Market Snapshot

| Indices | Week | YTD |

|---|

Lots of companies don’t succeed over time. What do they fundamentally do wrong? They usually miss the future.

— LARRY PAGE, CEO, ALPHABET (GOOGLE)

An iPhone belongs in your pocket, not on the road.

— Oliver Blume, CEO, Porsche

This week, Alphabet — the artist formally known as Google — temporarily surpassed Apple to become the most valuable company in the World. (Disclosure: GSV owns shares in Alphabet and Apple)

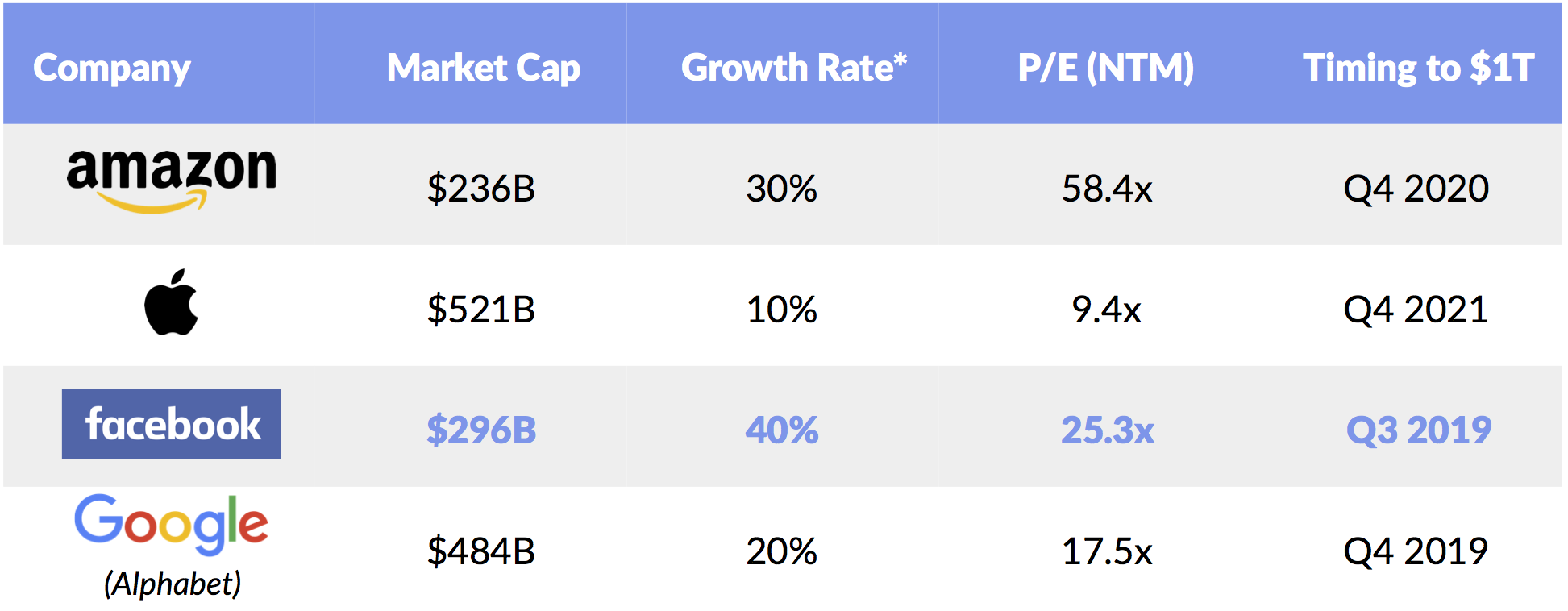

While Apple retook the mantle after broad market declines on Friday, Alphabet’s brief ascendence cast a fresh light on the race to become the first trillion dollar market value business. The four horses in the race are Amazon, Apple, Facebook and Alphabet. (Disclosure: GSV owns shares in Amazon and Facebook)

