Market Snapshot

| Indices | Week | YTD |

|---|

We hold these truths to be self evident, that all men are created equal, that they are endowed by their creator with certain unalienable rights, the amongst them are life, liberty and the pursuit of happiness.

— Declaration of Independence

We don’t have a Black America. We don’t have a White America. We don’t have a Latino America. We have the United States of America.

— President Barack Obama

A house divided cannot stand.

— PRESIDENT ABRAHAM LINCOLN

With horror, pain and grief, most of America watched the events of last week and feared for the future of our Country. Many of us were angry at what appeared to be executions of black men in Louisiana and Minnesota, and then in retaliation, for the brutal murders of five white police officers in Dallas.

Many of us also hoped that having elected a black man as President — twice — and with the “minority” population being the majority of the population in four states already (California, Texas, New Mexico and Hawaii), we had entered a post-racial society. Today, fourteen states have more “minority” births than white births per year.

Unfortunately, the violence of last week, combined with Ferguson, Freddie Gray, Eric Garner on Staten Island, the racially motivated assassination of two policeman in Brooklyn, and the Charleston church shooting show the naiveté of such hopes.

Racism is evil. Prejudice is evil. Hatred is evil. Injustice is evil. Disrespect for the men and women who put themselves in harm’s way to protect us and our freedom is evil. As a country, we can all be against evil and for love, empathy and equality.

Sports and rivalries are an interesting lens to gain some perspective on human nature and the ways people can come together around shared aspirations while ignoring their differences.

When I was in high school, I went to Minnetonka and our chief rival was Edina, which was disparagingly referred to as the “Cake Eaters”. Everyone in Minnetonka — the kids, the parents, the coaches — hated Edina and could go though a list of why they were despicable people. The funny thing was, I lived in Edina with my Dad. Even though I went to Minnetonka High School, many of my friends were from Edina… the evil “Cake Eaters”. And while I had heard all of the horrible things about how awful people from Edina were, I realized that my friends from both towns were remarkably similar. Plus, both had a mutual love for the Vikings and a hatred for the Green Bay Packers.

At the University of Minnesota, I was on the football team and half of my teammates (and friends) were black. Their backgrounds were very different than mine, growing up in places like South Chicago and Detroit, but we were all Golden Gophers. You realized that everybody bled red, and what mattered wasn’t your skin color, but the size of your heart. When a black teammate of mine experienced prejudice, it was like all of us were treated unfairly… and we were all enraged. All for One and One for All.

With the Olympics coming up in Rio, it is a great time for America to come together and root for our athletes as they compete against the rest of the World. It would be a great time for a modern-day Tommie Smith/John Carlos 1968 Mexico Olympics moment, putting a fist in the air to signal the ongoing fight for justice, dignity, and equality for all Americans.

Black lives matter. Officers’ lives matter. Military lives matter. ALL lives matter.

GSV 300 + The State of Play in the Global Growth Economy

A surprisingly strong jobs report last Friday was a catalyst for stocks to head skyward, despite increasing societal unrest. Gains on Friday capped an eight-day rebound of 6.5% that restored $1.4 trillion of market capitalization to U.S. shares, value that was erased in the aftermath of the U.K. vote to leave the European Union.

Job growth for June was 287,000, over 100,000 more than projections indicated. And while the unemployment rate rose to 4.9%, it was driven by “good news” for a change — more people are actually looking for work. At the same time, the 10-Year Note yield fell to an all-time low of 1.36%, reflecting both the slow growth environment and U.S. Treasuries being a relative safe haven in a scary World.

When it comes to tracking the state of play in the global growth economy, an old saying rings true: “If you can’t measure it, you can’t manage it.”

