Market Snapshot

| Indices | Week | YTD |

|---|

Boom!

As we reflect on 2017 — the year that was — it’s amazing what has happened over the past twelve months… and what hasn’t happened.

Many thought on January 20th, with the inauguration of the 45th President of the United States, Donald J. Trump, the Earth would stop turning, the sky would come crashing down, and life, as we knew it, would effectively come to an end.

Instead, not only did the Sun come up in the East on January 21st — and every day thereafter — a swagger came back into the step of the collective citizenry. The nasty rhetoric that engulfed the 2016 campaign faded away. A pragmatic attitude of getting stuff done “trumped” the Beltway gridlock that had become the norm. The ideology of Republican or Democratic issues blurred into American issues, guided by the collective realization that we are all on one United States of America TEAM.

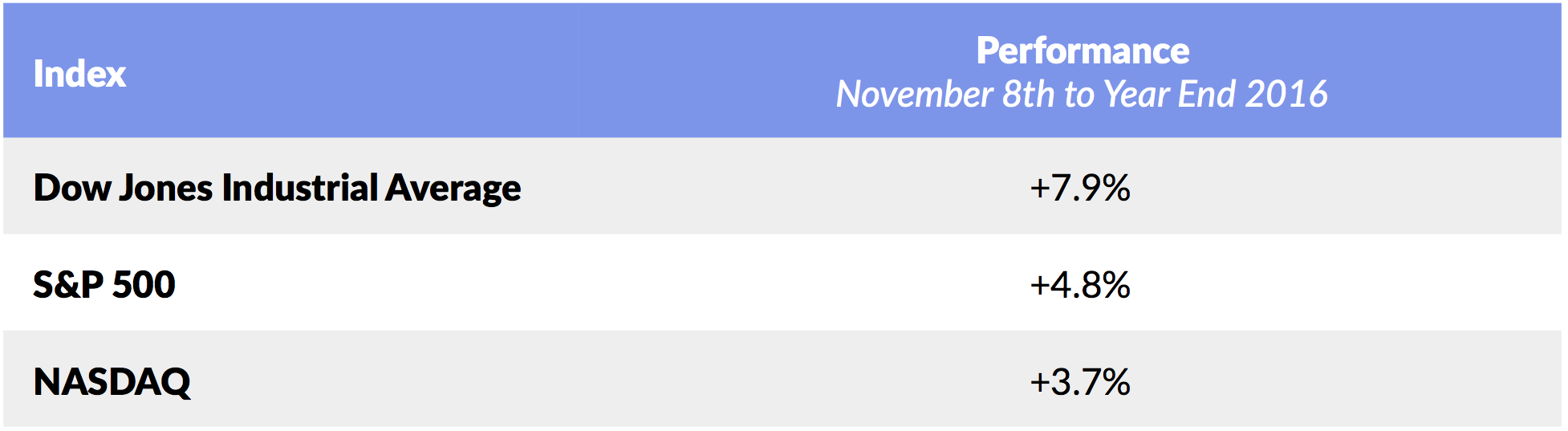

Consumer Confidence, which reached a fifteen-year high following the 2016 election, continued to climb throughout 2017. Markets, led by the Dow, which soared nearly 8% between November 8th and end of 2016, continued to march upwards.

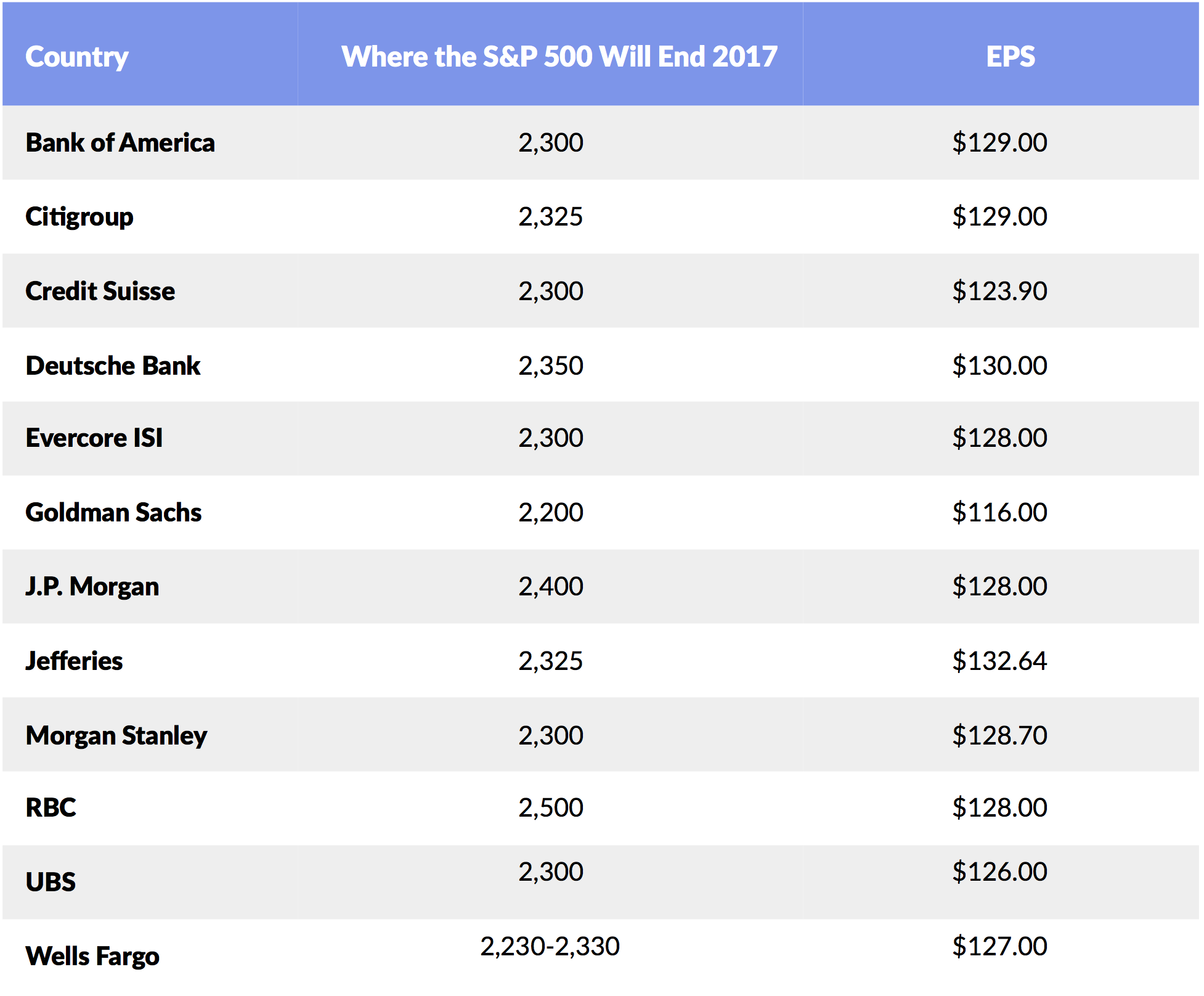

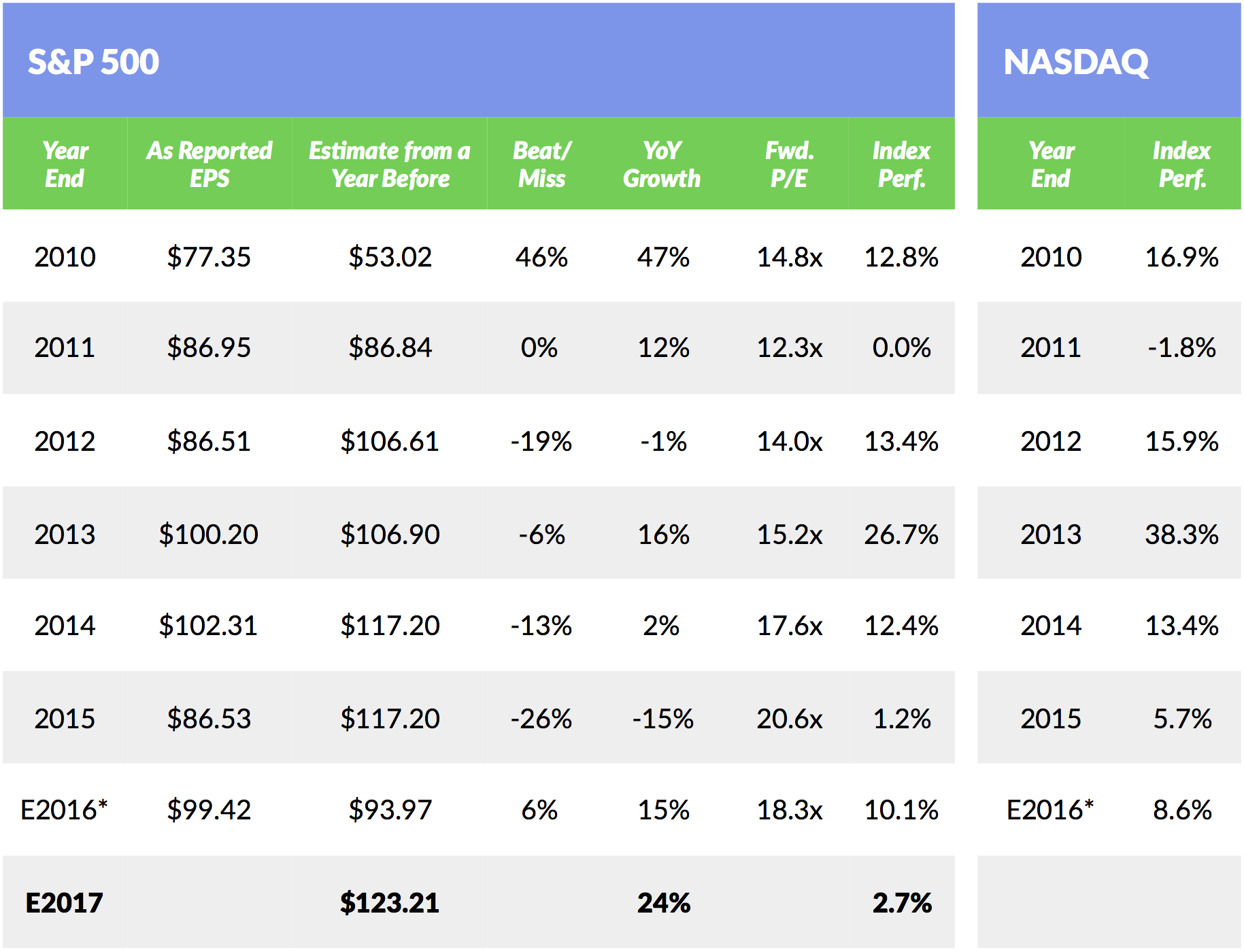

Entering 2017, analysts projected that earnings for the S&P 500 would increase a whopping 24% to $123, with a corresponding modest rise in the index of 2.7%. In reality, the index surged 15%, fueled by optimism, increased investment, and accelerating earnings.

Source: Capital IQ, GSV Asset Management

*2016 “As Reported EPS” is the 2016 EPS estimate as of December 2016

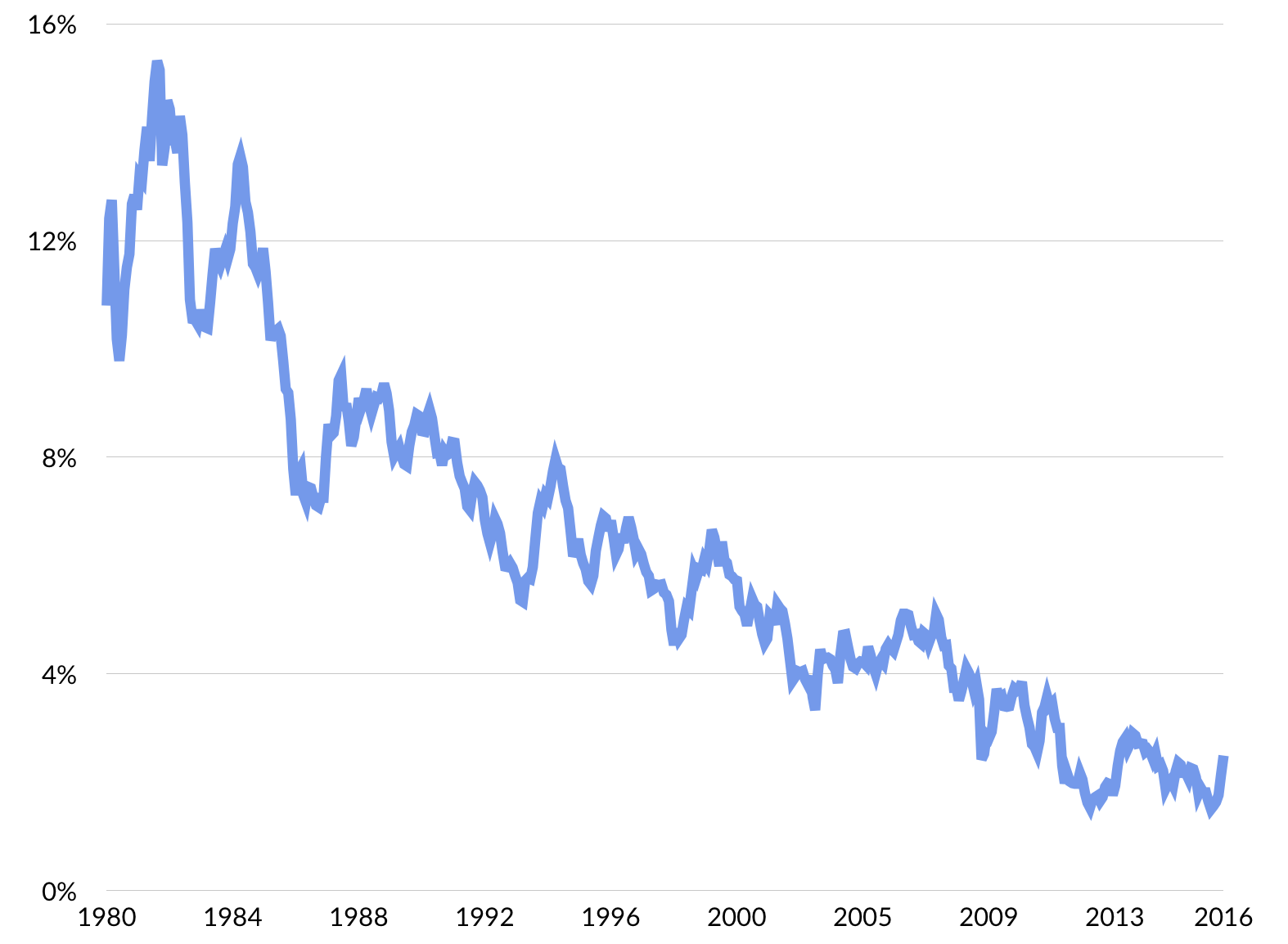

BEARS pointed to a forward P/E of approximately 18x on the S&P 500 as being overvalued versus a historic average of 16x projected earnings… especially in light of the fact that interest rates were likely to go up after a thirty five-year BULL market in bonds.