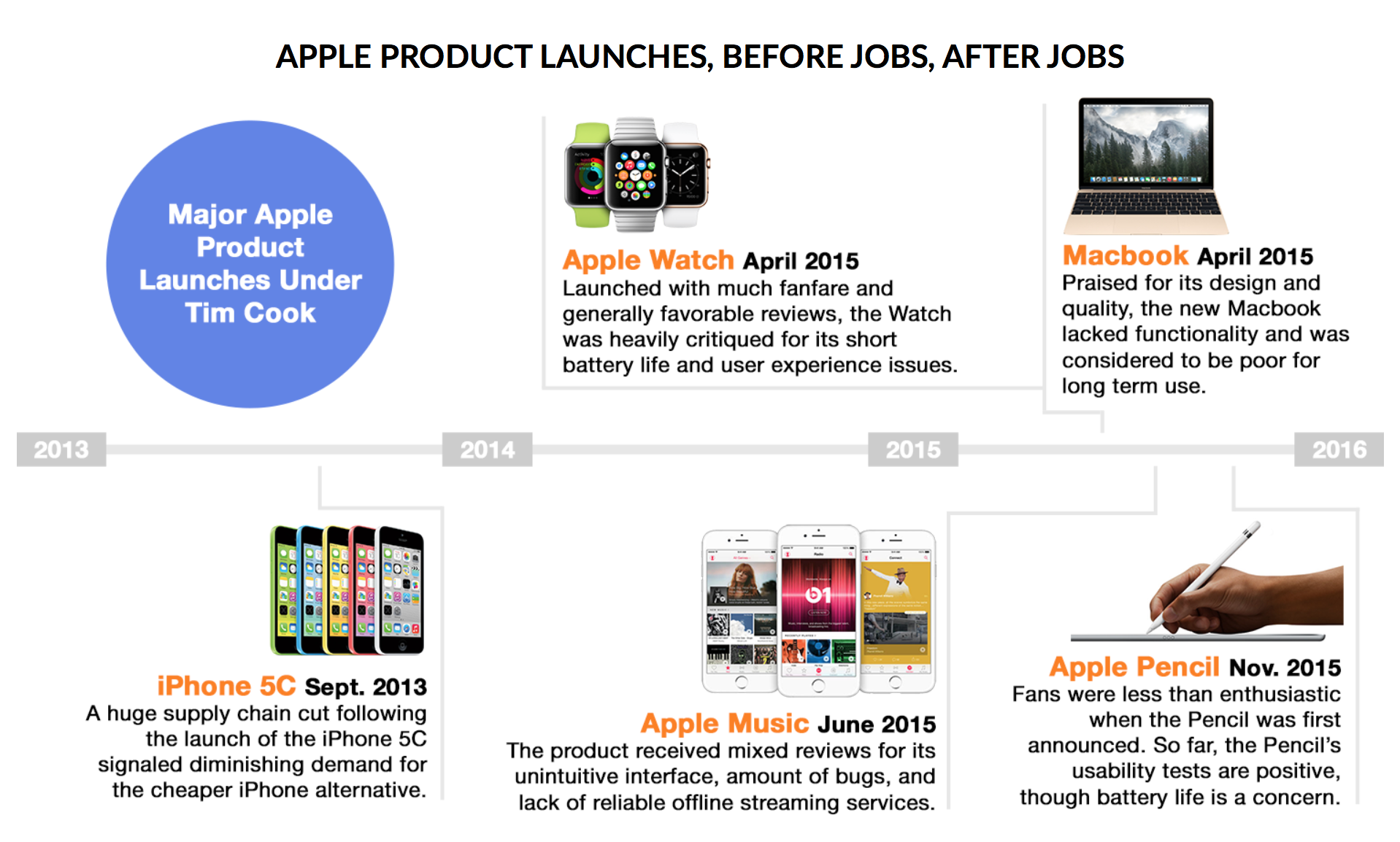

The favorite to reach $1 trillion has been Apple for some time, as its market value exceeded $700 billion in 2015. After the way too early passing of Steve Jobs, Apple has struggled to regain its MOJO with a series of ho-hum product introductions, from the Apple Watch to Apple Music.

