Market Snapshot

| Indices | Week | YTD |

|---|

On November 8th, GSV Capital (NASDAQ: GSVC) announced its Third Quarter 2017 financial results. Please click here for GSVC’s official press release, which captures detail reflected in the update below.

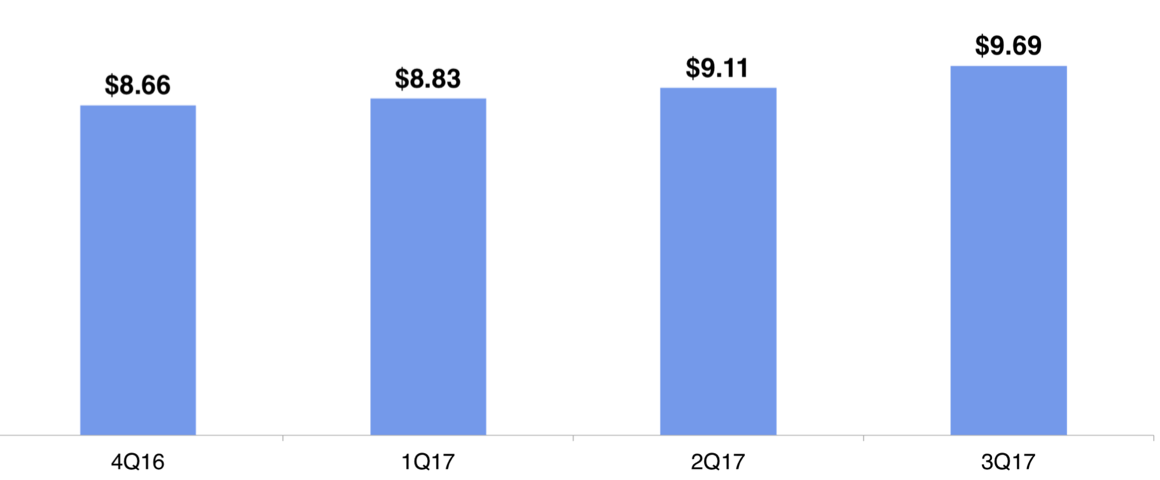

At the end of the Third Quarter, Net Assets totaled approximately $209 million, or $9.69 per share. This is up from approximately $202 million, or $9.11 per share at the end of the second quarter, and $192 million, or $8.66 per share at 2016 year end.

The GSV Capital team remains laser focused on specific, proactive steps to enhance shareholder value as we continue to concentrate the portfolio around blue chip, venture backed companies with a line of sight to an IPO or liquidity event.

- As part of ongoing expense reduction efforts, GSV Asset Management has agreed to voluntarily waive its management fee by 25 basis points in 2018. This is consistent with the fee waiver offered in 2017.

- On a related front, Management and the Board of Directors are reviewing GSV Capital’s incentive fee formula with the objective to better align shareholder and Management interests. We anticipate implementing a revised incentive fee formula prior to announcing our financial results for the fiscal year ending December 31, 2017.

- As of November 8th, 2017, GSV Capital has nearly completed the $5.0 million discretionary share repurchase program announced in conjunction with the company’s second quarter earnings report. GSV Capital’s Board of Directors has authorized an expansion of the repurchase program to an aggregate of $10.0 million and an extension through November 6th, 2018, whichever comes first.

- Finally, we are evaluating options to address GSV Capital’s convertible debt outstanding. This activity has been supported by liquidity from recently closed transactions, including shares sold in Chegg, Snap, and Spotify in the third quarter and subsequent to quarter end.

