Market Snapshot

| Indices | Week | YTD |

|---|

Quicker than you could say “Anthony Scaramucci,” he was gone, mercifully vanishing from the nation’s podium. The Mooch’s departure capped off a triple play, with “Spicey” Spicer and “Previous” Priebus relieved days before.

Is it live or is it Memorex? It has never been more difficult to determine as news breaking before our very eyes can’t possibly be true and articles unencumbered by actual facts are taken as gospel by the faithful. Stories of Hilary Clinton running a child sex ring out of a pizza shop in Washington D.C. — “Pizzagate” — went viral and with such legitimacy that both the New York Times and the Washington Post wrote articles debunking it.

“Fake News” has been bipartisan. Another viral story that became world news was the Irish government accepting “refugees” from America seeking asylum following the Trump election.

Non-sensational but truly sensational news — such as the Economy generating 1.2 million jobs since January — has been drowned out by fake stories… conservative rocker Ted Nugent killed in a hunting accident… more topless pictures of Vladimir Putin… the list goes on.

What’s ironic — and would seem to be fake given the reported chaos and crisis in confidence — is that markets are up big since Election Day. The S&P 500 and NASDAQ have risen 15.9% and 22.3% respectively. The Dow is up 20.5% and the GSV 300, an index of the 300 fastest growing companies in the world, has surged 32.9%.

At the same time, Market volatility is half of what would be considered normal. In fact, while public stock performance is better than it has been in a hundred years, the VIX volatility index is under 10 — 20 is even par.

While Fake News has become a phenomenon of late, it’s also obscuring the bigger news about the Fourth Estate itself.

Last month, as President Trump continually hammered a stable of traditional news outlets, Vice Media completed a $450 million financing led by TPG that valued the company at $5.7 billion. That’s nearly twice the value of the New York Times. Vice, whose investors include Technology Crossover Ventures (TCV), Walt Disney, 21st Century Fox, the Raine Group, and WPP, said it would use the new funds to produce “multi-screen” programming to complement the news, documentary, and reality series it makes and distributes around the world.

Why is Vice more valuable than the New York Times, the face of virtue in the news?

