Market Snapshot

| Indices | Week | YTD |

|---|

What has been will be again. What has been done will be done again. There is nothing new under the Sun.

— Ecclesiastes 1:9

Once you go Slack, you never go back.

— Li Jiang

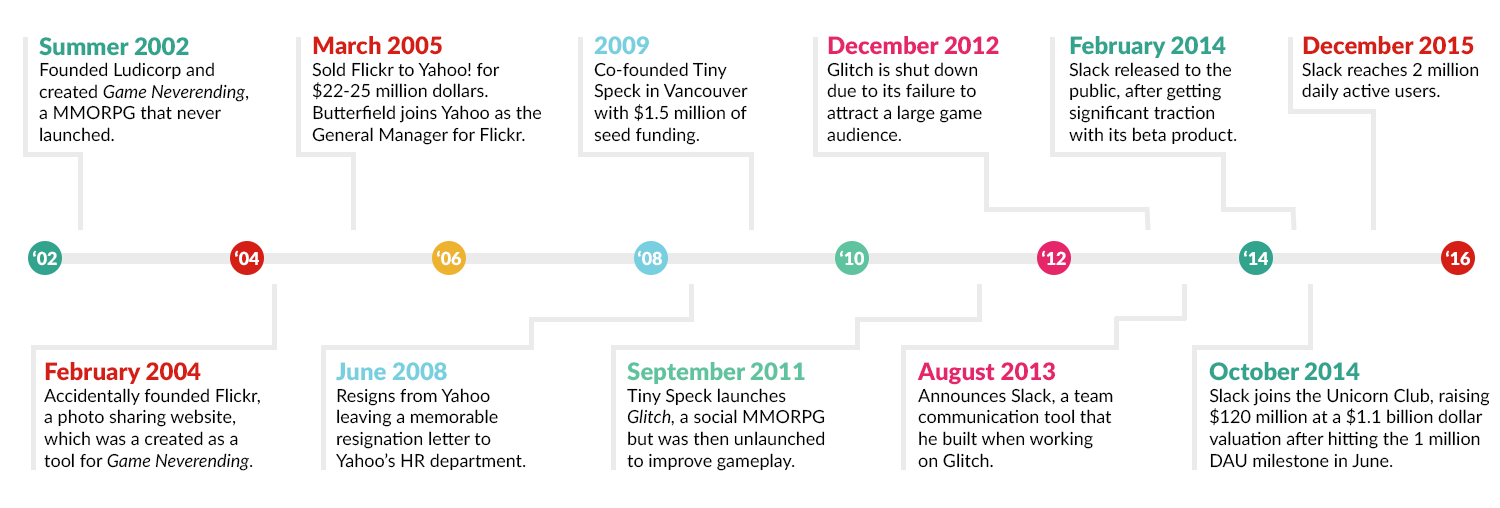

The first time Slack CEO Stewart Butterfield dragged the Phoenix from the ashes was in 2004. Three years after a gambit to create Game Neverending, an ambitious online role-playing game that stalled out of the gates, Butterfield turned failure into Flickr.

Finding inspiration in a food-poisoning induced fever dream, Butterfield took a side feature from his elaborate video game and molded it into the popular photo hosting site, which he sold to Yahoo for over $20 million. But he had unfinished business.

Source: GSV Asset Management

In 2009, after a brief stint with Yahoo, Butterfield raised $17 million from Andreessen Horowitz, Accel, and LinkedIn CEO, Jeff Weiner to create Glitch — the resurrection of Game Neverending. After its launch in 2011, he recalls the game being described as “Monty Python crossed with Dr. Seuss on acid.” It shut down a year later.