PORTFOLIO REVIEW

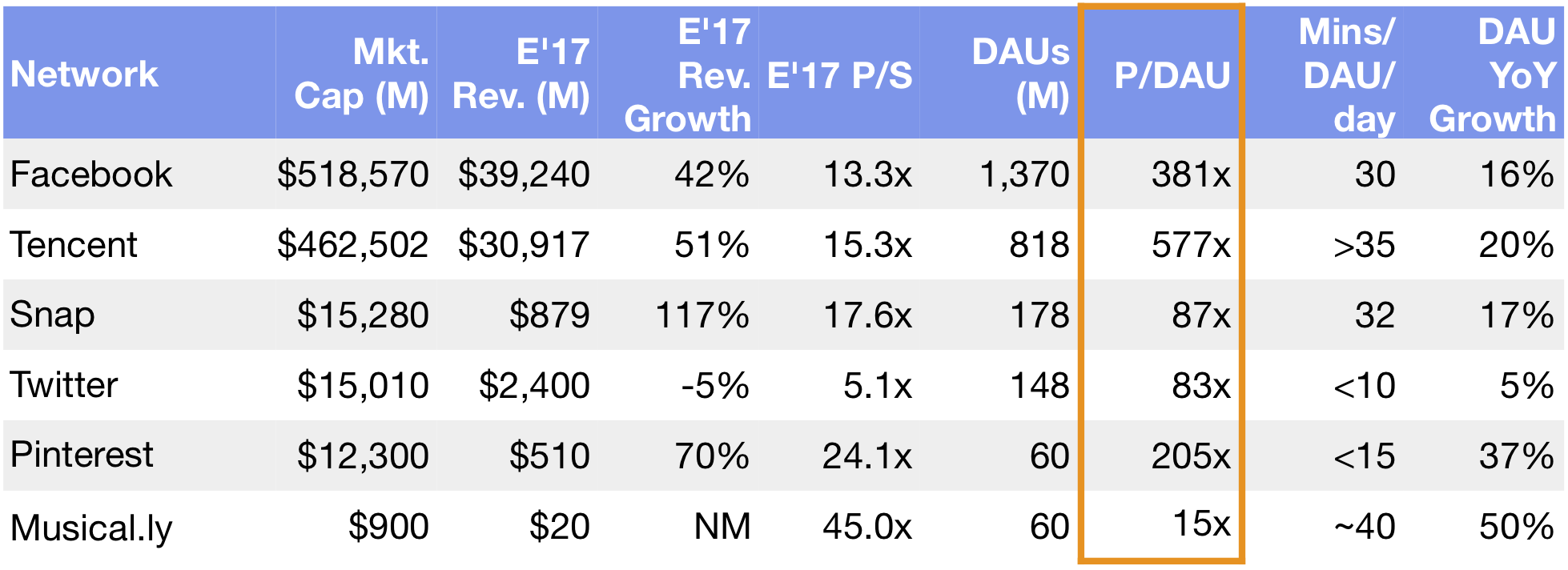

Of our five key investment themes, Cloud Computing and Big Data is the largest commitment, comprising approximately 36% of the total portfolio at fair value, excluding treasuries. Education Technology represents 34.5% of the portfolio, Social Mobile is 18.2%, Marketplaces is 10.8%, and Sustainability is approximately 1%.

As of September 30, 2017, there were 37 companies in our investment portfolio, compared with 46 a year ago. This reflects GSV Capital’s continued strategy of consolidating the portfolio around top positions and later stage companies.

