Market Snapshot

| Indices | Week | YTD |

|---|

Bill Parcells, the Hall of Fame former head coach of the New England Patriots famously said, “You are what your record says you are.”

Next weekend, under the leadership of Bill Belichick, the Patriots will take on the Philadelphia Eagles in Super Bowl LII. If you look back over “The Hoody’s” tenure as head coach, you get a pretty clear picture of who the Patriots are: 15 divisional titles, 8 Super Bowl appearances, 5 championships (with the opportunity for a sixth on Sunday).

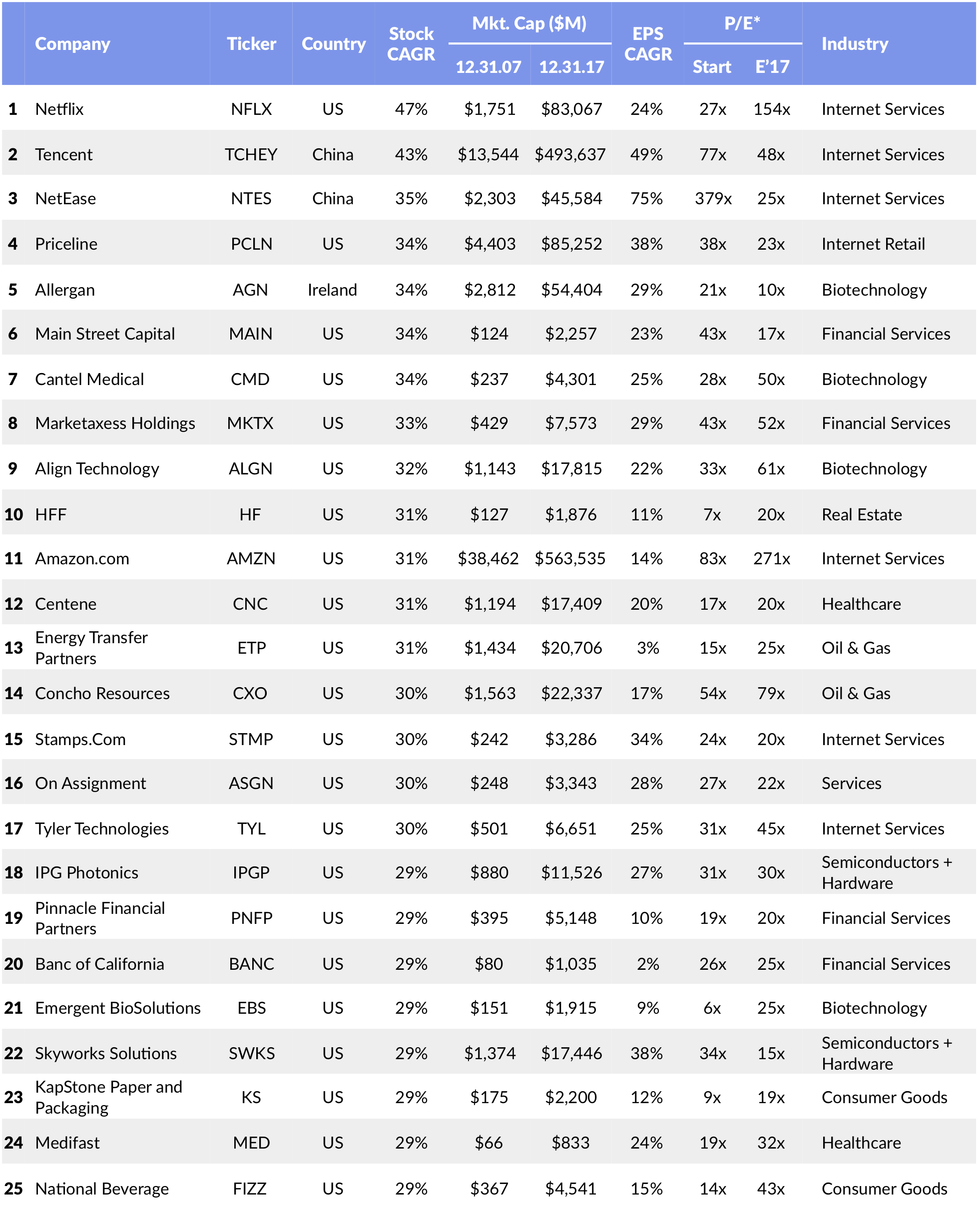

There isn’t a Super Bowl for the Global Growth Economy, but every year GSV conducts a 10-Year Top Performing Stocks Study, which screens all publicly traded companies in the United States for the top 25 by total return over the past decade. You are what your record says you are.

It is highly unlikely that GSV will fulfill its quest to find the “Stars of Tomorrow” by mining this list — success begets size, and size forges an anchor — but it is instructive to analyze the characteristics of top-performers.