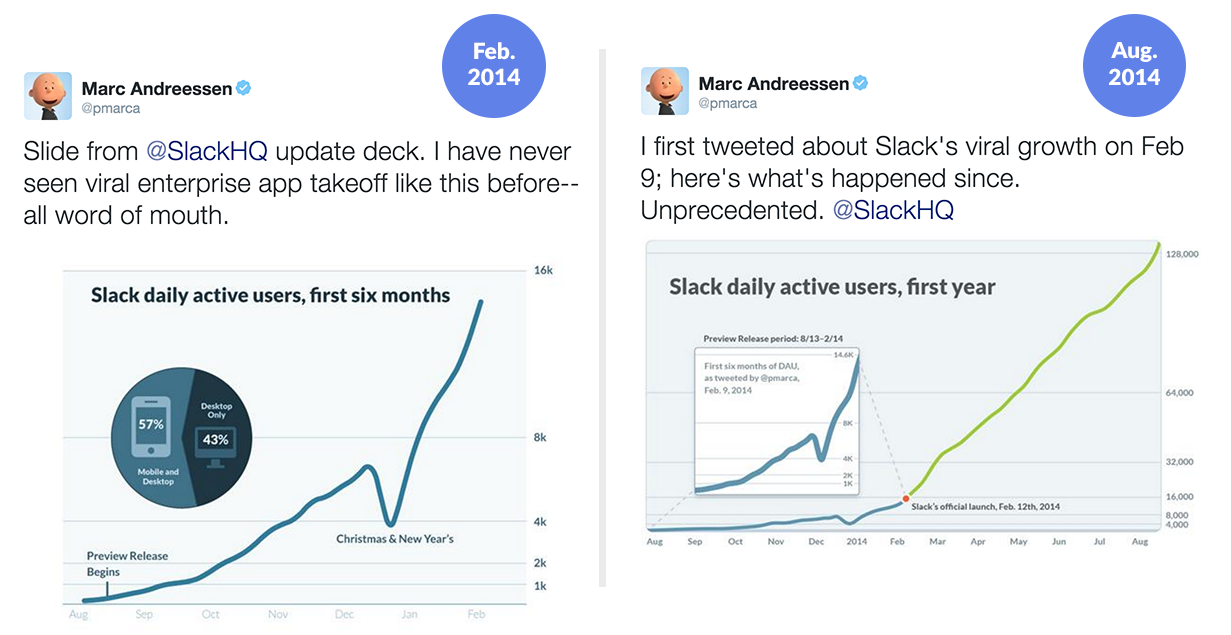

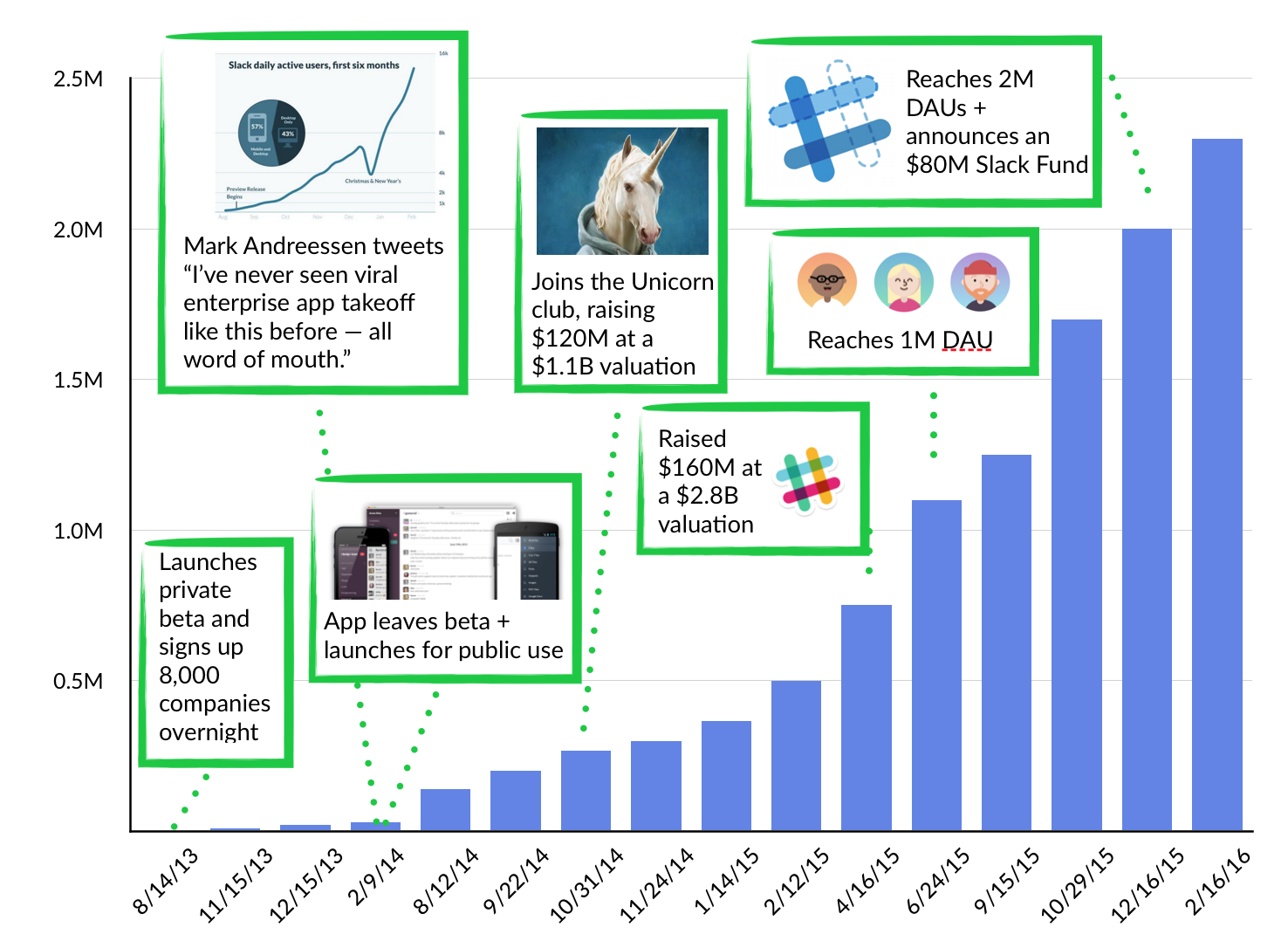

Once again, Butterfield turned a “glitch” into gold, creating a wildly popular communication platform from an internal chat system his TEAM developed while designing the game. Slack launched in 2013 and it went viral overnight.

In the 24 hours after a private beta release, Slack signed up 8,000 users. Butterfield hasn’t looked back.