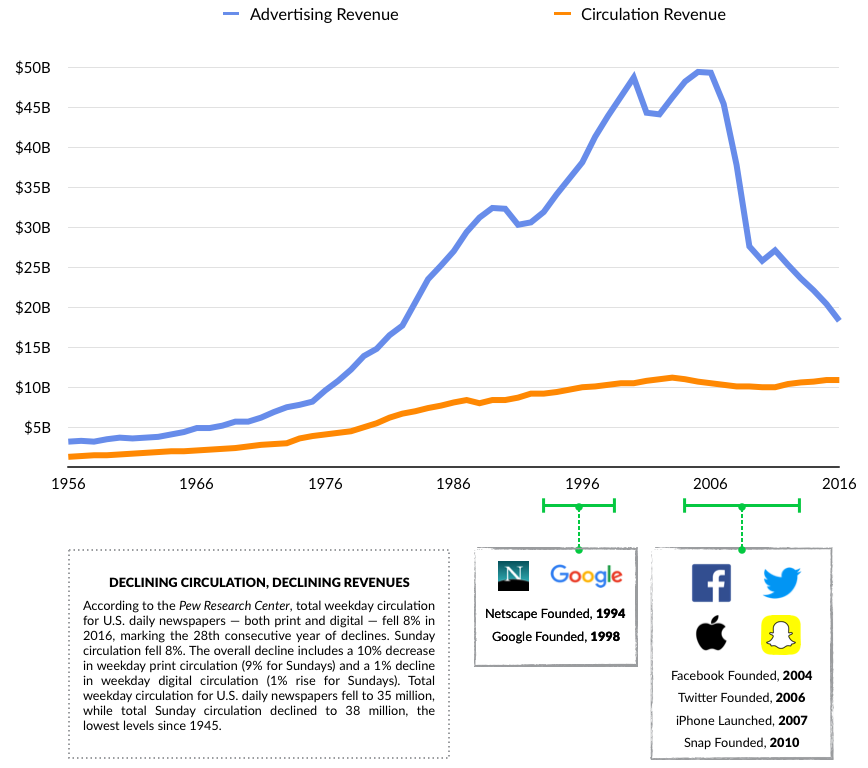

In just over 20 years, the news industry has undergone a fundamental transformation, which has happened in three phases starting with the launch of Netscape in 1994. The first phase was a Cambrian explosion of “news” as the Internet democratized access to information, as well as content creation and distribution. CNN.com went live in 1995 and the New York Times followed suit in 1996, but by 1999, a new phenomenon had arrived: “weblogs” or “blogs” — individuals publishing their own “news.”

In 1999, there were 23 blogs on the Internet. By 2006, there were 50 million. The Huffington Post, launched in 2005, created the first crowdsourced “newsroom” by aggregating bloggers through a branded channel.

The second phase was marked by the rise of curation mechanisms in the face of rapidly proliferating content. Social media platforms like Facebook and Twitter quickly became de facto news curation platforms as patterns of sharing across the “Social Graph” meant that certain stories could go viral. Google News and Flipboard, launched in 2006 and 2010 respectively, enabled people to create personalized news channels by aggregating content from a variety of sources.

In the third phase, we are coming full circle as consumers seek out engaging sources of information, ideas, and entertainment. Curation has proven to be a double-edged sword, on the one hand limiting a deluge of information but at the same time creating an echo chamber based on your own biases and the broader biases of your network.

But consumers are not simply turning back to the stalwart newspapers of yesteryear. As with businesses that are disrupting legacy consumer industries — from Airbnb in hospitality to Lyft in transportation and Spotify in music — people are demanding new and engaging digital content and physical experiences from brands that they love. (Disclosure: GSV owns shares in Lyft and Spotify)

ELEMENTS OF NEW “NEWS” MEDIA PLATFORMS

The news media platforms of the future combine three core elements, which in turn unlock a variety of monetization opportunities.

1. Digital

Developing a superior digital platform producing engaging digital content is table stakes in the new world of news media. In 2008, the average American spent 2.7 hours per day on digital media. Today we spend 3.1 hours per day on smartphones alone — more time than we used to spend on desktops, laptops, mobile, and other connected devices combined.

Over 87% of Millennials sleep with their smartphones and 97% U.S. high school and college students would rather lose every other possession before giving up their smartphone. Snapchat now reaches 45% of U.S. 18-34-year olds, which is 9x greater than the top 15 TV networks combined. Social everything — entertainment, communication, collaboration, shopping, education, and healthcare — is the future and it is going to be done anytime, anywhere on mobile devices.

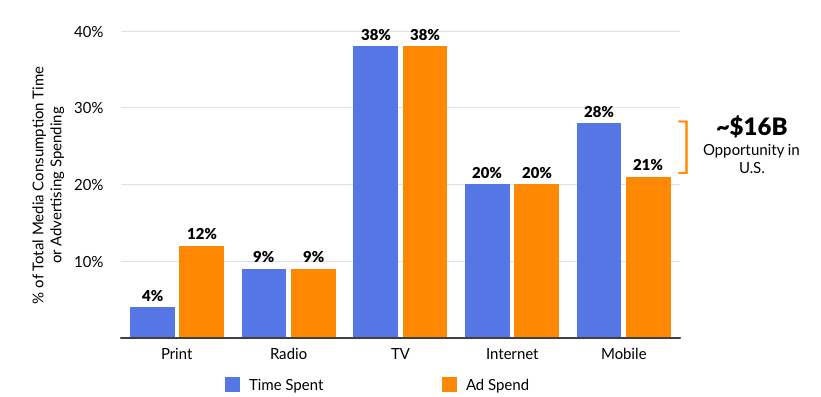

Despite this, advertising spending, long the lifeblood of the news industry, has yet to fully shift to where key audiences spend their time. In the United States, print still accounts for 12% of ad spending while only 4% of audience time spent. Mobile, by contrast, accounts for 21% of ad spending but 28% of audience time spent. This represents a $16 billion opportunity for digital media businesses, which should increase as time spent on traditional TV continues to decline.