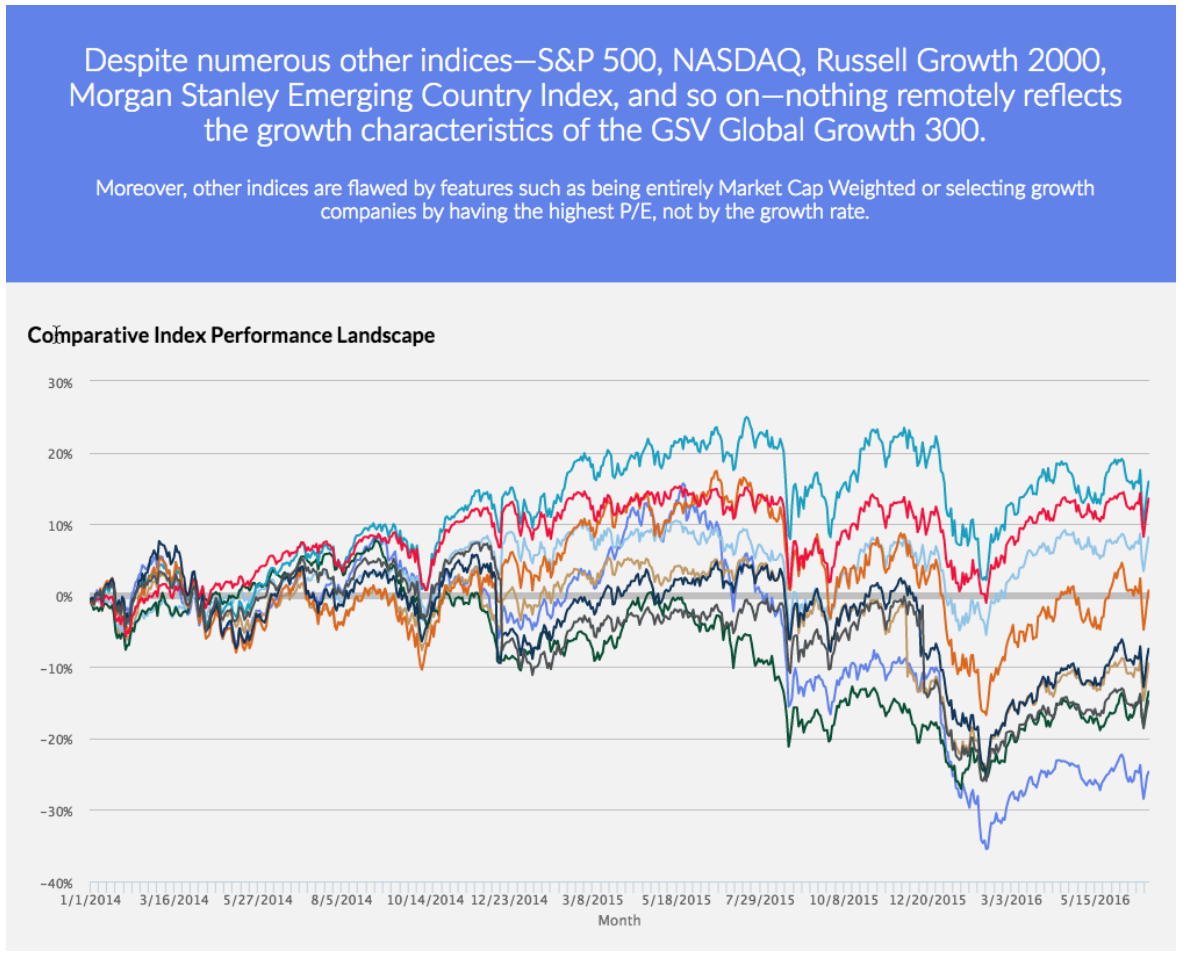

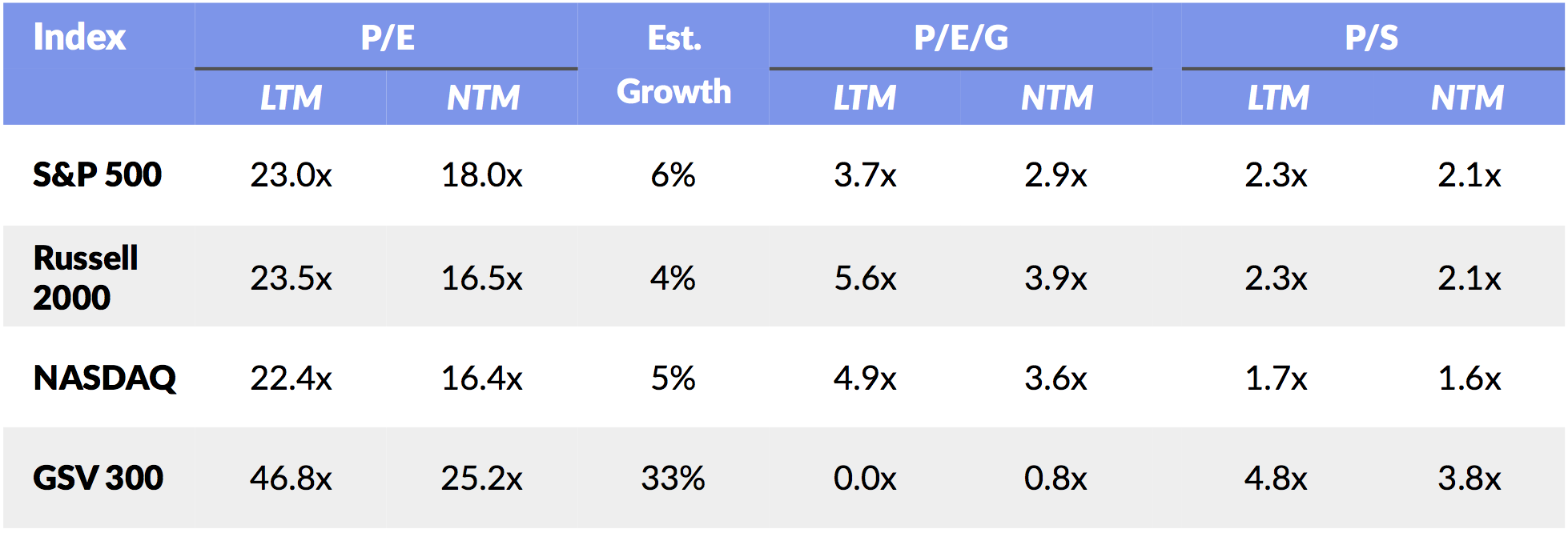

So in 2015, GSV launched the GSV 300 Index, which we believe is the best representation of what is truly going on with growth companies, their valuations, and performance. It is an index of 300 of the World’s fastest growing companies, selected systematically based on key fundamentals, including revenue and earnings growth, geography, valuation metrics, and market capitalization. Because the companies aren’t handpicked, the GSV 300 doesn’t look at all like the indexes that people typically use to analyze growth companies and growth investors.

Source: GSV Asset Management

The most relevant index for Institutional Investors to date has been the S&P 500, which is a good proxy for broad Market dynamics. But with a 5% long term growth rate, it hardly reflects conditions or performance for fast growing companies.