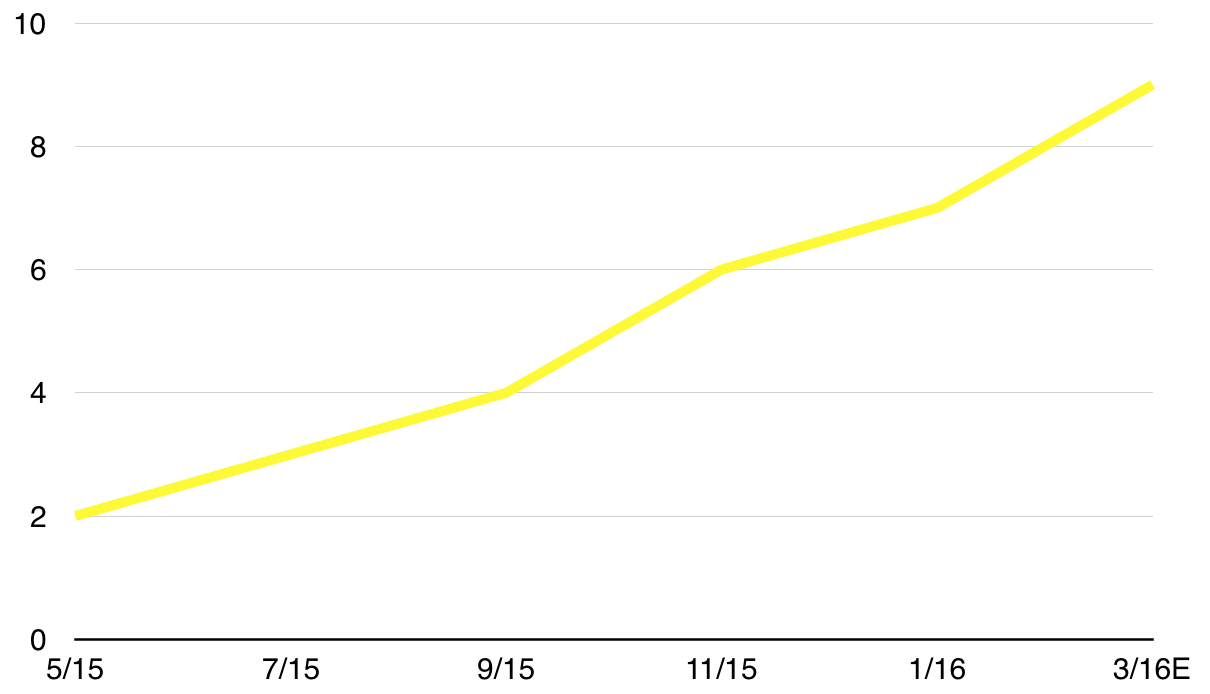

Just a year after its launch, investors valued the company at over $1 billion. It was pegged at $2.8 billion in April 2015, thanks to a fanatical, rapidly-growing customer base, which has skyrocketed from 500,000 daily active users to 2.3 million in just over 12 months. According to Business Insider and the Wall Street Journal, Slack is expected to close on a fresh $200 million financing in the coming weeks at a near $4 billion valuation, led by New York-based Thrive Capital.

STATE OF PLAY

The world is confronting a global epidemic of “Infobesity” fueled by a society that is Always On and plugged into an unending stream of information and communication.

Whether we go on a data diet, or simply figure out ways to use our amazing communication and information sharing tools without being consumed, Infobesity is emerging as one of the great challenges of our time.

Research suggests that the overload of information from social media, email and texting leads to frequent drops in IQ as high as 10 points — more than twice the impact of smoking marijuana found in comparable studies.

The impact of Infobesity is particularly evident in businesses, where teams are struggling to process and use vast quantities of information. According to studies from Bain & Company and Basex Research:

- Two-thirds of managers report that tension with work colleagues and loss of job satisfaction arise due to stress from information overload.

- One-third of managers suffer from ill health caused by information overload.

- More than 50% of knowledge workers feel that the amount of information they are presented with on a daily basis is detrimental to getting their work done.

- 30% of knowledge workers have no time at all for thought and reflection during their day, while 58% have only between 15 and 30 minutes.

Slack’s popularity stems from a simple value proposition. It helps people communicate and collaborate faster — and smarter. It is anti-Infobesity.

While its core is a highly intuitive messaging platform that connects individuals and groups, Slack is creating a Trojan Horse for a much broader offering. Its ambition is to become the hub at the center of the disparate tools people use share information and ideas.