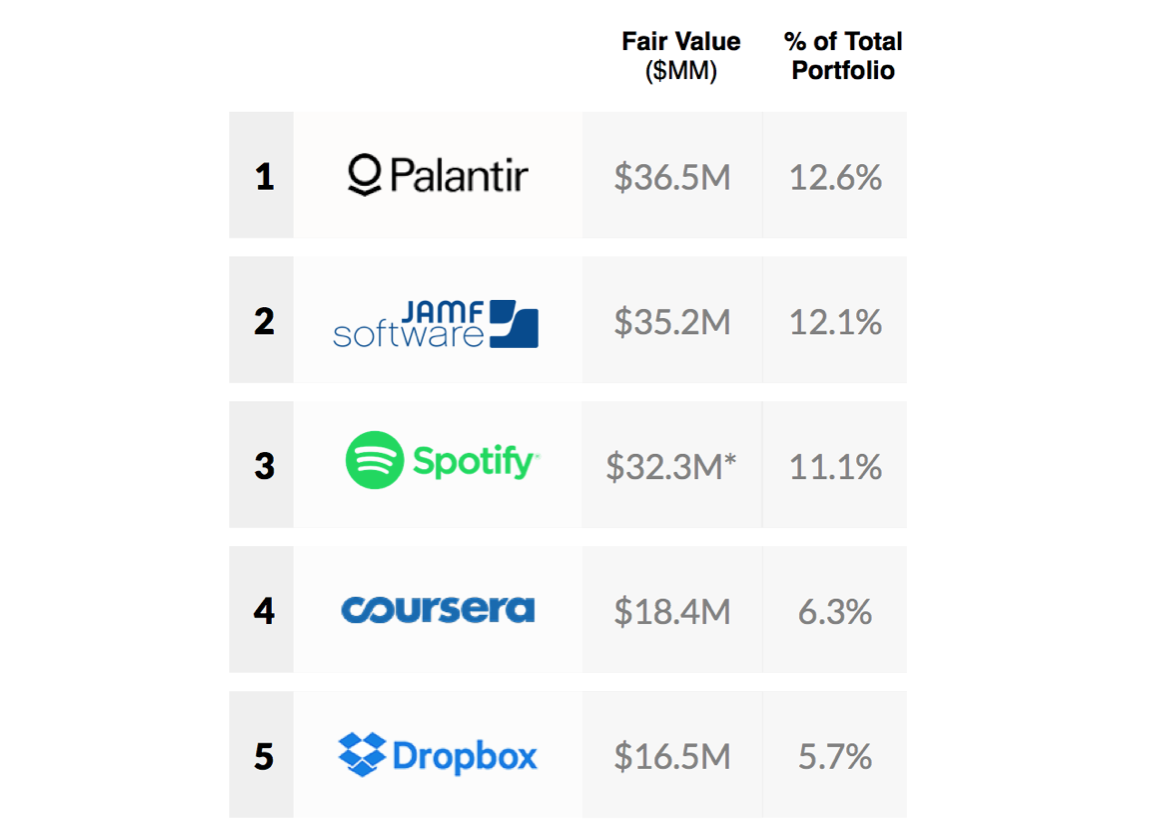

To emphasize this point, our top five positions — Palantir, JAMF, Spotify, Coursera, and Dropbox — account for approximately 48% of the total portfolio at fair value, excluding treasuries. By comparison, this approaches the weighting of the top 10 positions at the same time last year, which accounted for approximately 55% of the portfolio at fair value, excluding treasuries.

Historically, leading portfolio positions with a runway to an IPO or liquidity event have been a positive catalyst for our stock. In fact, GSV Capital traded at a premium to NAV in advance of high profile IPOs of Facebook and Twitter.

Our largest position continues to be Palantir, the disruptive big data, analytics, and security company that works with leading government, commercial, and non-profit institutions around the world. It accounts for approximately 13% of our total portfolio at fair value, excluding treasuries.

IDC estimates that Palantir operates in a sector that will grow from $150 billion in 2017 to over $210 billion in 2020. The company’s applications range from cyber security to capital markets intelligence, healthcare delivery, and defense. Importantly, while Palantir launched with a focus on large government contracts, CEO Alex Karp has indicated that corporate customers now represent over half of its revenue. Key clients include Airbus, AXA, Merck, BP, Deutsche Bank, and GlaxoSmithKline.

Source: GSV Capital

*Subsequent to third quarter-end, through November 8, 2017, GSVC sold 3,657 shares of Spotify at an average net share price of $3,800.00

Karp has suggested publicly that Palantir is positioned for an IPO, noting in February that he expects the company to be breakeven by the end of 2017. To date, Palantir has raised $1.9 billion of equity funding from syndicate of investors that includes Founders Fund, In-Q-Tel, and Tiger Global.

GSV’s second-largest position is JAMF, a pioneering enterprise IT management platform for Apple products. We are pleased to report that on October 11th the company announced a definitive agreement to be acquired by Vista Equity Partners, a leading private equity firm focused on software, data, and technology-enabled businesses. The transaction is expected to close in the Fourth Quarter of 2017.

While financial terms have not been disclosed, if completed, we believe the transaction will represent a return of approximately 3.5x on GSV Capital’s investment, which is reflected in our third quarter valuation. JAMF’s other primary backer is Summit Partners.

GSV’s third largest position is Spotify, the world’s leading music-streaming platform, which now counts well over 140 million users and 60 million paying subscribers across 60 international markets. To date, it has raised over $1.6 billion from a syndicate of investors, including Accel Partners, Founders Fund, Technology Crossover Ventures, and Goldman Sachs.

According to multiple reports, Spotify is considering a direct listing on the New York Stock Exchange in late 2017 or early 2018. At Third Quarter end, GSV Capital valued its position in the company at approximately $32 million, or 11% of the total portfolio at fair value, excluding treasuries. GSV’s Third Quarter valuation implies a value for Spotify of approximately $14 billion.

But we are seeing growing interest in the company as a potential listing approaches. On September 27th, Reuters and Forbes reported that private trades were valuing Spotify at about $16 billion. Since then, CNBC, Forbes, and Yahoo Finance have cited estimates that the company’s value could jump to $20 billion when it goes public.