It wasn’t one thing that helped America get its MOJO back. It was multiple initiatives. For sure, the $1 trillion, ten-year Public/Private Infrastructure Program to modernize the country’s roads, bridges, airports, electric grid, telecommunications, security, and schools created both an economic stimulus and a sense that we would not be left in the dust by other countries. To borrow a line from Thomas Friedman, visiting Singapore, Shanghai, or Dubai, and then returning to JFK Airport, was like going from the Jetsons to the Flintstones.

The bi-partisan support was both refreshing and to be expected. As one D.C. wag mused, “fresh asphalt was an aphrodisiac,” for Representatives as their constituents could “smell” that Washington was actually doing something for them.

Also, the “one time only” 10% incentive for repatriating the $2 trillion of off-shore profits from U.S. Corporations brought a $200 billion jolt into the economy. This was used to help jumpstart key infrastructure projects and to send a message that the United States was “open for business”.

Adding to the message that the United States would be competitive for businesses and talent was the big and bold tax overhaul that was enacted in 2017. Corporate tax rates went from 35% at the Federal level, which were among the highest in the World, to 15%, near the lowest. Individual tax rates were lowered to a two tier “flat tax” of 25% and 15%, with Capital Gains taxes lowered to 15%. These changes, not coincidently, were consistent with the conditions for GDP growth experienced in countries with a less burdensome tax and regulatory structure.

Source: The Economist, Wikipedia, GSV Asset Management

*Denotes highest rate

The net result of this was a BOOM in corporate and individual investment, which had a multiplier effect on the economy. Contrary to analysis from pundits that suggested tax cuts would only exacerbate the ballooning $20 trillion deficit, accelerating economic activity coupled with the elimination of tax loopholes actually resulted in a declining national debt.

One of the major issues of the 2016 Election was fillings seats on the Supreme Court, with the death of Justice Anthony Scalia creating a vacancy and an aging bench suggesting more to follow.

When candidate Trump published a list of the twenty one prospects to replace Scalia, the key takeaway was that the next Justice would reflect the rest of America — not just the elites who went to Ivy League Law Schools. The message was that diversity is more than skin color and gender.

The selection of Wisconsin native and Marquette Law School alumnus Diane Sykes of the Seventh District Court was greeted with cheers and jeers from both the left and the right… which means she was probably the right pick.

Beyond the economy and social psyche, there were three major issues that were silently killing America entering 2017. They were finally brought to the forefront.

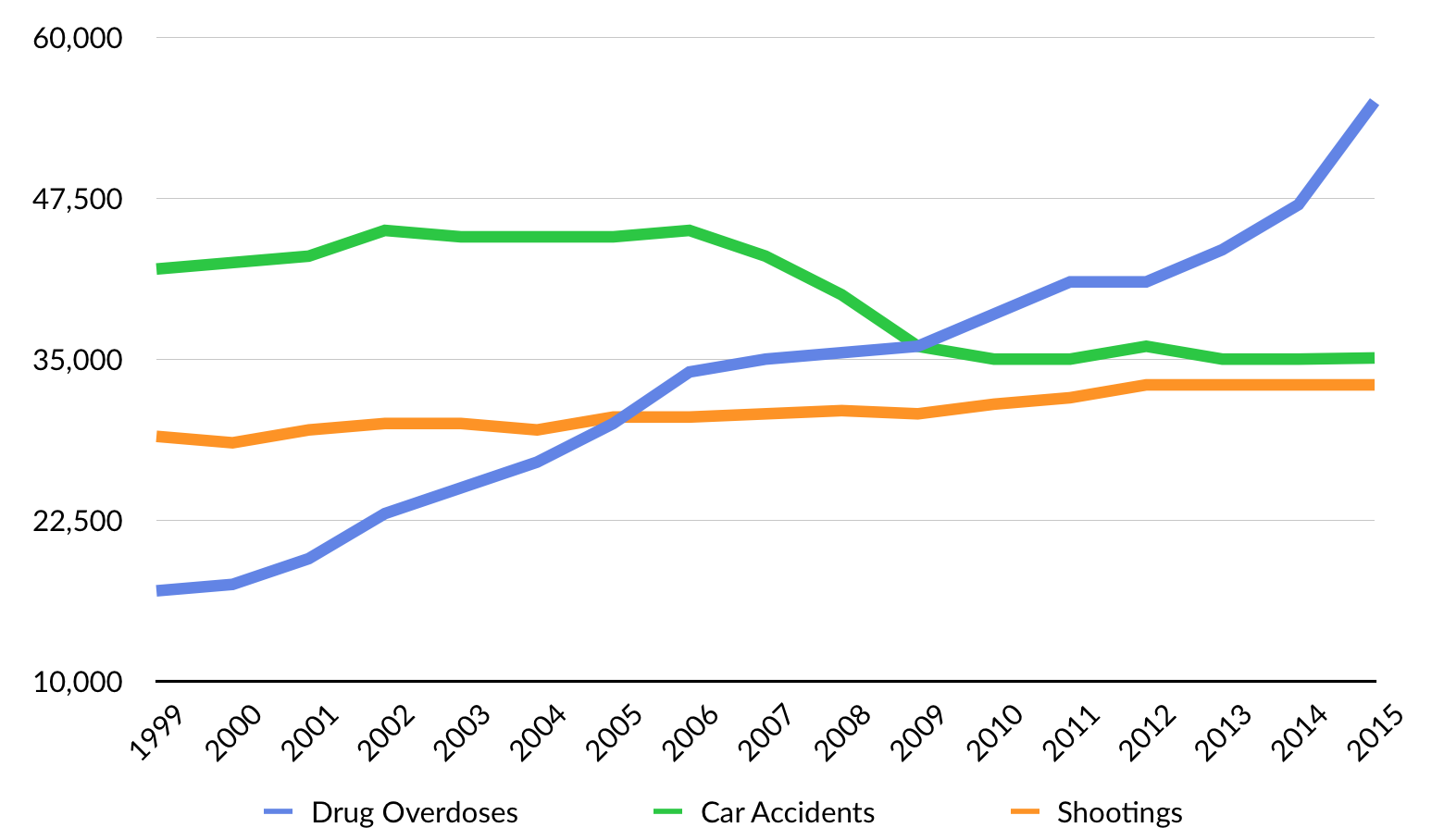

Killer #1 was the Drug Overdose Epidemic that was devastating society, causing more deaths annually than cars and guns. Prince’s death sparked serious soul-searching, highlighting the fact that there are more deaths per year from prescription drugs — opioids, which are synthetic heroin — than heroin and cocaine combined.

For a reference point, over 55,000 people died from a drug overdose in the United States in 2015, compared to 58,318 Americans who died in the entire Vietnam War. Health and Human Services Secretary Tom Price started tackling this issue by highlighting the enormity of the problem and turning up the heat to put physicians who recklessly prescribe these highly addictive drugs in jail.

Killer #2 was the Obesity Epidemic, with 38% of U.S. adults overweight according to the Center for Disease Control (CDC). This compared to 15% of the Adults being overweight in 1990. The resulting health issues included increased risk of heart disease, stroke and diabetes.

Culprit one was a “couch potato” phenomenon that had expanded from watching TV, to surfing the Web, and then compulsively using apps and playing games on smartphones and tablets. Nielsen estimates that media consumption has grown from five hours per day in 1990 to over 10 hours in 2016.

Culprit two was a gut glut driven by decades of growing consumption of cheap sweeteners — namely high fructose corn syrup — which could be found in everything from sodas to sports drinks and breakfast cereals. Additionally, the growth in two household incomes meant eating out more. Restaurant portions have gone up from seven ounces in 1950 to 42 ounces today.

The hard cost of obesity in the United States is $200 billion per year, with soft costs such as forgone productivity making it significantly higher.

The health issues from the Obesity Epidemic and resulting cost created an urgency for private and public action. Five cities — New York, Philadelphia, San Francisco, Oakland, and Boulder had passed a “Soda Tax” on sugary drinks entering 2017, with results showing a dramatic drop in consumption, notably among low income populations.

In 2017, the Soda Tax was routinely adopted policy measure, becoming as common as the Tobacco Tax. Big data integrated by insurance companies provided corporations with major financial incentives for employees to live more healthy lifestyles by exercising more and weighing less. Lower premium costs more than offset the expenses for corporate health and wellness programs.

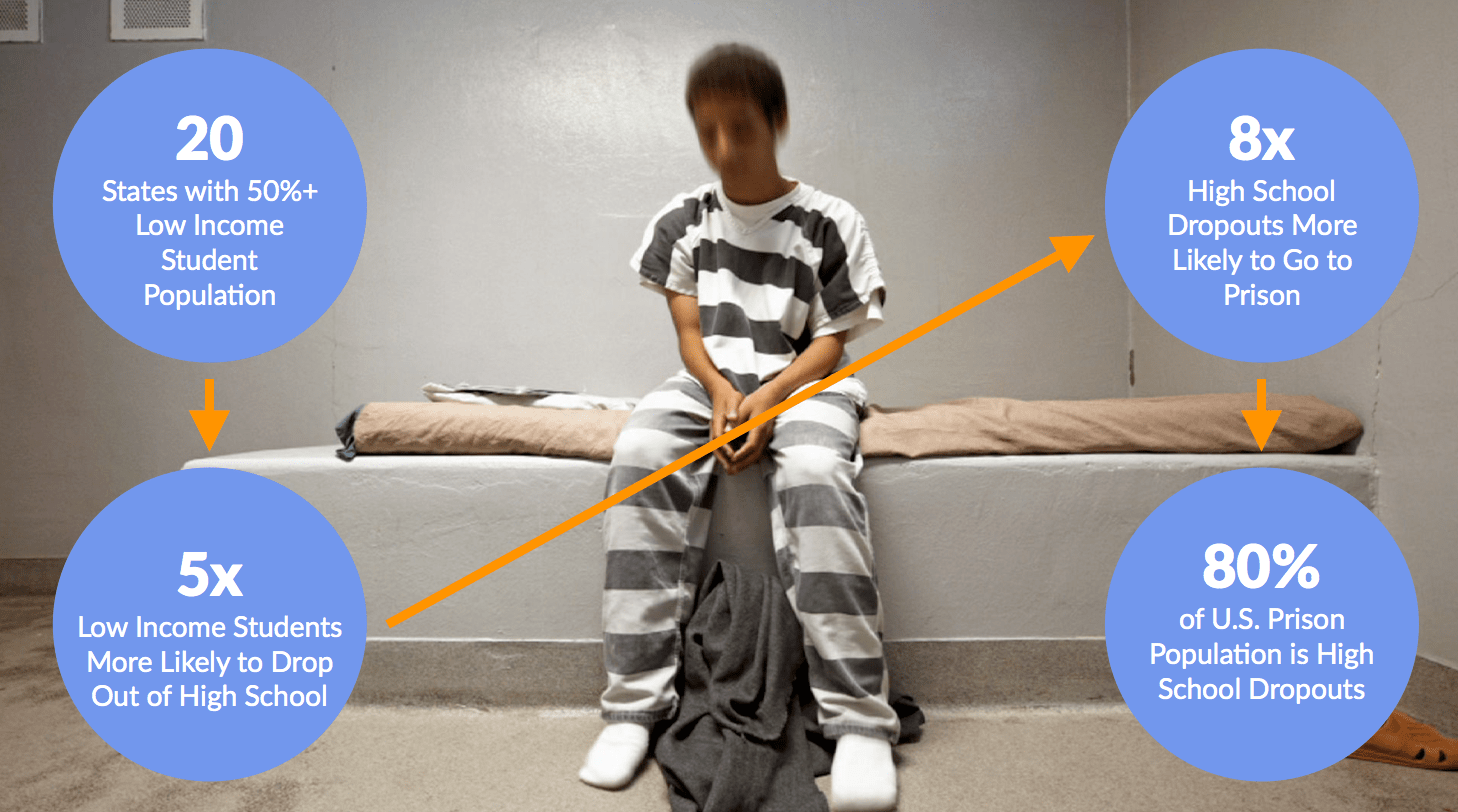

Killer #3 was the systemic and structural failing of our public K-12 education system, which had resulted in a majority of children in the United States not having the knowledge or skills to participate in the future. The correlation between family income and success in school was indisputable and indefensible.

Entering 2017, if you came from a low-income family, you were 5x more likely to drop out of high school. High school drop-outs were 8x more likely to go to prison. In fact, over 80% of the U.S. prison population was comprised of high school drop outs. Not to mention the fact that if you came from the bottom income quartile, you only had an 8% chance of graduating from college.

The reality is that if you are unlucky enough to pick poor parents and live in bad neighborhood, the chances for success in a knowledge economy is close to zero… which is both unfair and unsustainable. As Lotus founder Mitch Kapor once observed, “talent is equally distributed by zip code but opportunity is not”.

Secretary of Education Betsy DeVos took the “bull by the horns” and made school choice her “raison d’être,” despite facing steep opposition from the entrenched status quo. The positive news for America and its children was that finally, there were multiple constituents — parents, civil rights leaders, and businesses — willing to go toe-to-toe with people whose answer continued to be, “give us more time and more money.” The floodgates of change started to open.