Source: GSV Asset Management

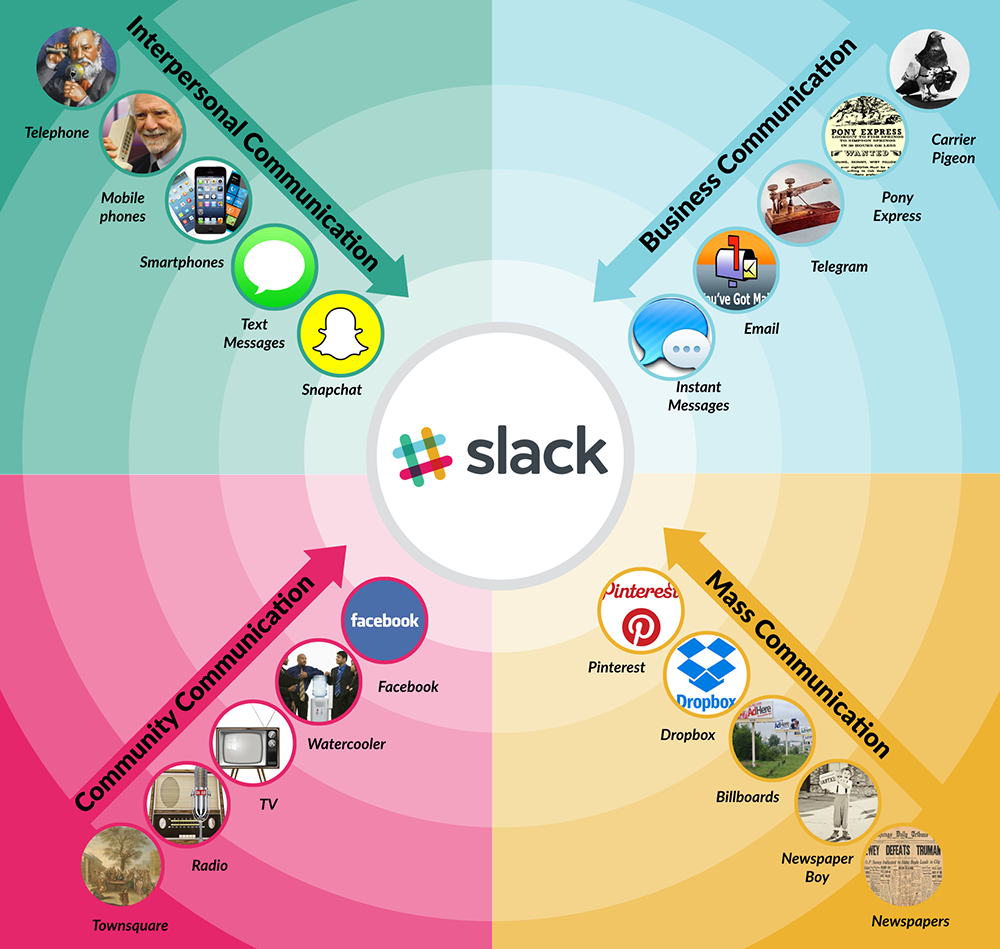

A hundred years ago, the use of the telephone, carrier pigeon, town square gatherings, and newspapers led to the creation of disparate forms of communication. Now, people text or Snapchat with their friends. They instant message or email their co-workers. To see community events, they look to Facebook. To advertise to the masses, they’re pinned to Pinterest. No one expects to Snapchat their manager or use Pinterest to effectively communicate with their grandparent.

But Slack is a platform that defies those boundaries. It’s a business communication platform that NASA, the Wall Street Journal, and Harvard University uses. It’s a platform for the masses, with users creating and building specialized interest groups with thousands of members. Finally, families and even couples turn to Slack as a platform of communication.

Additionally, Slack isn’t simply creating a messaging tool. It is developing an ecosystem of high-value productivity applications to streamline how people access and process information. Slack’s “App Directory” — equivalent the iTunes App Store — offers more than 280 services that can be seamlessly integrated on demand.

SLACK ECOSYSTEM

Source: GSV Asset Management

By integrating a variety of popular productivity applications — including Dropbox, GitHub, Google Apps, and Zendesk — into a seamless communication stream, Slack creates powerful efficiencies and network effects. (Disclosure: GSV owns shares in Dropbox and Alphabet).