The fact that the S&P 500 is solely a market cap weighted index is problematic in that a $100 Billion Market Cap Company has 100x the impact on the Index as a $1 Billion Market Cap Company… not realistic in that a portfolio manager who viewed two portfolio companies as being equally attractive would have 100x more of that company in their portfolio.

The most well-known index, the Dow Jones Industrial Average (DJIA), is created with an even more bizarre rationale in that it is weighted by share price. So in other words, if one stock was $30 per share and another was $300 per share, the $300 stock would have 10X the influence on the DJIA as the $30 stock.

The GSV 300 Index is constructed using a three-step process, which is summarized below: Screening, Ranking + Scoring, and Index Weightage. For a full description of the GSV 300 construction methodology, please click HERE.

GSV 300 Snapshot

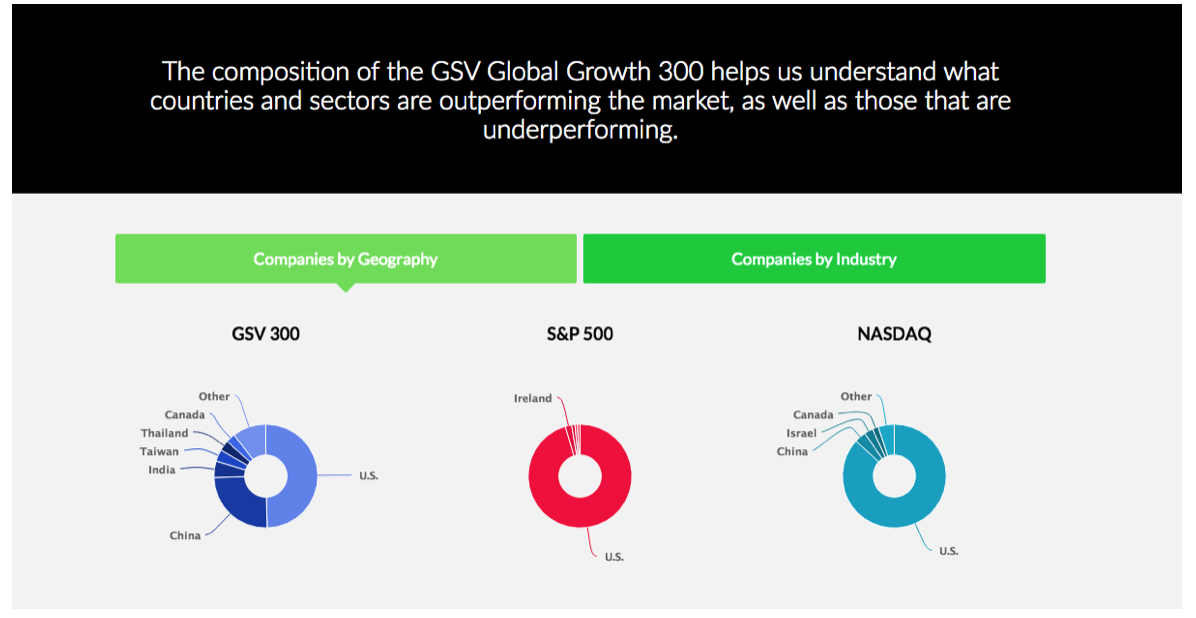

As of the end of the second quarter in 2016, the average market capitalization of GSV 300 constituent companies was $4.9 billion, with a median of $1.5 billion. The 10 largest companies account for 25% of the index. By comparison, the top five companies in the NASDAQ — Apple, Microsoft, Amazon, Facebook, and Alphabet (Google) — account for over 37% of the index alone.