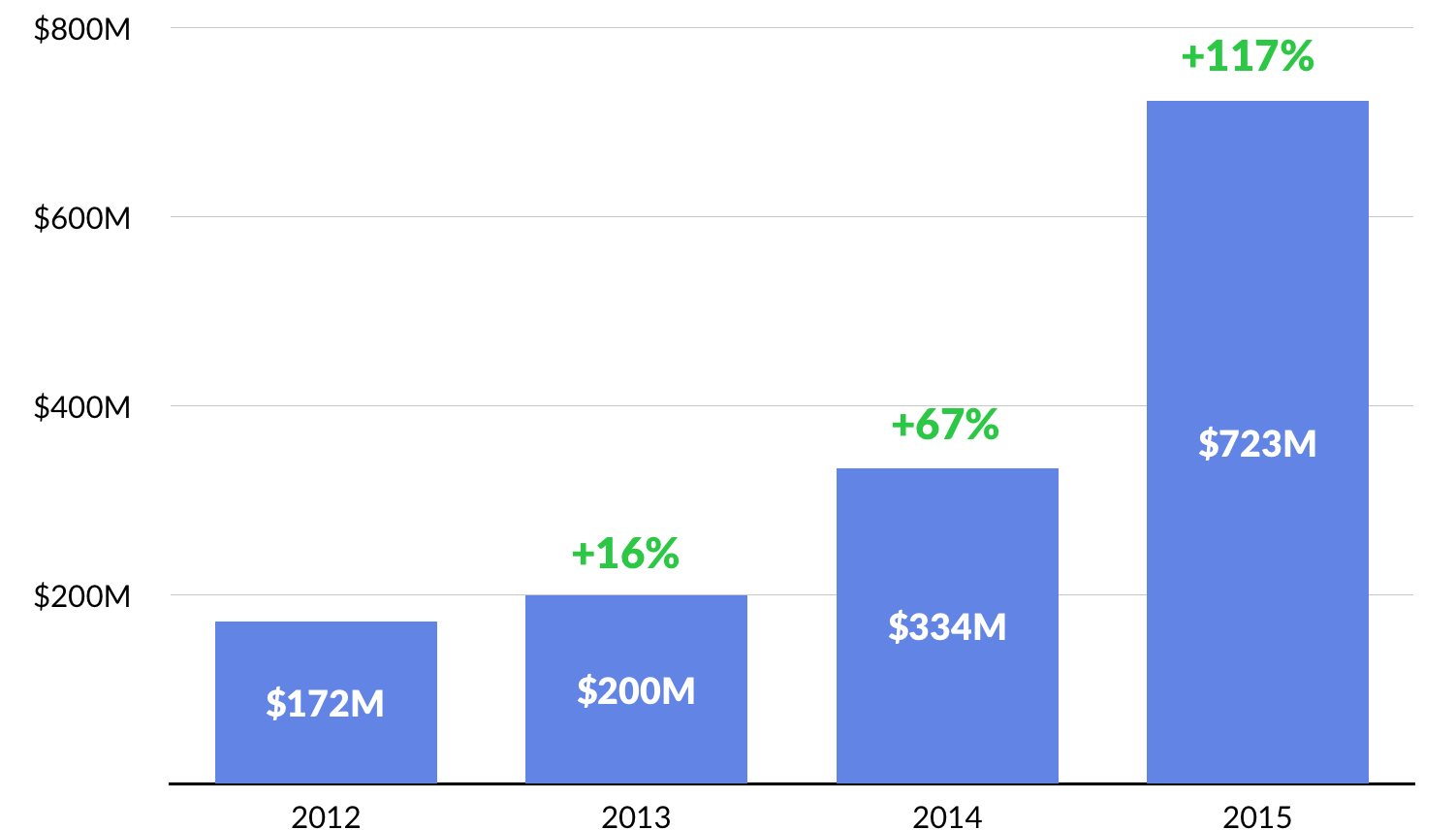

Removing barriers for people to obtain the knowledge required to be an effective participant in a dynamic global marketplace continued to be a major challenge and opportunity in 2017. Radical models that provided high quality education at little or no cost, such as Coursera, EdX, Chegg, and Course Hero, continued to disrupt the $600+ billion higher education industry. (Disclosure: GSV owns shares in Coursera, Chegg, and Course Hero)

Two key trends began to rapidly redefine how we learn, and ultimately, the career paths of the future: “Hollywood Meets Harvard” — creating highly engaging, scalable content— and “Knowledge as a Currency” — augmenting your degree with a broader knowledge “portfolio.” The fundamental shift was towards a model where everyone could continuously and affordably refill their “knowledge tanks” without dropping out of life to get an expensive degree.

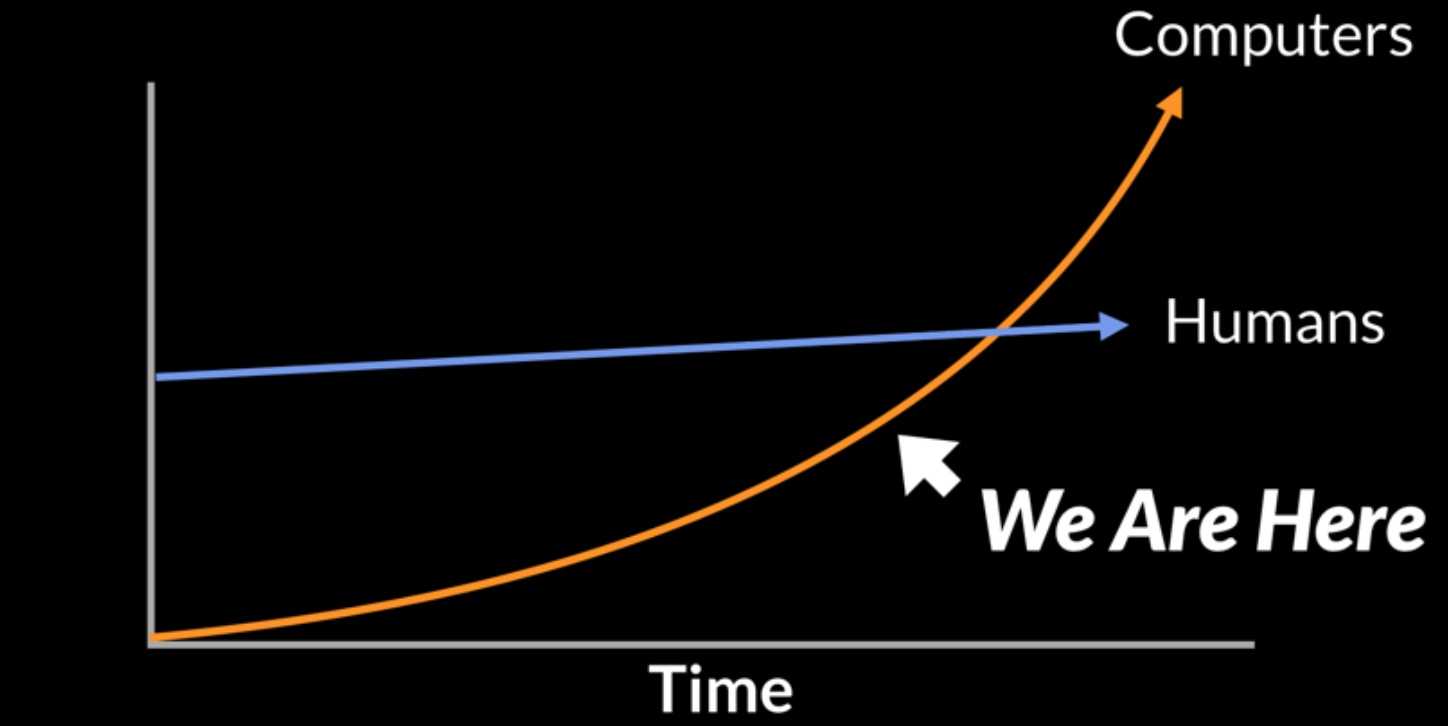

The timing couldn’t have been more critical. Technology is accelerating faster than our ability to change. The foundation for effectiveness in the future is the ability to learn on an ongoing basis, coupled with skills such as adaptability and entrepreneurship.

Click HERE to download 2020 Vision: A History of the Future, GSV’s white paper identifying key trends, companies, technologies, and entrepreneurs driving the Education and Talent sector)

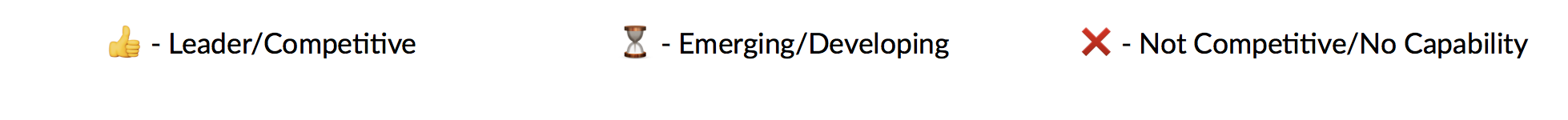

In 2017, Silicon Valley continued to innovate, accelerate and consolidate. Technology is all about disproportionate gains to the leader in a category, with “platforms” evolving rapidly, filling in category and product maps.

Two valuable tech assets were gobbled up in 2017. Twitter (finally!) was acquired by Alphabet (Google), rounding out its search continuum. Microsoft purchased Slack, continuing a string of smart moves adding to Satya’s reputation and Microsoft’s market cap.

In 2017, AT&T’s acquisition of Time Warner was approved, with the initial collective view that it was a yawn, or maybe even America Online 2.0. This view was quickly replaced with the realization that the combination was a game-changer. In comparison, Verizon seemed like it was playing small ball with its take-out of Yahoo. Comcast, left itching to make a move, took a run at Sprint and DreamWorks.

In another sign that media was transforming before our eyes, 2017 marked the beginning of an epic limelight battle between the streaming services — Netflix’s 13th and Amazon’s Manchester by the Sea both took home Oscars — a first for a digital platform.

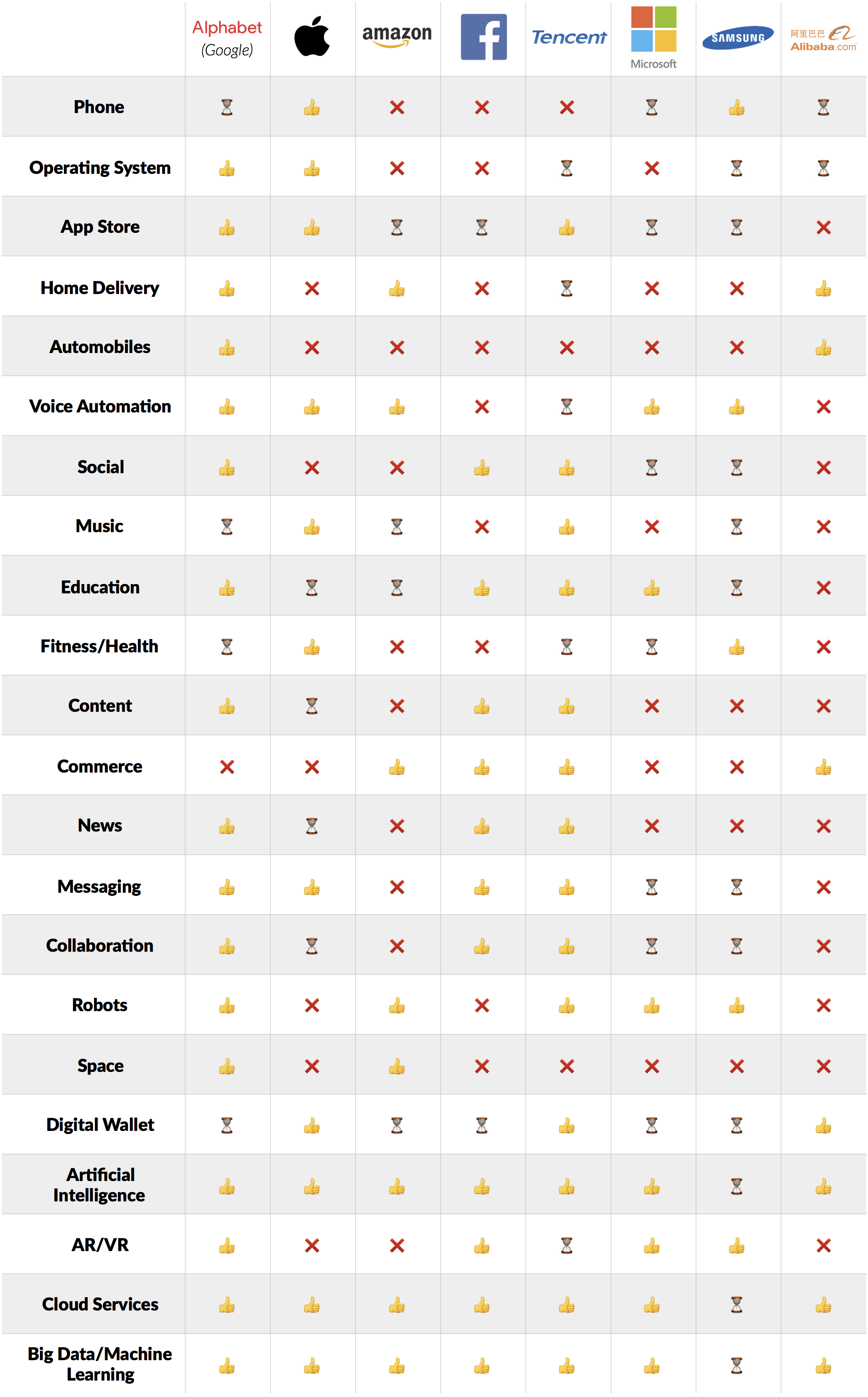

Looking at GSV’s Global 25 — which is comprised of the top public, global growth companies — going into 2017, the median P/E was 22x and the median projected growth rate was 26%. Strong continued growth, coupled with a surge in investor optimism, catalyzed outsized stock performance.

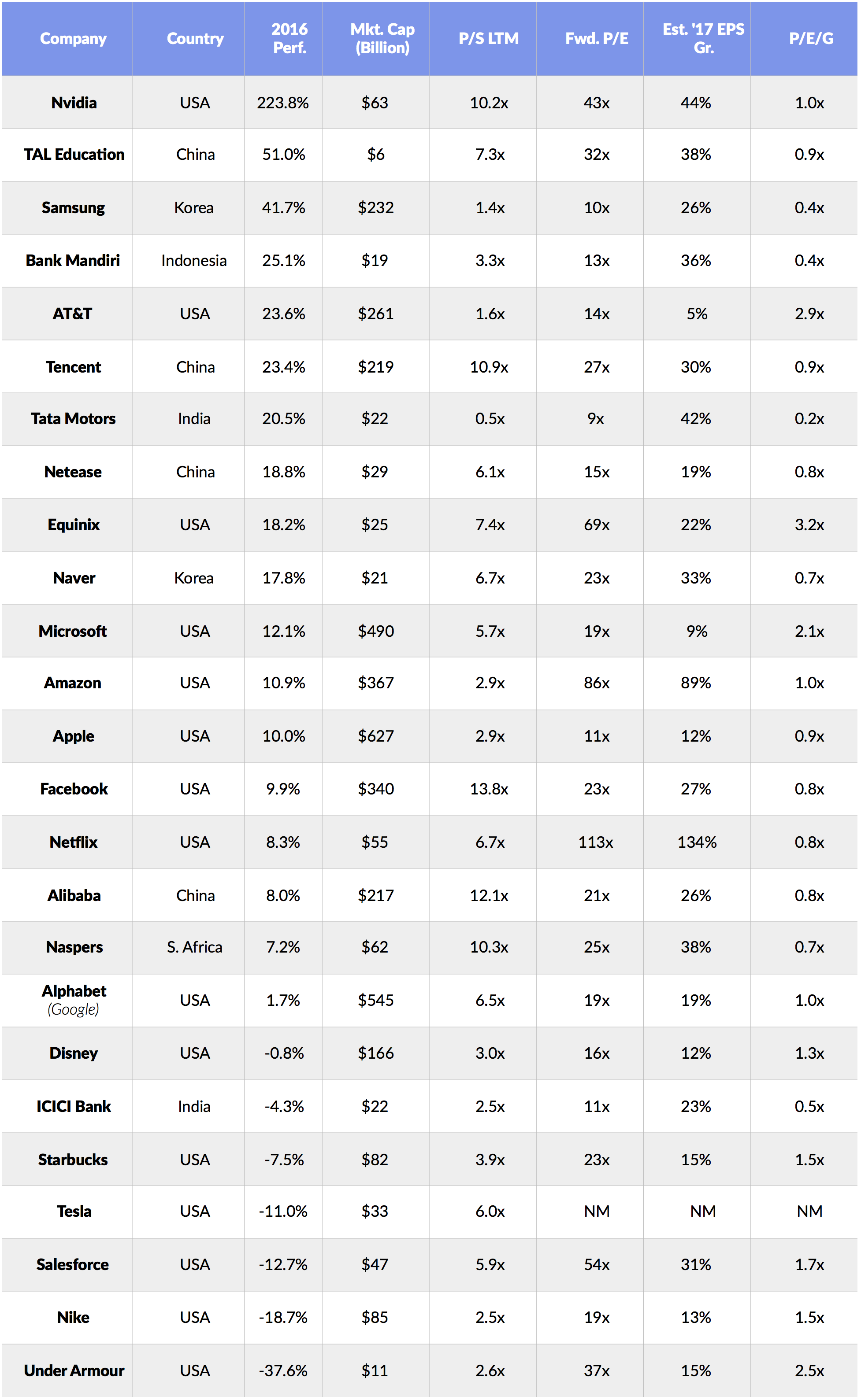

In 2017 and beyond, the GSV Global 25 will increasingly be populated by a group that we call the “VChIIPs” — Vietnam, China, India, Indonesia, and the Philippines.