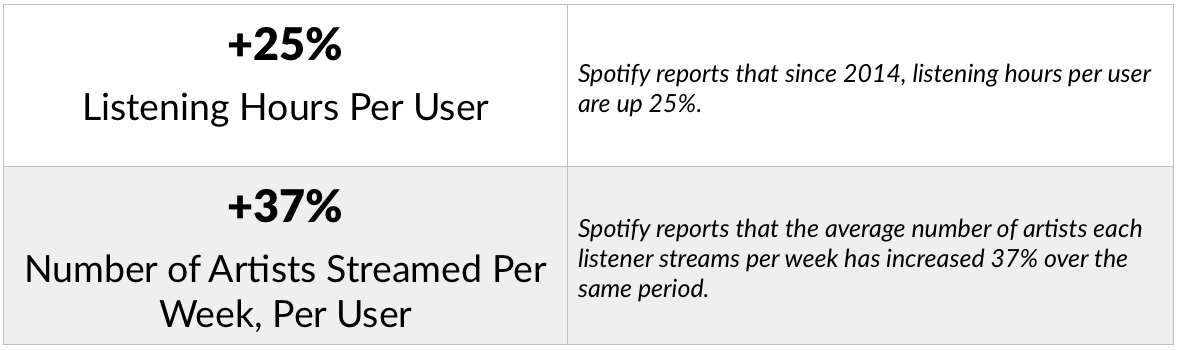

While we are pleased to see growing excitement around Spotify, the company’s long-term valuation growth has been driven by outstanding fundamentals. Spotify reports that since 2014, listening hours per user are up 25%, and the average number of artists each listener streams per week has increased 37% over the same period. In other words, not only are people spending more time on the platform, they are engaging with a broader range of content. It’s a double play.

Not coincidentally, since 2014, Spotify has invested heavily to improve its core technology, including an advanced recommendations engine powered by artificial intelligence that tees up new music people love.

At the same time, as the company continues to renegotiate royalty agreements with leading record labels — including a crucial deal signed with Warner Music Group in August — we are seeing a positive impact on gross margins.

The net result is that Spotify appears to be well positioned for long term, open-ended growth in a market that Goldman Sachs predicts will double to $12.3 billion by 2020.

GSV Capital’s fourth-largest position is Coursera, the world’s leading digital education platform. Today Coursera reaches over 25 million learners with more than 2,000 courses from 149 premier global universities, including Stanford, Yale, Princeton, the University of Pennsylvania, Peking University, and others.

On the one hand, Coursera is capitalizing on new technology fundamentals that enable people to learn anytime, anywhere. But it is also addressing accelerating demand for lifelong education, sparked by the twin forces of globalization and automation, which are making career obsolescence a new reality.

Kaizen is a Japanese business term meaning “continuous improvement.” An education corollary is GSV’s concept of “KaizenEDU,” which means “continuous learning.” In a world with smart machines, you can no longer fill up your “knowledge tank” until age 25 and cruise through life. Effective workers must refill their knowledge tanks continuously. But it will not be feasible to drop out of life and take on massive amounts of debt to stay educated.

Coursera has the potential to democratize global access to high quality education with certificates from leading academic institutions that cost as little as $29 and accredited degrees in high demand fields like data science that start at $15,000. Lucrative, recurring revenue engagements with enterprise customers — including IBM, BNY Mellon, Boston Consulting Group, AXA, and L’Oreal — complement its consumer offering.

Coursera represents approximately 6% of the GSV Capital portfolio at fair value. In June, it completed a $64 million Series D financing at a valuation of approximately $800 million as reported by PitchBook. To date, the company has raised $210 million from a syndicate of investors that includes NEA and Kleiner Perkins.