Technology Leaders Take Notice

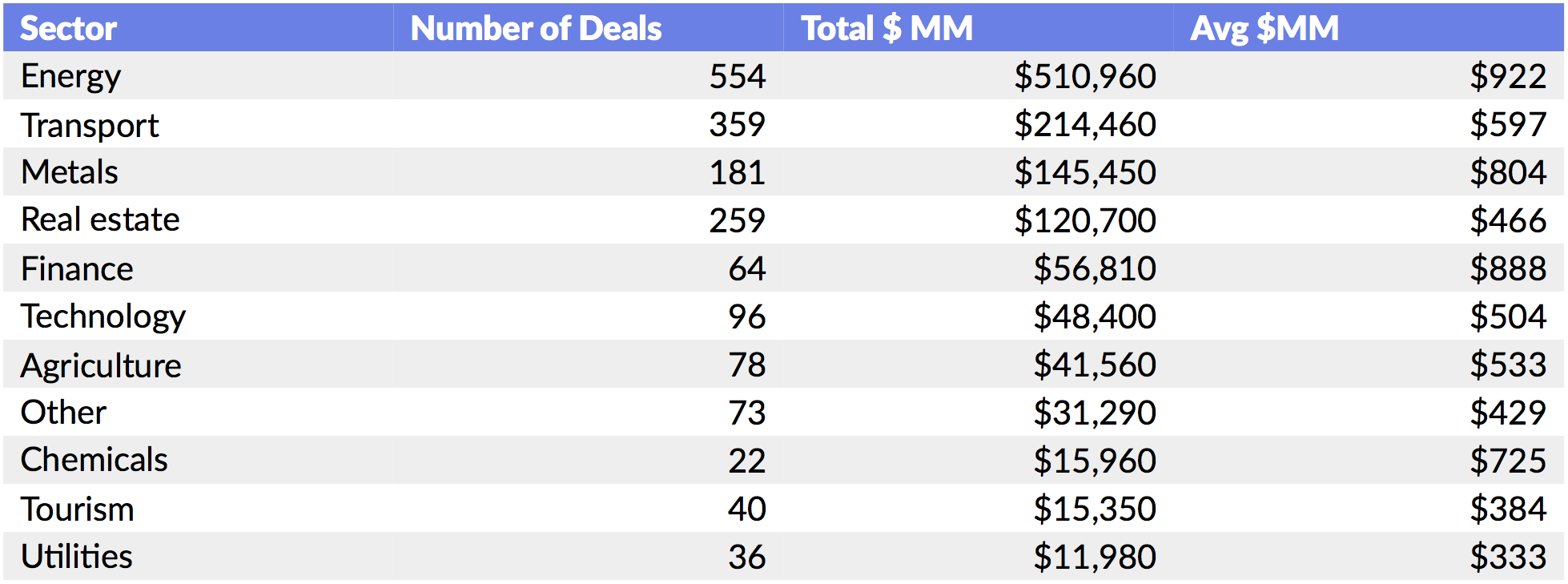

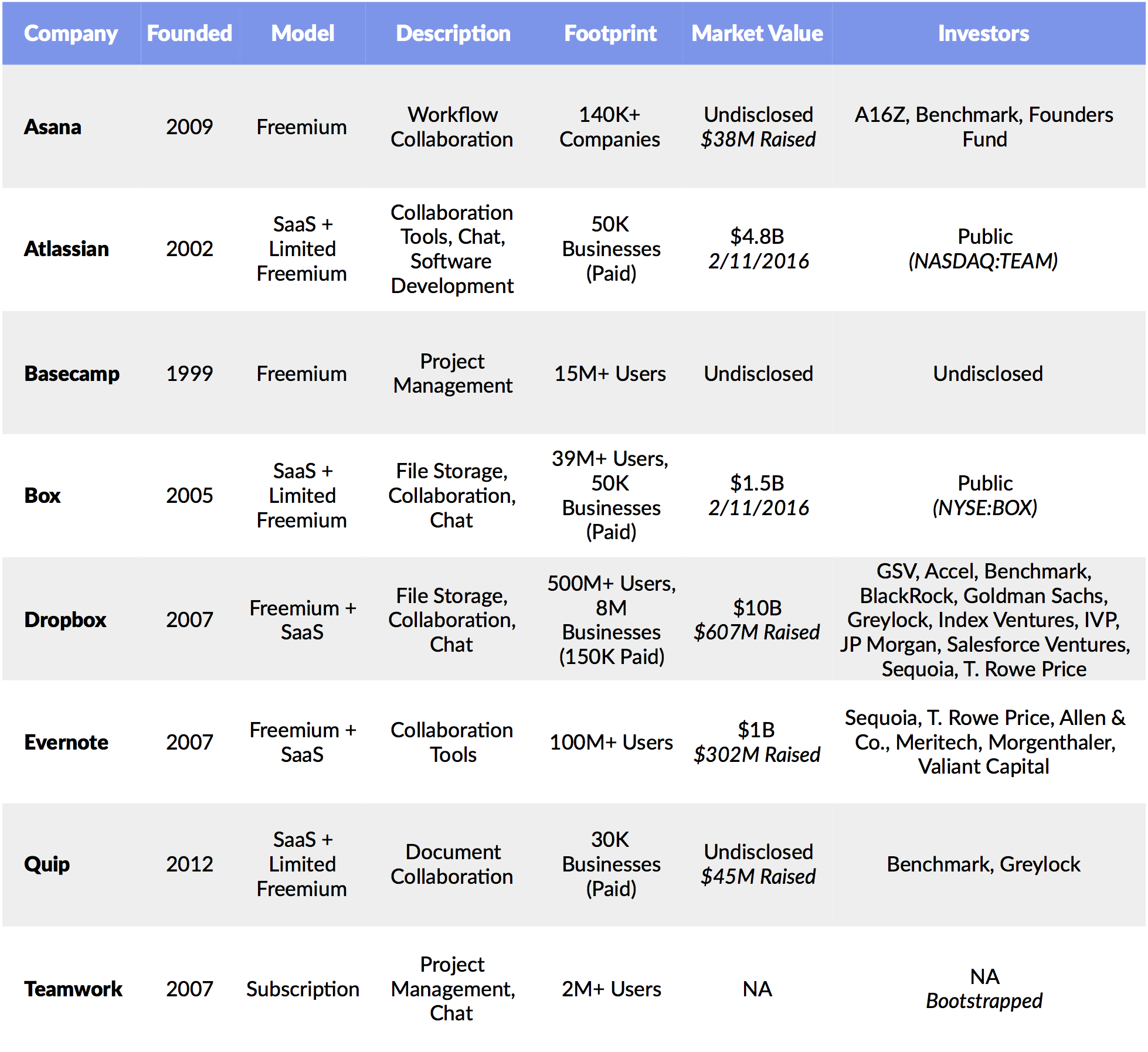

Gartner estimates that the enterprise market for “unified communication and collaboration” technology will surpass $42 billion in 2019. Until recently, efforts to streamline information exchange have largely been limited to legacy technology companies.

In 2007, IBM launched an enterprise social network called Beehive, which enabled employees to create and share personal profiles, organize events, and connect around shared projects. A decade earlier, it made broader waves with a $3.5 billion acquisition of Lotus Development Corporation, a pioneer in digital communication through its groundbreaking Notes platform.

Microsoft secured a spot in the Pantheon of Infobesity with the launch of Outlook in 1997. Later, it acquired the novel enterprise social network, Yammer, for $1.2 billion in 2012. In recent months, Microsoft mulled an $8 billion acquisition bid for Slack. Swayed by heavy skepticism from Bill Gates, it ultimately elected to invest in a deeper integration between its core business software and the messaging platform, Skype — a technology it acquired for $8.5 billion in 2011.

