Market Snapshot

| Indices | Week | YTD |

|---|

It’s not nice to fool (with) Mother Nature!

Hurricanes, earthquakes, wildfires, and extreme weather all contributed to a World that to many seemed out of control in 2017. Hurricane Harvey in Texas and Louisiana caused $190 billion in damages. Hurricane Harvey in Hollywood caused fatal damage to predatory male behavior and was the catalyst for Time’s “Person of the Year”, the #MeToo movement.

If evidence was required to show that money doesn’t buy happiness, exhibit A would be a soaring Global stock market, which we predicted last year. Exhibit B would be a 17-year low in unemployment. Exhibit C would be an economy that had its fastest growth since the New Millennium. Exhibit D would be the new tax bill, which saves the average tax payer $1,600 and lowers the top corporate rate from 35% to 21%. Exhibit E would be the stunning $2 trillion increase in U.S. homeowners’ value in 2017. Exhibit F would be J. Paul Getty’s character in All the Money in the World. The final exhibit would be that despite overwhelming economic prosperity, large segments of the population are in uproar about almost everything. But in particular, over our reality show President.

Especially irksome to the “Opposition Party” (which often includes his own Party) are his early morning tweets that tweak adversaries, with Senate Minority Leader Chuck Schumer calling him a “clown” and North Korean leader Kim Jong Un nicknaming him “Rocket Man”. Whether President Trump is crazy like a fox or crazy like Fox News is not yet obvious. But what is clear is that the World is paying attention. Interestingly, despite the hysteria, President Trump’s approval rating is essentially where President Obama’s was after the first year of his presidency.

Two of the most overwhelming shifts of power have an undeniable common denominator — investment in education. President Xi gave a four hour long speech to the Chinese Communist Party’s 19th Party Congress in October, and approximately 25% of it was devoted to the importance of education as a competitive weapon. In fact, the two largest market capitalization education companies in the World are from China and neither are twenty years old.

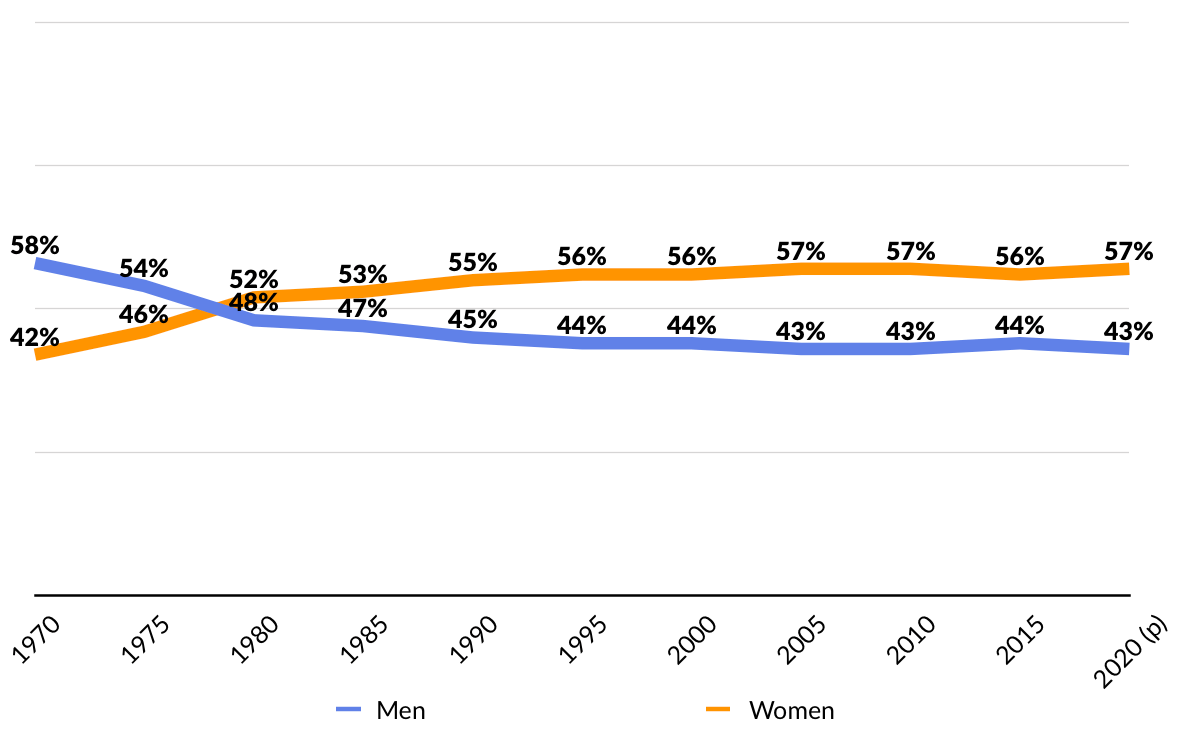

The Woman Power movement has hit a tipping point with female leadership emerging in every segment of society. The seeds of this wave were sown thirty years ago when the number of women in universities started to exceed men. Knowledge is in fact power. And in a knowledge based economy and Global marketplace, it makes the difference for not only how well an individual does, but also how well a company and a country does.

Given the strains on Mother Earth caused by Global growth and the Millennials’ hyper-concern for protecting the planet, Sustainability became the World’s greatest innovation challenge. It’s not just about being green. It’s about what a business’s mission is. It’s about wellness and water. Hence, companies that embrace this challenge and come up with viable strategies and solutions will thrive. But those that conduct business as usual will be in peril.

A likely victim of the enormous power and influence it has achieved is the tech industry, which now boasts the seven largest market capitalization companies in the World. Moreover, tech is also the Mother of the Mother of all disruptive forces… artificial intelligence. Anxiety, depression and anti-social behavior linked to addiction to smart phones and social media are only “fuel to the fire” to “techlash”.

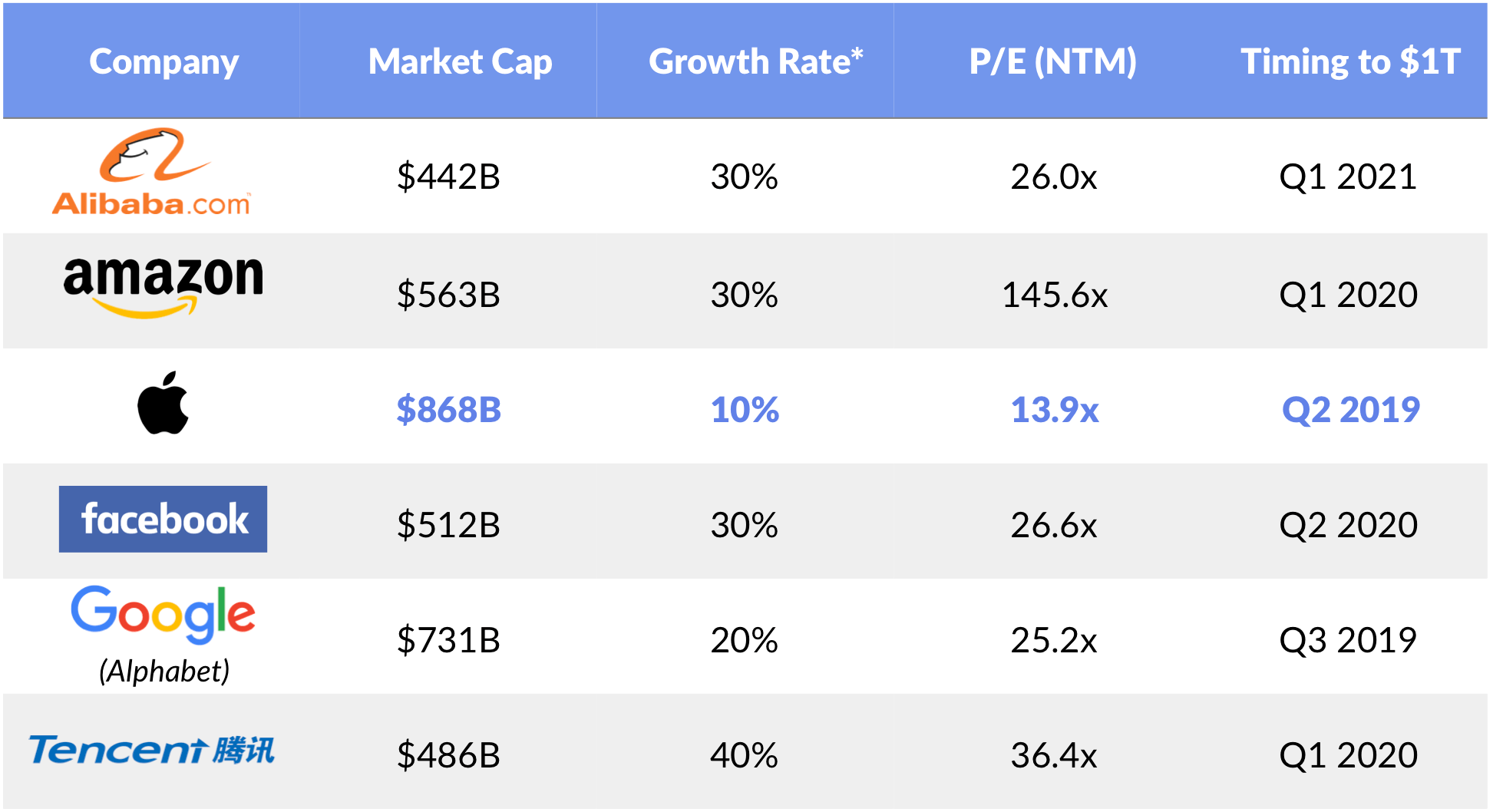

Today, Apple has a market value of $868 billion and a P/E of 14.3x. But it is growing earnings at over 10% per year. Hold P/E constant and assume growth of 10%, and Apple will hit the trillion dollar mark in the Summer of 2019. But it will be a photo finish with Alphabet, which would cross the line the Fall of 2019.

*GSV Estimate

Quietly, the likely winner for the first public company to reach one trillion isn’t a tech company. Other than the investment banks who have been scratching and clawing to be an underwriter for its IPO, the company that if it went public today would be twice as large as Apple is unknown to most of the World. In 2018, the Saudi Arabian Oil Company a.k.a. Aramco is targeted to go public with an estimated $2 trillion (that’s trillion with a “t”) market capitalization. The expected “float” or amount sold to the public is expected to be 5% of the company or $100 billion. For comparison, the previous record for proceeds from an IPO was Alibaba’s $25 billion.

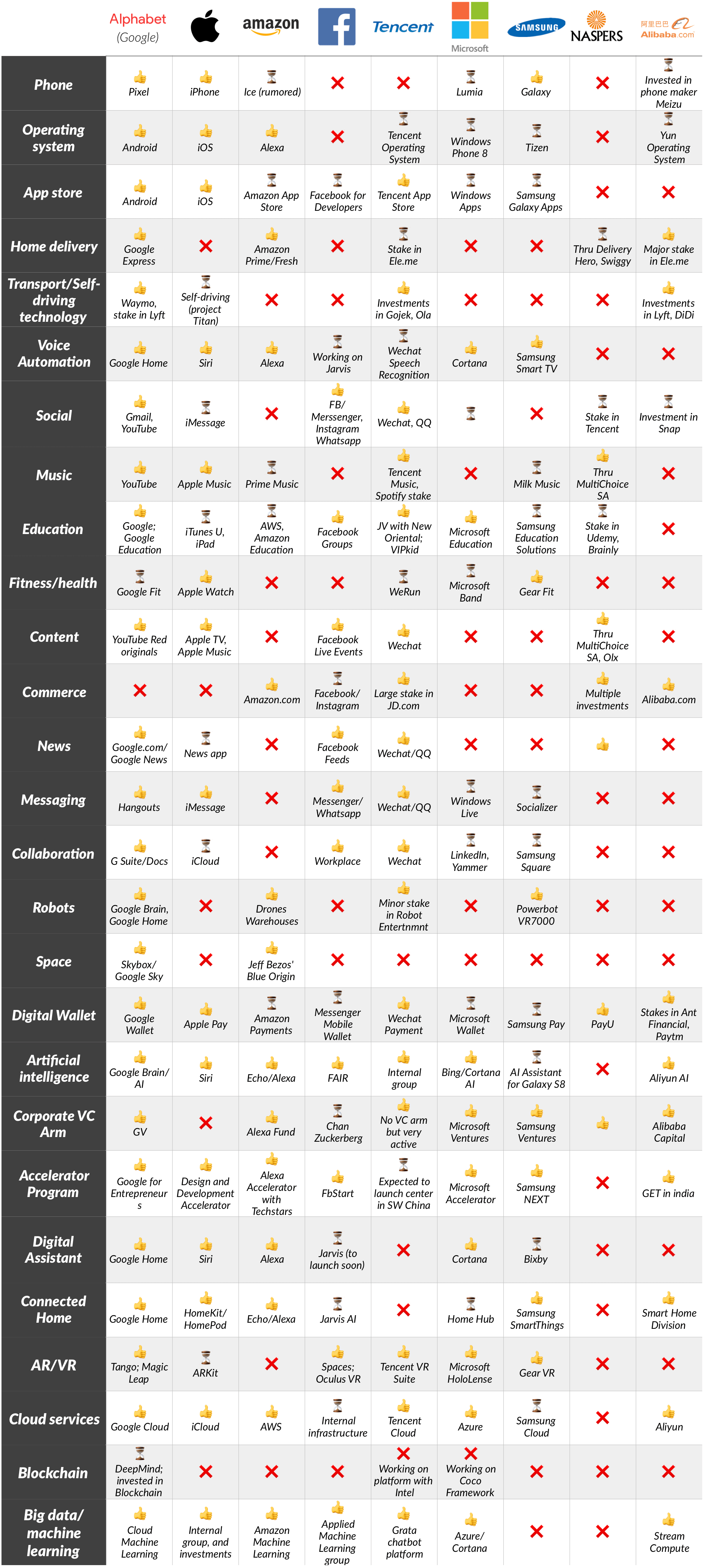

In 2018, Silicon Valley will continue to innovate, accelerate and consolidate. Technology is all about disproportionate gains to the leader in a category, with “platforms” evolving rapidly, filling in category and product maps.

