Market Snapshot

| Indices | Week | YTD |

|---|

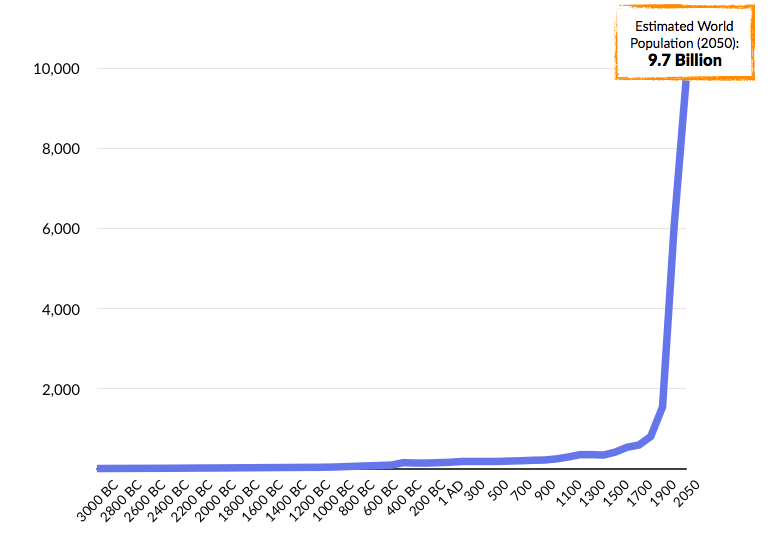

During the time of Christ, the human population on Earth was at a steady 200 million. In the 1800s, at the height of the industrial revolution, the human population passed the 1 billion mark. But today, about 200 years later, the population boomed to be over 7 billion. And by 2050, it’s expected to rise to 9.7 billion.

You can extrapolate a lot from a demographic forecast like that. But one thing is for certain — it’s going to be raining cats and dogs.

World Population From 3,000 BC to 2050 (in Millions)

Furry best friends have been by our side since pre-historic times. Dogs are believed to be the first domesticated animal, and it is estimated that humans began keeping canines as pets as early as 30,000 years ago. Other pets came later, including cats (3500 B.C), birds, fish, and more.

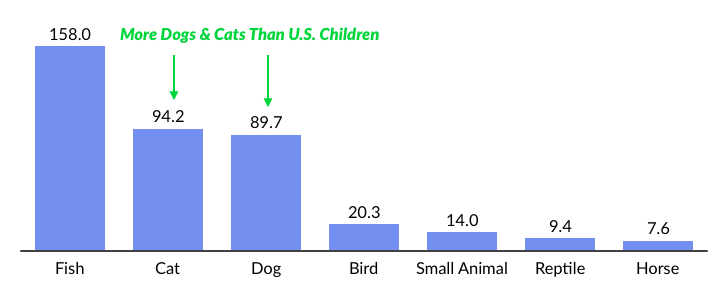

Today, pet ownership in the United States and around the world is surging. It has more than tripled in the U.S. since the 1990s and American pets outnumbered children for the first time in 2006. The trend has not abated.

In 2017, there were nearly 184 million pet cats and dogs, compared with 74 million children under the age of 18, and 24 million children under the age of five. In the United States, the growth in pets owned eclipses the population growth as more people are opting to have pets.

Taken broadly, pets are increasingly becoming people and entrepreneurs are reacting with innovative products and services in a market that has been devoid of meaningful change for the last century.

In the past, people mostly spent money on their pets for staples like food, standard veterinary care and basic supplies. But this is changing. After all, your dog needs luxury.

STATE OF PLAY

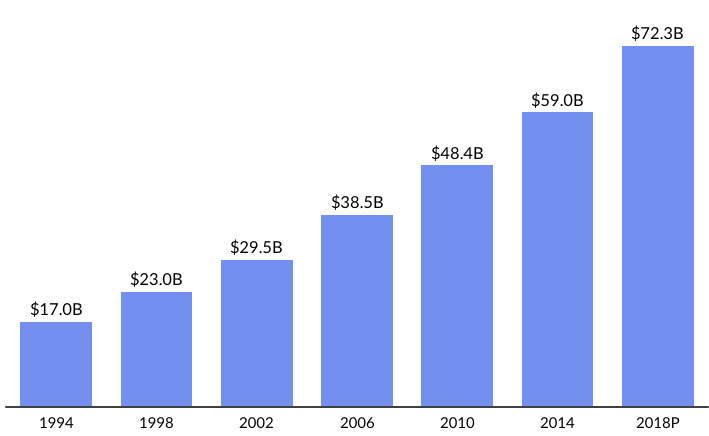

The $65 billion pet market has grown steadily over the past 20 years, but there are many reasons to believe that the spending is poised to grow much faster moving forward. At a baseline, demographic trends suggest that as people live longer, they will acquire an increasing number of pets in their lifetime. But more importantly, pet owners are ready and willing to increase their spending.

