Market Snapshot

| Indices | Week | YTD |

|---|

This weekend, GSV Capital portfolio company OZY Media hosted its third annual OZY Fest in Central Park in New York City. An event the New York Times has described as “TED meets Coachella,” OZY Fest is a gathering of emerging musicians, public figures, artist, chefs and entrepreneurs. (Disclosure: GSV owns shares in OZY)

This year’s headliners include the best-selling author Malcolm Gladwell, former Secretary of State Hillary Clinton, Laurene Powell Jobs, Common (Grammy + Academy award winning musician, actor, and advocate), Cindy Mi (Founder + CEO, VIPKID), athlete Alex Rodriguez, renowned chef Marcus Samuelsson, comedians Chelsea Handler, Michelle Wolf and Hasan Minhaj and more.

WATCH HILLARY CLINTON + LAURENE POWELL JOBS AT OZY FEST 2018 HERE

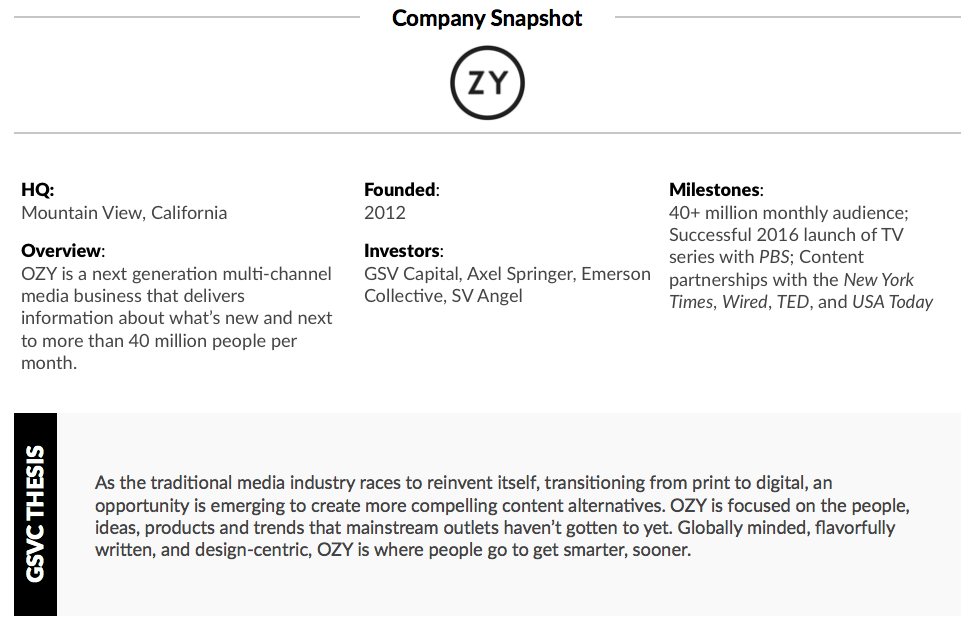

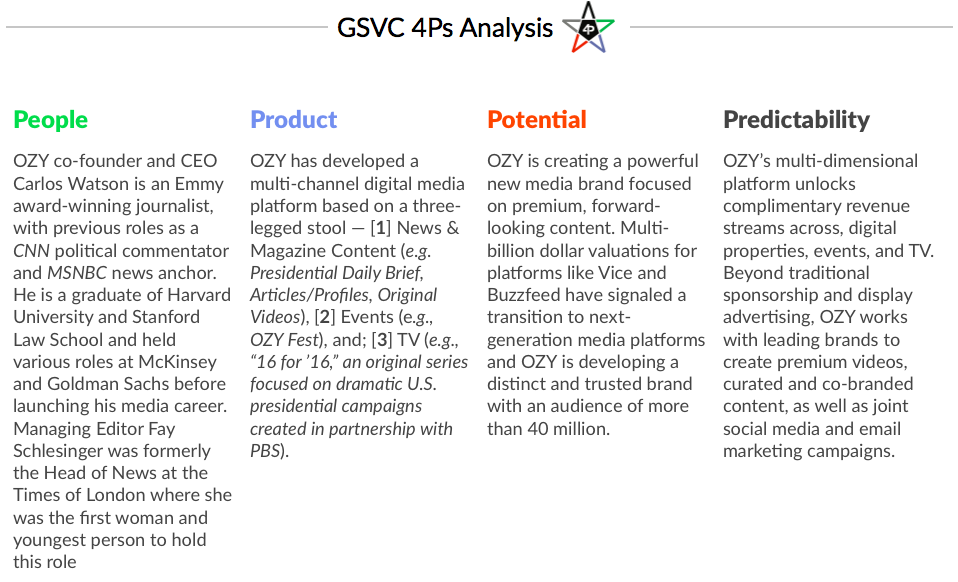

OZY Fest is the brain child of OZY Media, a next generation digital media platform. Launched in 2012, OZY is building the iconic media brand for the Change Generation by producing future-oriented content on unconventional and undiscovered trends, rather than stale news stories that are covered by existing outlets. The company has surged to an audience of over 40 million people per month — larger than The Economist, The New Yorker, or Politico — with original content focused on what’s new and next.

Co-founder and CEO Carlos Watson, a former CNN and MSNBC commentator, argues that by engaging people with truly differentiated content and experiences (e.g. events) OZY can address a premium brand vacuum in news media — think Apple’s brand halo in consumer electronics or what HBO’s once did versus Cable TV.

A digital media company hosting a physical event highlights a key trend — the Experience Economy. Physical locations are an important platform to create an unique customer experience, and accordingly, brands that were born on the internet are turning towards creating physical footprints to engage customers. In the same way Warby Parker creates Store experiences and Spotify creates Concerts, OZY is creating physical manifestation of the hottest trends the digital magazine covers through OZY Fest. But more broadly, OZY’s multi-pronged digital media platform reflects a massive shift in news and media, catalyzed by technology and the Internet.

STATE OF PLAY

In the history of the Fourth Estate, 2017 will go down as the year of “Fake News.”