TECHNOLOGY PLATFORM ARMS RACE

Leading artificial intelligence expert Andrew Ng, the former Chief Scientist at Baidu and co-founder of Coursera, stated that “AI is the new electricity.” AI will be the lifeblood that powers the next wave of technology companies. And it’s currently integrated in our daily lives in more ways than most realize. (Disclosure: GSV owns shares in Coursera)

55921.png)

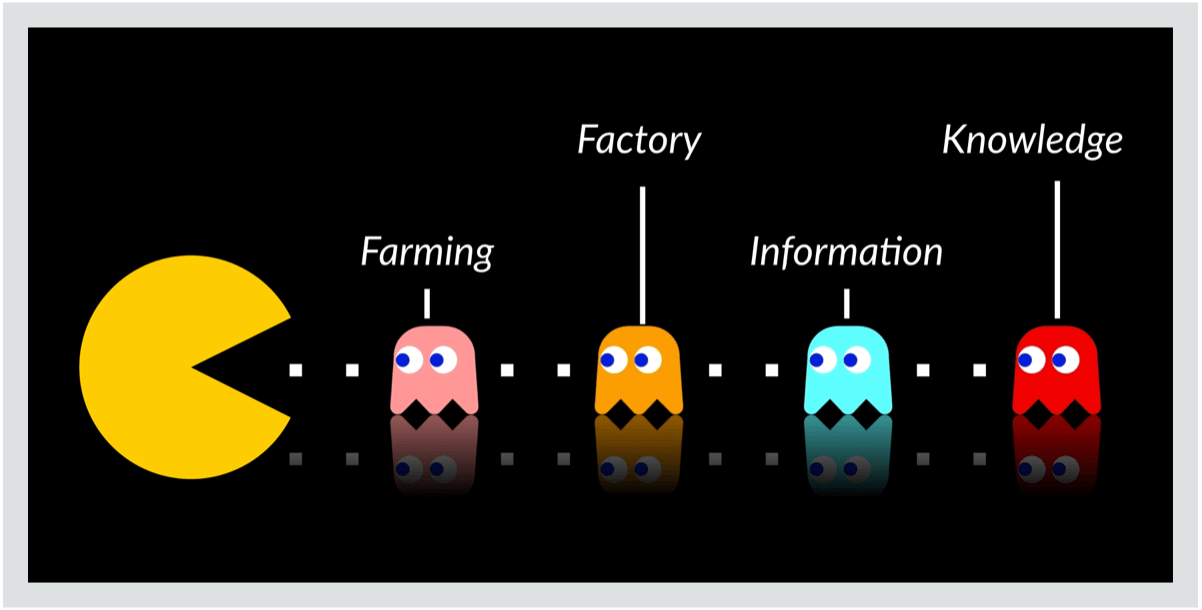

Perhaps there is not a more overhyped topic than the “Future of Work”. The basic diagnosis is that technology and, in particular, robots and artificial intelligence are going to take away all jobs as we know them. As a result, the government will have to provide the unemployable masses with a lifetime supply of food stamps and shelter.

In fact, it’s undeniable that technology will replace many jobs that currently exist. Authorities estimate that 50% of all current jobs will be made obsolete by technology in the next twenty years. But it’s also a fact that technology in various forms has been replacing jobs since the beginning of time. So while technology replaces jobs, it doesn’t replace work.

To prepare for an uncertain future, we suggest the 7C’s to augment reading, writing and arithmetic for what a knowledge worker needs to know: Critical Thinking, Creativity, Communication, Cultural Fluency, Civic Engagement, Collaboration and Character.

Those skills, in addition to “learning how to learn”, will be the foundation for participating in the future.

Read on to see what our crystal ball looks like going into 2018.

EIGHT PREDICTIONS FOR 2018

Contrary to conventional wisdom of a Trump apocalypse in 2017, public markets sprang to life. For the year, the S&P 500 was up 19.4%, NASDAQ was up 28.2%, and the Dow Jones was up 25.1%. The GSV 300, an index of the World’s 300 fastest growing public companies and a barometer for the broader Global growth economy, soared 57.1%.

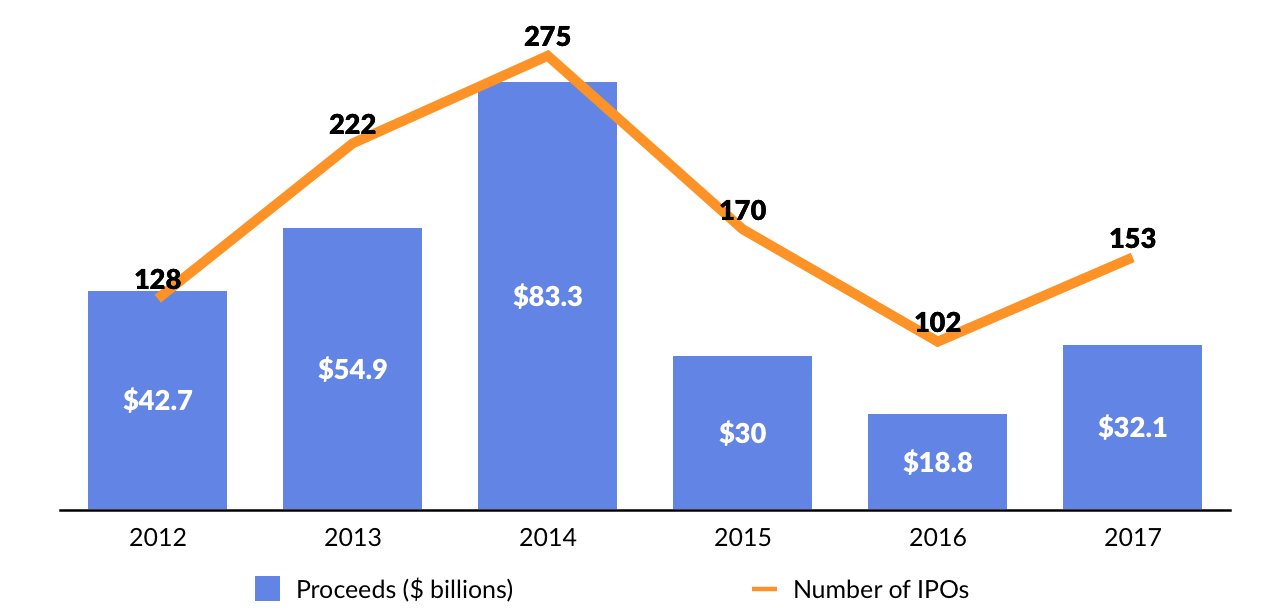

The Stock Market reflects the confidence investors have in the future, and the IPO market is an even more acute indicator. If investors are pessimistic, new issues shut down. If investors are optimistic, they treat IPOs like fresh oxygen that they can’t get enough of.

On a relative basis, the IPO market sprang to life in 2017, with 153 companies going public raising a combined $32.1 billion in proceeds. Compare that to 2016, where only 102 companies listed and IPO proceeds were a paltry $18.8 billion. In the past 15 years, there has been an average of 108 IPOs annually, down from the decade of the 90s, which had an average of 406 IPOs annually.

This March, Snap, the parent of Snapchat, raised $3.4 billion. It was the largest IPO of a U.S. company since Facebook, which raised $16 billion in 2012, and the largest overall since Alibaba, which raised $25 billion in 2014. Reportedly 10-times oversubscribed, it was greeted by eager investors, pricing above the range and popping 44%. Since its IPO, Snap’s market value has fallen to $18 billion as the company faces stiff competition from Facebook’s Instagram. Today, the company has over 178 million daily users creating 3.5 billion daily Snaps, and in November, Tencent took a 12% stake in Snap.

IPOs coming out of the Middle Kingdom picked up in 2017, with 16 Chinese companies listing in the United States including Best Logistics, search engine Sogou, and China Literature. In 2018, we expect to see more blockbuster IPOs from China, including DiDi and Xiaomi.

Also of note, seven Chinese education companies went public abroad including: Wisdom Education International Holdings (Hong Kong), Yuhua Education Group (Hong Kong), Minsheng Education Group (Hong Kong), Bright Scholar (NYSE), RYB Education (NYSE), RISE Education (NYSE), and Four Seasons (NYSE).

While we were pleased to see improving IPO activity in 2017, the recent trend points to a broader opportunity for the best names to break through an IPO backlog that has been building over the last fifteen years.

In January, Dropbox became the fastest Software-as-a-Service business to reach the $1 billion revenue run-rate milestone, according to a report by IDC. It hit the mark in eight years, beating SaaS leaders like Salesforce and Workday.

Impressively, CEO Drew Houston announced in April that the company had become profitable on an EBITDA basis. This follows a June 2016 announcement that Dropbox had achieved positive free cash flow. Today, Dropbox likely counts over 600 million users and 300,000 business customers – including a majority of Fortune 500 companies. Rarely have we seen a business operate with this combination of growth, profitability, and scale.

In July, Bloomberg reported that Dropbox is expected to hire Goldman Sachs as a lead adviser for a potential 2018 IPO.

According to multiple reports, Spotify — the World largest music streaming platform which now counts well over 140 million users and 60 million paying subscribers across 60 international markets — is considering a direct listing on the New York Stock Exchange in early 2018. To date, it has raised over $1.6 billion from a syndicate of investors including Accel Partners, Technology Crossover Ventures, and Goldman Sachs. Other IPO candidates such as Airbnb, Palantir, and Dropbox, will be watching Spotify’s direct listing closely, as that might turn out to be a more attractive choice.

64109.png)

Disclosure: GSV owns shares in Dropbox, Lyft, Palantir, Spotify

The company’s long-term growth has been driven by outstanding fundamentals. Spotify reports that since 2014, listening hours per user are up 25%, and the average number of artists each listener streams per week has increased 37% over the same period. In other words, not only are people spending more time on the platform, they’re engaging with a broader range of content. It’s a double play.

The list of IPO candidates goes on.

In 2016, Vice Media CEO Shane Smith indicated that he was in discussions with major banks about taking his $4 billion company public. That year, WeWork CEO Adam Neumann remarked in an interview that, “we’re not afraid to go public.” WeWork is now valued at $20 billion following a $4.4 billion financing led by Softbank in August.

At the Wall Street Journal’s Global Technology Conference, Palantir CEO Alex Karp suggested that the company had prepared itself should it decide to go public in 2017 or 2018. Creating liquidity opportunities for employees was one of the motivations.

In February, Karp predicted that the company would be breakeven by the end of 2017, noting that Palantir’s cash burn rate has decreased by approximately 60% versus 2016. Palantir’s operations in the UK are profitable today, as European revenue has roughly tripled over the past three years.

IDC estimates that Palantir operates in a sector that will grow from $150 billion in 2017 to over $210 billion in 2020. The company’s applications range from cyber security to capital markets intelligence, healthcare delivery, and defense. Importantly, while Palantir launched with a focus on large government contracts, corporate customers now represent over half of its revenue. Key clients include Airbus, AXA, Merck, BP, Deutsche Bank, and GlaxoSmithKline.

While Uber and Lyft continue their rapid growth, China’s DiDi Chuxing may be an IPO candidate to watch in 2018 now that it has absorbed Uber China. At $56 billion, DiDi is the World’s most valuable private company, and it now completes over 25 million rides per day with a network of 21 million drivers.

“Copycat” is rarely a term of endearment. But most great innovators have also been great imitators. Pablo Picasso once said, “Good artists copy, great artists steal.” It’s a lesson one of Silicon Valley’s great artists took to heart as he built a $650+ billion business. Steve Jobs created a culture at Apple that was built on “shamelessly stealing” great ideas, and then making them better than anyone could imagine.

