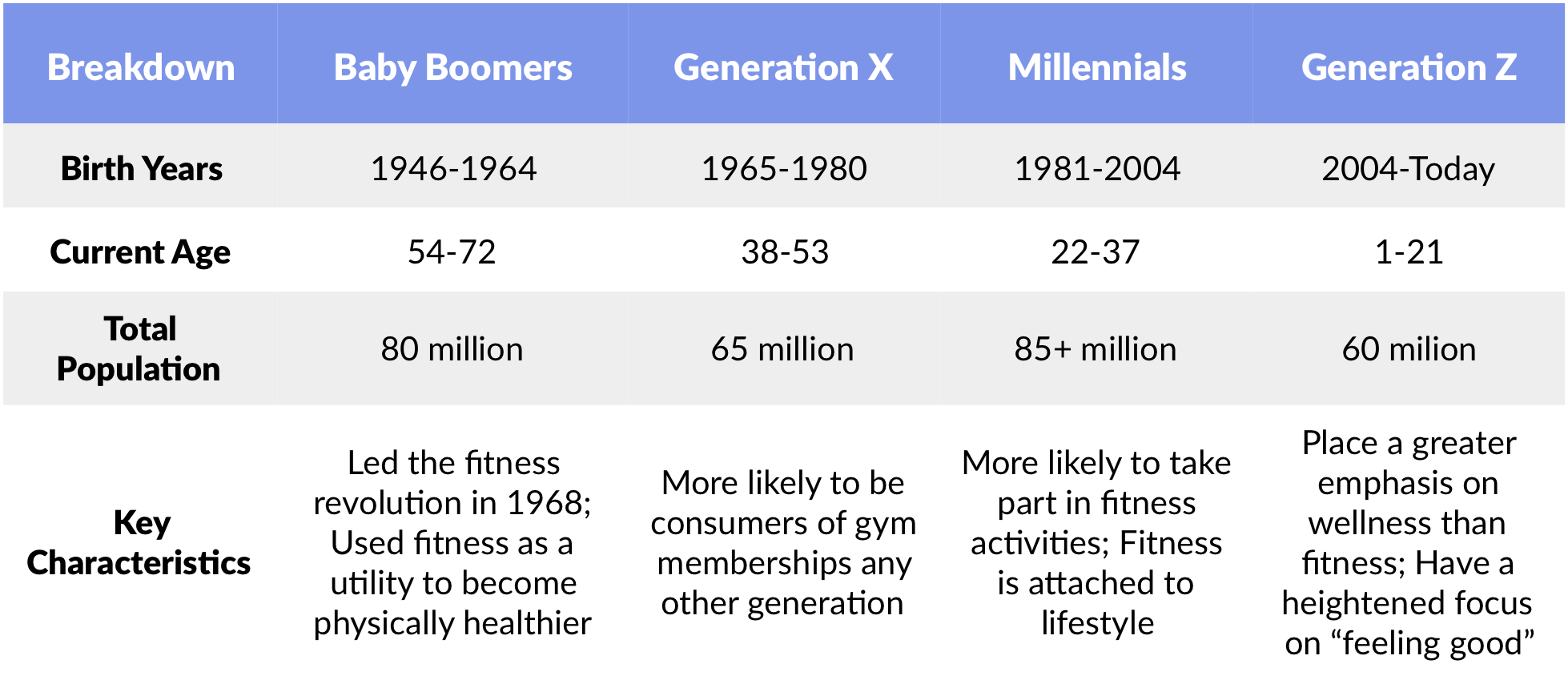

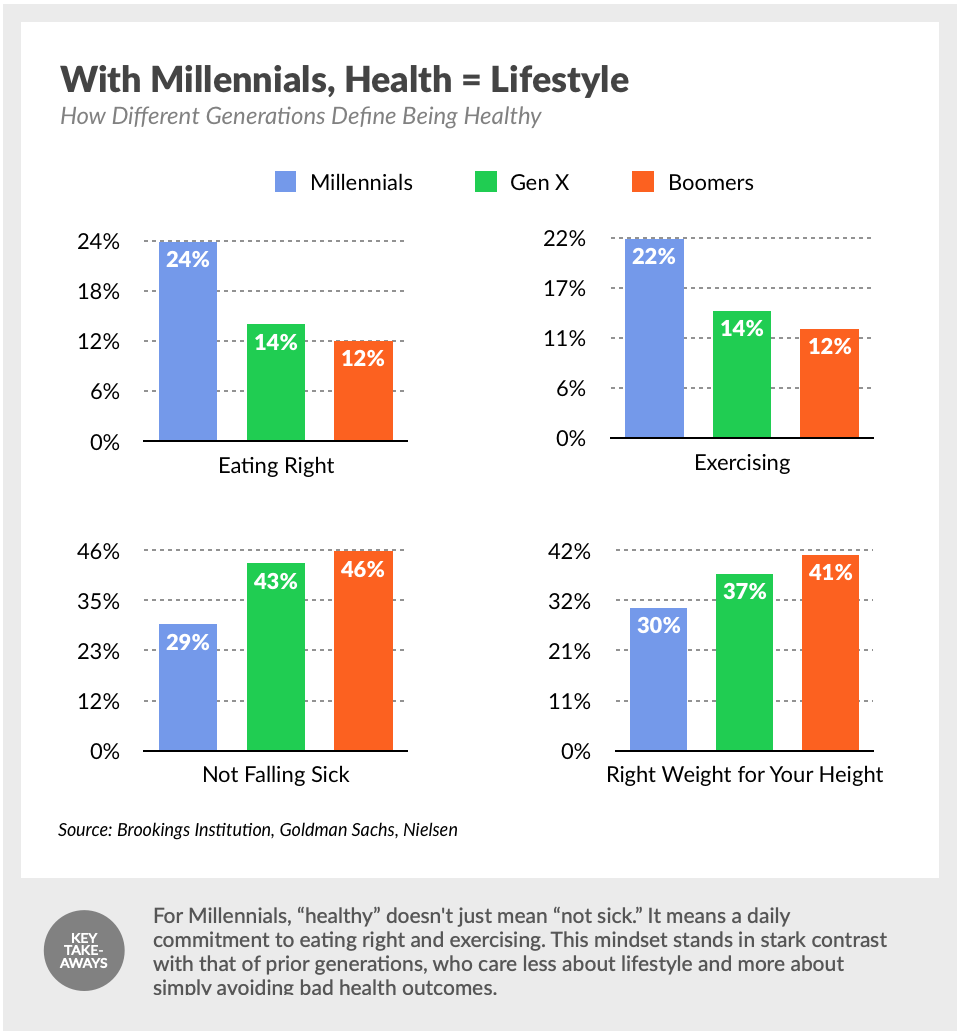

At the center of the megatrend is the Millennial generation, who have grown up in a world with information at their finger tips during the rise of smartphones and technology. As such, this generation is quite different than those that came before them.

