Market Snapshot

| Indices | Week | YTD |

|---|

The concept is interesting and well-formed, but in order to earn better than a “C”, the idea must be feasible.

— Yale University professor in response to a paper submitted by then student Fred Smith (Founder & CEO, FedEx) outlining his vision for a scalable, overnight delivery service (1965)

As the legend goes, Fred Smith dreamed up the blueprint for FedEx in a college paper for a Yale management class that earned him a “C” because the idea was too far-fetched. Years later, the sample package displayed in the company’s first print advertisements featured a return address at his alma mater in New Haven.

Folklore or not, Smith’s vision of creating a sophisticated, nationwide overnight logistics network — which would “absolutely, positively” deliver business-critical parcels on schedule — would have understandably seemed impossible at the time.

The classic reaction to a revolutionary idea is that it must be impracticable, otherwise somebody would have already done it. Heretofore, the market had failed to produce a viable solution to meet the business needs of the emerging information economy, and sophisticated technology companies like IBM and Xerox had resorted to sporadically flying badly needed computer parts from city to city on private planes.

Today, FedEx is a shining example of innovation and entrepreneurism, with a nearly $45 billion market value. But to say that the company went straight to the top would truly be a myth. Down to their last $5,000 on a Friday afternoon — after Fred Smith had poured his entire $4 million inheritance into the business and raised another $90M (approximately $500 million today’s dollars) — FedEx’s primary backer, General Dynamics, would not cut a check to cover the company’s expected $24,000 fuel bill on Monday.

Wilson took the company’s remaining money to Las Vegas over the weekend and parlayed it into $27,000 on the Black Jack tables so FedEx planes could fly on Monday. Without this “business decision” we would never have heard of FedEx, except as a hair brained idea that took naive investors for a ride.

In the early 2000s, many thought the next innovation in delivery logistics had arrived: same-day services focused on consumers.

But in the dot-com bust that followed, on-demand delivery services like Kozmo, Urbanfetch, and Webvan weren’t just high-profile failures. They became a symbol of the excess that fueled the crash. After their demise, hindsight forged conventional wisdom: Web-enabled same-day delivery was not a viable business model because it is simply too expensive to build warehouses, manage inventory and pay couriers.

At its peak (or valley, depending on your perspective), Kozmo was charging $2 per delivery while hemorrhaging money on courier and warehouse expenses (in 1999, Kozmo reported $3.5 million of revenue on $29 million of expenses). John A. Deighton, a Harvard Business School professor who has written case studies on companies like Kozmo and Webvan, likes to compare the delivery business to shining shoes: “You make as much profit on one shoe as you do on a thousand shoes. There’s just no scale.”

But something funny happened in 2013. Companies promising instant gratification from same-day delivery services roared back to life, raising over $8.5 billion through 2015, backed by heavy-hitters like Sequoia, Greylock, Accel and Khosla Ventures.

In the span of 2014 to 2015 alone, Berlin-based Delivery Hero raised over $1.2 billion across an alphabet soup of financings. China’s Ele.me, a popular restaurant delivery platform, secured a $980 million investment from Tencent and others (followed by a $1.25 billion strategic investment from Alibaba in April, 2016). Others crossing the $100 million investment threshold included Instacart ($264 million), Deliveroo ($200 million), and Postmates ($130 million). As private financings surged, Benchmark-backed GrubHub recorded a successful IPO in 2014 and is valued at over $2.5 billion today.

It is tempting to write this trend off as evidence of the Internet Bubble 2.0, where broken business models are being resurrected by market froth. Indeed, 2016 funding for same-day delivery services appears to have substantially dropped off the torrid pace set over the last two years.

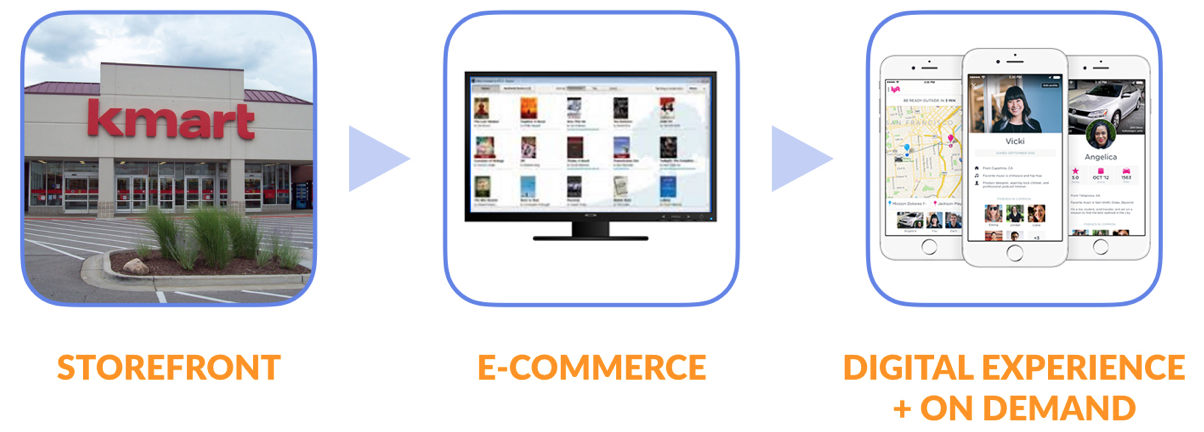

But while the new crop of business may sound eerily familiar, the fundamentals are very different than the dot-com days. Looking at digital commerce more broadly, we are in the early stages of reinventing the way we buy, and ultimately experience a broad range of products and services.

