Market Snapshot

| Indices | Week | YTD |

|---|

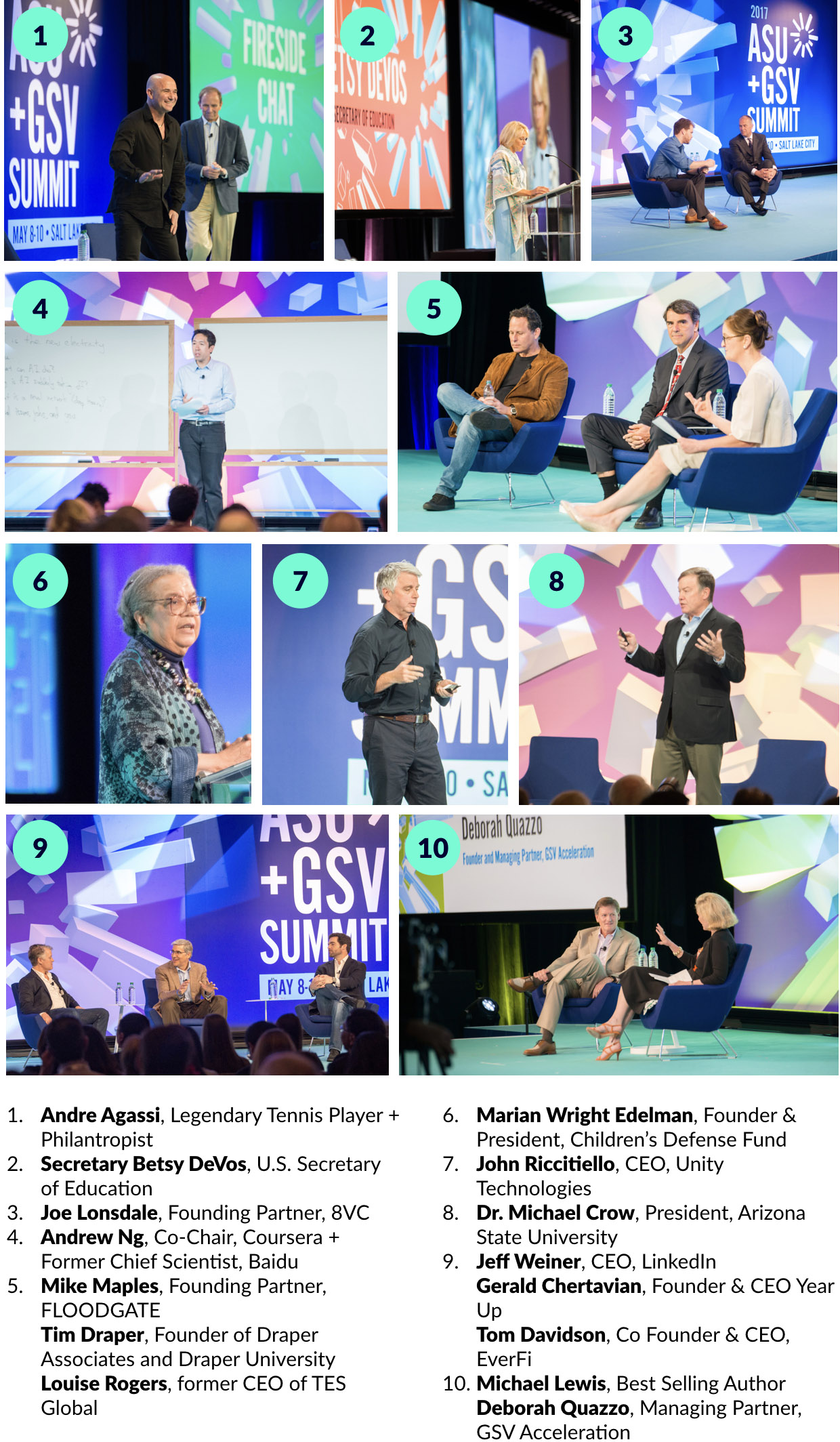

Last week we hosted the eighth annual ASU GSV Summit in Salt Lake City, a gathering of leaders from across the global innovation economy with the mission of accelerating exponential ideas in education and talent. We welcomed over 3,500 attendees from 40 countries, including 800 speakers and 400 presenting companies.