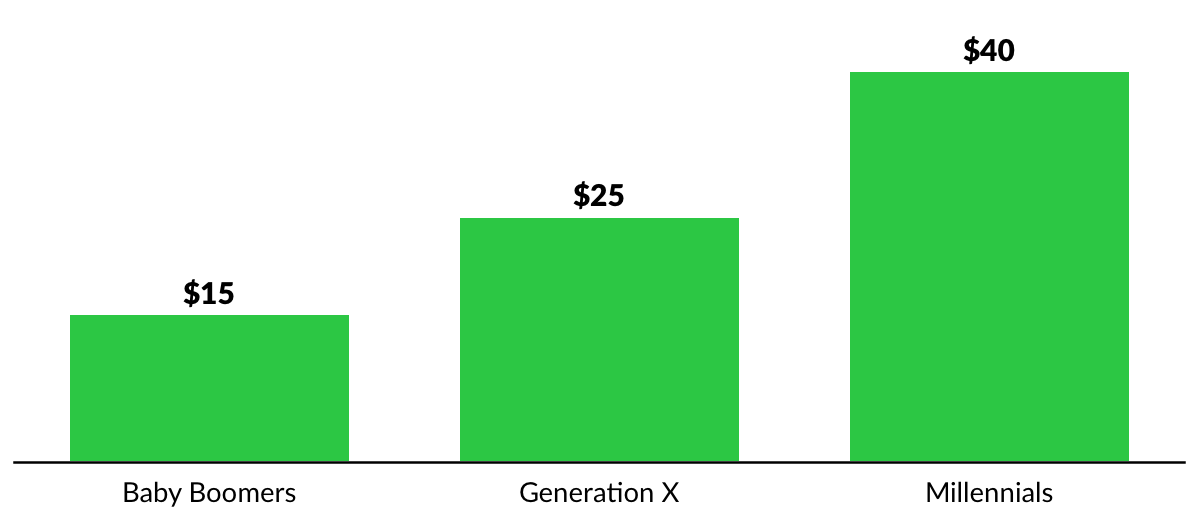

Millennials uniquely take part in fitness activities more than any other generation. Approximately half of adults who exercise are millennials. As such, it’s not a surprise that Millennials spend the most on fitness and health when compared to other generations.

To Millennials, fitness is about community and to them, exercising is table stakes. Wellness is a fundamental priority and their solution for long-term happiness and wellbeing is eating right and staying active.

Being healthy is no longer about being in physical shape. It’s also about being healthy mentally and spiritually to reach a harmonious balance between the Mind, the Body and the Soul.

SoulCycle is a leader in the Mind, Body, Soul megatrend, combining a fitness experience with the mindfulness of meditation in a consumer brand people love. There is nothing about what SoulCycle does that can be patented. The casual observer might even mistake it for a “spinning class.” But when you study SoulCycle, you realize that its monster success derives from doing a hundred little things better than anybody else.

Riding on this megatrend is New York-based Peloton. Founded in 2012, Peloton is building the World’s largest fitness platform without owning a single gym. Unlike traditional boutique fitness shops, Peloton strategically avoids costs of maintaining physical sites and hosting live classes at numerous studios. Instead, Peloton hosts classes at its flagship class in New York City, digitizes the instruction, and makes the class available on its digital platform for hundreds of thousands of subscribers, who can access the class on demand.

Since its founding in 2012, New York-based Peloton has built its own tribe of Peloton fanatics. Peloton’s flagship product is a high-end fitness bike that is equipped with a touchscreen that allows riders to access spin classes on demand. In 2018, Peloton announced its second product, Peloton Tread, a high-end treadmill.

Riders enjoy the experience so much that there is virtually zero churn and the company’s monthly subscription retention rate is 99%. As of the beginning of 2018, Peloton had sold over 200,000 bikes and has over 600,000 subscribers paying $39/month to access live classes. With a NPS of 91 — the second highest after Tesla — Peloton has created a highly engaging product which people love and will continue to use.

