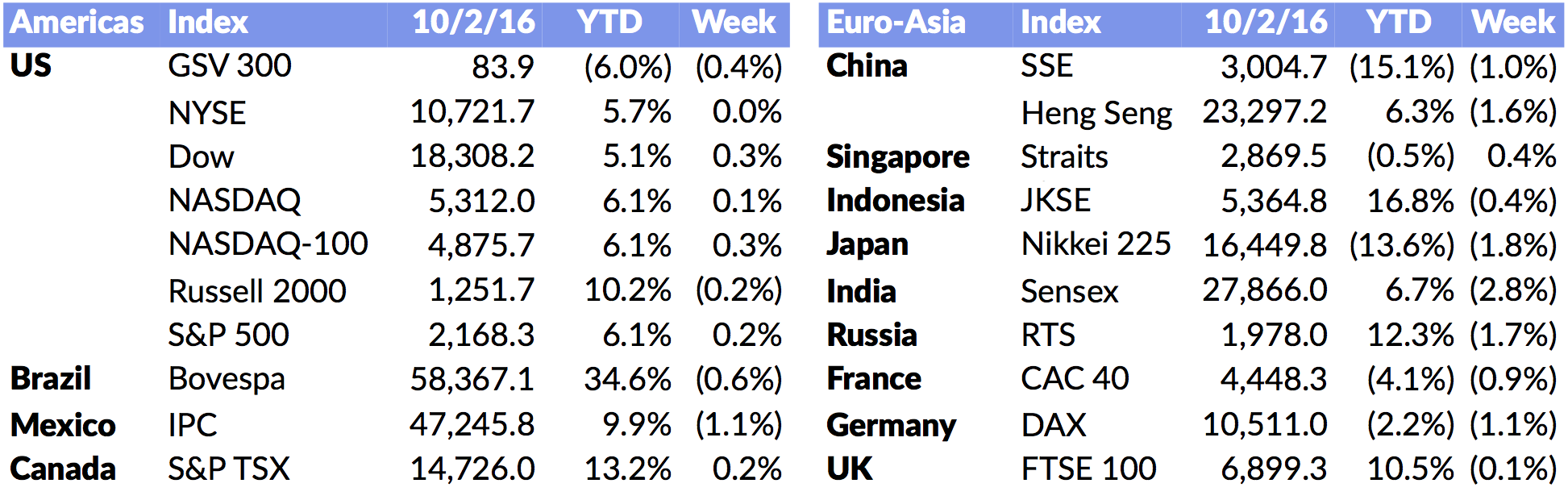

Market Snapshot

| Indices | Week | YTD |

|---|

By Mark Flynn

In the past six months, we lost two legends. Two men who sought to make a difference — one individual at a time.

Bill Campbell and Arnold Palmer were proud sons of their western Pennsylvania heritage. Bill, a Homestead native, never forgot his roots and the values that shaped him. Arnold, the son of a Golf Pro in Latrobe, never truly left his.

Their similarities are numerous; charisma, competitiveness and compassion. Above all they both cared about people and made it their life’s mission to “pay it forward.” These giants exuded the gift of humility.

Admirers bestowed Bill as “The Coach” and Arnold as “The King.”

I had the privilege of coaching 8th grade flag football with Bill and Michael Moe for 13 years. Many fall afternoons at 4:30, Bill made an early departure from an Apple, Intuit or Google board meeting to coach 13-year-old boys. Bill taught these young men that football and life require discipline, teamwork and a passion to be great. Bill set high expectations and challenged the men to excel on the field, in the classroom and in their community.

One of our teams had a set of twin brothers. One brother was 5 inches taller than his brother, fast and strong, highly self-confident and an excellent student. The smaller brother was introverted, lacking self-esteem and confidence. We found out that the smaller brother was behind in his school work. He would have to quit the team until he was caught up.