Looking in the rearview mirror, the economic engine for the last 100 years was the United States, Europe, Japan, and Canada. In 2000, with just 9% of the global population, these countries contributed over 50% of global GDP. But over the last 15 years, GDP growth in these countries has been flat-to-negative. Today they contribute just 41% of Global GDP.

A key driver behind this change has been aging populations. Over 26% of these populations are over the age of 60 while just 15% are under the age of 15. In Japan last year, there were more adult diapers sold than baby diapers. These dynamics are not changing anytime soon. The average (weighted) fertility rate in Canada, the United States, Europe, and Japan is 1.6. At a fertility rate under two, you’re essentially dying.

Looking ahead, the VChIIPs will drive global growth, investment, and entrepreneurship opportunities. These countries are home to over 43% of the global population and command 28% of global GDP, growing at 6.6%. If you look at the demographics, they are the mirror opposite of what you see in the developed countries. Just 11% the VChIIP population is older than 60, 24% is younger than 15, and the fertility rate is 2.3, driving organic growth.

Source: The Economist, World Bank, GSV Asset Management

*Includes Eurozone, United Kingdom, and Denmark

**2008-2013, as reported by the Economist, based on most recently-disclosed country data

The center of gravity is changing. Africa is on deck with five of the 10 fastest growing countries last year.

Read on to see what our crystal ball looked like going into 2017.

SEVEN PREDICTIONS FOR 2017

1. IPO Market Comes to Life

The Stock Market reflects the confidence investors have in the future, and not surprisingly, stocks behaved like many of us felt in 2016 — nervous. For the year, the S&P 500 was up 11.2% and NASDAQ was up 9.8%. But there was a heavy dose of volatility.

In the first quarter, the Blue Chip barometer S&P 500 experienced a frightening drop of 9% from January 1st to February 11th, followed by a 10% rise through the end of March. Brexit sparked another shock in June, sending indices spiraling after the referendum. But since their Brexit lows, the NASDAQ and the S&P 500 gained 17.2% and 12.0% respectively.

The IPO Market is even more of an indicator of the state of mind of investors — if they are pessimistic, new issues shut down and if they are optimistic, investors treat IPOs like fresh oxygen they can’t get enough of.

Despite predictions of the Trump apocalypse, we started to see some bullish signs from the IPO market in 2016, with Twilio’s June 23rd offering acting as a starting gun. Despite recent volatility, Twilio is trading at twice the $15 per share where it priced.

While there were a paltry 102 U.S. IPOs in 2016, there were 63 since Twilio, including notable listings from technology companies like Line, Talend, and Nutanix, which priced above range and popped over 27%, 42%, and 130% respectively.

The recent trend, points to a broader opportunity for the best names to break through an IPO backlog that has been building over the last fifteen years.

Source: GSV Asset Management

Disclosure: GSV owns shares in Lyft

Snap (Snapchat), a powerful new force in digital media, has already filed for an IPO that could value the company at $20-$25 billion, according to the Financial Times. The streaming music leader Spotify has also signaled its intent to go public. A 2016 $1 billion convertible note with aggressive IPO convert terms has become a countdown clock of sorts and CEO Daniel Ek has stepped in for co-founder Martin Lorentzon as Chairman of the business — another sign of a likely listing. (Disclosure: GSV owns shares in Snap and Spotify)

In July, Vice Media CEO indicated that he was in discussions with major banks about taking his $4 billion company public. Dropbox, which announced in June that it has become free cashflow positive, has had similar discussions, according to Bloomberg. At the Wall Street Journal’s 2016 Global Technology Conference, Palantir CEO Alex Karp indicated that the company had prepared itself should it decide to go public in 2017, which would create liquidity opportunities for employees. (Disclosure: GSV owns shares in Dropbox and Palantir)

China’s Didi Chuxing, which was valued at $33 billion in a September 2016 funding, could be primed to IPO now that it has absorbed Uber China. WeWork, where CEO Adam Neumann remarked in July that, “we’re not afraid to go public,” could surpass $1 billion in revenue run rate next year. The list goes on.

2. Abot Time

What happens in Vegas… stays in an Amazon data center forever.

In December, Wynn Resorts announced that it would install an Amazon Echo in each of the 4,748 rooms of its flagship Las Vegas property. Beginning in the Summer of 2017, the voice activated smart speaker powered by the digital assistant, “Alexa”, will enable guests to control the lights, television, room temperature, drapery, and other amenities. As CEO Steve Wynn observed, “[Alexa] becomes our butler, at the service of each of our guests.”

Wynn’s announcement underscores a key theme for 2017. Digital assistants and “Bots” poised to go from novelty to non-negotiable, sparked by rapid advancements in Artificial Intelligence (AI), coupled with popular hardware applications like the Amazon Echo.

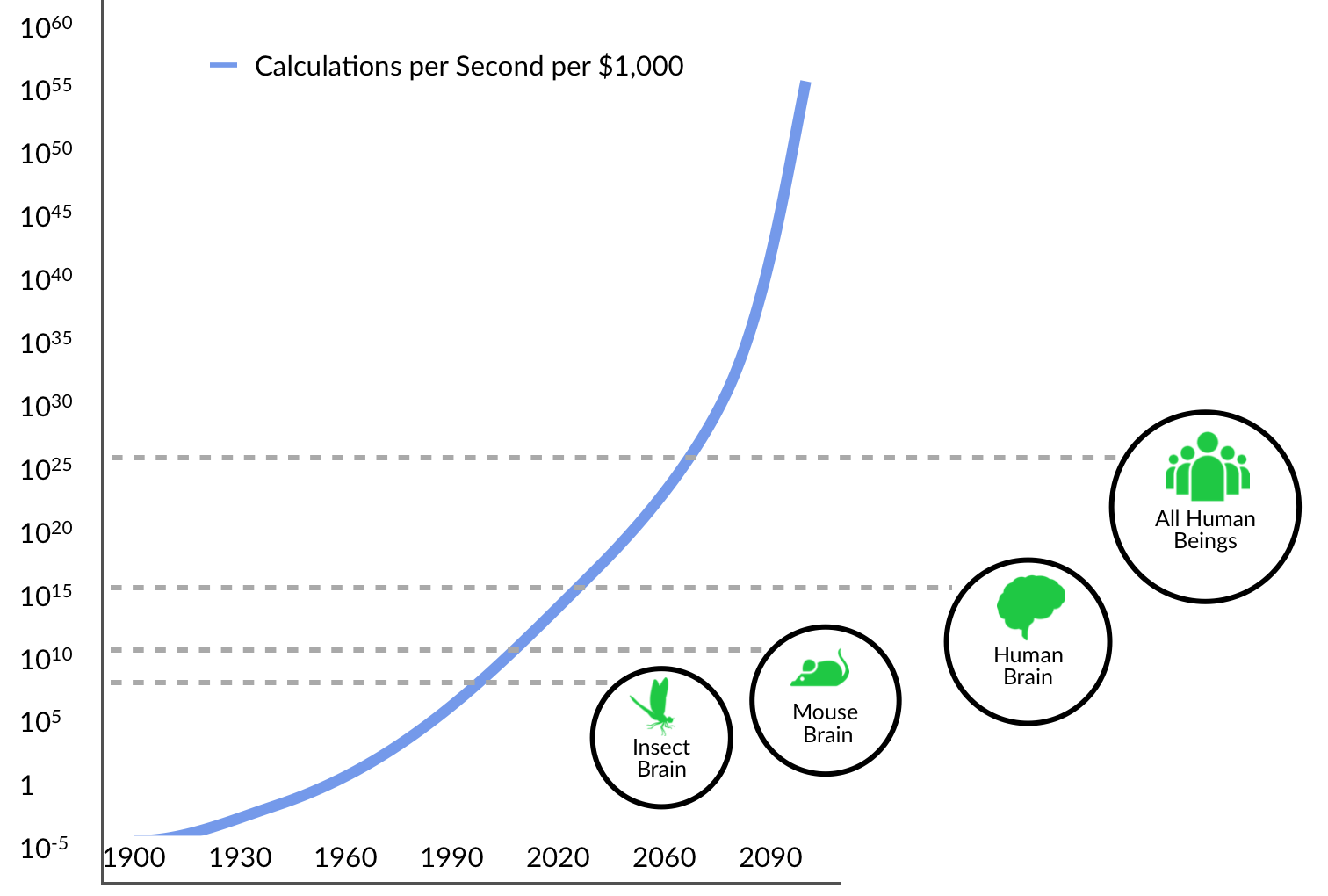

A consequence of exponential improvements in computing power, guided by Moore’s Law, has been the rise of “Machine Learning,” a process where computers “teach” themselves concepts and tasks by crunching large sets of data. It’s a way of getting computers to “know” things when they see them by producing rules that programmers cannot specify.

For example, Facebook’s facial recognition algorithm, Deep Face — which can recognize human faces with 97% accuracy — was created by feeding computers with millions of images of faces.

Source: Ray Kurzweil, GSV Asset Management

Applying this technology to conversational speech recognition led to the launch of Apple’s Siri in 2011— the first broadly distributed advanced consumer digital assistant. A year later, Alphabet (Google) launched Google Now.

But it’s Amazon’s Alexa — which wasn’t released until 2014 — that is becoming the face of digital assistants. Why?

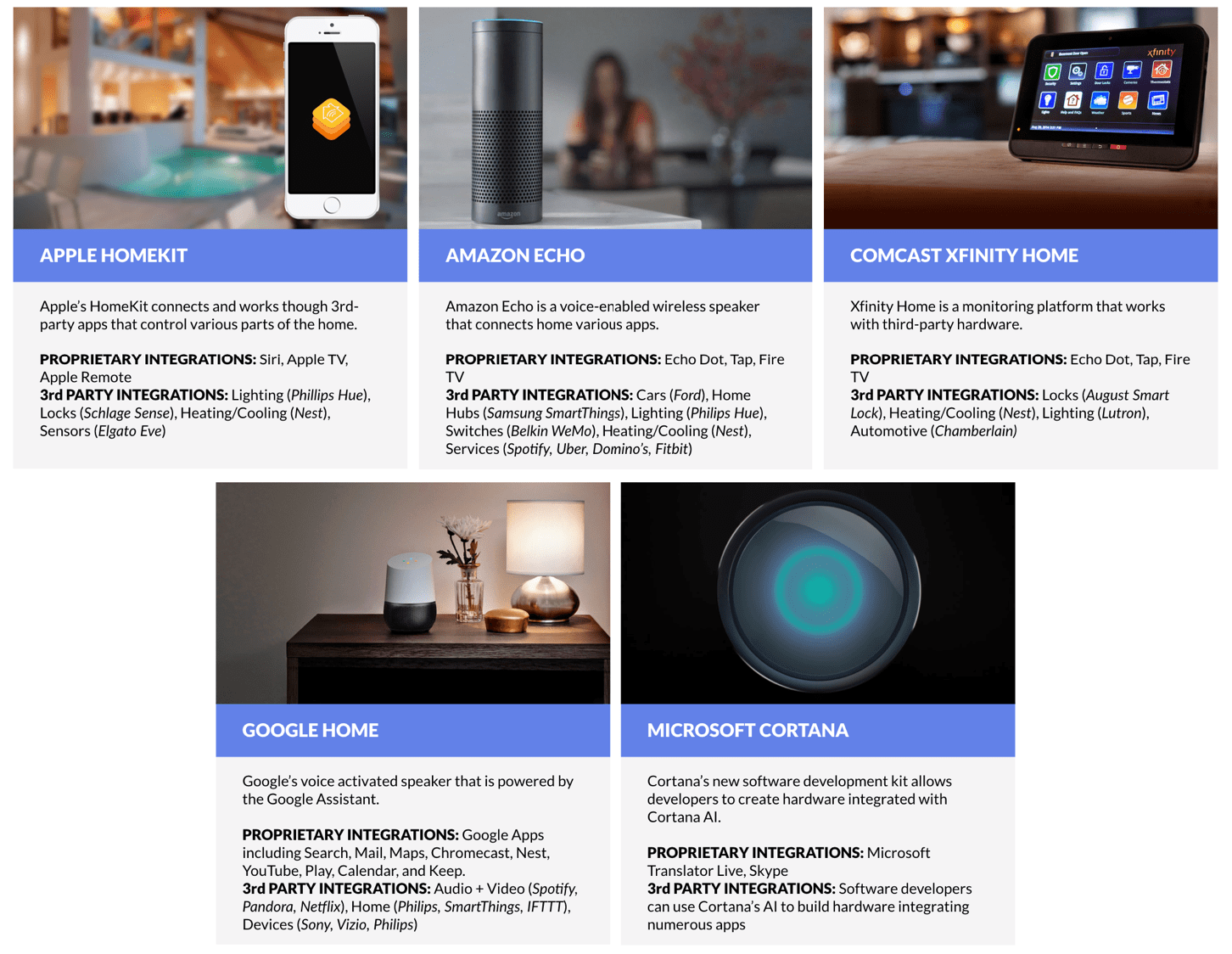

Ironically, Amazon is winning with hardware. Unlike Siri, which resides in a crowded field of iPhone apps, or Google Now, which is embedded in Android applications like “Search”, Alexa was launched as the flagship feature of the sleek Echo speaker. Buying an Echo was like buying a robot. It captured the public imagination, selling 4.4 million units in its first year. Amazon is projected to sell over nine million units in 2016 — it moved 9x more Echoes this Christmas than last year — and more than 40 million per year by 2020 alone. That’s a $4+ billion revenue line.

