Market Snapshot

| Indices | Week | YTD |

|---|

In 2001, Apple launched a marketing campaign for its new line of iBook computers with the slogan, “Rip, Mix, Burn.” The implication was that with the machine’s next generation optical drive, users could copy CD music albums onto their computer (“Rip”), assemble their own playlists (“Mix”), and then create new personalized CDs (“Burn”).

Record labels revolted. It was a blatant invitation to pirate music. When the first iPod was released shortly thereafter — a device that eliminated the need to “Burn” anything — Apple included a wry warning on the box: “Don’t steal music.”

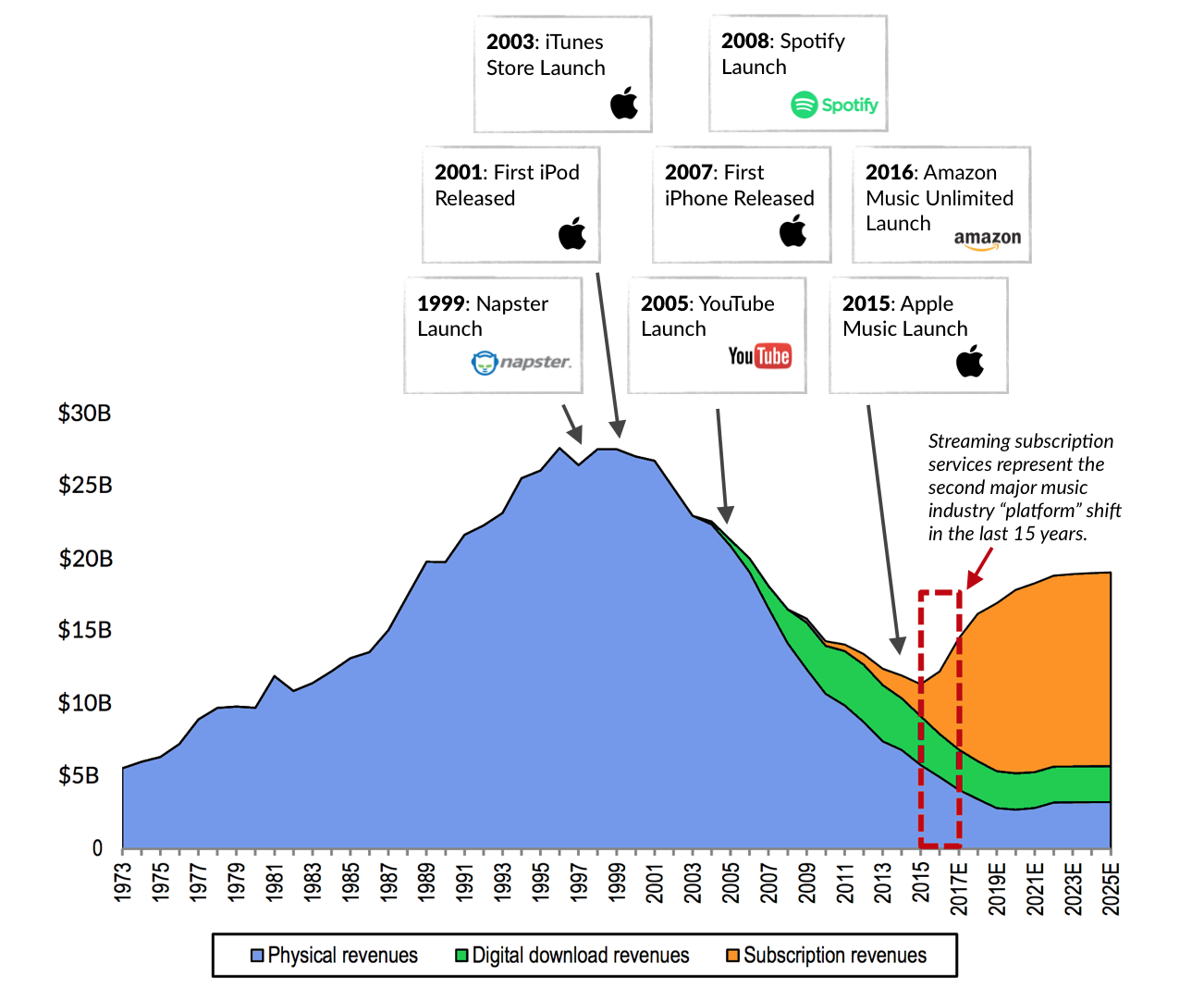

Two years later, Apple launched the iTunes store. Combined with the iPod, it eliminated the need to copy or burn anything. It was the dawn of an age of digital music. When iTunes arrived in 2003, U.S. CD sales stood at $12 billion. Last year they were just $1.5 billion.

Digital music also meant personalized music as listeners were no longer beholden to purchasing an entire album — bad news for the bottom line of artists and labels. The burgeoning digital segment did little to offset the nosedive in physical album sales. But in recent years, the picture has gotten rosier for the music industry, which last year recorded its first twelve months of growth since 1998. Did we hit rock bottom? Maybe. But another innovation shift is catalyzing growth.

PLATFORM SHIFT: FROM PHYSICAL TO DIGITAL DOWNLOAD TO SUBSCRIPTION