Bill thought otherwise. He believed it would further hurt the kid’s fragile self-confidence. Bill met with the Principal, the parents and the player and brokered a solution allowing him to remain on the team with a pledge to enhance his studies. Within days you could see an appreciable change in outlook, self-confidence and performance. Bill’s compassion changed this young man’s life — and my life as well.

The 8th grade football field is adjacent to the convent that houses over 50 retired nuns. Coach Campbell’s booming voice and colorful language carried well beyond the field’s boundaries. Urban legend has it that one afternoon Sister Roughan approached Bill about “toning it down” just a bit. Bill compromised so that every time he swore he’d contribute $1 to the Athletic Fund. A few years later the entirety of the athletic fields were converted to synthetic turf. Coach fondly recognized the generosity of the “Silent Boosters.” Perhaps only Sister Roughan knew that it was the generosity of one Not-So-Silent Booster.

2979.jpg)

It was fitting that Bill’s funeral mass was celebrated on a football field. In front of me at the funeral was the spitting image of Bill’s legacy: Larry Page, Founder and CEO of Google, seated next to Bruno, Bill’s favorite caddy from Mexico who had flown up to pay his respects. Bill’s reach, influence and generosity extended well beyond just his hometown of Homestead, the fields of Columbia University or the boardrooms of Silicon Valley. He coached a generation to serve others.

In 2005, I partnered with Jimmy Bryant in a golf tournament. Turns out Jimmy is one of the best amateur players in western Pennsylvania and coincidentally Arnold Palmer’s dentist. During the summer months, Jimmy regularly played golf with Arnold at their home course, Latrobe Country Club. If ever in the Pittsburgh area, Jimmy invited me to play Latrobe and he’d see if Arnold might join us. Happens that I had a meeting in Pittsburgh in September 2006 and asked Jimmy if the offer to play was still open.

As luck would have it, Jimmy confirmed our date and suggested that Arnold would like to host us for lunch. As I arrived at Latrobe CC, I learned the Jimmy was running late, though Mr. Palmer was looking forward to lunch in the club house. Rarely have I met a more gracious, warm and cordial host. He proudly welcomed me to Latrobe CC and we enjoyed a delightful lunch. Arnold made me feel that I was “The King!”

As we left the clubhouse and proceeded to the first tee, there was a group on the practice putting green waiting to tee off. As we approached, the group stepped aside as if to allow for the parting of the Red Sea. Arnold recognized the member and knew he was VP Sales for Rolling Rock Beer, Latrobe’s largest employer. Arnold asked the member if his guests were Rolling Rock customers. In fact, he said, they were all major Rolling Rock distributors.

Arnold then went out of his way to make the guests feel welcome to Latrobe CC. As he shook hands with each of them, he let them know that Rolling Rock was the only beer he’d ever drink. He gave each of them his colorful umbrella lapel pin. Arnold asked if they had a few more minutes as he’s like to get the camera from the Pro Shop for a team photo. Arnold himself would make sure each of them received the picture. Arnold went out of his way to make every person he met feel like they were “The King.”

On the tenth tee, the highest point of the course, Arnold took me aside and tearfully pointed to his deceased wife Winnie’s favorite spot on the property. He showed me his fishing stream, the sledding hill and his duck hunting blind. He exuded pride and love for his very special dwelling place.

Arnold was born to compete. On the 12th tee, Arnold explained he’d challenged the Callaway engineering team to find him an extra 10 yards off the tee. “Do whatever it takes!” Arnold’s “go-for-broke” mentality captured four birdies that September afternoon, meaning he’d pocket most of the cash. As we finished the round, Arnold sheepishly asked if, by chance, I would join him for a beer and celebrate our friendship.

I left Latrobe $10 dollars poorer, though forever enriched knowing that Arnold’s impromptu acts of kindness defined how he lived his life, and will forever shape my outlook towards others.

Robert Browning wrote, “Ah, but a man’s reach should exceed his grasp, or what’s a heaven for”? Bill Campbell and Arnold Palmer never limited their reach, or set their sights only on the special few. These are men built for others.

Who was coachable? Anyone. Who was the king? Everyone.

