Market Snapshot

| Indices | Week | YTD |

|---|

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us…

— Charles Dickens, A Tale of Two Cities

Inequality is the parent of revolution.

— Aristotle

On Tuesday, Americans finally go to the polls to elect the 45th President of the United States. Most of us can’t wait for it to be over as the race to the White House feels like a creepy season of “The Bachelor,” where you don’t really want to see anybody get the final rose.

Leadership always matters. But we are in particularly rough waters, and the decisions made by the Captain of the Ship can have Titanic-type implications.

On one side of the coin, unemployment is less than 5% and 15.5 million jobs have been created since February of 2010. On the other side of the coin, job growth hasn’t kept up with population growth — 17.5 million during that same time period — and 14 million people have dropped out of the workforce. So really, unemployment is closer to 10%.

Today, GDP per capita — the best measure for standard of living — is $56,000 per person in the United States. That’s the good news.

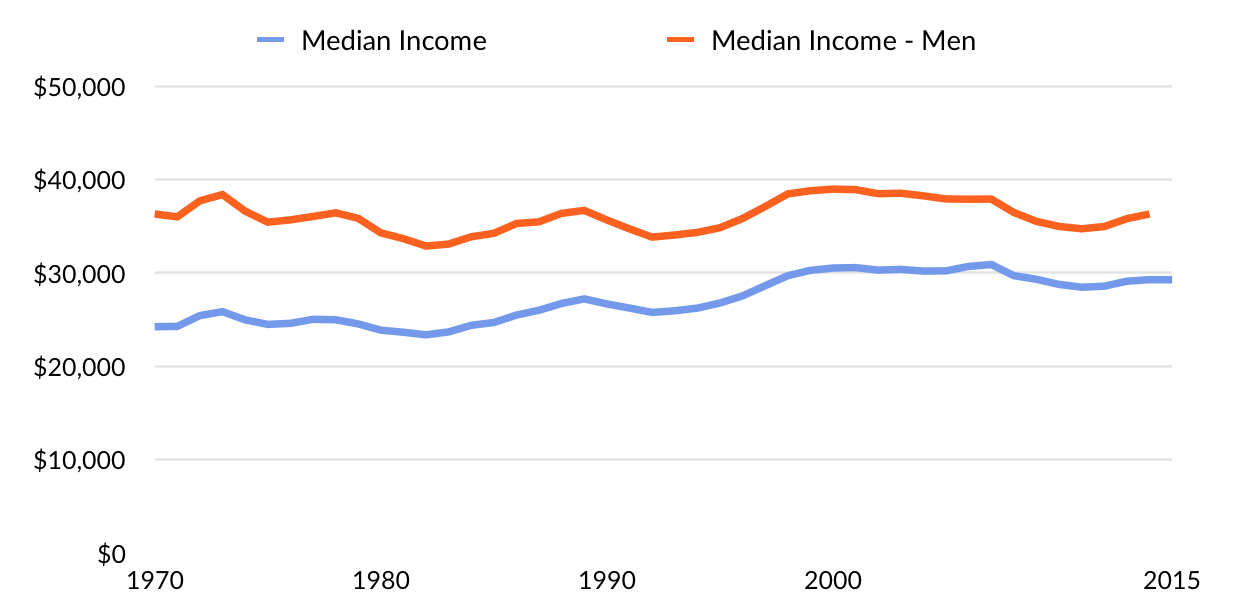

The bad news is that median family income has been flat for 40 years and countries like Singapore and Ireland have soared past the United States in GDP per capita in the past ten years. GDP growth hasn’t been above 3% in the past eight years and corporate profit growth is negative over the past twelve months.

Source: U.S. Census Bureau

In a country as great as America, everybody should have access to quality healthcare and “Obamacare” was an attempt to accomplish this. Unfortunately, the law has been muddled in unintended consequences, with healthier, younger people opting out of coverage. Healthcare premiums are up 22% overall — examples of coverage costing 50% more are not uncommon.