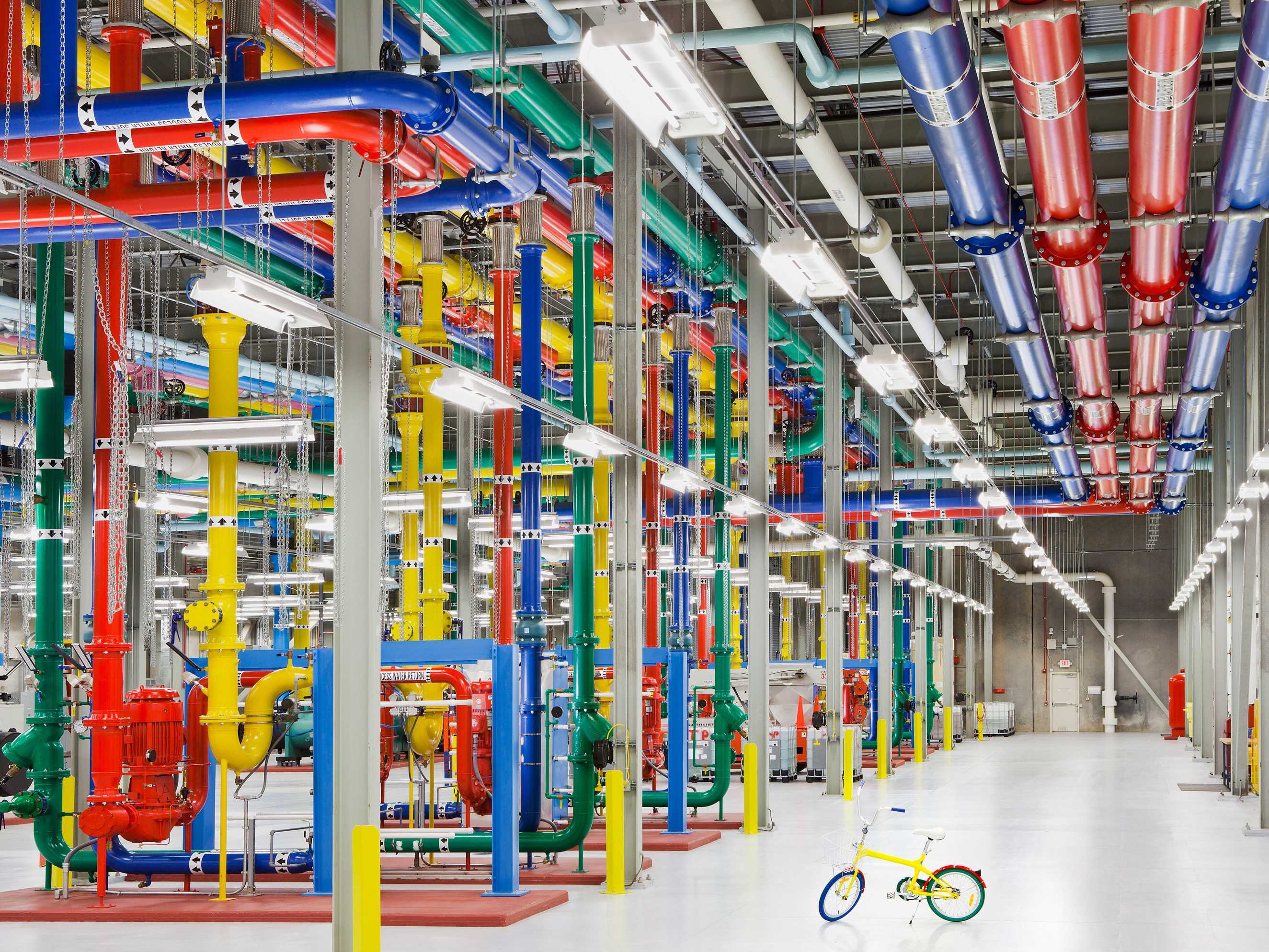

In recent years, Alphabet has gained some real traction with bets on YouTube, Nest, and Android all producing dominant services in their respective areas. Amazon, powered by Amazon Web Services (AWS), has continued to surge. Estimated to be worth over $160 billion, AWS entered 2016 with customers in 190 out of 196 countries — just about every corner of the World.

THE RACE TO A TRILLION

In 2013, we wrote about the “Race to a Trillion”, adding Facebook to the mix as a dark horse candidate. With a $119 billion market cap at the time, “long shot” sounded like an understatement to many (Disclosure: GSV owns shares in Facebook):

Facebook with a market cap of $119 billion is definitely the underdog of the Big Four to reach $1 trillion first, and with just $7 billion in sales and a rich price-to-sales of 17.5x and 67x price-to-earnings, tough to see FB getting to a $1 trillion on multiple expansion. That said, as the World’s communication and collaboration platform, the leverage to its model is enormous and while it’s a long way back in the pack — it has the opportunity to grow at the highest rate for the longest time, in my opinion. So, if it could grow its revenues at its historic 100% growth and keep the current valuation ratio, it would reach the $1 trillion club by 2017… unlikely but not beyond the realm of possibilities.