Source: GSV Asset Management, TechCrunch, Company Disclosures

But Slack’s sudden ascendance has caught the attention of a new generation of technology leaders. Facebook recently unveiled Facebook at Work, a product aimed directly at the enterprise market that enables businesses to create dedicated social networks among their employees. It is being tested by nearly 300 companies, including the Royal Bank of Scotland and Club Med, which together have 25,000 employees using the service. More than 60,000 companies requested to join the beta test. (Disclosure: GSV owns shares in Facebook)

In late 2015, Alibaba announced the launch of DingTalk, an integrated communication platform targeting the 8.5 million small and medium-sized businesses that are active sellers on its e-commerce sites. It has over a million early adopters to date.

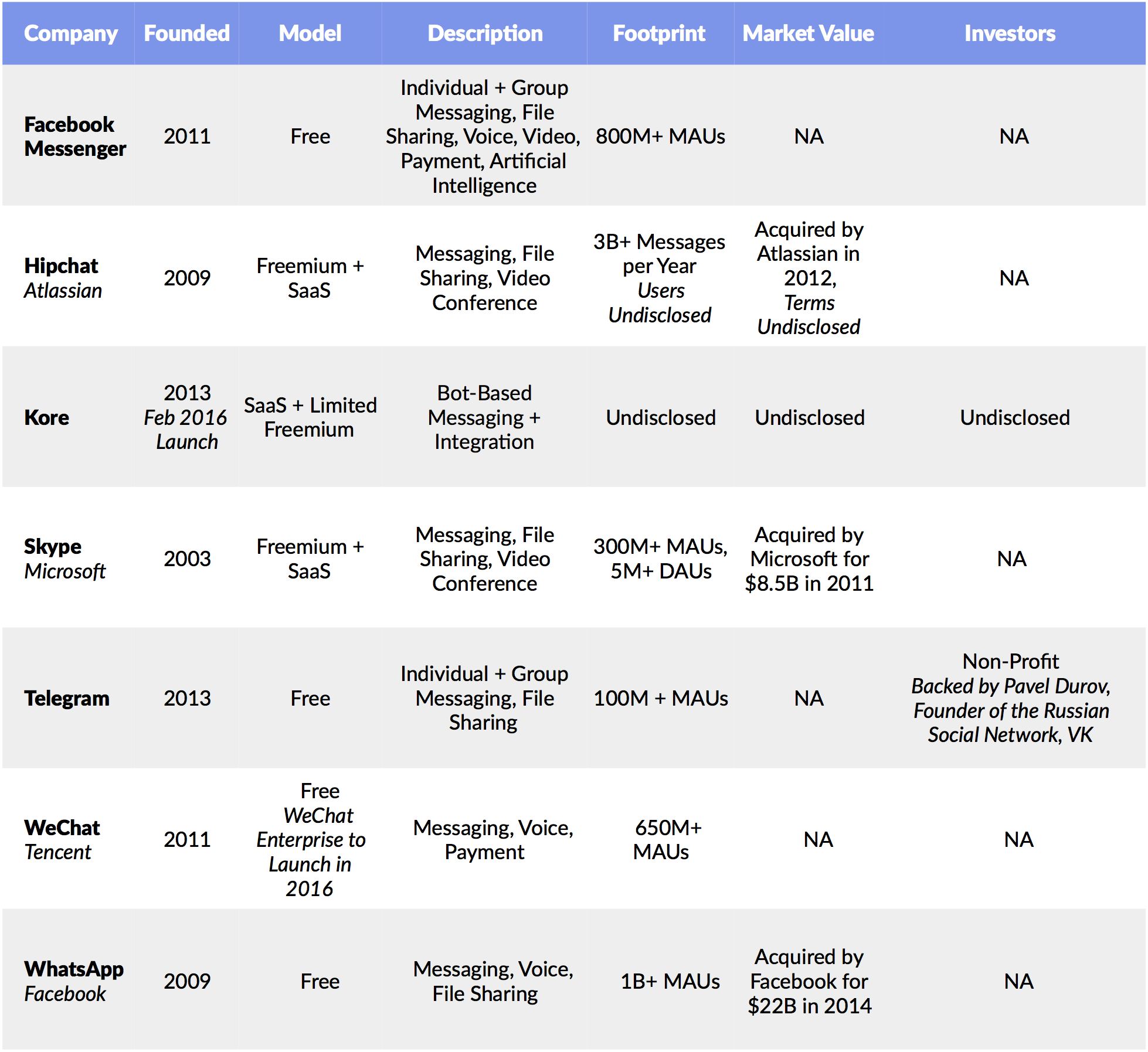

Communication + Collaboration Apps, Platforms

While Slack has grabbed headlines with meteoric user and valuation growth, a crop of new companies focused on smarter communication have emerged in recent years. Telegram, a free service that mimics core Slack features launched in 2013 and already counts over 100 million users.

Acquired by Atlasssian in 2012, Hipchat is a freemium service with striking similarities to Slack. On top of team messaging, Hipchat is also a mobile platform that offers third-party app integrations, voice and video calling, and file storage. Unlike Slack, Hipchat has built-in enterprise software capabilities, a product line that Slack is rolling out later in 2016.

Tencent’s WeChat, with 650 million users, announced that it will launch an enterprise service in 2016. WeChat Enterprise will offer integrated file sharing as part of a suite of utilities targeting corporate users.