NERVOUS MARKETS, SIGNS OF LIFE

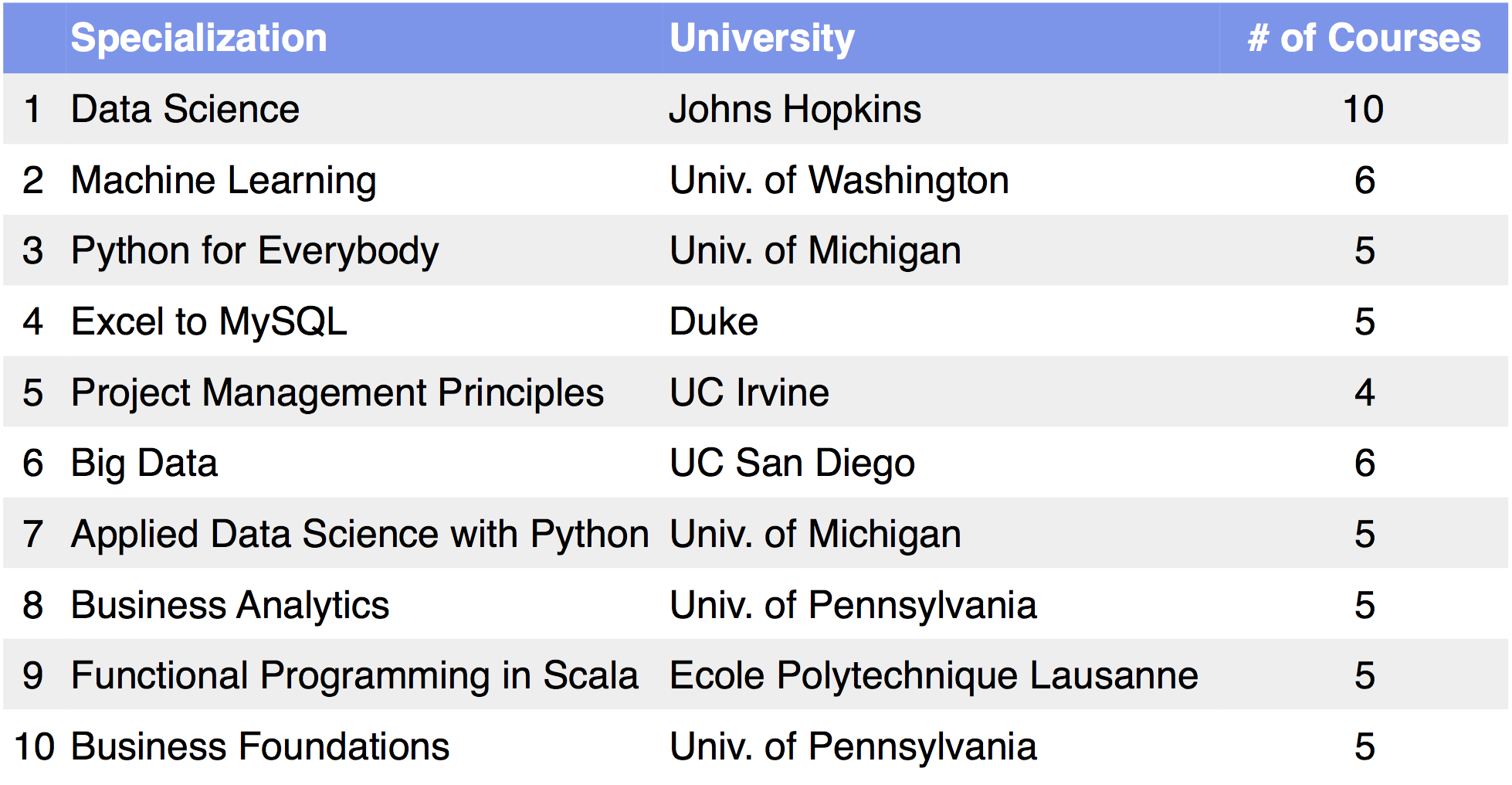

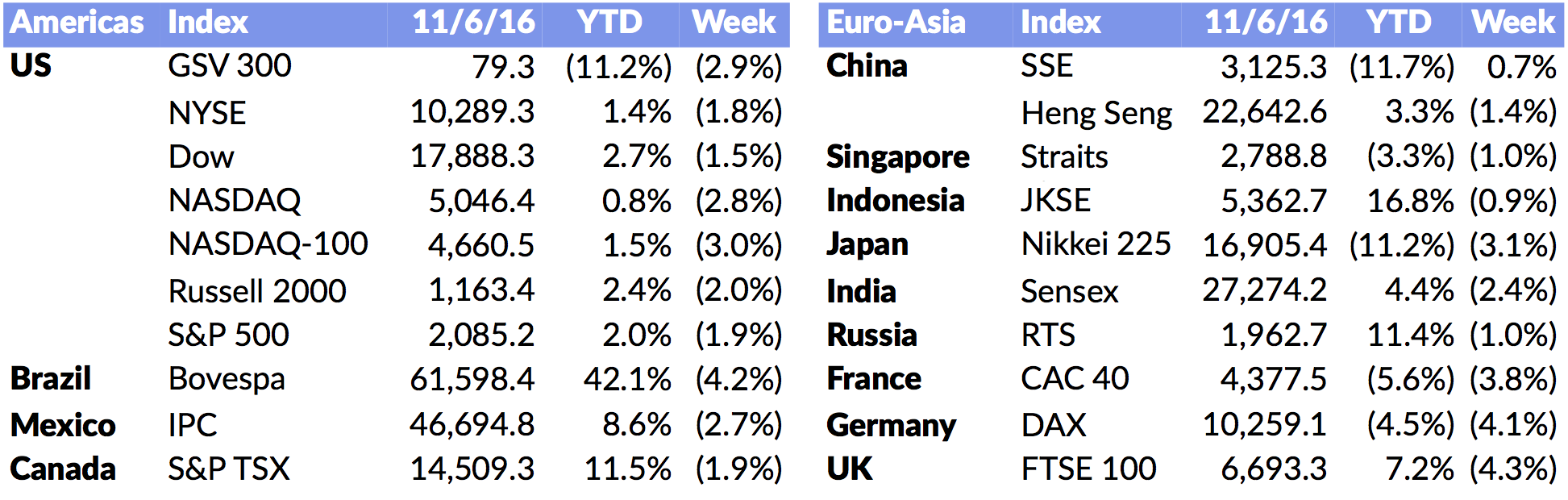

The Stock Market reflects the confidence investors have in the future, and not surprisingly, stocks are behaving like many of us feel — nervous. Year to date, the S&P 500 is up 2% and NASDAQ is up 0.8%. But there has been a heavy dose of volatility.

In the first quarter, the Blue Chip barometer S&P 500 experienced a frightening drop of 9% from January 1st to February 11th, followed by a 10% rise through the end of March. Brexit sparked another shock in June, sending indices spiraling after the referendum. But since their Brexit lows, the NASDAQ and the S&P 500 have gained 10% and 4% respectively.

The IPO Market is even more of an indicator of the state of mind of investors — if they are pessimistic, new issues shut down and if they are optimistic, investors treat IPOs like fresh oxygen they can’t get enough of.