We all remember the Periodic Table of Elements from Chemistry 101. There are 118 unique elements, but the magic happens when you combine them. Two Hydrogens and one Oxygen makes water. Sodium and Chlorine makes salt.

The Summit has its own unique blend of elements — including entrepreneurs, educators, investors, business leaders, technologists, and philanthropists — colliding and combining to create change. Steve Jobs once said that, “the Macintosh turned out so well because the people working on it were musicians, artists, poets and historians – who also happened to be excellent computer scientists.”

As I observed in my opening night speech, that’s the animating idea behind the ASU GSV Summit.

The key “elements” of the 2017 Summit included speakers like LinkedIn CEO Jeff Weiner, civil rights and education leader Marian Wright Edelman, current U.S. Secretary of Education Betsy DeVos and former Secretary Arne Duncan, leading venture capitalists Mike Maples, Joe Lonsdale and Tim Draper, legendary tennis player and education entrepreneur Andre Agassi, acclaimed author Michael Lewis, and many others.

GRAVITATIONAL SHIFTS

This year we framed the Summit with the “gravitational shifts” that are shaping the future of education and talent. One key shift, which we’ve written about in recent weeks, is the acceleration of automation, digital disruption, and the global knowledge economy.

The rise of Amazon underscores this point. Amazon was launched in 1994 — the same year Marc Andreessen co-founded Netscape, effectively creating the Internet as we know it. Amazon started as a novel way to order books and it helped retailers like Target fulfill their fledgling online orders. At the time, Sears, once the most largest retailer in the world, had a $16 billion market value.

Today, Sears is worth $1 billion and it recently announced that it may have to file for bankruptcy to protect itself from creditors. Amazon is now worth over $450 billion. But it wasn’t just Sears that got steamrolled because it failed to capitalize on the digital tracks laid by companies like Netscape, and later Apple and Google.

Source: Yahoo Finance

*Peak Market Value 2006

As department stores hemorrhage market value, jobs are departing. In fact, retailers like Macy’s, Nordstrom, and JCPenney have shed over 100,000 jobs since October 2016.

To put that in perspective, that’s more than the total number of coal miners employed in the United States. The campaign trail rhetoric might evolve from the plight of the rust belt to the “fall of the mall” in 2020.