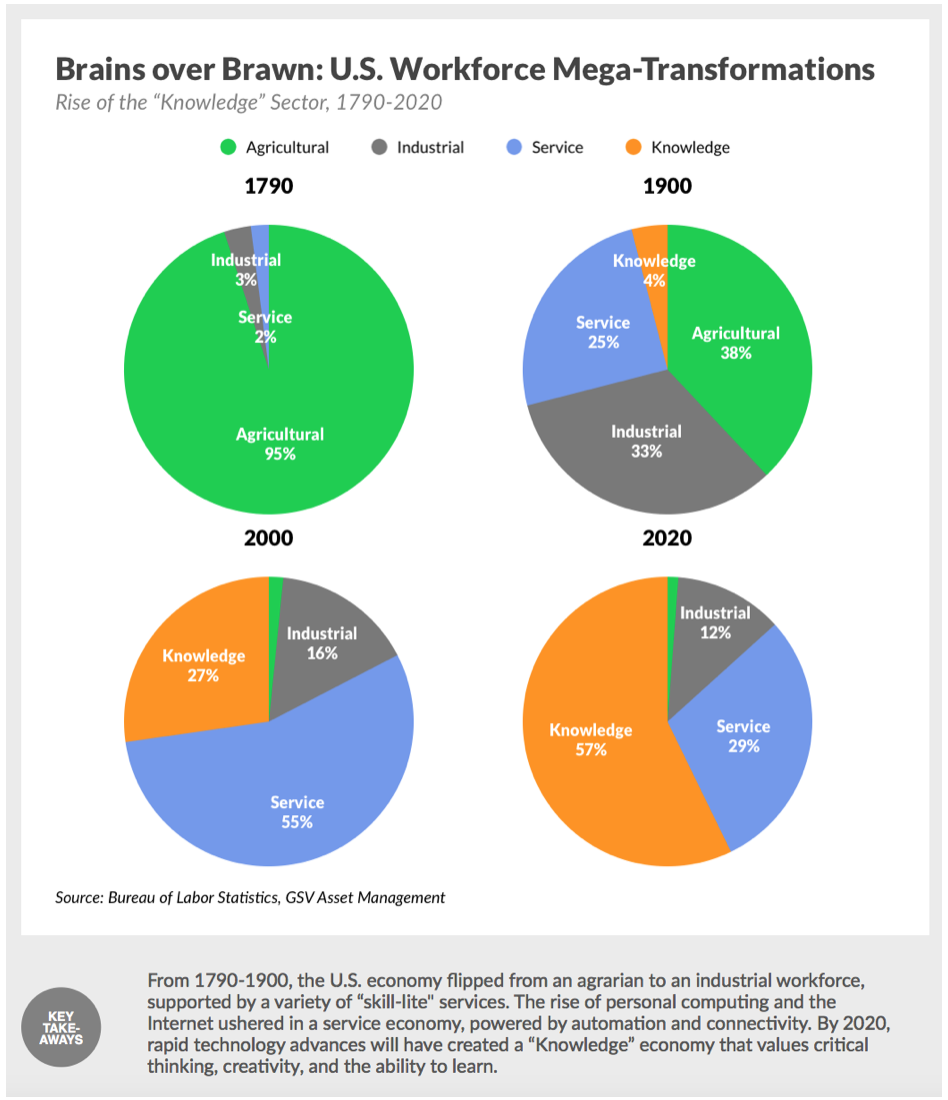

Throughout history, whether in pre-industrial or industrial times, great nations developed based on their access to physical resources or their ability to surmount physical barriers. England and Spain crossed oceans, Germany turned coal and iron into steel, and the United States exploited a wealth of agricultural and industrial resources to become the World’s breadbasket and industrial superpower.

But the advent of the personal computer, the Internet, and the digital delivery of information shifted the World’s focus from physical capital to human capital. The most valuable resources in a physical economy are commodities like coal, iron, and oil. Their value is judged by metrics like purity and volume. In a knowledge economy, the most valuable resource is talent. Talent is valued based on brainpower, and the ability to acquire, deliver, and process information effectively.

The Service Economy that developed after World War II started to shift education requirements. If you wanted to participate in the service industry — in jobs ranging from accounting to retail sales to entertainment — some formal education was required. Brains started to win out over brawn.

Gaining knowledge was worthwhile; these jobs were safer, less strenuous, and often better paid. Nevertheless, the education demands were still fairly low: in 1950, roughly 20% of the rising U.S. workforce had some college education by age 30, and only 20% of jobs required a postsecondary credential.

The Personal Computer revolution that began in the mid-1970s displaced a wide range of manual labor, administrative, and clerical jobs — many that were lucrative and desirable. The World changed again when Netscape debuted on Wall Street in 1995. Broad Internet connectivity transformed communication, making an individual’s actual workplace less relevant.

Now, U.S. workers faced competition not only from computers, but also from low-cost talent pools thousands of miles away. One click and you were connected to your service representative in Mumbai. In developed countries, knowledge work became the new area of opportunity.