2. Brand + Curation

In a world where information is a commodity and “infobesity” is crippling, powerful brands are the key differentiator for emerging news media businesses.

OZY Media, launched in 2012, has surged to an audience of 30 million people per month — larger than the than The Economist, The New Yorker, or Politico — with original content focused on what’s new and next. It covers game-changing people, places, trends and ideas 6-12 months before they capture mainstream media attention. (Disclosure: GSV owns shares in OZY)

Co-founder and CEO Carlos Watson, a former CNN and MSNBC commentator, argues that by engaging people with truly differentiated content and experiences (e.g. events) OZY can address a premium brand vacuum in news media — think Apple’s brand halo in consumer electronics or what HBO’s once did versus Cable TV.

Vice Media has become the go-to source for people seeking content that is raw, edgy, and off-the-wall. It has built its reputation based on “stunt journalism” — most notably, in 2013, Vice orchestrated Dennis Rodman’s first visit with North Korean president Kim Jong Un, marking the first live interaction between Americans and the North Korean ruler.

Some of Vice’s most viewed documentaries on YouTube include “World’s Scariest Drug” (25 million), “Making the World’s First Male Sex Doll” (22 million) and the “Giants of Iceland” (19 million).

Founded in 2013 by Jessica Lessin, a former reporter for the Wall Street Journal, The Information has become a must-read intel source inside the venture and tech community. It is singularly focused exclusive stories and in-depth analysis of emerging companies and and leading investors in the global growth ecosystem.

The company aims to extend its reach and impact with The Information Accelerator, which is exclusively focused on incubating, funding and supporting news businesses and reporters aligned with their mission to save high-quality journalism.

A related trend is the rise of news media platforms focused on specific affinity groups, including powerful brands focused on women. Notable companies include Refinery29, which has over 2.5 million subscribers watching 300 million videos monthly and Bustle, which has over 80 million readers.

Female celebrities have taken interest in digital media. Gwyneth Paltrow, Reese Witherspoon, and Lena Dunham have all launched popular media brands and content.

Compelling media brands with engaged audiences unlock more lucrative advertising opportunities — including native advertising, which are integrated into the content and brands that surround them.

In 2010, Intel and Vice partnered on a $40 million Vice-produced series funded entirely by Intel that showcased the work of contemporary artists called the Creators Project. It launched with a website as well as print and television content, and events in five global cities.

Vice CEO Shane Smith recalls the transformative opportunity the Intel deal represented:

That program built the company. You learn, holy shit, we could do a $40 million deal with Intel where we actually create content that we like, and they don’t give notes! Why were we doing banner ads? Those $40 million deals have turned into $100 million deals.

Native advertising spend has increased by 600% from 2014 to 2016 and is projected to reach $28 billion in the United States by 2018.

3. Multichannel Platform

A new key fundamental for media platforms is creating a multi-channel delivery model. It’s not enough to engage an audience through a single medium.

In September 2016, for example, OZY partnered with PBS to premiere a primetime program called “The Contenders – 16 for ’16,” an 8-part documentary series dissecting the most dramatic presidential campaigns in U.S. history. The series, which aired on PBS and BBC before the 2016 Presidential Election, attracted over 30 million viewers.

In 2015, Vice announced a major partnership with HBO to distribute original content through the network. Vice has also inked lucrative deals with A&E and MTV to exclusively air original content on their channels.

Founded in 2006, Buzzfeed made a name for itself with click-bait and information-lite content that can easily go viral on third party social media platforms. In 2015, the company launched Tasty, a collection of aesthetically-pleasing instructional videos about food made specifically for Facebook. Today, Tasty is producing some of the most popular digital content in the world. Its videos were watched 1.1 billion times in June alone and some months, the number of views reach over 3 billion.

