Market Snapshot

| Indices | Week | YTD |

|---|

The more we share, the more we have.

— Leonard Nimoy

We are all connected in the great Circle of Life.

— Rafiki in Lion King

I feel your pain.

— President Bill Clinton

BOOM! The U.S. economy is roaring ahead with a GDP growth rate over 4%, fueled in part by tax cuts. Unemployment is at 3.7%, which is the lowest its been since 1969. The dollar is surging. Inflation, as measured by CPI, is nearly zero coming in at 0.1% for September.

BANG! Despite the aforementioned, stocks fell hard last week with NASDAQ dropping 3.7%. The S&P 500 fell 4.1% and the Dow was down 4.2%. Worse off were emerging markets with the Shanghai Composite off 5.2% and nearing four year lows… and every other major market was negative last week. The exception was Brazil, whose stock market was catalyzed by investors support of Jair Bolsonaro in the Presidential election.

BONG! Recreational marijuana use becomes legal in Canada on Wednesday, October 17th. Canada will become the second country in the World after Uruguay to make pot legal. The United Nations has said the market for marijuana is over $150 billion, which is almost double the size of the coffee market. That’s reason enough to see cannabis companies such as Canopy and Aphria’s market value and valuation metrics surge in the past couple years to $10 billion and $3 billion, respectively.

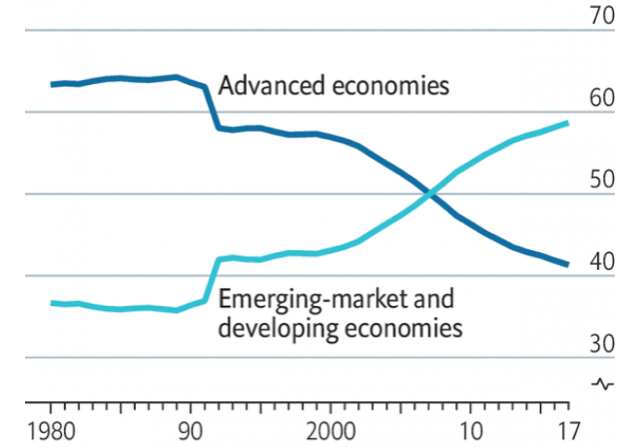

Based on headline economic data, it seems like “Happy Days are Here Again” should be the ditty we are singing in the United States. But the reality is that globalization and the Internet have made the World increasingly interconnected. Moreover, whereas advanced economies were the majority of global GDP historically, today emerging economies are now nearly 60% of the overall global economy.

The bad news is that the bad news is not isolated to where it’s happening — it’s shared and contagion is a new perpetual phenomena. The good news is that innovation and ideas can spread across the globe at breathtaking speeds. Nowhere is this more apparent than in the “Sharing Economy,” where billion dollar global “start-ups” such as Airbnb and Uber have been created seemingly overnight.

Goldman Sachs estimates that the global ridesharing market was worth $36 billion in 2016. By 2030, it is projected to grow 8x to over $285 billion. Importantly, ridesharing has significant room to expand across both developed and developing countries. In the United States, for example, only 15% of consumers have used ridesharing services to date.

Against this backdrop, Lyft’s market share in the United States has increased from less than 10% in 2014, to over 35% today. In 2017, Lyft’s growth rate in the United States was almost triple that of Uber. At the same time, the average number of annual rides per Lyft user has increased from 32 times in 2016 to over 40 times in 2017. Earlier this year, Lyft announced that it had completed its 1 billionth ride.

These gains have been driven by Lyft’s operational excellence, but also by a brand that is definitively viewed to be more driver- and rider-friendly than Uber. For example, the number of U.S. consumers who said they would consider taking Lyft jumped to 9.6% in Q1 2017 (most recently reported data), up from 5.6% in Q4 2016. Uber fell from 18% to 14% in the same period.

The same dynamic is expressed in Lyft’s superior driver satisfaction indicators, a key area of strategic focus for the company. For example, on May 23, 2018, Lyft announced a $100 million commitment to provide a range of driver support services, including subsidized oil changes, basic car maintenance, car washes and more.