At the same time, a broader range of consumer and enterprise productivity platforms are converging around this theme. Dropbox, for example, which just surpassed 500 million users and 150,000 business customers, is developing a virtual “workspace” to make it easier for people to communicate and work together on shared files.

Source: GSV Asset Management, CrunchBase, Wall Street Journal, Company Disclosures

Public Comps

With an upcoming financing at an expected $4B valuation, Slack remains priced for hyper-growth. Its $64 million revenue run rate translates into an eye popping 63x P/S. But the fundamentals are evolving quickly.

**Projected Post-Money Valuation on a $200M Financing Expected to Close in March 2016, Led by Thrive Capital, as Reported by the Wall Street Journal and Business Insider

We anticipate enormous upside on Slack’s pricing. Currently the company’s Average Revenue Per User (ARPU) per month is $7.90. The ARPU/month should move closer to $20 as Slack continues to add new integrations and functionalities, and with expansion into larger business customers.

Of its 2.3 million daily active users, nearly 700,000 are paying customers — just two years after its launch. Slack is growing 3-5% per week — it is on pace to double its users every five months — with signs of acceleration as the brand becomes better known and network effects take hold. CEO Stewart Butterfield reports that 20% of Slack’s active users joined the platform in the last two months. On average, users spend over two hours using Slack per day.

THE POWER OF SLACK

Slack’s success reinforces the Silicon Valley adage that first isn’t always best… the early bird gets the turd. Facebook followed MySpace and Friendster. Google’s search engine followed Excite, Lycos, and AltaVista. Spotify continues to defy the naysayers who claimed that it would not overcome iTunes or survive the launch of Apple Music.

Unlike its predecessors, Slack was able to catch the wave of the powerful Mobile megatrend. In 2008, during the age of Skype, Yammer and HipChat, the average American spent 2.7 hours per day on digital media. By 2015, we spent 2.8 hours per day on smartphones alone — more time than we used to spend on desktops, laptops, mobile, and other connected devices combined.

Source: MIT Technology Review

More and more people are getting work done on mobile devices, collaborating with people halfway across the globe instantaneously. Slack, with it’s intuitively-designed, mobile first platform, creates a perception that staying in touch with co-workers is effortless.

Unlike other platforms, Slack’s core feature funnels messages into channels that everyone team member can see. This in turn creates an online “water-cooler” effect that allows people to overhear what else is going on in a company, which research has shown can enhance productivity, communication, and drive business impact.

Slack is winning with a better product that people love. It offers far more utility than basic messaging apps that are scrambling to catch up, and has a superior design than enterprise communication tools like Salesforce Chatter that have been buried in broader product suites.

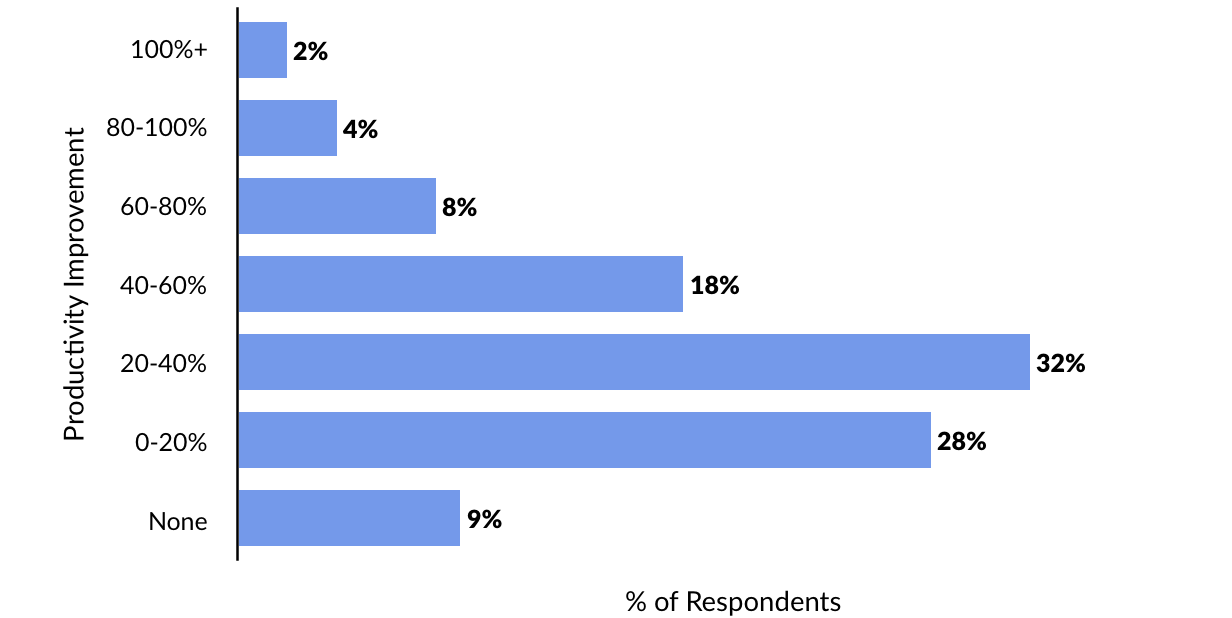

According to a survey of its users, Slack adoption has resulted in a 49% reduction in email volume. Nearly 80% of users indicate that it improves transparency and office culture, while reducing the number of superfluous meetings by 24%. On average, users report productivity increases of more than 32%.