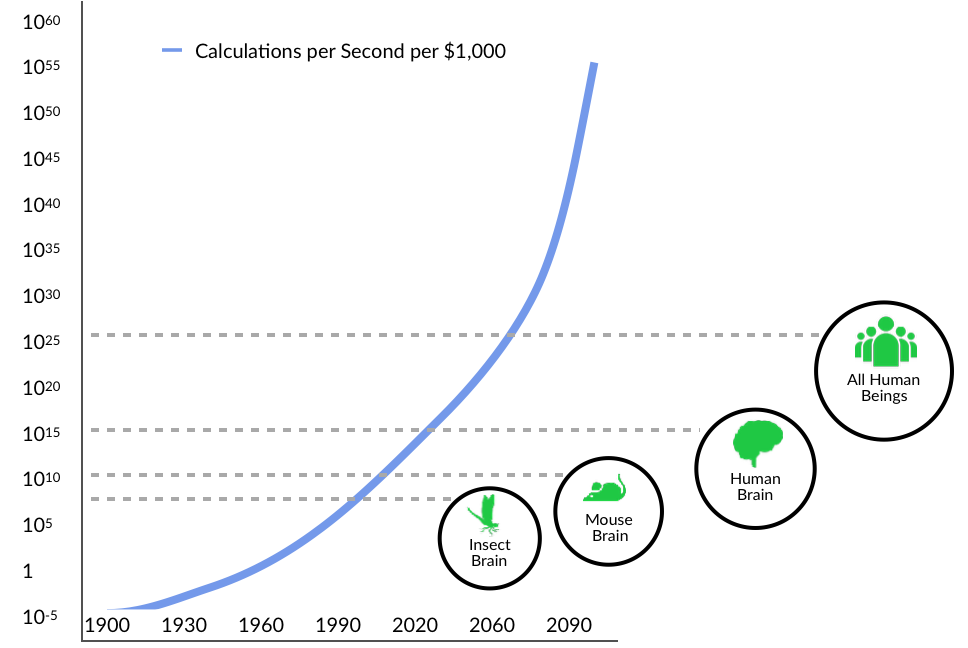

Today there is a prevailing sense that rapidly accelerating digitization and automation is triggering an economic shift unlike any we have seen before. As MIT scholars Erik Brynjolfsson and Andrew McAfee observe in The Second Machine Age, an unsettling future is taking shape characterized by massive unemployment and economic disruption stemming from the fact that as computers get more powerful, companies will have less need for workers of any kind.

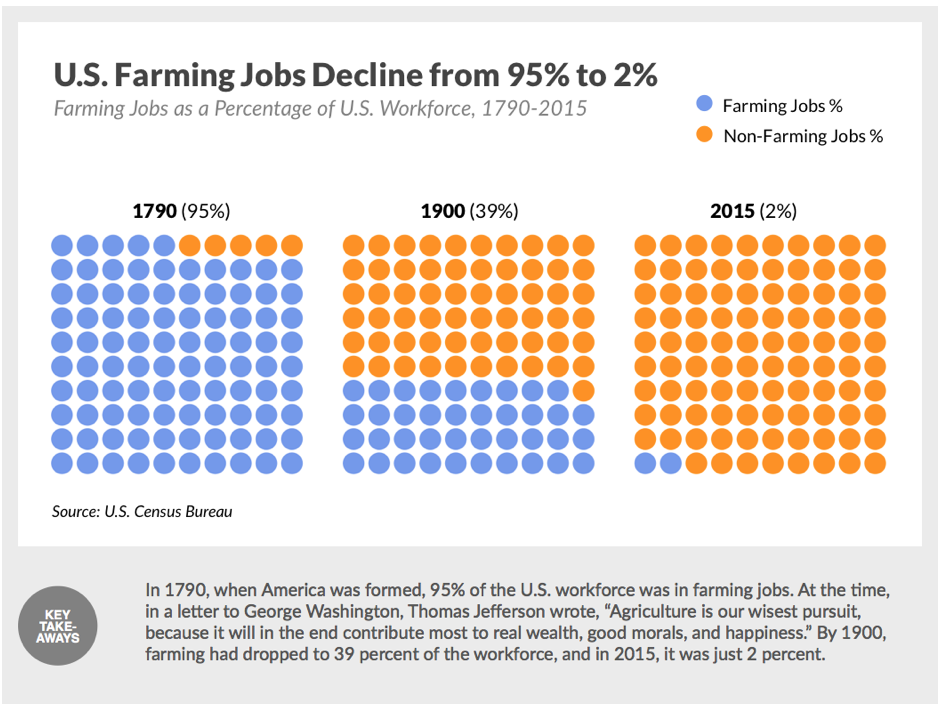

Oxford researchers have projected that 47% of American jobs are at “high risk” of being automated in the next 20 years. McKinsey estimates that 12 million U.S. “middle skill” jobs will be eliminated by 2025. A White House economic report predicted that 83% of jobs that pay less than $20 an hour will be eliminated by automation.

