Market Snapshot

| Indices | Week | YTD |

|---|

In the classic movie Groundhog Day, Bill Murray, a hapless reporter stuck in a single day time loop, asks an oblivious colleague, “Well, what if there is no tomorrow? There wasn’t one today.”

The national debate over the future of U.S. healthcare, sparked by the passage of Obamacare in 2010, has made it hard to see “tomorrow” for medicine, insurance, and wellness services. Since then, Congress has voted 62 times to repeal the law, including a vote on Groundhog Day, appropriately enough. Innovation has been a secondary concern.

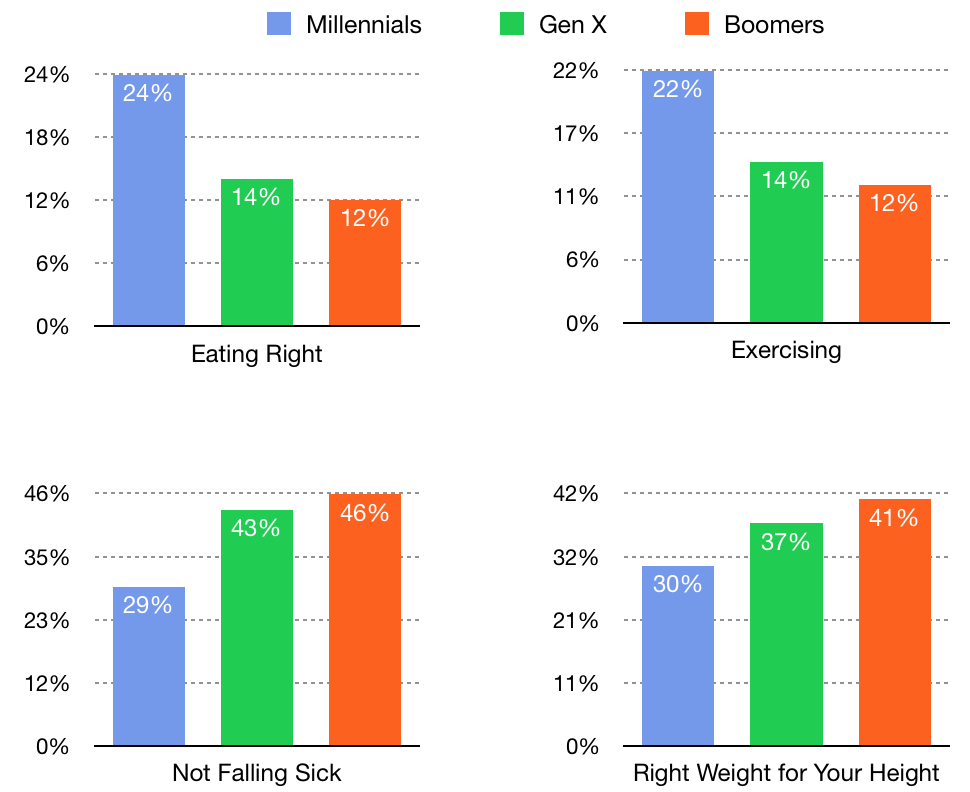

A macro issue has been that the old guard of the healthcare industry — from the CEOs of pharmaceutical and insurance companies to policymakers on Capitol Hill — hail from the Baby Boomer generation. It is made up of the kids hatched in the United States between 1946 and 1964, the bookends being the end of World War II and the invention of the birth control pill.

But America’s 90 million Millennials, hailing from the country’s largest generation, have the most to gain from our healthcare future. And they have a profoundly different world view that is beginning to drive true innovation that will reshape how we think about health, wellness, and medical services.

Unlike the “Leave it to Beaver” Baby Boomer environment, the Millennials grew up in a hot World with countries disintegrating in front of their eyes and institutions of all stripes losing credibility. The “Fall of the Wall” in Berlin in 1989 was a catalyst for Global Capitalism — but also for a global map of power politics prone to rapid change.

In the United States, the Oklahoma City bombing in 1995, the Columbine shooting in 1999, and the September 11th terrorist attacks left parents feeling much less secure about exposing their children to the outside World.

Playing video games at home was a safe activity compared to being out in a dangerous society. Growing up as Digital Natives in a global community allowed Millennials to create their own language and customs.

Watching their parents lose their jobs, houses, and self-esteem during the 2008 financial crisis — along with big banks being cut down to their knees — instilled a self-reliant ethos among Millennials.

Going to War in Iraq under the premise that Saddam Hussein had Weapons of Mass Destruction and finding none further fed distrust.

Why do nearly 40 percent of Millennials have a tattoo?

Often, the people who have the strictest parents go wild when they first set off on their own. For a generation that grew up with families trying to shield them from threats of all kinds — terrorist, financial, and cyber — self-expression has become a natural response.

MILLENNIAL HEALTH

For Millennials, “healthy” doesn’t just mean “not sick.” It means a daily commitment to eating right and exercising. This mindset stands in stark contrast with that of prior generations, who care less about lifestyle and more about simply avoiding bad health outcomes. The rise of fitness trackers like Fitbit underscore a massive public interest in taking ownership of health and wellness.

When it comes to products, Millennials are non-committal. From homes to cars, music, and luxury goods, they are reluctant to buy, turning instead to an expanding marketplace of on-demand “sharing” services.

