Market Snapshot

| Indices | Week | YTD |

|---|

Technology and travel have throughout history been inextricably linked to the wealth, sovereignty, and power of nations. China’s invention of the compass in 1044 was a key reason why the Middle Kingdom was a major power for five hundred years. Portugal’s invention of the technologically advanced Caravel ship in the 15th century enabled the tiny nation to rule the seas, effectively controlling global commerce, travel, and power politics for a hundred years.

Orville and Wilbur Wright sparked the beginning of the Aviation Era on December 17th, 1903 — which ultimately meant that if a nation could control the airspace above a country, it could also control what was on the ground.

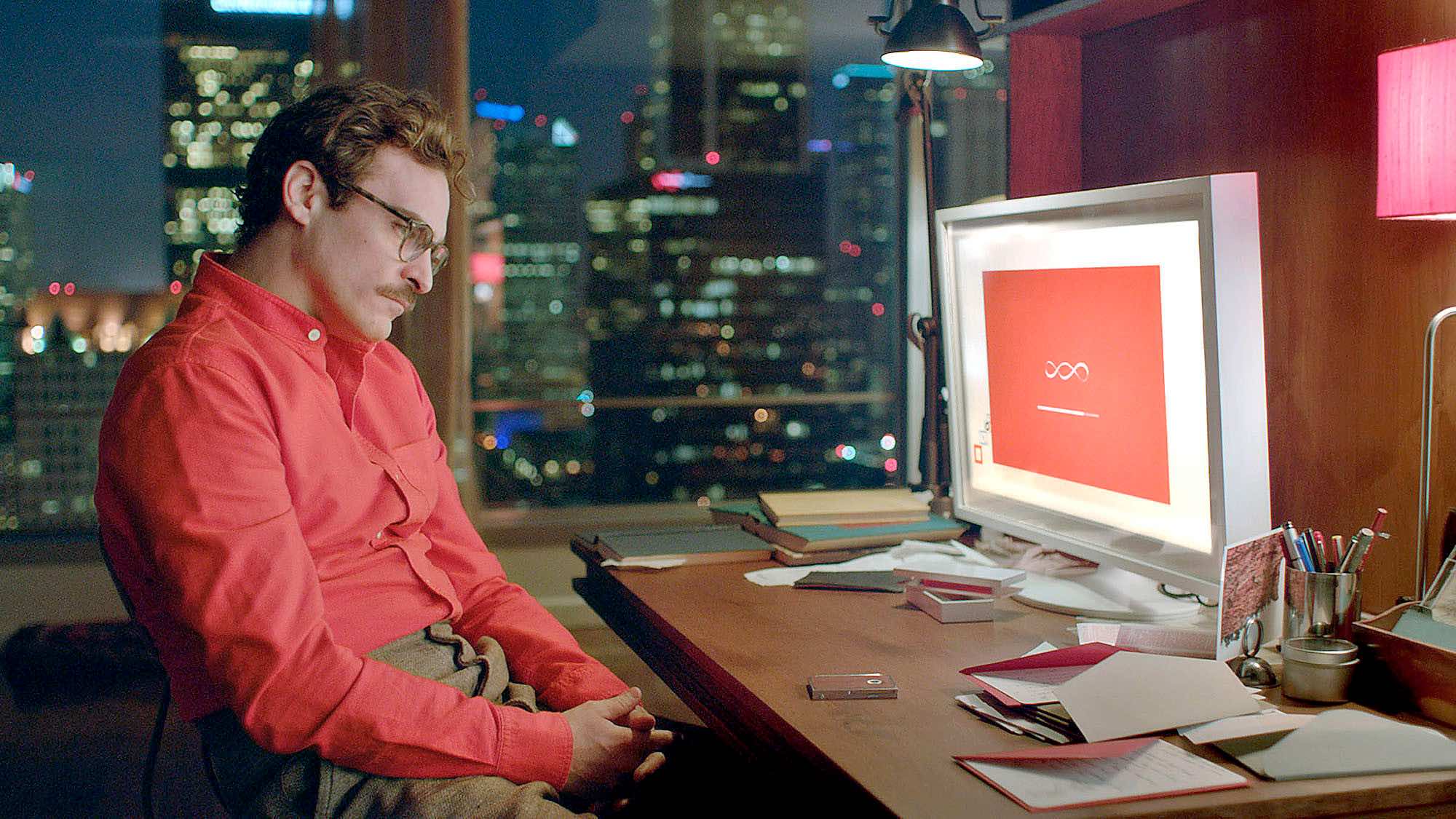

The next frontier for the wealth, sovereignty, and power of nations is now outer space, with spoils going to the new “Masters of the Universe”.