On the one hand, it was a year where articles unencumbered by facts went viral. “Pizzagate” — the story of Hilary Clinton running a child sex ring out of a pizza shop in Washington D.C. — spread so quickly and with such legitimacy that both the New York Times and the Washington Post wrote articles debunking it. Another fan favorite was the Irish government accepting “refugees” from America seeking asylum following Trump’s presidential victory.

At the same time, President Trump spent 2017 hammering the “Fake News” in an escalating battle with various major media organizations, popularizing the term in the months before his inauguration. CNN was the most frequent object of his ire. Fox and Friends were, well, a friend.

By September 2017, Dictionary.com announced it would add the phrase as an official entry. Collins Dictionary followed suit in November, naming “Fake News” its 2017 word of the year, and The Oxford Dictionary looks poised to follow suit.

Many are speculating whether the Fake News phenomenon is bad news or good news for the media industry. Our view? It’s neither. But it does crystallize a broad set of fundamental shifts in the media landscape that will result in a significant wave of consolidation in 2018. Specifically, we expect to see a separation of winners and losers among high flying digital media newcomers.

Last July, Vice Media completed a $450 million financing led by TPG that valued the company at $5.7 billion. That’s nearly twice the value of the New York Times. Vice, whose investors include Technology Crossover Ventures (TCV), Walt Disney, 21st Century Fox, the Raine Group, and WPP, said it would use the new funds to expand its multi-channel programming, which includes news, documentaries, and reality series distributed through Vice’s digital channels and third parties like HBO.

Why is Vice more valuable than the New York Times, the face of virtue in the news?

In just over 20 years, the news industry has undergone a fundamental transformation, which has happened in three phases starting with the launch of Netscape in 1994. The first phase was a Cambrian explosion of “news” as the Internet democratized access to information, as well as content creation and distribution. CNN.com went live in 1995 and the New York Times followed suit in 1996, but by 1999, a new phenomenon had arrived: “weblogs” or “blogs” — individuals publishing their own “news.”

