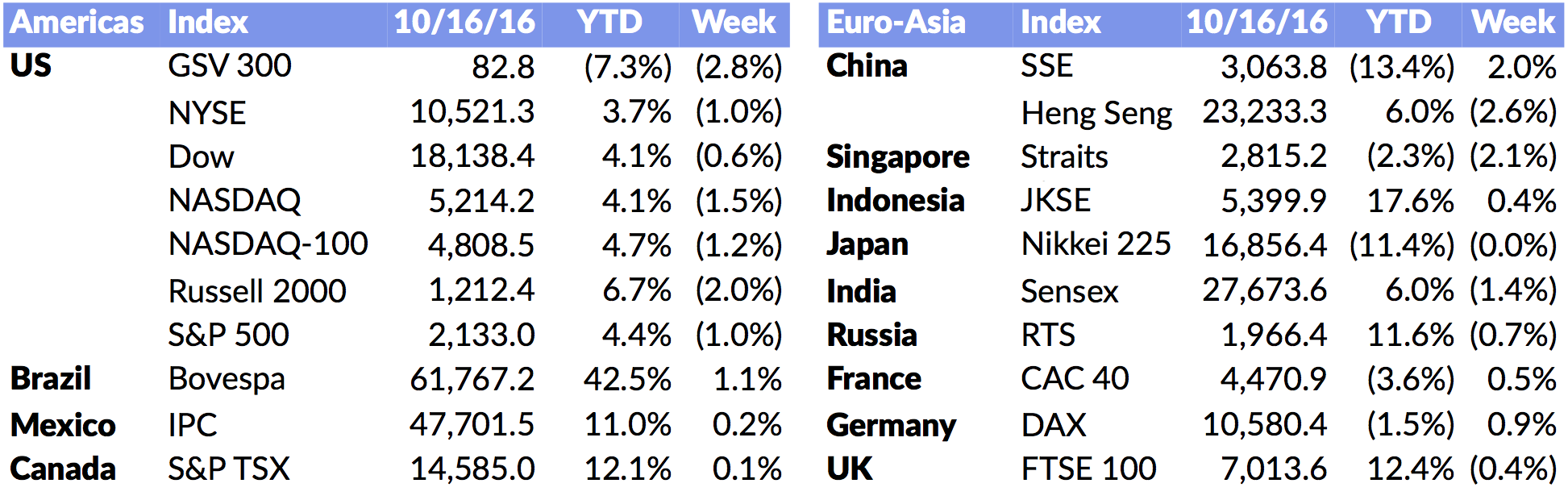

Market Snapshot

| Indices | Week | YTD |

|---|

The future for me is already a thing of the past.

— Bob Dylan, Nobel Laureate (Literature, 2016)

Looking in the rearview mirror, the economic engine for the last 100 years was the United States, Europe, Japan, and Canada.

In 2000, with just 9% of the global population, these countries contributed over 50% of global GDP. But over the last 15 years, GDP growth in these countries has been flat-to-negative. Today they contribute just 41% of Global GDP.

A key driver behind this change has been aging populations. Over 26% of these populations are over the age of 60 while just 15% are under the age of 15. In Japan last year, there were more adult diapers sold than baby diapers.

JAPAN’S UPSIDE DOWN DIAPER MARKET

In 2015, there were more adult diapers sold than baby diapers in Japan

These dynamics are not changing anytime soon. The average (weighted) fertility rate in Canada, the United States, Europe, and Japan is 1.6. At a fertility rate under two, you’re essentially dying.