STATE OF PLAY: SPACE

Until recently, the rule with rockets has been that what goes up usually comes down in pieces. The cost of getting anything into orbit — from satellites to people and supplies — has routinely cost upwards of $250 million per launch because expensive rockets are used once before falling from the sky like confetti. It would be like having a commercial aviation industry where planes were flown once and then discarded — not exactly cost efficient or scalable.

Elon Musk’s SpaceX and Jeff Bezos-backed Blue Origin are shattering the old paradigm by making rocket reusability a reality. In April, Blue Origin successfully landed its New Shepard rocket, its third successful test flight in less than five months. This week, SpaceX landed a rocket on a robotic barge nicknamed “Of Course I Still Love You” off the coast of Florida, its second successful landing in five weeks.

The personal computer paved the way for a new category of software companies. Affordable computing infrastructure like Amazon Web Services (AWS) spawned scores of cloud applications. Today, reusable rockets are poised to drive down cost and catalyze a variety of space applications — from travel to satellite-enabled logistics, business intelligence, and security.

To date, global Space innovation has effectively existed as a closed platform built on funding from government agencies — headlined by NASA, which spends roughly $43 billion per year on a variety of initiatives. The net result is that a small ecosystem of multi-billion dollar aerospace companies has become a fixture, subsisting for decades on government contracts.

Companies like Boeing, Lockheed Martin, and Airbus — together commanding more than $200 billion in market value — provide a full range of services to get people, satellites, and supplies into Space.

A key inflection point for the Space industry came in 2012, when the SpaceX Dragon became the first commercial spacecraft to visit the International Space Station (ISS). It signaled that Space was open for innovation and that SpaceX was more than just an expensive hobby for CEO Elon Musk.

Musk has grabbed headlines with a commitment to colonize Mars in his lifetime, suggesting recently that the company would target sending a spaceship to the Red Planet as early as 2018. He has even enlisted the services of Jose Fernandez — the acclaimed costume designer for superhero movie franchises including Batman and Captain America — to design “stylish and heroic” spacesuits for the company’s astronauts.

But the company has moved beyond capturing the World’s imagination. With a $1 billion 2015 Series E financing in the rearview mirror, led by investors including Google, Fidelity, Founders Fund, Draper Fisher Jurvetson (DFJ), and others, SpaceX is the lead architect of a new platform for Space innovation. Accelerated innovation, entrepreneurial activity, and investment opportunities will follow.

PIONEERS: KEY COMPANIES AND PEOPLE

Next-generation satellite launch and management platforms like Vulcan Capital backed Spaceflight Industries are making it more efficient and affordable for companies to place satellites into orbit. Accion Systems is re-imaging the satellite altogether with advanced components that enable the creation and deployment of Nanosatellites, or “Nanosats”. Ranging from the size of a shoebox to a refrigerator, Nanosats are significantly smaller and affordable than traditional satellites.

As James Crawford, the founder and CEO of satellite imaging startup Orbital Insight observed, “In the old days, when satellites were like mainframes, incredibly expensive, if you managed to get an image, you probably spent $10,000 on them.” New satellite technology fundamentals, coupled with declining costs for computing power and data storage, have changed the paradigm.

In the next twelve months, Planet Labs will have deployed 150 Nanosats (“Doves” in Planet Labs vernacular), the largest fleet of Earth imaging satellites in the market — among private companies and government agencies alike.

But small satellites are only part of the equation. Planet Labs, which produced the first set of daily, global earth images, is generating 370,000 images and 11 terabytes of data per day.

The applications for new troves of imaging information from Space are wide-ranging. Weather services can utilize sensors on Nanosats to gather better data and provide a clearer picture of climate patterns. Governments agencies can analyze imagery to monitor deforestation and environmental impact over time. Companies like Spire are dramatically improving global supply chain management by using satellite imaging to eradicate the “data dead zones” that exist across the Earth’s oceans. Until recently, it was possible to track a UPS truck to a city block, but cargo ships carrying millions of dollars worth of goods remained elusive. Spire is changing that.