Not surprisingly, the same dynamics have played out when it comes health services. The 2015 PNC Healthcare Survey found that while 80% of Baby Boomers visit a primary care physician, only 60% of Millennials do. And for those that have a regular doctor, 40% wouldn’t recognize them on the street. Millennials are just not inclined to commit to a single care provider, which implies limited scheduling options and a fixed location for service.

As the next generation of healthcare companies emerges, we are seeing innovation sparked by Millennials — digital natives that are demanding personalized, on-demand, and socially-conscious services. Change isn’t going to come from the White House or the halls of Congress. It’s going to come from the entrepreneurs who are reimagining tomorrow.

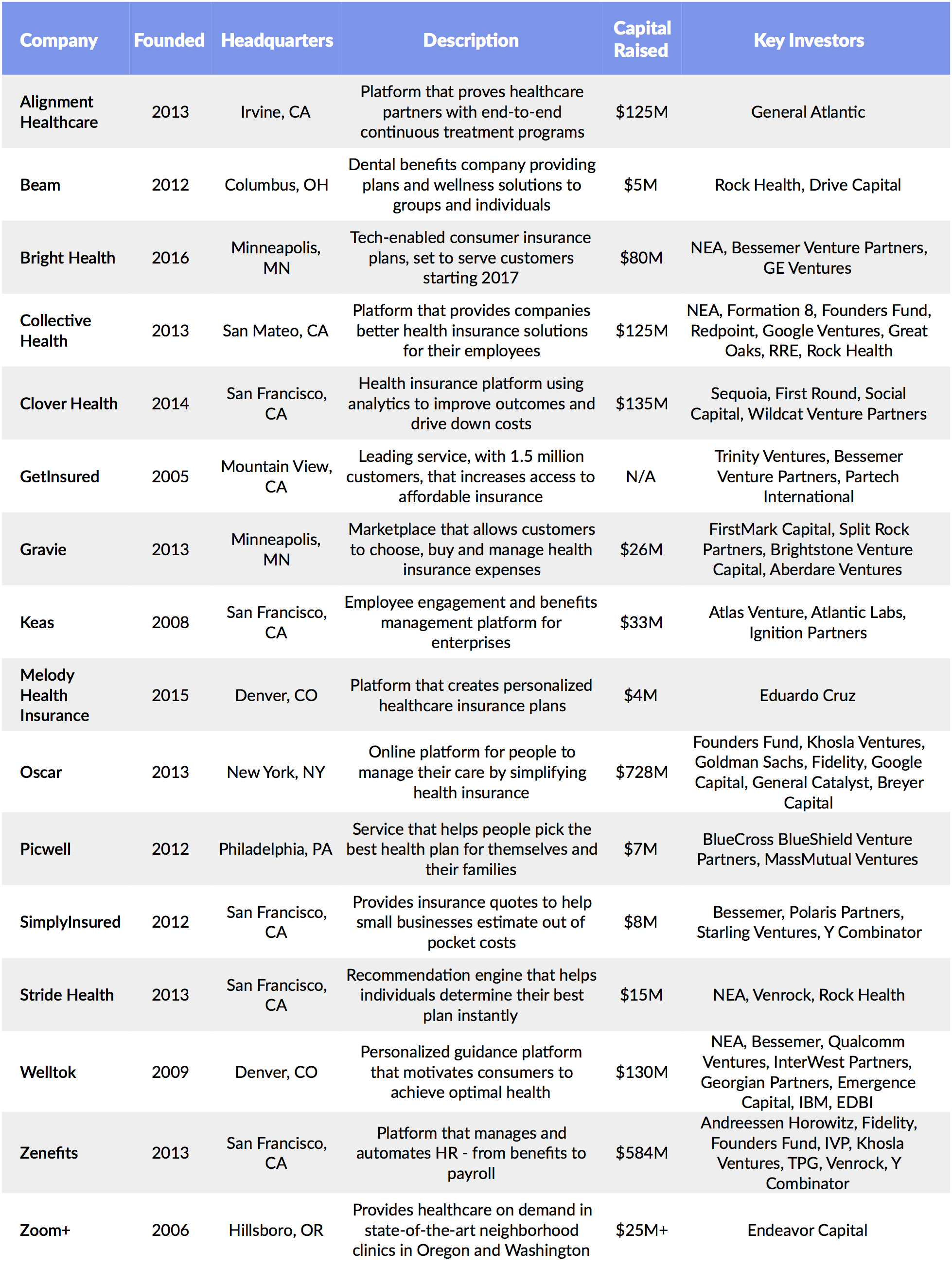

SMART INSURANCE

To say that Americans don’t like health insurance companies would be more than a mild understatement. A 2015 survey by the American Consumer Satisfaction Index that asked consumers to rank their satisfaction with companies across 43 industries found that health insurers placed in the bottom five — ahead of only Internet service providers, cable companies, the U.S. Postal Service and fixed-line telephone services. Even banks received higher marks.

Companies like Clover Health are changing the paradigm by using data and mobile technology to reduce costs, improve outcomes, and deliver a superior customer experience. Backed by Sequoia and First Round Capital, Clover’s initial goal is upend the Medicare health insurance market, which is dominated by sprawling incumbents like UnitedHealth and Cigna, which have a combined market value over $150 billion.

To do this, Clover collects a range of patient data like lab test results, radiology results, and routine checkup absenteeism to get an overall profile of a person’s health and risk profile. It then uses software models to automatically identify issues — like patients not regularly taking a prescription — and intervenes early with nurse practitioners and social workers that are equipped for home visits. As Clover co-founder Kris Gale observed in a recent interview with TechCrunch:

If we know something is on a 30-day refill and we haven’t seen a claim in 35 days, we know they aren’t taking it regularly. We can reach out and intervene. This is info that’s available to us because we’re the payer… The doctor doesn’t know if they’re getting that filled unless they’re asking them regularly. That’s part of the data advantage.