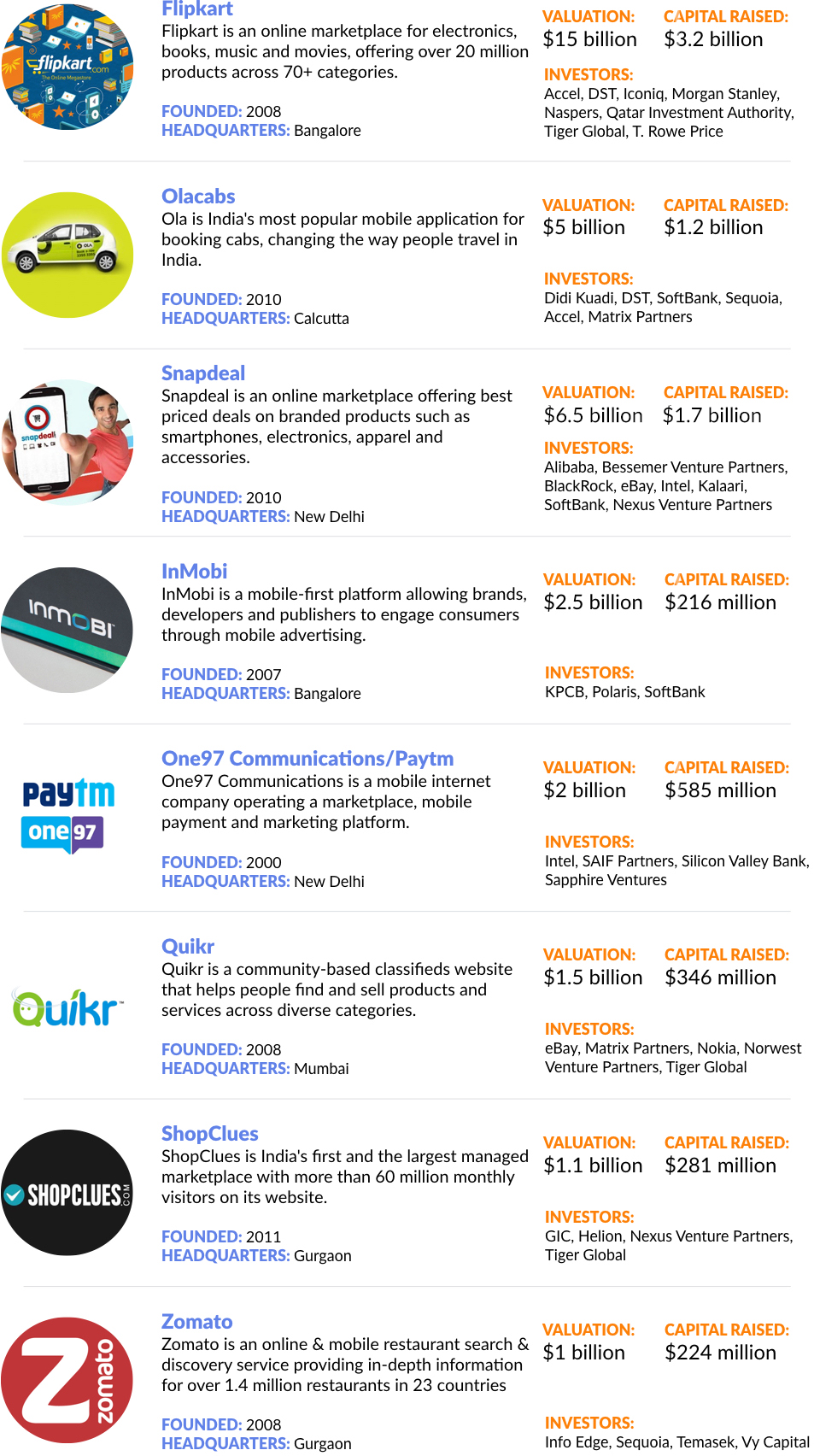

Where is the growth and opportunity as we look ahead? We call it the VChIIPs — Vietnam, China, India, Indonesia, and the Philippines.

These countries are home to over 43% of the global population and command 28% of global GDP, growing at 6.6%. If you look at the demographics, they are the mirror opposite of what you see in the developed countries. Just 11% the VChIIP population is older than 60, 24% is younger than 15, and the fertility rate is 2.3, driving organic growth.

The center of gravity is changing. Africa is on deck with five of the 10 fastest growing countries last year.

Source: The Economist, World Bank, GSV Asset Management

*Includes Eurozone, United Kingdom, and Denmark

**2008-2013, as reported by the Economist, based on most recently-disclosed country data

Interestingly, conventional wisdom is that the China growth story is yesterday’s news. Exports in China were down 10% last month, which gave the “Chinese-Sky-is-Falling Crowd” extra ammunition.

But the Chinese story is just beginning.

If you look at the growth dynamics, it’s truly remarkable. A key catalyst is massive urbanization that is constant around the world but exploding in China. If you look at the United States, there are 10 cities with a population of one million or more. In China, there are 160. These are young people who are embracing technology, brands, and digital commerce. They’re getting ready to change the World.

The official population for Shanghai is 34 million. But demographers will tell you that based on cellphone subscription data, it’s probably over 40 million. That is larger than the entire population of Canada. Most people have never heard of China’s tenth largest city, Xi’an. With a population of nearly 13 million, it is bigger than Sweden.