In 1999, there were 23 blogs on the Internet. By 2006, there were 50 million. The Huffington Post, launched in 2005, created the first crowdsourced “newsroom” by aggregating bloggers through a branded channel.

The second phase was marked by the rise of curation mechanisms in the face of rapidly proliferating content. Social media platforms like Facebook and Twitter quickly became de facto news curation platforms as patterns of sharing across the “Social Graph” meant that certain stories could go viral. Google News and Flipboard, launched in 2006 and 2010 respectively, enabled people to create personalized news channels by aggregating content from a variety of sources.

In the third phase, we are coming full circle as consumers seek out engaging sources of information, ideas, and entertainment. Curation has proven to be a double-edged sword, on the one hand limiting a deluge of information but at the same time creating an echo chamber based on your own biases and the broader biases of your network.

NEW “NEWS”

Today, consumers are not simply turning back to the stalwart newspapers of yesteryear. As with businesses that are disrupting legacy consumer industries — from Airbnb in hospitality to Lyft in transportation and Spotify in music — people are demanding new and engaging digital content and physical experiences from brands that they love. (Disclosure: GSV owns shares in Lyft and Spotify)

So where does Fake News figure into this sea change?

Dictionary.com defines “Fake News” as, “False news stories, often of a sensational nature, created to be widely shared online for the purpose of generating ad revenue via web traffic or discrediting a public figure, political movement, company, etc.”

Without question, “Fake News” has sparked a flight to quality that has benefited new and legacy media companies alike. Now more than ever, people are willing to pay for content they trust. Revenue from digital only subscriptions at the New York Times, for example, jumped 44%, or $75 million, in the first nine months of 2017. The New Yorker and Washington Post have seen record growth as well.

Yet on the whole, 2017 has been a dicey year in the media business. At the end of the third quarter, advertising revenue at the New York Times was down $20 million year-over-year. At Vanity Fair, the editorial budget faces a 30% cut. Oath, the offspring of Yahoo and AOL’s union, is shedding more than 500 positions as it scrambles to fit inside the Verizon conglomerate. IAC is exploring offers to offload The Daily Beast. Ziff Davis acquired Mashable at the fire sale price of $50 million, or about a fifth of its former valuation. Even Vice and BuzzFeed, are projected to miss their 2017 revenue targets by 20%.

None of this is the direct result of Fake News. But Fake News has been propelled by a proliferation of content-lite media platforms that have bet their future on reaching massive audiences with “Clickbait” content to generate advertising revenue. The problem — other than reality distortion — is that there just isn’t enough advertising revenue to go around.

A new key fundamental for media platforms is creating a multi-channel delivery model. It’s not enough to engage an audience through a single medium.

In September 2016, for example, OZY partnered with PBS to premiere a primetime program called “The Contenders – 16 for ’16,” an 8-part documentary series dissecting the most dramatic presidential campaigns in U.S. history. The series, which aired on PBS and BBC before the 2016 Presidential Election, attracted over 30 million viewers.

In 2015, Vice announced a major partnership with HBO to distribute original content through the network. Vice has also inked lucrative deals with A&E and MTV to exclusively air original content on their channels.

Investment Activity + VC Funding

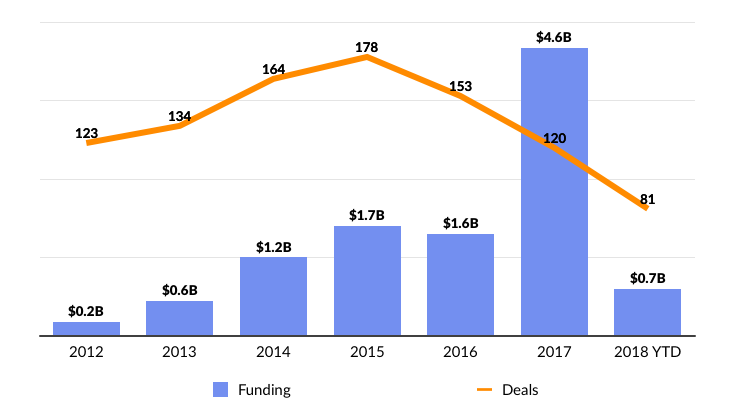

2017 saw record funding towards Digital Media startups with $4.6 billion of funding deployed across 120 deals. The bulk of the funding went towards mega-rounds raised by Bytedance, Group Nine Media and Vice, which raised $3 billion, $485 million, and $450 million, respectively.