Source: Thomson Reuters, GSViQ, NASDAQ, Wonda

*P/E starts at first profitable year

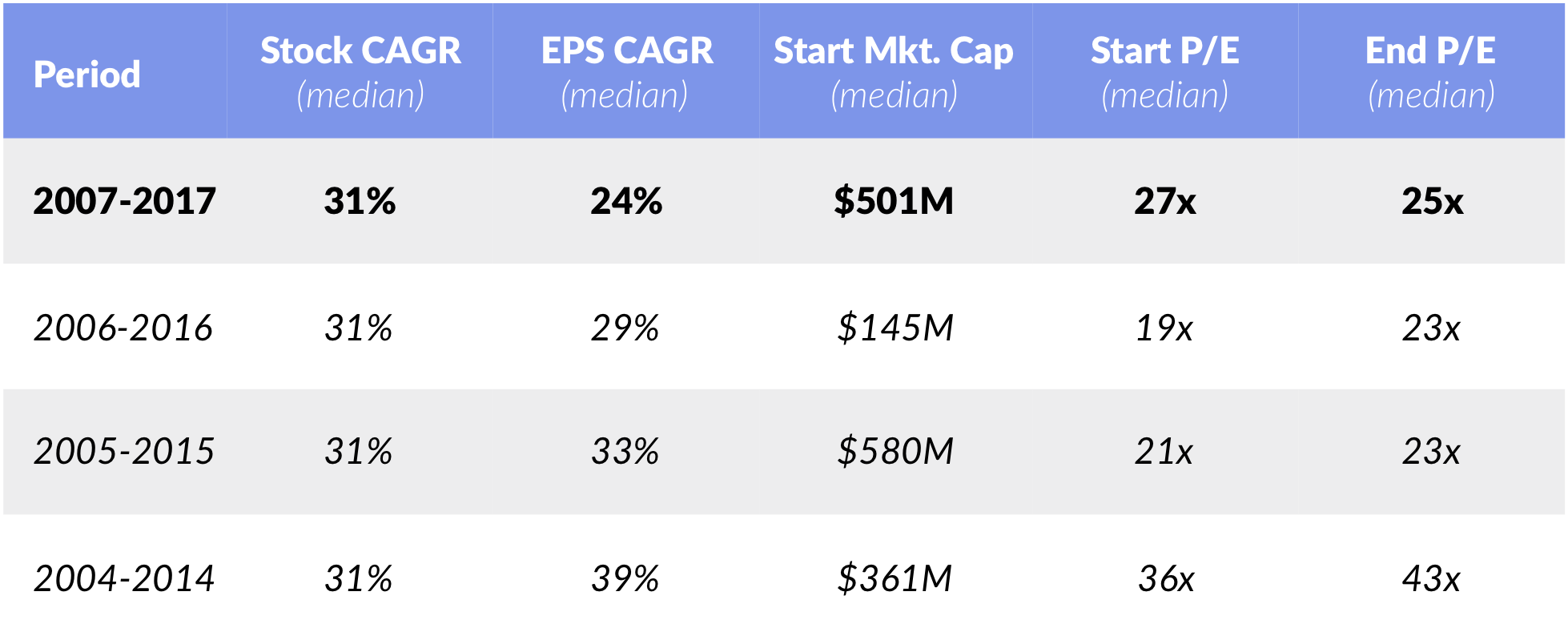

The median stock performance of the top 25 companies over the 10-year period was 31% compound annual growth rate (CAGR) — which implies that stock value is nearly doubling every two years, according to the “Rule of 72.” The median market cap at the beginning of the period (12/31/07) was $501 million.

The median P/E for the top performers at the beginning of the 10-year period was 27x, slightly higher than today’s Market multiple. But as we’ve learned from past studies, a low or discounted P/E isn’t an important variable for ascendent companies. P/E ratios are often already high at the beginning of a period of outperformance.

Cleary, that the secret to big success isn’t about finding beaten-down stocks. It’s about identifying the fastest growers.

The key trait of top performing stocks is that they always have high earnings growth for the period of outperformance. The median EPS growth of the top 25 companies in this year’s study was 24%. EARNINGS GROWTH DRIVES STOCK PRICE OVER TIME.