Amazon’s ambush has broader implications. As with the smartphone, we’re seeing early signs of platform wars around connected homes, with “Smart Speakers” like Echo as a gateway. You can use the device to control a variety of smart appliances and on-demand services through integrations with companies like Samsung, Philips, Belkin, and Uber. It recently released an open API framework to enable the integration and management of other devices and services.

Apple, which launched HomeKit in 2014, and Alphabet, which launched Google Home in 2016, are scrambling to catch up.

The sudden rise of Amazon’s Alexa has comes against a broader swell of personalized, AI-enabled services. Chat-based “Bots,” which automate a variety of interaction-based services, are exploding.

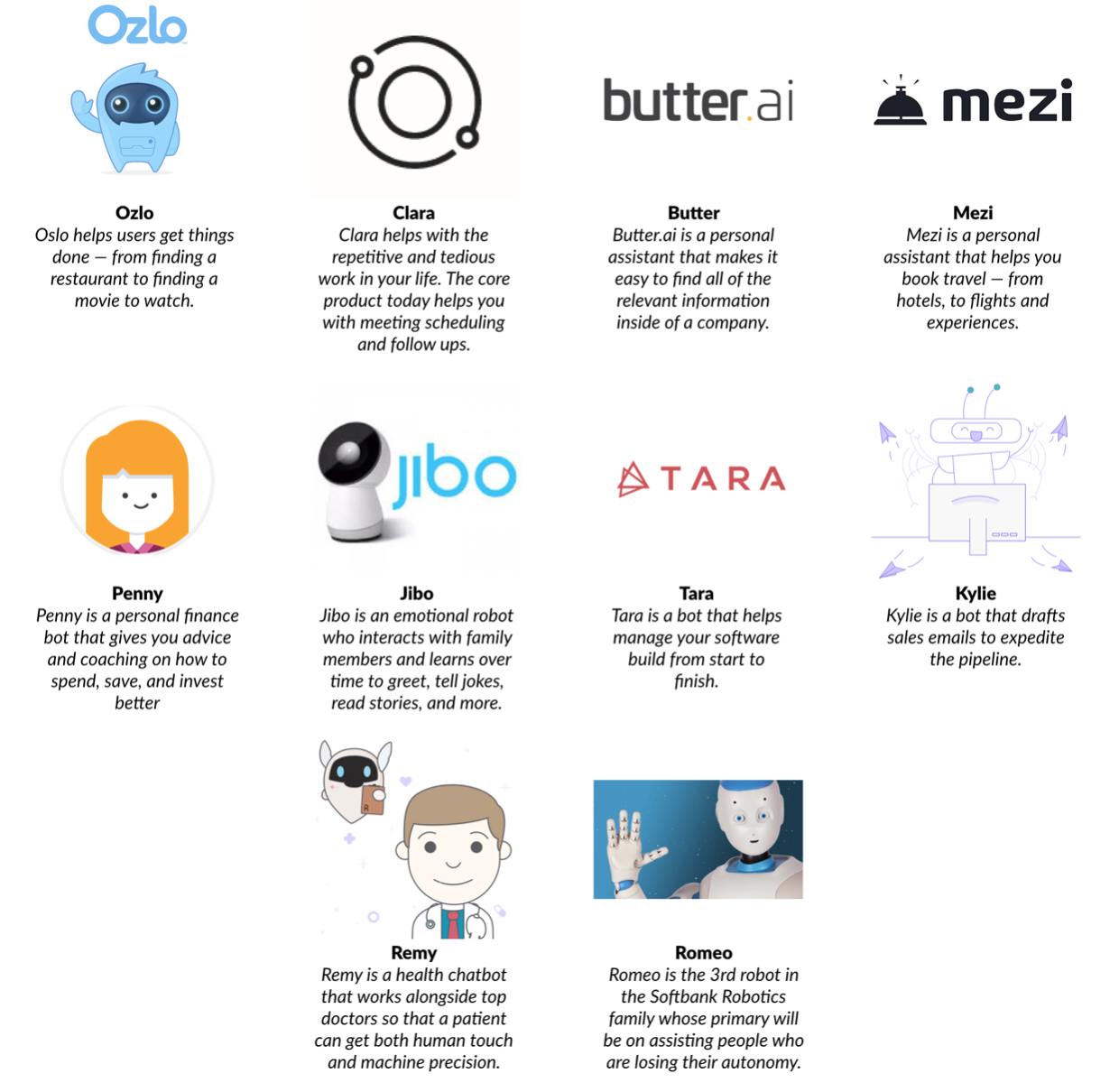

Penny, for example, provides users with advice on how to spend, save, and invest smarter. If you have a project for freelancers, Tara will chat with you to understand your goals and specs, before curating a group of contractors to finish the job. It manages back-and-forth communication until project completion, getting smarter with each new customer. The list goes on.

Here are some Bots — chat-based and beyond — to watch in 2017.

My good friend Bill Campbell used to say, “You’re as dumb as a post” to our football team. And today, that would be a compliment as posts have become smart, embedded with sensors as is everything from toasters to cars and shoes.

The Internet of Things is effectively a catch-all for connecting devices — from consumer objects to industrial equipment — onto a network. This enables information gathering and remote device management via software to increase efficiency. It also enables the creation of new services, to achieve, health, safety, business, or environmental benefits. But increasingly, anything than can be connected will be connected. Accordingly, we’re poised to see a rapid proliferation of IoT devices. Today, Cisco estimates that there are 18 billion such devices, growing to 50 billion by 2020.

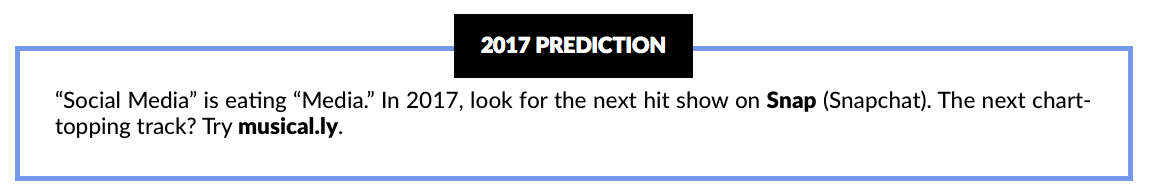

3. From Showtime to Snaptime

“Kids, turn off the TV!”

You may not hear this as much from parents in 2017. Kids, teens, and millennials are all ditching the TV in greater numbers as self-broadcasting emerges as a key megatrend in media. Here’s how it works:

“Channel 1” — Snapchat: Watch Stories from your friends to see what they were up to in the past 24 hours. Then catch up on sports highlights on the ESPN channel in Discover. Finally, check out the latest from your favorite celebrities — looks like Rihanna had an epic Christmas party at her house in Barbados…

“Channel 2” — Facebook: Watch a few Live videos from your friends last night. That puppy video your cousin shared? It already has half a million likes. Then catch up on trending news.

“Channel 3” — Instagram: Check out David Beckham pouring a can of Guinness into the Christmas beef stew. And watch Shakira singing a preview of her new song. Then catch up on your other friends who are not on Snapchat yet.

“Channel 4” — Musical.ly: Watch your friend lip-syncing to Sia’s new song…

“Channel 5” (if you have time) — Twitter: Watch some live sports coverage. Check in on what the The Donald has to say.

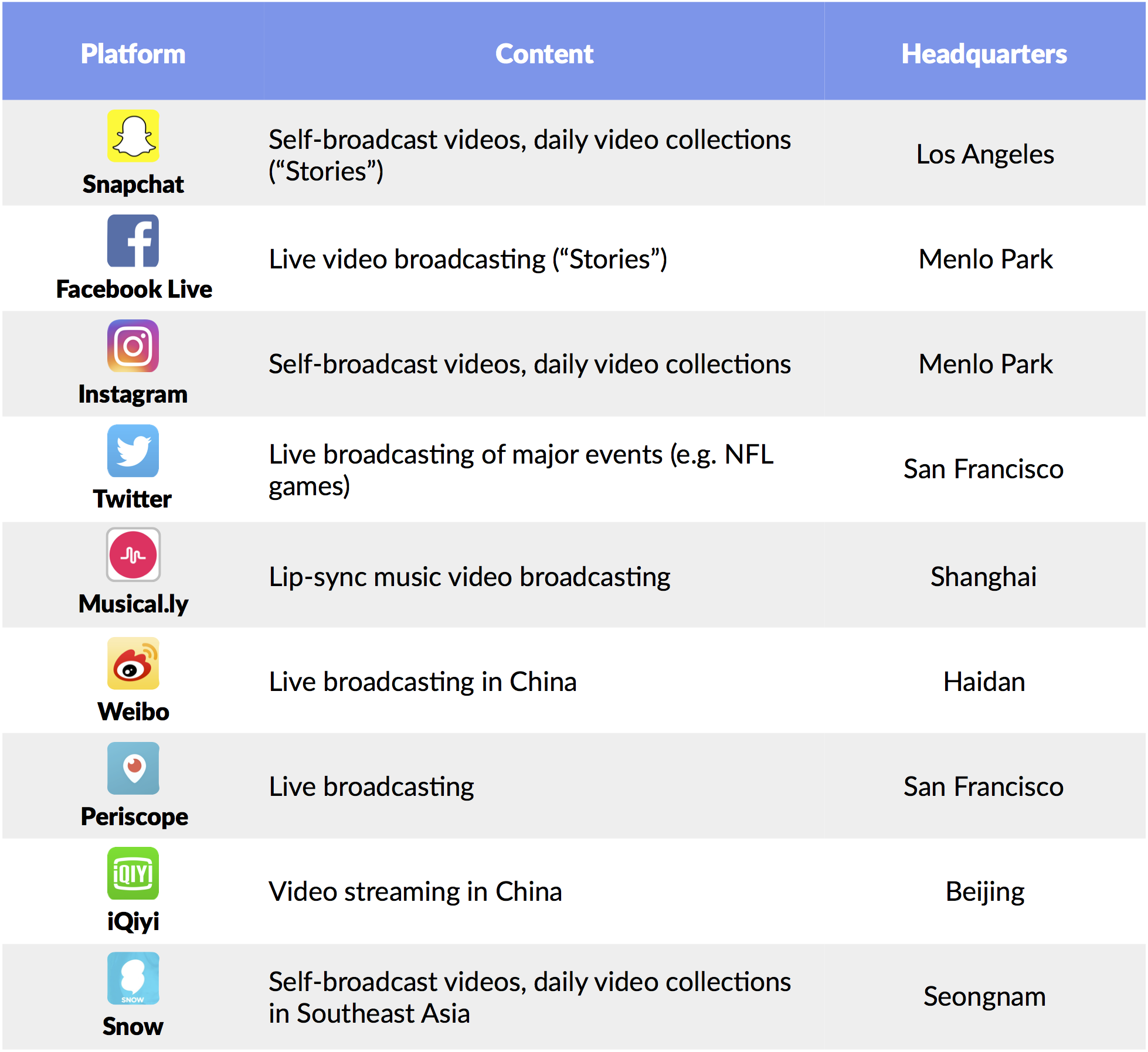

We are entering a phase where self-broadcasting platforms are poised to deliver a death-blow to traditional television. A key catalyst has been rapidly improving Internet connectivity, allowing for the high-quality display of live broadcasting. Another has been the continued evolution of smartphones to devices with large, high-definition screens. Watching video on your phone is no longer tough on the eye. And recording yourself is simple — just tap Snapchat, and it’s “Action!”

To illustrate the power and magnitude of this trend, consider that 75% of ESPN’s Millennial audience watches ESPN content from the Discover channel on Snapchat. Only 25% actually watch the content on ESPN, the “TV channel.” Similar shifts are happening on other media platforms. People Magazine, Cosmopolitan, National Geographic, MTV, Refinery 29, Vice Media — all are seeing strong user engagement through the Snapchat Discover platform.

Additionally, Disney just announced that it will create a new post-episode program for its hit show, The Bachelor. The new production will be streamed on Snapchat as a Story, available for 24 hours following each episode. That’s just the first of several upcoming Disney-ABC Snapchat series. Look for more to follow in 2017.

In 2016, Snapchat paved the way for the self-broadcasting boom, evidenced by a surging number of video views per day. As of April 2016, Snapchat users watched over 10 billion videos per day. We estimate that this number is close to 20 billion today. And with well over 150 million daily active users, Snapchat is among the most engaging media platforms in the World. Its users spend between 25 and 30 minutes in the app per day, on average.

A broader range of platforms are pouring into self-broadcasting. In April, Facebook launched Live, allowing its users to broadcast and post live content. Twitter has jumped into sports, striking deals with the NFL and NBA to stream games live. Instagram copied Snapchat and added its own Story option. Musical.ly, which was originally created to be an education app, relaunched as a popular self-broadcasting platform for music videos.

In South Korea, Naver-backed Snow recently raised $45 million from Line. Effectively a Snapchat copycat, it has been downloaded by over 90 million users to date, doubling in just six months. Facebook, Tencent and Baidu have all made acquisition overtures in recent months, but Line’s management reportedly aims to grow the business and spin it off through an IPO.

While Snow has consistently topped the app rankings in South Korea and Japan, it recently fell behind local competitors in China. Shenzen-based Faceu, a face recognition camera app, and Tencent’s Pitu is an automatic make-up and motion sticker app — have both surpassed Snow in China’s app ranks.

Baidu’s iQiyi.com is yet another platform to watch in 2017. One of the largest video streaming sites in China, iQiyi had 20 million paid users in June 2016, up from 10 million in December 2015. It now ranks as the top video-streaming app in China, according to App Annie data, and it is in preparation for a possible 2017 IPO that could value the unit at $5 billion.