The net result is lower costs for both Clover and its customers, not to mention better health outcomes. In 2015, for example, seniors using Clover Health had 50% fewer hospital admissions and 34% fewer hospital readmissions than the average group of Medicare patients in the New Jersey areas it serves.

Next generation insurance providers include Oscar, Zoom+, Clover Health, Melody Health Insurance, and Beam Dental. In February 2016, Oscar, completed a $400 million financing led by Fidelity Investments, which valued the company at $2.7 billion. Last week, Oscar secured a key hire, naming Alan Warren — a former Google executive overseeing the Google Docs and Google Drive product lines — as its Chief Technology Officer.

A second key segment of related companies is purely focused on the buying, selling and management of health insurance. These include Zenefits, Collective Health, Stride Health, GetInsured, SimplyInsured, Gravie, and Picwell.

Health-insurer and insurance-technology startups raised more than $1.2 billion in venture funding in 2015. That’s more than double the $570 million raised in 2014, and 10 times the $123 million raised in 2013, according to CB Insights.

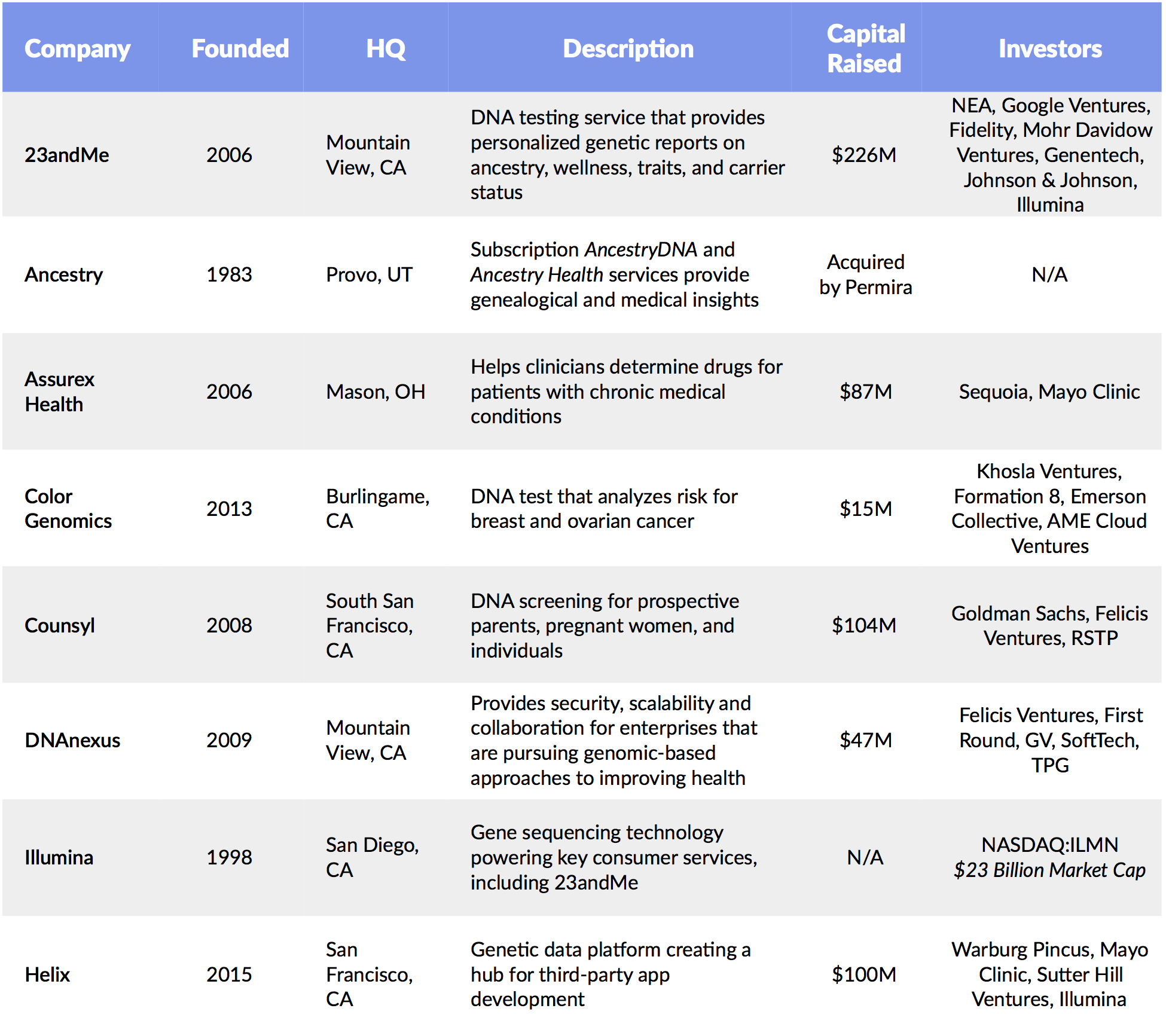

PERSONALIZED MEDICINE

Your 23 Pairs of Chromosomes

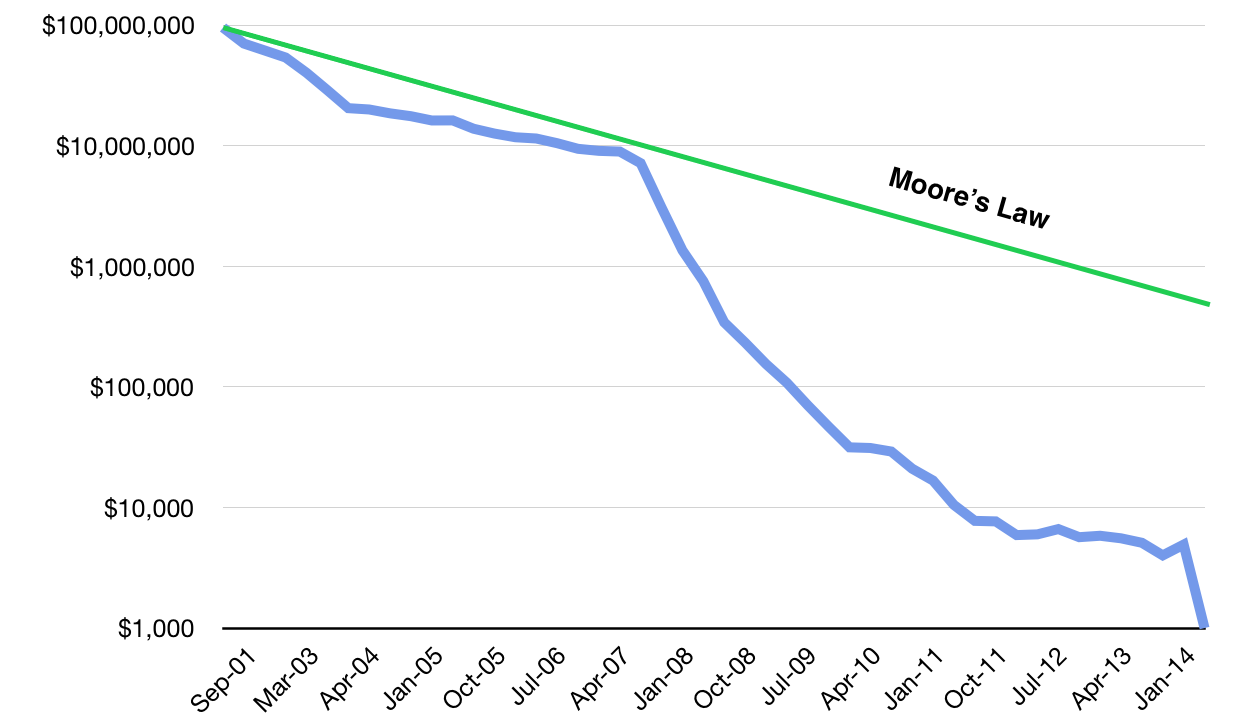

Interest in gene exploration dates back nearly 200 years to Gregor Mendel, the father of modern genetics. But it wasn’t until the mid 1980s that technology and Moore’s Law made it possible to use software to sequence the over three billion genetic bases that make up the human body.

Unprecedented in terms of international collaboration and public-private partnerships, the Human Genome Project was launched in 1990 with the goal of mapping the entire human genome in what seemed like an unrealistic 15 years.

In April 2003, it was announced that the entire human genome had been mapped at a cost of $3.8 billion. Beyond scientific gains, the ROI was staggering. The Human Genome Project generated an economic impact of $796 billion from 1990 to 2010 alone.

Moore’s Law and the Megatrend of “Software Eating the World” are having a revolutionary impact on the cost for an individual to receive their own genetic map. In 2008, it cost $1 million dollars for a person to create a personalized gene map. By 2011, it was $100,000. In 2014, it cost $1,000 — less than a chest X-Ray — and today you can get a personal genetic report for less than $300.