The renaissance of same-day delivery in recent years has been focused on applying powerful new technology and business models to create efficiencies for customers. The next frontier will be creating a superior experience, which means we’ll have to think differently about e-commerce altogether.

NEW FUNDAMENTALS

Connected Consumers

We are riding powerful tailwinds that are rapidly transforming the world as we know it. In 2000, there were only 370 million people on the Internet (roughly 5% of the world’s population), smartphones were a fantasy, and applications off of a platform had not been invented.

Today, digital infrastructure is in place, with three billion people on the Internet, over 2.6 billion smartphones in the hands of Digital Natives, and 226 billion apps having been downloaded from Apple and Google. These dynamics have paved the way for an App Economy where disruptive businesses can launch at lightening speeds, going from idea to “Billion Dollar Baby” seemingly overnight.

Uber and Lyft, for example, have been able to rapidly achieve scale because they have a direct channel to 2.6 billion potential customers who are smartphone owners. But more importantly, these platforms leverage the innate capabilities of a smartphone — from GPS to maps, messaging, and integrated payments — to deliver an experience that is far superior than hailing a taxi on a street corner. These same dynamics are upending old models for delivery and logistics.

Powerful Computing + Big Data

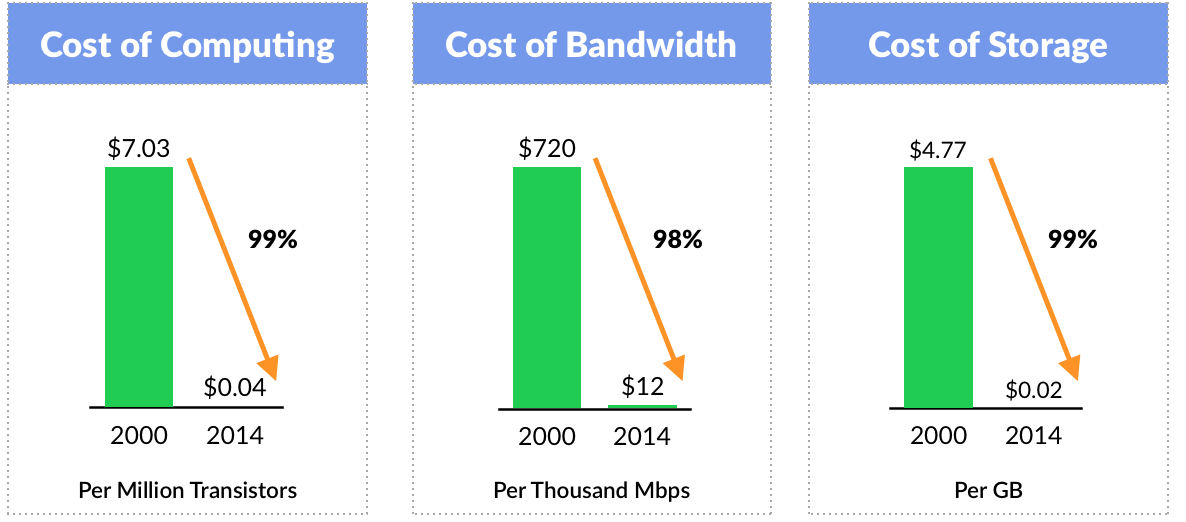

In 1965, Gordon Moore predicted that the number of transistors on an integrated circuit would double every two years. The effect of “Moore’s Law” is that computing power has doubled (or, costs have been halved) every two years for the past 50 years. If the automobile industry would have had its own Moore’s Law, a Ford Taurus that cost $20,000 in 1990 would essentially be free and you’d throw it away after you drove it.

Dramatic reductions in storage and computing costs are enabling startups and large businesses alike to create sophisticated platforms to manage the challenging logistics associated with last-mile, same-day delivery. The combination of powerful GPS and mapping software — which can be accessed on any smartphone — means that delivery armies can be deployed efficiently, optimizing routes, timing, and the management of real-time customer requests.

Mobile Workforce + Peer-to-Peer Models

In the ’90s, Webvan built several $35 million, 350,000-square-foot distribution centers, and managed a fleet of delivery trucks operated by an army of drivers. Instacart, by contrast, offers one-hour grocery delivery in 24 cities with a small team of engineers and administrators based in San Francisco. There are no trucks and warehouses.

Instead, Instacart engages thousands of “Personal Shoppers” in target geographies through a flexible peer-to-peer marketplace — the same model that underpins ride-sharing platforms like Uber and Lyft — trading fixed labor costs for a fluid contract workforce. Instacart ultimately captures a portion of delivery fees, arbitraging grocery prices as it chooses, while establishing fee-based relationships with retailers seeking access to its distribution channel.

New players in the same-day delivery market, including Postmates, DoorDash, and others, have applied similar models to quickly achieve scale. A key trend supporting this model is the fact that the U.S. workforce is increasingly operating outside of the traditional corporate structure, a dynamic that Daniel Pink forecasted in his 2001 book Free Agent Nation.