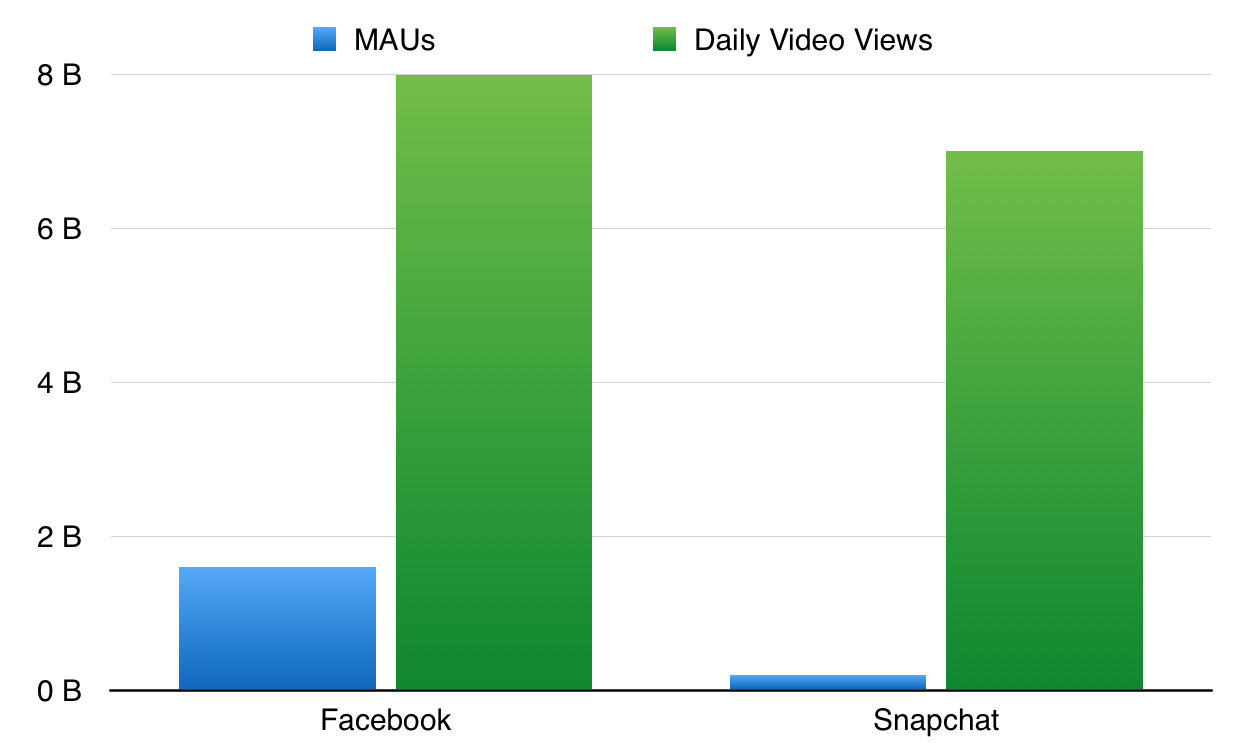

Coming from way back, Facebook is starting to look like it might make it to the trillion dollar finish line first. It has been propelled by a monster network of nearly 2 billion people and the home runs Zuck has hit with high risk venture bets in Instagram, WhatsApp, and Oculus.

Source: Facebook, GSV Asset Management

Today, Facebook has a market value of $296 billion and a P/E of 25.3x. But it is growing earnings at over 40% per year. Hold P/E constant and assume growth of 40%, and Facebook will hit the trillion dollar mark in the Summer of 2019. But it will be a photo finish with Alphabet, which would cross the line near the end of the year.

Source: Capital IQ, GSV Asset Management

*GSV Estimate

THE AGE OF EXPONENTIAL IDEAS

The Race to a Trillion underscores a broader point. We have entered an age of exponential ideas. “Linear” businesses are going extinct.

Why does Green carmaker Tesla trade at 18x the P/E of General Motors? Because a Tesla now gives you the ability to drive 270 miles and you can recharge your car in the time it takes to grab lunch. If Teslas only went 40 miles, the company would be dead in the water. Add in the fact that Teslas are effectively computers on wheels (with hands-free mode they drive themselves) and stylish to boot, and you have a game-changing product.

General Motors, in contrast, spends over $7.2 billion per year on R&D, and the net result has been the Cadillac ELR, which will take you 35 miles on a charge.

In early January, the company announced a $500 million investment in the ride sharing platform Lyft and laid out plans to develop a network of on-demand self-driving cars. A week later, it announced the acquisition of the ride sharing service Sidecar. As millennials continue to opt for cars on demand as opposed to cars in the garage, GM is scrambling to catch up with the future (Disclosure: GSV owns shares in Lyft).