–

GSV 300 + THE STATE OF PLAY IN THE GLOBAL GROWTH ECONOMY

Growth stocks came to life in the third quarter with the GSV 300 up 11%, the NASDAQ up 9.7% and the S & P 100 up just 3.3%. Mega-cap growth companies such as Apple which leapt 18%, Amazon advancing 15.9% and Facebook up 12% for the quarter led the way. Not coincidentally, the strong action in growth stocks woke up a here-to-fore comatose IPO Market with 33 new issues pricing in the third quarter.

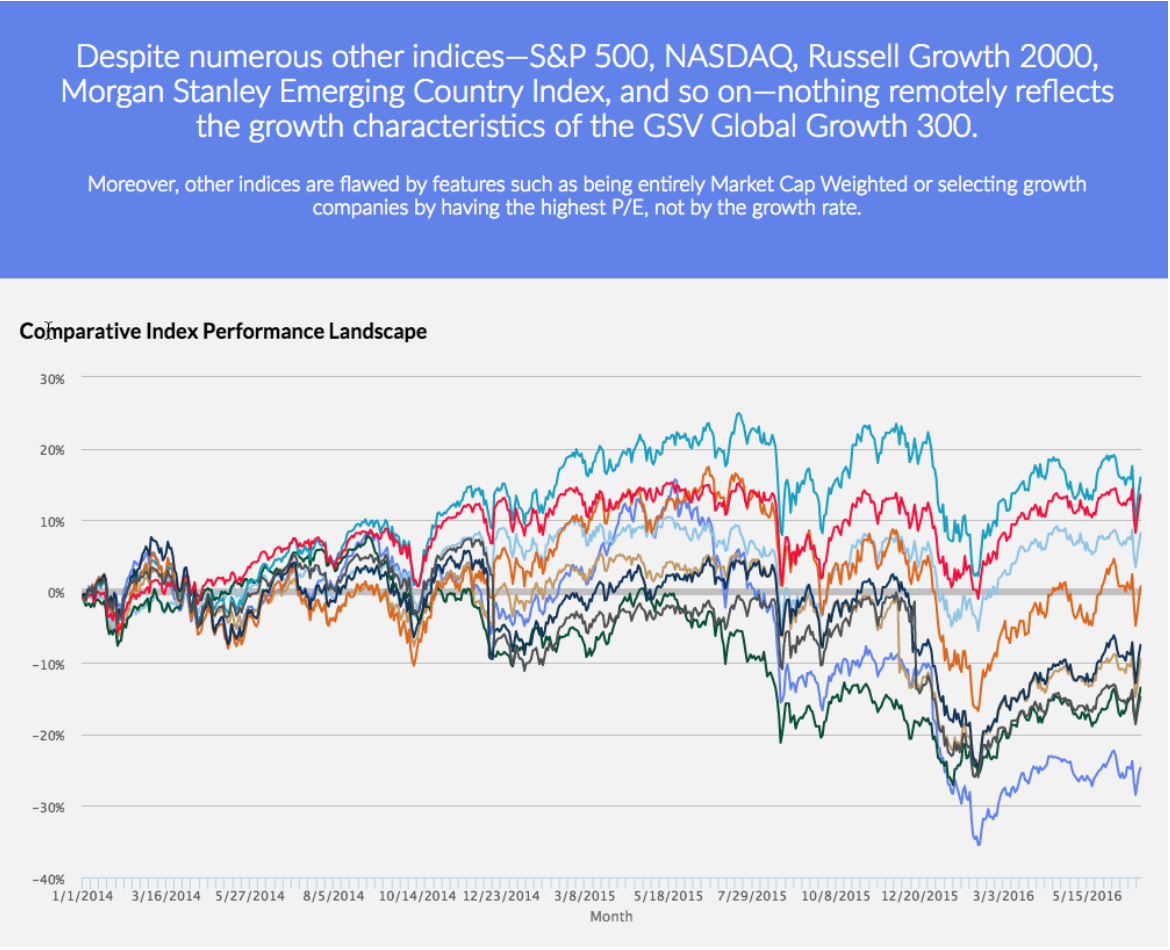

In 2015, GSV launched the GSV 300 Index, which we believe is the best representation of what is truly going on with growth companies, their valuations, and performance.