Streaming platforms like Spotify, Pandora, and Apple Music, which generate revenue from advertising and subscription fees, have effectively gone from a standing start in 2008 to generating $2.9 billion in 2015. Since its launch that year, Spotify has seen its user base grow from zero to over 100 million, with more than 40 million paying subscribers. (Disclosure: GSV owns shares in Spotify)

What’s remarkable is that the rise of streaming platforms marks the second major platform shift for music in the last 15 years. Today, streaming accounts for 61% of digital music revenue, up from 45% a year ago. Downloading music is already going the way of the CD.

LEADERS & LAGGARDS

Apple’s iTunes disrupted the music industry by “unbundling” albums, enabling people to pick and choose songs to create their music portfolio. Combined with its highly popular iPod, Apple became a dominant force in music for the rest of the decade.

But in 2008, when Daniel Ek and Martin Lorentzon launched Spotify’s on-demand streaming service, a new disruptive force emerged. Instead of “owning” music, Spotify enabled people to access a massive catalog of music on demand through a superior user experience.

In 2015, CEO Daniel Ek revealed that more than 50% of Spotifiers are under the age of 27. Remarkably and impressively, given the young demographic, subscribers are faithful and the churn is tiny — 70% of the 2010 subscriber cohort still gladly pays the monthly subscription fee — college kids would rather have their electricity shut off than their Spotify account.