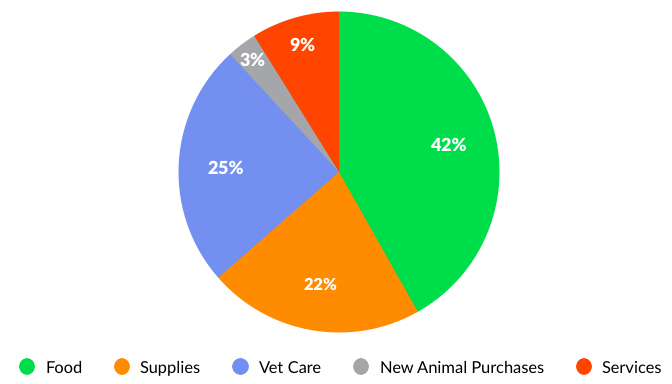

To date, pet spending has been tracked across five core categories:

- Food

- Supplies

- Services (Grooming & Boarding)

- Vet Care

- New Animal Purchases

With the exception of e-commerce, there has been little innovation in the products and services available to current and prospective pet owners over the last 50 years. With the emergence of global megatrends including Mobile, Marketplaces (especially Peer-to-Peer), Wearables, and Wellness, the pet market is ready for a flood of new offerings.

Pets.com didn’t seem like such a great idea in the 90s when it spontaneously combusted. But like many e-commerce businesses from the Dotcom Bubble, sometimes the early bird gets the turd.

Chewy.com, which launched in 2011, has become one of the world’s fastest growing e-commerce platforms, reaching nearly $900 million of revenue in five years according to Recode. In August 2017, Petsmart logged the largest e-commerce acquisition by buying Chewy for $3.4 billion. Prior to its acquisition, the company had raised over $450 million from investors including BlackRock, Allen & Company, Wells Fargo, and Greenspring Associates.

Source: Petfood Industry, Thomson Reuters, Yahoo Finance, GSViQ

This January, SoftBank’s Vision Fund announced a $300 million investment in dog-walking startup Wag. Following the financing, Wag also announced the appointment of a new CEO, Hilary Schneider, the former CEO of LifeLock. Launched in 2015, Wag provides on-demand walking and boarding services for dogs.

Another notable merger was Rover and DogVacay’s union in March 2017. Combined, the company is now the largest pet services marketplace in the United States and has its sights set on global expansion.

KEY TRENDS

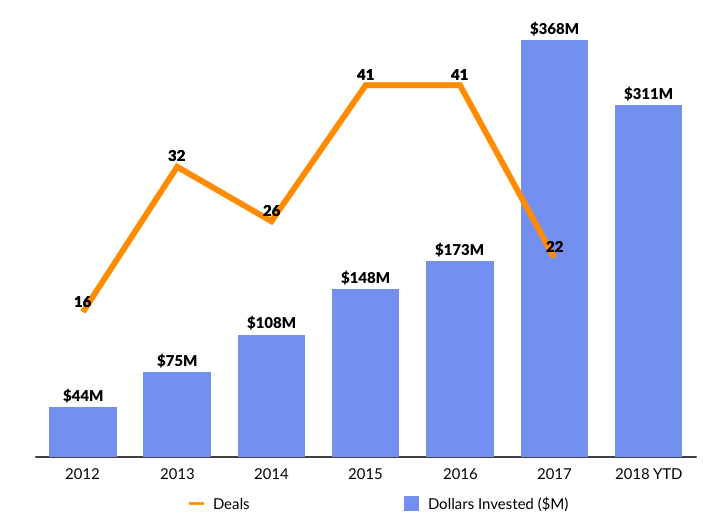

According to CB Insights, VC investment in “Pet Tech” startups has risen from $44 million in 2012 to $368 million in 2017. The early part of 2018 was headlined by SoftBank’s $300 million investment in Wag.

1. On-Demand Services

According to the Harvard Business Review, U.S. consumers spent $57.6 billion in the on-demand economy in 2016. This sector expected to boom, largely driven by millennial consumer habits, who have grown up to expect on-demand, all the time.

On-demand services for pet owners, such as daycare or walking, appeal to existing pet owners but also encourage new pet owners to own pets. These services add convenience towards pet ownership and allows owners — new and old — to undoubtably rely on effortless, high quality care for Fido. Over time, the lifetime value of on-demand pet service users will continue to accelerate as owners increasingly rely on pet services to accomplish their needs.