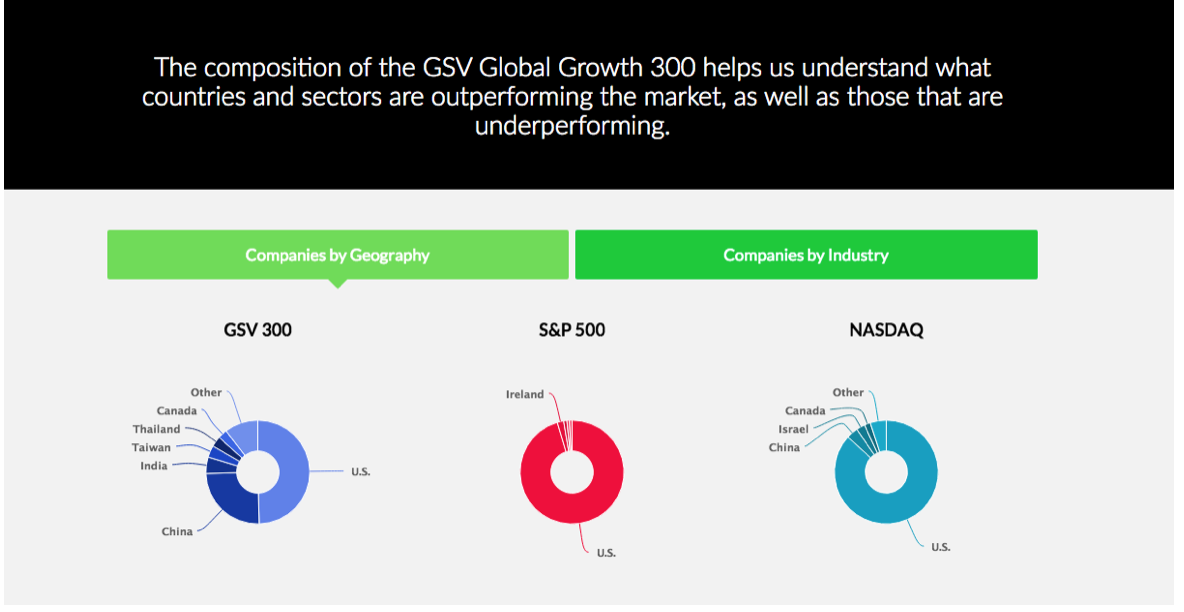

It is an index of 300 of the World’s fastest growing companies, selected systematically based on key fundamentals, including revenue and earnings growth, geography, valuation metrics, and market capitalization. Because the companies are not handpicked, the GSV 300 doesn’t look at all like the typical indexes that people use to analyze growth companies and growth investors.

The most relevant index for Institutional Investors to date has been the S&P 500, which is a good proxy for broad Market dynamics. But with a 5% long term growth rate, it hardly reflects conditions or performance for fast growing companies.

The fact that the S&P 500 is solely a market cap weighted index is problematic in that a $100 Billion Market Cap Company has 100x the impact on the Index as a $1 Billion Market Cap Company… not realistic in that a portfolio manager who viewed two portfolio companies as being equally attractive would have 100x more of that company in their portfolio.

The most well-known index, the Dow Jones Industrial Average (DJIA), is created with an even more bizarre rationale in that it is weighted by share price. So in other words, if one stock was $30 per share and another was $300 per share, the $300 stock would have 10x the influence on the DJIA as the $30 stock.

The GSV 300, by contrast, is constructed using a systematic three-step process, which is summarized below: Screening, Ranking + Scoring, and Index Weightage. For a full description of the GSV 300 construction methodology, please click HERE.