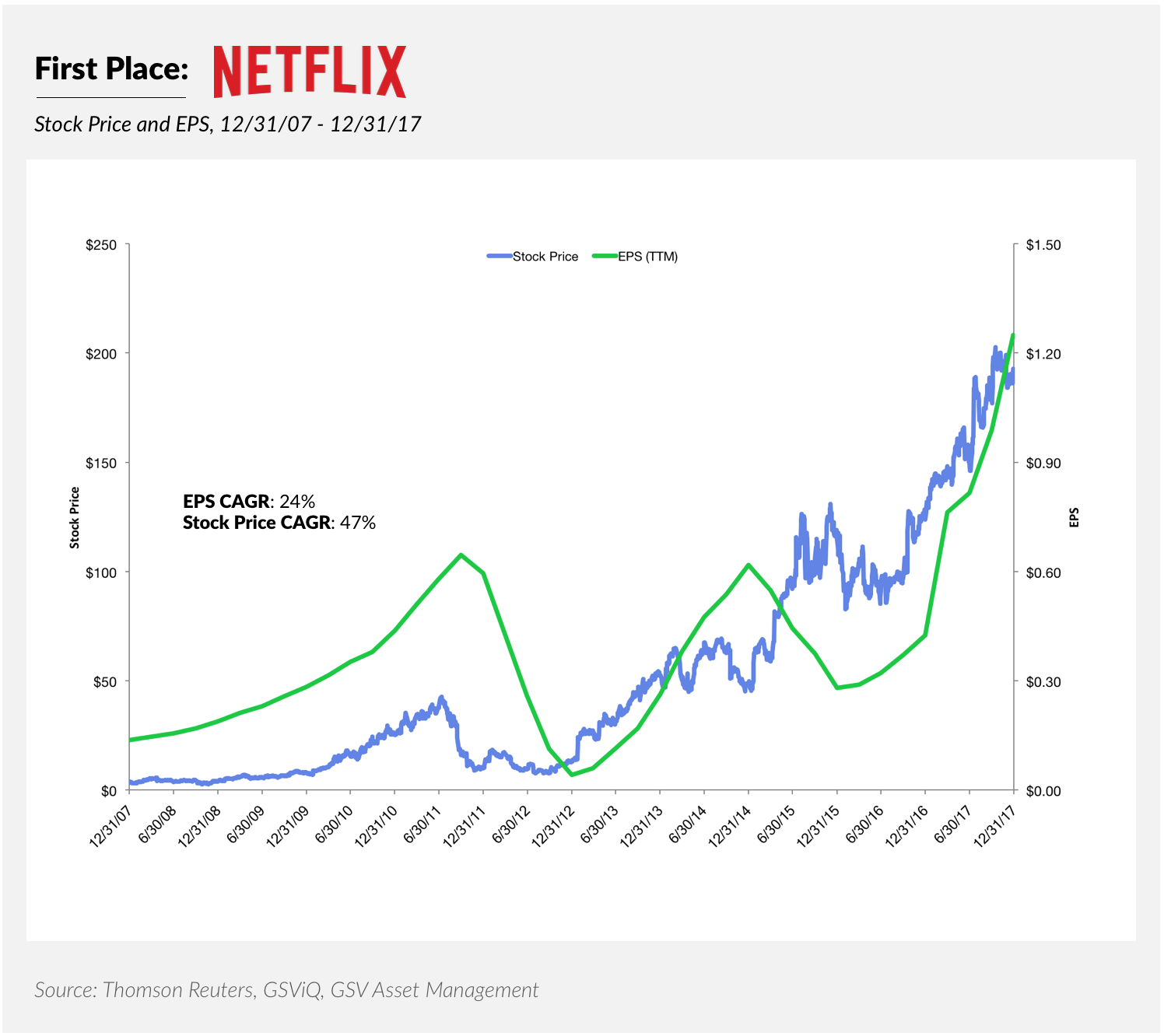

The top-performing stock in this year’s study was Netflix with a 47% stock price CAGR and a 24% EPS CAGR over the past decade. Just this week, Netflix’s market value surged past $100 billion as the company continues to impressively grow its subscriber numbers, powered by the success of Netflix’s original programming. Last year alone, Netflix’s original programming picked up 20 Emmy awards.