This has played out in China on a massive scale. Beginning in the early 1990s, a boom in Global manufacturing outsourcing, sparked in part by access to cheap Chinese labor, became a driver of breakneck growth for the Middle Kingdom. It didn’t take long for local manufacturers and suppliers to realize that they could make more than component pieces. Phones and consumer electronics with names like “aPod” and “Nokla” flooded the market in the decade that followed.

The rise of the “Great Firewall of China” — a phase coined by Wired in 1997 to describe China’s widespread Internet censorship apparatus — created opportunities for copycats in the realm of software. The blocking or limitation of Western sites enabled Chinese entrepreneurs to carbon copy almost every blue-chip e-commerce and social media company that has emerged over the last twenty years.

42889.png)

Source: Yahoo Finance, Wall Street Journal, GSV Asset Management

* Denotes estimate

But the imitator has become the innovator. China is intent on creating its own consumer brands, exporting them, and putting up roadblocks for foreign players. Alibaba (e-commerce), Tencent (digital media), Xiaomi (mobile devices), China Mobile (mobile), DJI (drones), and Baidu (search & Internet services) — collectively valued at over $1.2 trillion — are just a few examples of what China has in store for the World.

And venture capital is following suit. According to the Wall Street Journal, in 2017, over 3,400 venture capital and private equity funds in China raised $240+ billion. That number is more than double of the amount raised in 2015 and is 10x more than 2006. Consultancy group Zero2IPO estimates that 12,000 investment firms in China manage $1.3 trillion, an increase from 8,000 firms managing $750 billion in 2015.

Several factors that are creating positive fundamentals to drive economic growth in China include: the rising middle class with migration into cities; significant emphasis and investment in education; China being in the center of the surging VChIIPs (more on that later); investment in modern transportation infrastructure in major cities; massive savings as a percentage of income.

However, negative factors include: mass pollution (however the government is addressing this with major green technology initiatives); an aging population hurt by the “One Child” policy; lack of transparency and integrity in financial reporting.

But if you look at the growth dynamics, it’s truly remarkable. A key catalyst is massive urbanization that is constant around the World but exploding in China. If you look at the United States, there are 10 cities with a population of one million or more. In China, there are 160. But more impressively, 35 Chinese cities have economies as large as entire countries, such as: the Philippines, Switzerland, the U.A.E and Sweden.

Importantly, these urban behemoths are clusters of young people who are embracing technology, brands, and digital commerce. They’re getting ready to change the World. Accordingly, we’re seeing accelerating innovation, with transformative businesses being created and accelerating venture investment activity across major Chinese cities.

Our view is that while the country has unmistakable cons, you want to be long on China. While you can’t predict the short term ebbs and flows, China is a Mega-theme for the future. Today, the Middle Kingdom is positioning itself at the center of the Global innovation economy and the Global Silicon Valley. The Innovator is now leading the World in producing startups that are tackling some of the World’s most challenging problems.

And if this seems like fiction, here’s a dose of reality. A few weeks ago, the Chinese authorities, using its vast camera system and facial recognition technology powered by Megvii Face++, took only seven minutes to locate a BBC reporter.

In three years, China plans for its homegrown AI to match that of the Western World. By 2025, Chinese AI will make “major breakthroughs”.

And by 2030?

In the words of the Karate Kid, “the student has become the master.”

Reasonable people can disagree. And they do — vehemently — when it comes to Bitcoin.

In September 2017, JPMorgan CEO Jamie Dimon remarked that, “If we had a trader who traded Bitcoin I’d fire them in a second. For two reasons: It’s against our rules, and they’re stupid. And both are dangerous.” At the time, one Bitcoin was worth about $4,200.

Just a few months earlier in May, Fidelity Investments CEO Abigail Johnson emphatically announced, “I’m a believer… I’m one of the few standing before you today from a large financial services company that has not given up on digital currencies.” At the time, Bitcoin traded at $2,200.

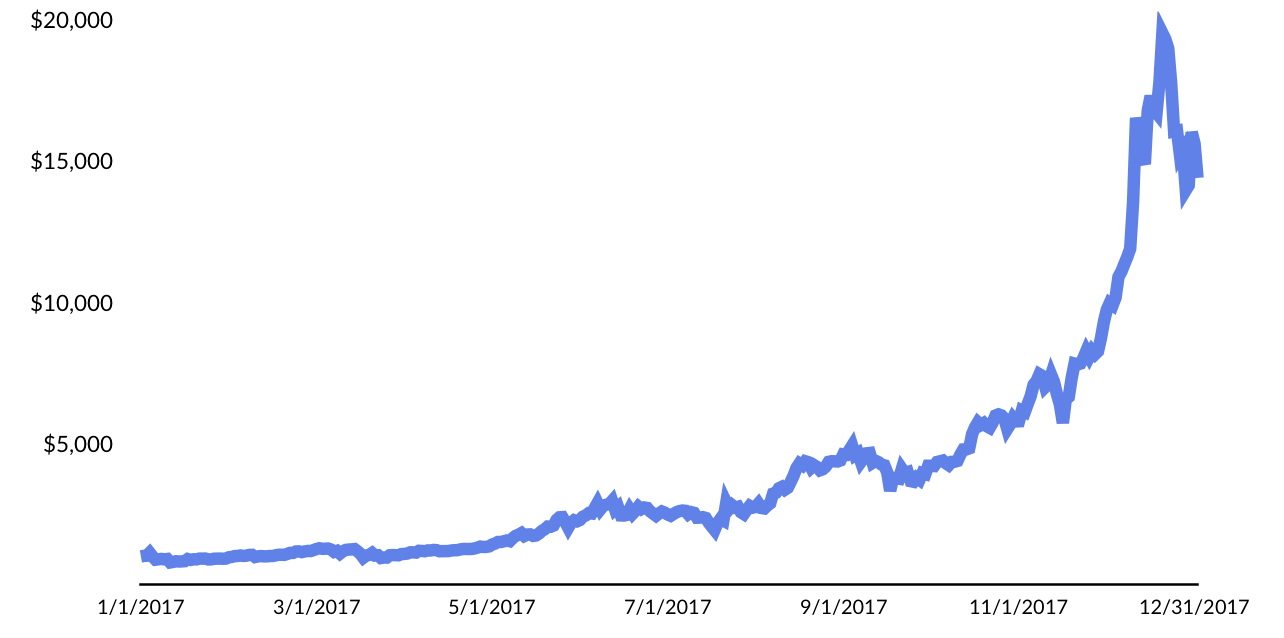

Today, the price of Bitcoin floats around $13,000, and on December 17, 2017, it reached its peak, briefly passing $20,000. Oh, to have bought in at $600 in March 2014 when Warren Buffett said, “Stay away from it.”

Bull or bear, we think the energy and excitement around Bitcoin points to a transformative innovation that is taking place reminiscent of revolutionary technologies such as the Internet and the automobile. While capital inflow and heightened participation becomes speculative, at some point there will be a dramatic shake out that occurs. But what emerges in the end will be larger and more significant than what any optimist can imagine.

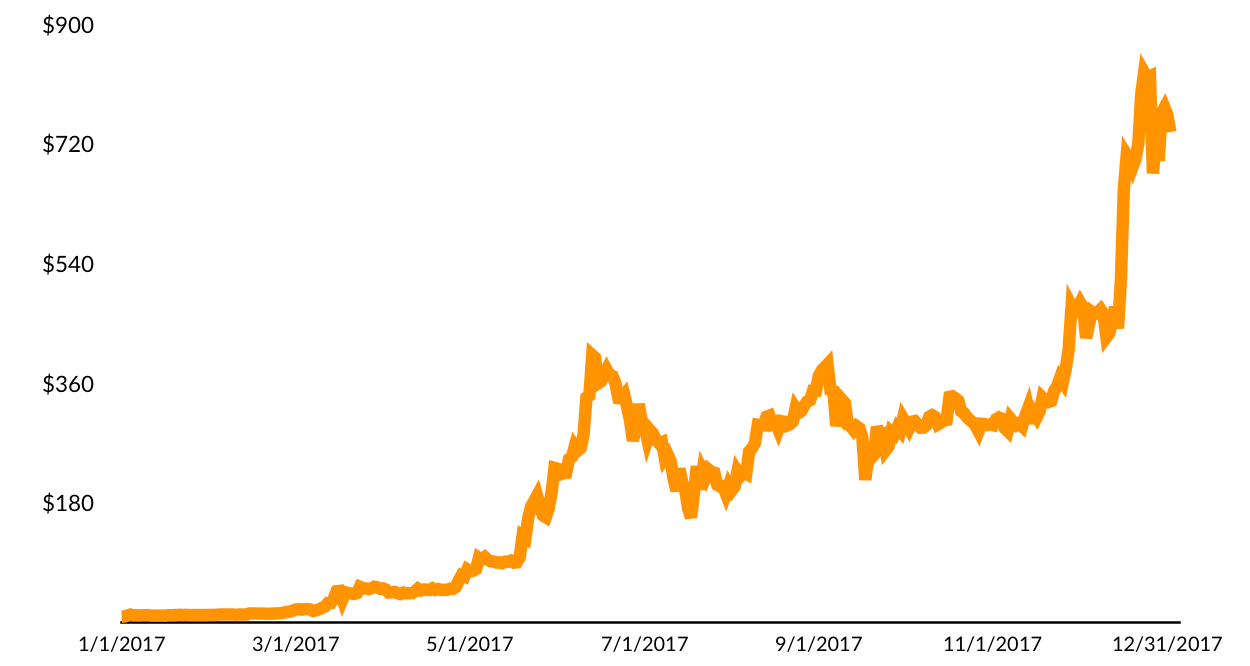

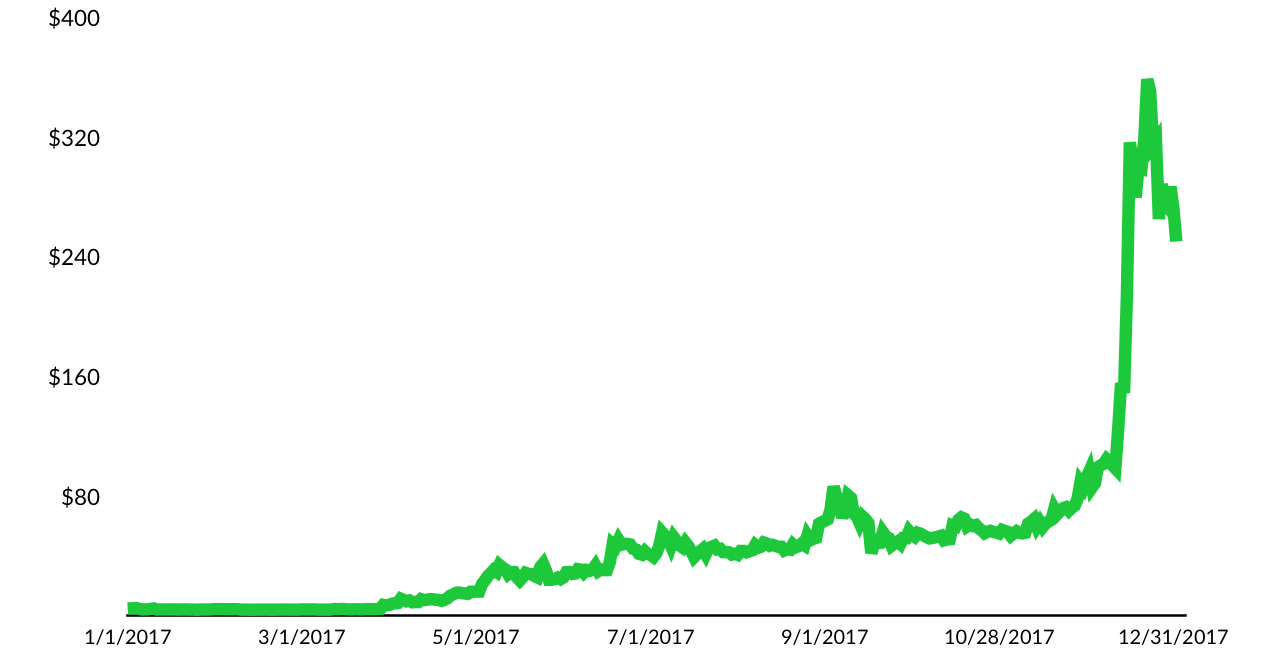

It’s not hard to argue that Bitcoin and related cryptocurrencies have looked bubbly of late. For the year, Bitcoin, Ethereum and Litecoin are up 1,300%+, 8,900%+ and 5,200%+, respectively.