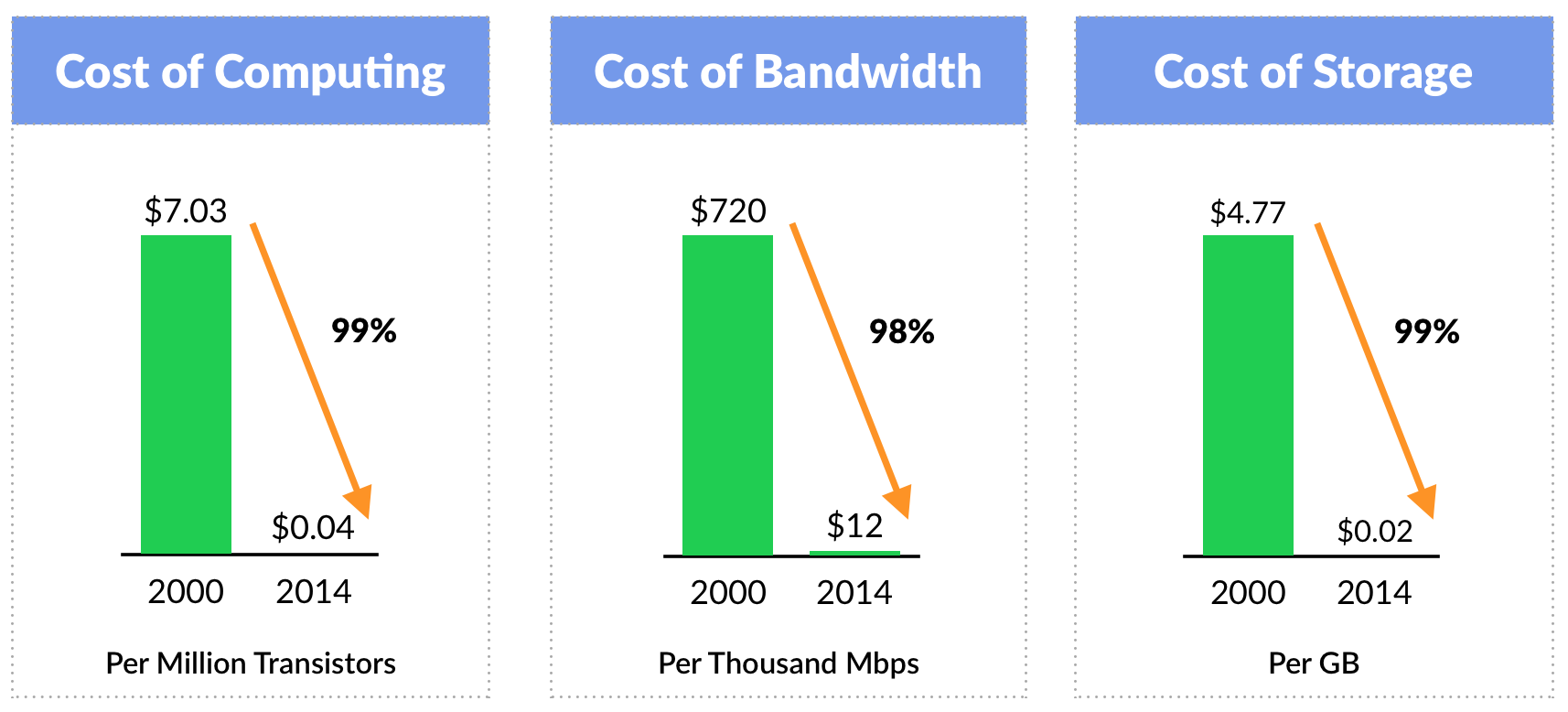

The catalyst behind the technology that powers Tesla and powerful digital marketplaces like Lyft has been Moore’s Law.

In 1965, Gordon Moore predicted that the number of transistors on an integrated circuit would double every two years. The effect of “Moore’s Law” is that computing power has doubled (or, costs have been halved) every two years for the past 50 years. If the automobile industry would have had its own Moore’s Law, a Ford Taurus that cost $20,000 in 1990 would essentially be free and you’d throw it away after you drove it.

Source: Deloitte

Interestingly, while Moore’s Law has been the foundation and catalyst behind the Technology Revolution, it’s not a physical or natural law… it is a conjecture. In other words, the “Law” that has transformed computing and society was really more of a vision of what could become. It was a force of will. Nonetheless, the belief in Moore’s Law has enabled engineers and technologists to imagine a World where you could have a computer in your pocket, self-driving cars, and personalized medicine.