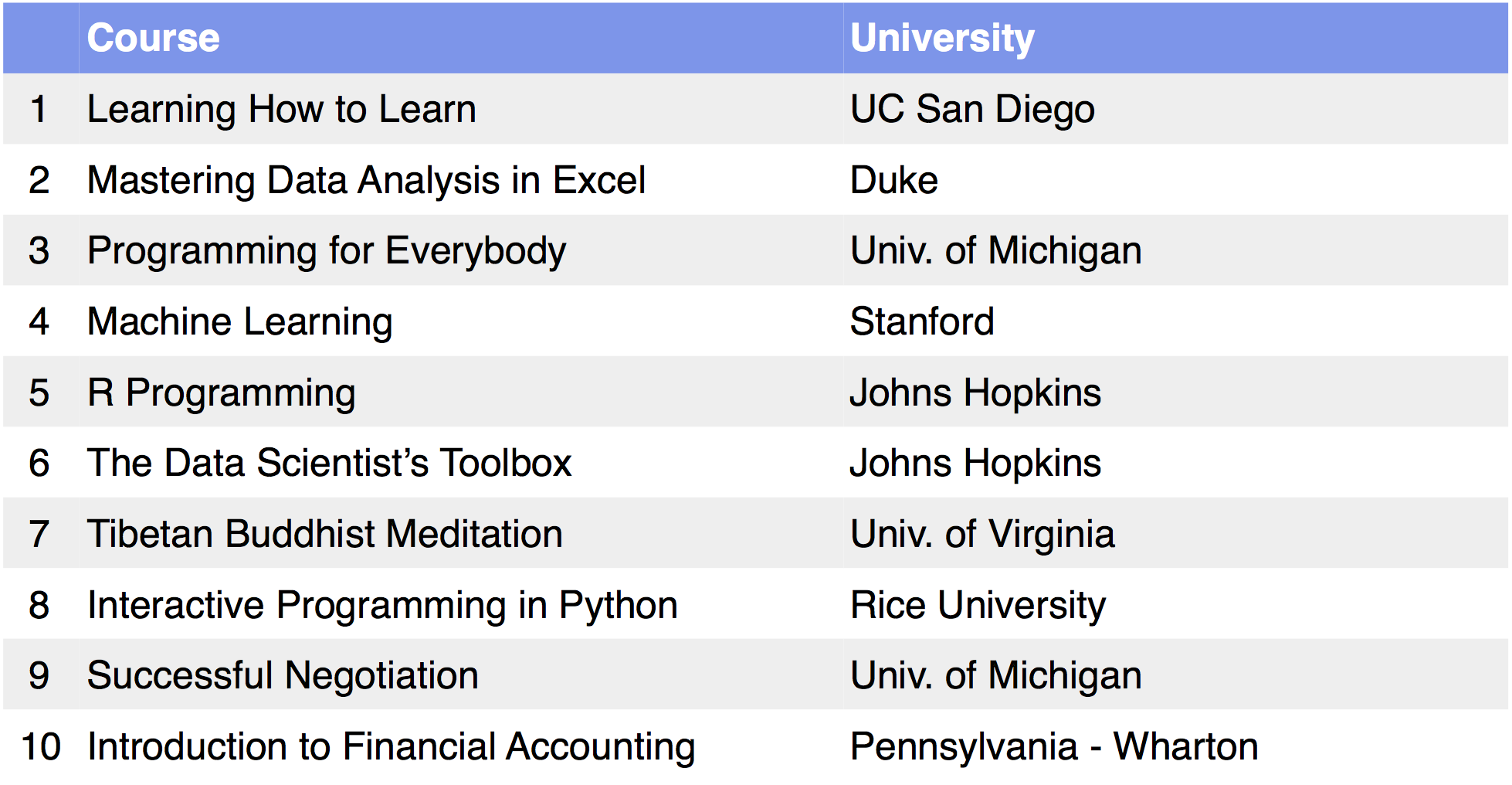

Despite the news, noise, and predictions of the apocalypse, we are starting to see some bullish signs from the IPO market, with Twilio’s June 23rd offering acting as a starting gun. Despite recent volatility, Twilio is trading at more than twice the $15 per share where it priced.

While there have been a paltry 95 U.S. IPOs to date, there have been 55 since Twilio, including notable listings from technology companies like Line and Talend, which both priced above range and popped over 27% and 42% respectively. Nutanix, which made its public debut in late September, popped more than 130%. While its stock has cooled off in recent weeks, Nutanix is trading 50% above its issue price.

NEW FUNDAMENTALS

The recent trend points to a broader opportunity for the best names to break through an IPO backlog that has been building over the last fifteen years:

- The supply of rapidly growing, small companies with the potential for large IPOs is a fraction of what it has been historically. From 1990 to 2000, there was an average of 406 IPOs in the United States per year. From 2001 to 2015, there has been an average of 111 IPOs.