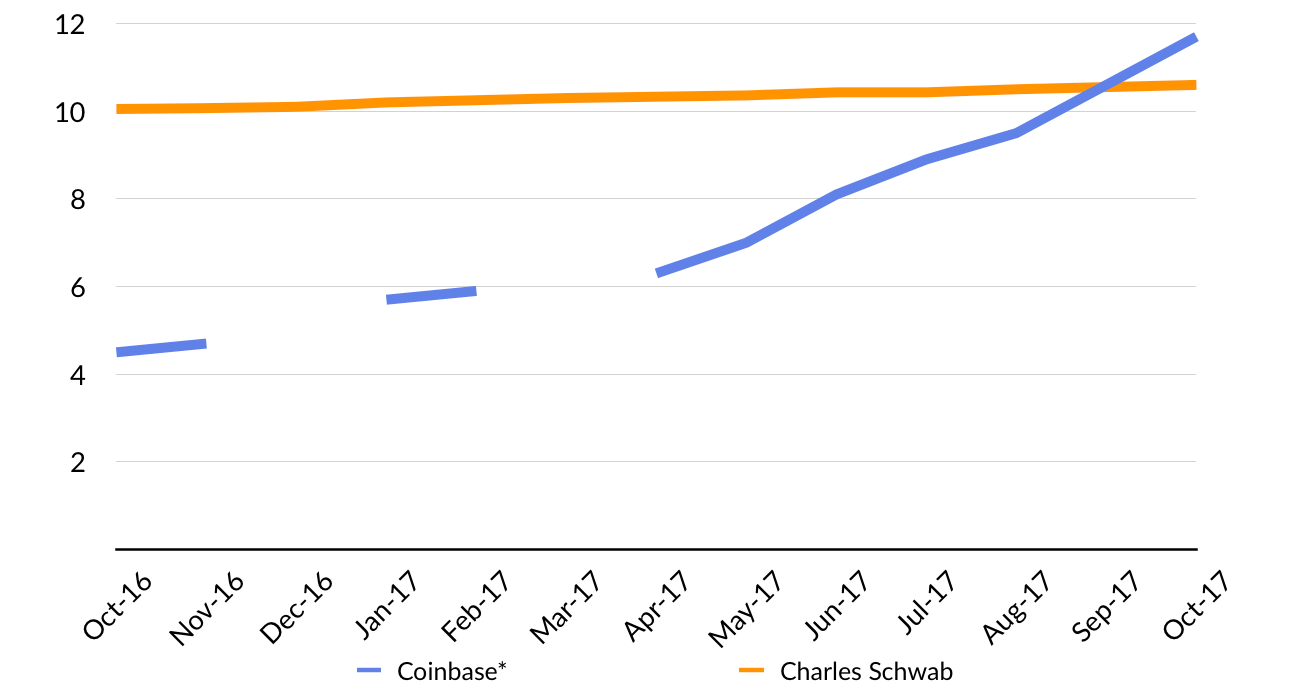

At the same time, cryptocurrency exchanges have exploded, following the booming interest in the category. This fall, Coinbase, a digital currency wallet that allows traders to buy and sell cryptocurrencies including Bitcoin, Ethereum, and Litecoin, raised a $100 million Series D at a $1.6 billion valuation. It is backed by a syndicate that includes Andreessen Horowitz, IVP, Union Square Ventures, Greylock, DFJ, The New York Stock Exchange (NYSE), Battery Ventures, Spark Capital, and others.

To put this in perspective, Coinbase now has 11.7 million accounts, up 148% from a year ago. Compare that to Charles Schwab, which reported in November that it had 10.6 million accounts, up only 5% from last year.

*Blanks denote months with no publicly available data

The Bitcoin craze has some of the same manic, irrational characteristics of bubbles past. In a classic case, Tulip prices soared in the Netherlands in the 1600s as speculators capitalized on widespread interest in the flowers.

Tulips, imported from the Ottoman Empire, were introduced in the Netherlands at the height of the Dutch Golden Age. The rarity and beauty of Tulips helped them find immediate favor with the Dutch elite, who eventually used the flowers as a status symbol. Tulip prices rose steadily as the flower gained broad popularity.

Soon, a tulip futures market blossomed as speculators began trading forward contracts at eye-popping prices. At the height of the craze, one flower could sell for more than 10 times the annual income of a skilled craftsman or the price of a nice canal house in Amsterdam. But the tulip market ultimately imploded, bankrupting scores of speculators and sending the Netherlands into an economic depression.

“Tulip Mania” was one of the first great documented speculative bubbles, but in the words of King Solomon, there is nothing new under the sun. From the South Sea Bubble (1711, United Kingdom), to the Great Depression (1929, United States), The Lost Decade (1980s, Japan), The Dot-Com Bubble (2000s, Silicon Valley), and the Housing Bubble, extraordinary popular delusions and the madness of crowds are recurring phenomena.

46482.png)

Regardless of how the price of Bitcoin moves in the coming months, there’s something special brewing in 2018.

Fundamentally, digital currency is at the intersection of several megatrends that are driving change in the Global growth economy.

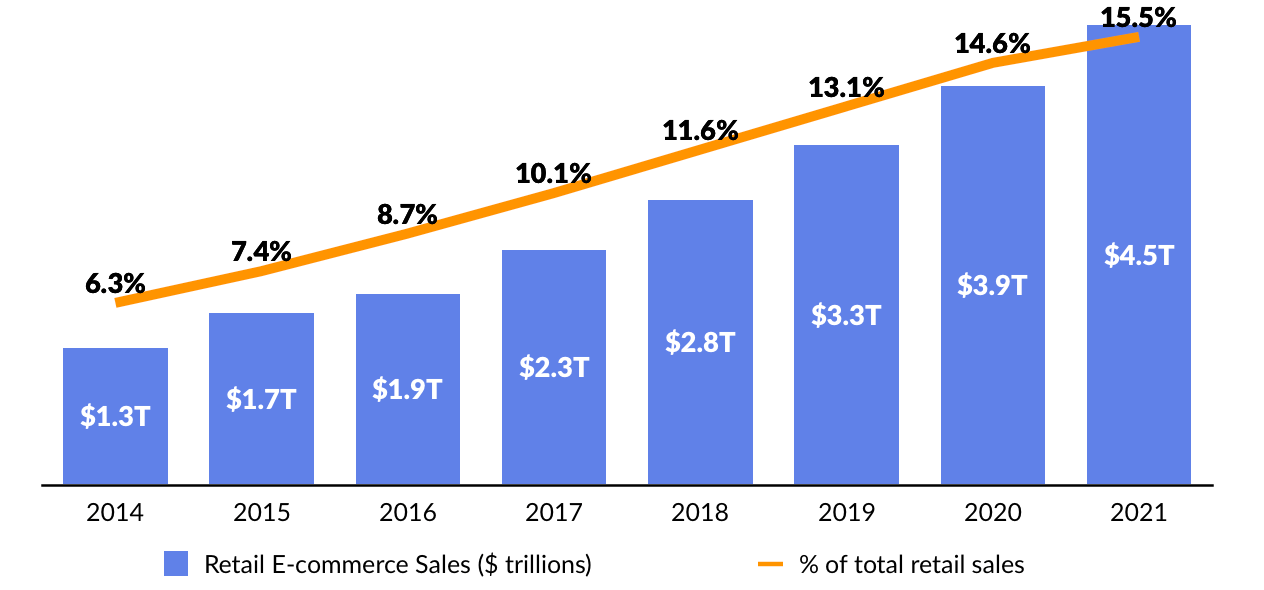

Following the rise of the Internet, Global e-commerce platforms like Amazon and Alibaba are making arbitrarily-defined national currencies less relevant. It’s part of the reason why the glory days of Forex are coming to an end. In 2003, the Global e-commerce industry recorded revenues of $70 billion. By 2006, it had risen to $136 billion, and by 2016, it had grown over 10x to $1.9 trillion. By 2021, e-commerce is expected to reach $4.5 trillion.

But what’s even more exciting is the technology enables Bitcoin and its broad applications.

Bitcoin is built on a peer-to-peer technology framework called the “blockchain,” which is the essence of the new currency. The blockchain is a decentralized, public ledger that records information about transactions occurring in real-time. As transactions occur, it forms “blocks” that are linked together through an encrypted mathematical function, thereby forming a chain of records. Presto, “Blockchain.” The technology is poised to enter the pantheon of inventions alongside the printing press and the Internet.

To paraphrase Marc Andreessen, blockchain gives us, for the first time, a way for one Internet user to transfer a unique piece of digital property or information to another Internet user, such that the transfer is guaranteed to be safe and secure. Everyone knows that the transfer has taken place, and nobody can challenge the legitimacy of the transfer.

But Bitcoin is just the beginning. The underlying technology can applied to all manner of “exchanges,” whether or not they’re related to money. The consequences of this breakthrough are hard to overstate.

Here’s Andreessen in a 2014 interview with the Washington Post:

Digital stocks. Digital equities. Digital fundraising for companies. Digital bonds. Digital contracts, digital keys, digital title, who owns what — digital title to your house, to your car. Like for example, you get a digital title on a car, attached to a digital key, where you own your car on the Bitcoin blockchain and on your smartphone. The key for opening your car and starting your car is tied to that title. And if I sell you my car, automatically you get title, and you get the key that lets you operate the car, and it’s all digital, and it’s all unique, and it can’t be cracked. You’ve got digital voting, digital contracts, digital signatures… If we had had this technology 20 years ago, we would’ve built it into the browser.

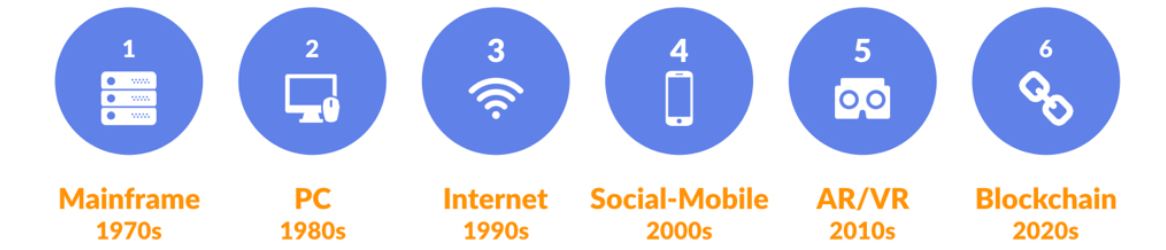

Today, there’s an emerging belief and a lot of momentum in the idea that blockchain is the next major platform in computing. In the same way that the World went from mainframe to PC to Internet to Mobile — and in recent years, to Augmented and Virtual Reality — blockchain has the potential to be a transformational technology.

A first generation of startups have surfaced that are creating enterprise applications using blockchain technology, which can be applied across a variety of industries. Working with large companies like banks and insurance providers, companies like Blockstream, BitFury, and Factom are laying the “digital tracks” that will enable broader application and adoption of the technology.

Ethereum, a non-profit that is creating a blockchain framework intended to be more flexible than the original model which was created for Bitcoin, has helped evangelize the technology beyond cryptocurrencies. Moving forward, we see key areas for the emergence of additional blockchain “blockbusters:”

In the history of the Fourth Estate, 2017 will go down as the year of “Fake News.”

On the one hand, it was a year where articles unencumbered by facts went viral. “Pizzagate” — the story of Hilary Clinton running a child sex ring out of a pizza shop in Washington D.C. — spread so quickly and with such legitimacy that both the New York Times and the Washington Post wrote articles debunking it. Another fan favorite was the Irish government accepting “refugees” from America seeking asylum following Trump’s presidential victory.

At the same time, President Trump spent 2017 hammering the “Fake News” in an escalating battle with various major media organizations, popularizing the term in the months before his inauguration. CNN was the most frequent object of his ire. Fox and Friends were, well, a friend.

By September 2017, Dictionary.com announced it would add the phrase as an official entry. Collins Dictionary followed suit in November, naming “Fake News” its 2017 word of the year, and The Oxford Dictionary looks poised to follow suit.