Anne Wojcicki co-founded 23andMe in 2006, on the heels of the Human Genome Project, after a decade on Wall Street as a health care analyst convinced her that the way we treat illness and create new drugs is fundamentally broken. Reflecting on the billions of dollars pharmaceutical companies pour into drug discovery in a recent Inc. interview, Anne remarked, “It just felt like there was this massive amount of waste.”

A chance encounter with Markus Stoffel, a leading molecular biologist at ETH Zurich, left her convinced that the key to creating a new health and medicine paradigm was to aggregate the World’s genetic data and discern patterns to prevent and combat diseases like Parkinson’s and Alzheimer’s. Big Data meets Big Pharma.

23andMe launched with a mail-order test kit that generated a detailed genetic report for $1,000. A simple saliva sample produced insights across nearly 200 categories — including risk factors for inherited diseases like cystic fibrosis, genetic traits like lactose intolerance, and various details about your genealogical history. By 2012, 23andMe had driven the price down to $99.

In 2013, Uncle Sam dealt 23andMe a potential death blow. The Food and Drug Administration ordered the company to stop marketing its flagship tests, deeming them unregulated medical devices. Regulators argued that consumers could misinterpret this health data, which had not been clinically validated, and take action based on a “false positive” result.

While many would have wilted, Anne Wojcicki played offense. With its popular product sidelined, 23andMe partnered with pharmaceutical companies like Genentech and Pfizer, trading access to its DNA database in exchange for upfront payments and a cut of revenue from new drugs developed using it. At the same time, the company worked with the FDA to get an approved genetic test back on the market.

In late 2015, with the required Federal approvals in hand, 23andMe relaunched its genetic reporting service targeting four categories: ancestry, wellness, traits, and carrier status. With over one million customers and a $115 million Series E financing in October 2015 that valued the company at $1.1 billion, 23andMe is once again pushing the boundaries of personalized medicine.