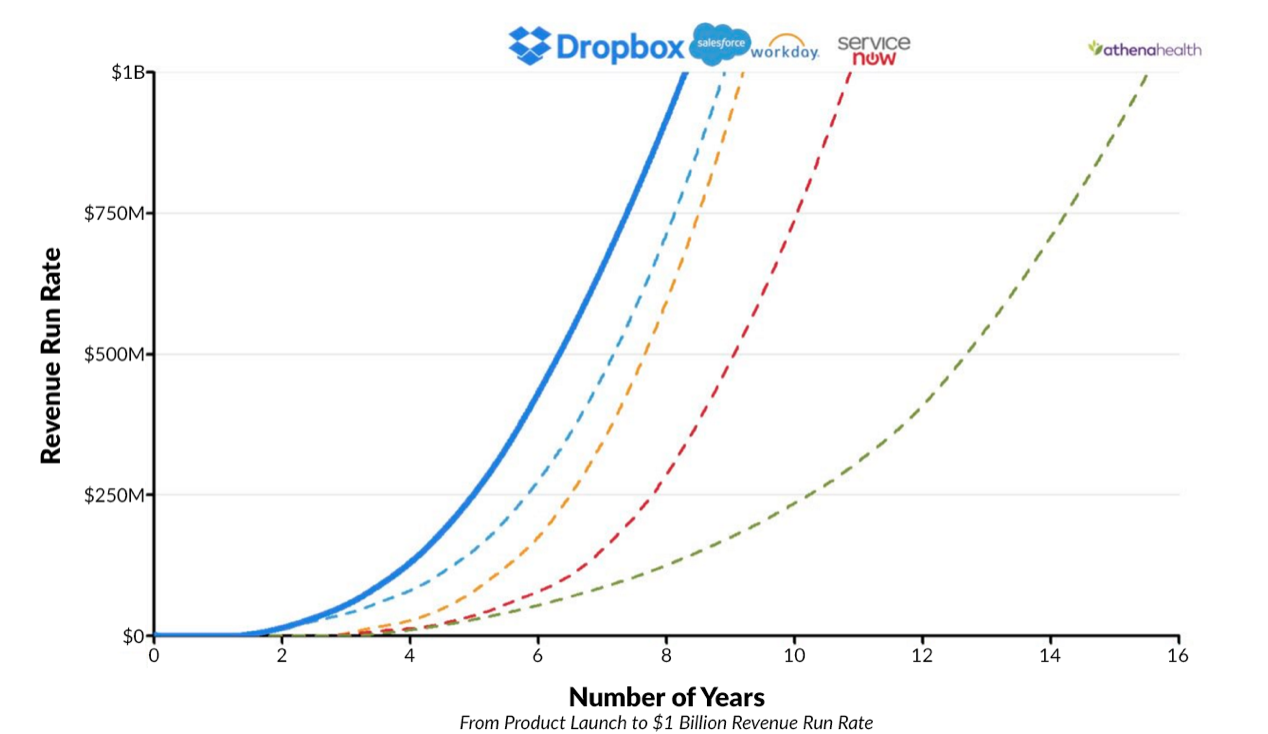

Dropbox rounds out the top five, representing about 6% of the GSV Capital portfolio at fair value. It continues to be widely viewed as a top IPO candidate following July reports from Bloomberg, Business Insider, and others that the company was likely to hire Goldman Sachs as a lead advisor.

The fundamentals speak for themselves. Dropbox is the fastest Software-as-a-Service business to reach a $1 billion revenue run-rate, according to IDC. It has reported that it is profitable on an EBITDA basis since April. And it counts over 500 million users and 200,000 business customers — including a majority of Fortune 500 companies.

To date, Dropbox has raised over $600 million from a syndicate of investors, including Sequoia, Benchmark, Accel, Goldman Sachs, BlackRock, Greylock, Morgan Stanley, and T. Rowe Price.

Outside of the top five, Lyft announced that it raised $1 billion at an $11 billion valuation on October 19th. The financing was led by CapitalG, a venture investment arm of Alphabet. (Click HERE to read GSV Asset Management’s recent analysis on the state of play in the global ridesharing market.)

GSV Capital’s Third Quarter valuation implies a value of approximately $6.7 billion for Lyft. The position is currently marked at a fair value of $8.8 million.

We remain extremely bullish on Lyft’s long-term growth potential. The company reported its 500 millionth ride in October, and in 2017, it has already completed more rides than in all previous years combined. Lyft is now available to 95% of the U.S. population — up from 54% at the beginning of the year.

To date, Lyft has raised over $3.6 billion from investors including Andreessen Horowitz, General Motors, Founders Fund, KKR, Alibaba, AllianceBernstein, Coatue, and others.