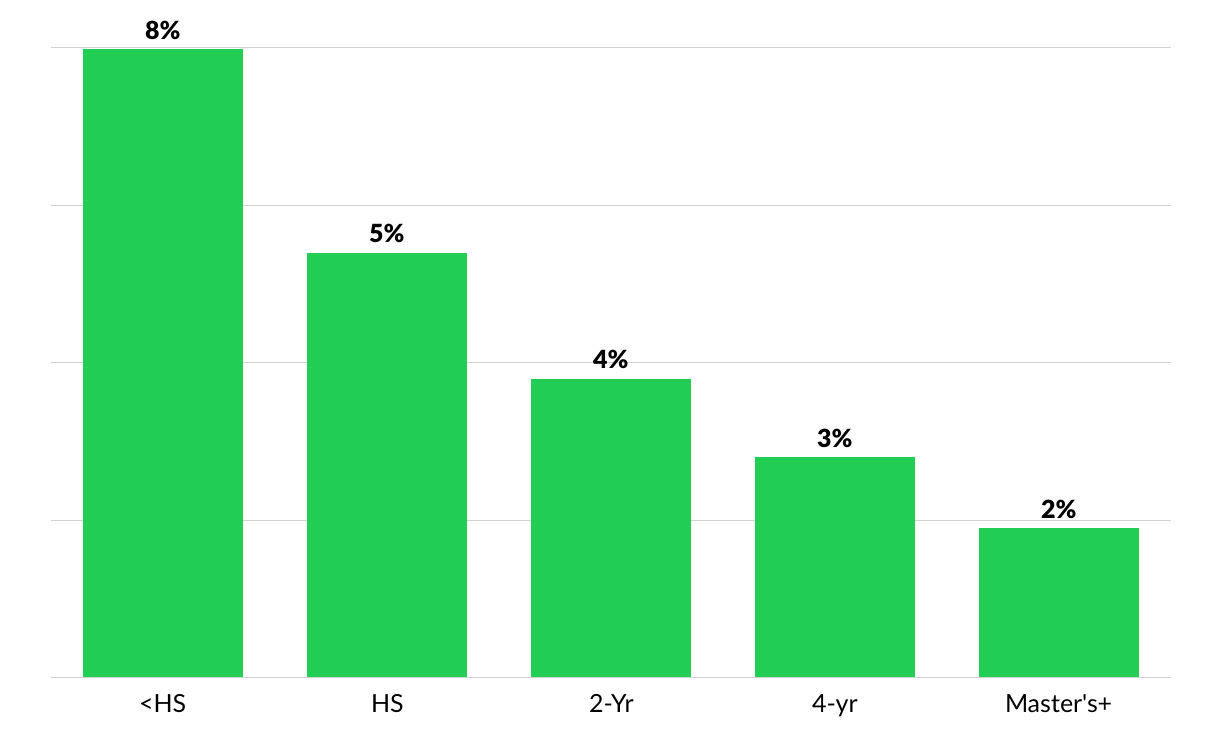

The good news is that the e-commerce sector has created 355,000 new jobs since 2007. But the bad news is that these new jobs are quickly being automated. Amazon already “employs” over 45,000 robots in its warehouses today. Chinese manufacturers, once famous for cheap labor, purchase over 90,000 industrial robots per year, a number that is projected to exceed 175,000 by 2020. All in all, there are over 350 million global manufacturing and warehouse workers whose jobs are vulnerable to automation.

Amazon’s digital assistant Alexa is a preview of what’s next. The company recently announced that Alexa now has over 12,000 distinct “skills” in her toolkit — up from 1,000 in June 2016. New “features” announced include whispering and pausing for emphasis. Soon, all jobs will be in play.

This isn’t the end of history. As sure as the sun rises in the East, automation will continue to eat jobs… but it doesn’t eat work. But increasingly, to participate in the future, people can no longer fill up their “knowledge tanks” until age 25 and then drive off through life. They will need to continuously learn from the moment they are born until the time they retire — if they ever retire at all.