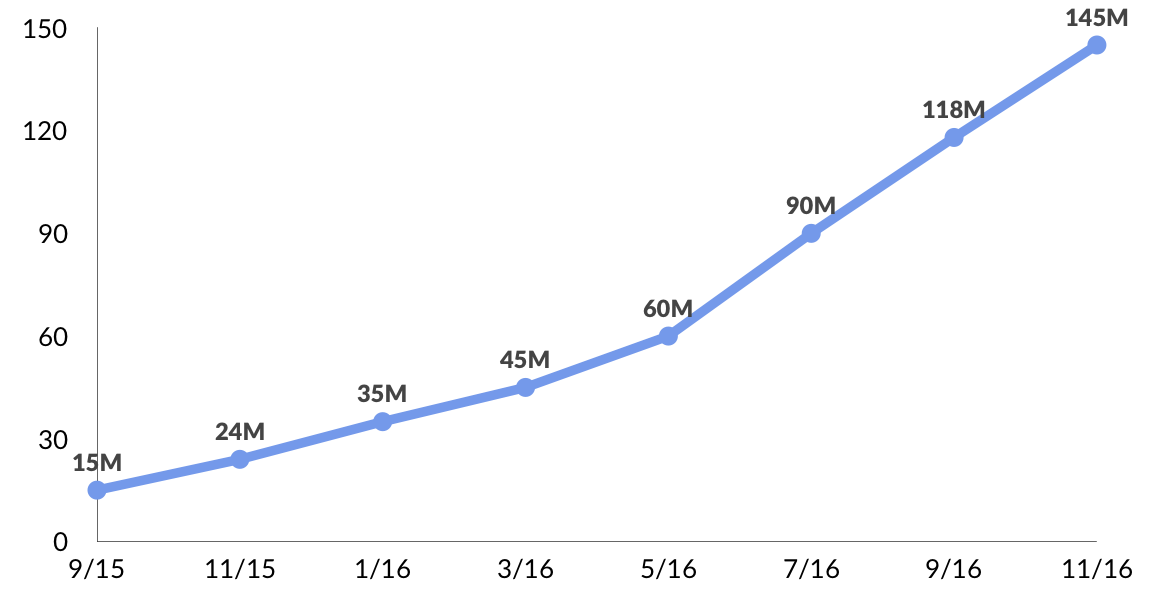

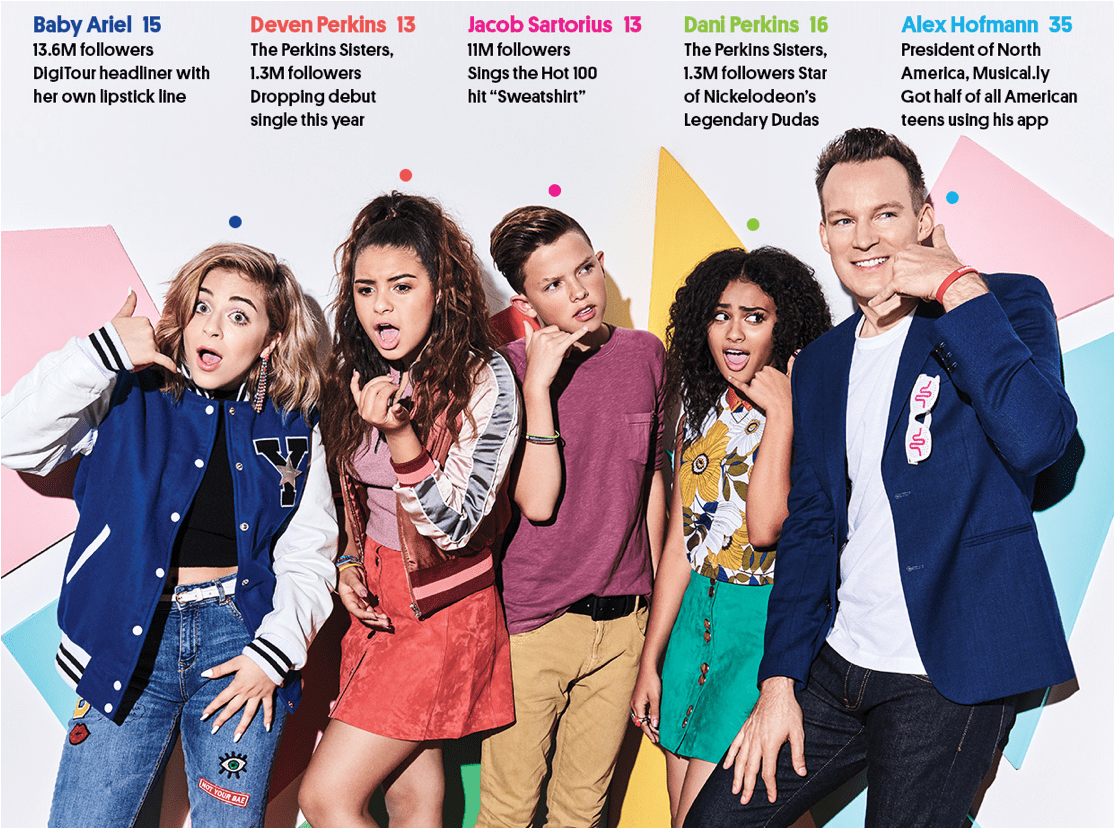

The World’s fastest-growing social media and self-broadcasting platform is musical.ly, which is now used by half of all U.S. teens, according to company disclosures. The app lets users broadcast 15-second clips of themselves lip-synching to hit songs with layered-on graphics, time lapses, and other “special effects.” It’s combining music and video in a distinct experience — think air guitars, dancing, and Snapchat filters all in one.

Interestingly, while Snap’s (Snapchat) market value has been bolstered by a distinctly younger user base, musical.ly is moving even further upstream. A substantial majority of its users are between the ages of 10 and 20, and nearly three quarters are girls.

As with Snap, the age distribution is changing as the app manages to attract broader demographics. Six months ago, almost 90% of users were below the age 24. Today it is just over 60%.

Source: GSV Estimates (based on company announcements and reported growth)

Hugely popular in schools, musical.ly now counts over 140 million registered users, up from 10 million in September 2015. It is currently adding 13 million new users per month. What’s also impressive is that the app now has 40 million daily active users — which is about the same size as Pinterest. And about 25% of its DAUs are creating content. The estimated average time spent per day is around 15 minutes, on par with Instagram or Whatsapp, but below Snapchat’s 25-30 minutes.

The app is so popular that global stars like Selena Gomez, Ariana Grande, Shakira, and Jason Derulo are using it to connect with fans. It also serves as a platform for young artists to quickly create a brand. One of the most famous newcomers is Carson Lueders, 15, who has over three million followers on musical.ly. His managers Johnny Wright and Melinda Bell have helped the likes of *NSYNC and Britney Spears launch their careers.

Another one is 14-year-old Ariel Martin, who was bored at her grandparents house when she saw a friend post a musical.ly video on Instagram. She quickly signed up and lip-synced to Niki Minaj’s “I’m legit.” Things took off immediately, and her success story put her on the map of the pop industry. Just a year later, she has become a top “Muser” with 15 million fans, and her musical.ly tutorial on YouTube has over 10 million views. Ariel has since signed several noteworthy brand deals, including the launch of a popular lipstick line.

Heading into 2017, we expect Snap will lead the way in the race for the new “TV.” While the real telly might be running in the background, we will be watching more content on our phones then ever before. Advertisers will scramble to adjust their strategies, paying premiums to be part of “the club.” Same goes for major media companies. The inflection point is now.

4. Blockchain Becomes a Blockbuster

Throughout history, “open systems” have constantly upended “closed systems” by creating superior efficiency, quality, transparency, and access. Free markets outperform rigged models like socialism. Competition drives innovation and better prices. Monopolies create rents.

It wasn’t too long ago that BlackBerry was the coolest technology company in the World. People were so addicted to their BlackBerries that they were called “Crackberries.” Remarkably, in 2007, BlackBerry and Apple were both roughly $70 billion market value businesses.

Then Apple launched the iPhone. Today, Apple’s value has ballooned to over $600 billion, while BlackBerry has decreased more than 90% to $4 billion. What happened?

A major part of the story is that Steve Jobs and the Apple TEAM created an insanely great product. But the critical innovation was Apple’s unprecedented open mobile operating system, iOS, which enabled third-party developers to easily create apps for the device — effectively harnessing the wisdom of crowds to create a rich user experience. By the time BlackBerry launched its first app platform in 2009 — a full two years later — iPhone customers had already downloaded one billion apps.

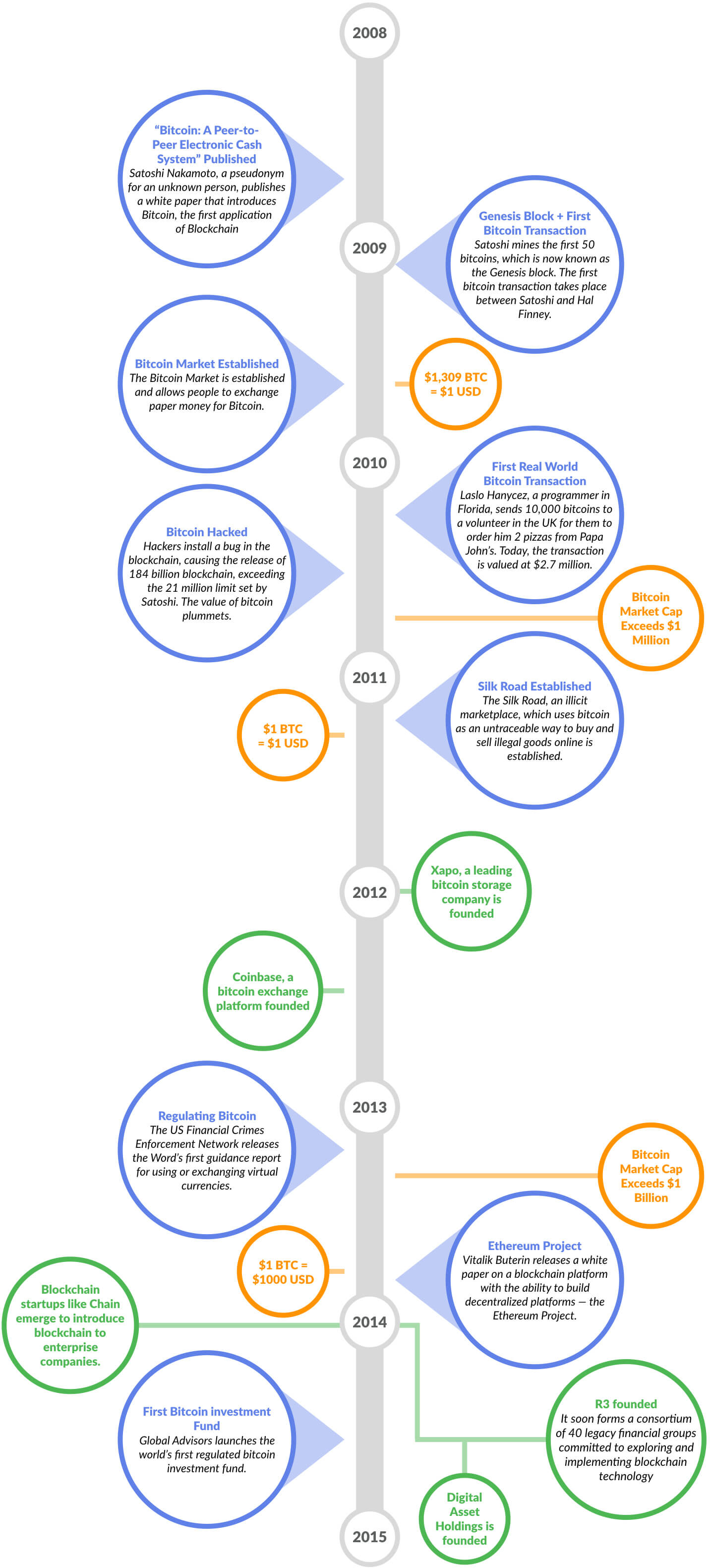

If you zoom out, the Internet, in conjunction with the personal computer and then the smartphone, has ushered in an age of decentralized, open information and communication. The launch of Bitcoin in 2009 marked the next frontier for open platforms.

At face value, Bitcoin promises an alternative to one of the World’s quintessentially “closed” platforms — money. Instead of relying on central banks for validity and subjecting people to arcane exchange mechanisms, Bitcoin is an open, electronic, peer-to-peer currency. It’s not without controversy.

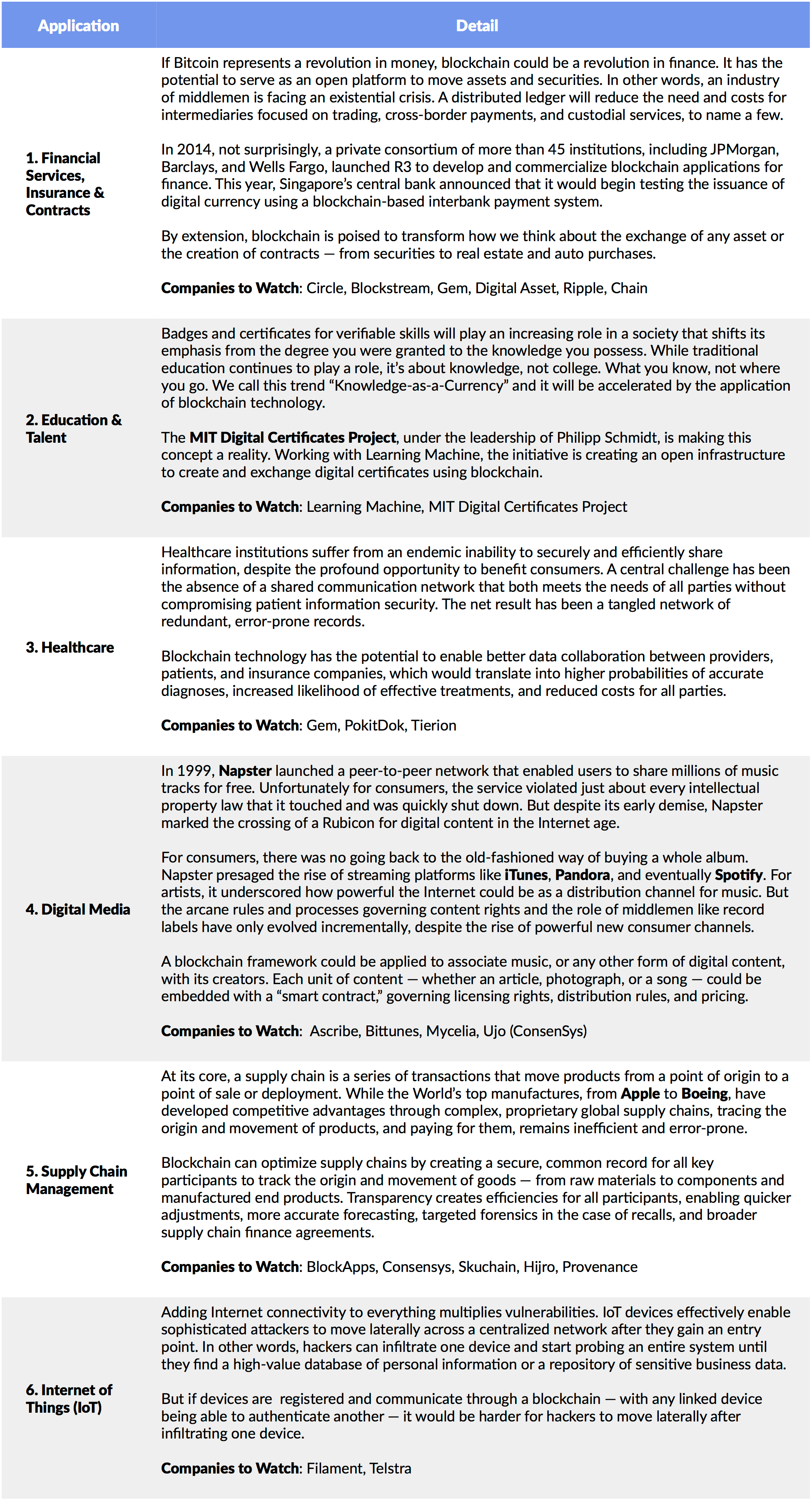

But while the future of Bitcoin is uncertain — it could be the Facebook or the MySpace of so-called “cryptocurrencies” — the underlying technology powering it, “Blockchain,” is here to stay. Effectively a decentralized, open-source public ledger for the exchange of information, blockchain has the potential to transform any industry that relies on middlemen and “honest brokers” for critical functions — from finance to supply chain management and academic credentialing.