GSV 300 Snapshot

As of the end of the third quarter in 2016, the average market capitalization of GSV 300 constituent companies was $5 billion, with a median of $1.4 billion. The 10 largest companies account for 25% of the index. By comparison, the top five companies in the NASDAQ — Apple, Microsoft, Amazon, Facebook, and Alphabet (Google) — account for 32% of the index alone.

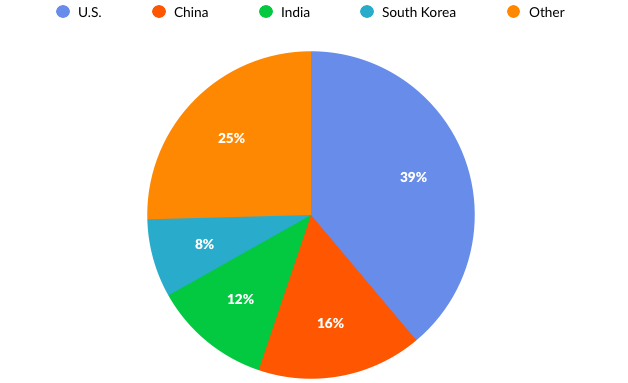

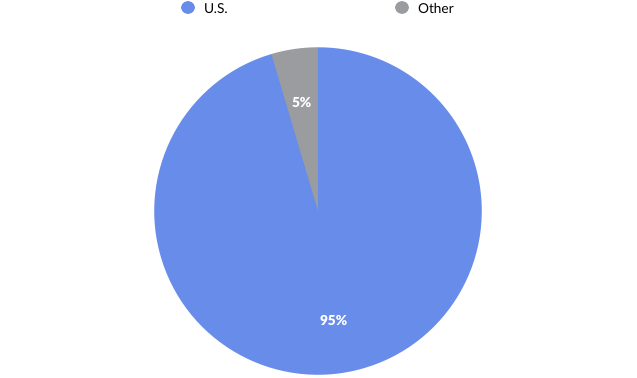

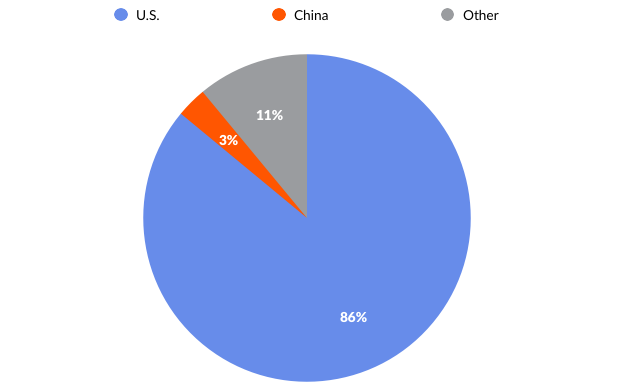

Looking at the GSV 300 by geography, 39% of the index weightage comes from U.S. companies. China is the second-largest geography at 16%, followed by India at 12%, and South Korea at 8%. By contrast, 95% of the S&P 500 and 86% of NASDAQ are represented by U.S. companies.