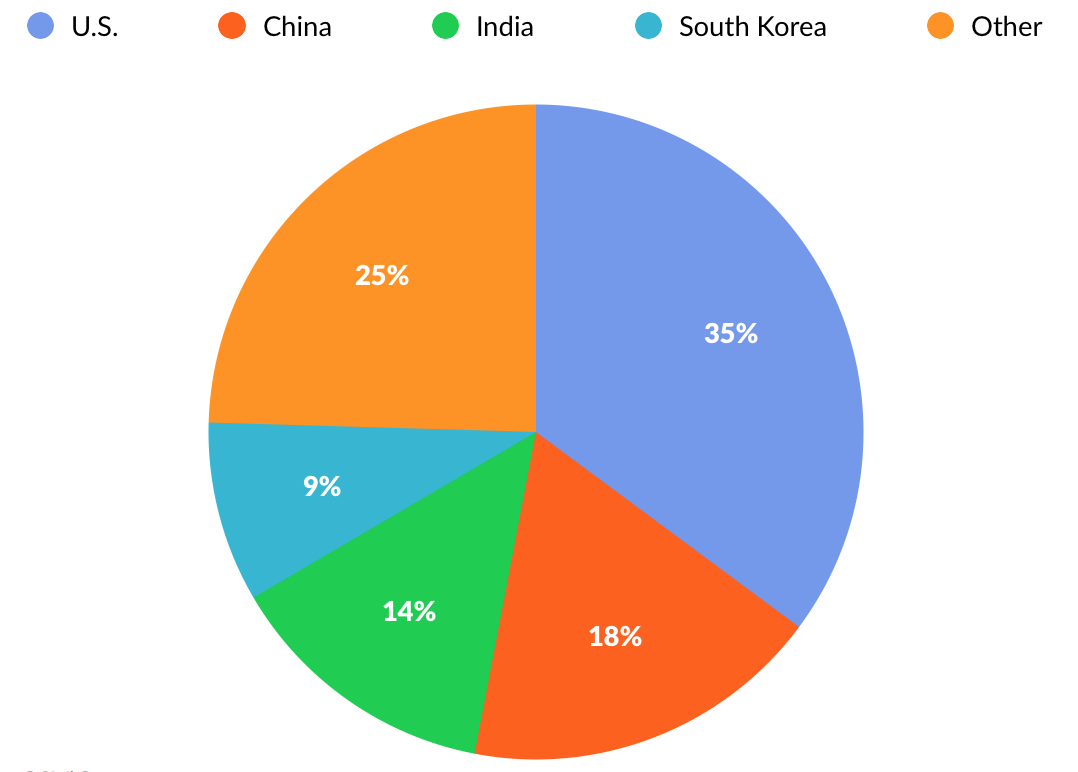

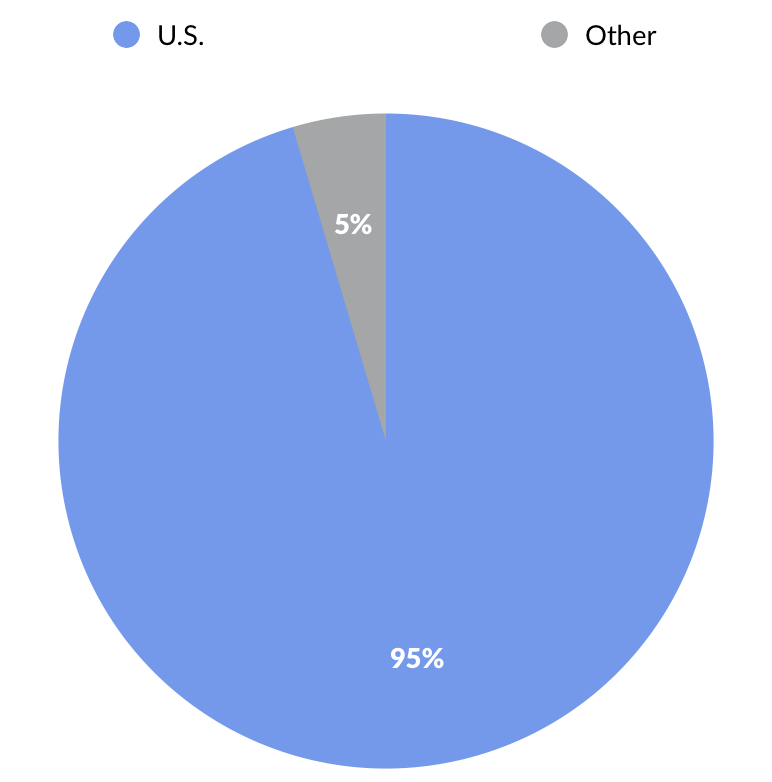

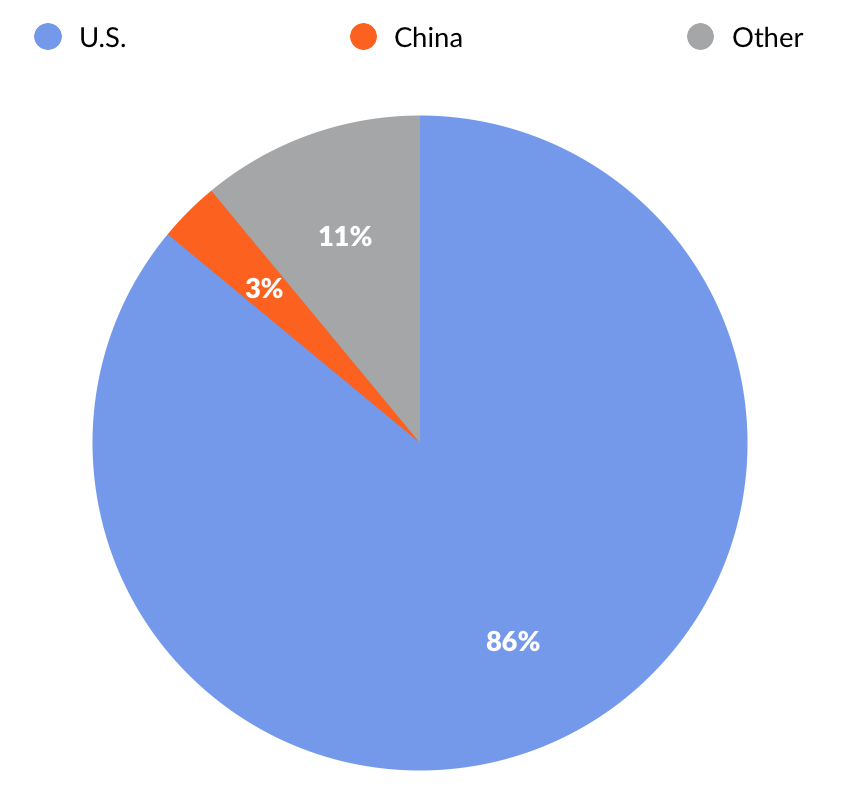

Looking at the GSV 300 by geography, 35% of the index weightage comes from U.S. companies. China is the second-largest geography at 18%, followed by India at 14%, and South Korea at 9%. By contrast, 95% of the S&P 500 and 86% of NASDAQ are represented by U.S. companies.