According to The Economist, between one-fifth and one-third of American workers are now freelancers, contractors or temps, up from 6% in 1989. A comprehensive study by Upwork pegged the number of U.S. freelancers at 53 million. The Department of Labor projects that the typical millennials will have 15 or more careers in their lifetime. Over 90 percent of Millennials expect to leave their jobs within three years and demands for flexible work schedules are increasing. (Disclosure: GSV owns shares in Upwork)

Enjoy is capitalizing on this trend with a different model. Employees fully salaried experts, focusing on higher margin product deliveries, effectively trading the cost of a storefront for a high quality mobile workforce. Same trend behind the rise of peer-to-peer models, but different approach. (Disclosure: GSV owns shares in Enjoy)

Digital Natives + Target-Rich Markets

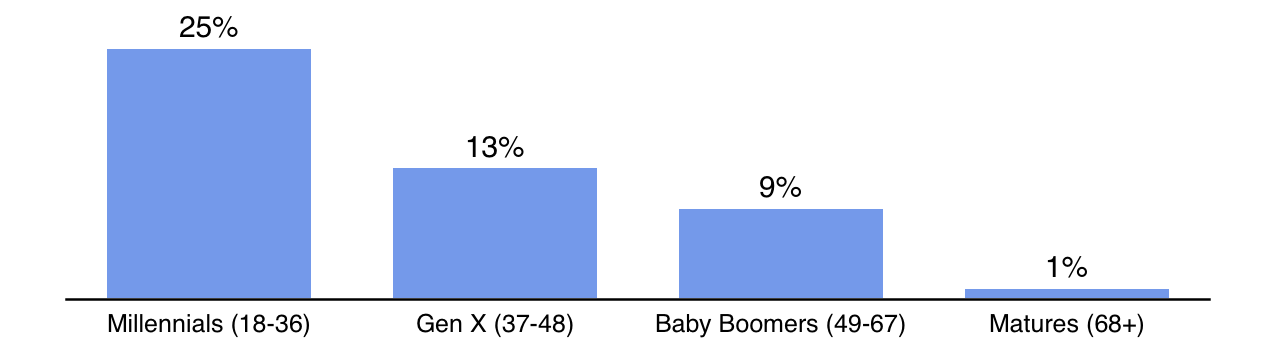

Demand for same-day delivery has been driven by Millennials, who are digital natives and tend to disproportionately welcome new technologies and business models. The most attractive markets for same-day delivery blend three core characteristics: 1) High Population per Square Mile, 2) High Millennial Population Percentage, and 3) Large Overall Population.

CONVENIENCE: RAPID, ON-DEMAND DELIVERY

Until recently, the most important development in e-commerce since it emerged in the 1990s is arguably the launch of Amazon Prime in 2005. Offering free two-day shipping for members, Amazon set a new standard for speed. For any e-commerce platform, anything slower might as well be the Pony Express. The new frontier is on-demand, same-day delivery.