SHANGHAI SKYLINE, 1990 VS. TODAY

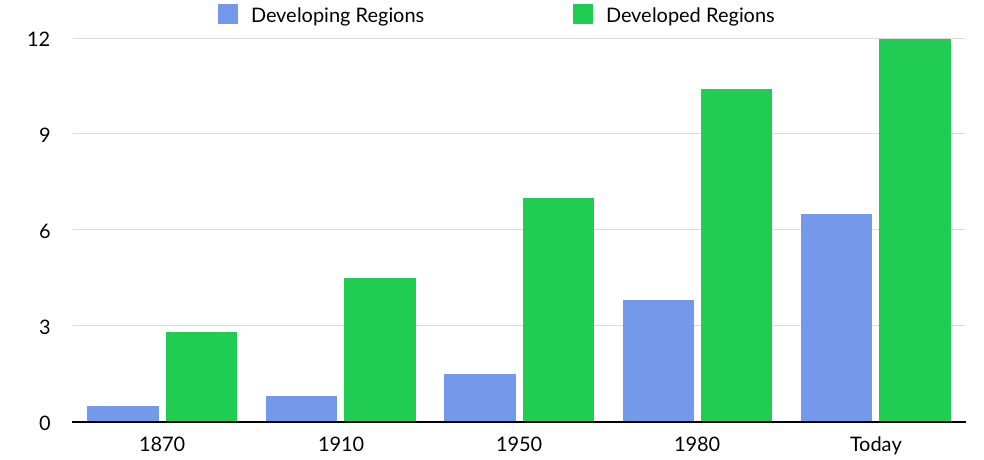

RISE OF THE MIDDLE CLASS

According to the Organization for Economic Cooperation and Development (OECD), the world is in the first inning of a demographic transformation that will result in the rise of a Global “Middle Class” numbering more than 4.9 billion people, ascending predominantly from the low income populations of the world’s developing and emerging economies. Defined as households that spend between $10 and $100 per day, the Middle Class is a cohort of CONSUMERS.

The world has never witnessed income growth at this speed or magnitude. China and India, for example, are doubling their real per capita incomes at 10 times the pace England achieved during the Industrial Revolution and 200 times the scale.