Data from space will continue to diffuse into broader industries. Investors, for example, can monitor traffic to key retailers as a leading indicator for financial performance. Based on a million satellite images Orbital Insight conducted a historical analysis on cars in the parking lots of Ross Stores, which successfully forecasted the retailer’s better-than-expected quarterly performance. The list goes on.

As entrepreneurs continue to apply new ideas and technologies to Space, we expect a drumbeat of game-changing businesses to emerge. Companies such as Planetary Resources and Deep Space Industries are developing the capability to mine resources from asteroids. In the future, minerals and water mined from near earth objects could directly supply the new Space economy without having to spend $10,000 per pound to launch resources into low Earth orbit and beyond.

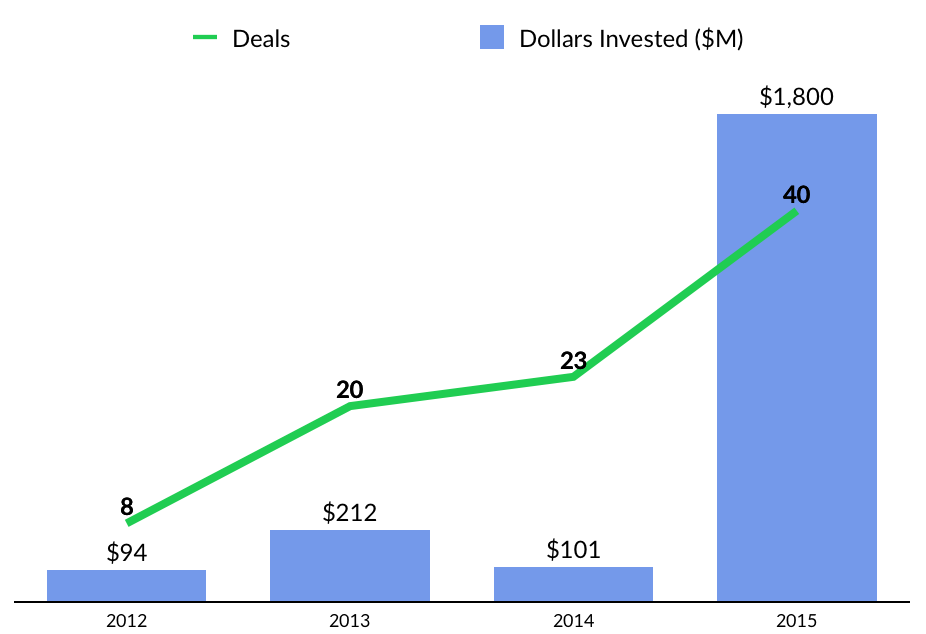

INVESTMENT ACTIVITY

Investors are taking notice. Steve Jurvetson (Managing Director, DFJ + Board Member at SpaceX and Tesla) has framed the opportunity this way:

Compared to other industries, I have never seen such an enormous margin for improvement. There’s this canonical thing about a startup needing to pitch a 10x improvement to be a worthwhile investment. You rarely see an entrepreneur pitch a 100x improvement. But in Space we’ve seen 1,000x, and really, we’ve seen 10,000x.

Many of the early headlines have centered on high-profile aerospace ventures from a billionaires club, including Jeff Bezos (Blue Origin), Richard Branson (Virgin Galactic), Elon Musk (SpaceX), and Paul Allen (Vulcan Aerospace). But Silicon Valley VCs are also betting big, pouring over $1.7 billion into Space-related companies in 2015 to date.