Personalized, Predictive Healthcare

The fact that everybody can and should have their own genetic profile has profound implications to the future of medicine and human life. This isn’t science fiction.

Instead of the normal reactive treatments patients receive under “modern medicine,” genetic mapping unlocks the potential for personalized prescriptions that could mean taking a new or modified drug, changing your diet or fitness routine, or any other combination of treatments that are tailored to your specific needs.

The first key impact is personalized prevention. Today, over half of 23andMe customers learn something from their test results that is “medically meaningful” — from a disease risk to a dietary trait. Understanding risks and health conditions enables people to take preventative measures, and as tests continue to improve, health and wellness service providers will be better equipped to help people avoid or stave off risk.

The second key impact is personalized medicine. Big Pharma companies are eager to purchase 23andMe data because it unlocks insights about how various drugs and treatments impact people across a variety of genetic profiles. As pharmaceutical R&D increasingly integrates massive genetic datasets, it will enable the development of tailored drugs that are more effective for sub-populations, or that minimize the risks of adverse reactions.

A benign example is Benadryl, which makes some children sleepy and others hyperactive. In the future, parents will be able to pick the Benadryl “flavor” that doesn’t make their kids bounce off the wall.

23andMe has assembled the World’s largest database of genetics and phenotypic data, which the company will begin aggressively mining as part of its recently-announced in-house therapeutics research strategy. Last year the company hired former Genentech research chief Richard Scheller, who will lead an in-house research TEAM focused on the discovery and development of new therapeutics. Look out Big Pharma.

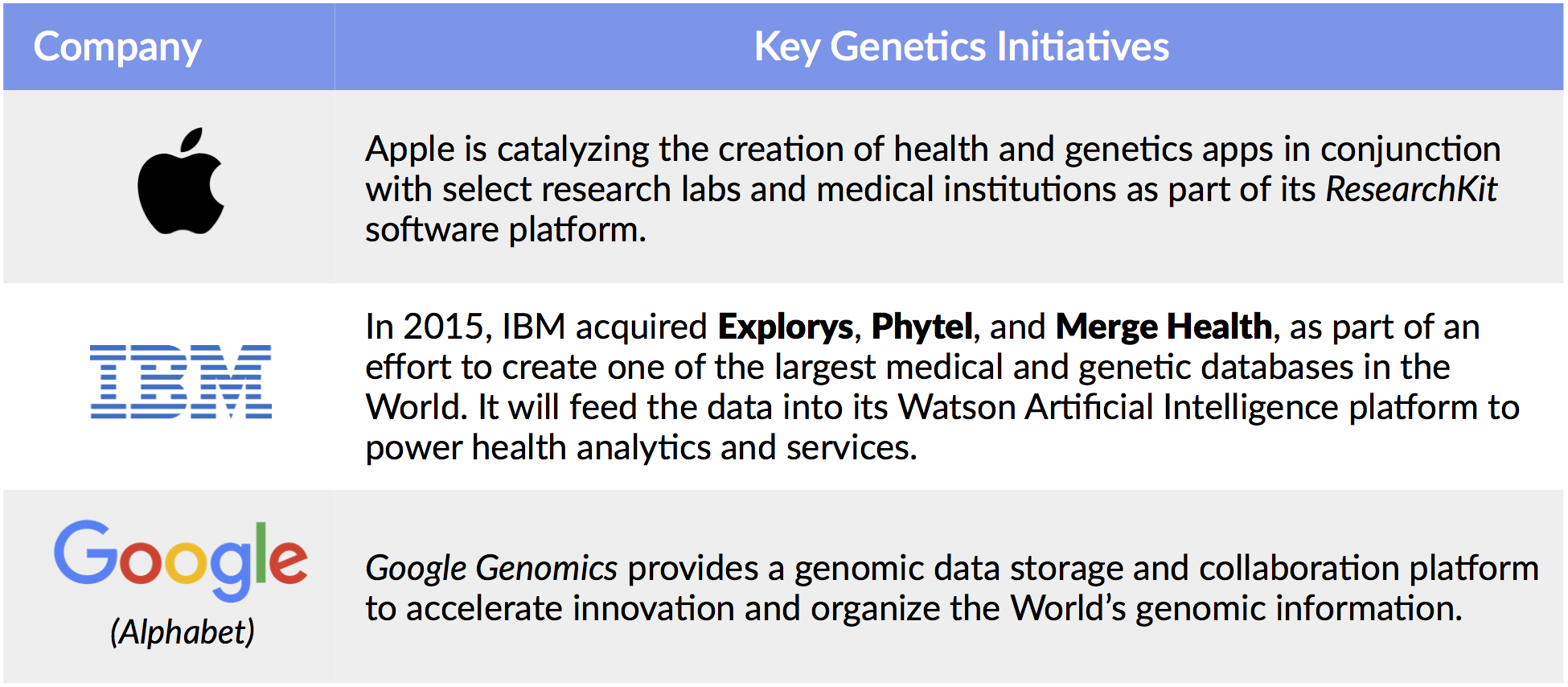

At the same time, leading technology companies are turning their attention to genetics, using Big Data to make healthcare smarter. IBM, for example, has been on a healthcare and genetics buying spree. In 2015 it acquired Explorys, a company spun out of the Cleveland Clinic with access to the anonymized health records of over 50 million people, and Phytel, which has access to population health management data. Big Blue could be sitting on one of the largest, most comprehensive health and genetic databases in the World.