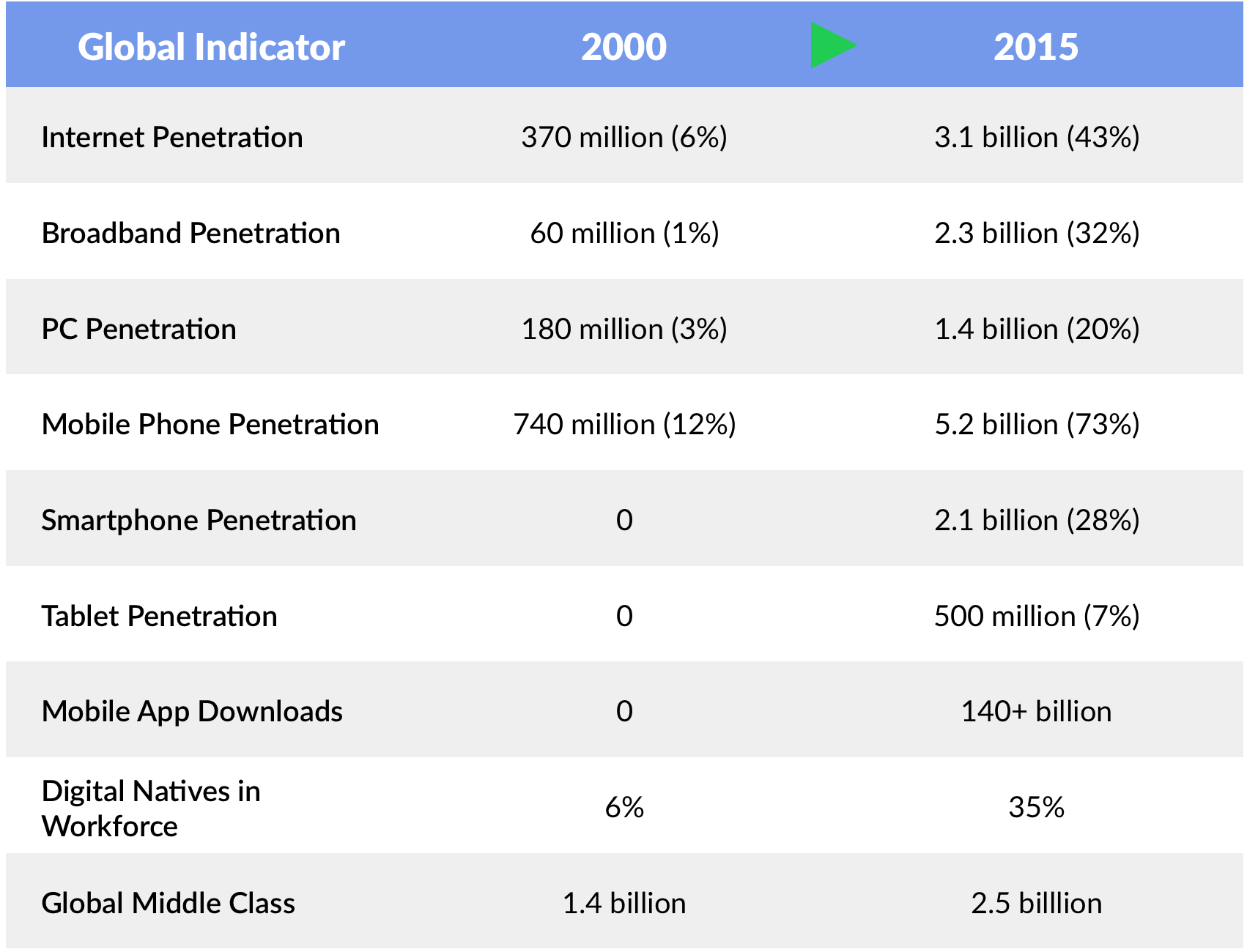

We are riding powerful tailwinds that are rapidly transforming the World as we know it. In 2000, there were only 370 million people on the Internet (roughly 5% of the World’s population), no one had heard of a smartphone yet, broadband was a fantasy, and applications off of a platform had not been invented.

Today, the “digital tracks” have been laid, with three billion people on the Internet, over two billion smartphones in the hands of Digital Natives, and 140 billion Apps having been downloaded from Apple and Google.