For Slack, the magic number is 2,000 messages. As Stewart Butterfield observed in a recent interview:

Based on experience of which companies stuck with us and which didn’t, we decided that any team that has exchanged 2,000 messages in its history has tried Slack — really tried it,” Butterfield says. “For a team around 50 people that means about 10 hours’ worth of messages. For a typical team of 10 people, that’s maybe a week’s worth of messages. But it hit us that, regardless of any other factor, after 2,000 messages, 93% of those customers are still using Slack today.

WHAT’S NEXT

Slack released a suite of new APIs designed to make it easier for developers to build new apps on top of Slack. The most intriguing of these is BotKit, an open-source framework for building automated services that users can access through conversational interfaces.

The aim is for Slack “bots” to increasingly automate the most tedious business interactions, from setting up meetings to expense reporting and recapping basic information to colleagues.

Birdly, a bot armed with advanced natural language processing capabilities, can automatically call up timely customer data directly within Slack from relationship management platforms like Salesforce and Zendesk.

The next frontier is the creation of SlackBots powered by Artificial Intelligence, particularly Machine Learning. Applications that observe and learn from patterns of communication and collaboration will be game-changers. They will escalate information that matters, when it matters. They will anticipate questions and problems and tee up answers and solutions.

Slack recently announced a partnership with a syndicate of leading venture capital firms — including Accel, Andreessen Horowitz, Index Ventures, Kleiner Perkins, and Spark Growth — to create an $80 million fund that will invest in software projects that complement its core technology. Since it’s inception, Slack invested in 3 companies, 2 of which create bots that are integrated on Slack’s core platform.

As for what’s next for the Slack platform, CEO Stewart Butterfield points Tencent’s WeChat as a model.

What’s interesting about WeChat is that its transformed from being a messaging app to becoming a portal, platform, and mobile operating system. A mobile-first platform, WeChat is a suite of apps that essentially integrates into the lives of its Chinese users. Users in China can access services that allow them to hail a taxi, pay the water bill, follow celebrity news, send money to friends and more … all in one app.

Essentially, WeChat combats Infobesity by converging daily aspects of life into one service. Slack aims to be the point of convergence for communication platforms.

A thousand years ago, all roads lead to Rome. Now, all roads lead to Slack? We may finally have a glimpse of life beyond the Age of Infobesity.

—

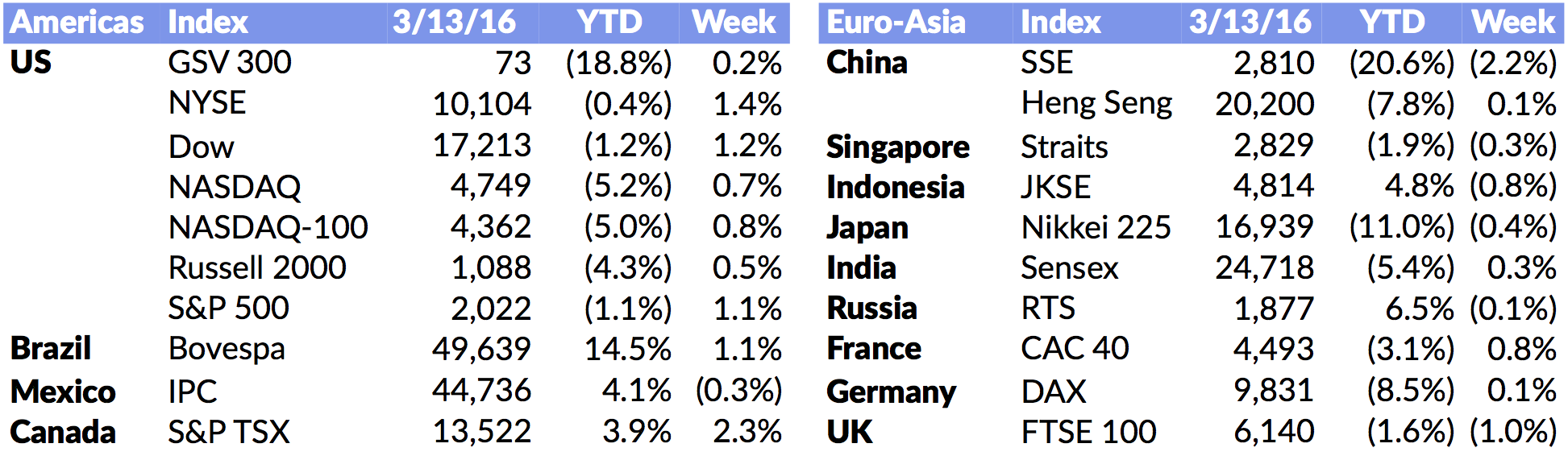

Stocks were up for the fourth week in a row, with NASDAQ advancing 0.7%, the S&P 500 moving up 1%, and the GSV 300 gaining 0.2%. The 10-Year Note yield moved up 11 bips to 1.98%.

The European Central Bank cut its rate even further into negative territory and increased its monthly asset purchases. European bank stocks rallied for the week.

Apple and the Department of Justice continued to fight over the iPhone encryption case. The next court hearing is March 22nd, the day after Apple is expected to announce new products. (Disclosure: GSV owns shares in Apple)

We continue to be BULLISH on the outlook for growth stocks and believe valuations are attractive for many leaders. Global technology franchises such as Facebook, Twitter, and Alphabet sell at modest P/E’s versus their leadership positions and growth characteristics. (Disclosure: GSV owns shares in Facebook, Twitter, and Alphabet)