Apple is collaborating with U.S. researchers to catalyze the creation of apps that will collect and apply user DNA to provide health insights and medical services. The apps will be based on Apple’s ResearchKit software platform, which launched in 2015. Alphabet (Google) launched Google Genomics for researchers to store and share genomic data, with the aim to accelerate key research breakthroughs and organize the World’s genomic data. (Disclosure: GSV owns shares in Alphabet)

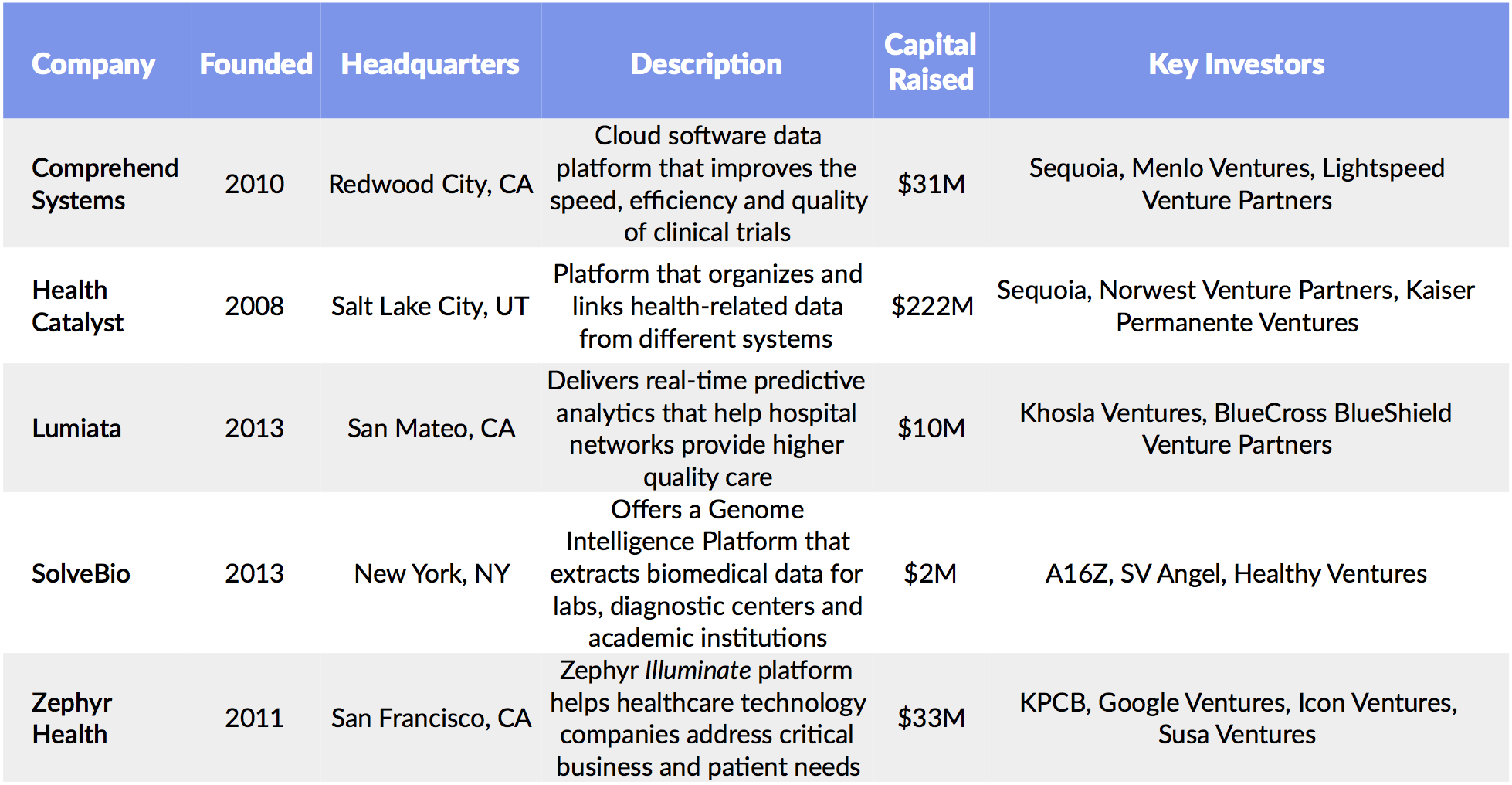

A wave of emerging startups is also attacking the opportunity to apply big data analytics to health, wellness, and pharmaceutical development. Founded in 2013, Khosla Ventures-backed Lumiata is creating the health industry’s “medical graph” to help medical practitioners more quickly identify patient needs and risk factors. The company combs oceans of data — from medical textbooks to scientific journal articles and public data sets — to map how patients and illnesses are connected.

Zephyr Health enables Life Sciences companies to extract insights from disparate global health data to streamline the drug development process (which typically takes 10 years and costs $4 billion) and better align therapies to emerging areas of patient need.