RIDE WARS

The ridesharing industry has taken shape rapidly across a few key phases, catalyzed by the launch of the iPhone in 2007. Beyond its groundbreaking hardware, the iPhone ushered in an “app economy” that enabled transformative new software applications to go from idea to millions of customers seemingly in the blink of an eye.

In many ways, ridesharing is the original “Killer App.”

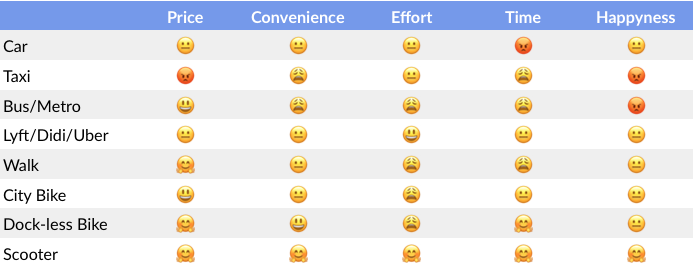

In the old model, you literally “catch” a cab. You stand on the edge of the street, put your hand up in the air while competing with other would-be riders, and pray for a car to swerve to a stop in front of you. Taxi drivers, meanwhile, troll around blindly for fares, relying on dead reckoning and luck to find passengers.

In the new world, with the click of a button, your ride appears where you want it, when you want it. You don’t need physical money — or even a credit card for that matter — to pay your driver. It’s all in the app.

And a transparent review process ensures that drivers treat their customers well. The better the service, the higher the star rating a driver receives — which in turn translates into a higher likelihood of being connected with riders. Similarly, passengers that consistently demonstrate bad behavior — from no-shows to disorderly conduct — can be removed from a ride sharing platform based on driver feedback.

Just how “killer” are ridesharing apps? Uber has completed over ten billion rides since it launched in 2009. Lyft has completed over 1 billion rides in North American since it launched. Didi completes an estimated 30 million rides per day.

Globally, a crop of newly-minted ridesharing Unicorns have emerged in key geographies around the world as entrepreneurs and investors have eagerly reaped the rewards of a “rapid follower” strategy — as opposed to the classic first-mover advantage.

Technology in general, and the Internet in particular, is all about disproportionate gains to the leader in a category. It’s often a winner-takes-all game.

At one point it appeared that Uber was positioned to run away with the global ridesharing industry. But today, a “winner-takes-some” picture is emerging, driven by local regulatory and competitive dynamics, as well as aggressive investor appetite to back the global “copycats.”

The rise of China’s Didi is instructive. Founded in 2012 — three years behind Uber — Didi managed to capture over 80% of the Chinese ridesharing market by 2015 while raising over $800 million from a global syndicate of growth investors, including Temasek, Tencent, and DST. That year alone, the company announced that it had completed 1.4 billion rides. Around that time, Uber announced it completed its one-billionth since inception.

Fast forward to August 2016 and Uber capitulated in its conquest for the Middle Kingdom, selling its China operation to Didi after burning an estimated $1 billion per year to compete in the market.

Today, Didi is thinking global, raising an astonishing $5.5 billion in April to fund its growth. But instead of “landing and expanding,” Didi is strategically partnering with — and aggressively investing in — regional ride-sharing companies. To date, Didi has backed Lyft (United States), Uber (in conjunction with its acquisition of Uber China), Careem (Middle East), 99Taxis (Brazil), Ola (India), Taxify (Europe), and Grab (Southeast Asia).