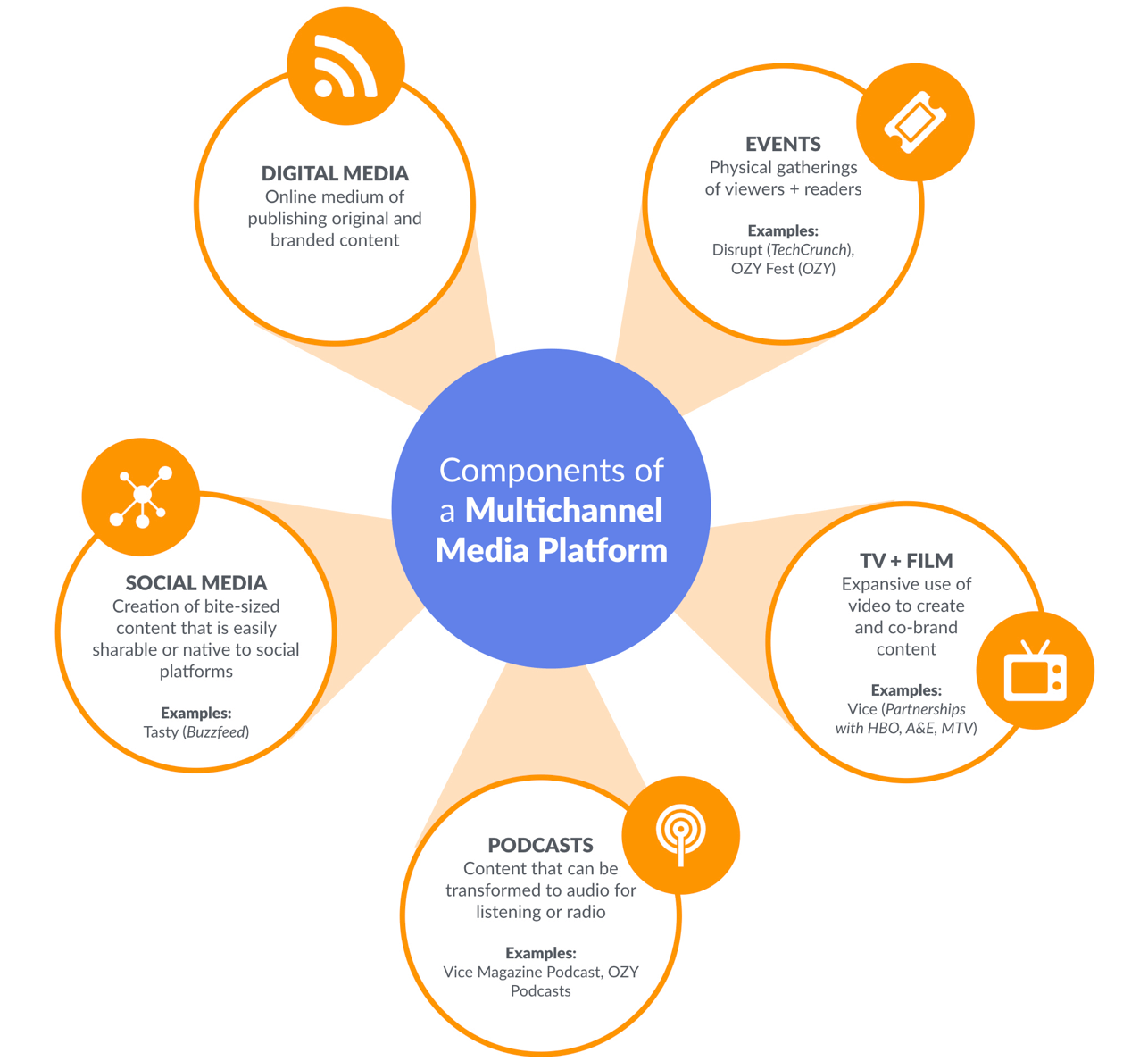

Many are speculating whether the Fake News phenomenon is bad news or good news for the media industry. Our view? It’s neither. But it does crystallize a broad set of fundamental shifts in the media landscape that will result in a significant wave of consolidation in 2018. Specifically, we expect to see a separation of winners and losers among high flying digital media newcomers.

In July, Vice Media completed a $450 million financing led by TPG that valued the company at $5.7 billion. That’s nearly twice the value of the New York Times. Vice, whose investors include Technology Crossover Ventures (TCV), Walt Disney, 21st Century Fox, the Raine Group, and WPP, said it would use the new funds to expand its multi-channel programming, which includes news, documentaries, and reality series distributed through Vice’s digital channels and third parties like HBO.

Why is Vice more valuable than the New York Times, the face of virtue in the news?

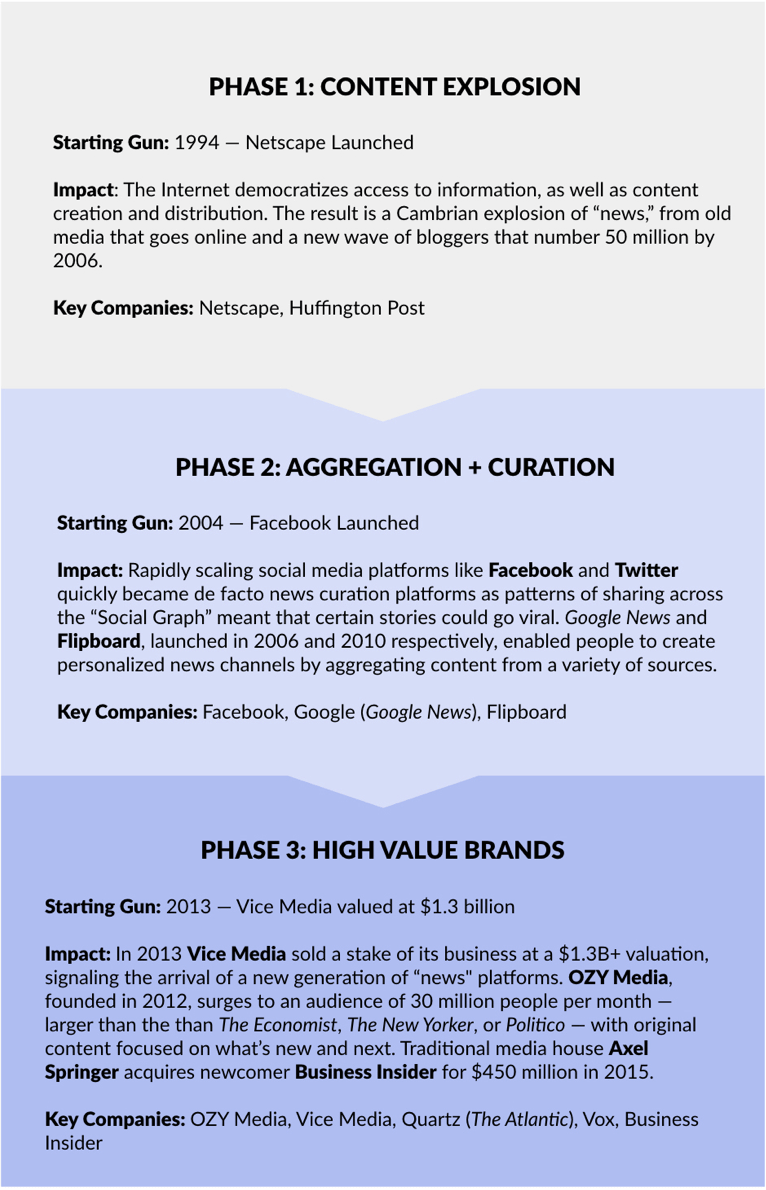

In just over 20 years, the news industry has undergone a fundamental transformation, which has happened in three phases starting with the launch of Netscape in 1994. The first phase was a Cambrian explosion of “news” as the Internet democratized access to information, as well as content creation and distribution. CNN.com went live in 1995 and the New York Times followed suit in 1996, but by 1999, a new phenomenon had arrived: “weblogs” or “blogs” — individuals publishing their own “news.”

In 1999, there were 23 blogs on the Internet. By 2006, there were 50 million. The Huffington Post, launched in 2005, created the first crowdsourced “newsroom” by aggregating bloggers through a branded channel.

The second phase was marked by the rise of curation mechanisms in the face of rapidly proliferating content. Social media platforms like Facebook and Twitter quickly became de facto news curation platforms as patterns of sharing across the “Social Graph” meant that certain stories could go viral. Google News and Flipboard, launched in 2006 and 2010 respectively, enabled people to create personalized news channels by aggregating content from a variety of sources.

In the third phase, we are coming full circle as consumers seek out engaging sources of information, ideas, and entertainment. Curation has proven to be a double-edged sword, on the one hand limiting a deluge of information but at the same time creating an echo chamber based on your own biases and the broader biases of your network.

But consumers are not simply turning back to the stalwart newspapers of yesteryear. As with businesses that are disrupting legacy consumer industries — from Airbnb in hospitality to Lyft in transportation and Spotify in music — people are demanding new and engaging digital content and physical experiences from brands that they love.

So where does Fake News figure into this sea change?

Dictionary.com defines “Fake News” as, “False news stories, often of a sensational nature, created to be widely shared online for the purpose of generating ad revenue via web traffic or discrediting a public figure, political movement, company, etc.”

Without question, “Fake News” has sparked a flight to quality that has benefited new and legacy media companies alike. Now more than ever, people are willing to pay for content they trust. Revenue from digital only subscriptions at the New York Times, for example, jumped 44%, or $75 million, in the first nine months of 2017. The New Yorker and Washington Post have seen record growth as well.

Yet on the whole, 2017 has been a dicey year in the media business. At the end of the third quarter, advertising revenue at the New York Times was down $20 million year-over-year. At Vanity Fair, the editorial budget faces a 30% cut. Oath, the offspring of Yahoo and AOL’s union, is shedding more than 500 positions as it scrambles to fit inside the Verizon conglomerate. IAC is exploring offers to offload The Daily Beast. Ziff Davis acquired Mashable at the fire sale price of $50 million, or about a fifth of its former valuation. Even Vice and BuzzFeed, are projected to miss their 2017 revenue targets by 20%.

None of this is the direct result of Fake News. But Fake News has been propelled by a proliferation of content-lite media platforms that have bet their future on reaching massive audiences with “Clickbait” content to generate advertising revenue. The problem — other than reality distortion — is that there just isn’t enough advertising revenue to go around.

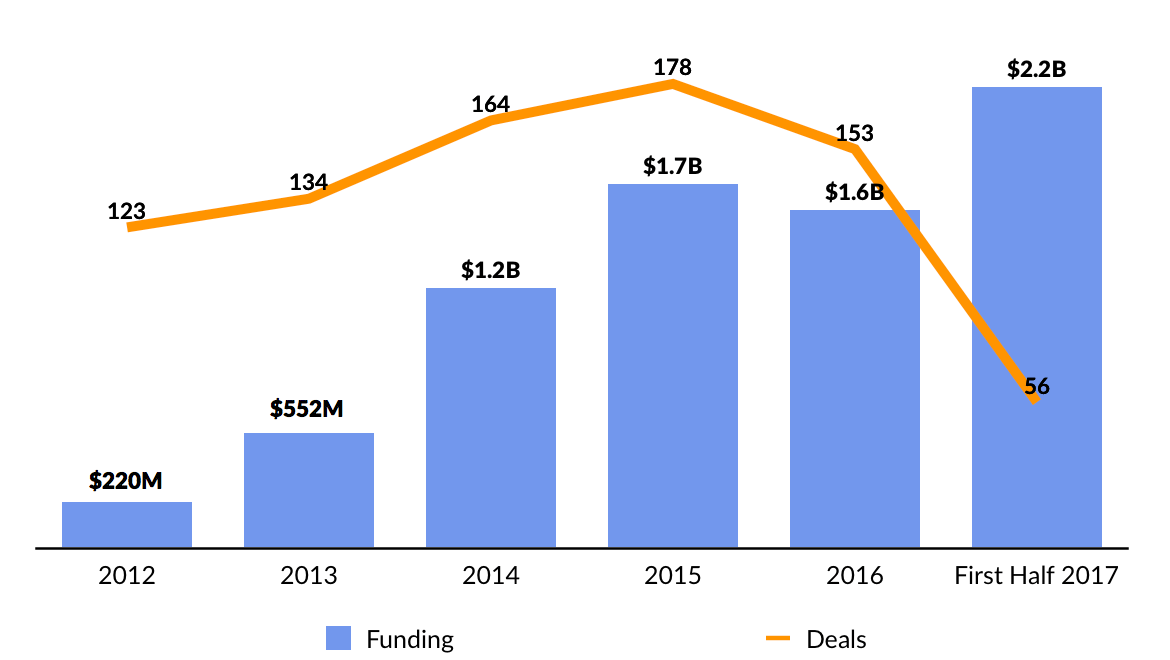

Since 2012, there has been over $7.5 billion of funding to digital media startups across 808 deals according to CB Insights. Despite $1.6 billion of funding in 2016, 90% of the growth in digital advertising came from just two companies, Alphabet (Google) and Facebook. In 2017, Google and Facebook are projected to account for approximately 61% combined of the U.S. digital ad market. No other company comes even close.

As The Atlantic’s Derek Thompson argues in “How to Survive the Media Apocalypse”:

Facebook and Google’s dominance stems from one of the great arbitrages in media history. Publishers still bear the cost of reporting, analyzing, and, well, publishing the news. Facebook and Google cinch the bloated web into the straitjacket of vertical content known as results pages and feeds. In the process, they collect unparalleled information about the interests and aspirations of their users and profit from their roles as digital gatekeepers. While some have compared Facebook and Google to cable companies distributing television shows, one difference is critical: TV distributors pay networks an “affiliate fee” for their entertainment, while Facebook and Google owe no such gratuity for the vast majority of its content.

Venture funding is likely to cool off significantly in 2018, which will compound challenges for digital media startups that rely on advertising. At the same time, winners — new and old — will begin to emerge based on the ability to demonstrate multi-channel revenue models. A flurry of consolidation — both M&A and brands folding — will follow.