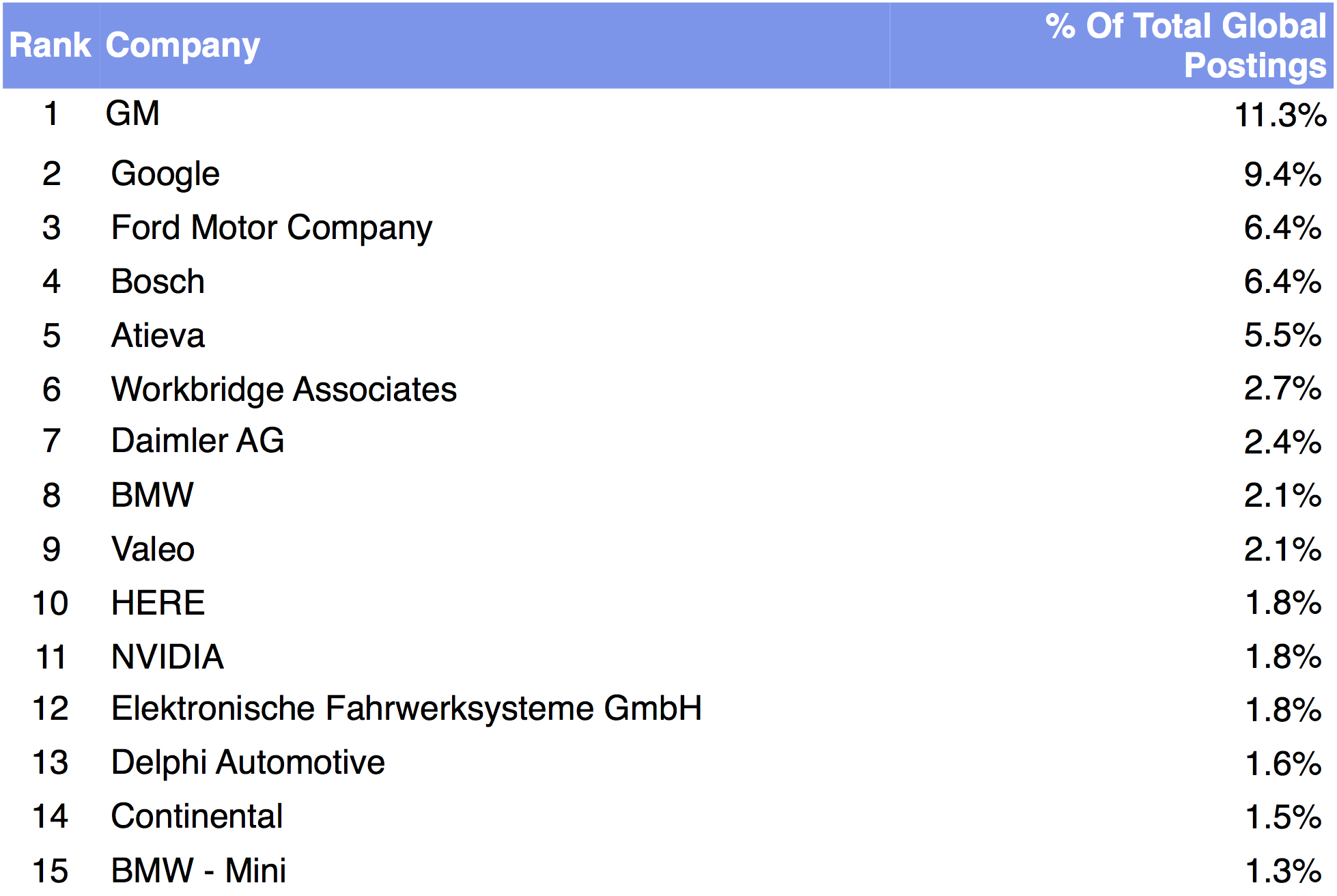

The VChIIPs are where the action is. According to the Brookings Institution, the Asia-Pacific region accounts for roughly 23% of global middle class consumption today. By 2030, it will be nearly 60%. This shift will create profound opportunities and challenges.

Consumers

Expanding populations with discretionary income is creating a remarkable opportunity for multinational corporations and homegrown startups. This trend will drive new product development and marketing dynamics for a generation.

Coca Cola, for example, has implemented a layered strategy for China in which Coke is sold in urban areas at a comparable price to Western markets. As a result, Coke is established as a brand to which new consumers aspire. At the same time, Coke is being sold in the countryside for less, but consumers must return the bottle to the vendor on the spot — a strategy that saves costs and drives down the price.

Facebook’s recent failed Indian gambit on “Free Basics” — a “free” internet service that drives users to Facebook applications — underscores the digital land grab underway in the VChIIPs.

But the VChIIPs are spawning a stable of game changing new businesses in their own right. China is intent on creating its own consumer brands, exporting them and putting up roadblocks for foreign players. Alibaba (e-commerce), Tencent (digital media), Xiaomi (mobile devices), China Mobile (mobile), Vipshop (digital retail), and Baidu (search & internet services) — collectively valued at nearly $870 billion — are just a few examples of what China has in store for the World.

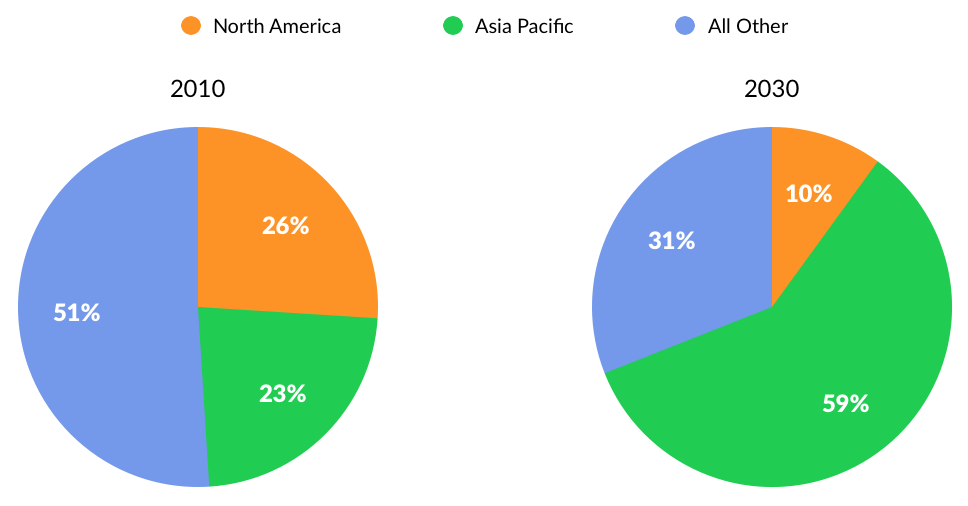

India, which has lagged China in recent decades, has had its own proliferation of consumer brands — without the onerous state protections of its neighbor in the Middle Kingdom.