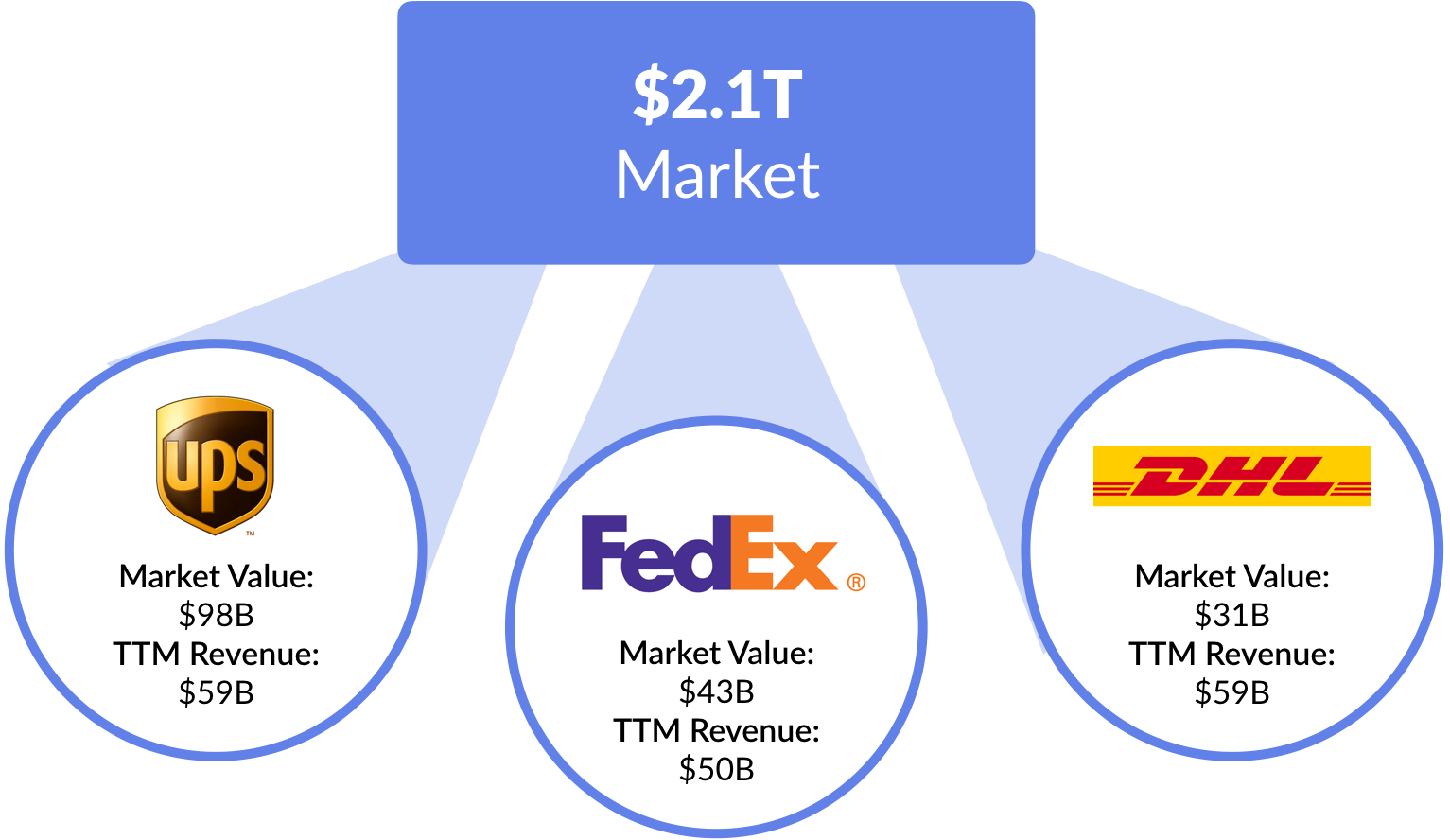

Economic models and opportunities vary in the market for same-day delivery services. According to the World Bank, the global shipping market — including ocean, air, and truck freight is a $2.1 trillion market. It is lead by FedEx, UPS, and DHL, which generated a combined $174 billion in revenue last year and represent $176 billion in total market value.

Global e-commerce sales are projected to reach $2 trillion in 2016, rising to $3.6 trillion over the next three years. Traditional shippers participate in this market to the extent that e-commerce platforms like Amazon outsource the delivery of packages (Amazon works with 20+ shippers to deliver its 600 million packages per year).

The opportunity for last-mile delivery services cuts across the traditional shipment and e-commerce markets, as well as the broader $22 trillion global retail market. Supply of same-day delivery services will induce demand, as people recognize that any product can be delivered anywhere at any time, and with a better experience.

Emerging Last-Mile Service Providers

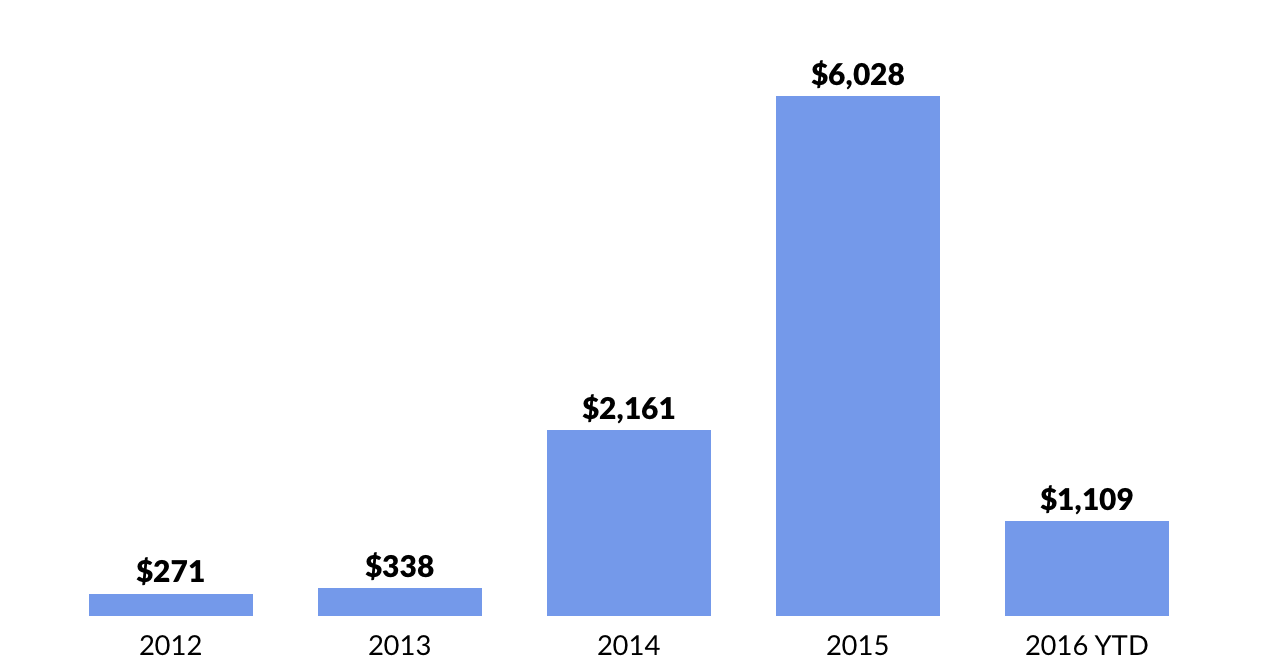

The hyper-competitive market for last-mile and same-day delivery services has been led by the emergence of well-financed startups, which have focused heavily on food delivery. In fact, of the estimated $9.9 billion raised by these services from 2012 through 2016 to date, $9.0 billion has been allocated to businesses focused on food — from ordering groceries to pre-prepared meals and restaurant takeout.