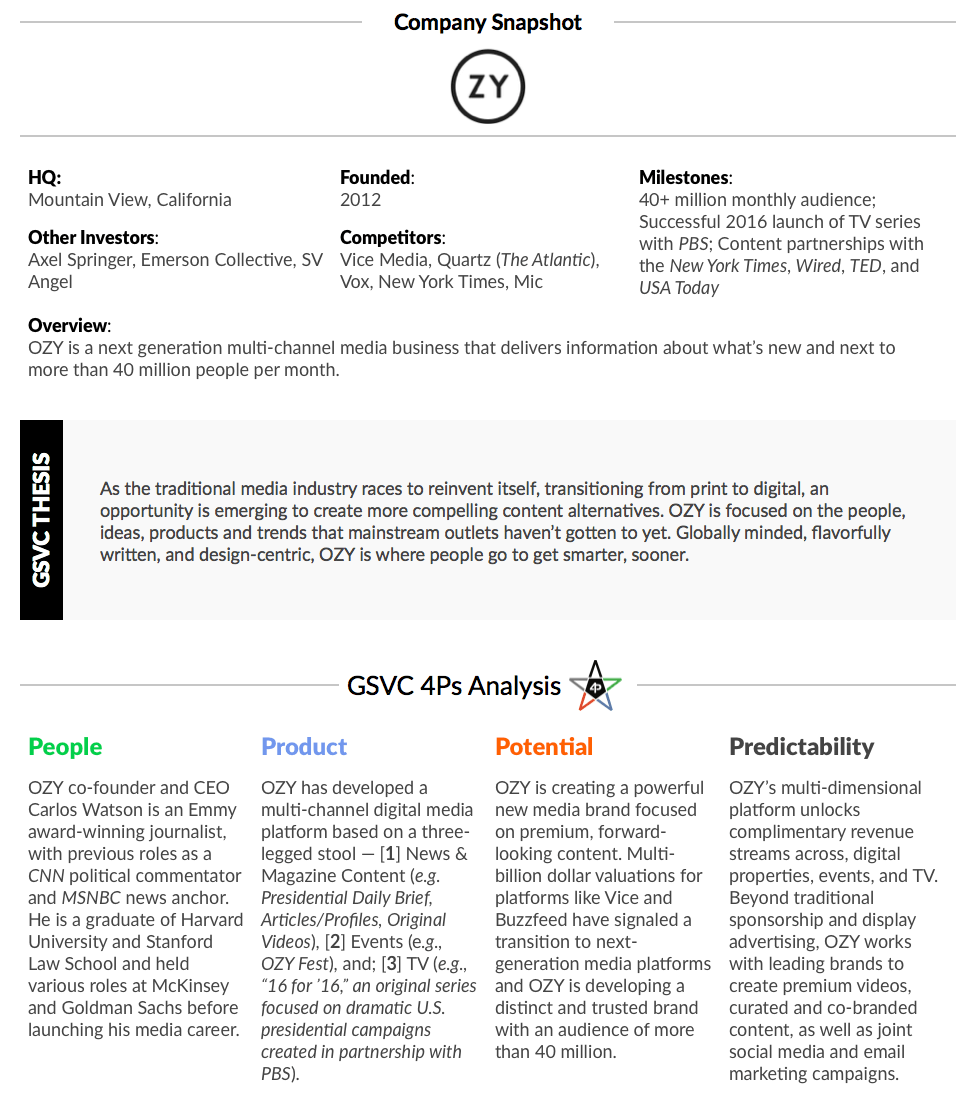

In September 2016, for example, OZY partnered with PBS to premiere a primetime program called “The Contenders – 16 for ’16,” an 8-part documentary series dissecting the most dramatic presidential campaigns in U.S. history. The series, which aired on PBS and BBC before the 2016 Presidential Election, attracted over 30 million viewers. (Disclosure: GSV owns shares in OZY)

In 2015, Vice announced a major partnership with HBO to distribute original content through the network. Vice has also inked lucrative deals with A&E and MTV to exclusively air original content on their channels.

ByteDance is an emerging star in the East with over 200 million daily active users. Currently valued at $22 billion, ByteDance is the leading AI-powered media platform in China, with major business lines in multiple aspects of media and entertainment, from news, to live video and online dating. The company’s most famous business unit, Toutiao, is an AI-driven news discovery app that has skyrocketed in popularity since its launch in 2012. Today, Toutiao has over 120 million daily active users who spend a mind-boggling 74 minutes on the app daily, topping that of Facebook, WeChat, Snap, and Instagram.

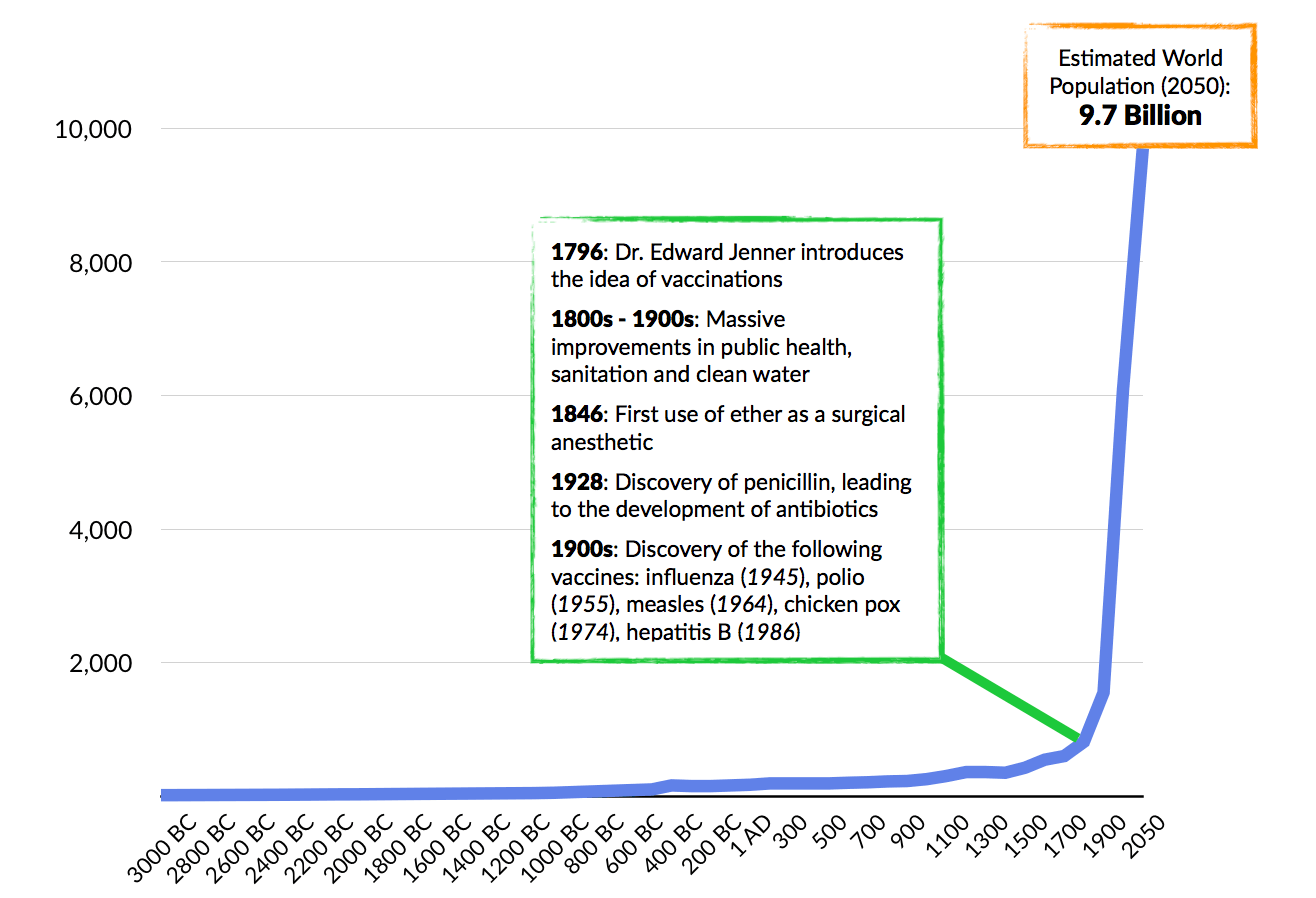

In 1 A.D., the human population on Earth was at a steady 200 million. In 1804, at the height of the industrial revolution, the human population passed the 1 billion mark. But in 2011, about 200 years later, the population boomed to 7 billion. And by 2050, its expected to rise to 9.7 billion.

Much of the increase between the 1800s to 2000s was due the innovations that led to the creation of modern medicine. Life expectancy increased and death rates plummeted due to the invention of vaccines (1796), surgical anesthetics (1846), antibiotics (1928) and implementation of public health initiatives. All in all, these initiatives led to a massive increase in the quality of life and prevented many of the common ailments that used to result in early fatalities.

But modern medicine hasn’t extended our natural lives a single year. It has saved mankind from premature deaths and allowed people to live more holistic lives. Even if diseases such as cancer, diabetes or heart disease are overcome, it still only means that people can live to 100… but not much more.

As attention is turned towards extending human lives to 200 or even 500, medicine will have to turn a new chapter towards understanding what it means to reengineer the human body to regenerate. And major science parks and corporations are heightening their focus on uncovering the mysteries of human longevity. Google’s Calico is the first of many expected major initiatives aimed at providing insights on genetics, human health, and cell biology to prolong life.

Many other major research initiatives have been conducted on stem cells, which hold an enormous potential to promote human longevity. And while stem cells are not new news like CRISPR, the pace of innovation in this field is accelerating. In the past decade, two Nobel Prizes have been awarded to scientists working on stem cells. In 2010, a person with a spinal cord injury became the first individual to receive stem cell medical treatment. In 2012, it was discovered that stem cells showed promise to cure human blindness, and in 2014, researchers in Japan began clinical trials in human patients.

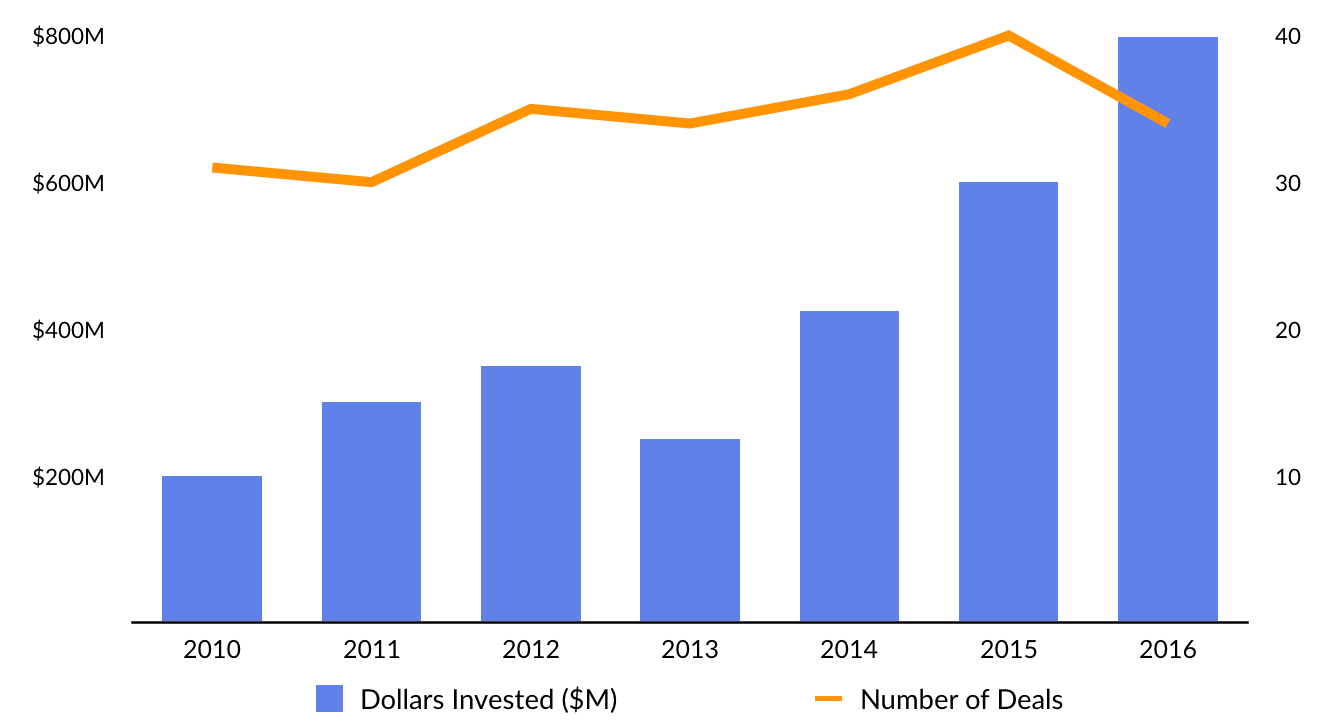

The private sector is taking notice. Venture funding into regenerative medicine startups has increased from less than $300 million in 2011 to over $800 million in 2016. Notable startups include San Diego-based Samumed, which has raised over $300 million and is reportedly valued at $12 billion. The company offers the promise of regenerating hair, skin, bones, and joints, by stimulating the production of specially targeted stem cells.