Countries of NASDAQ Constituent Companies as a Percentage of Index Weightage

Performance & Valuation

While the overall index was down by 2.3% for the quarter, a look at the geographic breakout indicates that the movement was largely driven by Chinese companies, which fell nearly 7%. India, by contrast, was up 6%, and the U.S. advanced 3.5%. All other geographies were flat.

Segmented by GSV investment theme, the most significant movement in the index was among “Education Technology” companies, which rose over 14% in the quarter. Companies in the “Sustainability” category fell 9%.

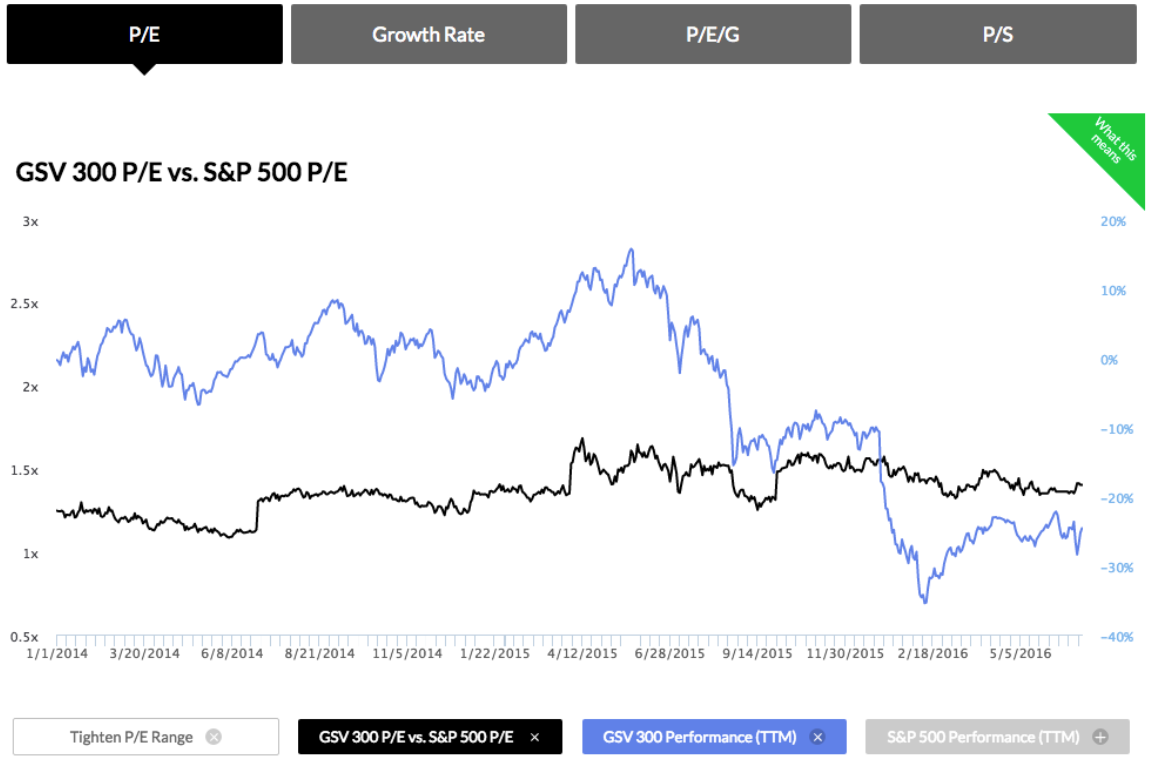

To date, the GSV 300 is down 15.6%, reflecting brutal first half of the year for many growth stocks, combined with turbulent public market dynamics in China. One might naturally expect us to be upset that GSV 300 had such brutal performance, but actually, we are pleased that we have created a scorecard that reflects what is actually going on in the World of growth stocks.

The T. Rowe Price New Horizons Fund, for example, has pursued a strategy of investing in small, high-growth companies since 1961. While it is actively managed, Peter Lynch observed in Beating the Street that the fund is, “as close as you’ll get to a barometer of what is happening to emerging growth stocks.”