Personalized, On-Demand Services

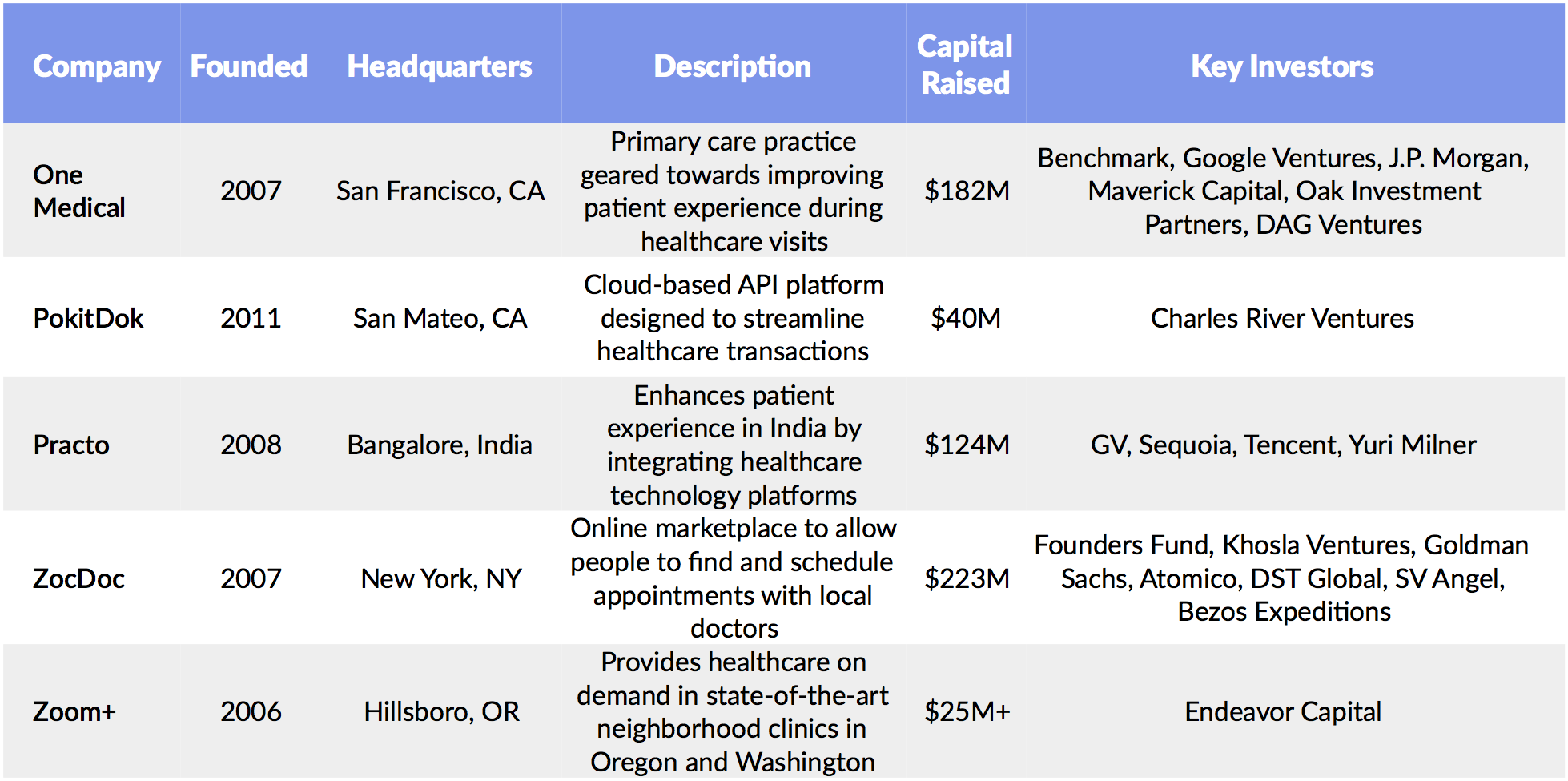

Beyond the science of personalized medicine, companies that provide or facilitate efficient, on demand health and wellness services are beginning to gain broad traction. One Medical, for example, offers patients a digital-friendly doctor experience. Patients pay a yearly fee on top of their normal insurance copays to get perks from the provider including email access to the doctor, online scheduling and prescription renewals, same day appointments, and treatment of common medical issues through the mobile app.

One Medical added 80,000 new patients in 2015 and currently operates in 40+ U.S. cities. It has raised $182 million from a syndicate of investors, including Benchmark, Google Ventures, and J.P. Morgan.

WHAT’S NEXT: MIND, BODY, SOUL

Living well may be the best revenge but it’s also a megatrend creating huge opportunities. We call it “Mind, Body, Soul”.

Last year, global spending on products addressing personal health, fitness, and sustainable living surpassed $300 billion. Sales of organic products in the United States surpassed $43 billion, and the Yoga industry, which is growing at a rate of 20% per year, has eclipsed $27 billion in sales.

But there is also surging demand for products and services that encourage mental well-being. The #1 class in the four-hundred year history of Harvard College is “Positive Psychology,” taught by Tal Ben-Sharar. It might seem counterintuitive that in a cohort of insanely ambitious, brilliant, “never-weren’t the best-at-anything-they tried” group of young adults, the thing they most crave is to find happiness. Similarly, the #1 course on iTunes U is “Mindful Meditations,” out of UCLA.

Sure, some of it could be driven by other Harvard studies, which show that happy workers are 37% more effective at sales, 31% more productive, and 19% more accurate in their work. But this is also a strong signal that something much more important is going on. Superstars needed to find happiness and meaning.