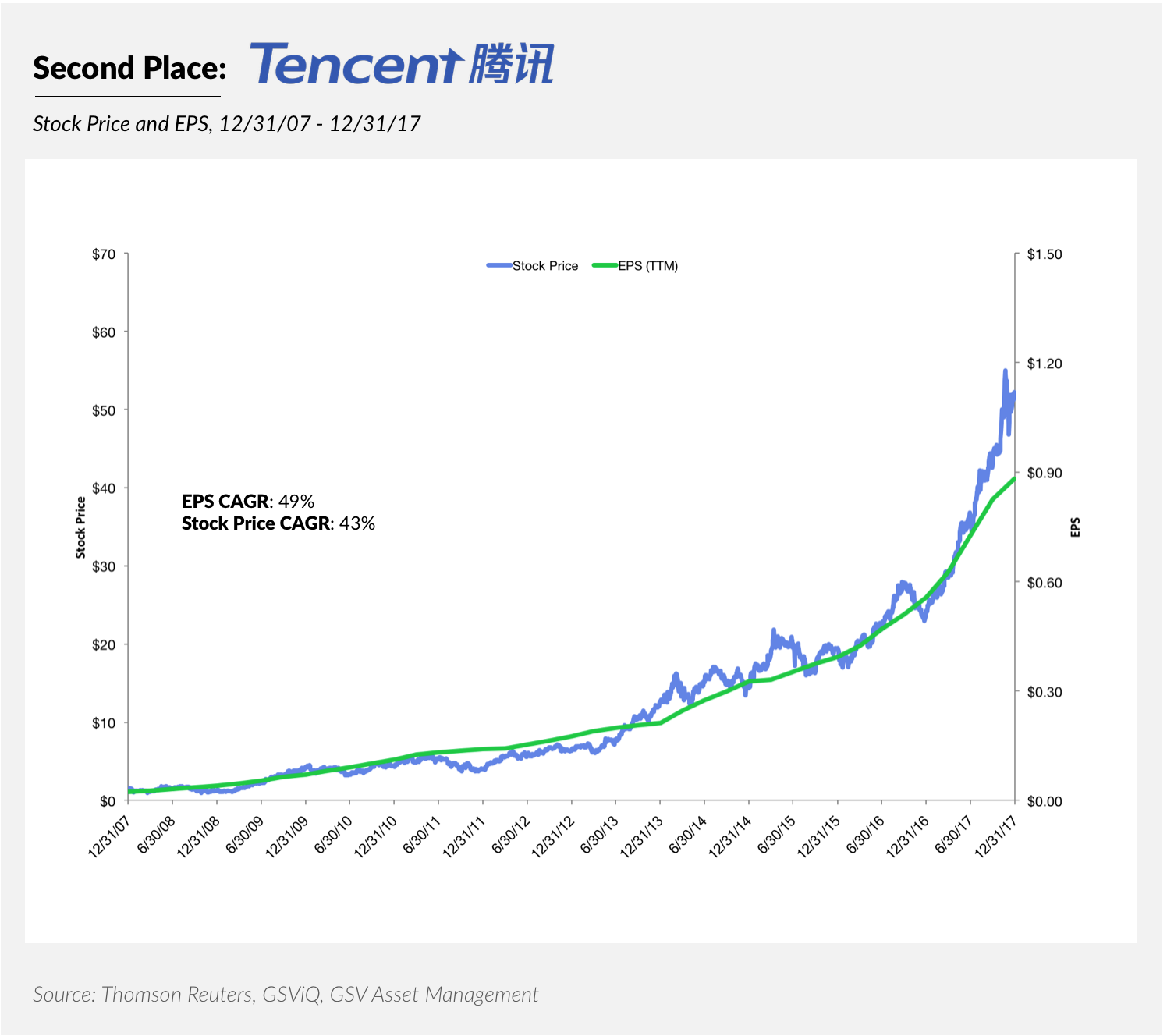

The second top-performing stock in this year’s study was Tencent. Founded in 1998, the Chinese technology and social media powerhouse has seen its stock price grow at a 43% CAGR over the past decade, catalyzed by compounded annual earnings growth of 49% in the period.