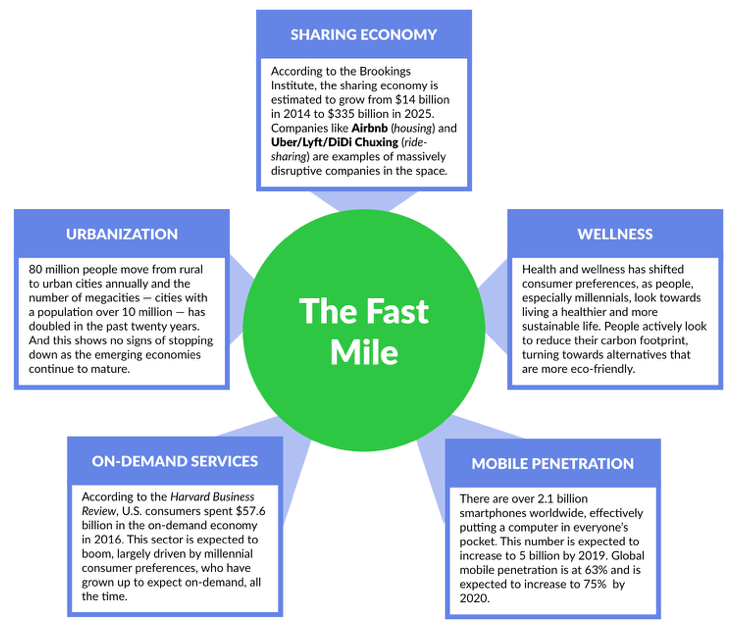

THE FAST MILE

Movement is in our DNA. Until about 10,000 years ago — or 99% of human history — there were few, if any homes or villages. People were nomadic, chasing food and gentler climates.

While we couldn’t change the weather, we learned how to domesticate plants and animals in what is now called the Neolithic Revolution. And when the food stopped moving, so did we.

In the next 10,000 years, historians might look back and name our era the “Metropolis Revolution.”

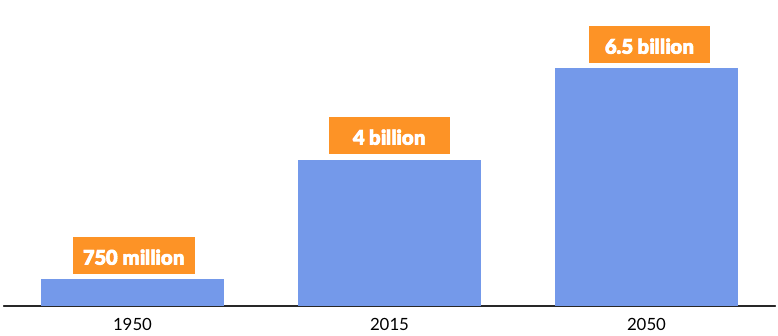

Today, the United Nations estimates that four billion people, or 54% of the World’s population, live in cities. In the next 15 years, the Economist projects that urbanization will increase average city density by 30%. By 2050, the ranks of urban dwellers will swell by 2.5 billion to nearly two-thirds of global population.

Source: The Economist, United Nations

If you look at the United States, there are 10 cities with a population of one million or more. In China, there are 160. The official population for Shanghai is 34 million. But demographers will tell you that based on cellphone subscription data, it’s probably over 40 million. That is larger than the entire population of Canada.

While we’re no longer nomads, we still move around. But increasingly, it’s all happening inside of cities. Today, urban travel already accounts for nearly two-thirds of the total distance people cover per year. Based on the current trend line, this will triple by 2050, stretching urban transportation systems to the breaking point.

The traditional solutions to congestion — building more roads and expanding public transportation — are constrained by cost and time. The future of human mobility will be shaped by new models and technologies — the “Fast Mile.”

Big Wheel, Big Deal?