The U.S. dog boarding and walking industry is a $13 billion, but highly fragmented market. As the leader in the space, Rover is leveraging the power of peer-to-peer marketplaces to bring efficiencies to the pet boarding market. Backed by leading investors like First Round, Foundation Capital, and TCV, Rover makes it easy to find and evaluate people willing to board dogs at a fraction of the cost of traditional kenneling operations. Rover also promises to attract dog-lovers, which will give consumers peace of mind when parting with their pets.

The company has built a reputation of providing quality services and only accepts 20% of applicants who register as a dog boarder or walker. Pet owners are highly satisfied with the service they receive, with 95% of services received a 5-star rating.

2. Supplies + Products

Over 60% of consumer spending on pets is towards purchasing supplies and food. Not surprisingly, some of the largest companies in the pet industry are food and supplies companies such as PetCo, Petsmart, Mars Petcare and Nestle Purina.

Forgoing the traditional brick and mortal retail method, companies like Chewy and Bark & Co are tackling the pet supplies industry using digital technology and new forms of commerce to attract consumers. Founded in 2011, Chewy is an online retailer of over 30,000 pet food and products and logged over $900 million of revenue in 2016. Petsmart acquired Chewy for $3.4 billion in August 2017 in an effort to build out the companies digital platform to complement its retail stores.

Bark & Co’s flagship product is the BarkBox, a subscription service that sends pet owners a monthly delivery of dog toys and treats. Since the company’s launch of BarkBox in 2012, Bark has launched a line of toys and an e-commerce website for dog owners. Today, Bark has shipped over 10 million BarkBoxes, and the company has raised $82 million from investors including 500 Startups Polaris Partners, RRE Ventures, and Lerer Hippeau.

Another group of companies in Pet Tech are focused on creating smart hardware products to allow owners to better interact with and monitor parts from away. Whistle, founded in 2012, creates a small device that allows owners to monitor a pet’s whereabouts and health from a mobile app. The company was acquired by Mars Petcare in 2016 for $117 million. Petzila and Petcube both create camera products to allow owners to interact with pets remotely.

Capitalizing on the “Pets are People” trend, increasingly, Pet Tech companies are focused on creating human-grade pet products to allow owners to have peace of mind in know their pets are ingesting the highest quality food and treats.

3. Veterinary & Pet Health

Net Promoter Scores (NPS) have become the gold standard for customer loyalty as they get to the heart of how passionate customers are for a product or service. An analogous proxy for how much people love their pets is a survey that asks dog and cat owners how much money they would spend to save their pet’s life. Interestingly, 61% would spend between $100 and $1000, and 25% would spend over $1000.

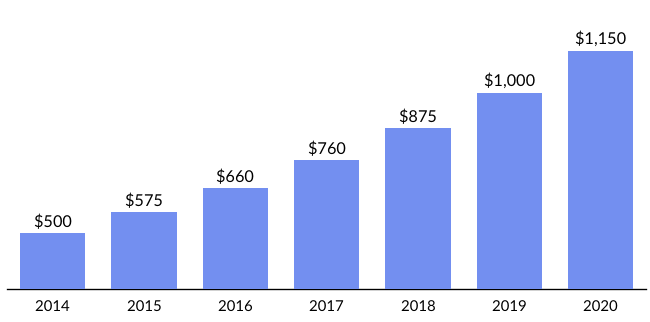

The North American Pet Health Insurance Association estimates that less than 1% of the nearly 180 million cats and dogs in the United States are currently insured. Beyond the logic of pet insurance for owners, the market opportunity for this industry is staggering. The few animals that are insured, for example, generated nearly $500M in annual premiums in 2013.

Today, there’s emerged a group of Pet Tech startups focused on providing services to owners to allow to them more easily access care.

Founded in 2010, Vets First Choice provides veterinary practices with digital tools like an online pharmacy and delivery service to allow them to optimize their practices and personalize engagement with customers. The company has raised $286 million from investors including Sequoia Capital, Wellington, Hillhouse, Clayton, Dubilier & Rice, and Polaris Partners. This April, Vets First Choice announced its merger with an animal health spin-off from Harry Schein to create a comprehensive veterinary care and services platform.

Chinese venture capital firm Hillhouse Capital Group, an investor in Vets First Choice, has acquired more than 500 veterinary clinics in an effort to build and run one of the largest animal health groups in China. According to the Information, the firm has reportedly spent $475 million on clinics. As pet ownership and spend continues to accelerate in China — pet care spending is expected to triple by 2022 — Hillhouse is positioning themselves at the center of the megatrend to capitalize on the surge of the pet health industry.

WHAT’S NEXT

We’ve already seen the “Pets Are People” trend proliferate and lead to the creation of a crop of companies focused on providing human-grade products for pets. Looking forward, the “Pets Are People” trend will continue to grow as pet owners seek to provide the best comfort, experience and products for their furry friends.