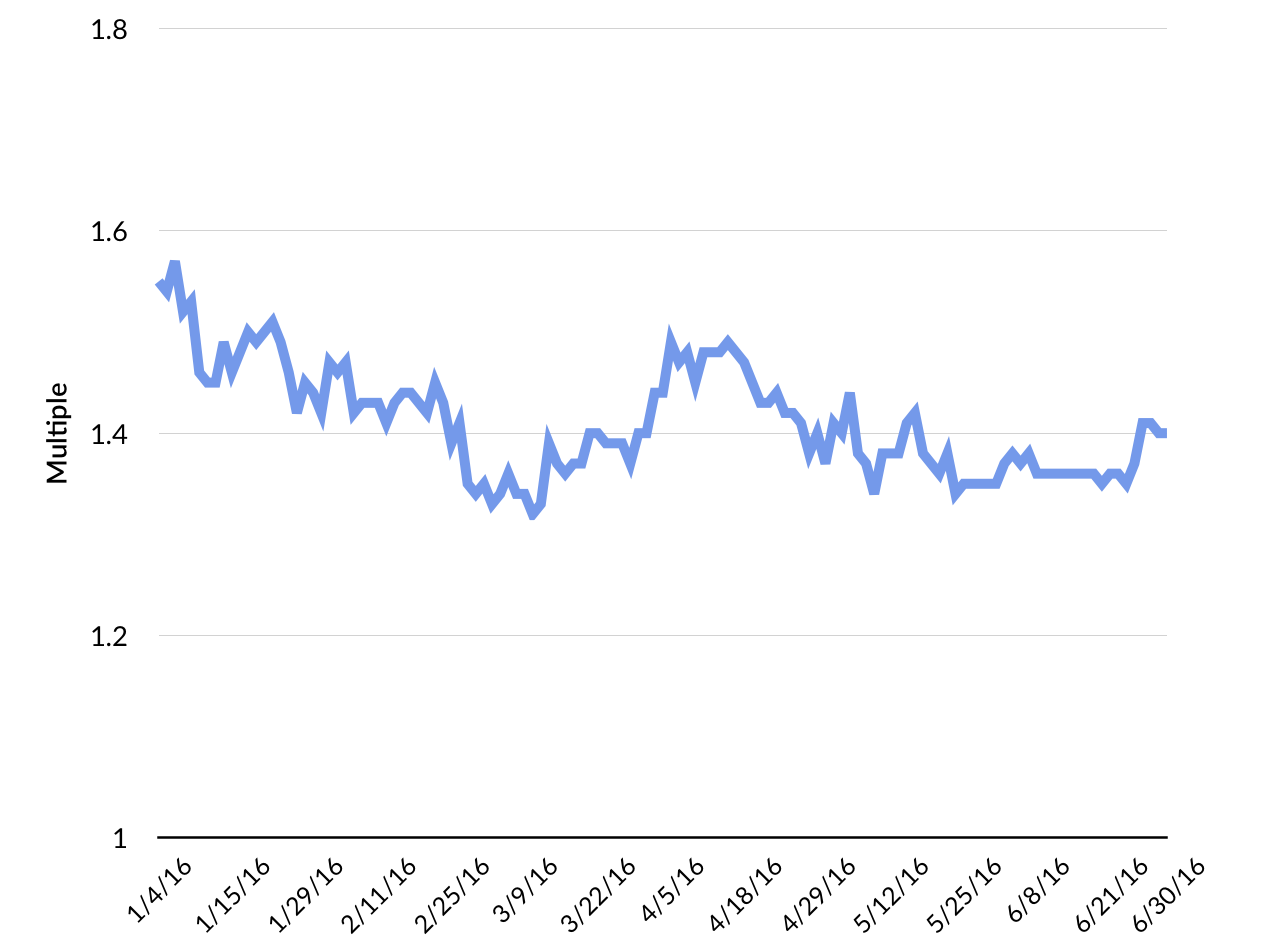

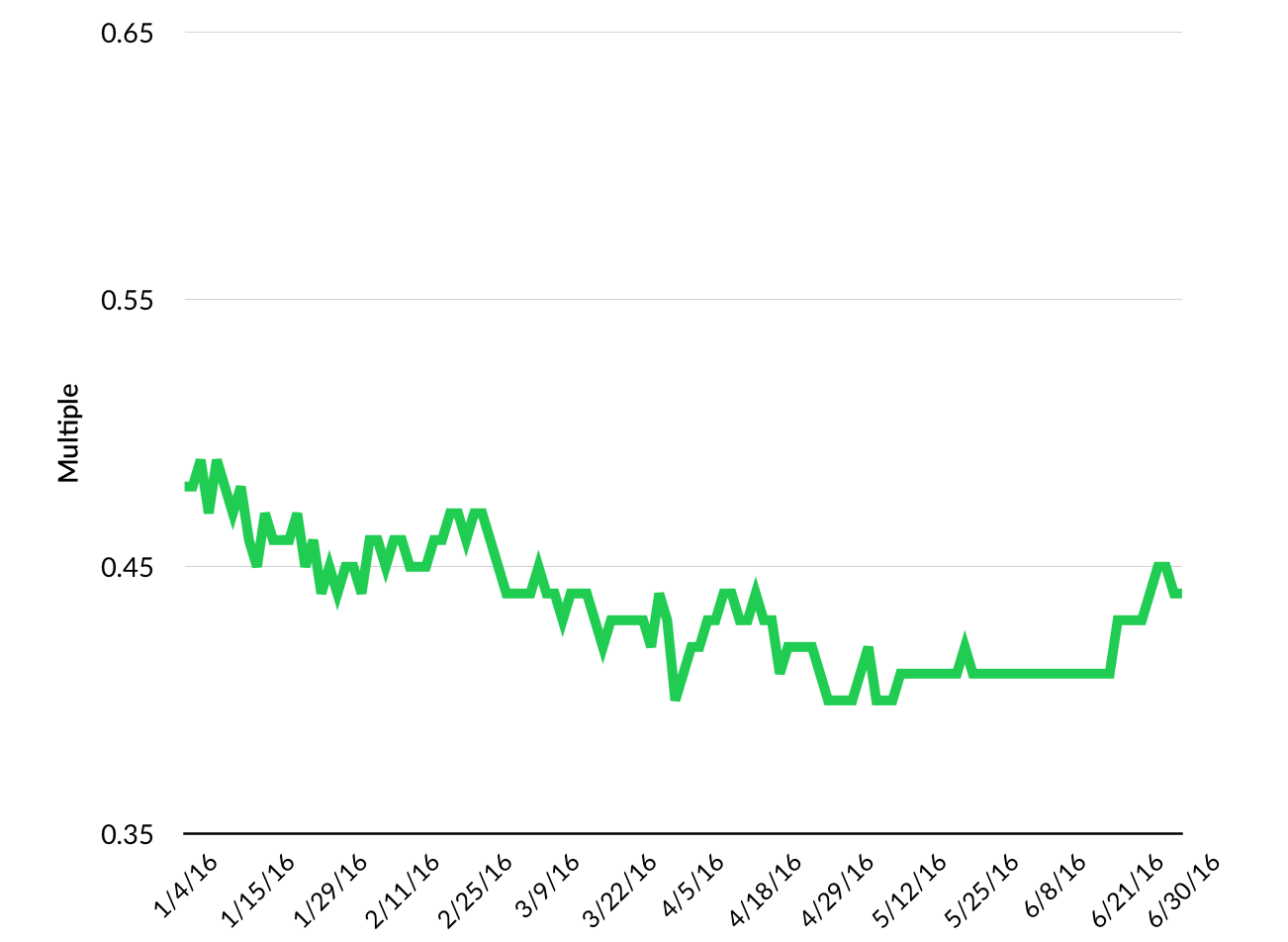

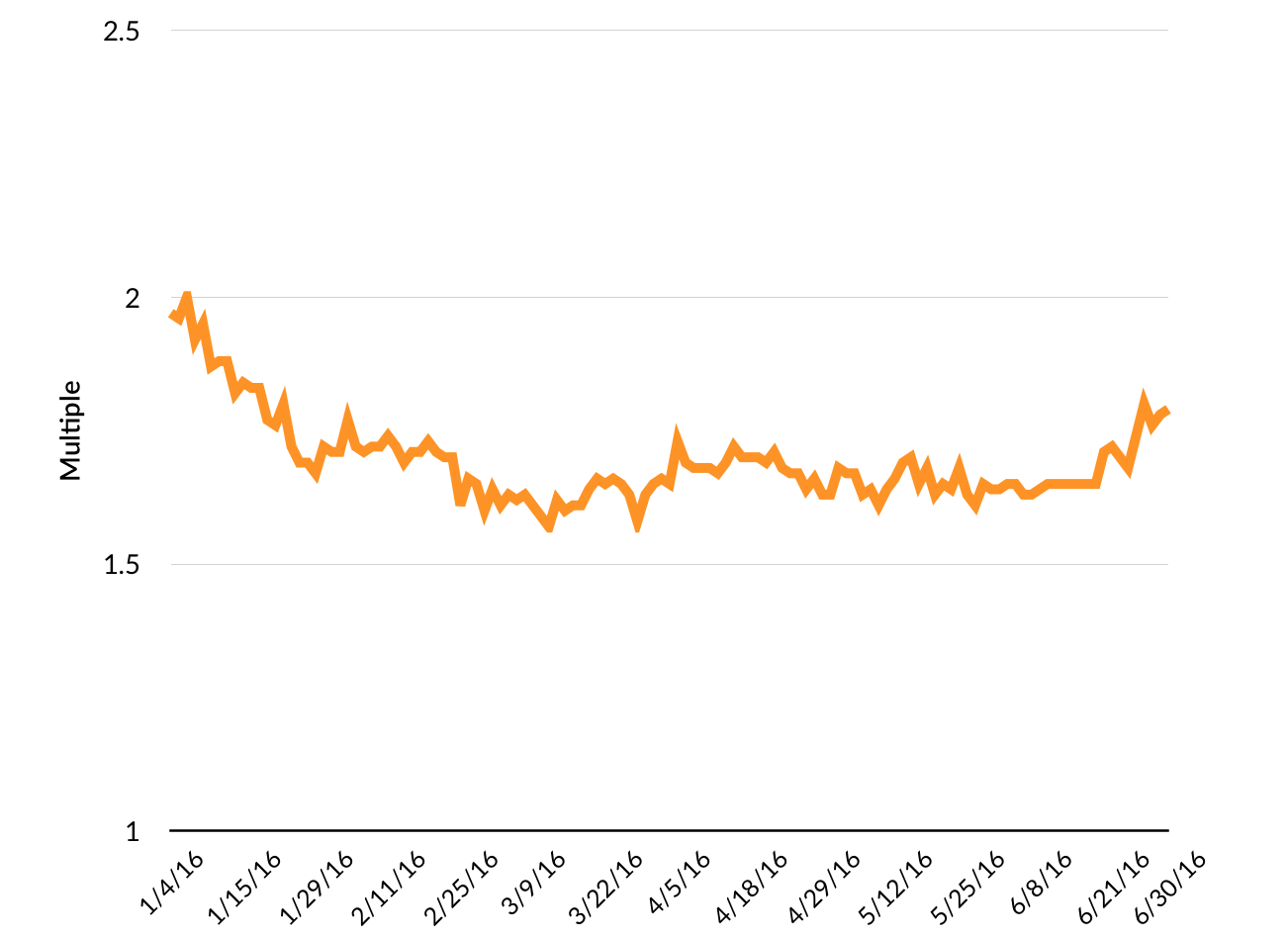

Since small companies are expected to grow at a faster rate than large companies, they usually sell at a higher P/E than larger companies. Logic might suggest, therefore, that the P/E of the New Horizons Fund would be higher than that of the S&P 500 at all times.

This isn’t always the case, and at times when it isn’t, the New Horizons Fund can be a smoke signal for an undervalued or overheated growth economy. Over the last 50 years, for example, the New Horizons P/E has risen to double that of the S&P 500 only four times.