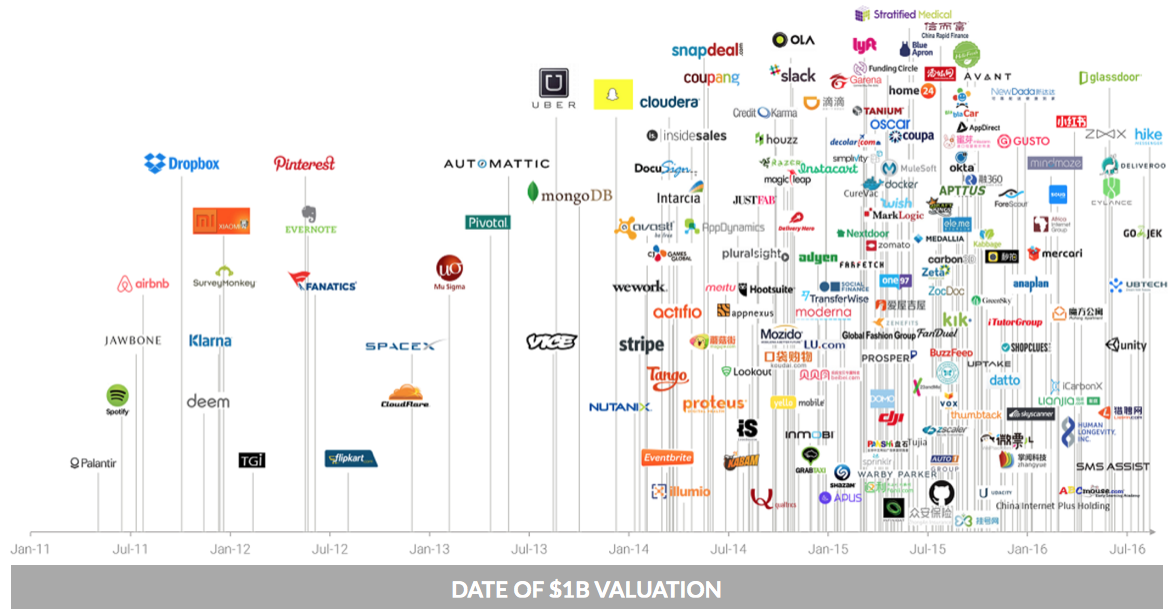

- Private companies are staying private much longer. The time from initial Venture Capital investment to monetization has gone from an average of three years in 2000 to approximately ten years today.

- By the time a company chooses to go public, it is typically larger and more mature, with much of the growth — and corresponding rapid value creation — behind it.

- “Digital Tracks” have been laid over the last twenty years, with over 3.1 billion Internet users, 2.6 billion smartphone users, and more than 226 billion apps downloaded in 2015. This allows technology entrepreneurs to go from an idea to reaching tens of millions of people at breathtaking speeds, with corresponding growth. Uber and Lyft, for example, were founded in 2009 and 2012 respectively. Today, they have delivered over two billion rides (Disclosure: GSV owns shares in Lyft)

Not surprisingly, Despite the IPO market being weak for much of the past fifteen years, Venture Capitalists haven’t stopped investing. VCs have invested in average of 3,200 companies per year since 2001, including 3,709 companies in 2015. We estimate that there are over 2,000 VC-backed private companies with a market value of $100 million or greater.

This new combination of fundamentals puts some context around the recent rise of “Unicorns” — private companies valued at $1 billion or greater — which are quickly becoming “Ubercorns.” In 2000, there was one Unicorn. Today, CB Insights reports that there are 174.

The broad megatrend underscoring evolving nature of growth companies and private/public markets is Digital Natives operating in a Digital Economy.

Today, for example, 56 million workers are Digital Natives, up from zero 25 years ago. During that time we have rapidly shifted from a physical economy with tangible goods to a virtual, digital economy. And increasingly, it looks like a Global Silicon Valley.

Twenty-five years ago, the five largest market cap companies in the World manufactured and sold products. They were built over many, many years. Today, the five largest enterprises in the World are technology companies. The oldest is Microsoft, which was founded in 1975.

The 9th, 11th, and 12th largest Market Cap companies in the World are Alibaba, Tencent, and China Mobile. Incredibly, none of these companies are even 20-years-old.

—

Stocks continued to slide last week. NASDAQ, which was down 2.8%, suffered its worst week in nine months. The S&P 500 was down 1.9% and the GSV 300 fell 2.9%. Pundits cited a tightening Presidential election as the excuse for stocks dropping.

Facebook did a face plant, falling 8% despite putting up 91% EPS growth and 56% revenue growth. The company’s 2017 guidance of a more difficult ad placement environment and elevated investment spending caused investors to “unfriend” it.

Alibaba reported blow-away numbers, with EPS up 46% and revenues up 55%, but its shares fell nearly 5%. Apple and Alphabet (the artist formerly known as Google) also sank in sympathy.

A recent, interesting trend is the super strong growth in mobile ordering of food, evidenced by Dominoes, Papa Johns, and Starbucks. “Order Ahead” apps have been a positive catalyst for restaurants across the board. Also notable is the strong performance of gaming companies, including Electronic Arts, Take Two, and Activision.

Predictably, the IPO Market has hit the pause button, waiting for the Election to conclude. Only one new issue is expected this week, with a number of others postponing their public debuts.

We believe uncertainty is the friend of the long term, growth investor. Accordingly, we view the nervous action of stocks as a great opportunity to get a deal on companies such as Alphabet, Amazon, and Alibaba that are winning.