Through the automation eliminating traditional jobs, Bank of America Merrill Lynch predicts that there will be a $9 trillion reduction in employment costs. Additionally, AI technologies could reduce $8 trillion of costs in the manufacturing and healthcare industry and creating $2 trillion of efficiency gains through autonomous vehicles and drones. All in all, the annual disruptive impact of AI technologies could amount to up to $33 trillion.

What does that all add to? According to the McKinsey Global Institute, The AI revolution is transforming society 10x faster, at 300x the scale, and approximately 3000x the impact of the Industrial Revolution.

White collar jobs of all types are up against major challenges. By 2025 it’s estimated that $7 trillion will be managed by robo-financial advisors by 2025. The Associated Press is already using Artificial Intelligence to produce over 3,000 financial reports per quarter. Effectively, robots are managing money and reporting financial results.

For many, it feels like technology jobs are an Alamo.

It’s why Mark Zuckerberg said. “Our policy is to hire as many talented computer engineers as we can find. There aren’t enough people who have these skills today.” It’s why the U.S. Department of Labor projects there will be 1.2 million computer science related job openings by 2020. No less an authority than the Harvard Business Review called Data Science, “The sexiest job of the 21st century.”

The problem is that we are living in exponential times. The computer capability curve is getting steeper. Technology replaces the technologist. Automation is going from Blue Collar, to White Collar, to “No Collar”.

We don’t think that we’ve reached the end of history. We just need to think differently and reimagine reality. As Albert Einstein once said, “imagination is more important that knowledge.” One thing we know is that as sure as the Sun comes up in the East, automation will dominate to eat jobs. But it doesn’t eat work.

The story of the past few years is that “AI is going to eliminate all jobs.” It’s predicted that 50% of jobs are at risk of replacement in the next twenty years due to artificial intelligence and automation.

Renowned data scientist and Coursera chairman Andrew Ng has said that Artificial Intelligence is the new electricity. And what he means by that is that artificial intelligence will be ubiquitous, invisible, and change life as we know it.

2017 in particular was a watershed year for AI. First, people saw AlphaGo defeating Ke Jie, the number one ranked Go player in the World. Coupled with the fact that robots can now do backflips, and people are terrified and scared.

But people forget that humans have been doing backflips for millennia — football players do backflips for showmanship — and also that cats jump two meters with little effort. No one is afraid of a cat taking away jobs. So, while a horse that can count to ten is an exceptional horse… it isn’t a great mathematician.

There is a huge opportunity for automation to augment and improve the way we live. Already, we’re seeing autonomous vehicles on the road from companies including Tesla, Waymo, Lyft, and Uber. There are approximately 1.3 million car accident deaths annually. With autonomous driving, it is expected that there will be a reduction in 90% of road accidents… saving over a million lives. With personalized learning and autonomous teaching, how many children’s lives can be saved and prevented from being left behind in an exponential future?

What we know is that AI is a double edged sword. On one hand, AI will continue to eliminate jobs and displace workers. On the flip side, there is tremendous untapped upside in the value that the technology will create in society.