Source: Gartner, Nielsen, A.T. Kearney, eMarketer, KPCB, GSV Asset Management

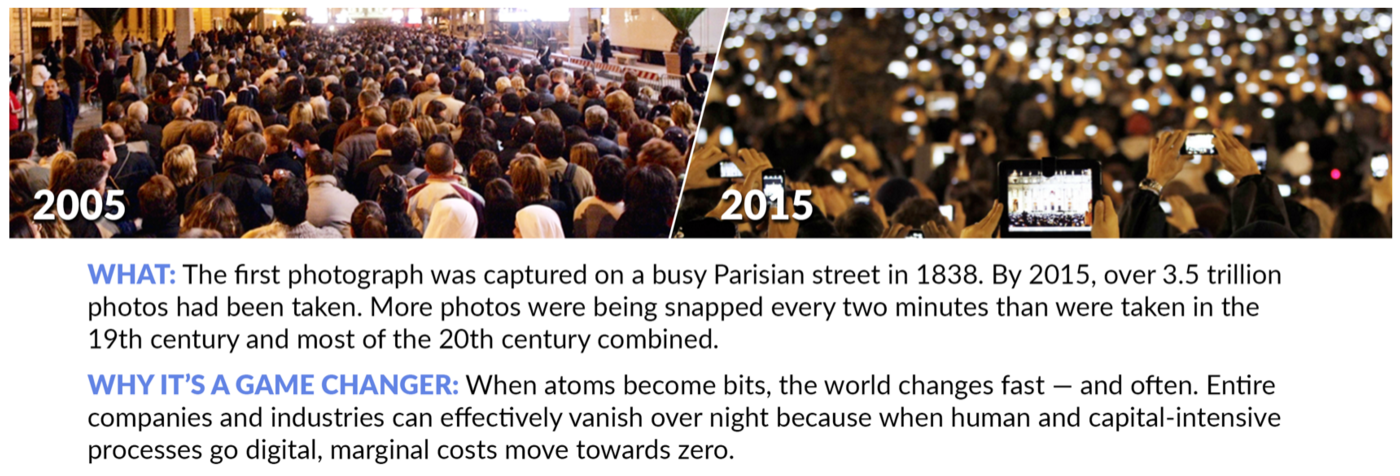

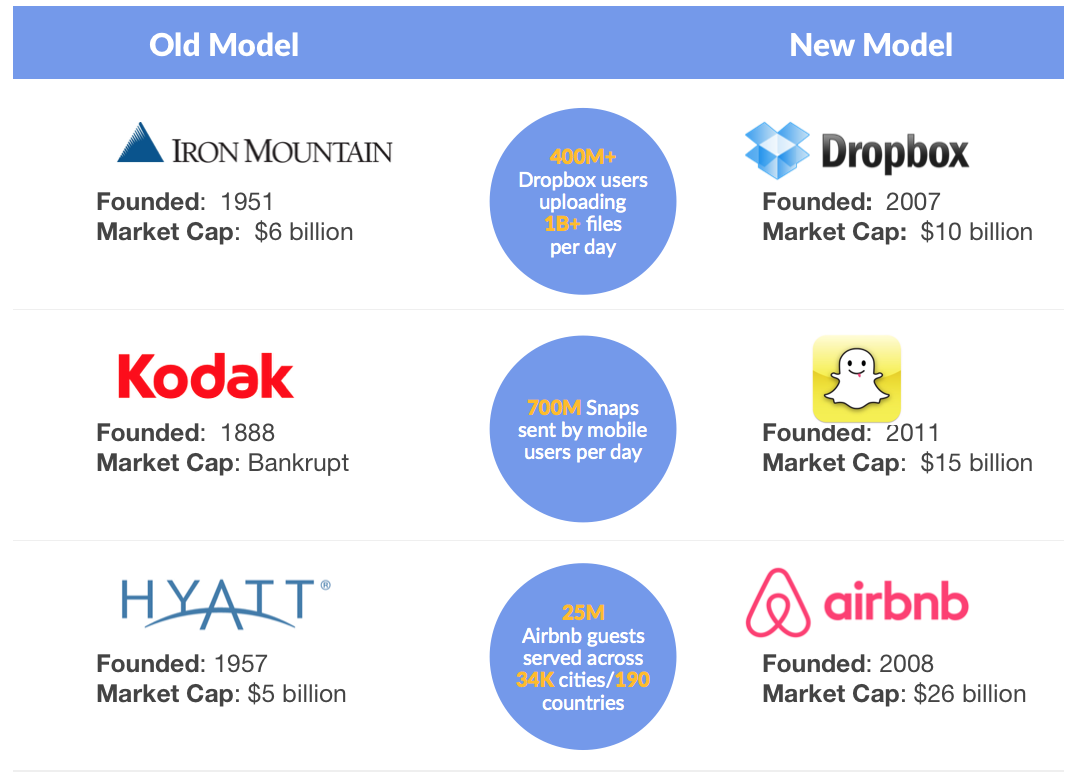

Digital Tracks have ushered in Digital Disruption as new technologies upend Old World business models and ideas. While digitization dramatically increased the quantity and convenience of photography, for example, it also completely redefined the economics.

Smartphones made everyone a photographer and Instagram rode this trend in 2010 to cultivate a network of 200 million people uploading 60 million photos per day. Just a year after its founding, the company was sold to Facebook for over $1 billion. Instagram had 15 employees at the time.

Contrast these figures with pre-digital age giant Kodak — synonymous with photography — which at one point employed 145,000. Ironically and tragically, 132 years after its founding, and at the inflection point of the photography boom, it went out of business. Facebook acquired Instagram just months later.

Uber, the fastest growing company in the history of the World and the fastest new verb, has achieved a $62 billion valuation just six years after its founding in 2009. While this screams “bubble” to some — in our way of thinking, it screams the question of where else value can be created that quickly. Essentially, Uber was built on three new technology fundamentals: ubiquitous mobile devices, hyper connectivity, and cheap computing with unlimited storage.