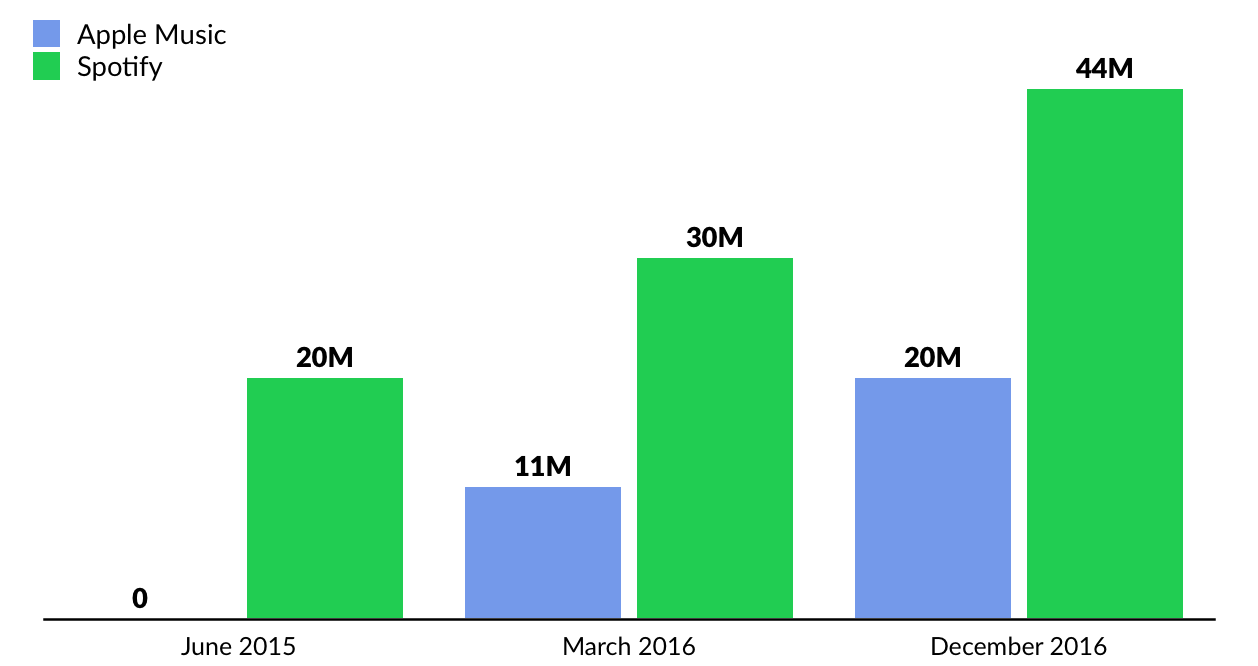

Not surprisingly, in 2015 Apple struck back with its own streaming service, Apple Music, on the heels of a $3 billion acquisition of the popular headphones-maker, Beats. Drawing on a 900 million-member iTunes user base, coupled with a massive marketing campaign, Apple Music has taken off well.

It just surpassed 20 million paying users, but growth has already begun to decelerate. Today, it’s expanding at roughly the same pace as Spotify, however the latter is over twice the size. And once users expend the 3-month free trial period on Apple Music, they appear to be churning out quickly.

Over the last six months, Spotify added 10 million paying users, while Apple Music only added six. Spotify appears to be distancing itself at the top, remaining the clear leader in the on-demand music category. Today, it’s valued at $8.5 billion.

*Monthly Active Users (MAU)

Meanwhile, Pandora, which launched in 2004, is struggling and losing market share. Largely known as a radio-shuffling app (users can’t control the songs that are played) generating advertising revenue, it recently announced the launch of a $5/month streaming service called “Pandora Plus.”

But the new service is unlikely to be a viable alternative to Spotify or Apple Music. It enables users to “skip” more songs they don’t like, replay others, and in some cases, to listen to music offline. This isn’t even table stakes in an environment where users expect unlimited song choices.

In the third quarter of 2016, Pandora’s active listener base decreased 1% to 78 million, continuing a deceleration trend. Subscription revenue, which makes up only 16% of its business, was up a mere 1%.

*Monthly Active Users (MAU)

Jay Z’s Tidal is struggling too. The company generated $47 million in revenue in 2015, up 30% year-over-year. But net losses doubled to $28 million, according to filings from its parent company Aspire AB. A very different story than Spotify’s +80% revenue growth last year, and +67% current, annualized, paid user growth.

Emerging Platforms

A new music player to watch out for is Amazon. Continuing its aggressive investment in digital media, the company recently launched Amazon Music Unlimited, an on-demand music service comparable to Spotify and Apple Music, costing the same $10 per month (or $7 per month for Amazon Prime members).

Earlier this summer, Amazon also launched its personal assistant device, Amazon Echo (better known as Alexa — Echo’s inner voice). It is projected to sell nine million units in 2016, climbing to 40 million units by 2020. Not surprisingly, Amazon is offering discounted music platform subscriptions to Echo owners.

As with all emerging industries, China is poised to make a massive dent in streaming music in the coming years.

Ever heard of Kugou, Kuwo, or QQ Music? These are China’s leading music platforms. Kugou and Kuwo are owned by China Music Corp (CMC), and QQ Music is owned by Tencent. Earlier this year, Tencent bought a controlling, 60% stake in CMC, valuing the business at $2.7 billion. Tencent is now planning to combine the three businesses into one, a subsidiary that will reportedly be valued at over $6 billion.