Tasty has also launched nine spin-offs featuring culture-specific or thematic cuisine. All in all, across its entire empire, Tasty has nearly 165 million Likes on Facebook, making it the third most liked page on Facebook’s platform, eclipsed by only Facebook itself.

By building out a video and social media-specific leg to its business, Buzzfeed has transformed and augmented its business model with Tasty alone. Tasty is profitable and is Buzzfeed’s fastest growing revenue source. Buzzfeed continues to capitalize on the Tasty platform and published The Tasty Cookbook, a New York Times bestseller which has sold over 150,000 copies, and is releasing a cooktop, The Tasty One Top, later this fall.

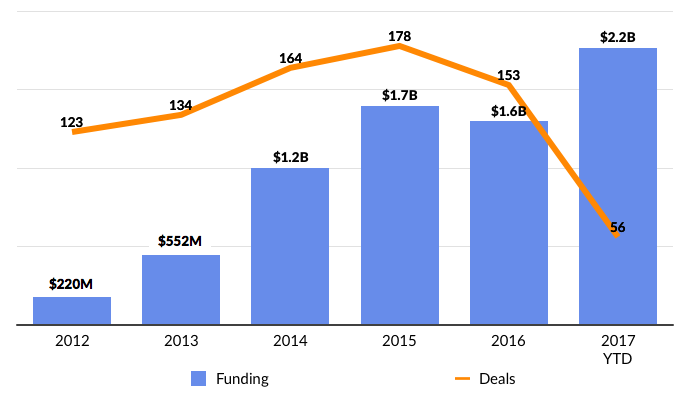

INVESTMENT + STARTUP ACTIVITY

Since 2012, there has be over $7.5 billion of funding to digital media startups across 808 deals according to CB Insights. The second quarter of 2017 included the three largest financing rounds for digital media startups with Toutiao, Group Nine Media, and Vice raising $1 billion, $485 million, and $450 million, respectively.

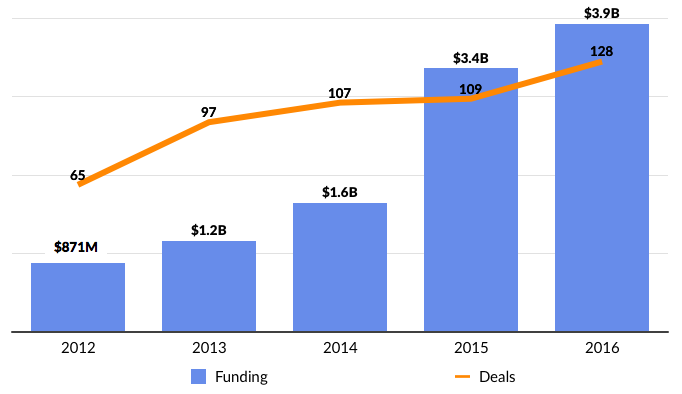

Corporate strategic investment activity has accelerated as transformational new businesses have emerged in recent years. German media heavyweight Axel Springer, for example, has rapidly shifted its traditional print media business towards an array of digital opportunities. In 2000, none of Axel Springer’s operating profit came from digital initiatives. By the end of 2016, it was over 72%.

In September 2015, Axel Springer acquired business-focused news site Business Insider for $450 million. Other digital media investments in Axel Springer’s portfolio includes OZY, Mic, NowThis and Thrillist.

WHAT’S NEXT

Last October, four media brands — Thrillist (lifestyle), NowThis (video news), The Dodo (animals), Seeker (Discovery’s digital network) — came together to form Group Nine Media, with the Thrillist’s Ben Lerer becoming CEO of the holding company. Group Nine Media’s deal was worth $585 million, including a $100 million investment from Discovery Communications.

We expect to see continued consolidation among brands and media platforms that are unable to create defensible, multi-channel business models.