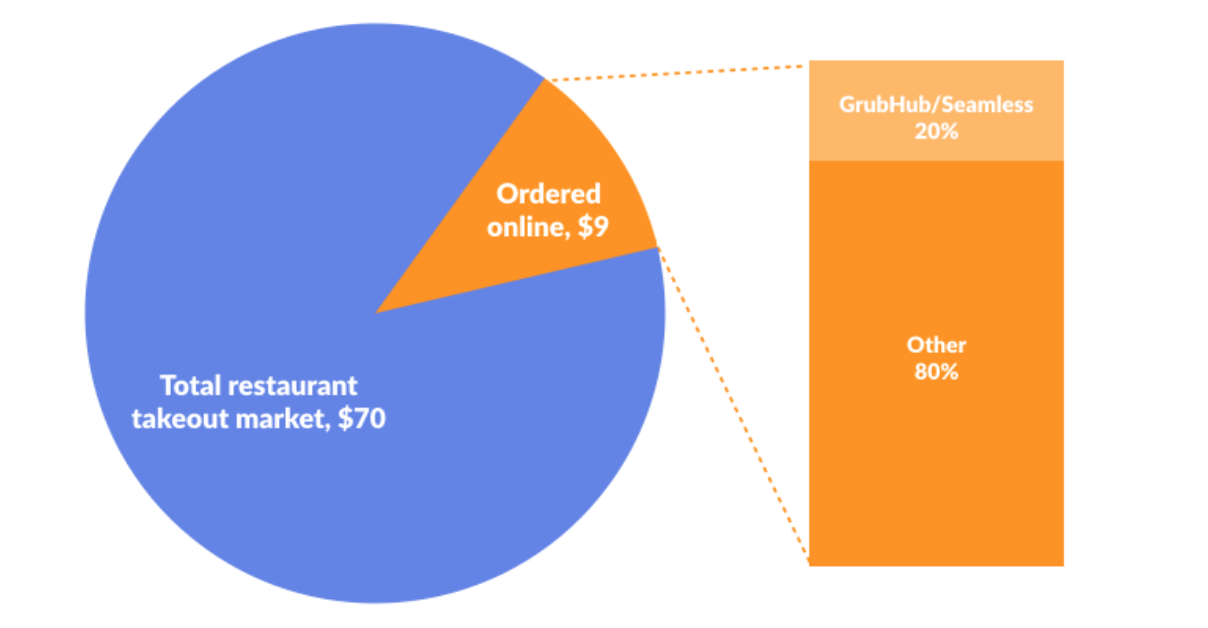

Restaurant take-out delivery, specifically, has been extremely active given the potential frequency of orders (daily), relative to the current levels of digital transactions. The estimated total restaurant takeout market in the United Sates alone is $70 billion per year. Only $9 billion is ordered online, with GrubHub accounting for 20% of the business.

Emerging Providers of Last-Mile and Same-Day Delivery Services

E-Commerce

Today, Amazon Prime counts nearly 54 million members in the United Sates, reaching nearly half of U.S. households. Prime members spend 1.8x the average consumer. This week, Amazon held it’s second annual “Prime Day” — which includes a variety of deals for members — generating an estimated $600 million of incremental revenue.

In December 2014, Amazon launched Prime Now, a same-day delivery service for over 25,000 products across 25 categories, including household items, groceries, electronics, gifts, and seasonal items, as well as restaurant and local store delivery in select cities.To date, 25% of Amazon’s prime members have used the service. Over 70% of Prime Now customers use it multiple times per month, and 24% do so at least one per week.

Look for Amazon, Alibaba, and other global e-commerce leaders to expand these services as they capitalize on broad, integrated logistical networks reaching wide geographies.

Technology & Logistics Players

While Alphabet (Google) does not have Amazon’s warehouse footprint, it launched a pure play same-day delivery service called Google Express in 2013, betting on its ability to use superior data and analytics to optimize routes and efficiency. In February, it added fresh grocery delivery in conjunction with a network of partners, including Costco, Whole Foods, and others.

Alphabet’s long-term plans for the service remain unclear. The effort may simply be to demonstrate proof-of-concept, and then license the platform to companies focused on this strategy (think autonomous vehicles powered by Google Maps). Another consideration may be product searches, which have increasingly moved from Google to Amazon. Today, 44% of shoppers begin their product searches on Amazon, while 34% start with a search engine.

Uber, with over one million drivers and an advanced logistics platform, has quietly begun to enter the same-day delivery market with the launch of UberRush in 2014. It enables customers to request couriers and deliver packages through the company’s app, just like a taxi. In June, Uber announced the release of an UberRush API, which will enable retailers to easily plug the service into their online ordering platforms as a delivery option. In early 2016, the company rolled out UberEats in 10 cities, allowing customers to receive takeout orders from local restaurants in 30 minutes or less.

In a bid to compete directly with similar offerings from Amazon and Instacart, Walmart recently announced a partnership with Uber and Lyft to test a grocery delivery service. Terms and pricing have not yet been disclosed.

CONVENIENCE VS. EXPERIENCE

The accelerating entrepreneurial activity and competition around same-day delivery services is squarely focused on convenience. It’s about ordering from any device and rapidly getting a product to your front door.

For participants in this market — old and new — growth is fundamentally driven by logistics, not an expansion of products, offerings, or experiences. This is a market where you win on scale and efficiency. It could be winner-take-all or winner-take-most, and leaders like Amazon and GrubHub loom large.

But if you look at the world of physical stores, many compete on service — the customer experience — not just efficiency. For every Best Buy, there is an Apple store. For every Target, there’s a Nordstrom. The next wave of digital commerce will bring a renewed focus on combining efficiency with a superior personal experience.