UNITY Biotechnology takes a different approach to reverse aging by eliminating senescent cells, which are cells that have permanently stopped dividing. Our bodies use cellular senescence as an “emergency brake” to stop cells from dividing to prevent the proliferation of tumors. But these senescent cells accumulate in our bodies with age, secreting inflammatory chemicals that harm nearby cells.

As a result, these cells result in common “old age” diseases including osteoarthritis, atherosclerosis, eye diseases, and kidney diseases. By eliminating these senescent cells, UNITY aims to prevent the development of fatal and debilitating diseases. The company has raised $154 million since its founding in 2009 from investors including Venrock, Founders Fund, Vulcan Capital, Jeff Bezos, Fidelity, and the Mayo Clinic.

In December 2016, pharmaceutical giant Bayer and Versant Ventures partnered to launch BlueRock Therapeutics, a stem cell therapy company, committing a combined $225 million into the effort. The company develops stem cells that can be used to develop organs that are suitable for transplants.

Other startups, like Y Combinator alumnus Forever Labs, are attacking the issue of human longevity by preserving and enhancing young stem cells so they can be used in therapeutic applications at a later date. It’s a call option on a potential “fountain of youth” as material treatments are developed in the coming years.

Forever Labs’ President Dr. Mark Katakowski spent the last 15 years studying stem cells and found that, like regular cells, they lose their function as they age. Better to store them now. He co-founded the company with Steve Clausnitzer (CEO) and Edward Cibor (Chief Management Officer) to build a stem cell storage company that allows people to capitalize on the opportunity while they’re still young.

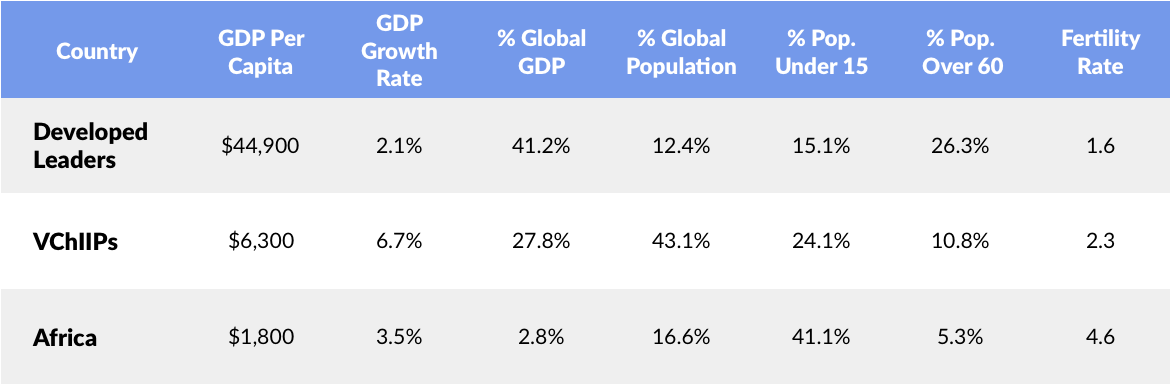

Looking in the rearview mirror, the economic engine for the last 100 years was the United States, Europe, Japan, and Canada.

In 2000, with just 9% of the Global population, these countries contributed over 50% of Global GDP. But over the last 15 years, GDP growth has been flat-to-negative. Today the old guard contributes just 41% of Global GDP.

A key driver behind this change has been aging populations. Over 26% of these populations are over the age of 60 while just 15% are under the age of 15. In Japan last year, there were more adult diapers sold than baby diapers.

These dynamics are not changing anytime soon. The average (weighted) fertility rate in Canada, the United States, Europe, and Japan is 1.6. At a fertility rate under two, you’re essentially dying.

Where is the growth and opportunity as we look ahead? One area to look is a group of countries we call the “VChIIPs” — Vietnam, China, India, Indonesia, and the Philippines.

The VChIIPs are home to over 43% of the Global population and command 28% of Global GDP, growing at 6.7%. If you look at the demographics, they are the mirror opposite of the World’s developed countries. Just 11% of the VChIIP population is older than 60, 24% is younger than 15, and the fertility rate is 2.3, driving organic growth.

But Africa is on the horizon. It claims five of the 10 fastest growing countries by population and three of the 10 fastest growing countries by GDP.

Source: International Monetary Fund, World Bank, GSV Asset Management

*2017, as reported by the International Monetary Fund

And the VChIIPs are spawning a stable of game changing new businesses in their own right. China is intent on creating its own consumer brands such as Alibaba, Xiaomi and Tencent, exporting them and putting up roadblocks for foreign players.

India, which has lagged China in recent decades, has had its own proliferation of consumer brands including Flipkart, Ola, InMobi, and Paytm — without the onerous state protections of its neighbor in the Middle Kingdom. Finally, among the remaining VChIIPs, Indonesia — home to Tokopedia (Digital Marketplace, $1+ billion market value), and Go-Jek (Transportation & Logistics, $3 billion market value) — is on deck.

And increasingly, dynamic companies born and raised in the VChIIPs — China in particular — are hitting the Global stage to actively compete against tech leaders in the United States.

79186.png)

It wasn’t long ago that conventional wisdom held that the functioning of our brains — including neurological maladies — is set early in life. The capacity to train and improve the diverse mental abilities that make up our intelligence was not considered possible.

But over the last twenty years, researchers have demonstrated that the brain is in fact “plastic” — it can physically remodel itself. The implication is that brain “plasticity” can be manipulated in ways that treat and prevent afflictions that were once deemed permanent.

The convergence of neuroplasticity research with powerful new digital technologies — from gaming to virtual reality — will lead to transformative innovation. Dr. Adam Gazzaley, the visionary Founding Director of Neuroscape at the University of California, San Francisco (UCSF), is at the vanguard.

In 2013, Dr. Gazzaley demonstrated that swerving around cars while simultaneously picking out road signs in a video game could improve the short-term memory and long-term focus of older adults. Some people as old as 80, the research noted, began to show neurological patterns of people in their 20s.

The game, NeuroRacer, was an unprecedented collaboration between the best in digital media and the best neuroscience. Working with top designers from LucasArts — creators of the Star Wars video game franchise — the vision was to create a highly engaging video game that fundamentally improved the functioning of the mind. Dr. Gazzaley and his team demonstrated that you could truly use gaming to train the brain. His findings were featured on the cover of Nature on September 5, 2013, with the title, “Game Changer.”

Peel away the entertainment layer and storyline, and video games are simply complex problems waiting to be solved by players. Games force users to process information and master skills in real time. The game does one thing, the player responds. In order to beat the game, the player needs to master the system.

3526.jpeg)

The fundamental concept that has driven Dr. Gazzaley’s work is applying “closed-loop” systems in the form of video games that target specific neurological objectives.

The first step is to identify the target of the game — the different facets of our cognitive capabilities and the underlying neural systems that drive them. These include attention, working memory and goal management.

Next, a game is designed to emphasize those abilities. It records performance in real time and adapts itself to focus on the areas where users most need help. That goes back to your brain and creates the desired closed loop.

In closed-loop systems, the system 1) challenges the user with an intervention; 2) records the influence of the challenges in real time; and 3) immediately updates the challenge to be more effective to get the desired outcome. This personalized feedback locks users into a constant cycle of improvement, and this technique, coupled with fun and immersive video games, can result in transformational outcomes.

In 2011, Gazzaley co-founded Akili, a company with a mission to create validated cognitive therapeutics, assessments, and diagnostics delivered through high-quality video games. The company is partnered with leading Universities (University of Washington), pharmaceutical and biotech companies (Pfizer, Shire, Merck, Amgen) and foundations (Autism Speaks) to develop novel games that treat ailments such as ADHD and Alzheimers through their flagship product Project: EVO, which is currently seeking FDA approval.

Today, one third of people die from some form of dementia. Over 2 billion people suffer from brain-based challenges, which rolls into more than $2 trillion of economic loss from suppressed productivity. Furthermore, 10% of children Worldwide are diagnosed with ADHD and another 10% of Americans adults suffer from mood disorders. Traditional health care tackles these ailments with prescription drugs, which often result in unwanted, sometimes life-threatening side effects, especially in children or the elderly.

The use of neurogames is a revolutionary new therapeutic model to restore and improve cognitive function. Soon, physicians will be prescribing games, as opposed to drugs, to effectively treat brain diseases and disorders. Adderall and other blunt instrument pharmaceuticals with terrible side effects are going to look like medieval medicine before long.

One Neuroscape game, Body Brain Trainer (BBT), is a full-body motion capture game that improves brain function by simultaneously challenging the core aspects of cognitive control — attention, working memory, multitasking — while prompting increasingly strenuous physical activity.

The game monitors the participant’s heart rate and uses adaptive algorithms to consistently ensure that players are challenged both physically and mentally. It’s scientifically proven that exercise can significantly improve brain function. By coupling that with brain training, BBT has the potential to enhance cognitive abilities more than physical or brain training alone.

Beyond treating disorders, the next step is to apply this technology to reimagine education. A game like Body Brain Trainer puts “gym class” or “working out” in an entirely different context. In the future,”learning” will no longer be limited to mastering skills and content. It will be about optimizing your brain.

83410 (1)5195.jpg)

Movement is in our DNA. Until about 10,000 years ago — or 99% of human history — there were few, if any homes or villages. People were nomadic, chasing food and gentler climates.

While we couldn’t change the weather, we learned how to domesticate plants and animals in what is now called the Neolithic Revolution. And when the food stopped moving, so did we.

In the next 10,000 years, historians might look back and name our era the “Metropolis Revolution.”

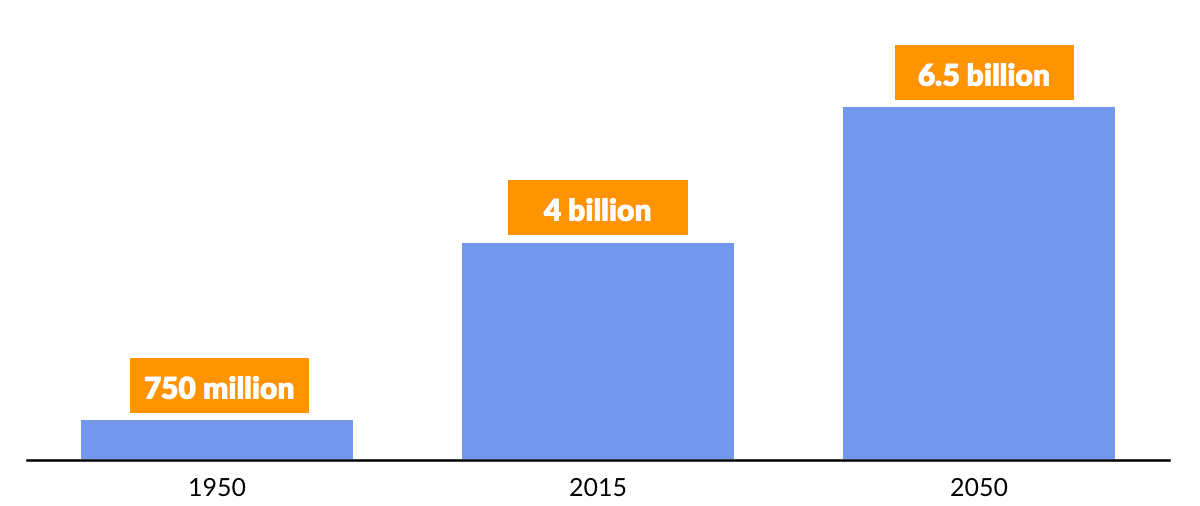

Today, the United Nations estimates that four billion people, or 54% of the World’s population, live in cities. In the next 15 years, the Economist projects that urbanization will increase average city density by 30%. By 2050, the ranks of urban dwellers will swell by 2.5 billion to nearly two-thirds of Global population.

Around 80 million people annually move from rural to urban areas and the number of megacities — cities with a population 10 million or greater — has doubled in the past two decades, from 14 in 1995 to 31 in 2017. It’s estimated that by 2100, over 80 cities across the World will have a population over 10 million.

The rise of Global urbanization, coupled with a corresponding increase in the number of vehicles on the road, has pushed city traffic to the limit. In Mexico City, for example, the city with the most traffic congestion in the World, drivers spend two thirds of their time in the car in gridlock. And with a population of eight million, Mexico City isn’t even considered to be a“megacity” (10+ million population).