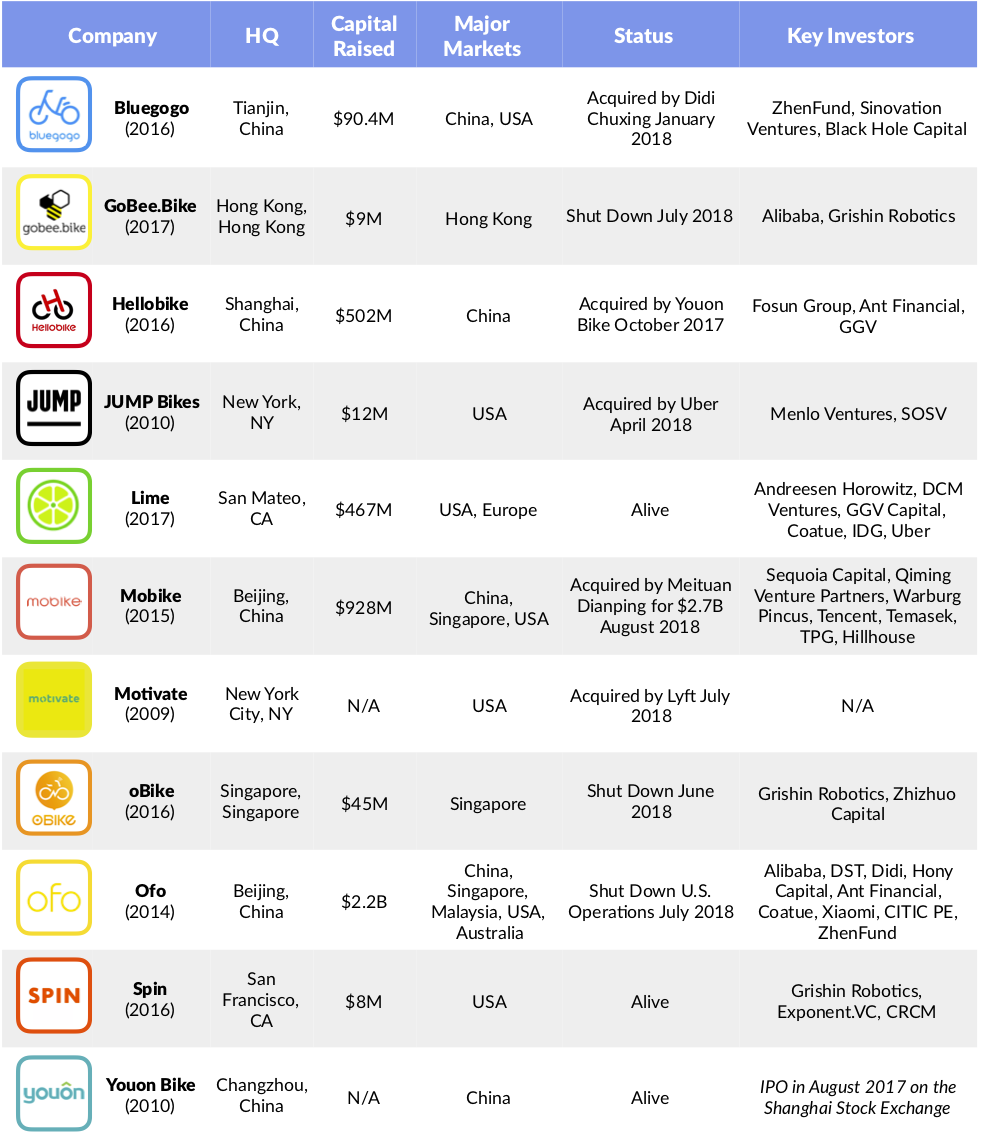

In a few short years, bike-sharing has emerged as the fastest growing sector of the on-demand “Sharing Economy.” Venture funding for bike-sharing startups exploded in 2017, largely driven by the mega-rounds raised by Chinese early-movers Ofo and Mobike ($1.9 billion in combined 2017 financings).

Why the VC feeding frenzy? In two years alone, these companies have amassed over 100 million users who are completing 25 million rides per day. Low barriers to entry and a quick payback period on bike fleet investments have enabled bike-sharing startups to scale rapidly.

The bike-sharing gold rush is not without risks. In China, which is home to over 20 million shared bikes, vandalism and theft (often at the behest of competitors), as well as general disregard on behalf of consumers, has led to the proliferation of bike graveyards. Wukong reportedly lost 90% of its bikes the first six months after it launched in January 2017.