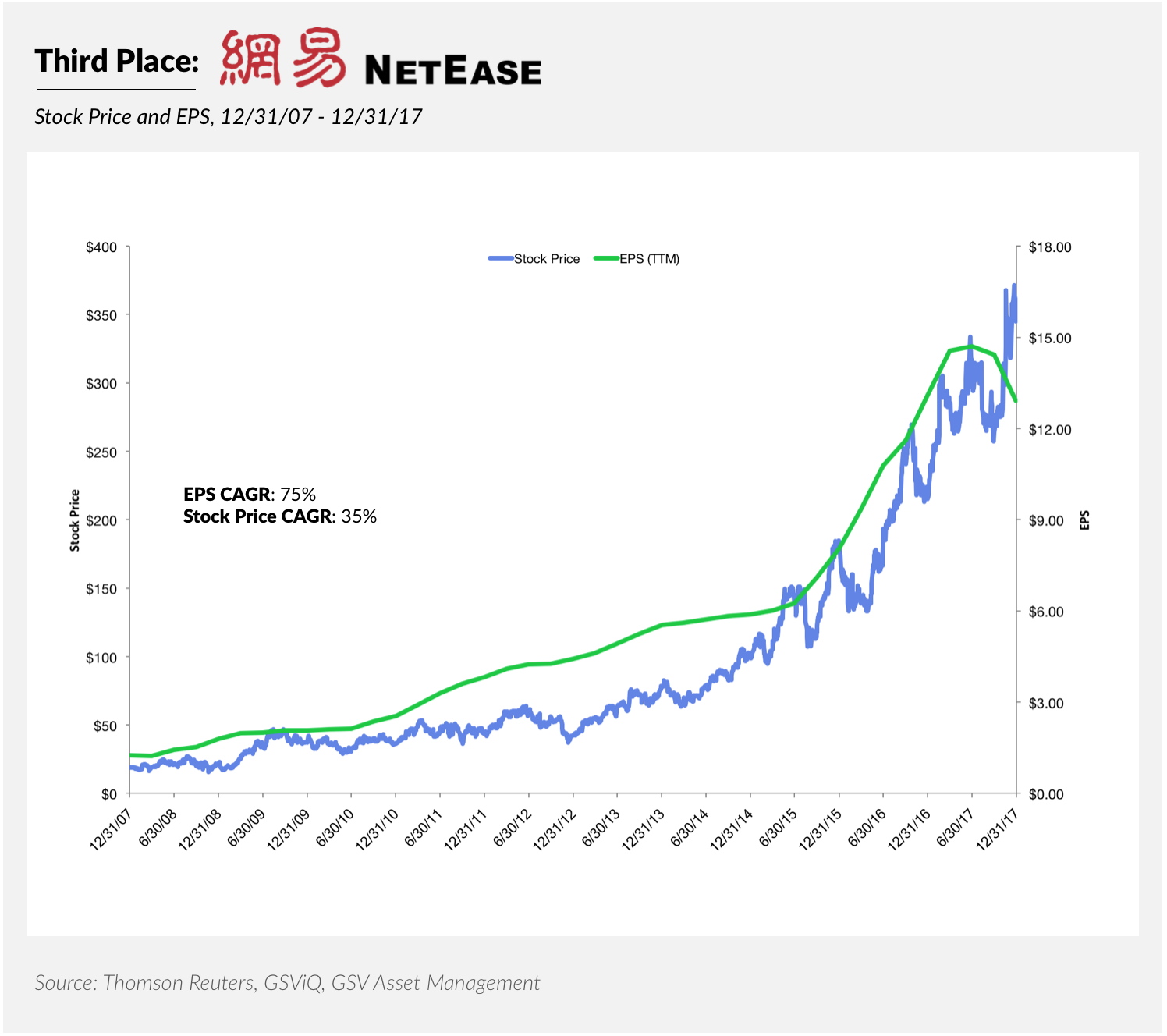

Rounding out the top three is Chinese gaming and media platform NetEase, which rose 20 spots from last year’s study. The company clocked a 35% stock price CAGR and its 75% annual earnings growth rate topped all companies in the top 25.

Tencent and NetEase’s top ranking is a notable reminder of the increasing impact China will have on global innovation and growth. Interestingly, conventional wisdom is that the China growth story is yesterday’s news.

But it’s just beginning.