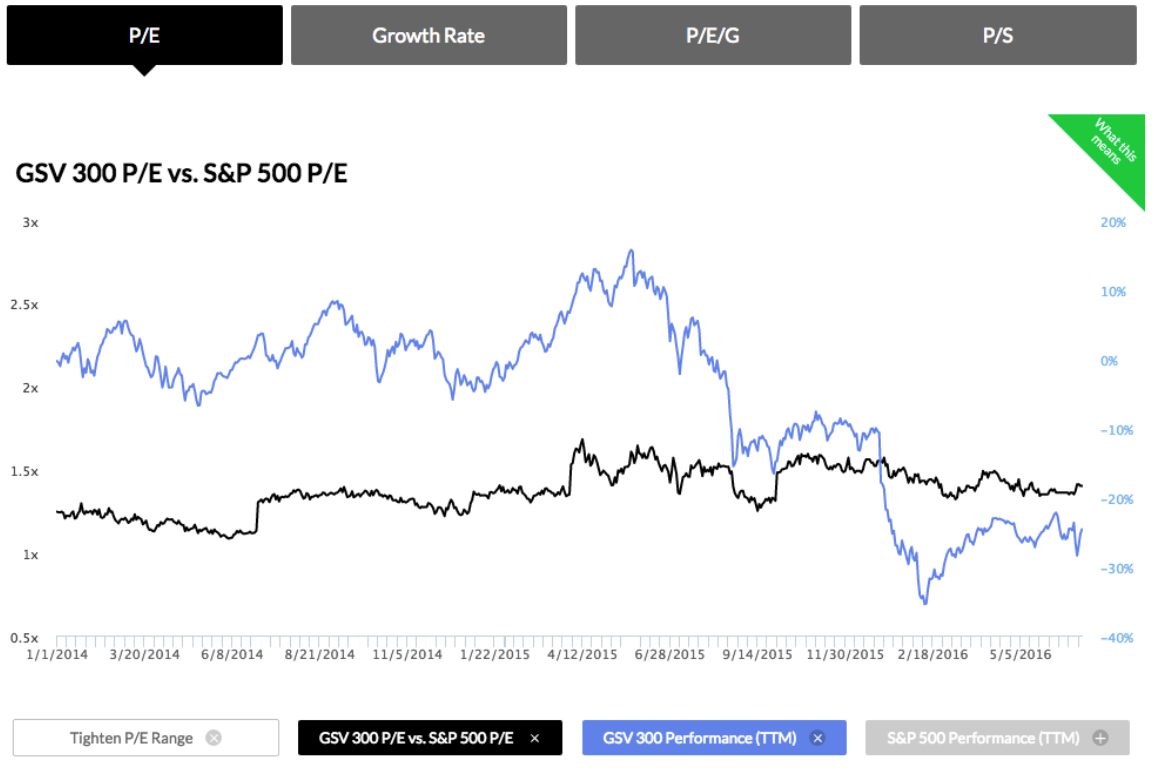

Performance & Valuation

The overall index was up 11% for the quarter. A look at the geographic breakout indicates that the momentum was largely from Indian and U.S. companies, which were up 15% and 11% respectively. Chinese companies, by contrast, rose a modest 2%. Segmented by GSV investment theme, the most significant Q3 gains were made by “Marketplace” companies (up 25%) and “Education Technology” companies (up 24%).

To date, the GSV 300 is down 6%, reflecting a brutal first half of the year for many growth stocks, driven by “Brexit” fears and turbulent public market dynamics in China. One might naturally expect us to be upset with the performance of the GSV 300. But we are actually pleased to have created a scorecard that reflects what is actually going on in the World of growth stocks.

The T. Rowe Price New Horizons Fund, for example, has pursued a strategy of investing in small, high-growth companies since 1961. While it is actively managed, Peter Lynch observed in Beating the Street that the fund is, “as close as you’ll get to a barometer of what is happening to emerging growth stocks.”

Since small companies are expected to grow at a faster rate than large companies, they usually sell at a higher P/E than larger companies. Logic might suggest, therefore, that the P/E of the New Horizons Fund would be higher than that of the S&P 500 at all times.

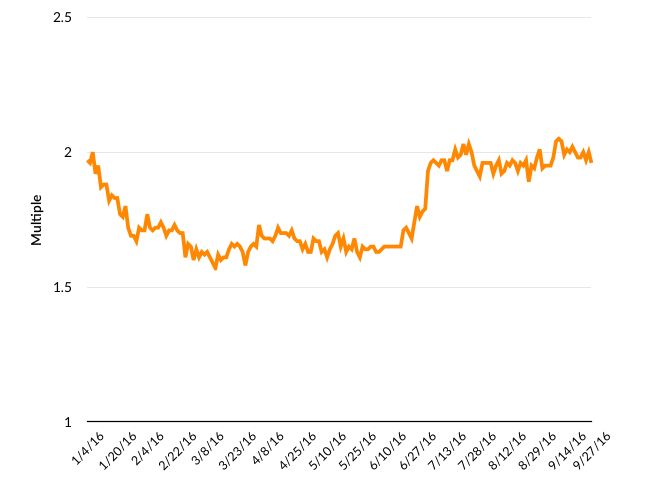

This isn’t always the case, and at times when it isn’t, the New Horizons Fund can be a smoke signal for an undervalued or overheated growth economy. Over the last 50 years, for example, the New Horizons P/E has risen to double that of the S&P 500 only four times.