Kugou is the largest mobile music service in China, with a 28% market share, followed by QQ Music’s 15%, and Kuwo’s 13%. Collectively, CMC and Tencent now reach 56% of the 450 million mobile music users in China. While it is more than twice Spotify’s global user base, the majority of music in China is unlicensed or pirated. Still, it will be a force to be reckoned with.

Inflection Point: Royalties

Royalty negotiations with major record labels continue to be a chess game. Spotify’s growth has impressed, but it still needs to turn a profit. While the company has demonstrated free cash flow in previous quarters, it will likely have its first profitable quarter next year. But the bigger question is how much it can improve economics vis-à-vis record labels.

So far, the record label Oligopoly has been giving up inches, not feet. Royalties remain close to 70%, and they only hand over 10-20% to the artists. In other words, out of every $100 of sales, the artist gets $10-20, Spotify gets $30, and the record company gets $50-60.

This imbalance remains ripe for disruption. But what is the right split?

The artist — the creator of the product — should be capturing the lion’s share of the revenue. For argument’s sake, let’s say that is up to $50 of every $100 generated. Spotify, as the distribution platform, should be getting $30, and the labels, who provide limited value-added services to the artists, should capture $20. This would put the music industry much more in line with leading sports leagues, where athletes only give up about 10-25% of their income to managers.

Given Spotify’s paid user growth in the 50-60% range this year, we expect it will grow its top line just above 50% (accounting for the launch of “family plans” that will decrease overall ARPU). In 2015, Spotify reported $2.2 billion in annual revenue, so it will likely finish 2016 at around $3.3 billion. After paying out royalties of close to 70%, that leaves the company with about $1 billion in gross profit.

Given Spotify’s software platform model, it would have significant operating leverage if royalties were to drop to 60% levels. In that scenario, EBIT margins could quickly go up to 20%. To get there, it’s a matter of time and game theory. The more powerful Spotify’s platform becomes, the more negotiating power it will have against record companies. Additionally, artists are increasingly finding alternative ways to promote themselves and record labels will have to lower their rates to stay competitive.