Similarly, a variety of research — including studies by Stanford’s Dr. Carol Dweck, the pioneer of the “Growth Mindset” — have demonstrated that learning things doesn’t just make you smarter. It makes you happier, healthier and more successful. It doesn’t matter what you learn, as long as it’s new and sparks your curiosity. Companies like Curious.com and Coursera, while offering a variety of career aligned learning opportunities, have been catalyzed by this trend in making a wide range of learning opportunities available to learners for free or minimal cost. (Disclosure: GSV owns shares in Curious and Coursera)

One of our favorite companies at the center of this theme was SoulCycle. Founded in 2006 by Elizabeth Cutler and Julie Rice, SoulCycle offered a window into the power of Mind, Body, Soul — an emerging desire across demographics to have a healthier and more fulfilling life.

There is nothing about what SoulCycle does that can be patented. The casual observer might even mistake it for a “spinning class.” But when you study SoulCycle, you realize that its monster success derives from doing a hundred little things better than anybody else.

The bikes are specially designed for SoulCycle to develop your “core.” The program emphasizes every muscle in your body, so that after 45 minutes, you’re wiped. The instructors are trained to be both inspirational and aspirational. The music is perfectly choreographed. Despite the heavy sweat, SoulCycle studios sparkle and smell fresh. And there is plenty of cool SoulCycle swag, so you can proudly display that you’re a member of the tribe.

Pushing the Mind, Body, Soul concept to new boundaries in 2015, top Neuroscience researcher, Dr. Adam Gazzaley, created Body Brain Trainer, a brain game that interlaced cognitive challenges with increasingly strenuous physical activity, effectively throwing a new light on PE class. Exercise, eating right, getting enough sleep, and learning are all showing positive correlations with living healthier, happier, and more productive lives.

The future of healthcare, as well as a wide range industries — from food to education and consumer products — will be found at the intersection of the Mind, Body, and Soul.

—

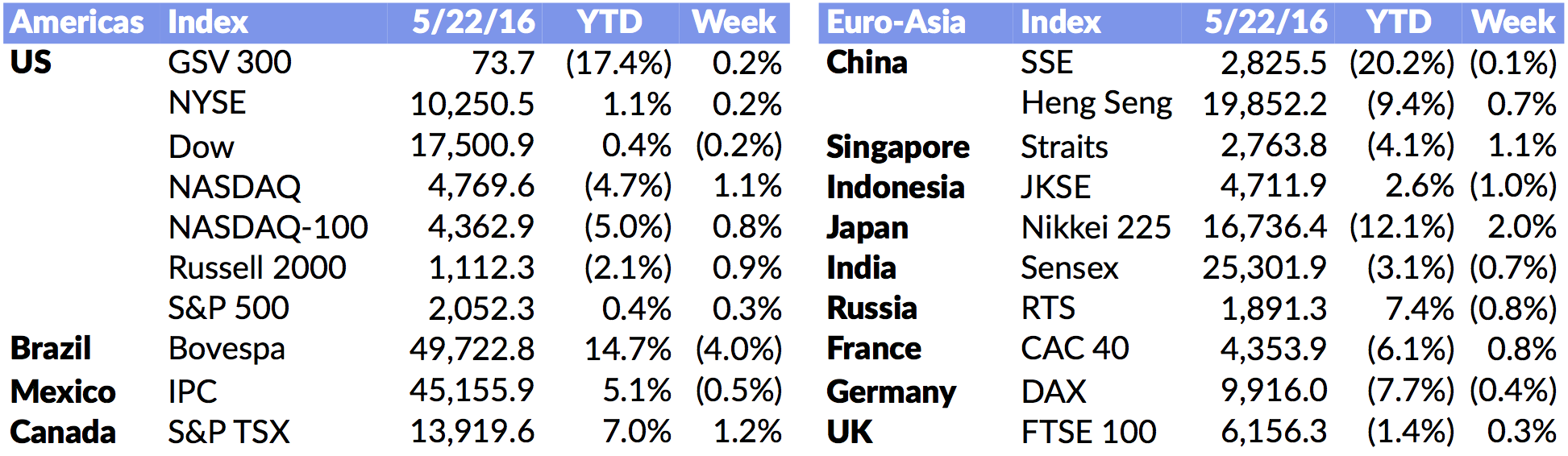

Groundhog Day is the right analogy for the Market as well, with stocks seeming to continuously be in motion but getting nowhere. Last week, NASDAQ was up 1.1%, the S&P 500 was up 0.3%, and the GSV 300 advanced 0.2%, but over the past 52 weeks, most indices are flat to down.

Walmart’s stronger than expected results improved the mood of the Market, after it became depressed by reading FOMC notes indicating that the Fed was itching to raise rates. In other public company news, Fitbit acquired digital wallet Coin.

After being deader than a doornail, a pulse was found in the IPO Market with 4 new issues last week and 7 expected this week. Pricing was OK with three of the IPO’s pricing within the range and one below.

On the private company front, Alibaba Pictures, the film and TV subsidiary of Alibaba, raised $260M at a $2.1B valuation from CDH, Ant Financial, and Sina.com. Clover Health raised $160M from Greenoaks Capital, Sequoia, and First Round. Clover combines data with preventative care to provide improved health care solutions to customers. ThoughtSpot raised $50M from Khosla, Lightspeed, and General Catalyst and is a search driven data analytics service for enterprise customers. Tantan raised $32M from DST, KPCB, Vision Plus, and LB Investments. Tantan is a Chinese social networking app with 2.5M DAUs, and with 80% of users below age 30 (more or less the Chinese Tinder equivalent).

It’s hard to predict the zigs and zags of the Market, but we do know in the long term, earnings growth drives enterprise value. We will continue to focus on identifying the companies we think have strongest and most sustainable growth fundamentals.