To paraphrase Marc Andreessen, blockchain gives us, for the first time, a way for one Internet user to transfer a unique piece of digital property or information to another Internet user, such that the transfer is guaranteed to be safe and secure. Everyone knows that the transfer has taken place, and nobody can challenge the legitimacy of the transfer.

In other words, Bitcoin is just the beginning. The underlying technology can applied to all manner of “exchanges,” whether or not they’re related to money. The consequences of this breakthrough are hard to overstate. Ethereum, a non-profit that is creating a blockchain framework intended to be more flexible that the original which that created for Bitcoin, has helped evangelize the technology. We see six key applications of blockchain emerging in 2017.

Source: GSV Asset Management

Click HERE to read GSV’s in-depth report on the state of innovation in Blockchain, including key trends, companies, and financing activity.

5. Drones Deliver

On December 14, Amazon CEO Jeff Bezos announced that the company had completed its first fully-autonomous drone delivery. In Cambridgeshire, a sleepy town in the English countryside, someone named Richard ordered an Amazon Fire streaming device and a bag of popcorn and found the goods at his doorstep 13 minutes later.

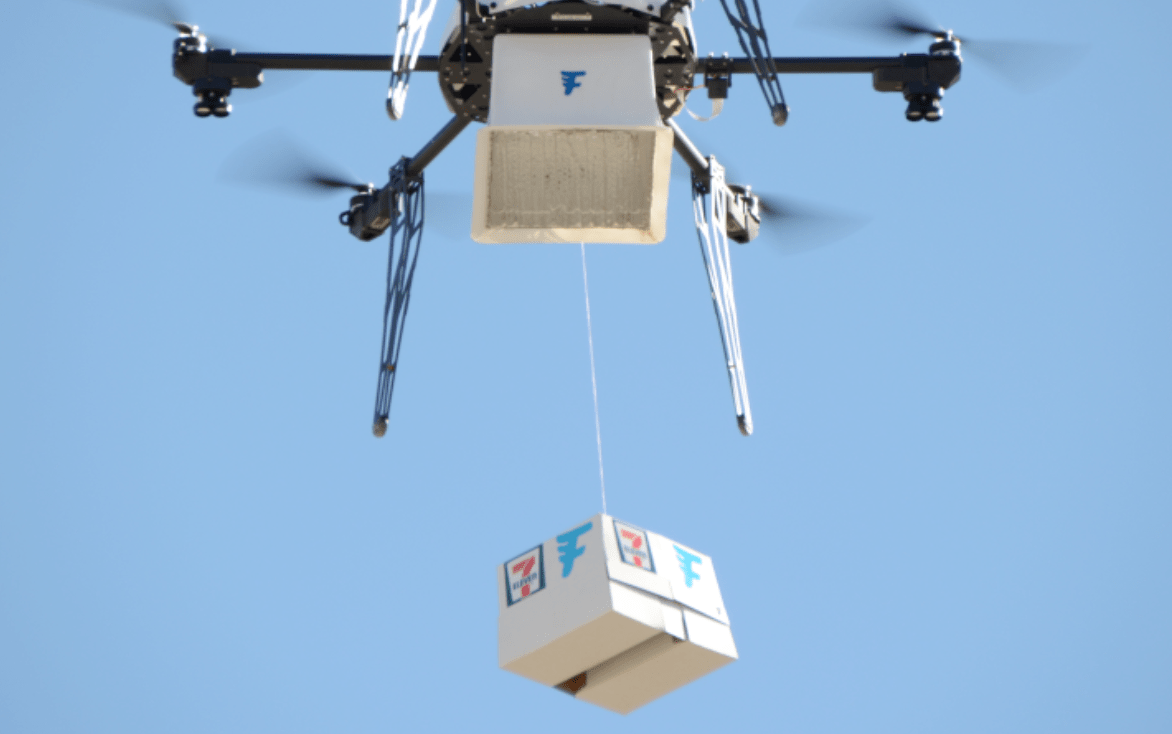

While Amazon will be a juggernaut in the future of drone deliveries, it was actually upstaged by 7-Eleven a few weeks earlier, which made trial food deliveries in partnership with the drone startup to Flirtey to a network of customers in Reno, Nevada. They all lived within a mile of the store.

Delivery drones are going from science fiction to consumer reality in 2017, and a variety of players have been laying the groundwork for years.

In 2015, Switzerland’s postal service began testing delivery drones in conjunction with California-based Matternet, which develops unmanned aerial vehicles and automated logistics networks. Germany’s DHL has been trialling its very own “parcelcopter” on the island of Juist in the North Sea since 2013.

In 2017, the French postal service will launch a drone delivery program to carry parcels on a set nine-mile route following approval from the French aviation regulatory authority. And in China, online retailer JD.com started the trial of a drone delivery program in November serving rural locations outside of Beijing, as well as Jiangsu, Shaanxi and Sichuan provinces. The list goes on.

But there’s much ground to cover before we see drone deliveries in cities at scale. The challenge of navigating tight quarters and dense foot traffic remains a constraint on ambitions to serve major markets like the United States where roughly two-thirds of the population live in urban hubs.

Amazon is one of six companies working with NASA and the U.S. Federal Aviation Administration (FAA) on developing an air-traffic management system to integrate autonomous drones into national airspace by 2019. It will have its own equivalent of roads, traffic lights, and “do not enter signs”. As regulation evolves, drone adoption will accelerate. But there’s much ground to cover.

But the first company to start making drone deliveries at a commercial, high-volume scale won’t be Amazon or DHL, but a startup sending medical supplies to remote hospitals in Rwanda to save lives.

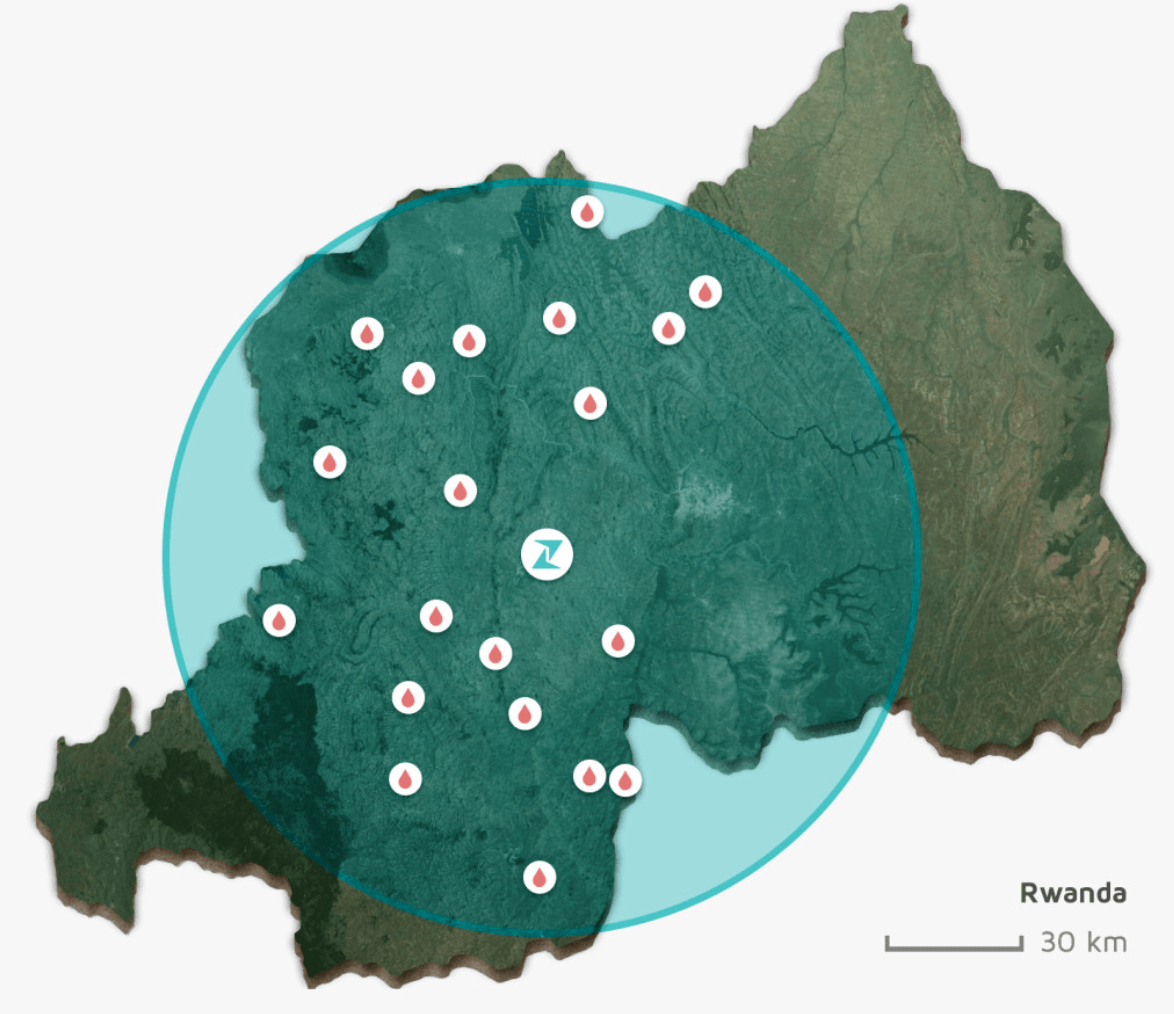

In July, San Francisco-based Zipline plans to begin using its new drones to deliver blood from Rwandan blood banks to rural areas for emergency transfusions. Right now, the country struggles to get blood to remote clinics that might not have a reliable way to store it, and can’t predict in advance which blood types they’ll need. Furthermore, 75% Rwanda’s roads are unpaved and often unusable during the rain season, making them impassable to the vehicles that are deployed to make emergency medical deliveries.

Working with UPS and vaccine distributor Gavi, Zipline’s goal is to have 15 autonomous aircraft deployed daily, making 150 deliveries to 21 medical stations throughout the Western half of Rwanda. With the addition of a second hub, the company believes that they can service the entire population of 11 million people.

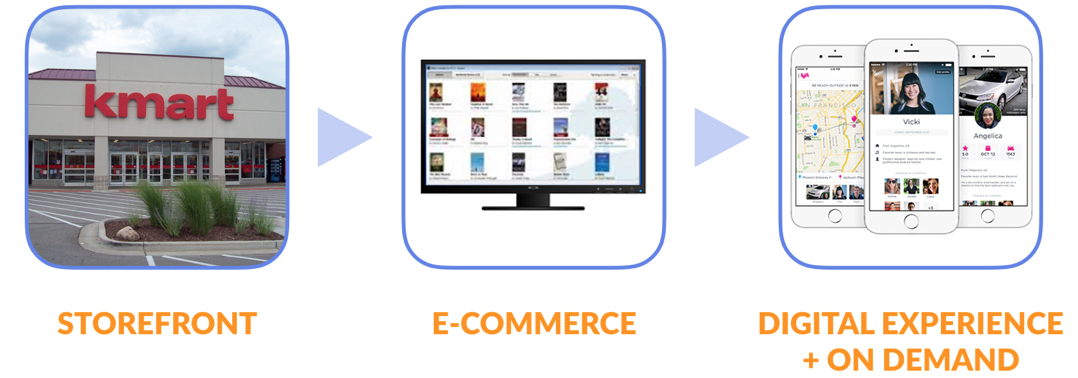

6. Commerce Gets Personal

On Black Friday last week, over 102 million Americans stampeded into retail stores across the country to take advantage of deep discounts on everything from diapers to drones and iPhones.

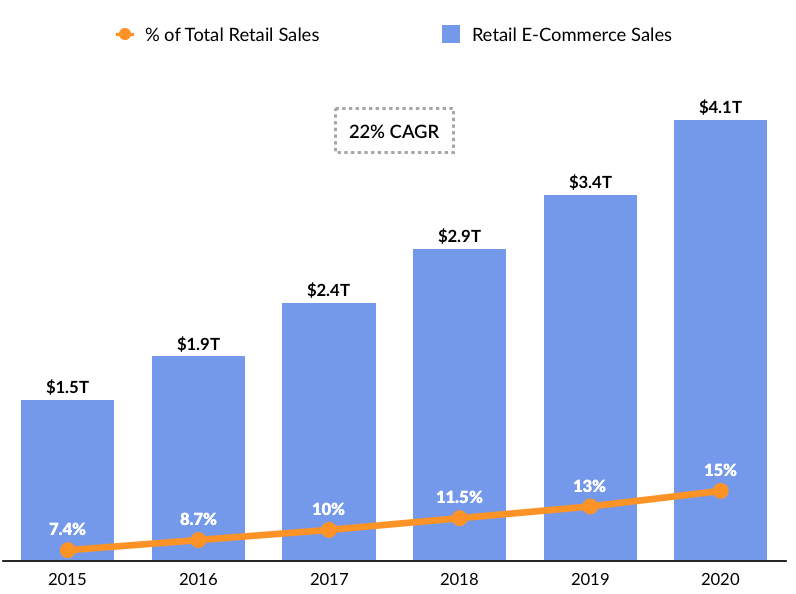

But impressive as this thundering herd may be, this year it was outnumbered for the first time by e-commerce shoppers, which clocked in at just over 103 million strong. Consumers spent $3.3 billion shopping online on Friday, a 22% year-over-year increase, and more than a third of these purchases were made on mobile devices.

In one sense, this is a story about gravity. In 2016, e-commerce is projected to account for only 8.7% of global retail sales. The growth opportunity remains staggering and online sales numbers will continue to smash old records.