In July 2018, Lyft announced the acquisition of Motivate, the largest bikeshare operator in North America. Motivate provides bike networks to a variety of key urban centers, including New York (Citi Bike), San Francisco (Ford GoBike), Chicago, Boston, Washington D.C., and Portland. This followed Uber’s acquisition of electric bikeshare company JUMP in April.

Scooter Frenzy

With the rise of companies like Bird, scooters have quickly become the new — and perhaps most popular — disruptor in urban transportation. They are grabbing market share from bike-sharing and even ride sharing services.

The feeding frenzy began just over one year ago when Bird and Lime started dropping motorized scooters with top speeds of 15 mph all over cities, unannounced. Scooters have quickly gone from fad to fixture, with people from all walks of life using them to get from A to B on workdays and weekends alike.

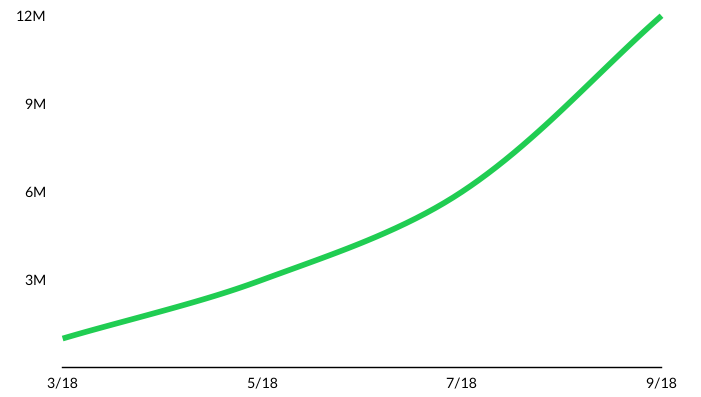

Santa Monica based Bird was founded in 2017 by Travis VanderZaden, who formerly had stints at both Uber and Lyft before starting Bird. Bird’s flagship product is their dockless electric scooter, which allows riders in cities to quickly get from point A to point B. In one year, Bird expanded to 100 cities, facilitated over 100 million rides, and became the fastest company to reach a $2+ billion valuation. The company has raised $415 million of venture funding from investors including Accel, Greycroft, Sequoia Capital, Index Ventures and CRV.

Uber and Lyft, fresh of their bike-sharing acquisitions, are each launching electric scooters on their platforms. In September, Lyft announced its first scooter sharing service in Denver. Earlier this month, Uber’s Jump-branded electric scooters touched down in Santa Monica.

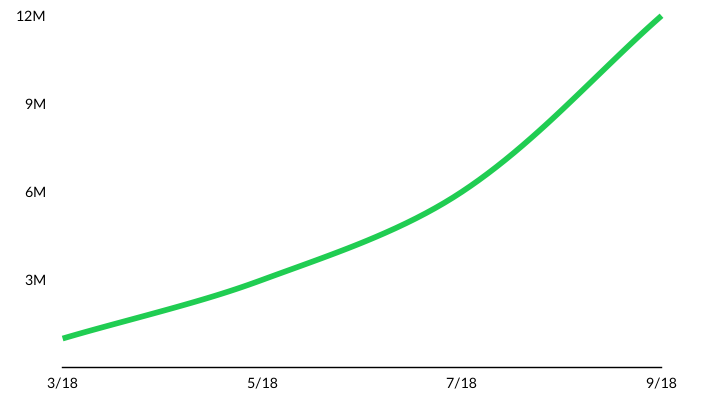

In an environment when many bike and scooter-sharing services have struggled to maintain momentum, Lime stands out.

The California-based company (formerly LimeBike) was founded in 2017 and launched as a dockless bike-sharing service, flooding the streets of the United States with fleets of bright green bikes. It quickly followed with electric scooters, sensing an opportunity to develop a portfolio of last mile services. It currently operates in over 100 cities globally and recently surpassed 11.5 million scooter and bike rides delivered since inception.