FROM MUSIC TO MUSICAL.LY

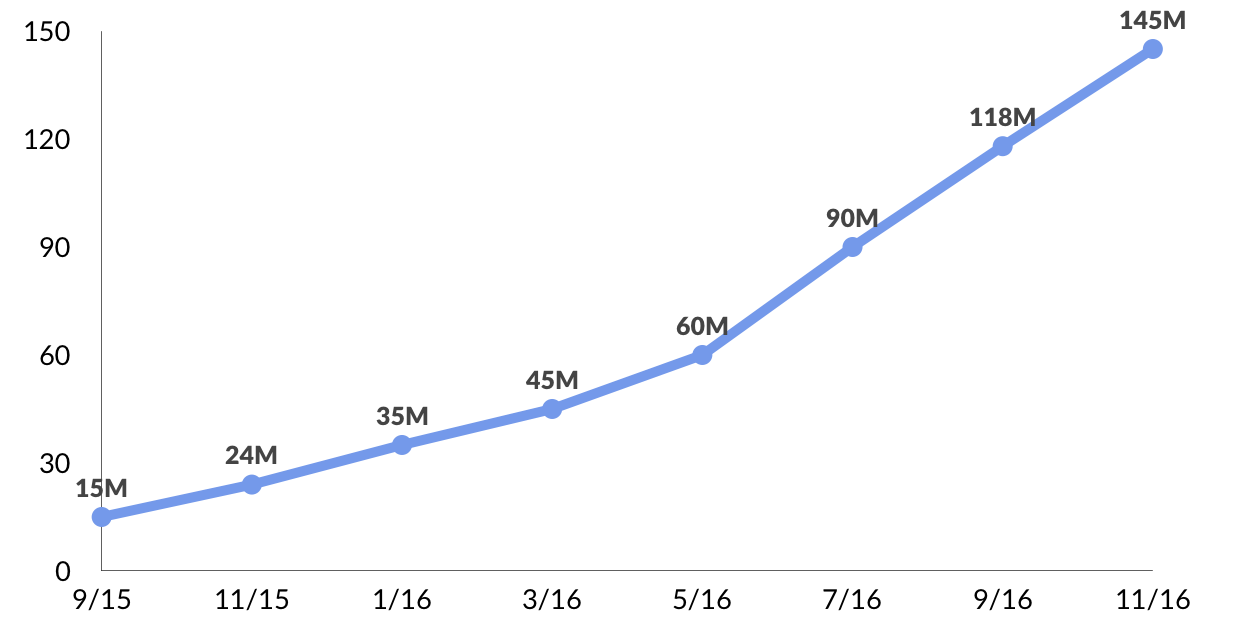

Meet musical.ly, the World’s fastest-growing social media and entertainment app, which is now used by half of all U.S. teens, according to company disclosures. It may be ushering in another wave of music innovation.

The app lets users broadcast 15-second clips of themselves lip-synching to hit songs with layered-on graphics, time lapses, and other “special effects.” It’s combining music and video in a distinct experience — think air guitars, dancing, and Snapchat filters all in one. (Disclosure: GSV owns shares in Snap)

Interestingly, while Snap’s (Snapchat) market value has been bolstered by a distinctly younger user base, musical.ly is moving even further upstream. A substantial majority of its users are between the ages of 10 and 20, and nearly three quarters are girls.

As with Snap, the age distribution is changing as the app manages to attract broader demographics. Six months ago, almost 90% of users were below the age 24. Today it is just over 60%.

Hugely popular in schools, musical.ly now counts over 140 million registered users, up from 10 million in September 2015. It is currently adding 13 million new users per month. What’s also impressive is that the app now has 40 million daily active users — which is about the same size as Pinterest. And about 25% of its DAUs are creating content and uploading one million songs per day. The estimated average time spent per day is around 15 minutes, on par with Instagram (15 minutes) or Whatsapp (25 minutes), but below Snapchat’s 30 minutes.

*GSV estimates based on public disclosures

The app is so popular that global stars like Selena Gomez, Ariana Grande, Shakira, and Jason Darulo are using it to connect with fans. It also serves as a platform for young artists to quickly create a brand. One of the most famous newcomers is Carson Lueders, 15, who has over three million followers on musical.ly. His managers Johnny Wright and Melinda Bell have helped the likes of N’Sync and Britney Spears launch their careers.

Another one is 14-year-old Ariel Martin, who was bored at her grandparents house when she saw a friend post a musical.ly video on Instagram. She quickly signed up and lip-synced to Niki Minaj’s “I’m legit.” Things took off immediately, and her success story put her on the map of the pop industry. Just a year later, she has become a top “Muser” with 15 million fans, and her musical.ly tutorial on YouTube has over 10 million views. Ariel has since signed several noteworthy brand deals, including the launch of a popular lipstick line.

Musical.ly has yet to turn on its monetization engine, but it is exploring a few compelling options:

- In May 2016, a promotion of Selena Gomez’s “Kill Em With Kindness” generated 1.3 million Muser clips. Later in the summer, musical.ly signed its first promotional deal with Warner Music, and then signed additional deals with all the other major labels. Its song catalog is growing, with over one million songs added today.

- In June, Coca-Cola launched its #ShareACoke campaign on musical.ly, which introduced a “User-Generated Ads” model.

- In August, musical.ly teamed up with MTV for a promotion tied to the Video Music Awards.

- In recent months, pop stars, including Selena Gomez, Ariana Grande, Meghan Trainor, and Jason Darulo, have been using the app to promote their newest singles.

In May this year, musical.ly reportedly raised $100 million at a $500 million valuation, and the app has hit the #1 spot on the App Store in 19 countries. It has consistently remained one of the top social media apps next to Snapchat and Instagram.

Interestingly, the company was initially launched as an education app called Cicada that featured short-form videos. But it failed to show meaningful traction and pivoted into music.

To diversify, musical.ly launched a separate live streaming video app in July. Called “Live.ly”, the app now counts over five million users. CEO Alex Zhu recently observed that videos with “lip-syncing” will increasingly be matched in volume with a range of content — from comedy, to sports and fashion.

Not surprisingly, Facebook’s Mark Zuckerberg remarked on a recent earnings call that musical.ly was on his radar.