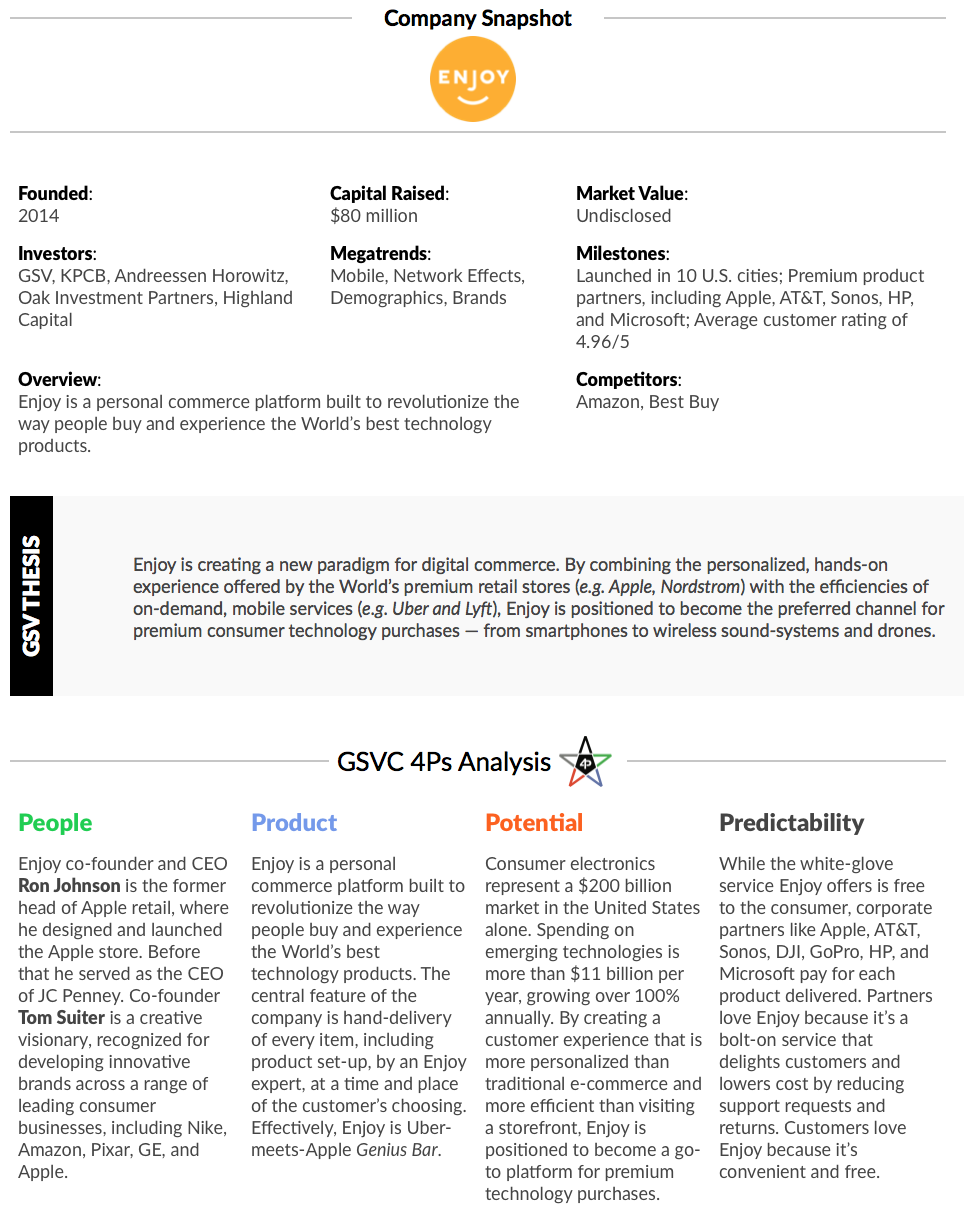

Enjoy, co-founded by former Apple retail head Ron Johnson, is at the forefront of this trend. It’s a personal commerce platform built to revolutionize the way people buy and experience the World’s best technology products — from smartphones to wireless sound-systems and drones. The central feature of the company is hand-delivery of every item within 2-3 hours, including product set-up by an Enjoy expert. Effectively, Enjoy is Uber-meets-Apple Genius Bar. (Disclosure: GSV owns share in Enjoy)

The magic is in the experience Enjoy delivers. Efficient, on-demand delivery is table stakes. Enjoy experts meet customers at a time and place of their choosing, arriving early 97% of the time. Delivery is free and the product prices are the same or less than Amazon, Best Buy, or the Apple store.

How does it work? Enjoy doesn’t build stores. It hires great people. Enjoy can deploy a team of highly trained, engaging product experts a lot less expensively than building a physical storefront. Effectively, it works off the same margins as a physical store, but with a different model.

While the white-glove service Enjoy offers is free to the consumer, corporate partners like Apple, AT&T, Sonos, DJI, GoPro, HP, and Microsoft pay for each product delivered. Partners love Enjoy because it’s a bolt-on service that delights customers and lowers cost by reducing support requests and returns. Customers love Enjoy because it’s convenient and free.

One of the biggest challenges for most e-commerce platforms, particularly newcomers, is that acquiring customers is prohibitively expensive. Enjoy is thinking differently about this paradigm as well. It works directly with manufacturers to integrate its “hand delivery with expert help” service as an option at the point of sale (e.g. you can select Enjoy when purchasing an iPhone through AT&T).