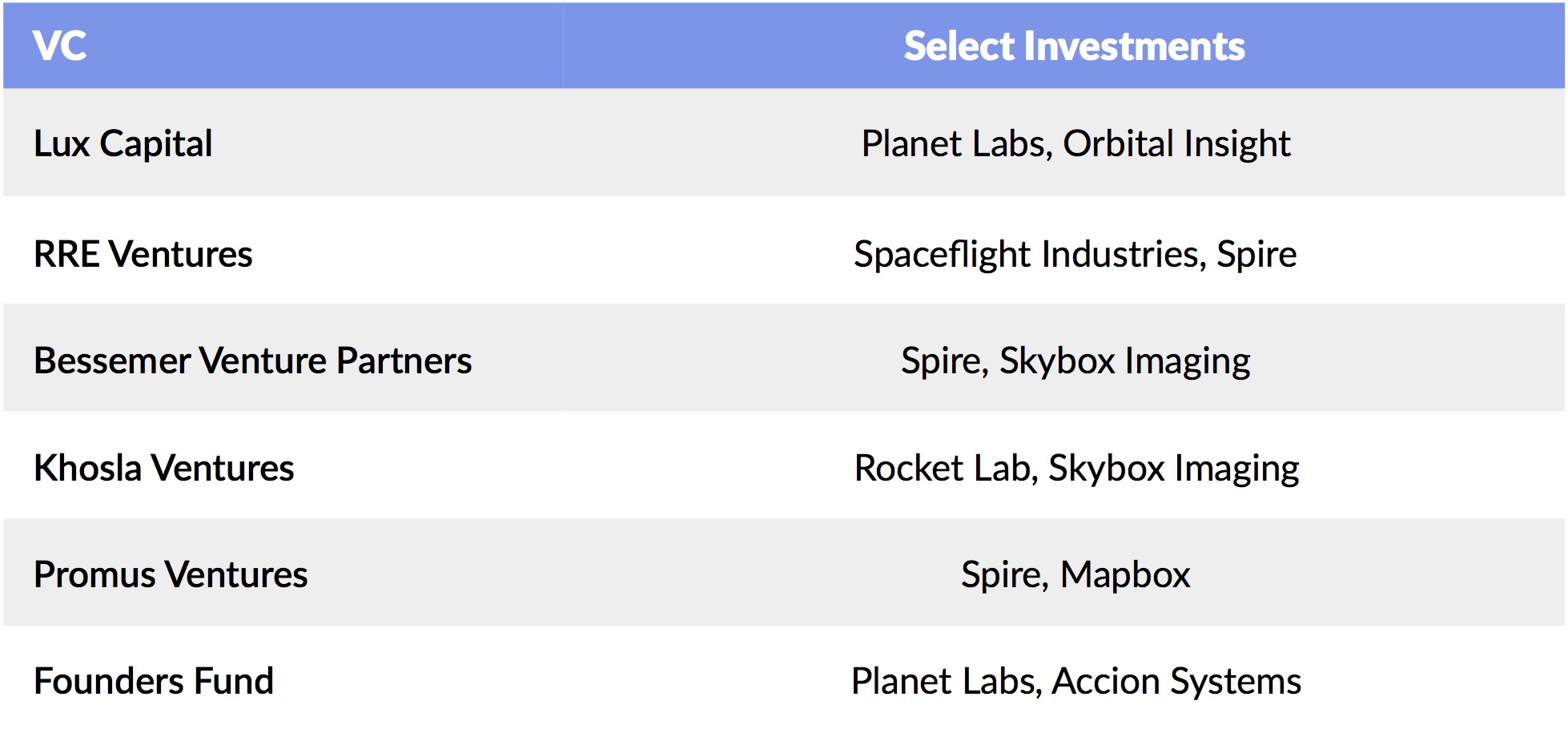

Although the venture ecosystem is nascent, early leaders are beginning to emerge. RRE Ventures, for example, has made multiple bets on innovative satellite services companies, including Spaceflight Industries (satellite launch services), Accion Systems (satellite propulsion), and Spire (satellite imaging for maritime) in the past year. Lux Capital joined both a $8.7M Series A for Orbital Insight (satellite imaging & software), as well as a $70M Series C for Planet Labs in 2015.

Ultimately, we are just beginning to sow the seeds of a much broader Space economy. A century ago, on January 1, 1914, the commercial aviation industry began with a single flight in Florida. Since then, commercial aviation has transformed the World in ways that were unimaginable then. Today, a generation of inventors and builders are looking to Space.

We’re headed to infinity and beyond.