Since its founding in June 2017, Lime has raised $467 million from investors including Andreessen Horowitz, GV, GGV Capital, IVP, DCM Ventures, IDG Ventures, Coatue and Fidelity. Lime’s most recent $335 million fundraise valued the company at $1.1 billion and included a sizable investment from Uber.

Despite strong momentum, the scooter wave will not continue unchecked. Cities are beginning to aggressively regulate these services to prevent over-supply (e.g., bikes and scooters littering sidewalks), and to ensure safety. Lime and Bird recorded their first fatalities this year from their scooters, which sparked the typical knee-jerk backlash.

But make no mistake. The dawn of the Fast Mile is upon us and urban transportation is in for an overhaul.

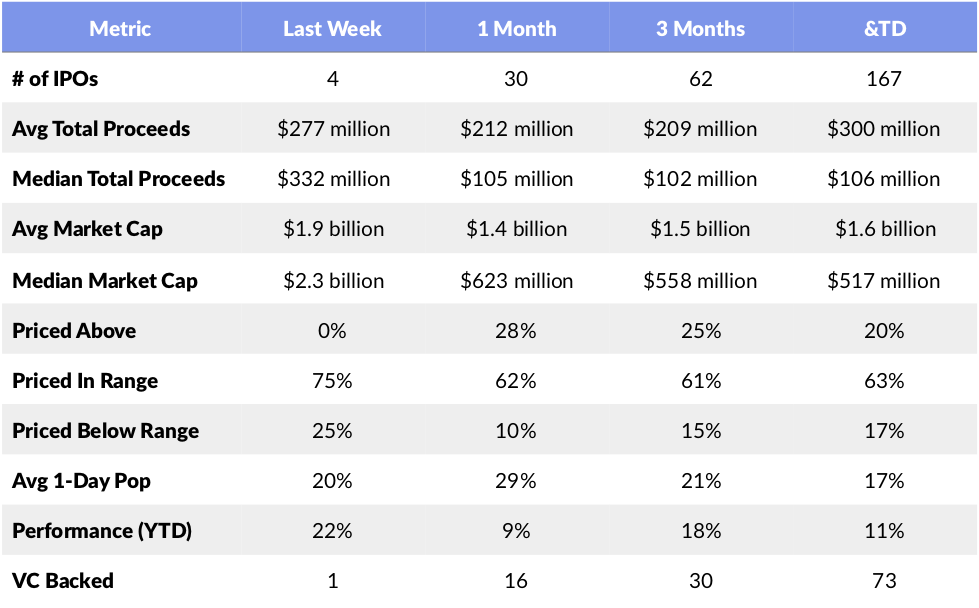

ROCKETFUEL IPO RECAP

Four companies raised $993M in IPO proceeds last week. Business planning software company, Anaplan, was the star performer with an IPO pop of 43%. The company sold 15.5M shares at the top end of its revised target range of $15 to $17 per share. The SF-based company’s shares ended trading at $24.3, valuing the company at close to $3B. Cancer startup Allogene Therapeutics was the other performer for the week with its shares popping 39%, valuing the company at over $2B. Allogene, which went public less than a year after it was founded, was the largest biotech company to go public since 2009. Allogene is led by Arie Belldegrun and David Chang, two of the executives that steered Kite Pharma towards a $12B sale to Gilead Sciences in 2017.

We have five companies on deck for next week planning to raise $1.3B in IPO proceeds. Solarwinds, an IT infrastructure company, plans to raise $756M, selling 42M shares between $17 and $19 per share. At the midpoint of the proposed range, the company would be valued at $5.6B. SolarWinds has 275,000 customers as of June 30, 2018, including 499 of the Fortune 500. The company was founded in 1999 and went public in 2009 before being taken private by Silver Lake Partners and Thoma Bravo in 2016. They will control 83% of the voting power after the IPO. The company’s revenues grew from $469M in 2016 to $728M in 2017, a 55% growth rate. But revenue growth for the first half of 2018 compared to the same period in 2017 was only 17%, while the net losses grew to $86M from $45M during the same period.