Watch Remarks From Enjoy Co-Founders Ron Johnson + Tom Suiter HERE

Ron Johnson (Right) and Tom Suiter (Left) Discuss the Future of Digital Commerce Reimagined at GSV Capital’s 2016 Investor Day

Enjoy believes that after delivering a delightful experience to customers, it will be able to invite them back to to purchase additional products over time. To date, the company has an average customer rating of 4.96/5.

In this respect, Enjoy is taking a page out of Amazon’s playbook from the 1990s. Amazon used to run e-commerce websites for brands like Target — a strategy that helped the company build scale before blossoming into its own brand.

Ultimately, Enjoy is part of a trend that transcends the delivery market. It is focused on creating a delightful experience for people that make digital purchases. In this respect, popular, emerging consumer businesses like SoulCycle are kindred spirits.

There is nothing about what SoulCycle does that can be patented. The casual observer might even mistake it for a “spinning class.” But when you study SoulCycle, you realize that its monster success derives from doing a hundred little things better than anybody else.

First, SoulCycle is a digital commerce platform. You go on your phone. You pick your class, your bike, your instructor, and your session time. Mobile payments are fully integrated.

And then you show up and have a delightful experience. The bikes are specially designed for SoulCycle to develop your “core.” The program emphasizes every muscle in your body, so that after 45 minutes, you’re wiped. The instructors are trained to be both inspirational and aspirational. The music is perfectly choreographed. Despite the heavy sweat, SoulCycle studios sparkle and smell fresh. And there is plenty of cool SoulCycle swag, so you can proudly display that you’re a member of the tribe.

Like Enjoy, SoulCycle starts digitally, and ends with an experience you love.

WHAT’S NEXT

Last summer, in a proposal to the FAA, Amazon unveiled a vision for a network of superhighways crisscrossing the skies for drones to deliver packages. It contemplates three segmented bands of airspace. From the ground up to 200 feet would be reserved for hobbyists. From 200 feet to 400 feet would be for high-speed commercial drones operating autonomously. From 400 feet to 500 feet would be a no-fly zone to act as a buffer between manned and unmanned aircraft.

The idea isn’t farfetched. In 2015, Switzerland’s postal service began testing delivery drones in conjunction with California-based Matternet, which develops unmanned aerial vehicles and automated logistics networks. Germany’s DHL has been trialling its very own “parcelcopter” on the island of Juist in the North Sea since 2013.

Amazon’s proposal is unlikely to get off the ground any time soon because FAA rules require drones to remain within line of sight, either of an operator on the ground or in a chase plane in the sky. This defeats the purpose of automated delivery vehicles, and the rule has broader constraints for commercial drone applications.

NASA, in collaboration with the FAA, is currently working with various universities and companies — including Google and Verizon — to design an air-traffic-control system for drones. It will have its own equivalent of roads, traffic lights, and “do not enter signs”. As regulation evolves, drone adoption will accelerate.

On the ground, companies like the London-based Starship Technologies are developing self-driving robots to complete local deliveries. Partnered with a variety of retailers and food delivery platforms, the company recently launched a trial phase in three European cities — London, Dusseldorf, and Bern. Look out for accelerating innovation in the last mile.

—

For the person who wanted to “get off the grid” and enjoy the “lazy days” of Summer last week, coming back to the office on Monday could be a pretty shocking re-entry.