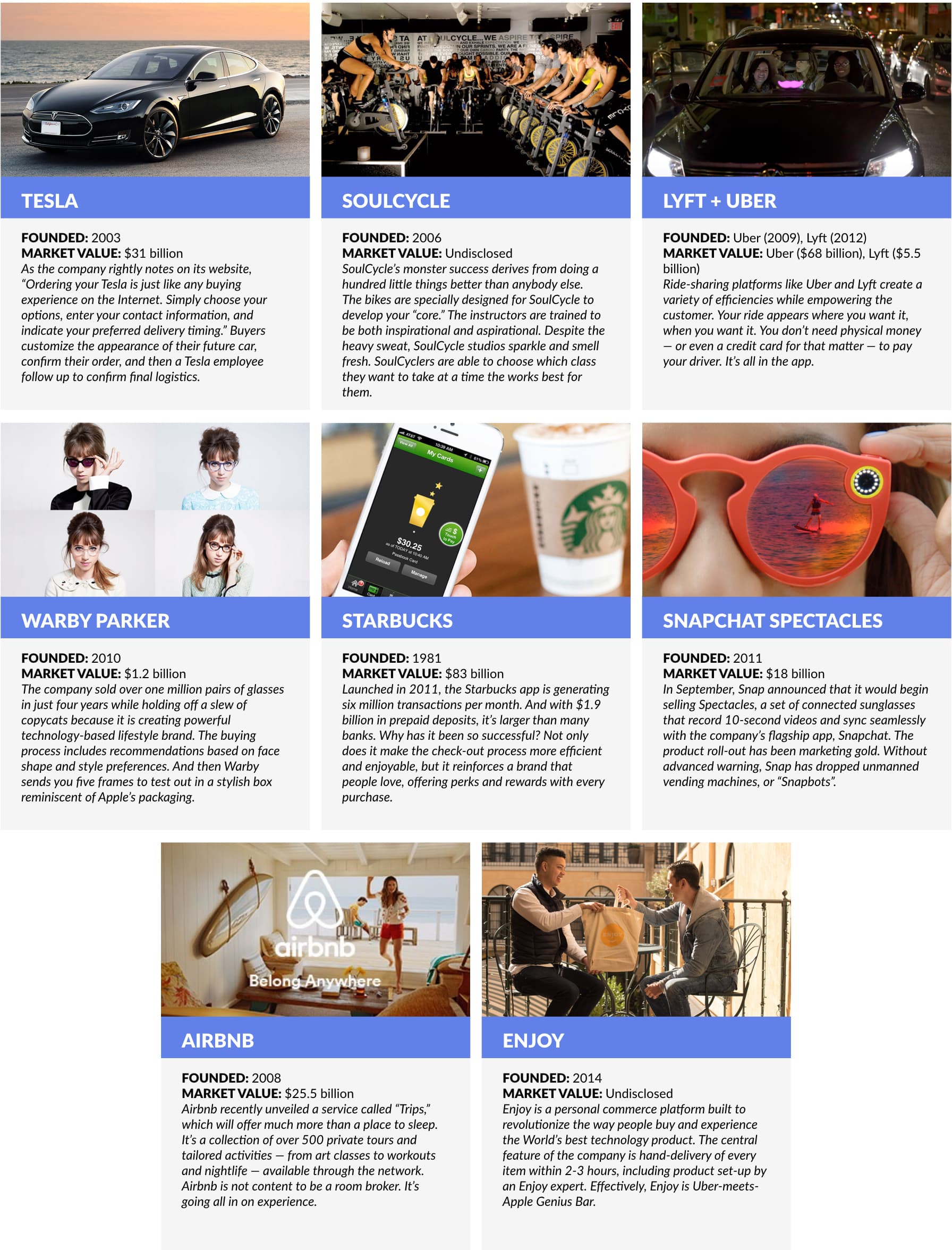

But lost in the lead-up to Black Friday was an announcement from Airbnb a week earlier that highlights a new frontier in the World of commerce. CEO Brian Chesky unveiled a service called “Trips,” which will offer much more than a place to sleep. It’s a collection of over 500 private tours and tailored activities — from art classes to workouts and nightlife — available through the network. Airbnb is not content to be a room broker. It’s going all in on experience.

The rise of Amazon, which accounted for over 30% of spending on Black Friday through “Cyber Monday”, has been about scale and efficiency. According to PiperJaffray, the company now has a warehouse or delivery station within 20 miles of 44% of the U.S. population. That’s up from 38% in 2015 and 26% in 2014.

Today, Amazon Prime counts over 54 million members in the United States, reaching nearly half of U.S. households. Prime members spend 1.8x the average consumer. This year, Amazon held it’s second annual “Prime Day” — which includes a variety of deals for members — generating an estimated $600 million of incremental revenue.

For participants in this market — old and new — growth is fundamentally driven by logistics, not an expansion of products, offerings, or experiences. That’s where experience comes in — and why Airbnb’s announcement is a window to the future.

If you look at the world of physical stores, many compete on service — the customer experience — not just efficiency. For every Best Buy, there is an Apple store. For every Target, there’s a Nordstrom.

The next wave of digital commerce will bring a renewed focus on combining efficiency with a superior personal experience.

The next wave of digital commerce will bring a renewed focus on combining efficiency with a superior personal experience.

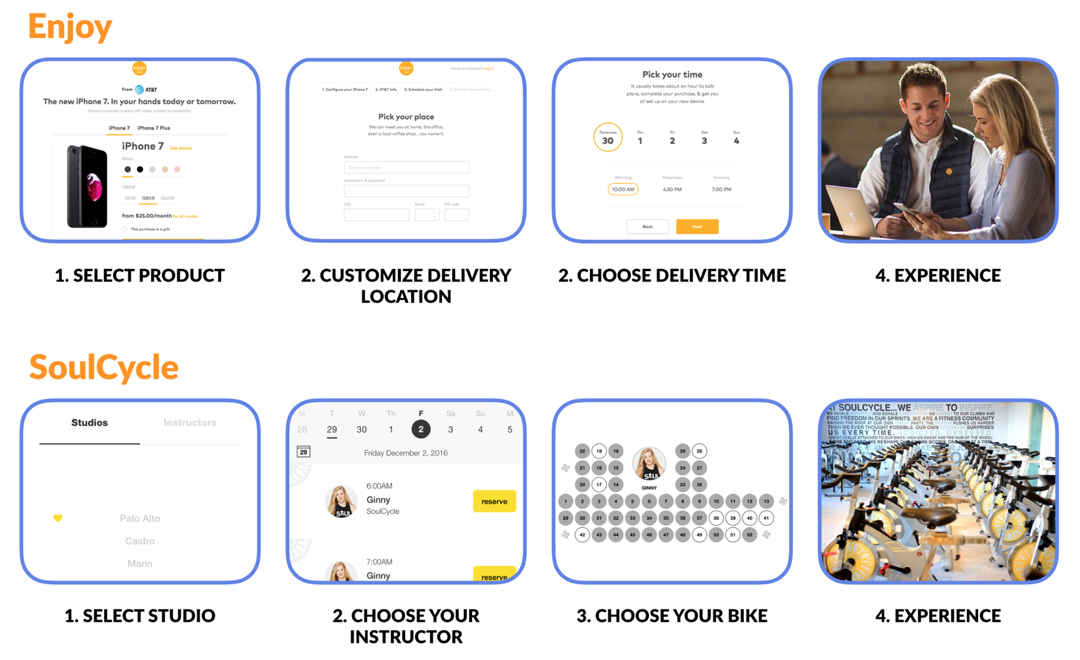

Enjoy, co-founded by former Apple retail head Ron Johnson, is at the forefront of this trend. It’s a personal commerce platform built to revolutionize the way people buy and experience the World’s best technology products — from smartphones to wireless sound-systems and drones. The central feature of the company is hand-delivery of every item within 2-3 hours, including product set-up by an Enjoy expert. Effectively, Enjoy is Uber-meets-Apple Genius Bar. (Disclosure: GSV owns share in Enjoy)

The magic is in the experience Enjoy delivers. Efficient, on-demand delivery is table stakes. Enjoy experts meet customers at a time and place of their choosing, arriving early 97% of the time. Delivery is free and the product prices are the same or less than Amazon, Best Buy, or the Apple store.

How does it work? Enjoy doesn’t build stores. It hires great people. Enjoy can deploy a team of highly trained, engaging product experts a lot less expensively than building a physical storefront. Effectively, it works off the same margins as a physical store, but with a different model.

While the white-glove service Enjoy offers is free to the consumer, corporate partners like Apple, AT&T, Sonos, DJI, GoPro, HP, and Microsoft pay for each product delivered. Partners love Enjoy because it’s a bolt-on service that delights customers and lowers cost by reducing support requests and returns. Customers love Enjoy because it’s convenient and free.

Ultimately, Enjoy is part of a trend that transcends the delivery market. It is focused on creating a delightful experience for people that make digital purchases. In this respect, popular, emerging consumer businesses like SoulCycle are kindred spirits.

There is nothing about what SoulCycle does that can be patented. The casual observer might even mistake it for a “spinning class.” But when you study SoulCycle, you realize that its monster success derives from doing a hundred little things better than anybody else.

First, SoulCycle is a digital commerce platform. You go on your phone. You pick your class, your bike, your instructor, and your session time. Mobile payments are fully integrated.

And then you show up and have a delightful experience. The bikes are specially designed for SoulCycle to develop your “core.” The program emphasizes every muscle in your body, so that after 45 minutes, you’re wiped. The instructors are trained to be both inspirational and aspirational. The music is perfectly choreographed. Despite the heavy sweat, SoulCycle studios sparkle and smell fresh. And there is plenty of cool SoulCycle swag, so you can proudly display that you’re a member of the tribe.

Like Enjoy, SoulCycle starts digitally, and ends with an experience you love. We see a new generation of businesses emerging that are creating advantages through experience.

7. Future Cars Today: Shared, Autonomous, Electric

In 2004, the Defense Advanced Research Projects Agency (DARPA) launched a Grand Challenge series, a multimillion-dollar competition for university robotics teams to design autonomous vehicles. A rivalry quickly developed between Stanford and Carnegie Mellon (the schools traded the top spots in the first two years of the competition) that shaped the early future of self-driving cars.

Sebastian Thrun, the leader of Stanford’s winning team, took a leave from the university in 2007 to work on Google Street View, and later founded the company’s self-driving-car project. In 2015, Uber announced a partnership with Carnegie Mellon to launch the Uber Advanced Technologies Center to develop and deploy self-driving cars through its ride-sharing platform. The first generation of vehicles, designed by Volvo, debuted on the streets of Pittsburgh in September.

Alphabet’s (Google) highly publicized self-driving car initiative served as a starting gun for the entire industry because it leapfrogged incremental ideas. As opposed to focusing on assisted driving, the company instead committed to creating a car without a steering wheel or pedals. It was the stuff of science fiction and it captured the World’s imagination. In December, Alphabet spun the initiative out as a standalone company, Waymo. And just last week, Chrysler completed 100 autonomous Pacifica minivans that will join the Waymo fleet in early 2017.

Look for autonomous cars to accelerate meaningfully in 2017.

For automakers, it’s a matter of survival. The combination of ubiquitous ride-sharing platforms with self-driving cars calls into question the need to buy a car. It’s why you’ve seen GM invest $500 million in Lyft in a long-term partnership to deploy a network of autonomous vehicles. Ford has announced that it will create a fleet of self-driving cars by 2021 in a shared network. Tesla’s cars are already outfitted with “Autopilot.” The list goes on.

Automakers, Ride-Sharing Platforms + Technology Platforms

For technology companies like Alphabet (Google), Baidu, Microsoft, and Apple, cars could be the next great computing platform. Baidu has partnered with the chipmaker nVidia to create an autonomous driving and navigation platform for use by third parties in 2018. Apple’s “Project Titan”, while recently rumored to be scaled back, shares a similar objective.

Ride-sharing platforms are the third leg of the stool. Interestingly, despite high-profile announcements and partnerships from Uber and Lyft, the lesser known nuTonomy was the first to get a network of on-demand, self-driving vehicles on the road, deploying a pilot in Singapore in early September. Later that month, it announced a partnership with Uber rival Grab to develop a broader driverless transportation network in the country.

On a related front, autonomous busses are poised to take the road in greater numbers in 2017. Two leaders to watch — Navya and EasyMile — hail from France. Navya has developed a 15-person bus called Arma, which has already been deployed to a number of geofenced sites in France. It will launch in Singapore in 2017 in partnership with Nanyang Technological University (NTU), shuttling students to and from the campus. EasyMile will offer limited service in Singapore too, as well as select European cities, including Helsinki.

While projections on the pace of autonomous vehicle adoption vary, Lyft founder John Zimmer offered a helpful analogy in a recent blog post:

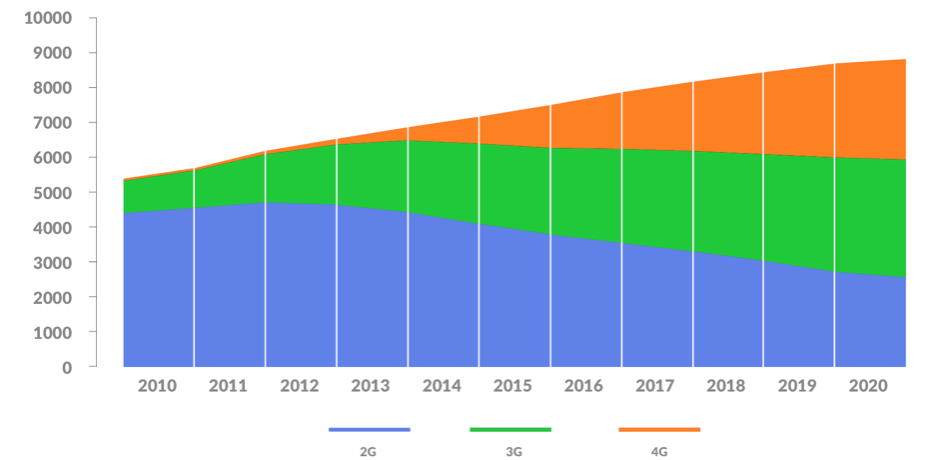

Remember when cell phone coverage transitioned from 3G to 4G? The 4G networks were slowly rolled out, first covering only the largest cities and eventually growing to cover larger and larger portions of suburban areas. This ensures that people are always covered, one way or another. If you spend most of your time in a place that’s only covered by 3G or even 2G, you still have a network to rely on. But as soon as you step into a spot with 4G coverage, you automatically get to try it. Just wait for the upcoming launch of 5G. Future 5G networks won’t be introduced to the world by new companies, they will be rolled out on top of the largest existing networks around the world.

The introduction of autonomous vehicles will follow the same pattern, until its the backbone of mobility.

The next hurdle is to create a regulatory framework for autonomous vehicles to take the road at scale. We anticipate this process will happen incrementally, where self-driving cars are first introduced in designated areas of cities and on specific roads, guided by digital “geofences.”

In the United States, the The Department of Transportation has announced a 15-point safety standard for the design and development of autonomous vehicles. The framework, released in September, calls for states to come up with uniform policies for driverless cars; and clarifies how current regulations can be applied to the technology. Expect the policy debate to heat up as the inevitably of our autonomous future continues to capture mainstream attention.

—

Coming from Michael Moe and the Global Silicon Valley TEAM on March 7, 2017, click HERE to pre-order The Global Silicon Valley Handbook, the exclusive guide to what you need to know to who you need to know in the innovation hotspots around the World.