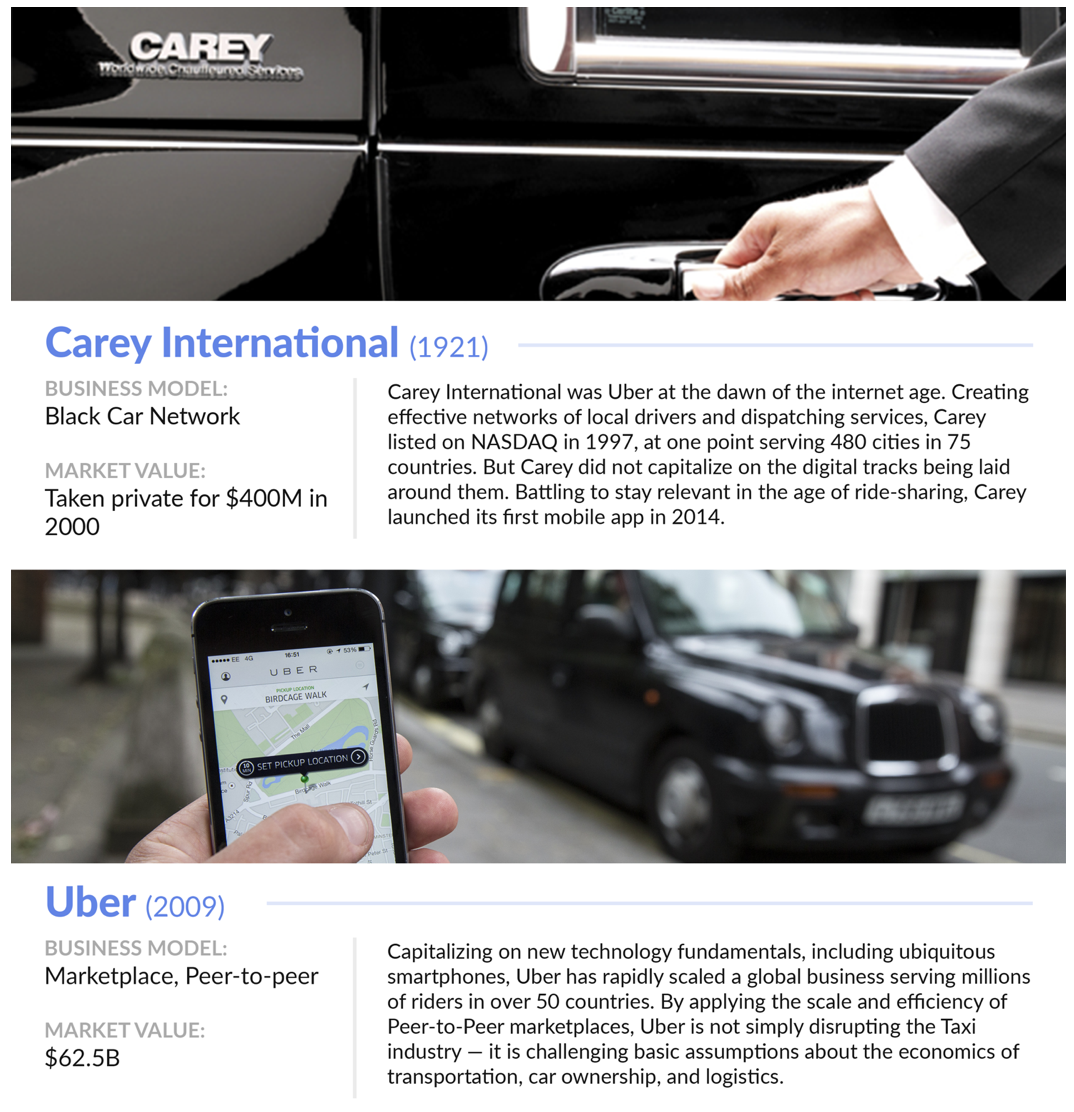

As is too often the case, the “early bird gets the turd.” Carey International was Uber before Travis Kalanick was born. Listed on NASDAQ in what seems like a century ago, (full disclosure: I was a research analyst covering it) Carey created a black car network spanning 1,000 cities around the globe.

Effectively it was a brand, an “800” number, and a scheduling service. Sound familiar?

Uber doesn’t own any of the cars in its network. The drivers are independent. Carey should have been Uber, but they lacked the imagination to see the impact that smartphones could have on their business. Carey launched its first app in 2014.

We’re seeing the same dynamics play out across a variety of industries, whether it’s Dropbox emerging as a disruptive force in file storage and collaboration, or Airbnb upending the hotel industry with a network of 60 million travelers in 34,000 cities across 190 countries. (Disclosure: GSV owns shares in Dropbox)

Source: Yahoo Finance, GSV Asset Management

Ironically, in a week where Google — a company that has set a gold standard for corporate innovation — briefly became the World’s most valuable business, Oliver Blume, the CEO of automaker, Porsche, offered the following response to a question about his company’s plans to develop self-driving cars: “An iPhone belongs in your pocket, not on the road.”

But in an age of exponential ideas, an iPhone does belong on the road. Cars are computers. Google gets it, and they’re reimagining the future by pushing the boundaries for self-driving cars. Apple gets it too.

Porsche was once a flagship for innovation excellence, hailing from a country that prides itself on superior engineering. But the rules have changed. Linear ideas are going nowhere, fast.