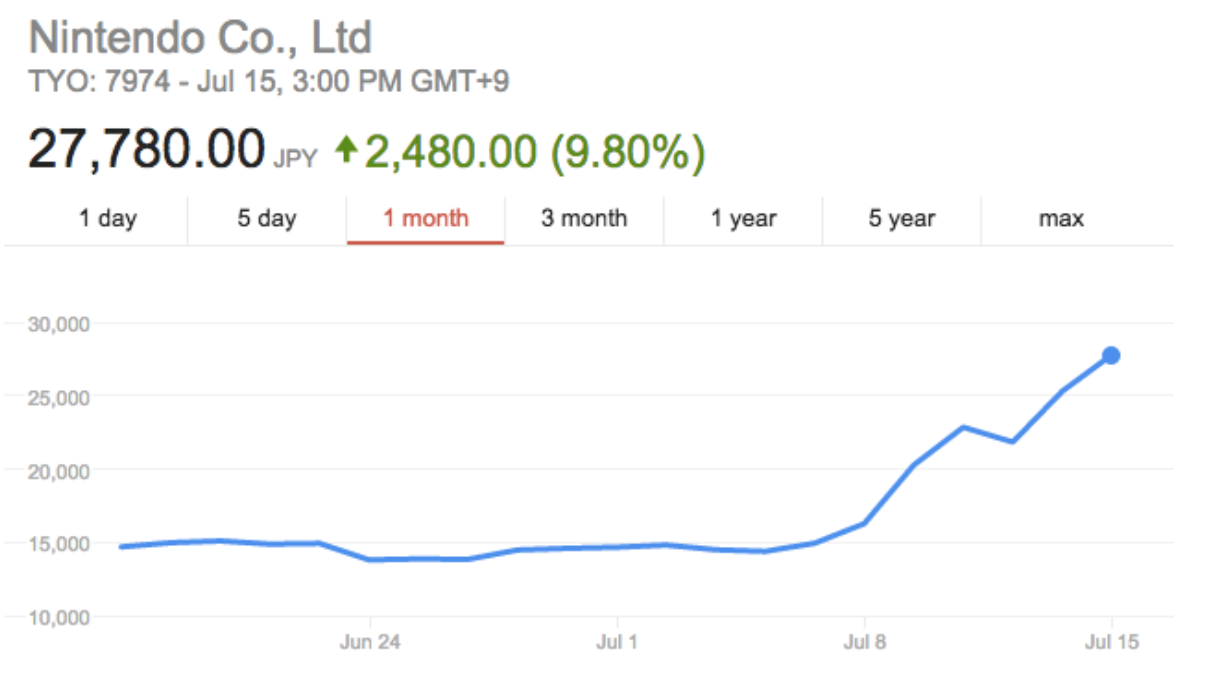

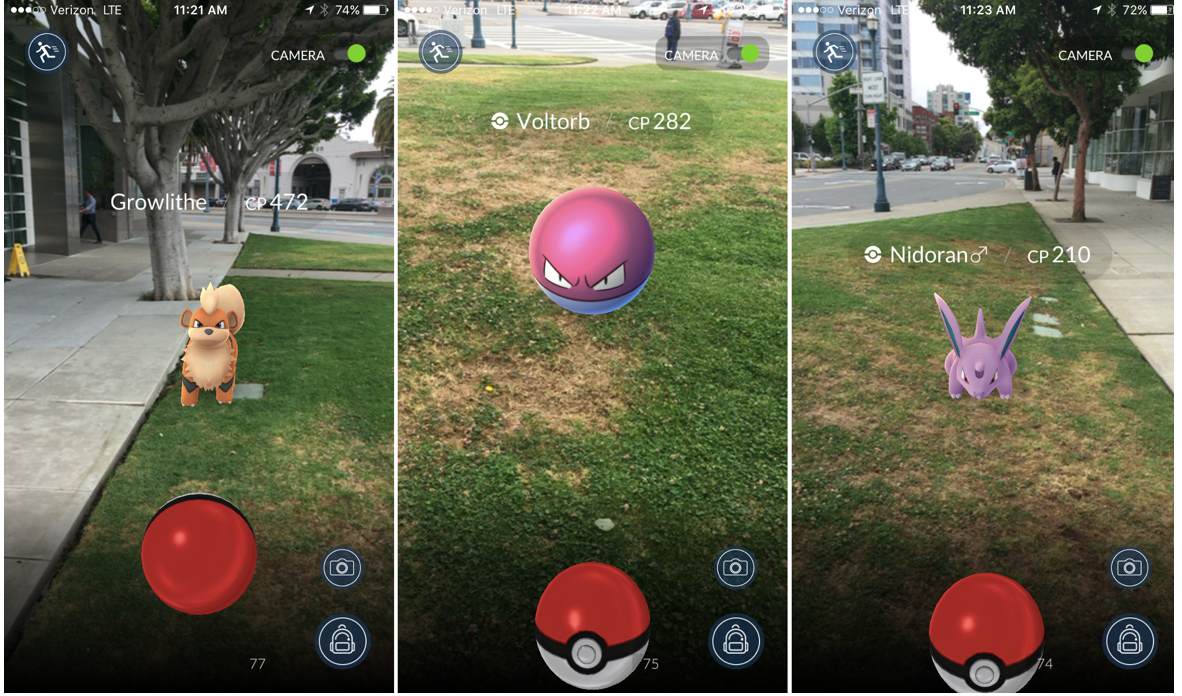

Let’s see… To start, it appears that half of society has become zombies, staring into their smartphones, chasing imaginary characters into light poles, funerals, and remote neighborhoods. It’s also unimaginable that the long-lasting Nintendo stock — the instigator of Pokemon Go — rose in value by nearly 100% in one week.

Second, our frenemy, Turkey, had a military coup that included the under-siege President Erdogan Facetiming his countrymen from an undisclosed location that everything was fine and he was firmly in charge. Not exactly a show of strength. But then, incredibly, he flew into Istanbul in the wee hours of the morning on Saturday to rally his supporters and off his opponents, showing everyone who was boss.

France got hit by another terror attack, this time in the until-now tranquil Mediterranean town of Nice, with 84 murdered. Humanitarian idol and Rock Star Bono was dining in the area and needed to be ushered to safety by police.

Upon grasping the upside down World realities of the previous week, and looking at the financial pages to see that stocks actually reached all-time highs (not a Market crash), it would be reasonable for Rip Van Winkle to be pretty convinced that this was all a dream.

But no, just like Donald Trump and Hilary Clinton being our two choices for President is not a dream, stocks actually rose to new highs with the S&P 500 and NASDAQ both rising 1.5% and the GSV 300 up 3.5%.

Two IPOs were priced last week, with Japan’s Line rising 50% to a $8.5 billion market capitalization and a 8.5x P/S — pretty good for a company only growing at 21%. Not surprising, with stocks acting better and Twilio’s soaring IPO a few weeks ago, a wave of IPOs are now coming online with seven new issues expected to price this week.

Notable private financings included Unity Technology, which raised $181 million at a $1.5 billion from DFJ, CIC and Thrive Capital, among others. Unify is a Sequoia-backed software platform for game developers, boasting 1/3 of the World’s top games, including Pokemon Go. CodeAcademy raised $30 million this week as well.

The fact that stocks are going up despite a slew of news that could be viewed negatively, including Brexit and negative second quarter earnings, is very BULLISH. Growth drives enterprise value and we will continue to focus on identifying and investing in companies we think have the highest and most sustainable growth potential.