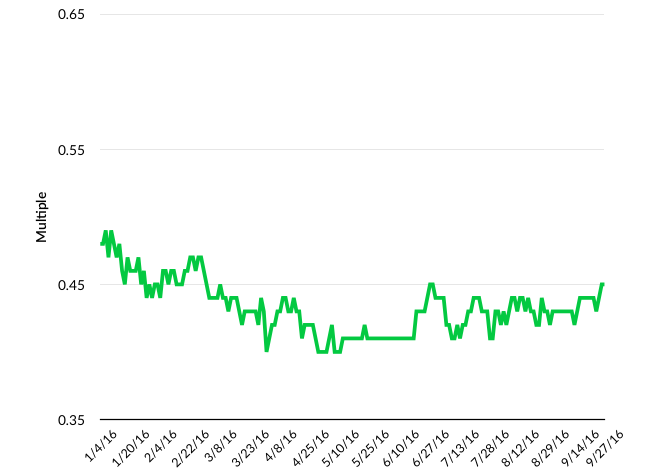

Currently, the GSV 300 has a P/E (forward) of 27.5x, or 1.6x greater than the S&P 500. Our thesis is that at over 2x, it’s a warning signal for growth stocks, and at under 1.2x, it’s a buying opportunity. We’ll monitor this trend, as well as the relationships of other key valuation metrics, to determine patterns over time.

IPOs

There were 30 IPOs in the third quarter. In 2016 to date, there have been 71 IPOs — 29 VC-backed — generating an average of $143 million in proceeds. Nine companies have priced above range, 47 in range, and 15 below. The average one-day pop stands at 13%.

Despite the news, noise, and predictions of the apocalypse, we are starting to see some bullish signs from the IPO market, with Twilio’s June 23rd offering acting as a starting gun. Twilio has traded up nearly 124% since it priced at $15 per share.

While there have been a paltry 52 US IPOs to date, there have been 12 since Twilio, including notable listings from technology companies like Line and Talend, which both priced above range and popped over 27% and 42% respectively. Nutanix, which made it’s public debut this Friday, popped more than 130%, making it the top performing IPO this year.

The recent trend points to a broader opportunity for the best names to break through an IPO backlog that has been building over the last fifteen years.

From 1990 to 2000, there was an average of 406 IPOs in the United States per year. From 2001 to 2015, there has been an average of 111 IPOs. In the last twelve months, only ten VC-backed technology companies have gone public, compared to a 31 per-year average between 2011 and 2015.

Despite the weak IPO market, Venture Capitalists haven’t stopped investing. According to the National Venture Capital Association, VCs have invested in an average of 3,200 companies per year since 2001, including 3,709 companies in 2015. We estimate that there are over 2,000 VC-backed private companies with a market value of $100 million or greater.

GSV Capital is focused on assembling a portfolio of the most dynamic, VC-backed private companies, including Dropbox, Palantir, Spotify, Coursera, and Lyft. We’ve done numerous studies over the last 20 years that consistently demonstrate a high correlation between sustainable growth and increasing enterprise value. Our philosophy, confirmed by research, is that fundamentals drive returns. (Disclosure: GSV owns shares in Dropbox, Palantir, Spotify, Coursera, and Lyft)

Accordingly, we will continue to focus on investing in businesses with the strongest growth fundamentals. GSV portfolio companies recorded revenue growth of 105% on average between 2014 and 2015, and we project that 2016 growth will top 100% once again.