Currently, the GSV 300 has a P/E (forward) of 25.2x, or 1.4x greater than the S&P 500. Our thesis is that at over 2x, it’s a warning signal for growth stocks, and at under 1.2x, it’s a buying opportunity. We’ll monitor this trend, as well as the relationships of other key valuation metrics, to determine patterns over time.

IPOs

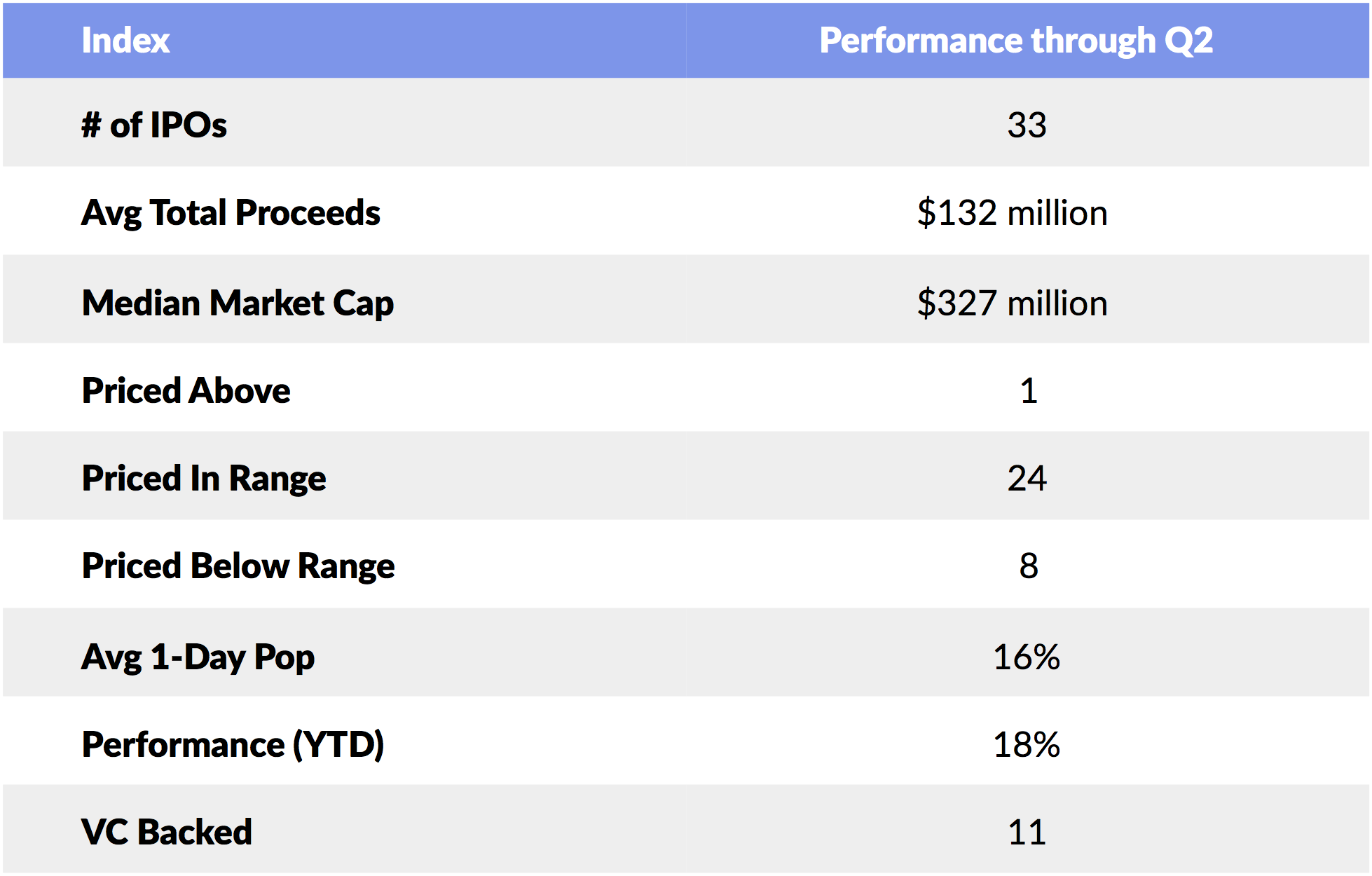

Through the end of Q2, there were 33 IPOs — 11 VC-backed — generating an average of $132 million in proceeds. One company priced above range, 24 priced in range, and eight priced below. The average one-day pop was was 16%.

Two notable technology IPOs priced at the end of the quarter. Acacia Communications, a fiber optics company specializing in long-haul deployments and networks connecting data centers, listed on May 12th. Backed by Summit Partners and Matrix Partners, Acacia recorded a first-day pop of 35%. It currently trades at a P/E (forward) of 17.9x with a $1.4 billion market value.

Twilio completed a highly anticipated IPO on June 22nd, notching a 92% first-day pop. Backed by a syndicate of leading VCs and institutional investors, including Bessemer Venture Partners, Founders Fund, Union Square Ventures, Redpoint, DFJ, Fidelity, and T. Rowe Price, Twilio raised $234 million in private capital and last recorded at private valuation at $1 billion. Today it is valued by public markets at $2 billion with a P/S (forward) of 15.6x.

Subsequent to the end of the second quarter, there have been nine additional IPOs, bringing the 2016 total to 42. The average one-day pop has dropped to 12%.