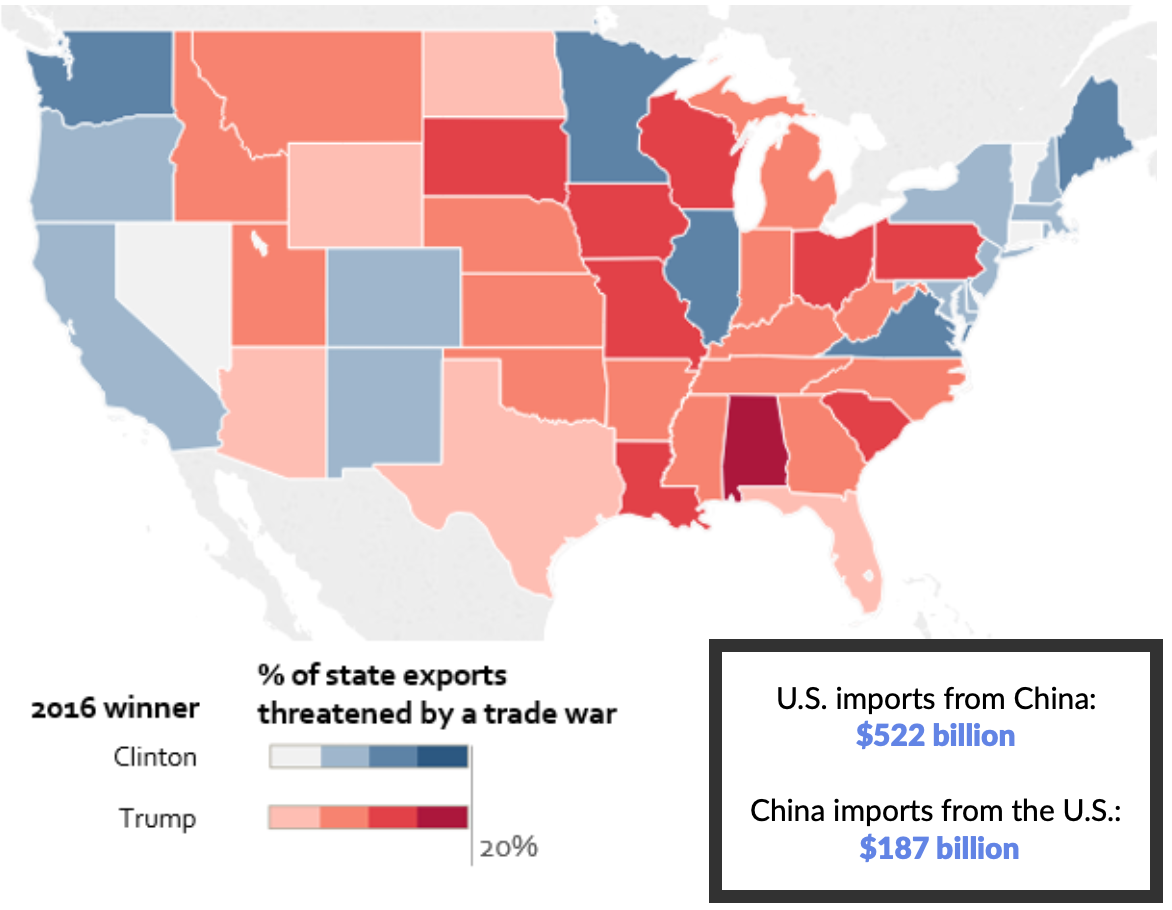

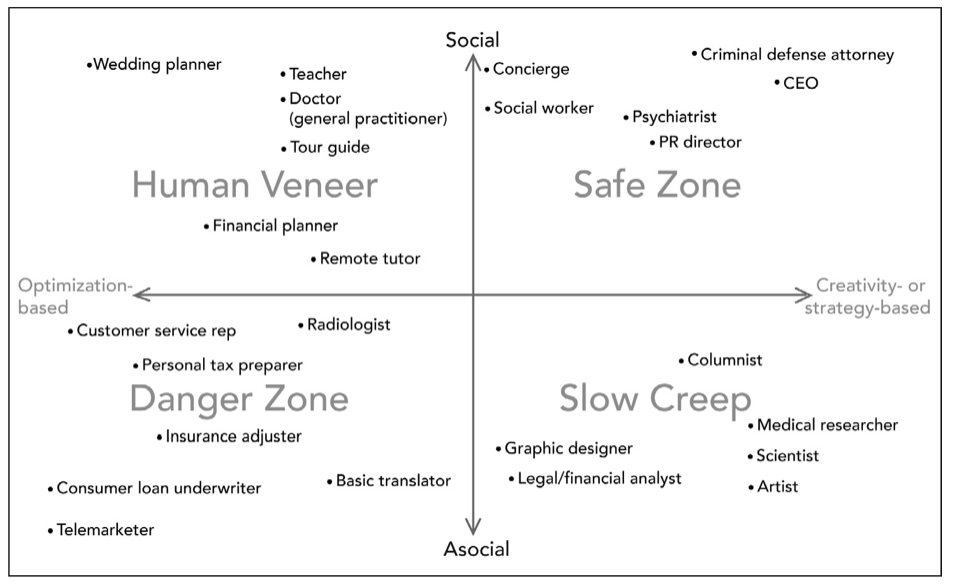

Artificial Intelligence is unlocking business efficiencies that were previously untapped, transforming what we do and how we do it. In AI Superpowers, Kai Fu Lee depicts the likelihood of automation in day-to-day jobs. The punchline is that artificial intelligence is great at completing menial and narrow tasks that are based on data… but not so great at completing tasks that require cross-domain strategy, human creativity, or complexity.

While we won’t expect a robot to complete complex surgeries in the next decade, the AI creates an open ended opportunity to help existing doctors and surgeons complete their diagnosis and jobs more effectively. For example, doctors diagnose lung cancer accurately approximately 50% of the time. Meanwhile, IBM’s Watson has been able to diagnose lung cancer accurately 90% of the time.

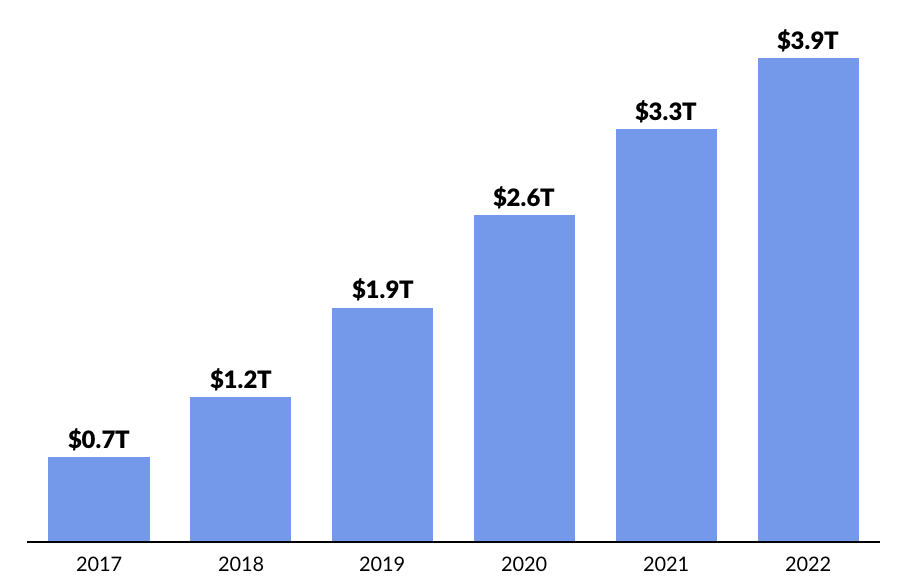

All in all, Gartner estimates that AI-driven business value will be nearly $4 trillion by 2022, increasing at a 35% CAGR over the next four years.

Already, we’ve seen AI venture capital investment balloon from $810 million in 2012 to $14.4 billion in 2017. And PwC predicts that AI will add $15.7 trillion to the global economy by 2030. To put that in context, $15.7 trillion is larger than the size of the Chinese economy.

As we enter 2019, AI will become increasingly integrated in our daily lives. What was nearly unimaginable a decade ago, today millions of Siris, Alexas, and Googles have joined U.S. households. The facial recognition technology that was only seen in science fiction movies is in our everyday iPhone X. Self driving cars are flooding roads around the World and students are learning from personalized robot tutors in the cloud.

The futuristic world depicted in the Jetsons might not be so far away.