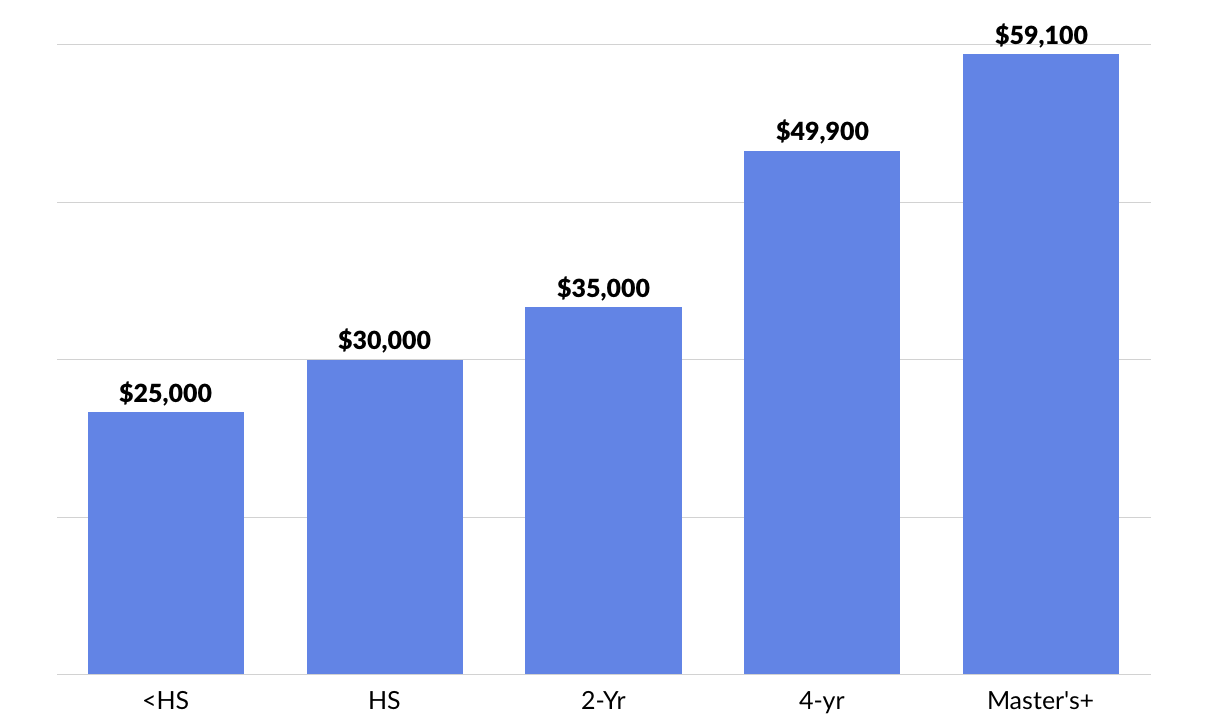

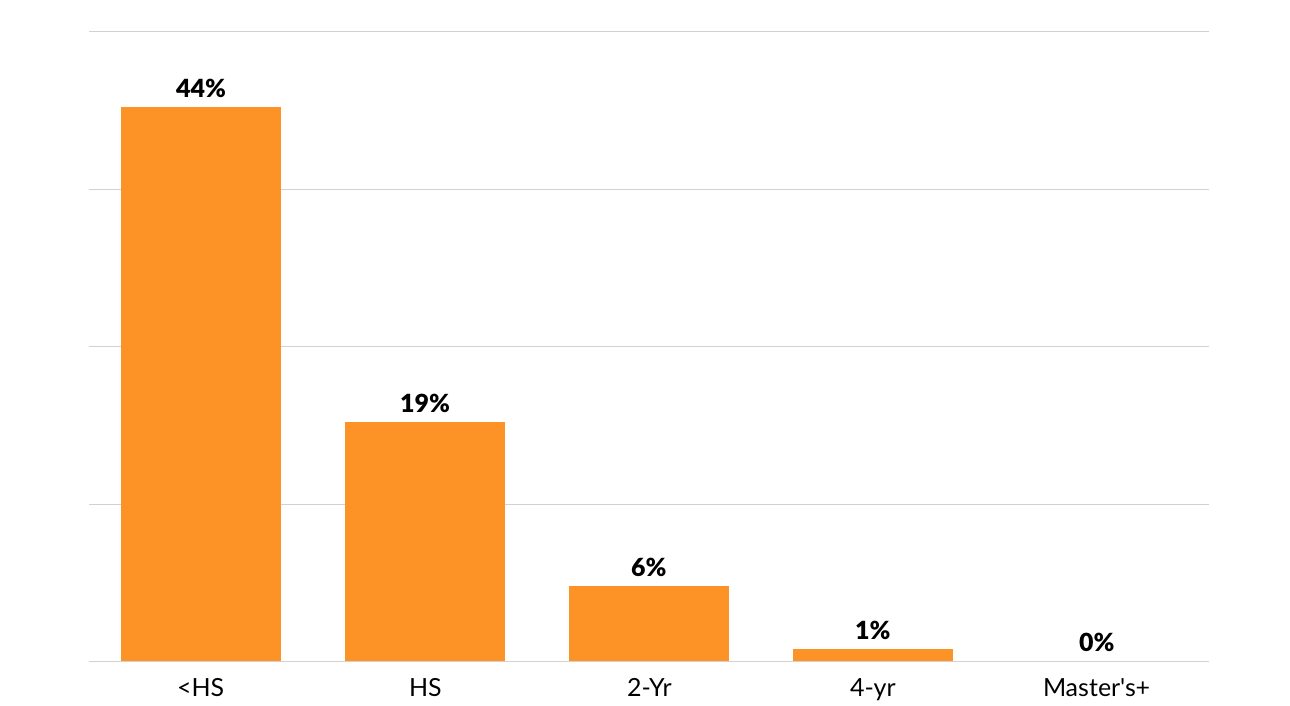

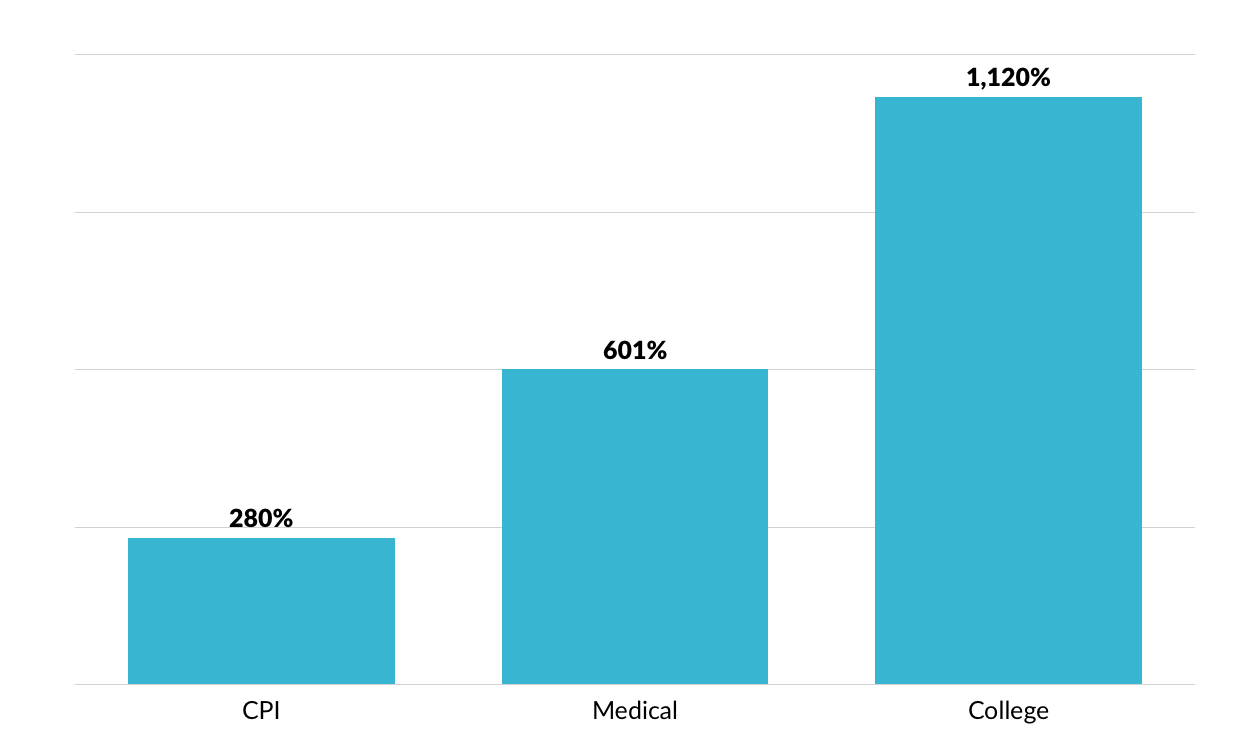

But the problem is that until recently, higher education — the gateway to more lucrative, stable employment — has required people to drop out of life and take on massive debt.