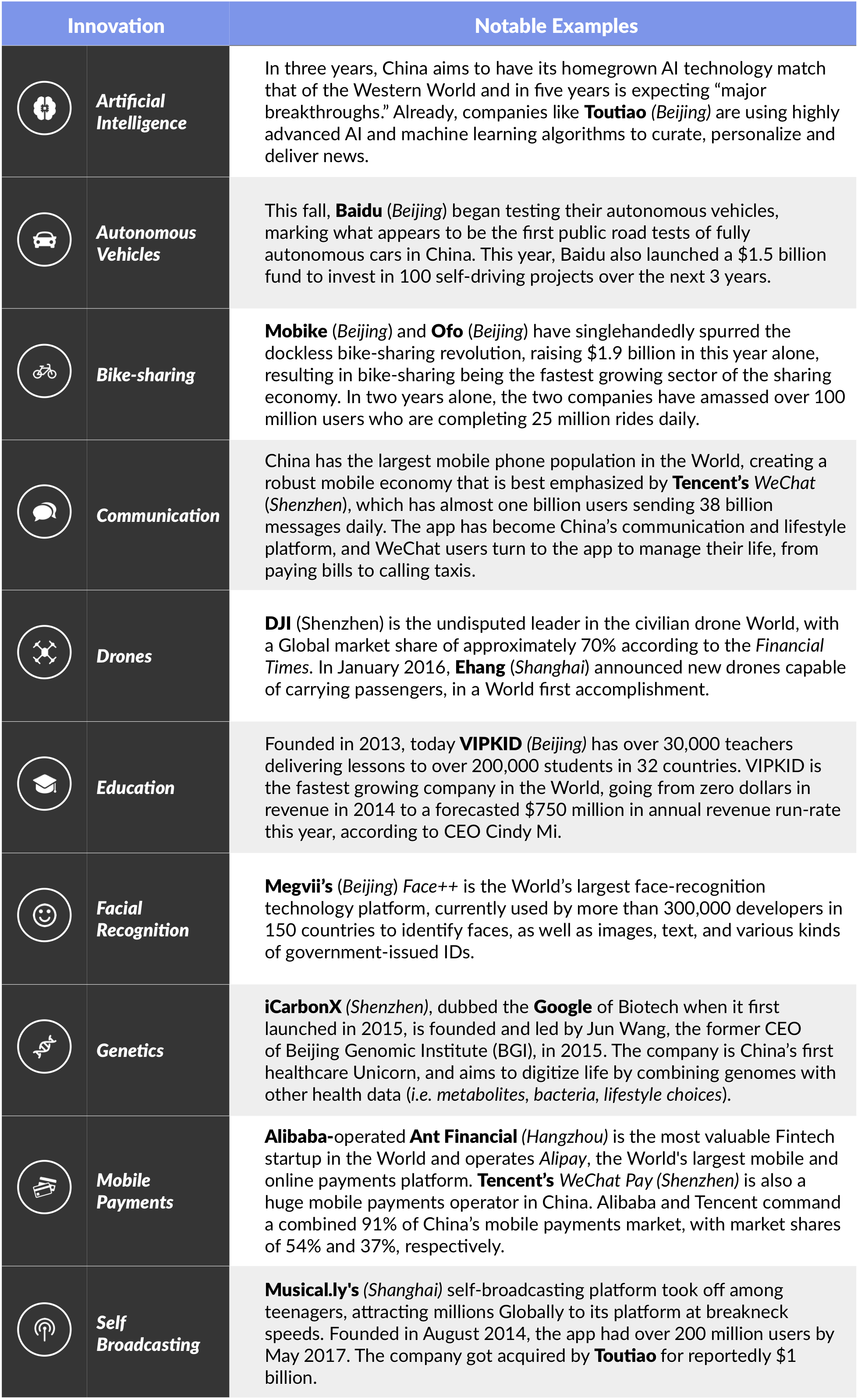

The imitator has become the innovator. China is intent on creating its own consumer brands, exporting them, and putting up roadblocks for foreign players. Alibaba (E-commerce; $507 billion market value), Xiaomi (Mobile Devices; $46 billion market value), China Mobile (Mobile, $216 billion market value), DJI (Drones, $10 billion market value), and Baidu (Search & Internet Services, $89 billion market value), are just a few examples of what China has in store for the World.

Today, the Middle Kingdom is positioning itself at the center of the Global innovation economy and the Global Silicon Valley. The Innovator is now leading the World in producing startups that are tackling some of the World’s most challenging problems.

The conclusions we reach from this study, and from over 20 studies we have done before, is that if we want to identify the companies that will appear on this list 10 years from now, we should:

1) Not select companies from this list as there has never been a company that remained for 20 years. If Apple were to notch the same stock performance in the next 10 years as it has for the past 10 years, it would have a roughly $40 trillion market cap — nearly 2x the entire U.S. Equity Capital Markets.

2) Focus on companies that have the potential to grow their revenues and earnings at high rates for a long time instead of shopping in the “Bargain Basement”. Additionally, the larger a company is, the harder it is to sustain high growth. Size forges an anchor, so the companies that will appear on this list in a decade are small today.

3) Focus on companies with the 4Ps — great PEOPLE, leading PRODUCT, huge POTENTIAL and PREDICTABILITY. The BIG stocks are created by companies that grow their business for a long time and the 4Ps are the ingredients in those special businesses.