Among the remaining VChIIPs, Indonesia — home to Tokopedia (Digital Marketplace, $1 billion market value), and Go-Jek (Transportation & Logistics, $1.3 billion market value) — is on deck.

Go-Jek, particularly, crystallizes the dynamic opportunities emerging from the VChIIPs.

Ride sharing, in most parts of the World, involves getting into someone’s car. But in a few countries, ride sharing is done on motorbikes. Thailand, Vietnam, India, and Indonesia have significantly more motorbikes than cars on the streets. The reason is simple — most of the population cannot afford a car. In Indonesia, approximately 80% of urban transportation is done on motorbikes, with an estimated 80 million motorbikes sold annually.

Go-Jek, which launched as a motorbike peer-to-peer ride sharing service, has quickly risen in popularity despite the entrance of heavy hitters like Uber in the region. It is applying technology in a way that makes sense for the nuanced Indonesian market. And now Go-Jek is evolving into an integrated logistics company. Additional announced services include Go-Send, Go-Eat, Go-Box, Go-Mart, Go-Busway, Go-Tix, Go-Massage, Go-Glam, and Go-Clean (you can guess what each entails).

Sustainability

William Faulkner, who served as a cultural ambassador for the State Department during the Cold War, remarked that if we simply gave people a used car and a TV, they would understand the benefits of the American model.

Unfortunately, under the current model, the Earth cannot sustain transition of VChIIPs into carbon copies of America. Today, we are already using 1.5 planets worth of resources to meet global consumption demands (it takes 1.5 years to replenish the resources we consume in a year). We will need another half of a planet to simply sustain the next generation.

According to a recent study by the University of Michigan, for example, if India, China and Indonesia were to use air conditioners at the same rate as the United States (they are on pace to do so), energy consumption in those countries would be 50x levels in the United States.

The International Energy Agency projects that global energy demand will grow 37% by 2040. This additional demand is equivalent to the total current annual consumption of the United States and European members of the OECD combined. China and India alone are expected to account for over half of the total increase.

Education

According to research from the Brookings Institution, the developing World is about 100 years behind developed countries in educational achievement. You might think these gaps would have tightened significantly with the technological advancements and increased connectivity of the Internet Age.

But educational models have remained effectively unchanged for over a century — which has resulted in linear progress.

In India, for example, the number of private universities doubled from 2007 to 2012 in response to massive demand for higher education and a growing knowledge economy. But linear growth through brick-and-mortar models has been no match for demographics. According to research from the Parthenon Group, India is on track to have 40 million more college-uneducated adults in 2020 than today.

The same dynamics that have paved the way for disruptive global businesses to launch at lightening speeds — from Uber, which is upending the transportation industry, to Airbnb, which is redefining the hotel industry — are now propelling a new generation of education and talent companies the will help the VChIIPs bridge the gap.

“Weapons of Mass Instruction” — rapidly growing, scaled education models with disruptive technology — are using the Digital Tracks that have been laid over the past 15 years to reach and impact massive audiences.

As GSV continues to seek out the the most dynamic growth companies in the World — what we call the Stars of Tomorrow — we believe an increasing number of opportunities will be emerging from our friends in the VChIIPs.

—

Stocks were heavy last week, burdened by a Fed that seems to be itching to raise rates and punk Third Quarter earnings. For the week, NASDAQ was off 1.5%, the S&P 500 fell 1.0% and the GSV 300 dropped 2.8%.

Earnings season was already expected to be uninspiring, with a forecasted sixth quarter in a row of negative earnings growth. Early results last week, including Alcoa’s mega-miss, had investors fleeing for the exits.

2016 IPO star Twilio didn’t twinkle last week, falling 24% on news that it was doing a secondary following its rocket ship earnings. Continuing the trend of the “Four Amigos” (Apple, Amazon, Alphabet, and Facebook) doing everything the other friend is doing, Amazon announced a music service and Facebook announced a business collaboration service called “Workplace”.

IPOs continued their upward beat, with four new issues coming to Market last week. One issue priced above the range and one price below — more or less what would expect in a normal IPO environment.

We continue to be optimistic on the outlook for leading growth companies as their advantages are in many cases accelerating. Accordingly, we remain BULLISH.