German media heavyweight Axel Springer has rapidly shifted its traditional print media business towards an array of digital businesses. In 2000, Axel Springer’s operating profit came from digital initiatives was 0%. By the end of 2016, it was over 72%. In September 2015, Axel Springer acquired business-focus new site Business Insider for $450 million. At the time of the acquisitor, Business Insider had 76 million monthly unique readers. Other digital media investments in Axel Springer’s portfolio includes OZY, Mic, NowThis and Thrillist.

This June, Quartz was sold to Japanese digital media firm Uzabase for $110 million. The acquisition priced Quartz at approximated $5.00 per MAU (monthly active user) and a 3x Price-to-Sales ratio. The company is on track to grow top-line revenues by 35% and is profitable.

WHAT’S NEXT

Leading artificial intelligence expert Andrew Ng, the former Chief Scientist at Baidu and co-founder of Coursera, stated that “AI is the new electricity.” AI will be the lifeblood that powers the next wave of technology companies and plays an increasingly large role in media.

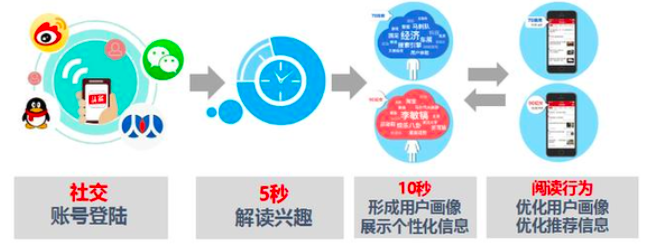

ByteDance is an emerging star in the East with over 200 million daily active users. Currently valued at $22 billion, ByteDance is the leading AI-powered media platform in China, with major business lines in multiple aspects of media and entertainment, from news, to live video and online dating. The company’s most famous business unit, Toutiao, is an AI-driven news discovery app that has skyrocketed in popularity since its launch in 2012. Today, Toutiao has over 120 million daily active users who spend a mind-boggling 80 minutes on the app daily, topping that of Facebook, WeChat, Snap, and Instagram.

Facebook is the World’s largest media platform, but produces none of its own content. Other technology platforms such as Nextdoor and Spotify are taking a page out of Facebook’s playbook to create unique media and advertising platforms that leverage its local network and media content.

Nextdoor, a private social network for local communities, has a highly attractive media advertising model from its “hyper-local” nature, resulting in above-industry-average click-through rates.

Today, Nextdoor covers over 180K active neighborhoods globally, and is in over 80% of US neighborhoods. Nextdoor is attractive for local business advertising, as those businesses are not able to target single neighborhoods through networks like Facebook or Google or Instagram. Its “classified ads” are helpful for real estate firms and for local service providers. Meanwhile, the ads are within user comments and questions, resulting in higher click-through rates, accordingly driving a higher CPM.

What’s next for Nextdoor? As the company maintains its unique service, the company can evolve to become the local news bulletin and has the potential to become the leading local neighborhood platform for communication and for local services.

Sweden-based Spotify continues to set the tone in the music space and revolutionize interactive media. Spotify is the leader in the music streaming industry, with Apple Music doing well in second place with 50 million users. Recently, Google made its third attempt to become a relevant player and launched YouTube Music — a direct copycat of Spotify and Apple Music.

But looking to the Far East, a new star is rising in the sky. Tencent Music is China’s largest music platform, impressively with 700 million MAUs (over 4x larger than Spotify), and with 15 million paying users (less than a fifth of Spotify). Nevertheless, the service is growing very fast and is planing a US IPO, at a rumored $30+ billion valuation.