NETWORK EFFECTS

Network effects are created when every node added to a network creates exponential value, as opposed to linear value. The best network effects businesses are seamless and invisible.

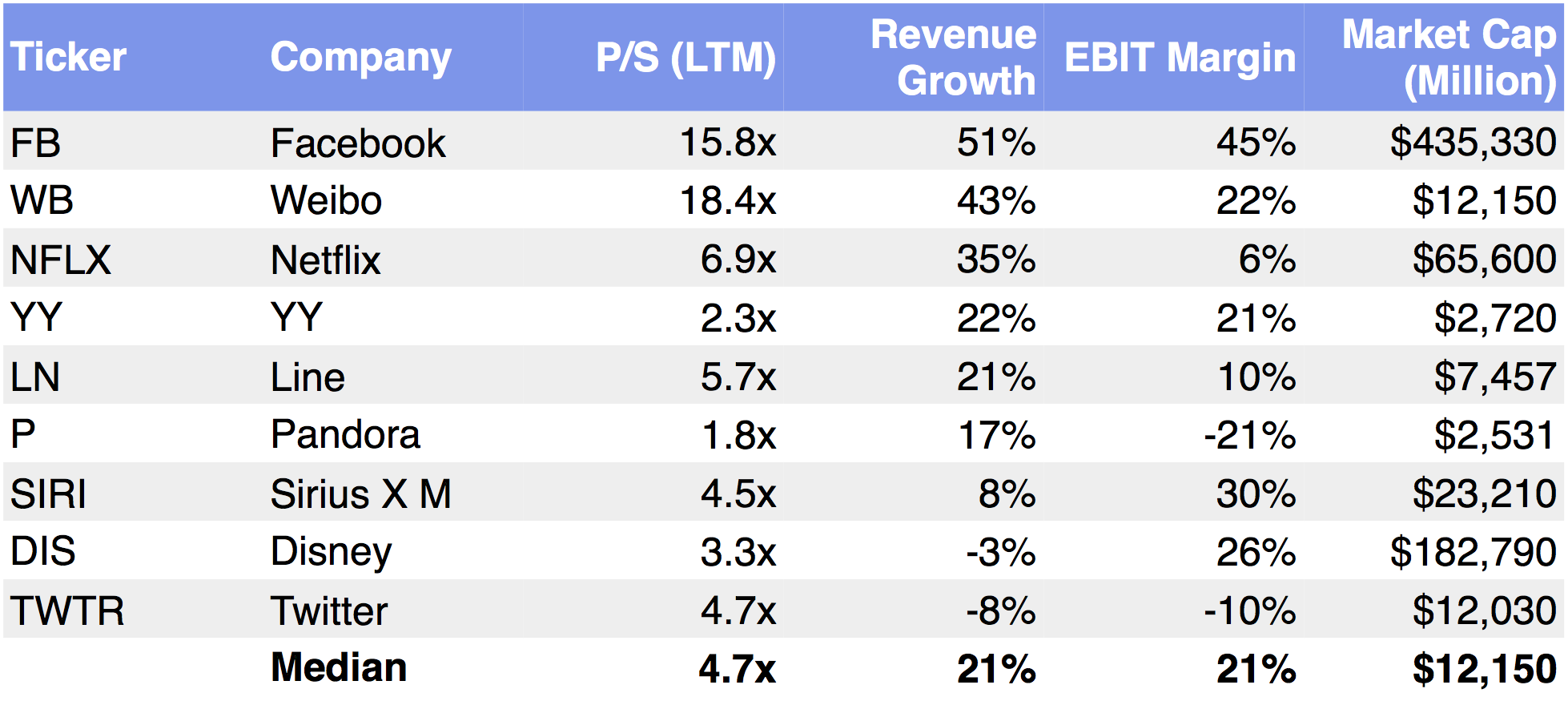

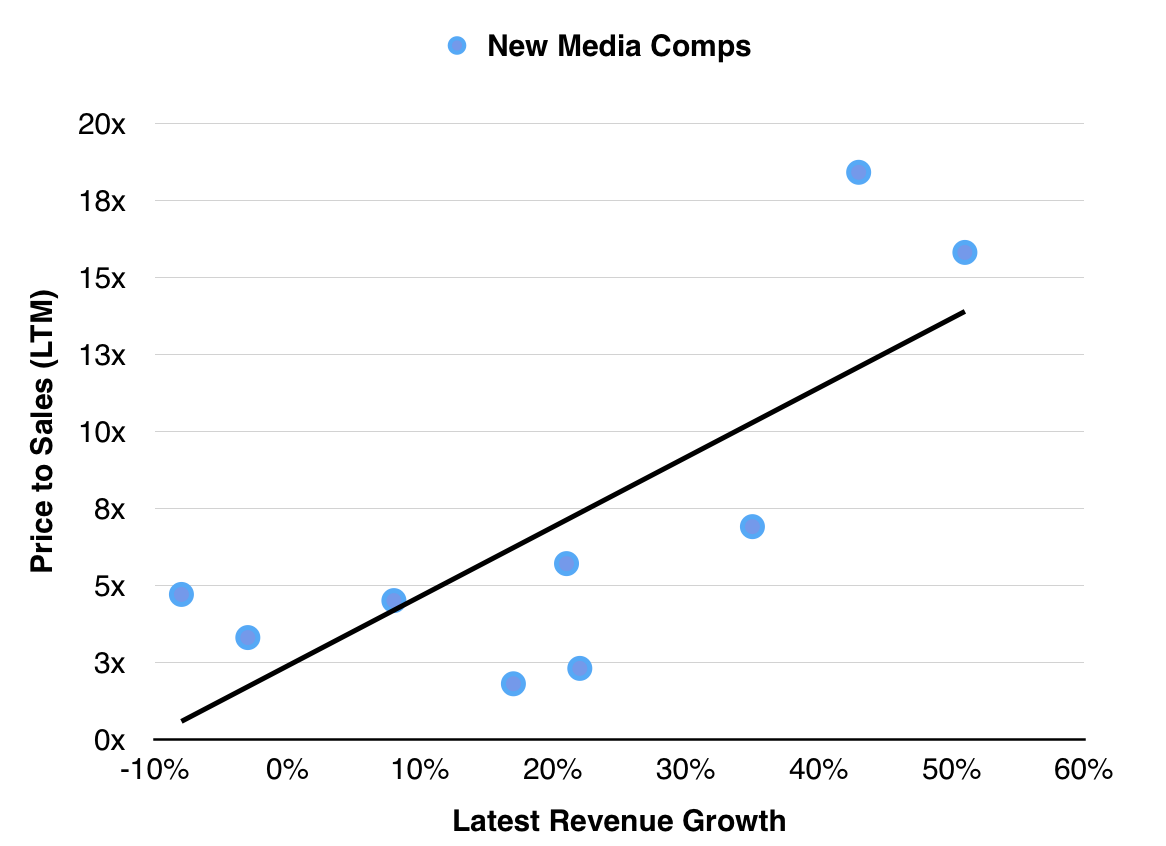

Facebook is a classic example. Every new member makes the experience more valuable for existing members and improves the platform’s data engine. Mark Zuckerberg has famously described this phenomenon as a “Social Graph.”

It has enabled Facebook to develop a new model for distributing information, recommendations, advertisements, and products. Instead of guessing what people want, Facebook can create a personalized experience for every user based on information gleaned from their network of relationships. As Facebook adds more and more people with more and more connections, the power of the platform grows exponentially.