—

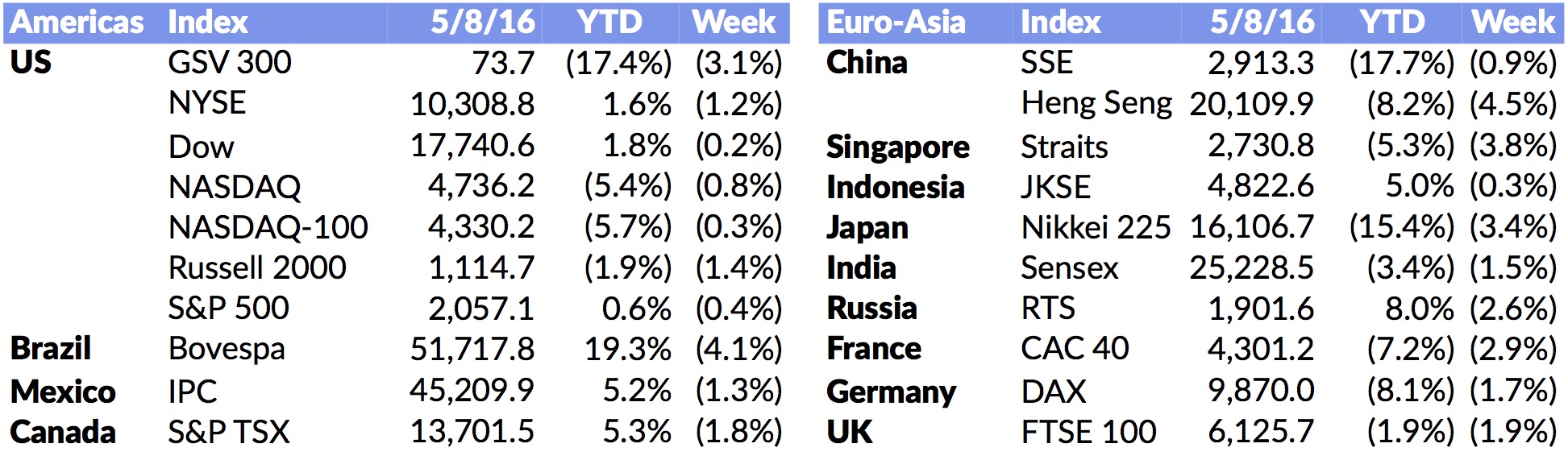

For the second week in a row, stocks fell, with NASDAQ down 0.8%, the S&P 500 falling 4%, and the Dow off 0.2%. The GSV 300 was down 3.1%. Sluggish U.S and Chinese economies were the concert du jour. The increasing likelihood of a President Trump or Clinton did not make the natives any less restless.

Job growth for April was a disappointing 160,000 increase. With nearly 90% of the S&P 500 having reported first quarter results, the average EPS fell 7.1%. More concerning were revenues that came in even softer than earnings.

There were two Biotech IPOs last week, with both pricing in range. Pop and performance were -8% and +22%, respectively. There are seven IPOs on deck this week including Acacia Communications, a Matrix Partners-backed company that provides low-power, high-speed interconnect modules for optical networks.

On the private financing front, Pivotal, an open source software development platform (“Platform-as-a-Service”), raised $253 million at a $2.8 billion valuation from Ford, Microsoft, EMC, VMware, and GE. Beyond its investment, Ford plans to use Pivotal’s platform to integrate advanced software into its automobiles.

Farfetch raised $110 million at a $1.5 billion valuation — up from $1 billion a year ago — from Temasek, and IDG. The London-based company partners with boutique fashion retailers to sell unique designer clothing and accessories at heavily discounted prices.

Age of Learning, the creator of the popular ABCMouse early learning app, was reported to have raised $150 million at a $1 billion valuation in 2015 from Iconiq. ABCMouse, which offers educational content for kids aged 2-8, recorded over $100M in revenue last year and was profitable. It has over 1 million subscribing families paying $7.95 per month.

China’s leading ride-sharing service Didi Kuaidi closed a $2 billion financing at a $25 billion valuation, raising $500 million more than originally planned. Israeli competitor Via is finalizing a $100 million financing. On a related front, ChargePoint, the world’s largest electric vehicle (EV) charging network with over 28,000 charging stations across the globe, raised $50 million from undisclosed investors.

Additionally noteworthy headlines from the ride-sharing industry included Uber’s reported partnership with Paytm and Alipay — the leading digital payment platforms in India and China respectively — to enable simple payment across 400 cities worldwide. Google and Chrysler announced that they will roll out self-driving minivans by end of the year. GM and Lyft will partner to test a fleet of self-driving Chevrolet Bolt electric taxis on public roads in the next 12 months. (Disclosure: GSV owns shares in Alphabet, Lyft)

It has been a challenging year so far for growth companies despite strong fundamentals and an overall environment of low growth — which should make rapidly growing businesses more attractive. We remain confident that over time, earnings growth drives enterprise value. Accordingly, we are very BULLISH on our opportunity to purchase the best growth companies at modest prices.