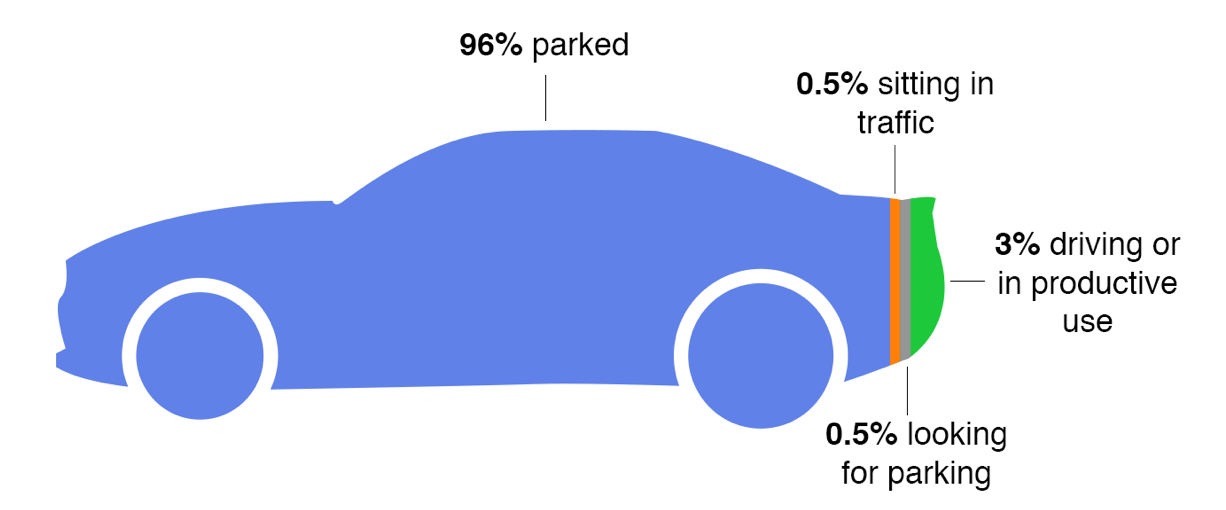

Americans spend over $2 trillion per year on car ownership — more than what we shell out for food. But shockingly, the 250 million cars in the United States spend 96% of the day parked. In other words, there are 240 million cars parked at all times. As Lyft co-founder John Zimmer has observed, BMW doesn’t make the “Ultimate Driving Machine” — it makes the “Ultimate Parking Machine”.

As is often the case, the greatest problems create the greatest opportunities — the bigger the problem, the bigger the opportunity.

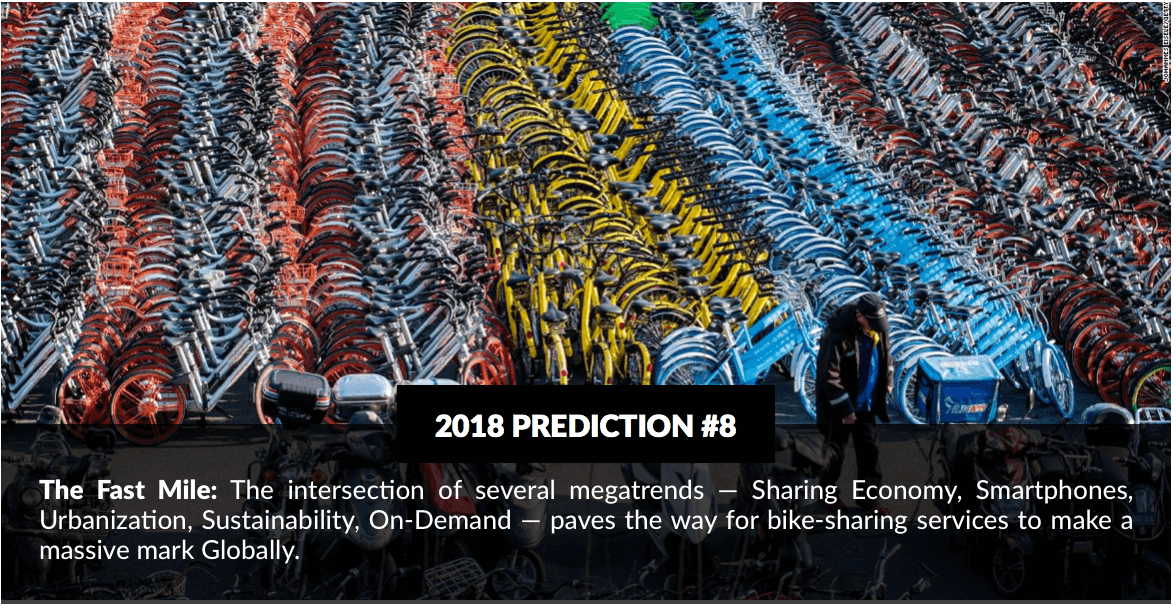

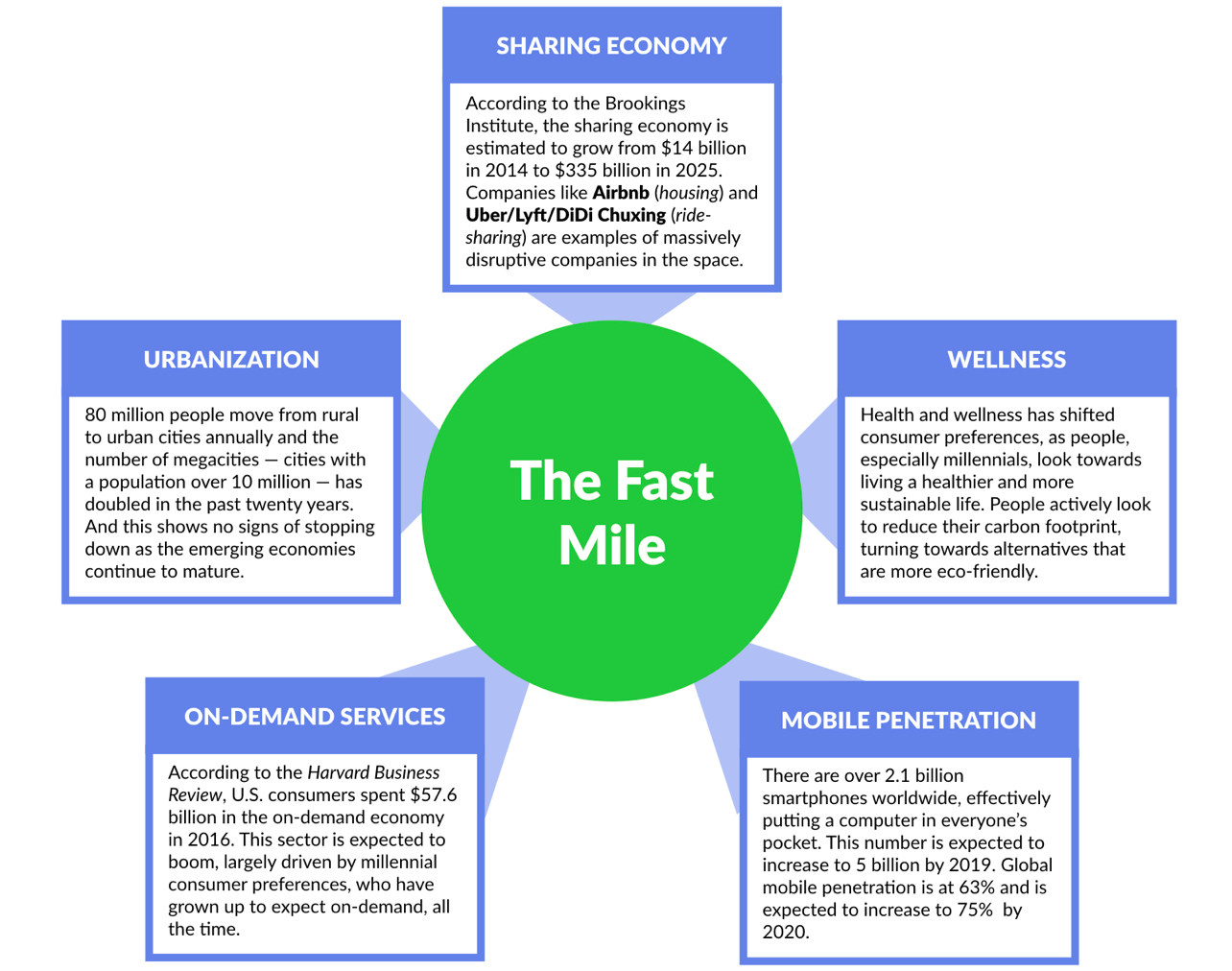

And thats where the “Fast Mile” comes in. Arising at the intersection of several megatrends — the sharing economy, smartphones, urbanization, sustainability, and on-demand services — the Fast Mile encompasses solutions that will add efficiency to the problem of last mile transportation in congested cities.

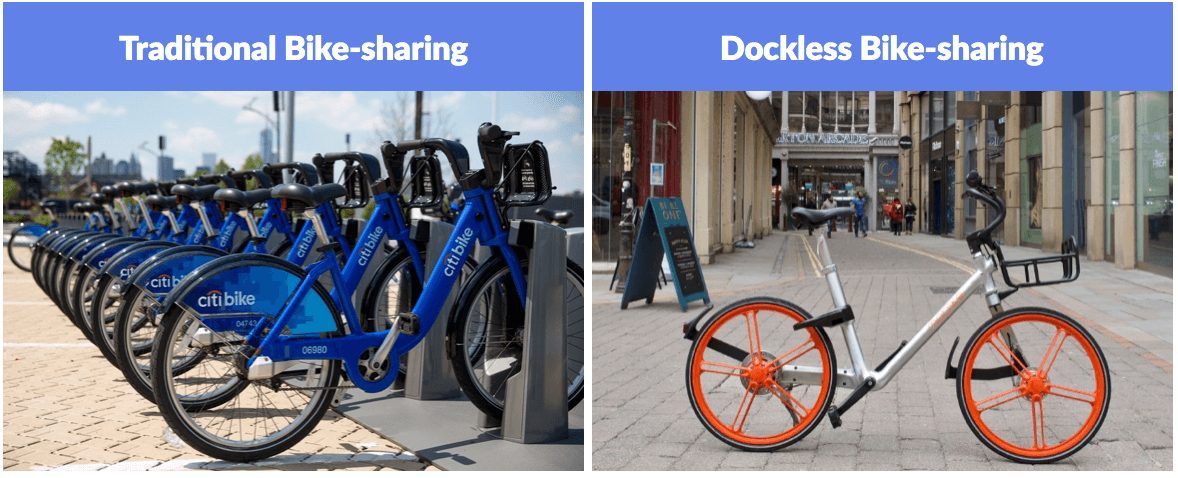

As we enter 2018, a new wave of Fast Mile initiatives will take off, led by dockless bike-sharing services.

Bike-sharing services are not new. They have been in existence in major metropolitan areas for the past decade. But, until recently, they haven’t been “smart.” Think about what Uber did to the black car industry. Believe it or not, Carey Limousine was a public company and its claim to fame was providing access to a Global network of high-end taxis. It was a network. Carey didn’t own any cars. Sound familiar?

In a similar way, an emerging group of bike-sharing startups are achieving massive scale — and they’re backed by serious investors. These companies are capitalizing on apps that enable users to easily locate, unlock, use and return bikes through an app.

Traditional bike-sharing services allowed riders to pick up bikes from docks scattered around metropolitan areas. Riders had to ensure that they picked up and returned the bikes to specific locations, otherwise they would be surcharged for their rides. While this service was useful, it didn’t allow riders the full flexibility to use bikes to get from point A to point B.

On the flip side, dockless bike-sharing allows riders to pick up and drop off bikes wherever they want, whenever they want. Riders are able to unlock bikes remotely using a mobile app, ride the bike to their destination, and then leave the bike there for the next rider to use. Unlike traditional bike-sharing services, dockless bike-sharing grants riders the full flexibility to use bikes at their convenience.

China is home to 10 of the 25 most congested cities in the World. So its not a surprise that the two leading bike-sharing companies — Mobike and Ofo — were born in Beijing. They raised over $1.9 billion alone in 2017. Why? In two years alone, these companies have amassed over 100 million users who are completing 25 million rides per day.

While dockless bike-sharing has hit major Asian markets, in Europe and the United States, the movie is just beginning. Global and homegrown players are rushing to secure the prime position in these markets. Mobike (China), Ofo (China), LimeBike (US) and Spin (US) are leading the land grab.

California-based LimeBike’s bright green bikes are now populating the streets of the United States. Founded in 2017, the company officially launched on the University of North Carolina-Greenboro’s campus. The company now operates in 35 markets — ranging from large metropolitan cities like San Francisco, Los Angeles, Seattle and Washington D.C. to college campuses. This month, LimeBike announced it surpassed one million rides, and it is poised to launch in Zurich and Frankfurt.

While seasonality in major cities— namely, the Winter — is an inherent check on the growth of bike-sharing adoption, we expect to see continued Spring surges across major Western cities.

Down the line, keep an eye out for the proliferation of other fast mile services, such as dockless electric bikes and scooters. Bird, a Santa Monica startup, is already providing electric scooters in the Los Angeles region. Suffice to say, there is much land to grab in 2018.