We believe that network effects in education and talent connect people (supply side), learning opportunities, and employment (demand side). The issue is that only 35% of people have a college education while 65% of the jobs being created require one.

Effectively, we’re Networking Education and Talent to Work. NETwork effects are going to help a military veteran become a commercial banker by taking a Wharton course from Coursera…The college student that uses Chegg’s Student Graph to get a relevant internship… The mother who left the workforce to raise her family wants to get current, confident, and connected through Reboot… Companies like AT&T that are using tools like Udacity to re-tool their workforce of 100,000 people… The people across the African continent who are long on talent but short on opportunity that are learning how to code through Andela and finding employment with the most important technology companies in the World. (Disclosure: GSV owns shares in Coursera and Chegg)

2017 ASU GSV SUMMIT HIGHLIGHTS

Legendary tennis player Andre Agassi joined the Summit on the keynote stage in an interview with acclaimed sportscaster Ted Robinson, reflecting on the lessons he learned during his decorated tennis career and discussing the initiatives his foundation is undertaking in education.

WATCH REMARKS FROM ANDRE AGASSI HERE

Tennis Champion and Education Philanthropist/Entrepreneur Andre Agassi Interviewed by Sportscaster + Ted Robinson, the “Voice of the 49ers”

This year’s Lifetime Achievement Award winner, civil rights leader and education advocate Marian Wright Edelman, argued that the United States will destroy its future if it it continues to neglect underserved children.

WATCH REMARKS FROM LIFETIME ACHIEVEMENT AWARD WINNER MARIAN WRIGHT EDELMAN HERE

Secretary of Education Betsy DeVos reflected on the current administration’s education priorities in an interview with Jeanne Allen (Founder & CEO of the Center for Education Reform), a leading champion of school choice and education reform.

WATCH REMARKS FROM BETSY DEVOS HERE

U.S. Secretary of Education Betsy DeVos Interviewed by Jeanne Allen, Founder & CEO of the Center for Education Reform

LinkedIn CEO Jeff Weiner, Year Up CEO Gerald Chertavian, and EverFi CEO Tom Davidson discussed the future of education and talent in a panel titled “All Roads Lead to LinkedIn”.

WATCH REMARKS FROM JEFF WEINER HERE

LinkedIn CEO Jeff Weiner with Year Up CEO Gerald Chertavian, Interviewed by EverFi CEO Tom Davidson

Joe Lonsdale the founding partner of 8VC and co-founder of Palantir, discussed his vision for the future of work, big data, and smart enterprises. (Disclosure: GSV owns shares in Palantir)

WATCH REMARKS FROM JOE LONSDALE HERE

Midas List venture capitalists Tim Draper and Mike Maples discussed VC and accelerating innovation in education and talent in a fireside chat moderated by former TES Chairman and CEO Louise Rogers.

WATCH REMARKS FROM TIM DRAPER + MIKE MAPLES HERE

Venture Capitalists Tim Draper and Mike Maples interviewed by Louise Rogers

Chegg CEO Dan Rosensweig explored the new fundamentals driving broad scale disruption across the higher education landscape.

WATCH REMARKS FROM DAN ROSENSWEIG HERE

Arne Duncan, the former Secretary of Education and now Managing Director at Emerson Collective, Don Graham, the Chairman of Graham Holdings and Jim Shelton, the President for Education at the Chan Zuckerberg Initiative discussed bridging D.C education and talent policy to emerging innovation.

WATCH REMARKS FROM ARNE DUNCAN, DON GRAHAM AND JIM SHELTON HERE

Other Highlights from the GSV team

- Suzee Han moderates a panel on Global Millennials — what makes the future leaders of tomorrow tick? (view HERE)

- Luben Pampoulov moderates a panel on mEDia — What implications do media models have for the future of learning? (view HERE)

76503.png)