IPO UPDATE & LOOKING AHEAD

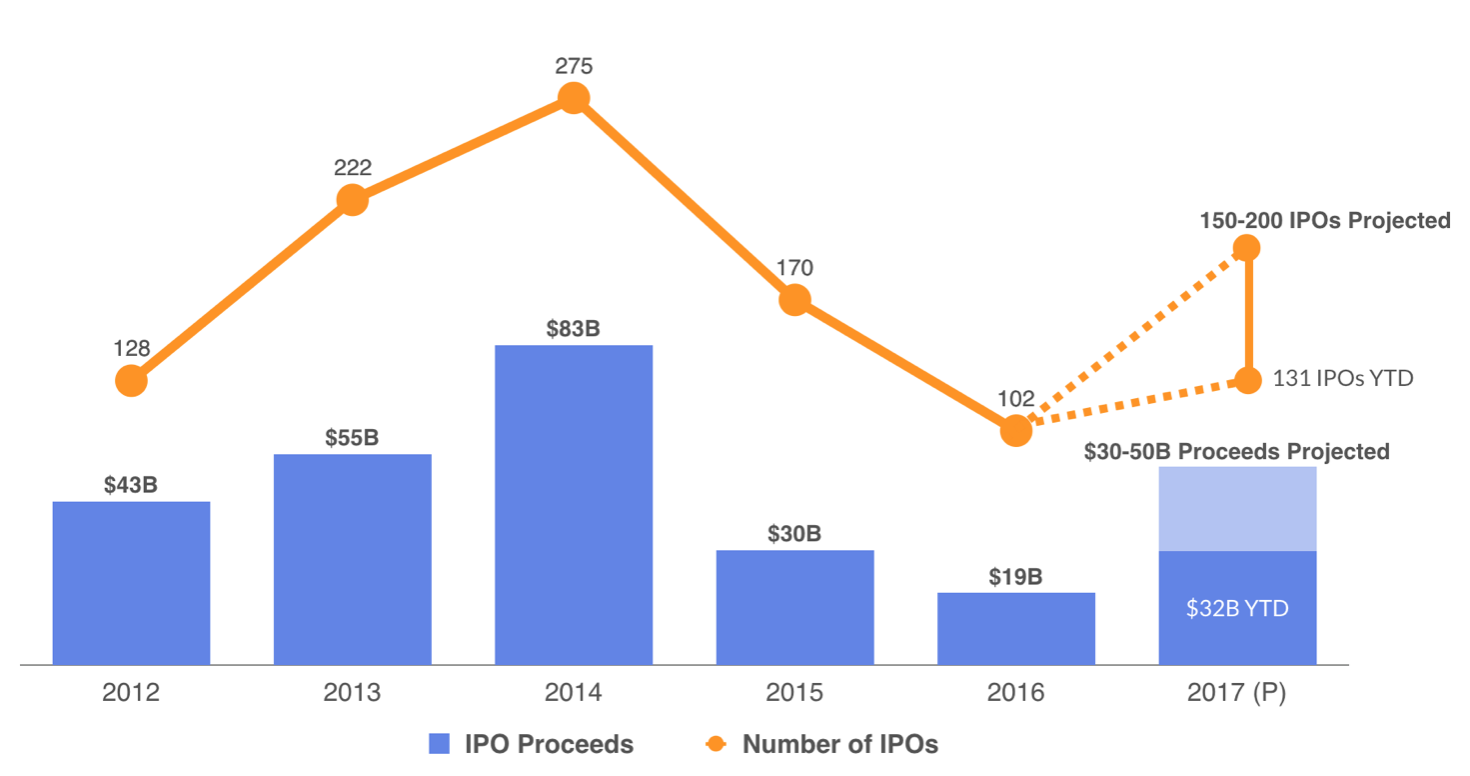

According to Renaissance Capital, there were 131 U.S. IPOs through November 8th, a 37% increase over the same period last year. At nearly $32 billion, proceeds raised to date are up over 88% year-over-year.

For context, just 102 U.S. companies went public in all of 2016 and only 40 were venture backed. There have been 46 VC-backed IPOs in 2017.

Source: Renaissance Capital, GSV Asset Management

Data as of 11/6/17

Through November 8th, 17% of IPOs priced above the range, 62% priced in-range, and the average one-day pop was 13%. Overall IPO performance was up 29%, which mirrors the positive movement in broader markets this year.

We maintain a strong conviction that GSV Capital shareholders will benefit from these tailwinds as we continue to concentrate the portfolio around what we believe to be some of the world’s most dynamic, venture-backed private companies. With GSV Capital selling at a roughly 39% discount to NAV as of November 7th, we believe that there continues to be a great risk-reward opportunity for our investors.