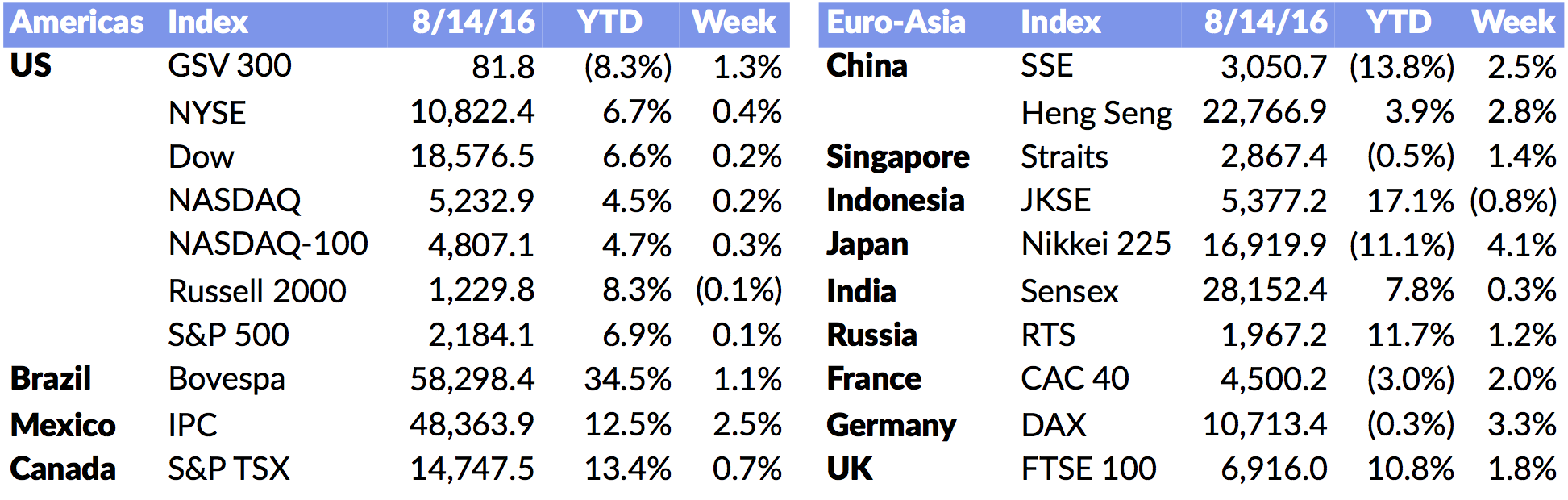

Market Snapshot

| Indices | Week | YTD |

|---|

The reasonable man adapts himself to the world: the unreasonable one persists in trying to adapt the world to himself. Therefore all progress depends on the unreasonable man.

— BERNARD SHAW

Great spirits have always encountered violent opposition from mediocre minds.

— Albert Einstein

Sometimes, it’s easier to describe what something is by giving an example of what it’s not. To wit, you might define what being “patriotic” is by using a vibrant illustration of something “unpatriotic”, such as burning a flag.

“Sustainability” is a concept that may be understood more crisply by showing what it is not.

It’s “unsustainable” to get three hours sleep a night and be a brain surgeon. It’s “unsustainable” to eat a quart of ice cream every day and be healthy. It’s “unsustainable” to be a habitual liar and have a good reputation.

Similarly, it is “unsustainable” to use finite, dirty fossil fuel to power society. It’s “unsustainable” to produce garbage that can’t be disposed of in an environmentally- friendly way. By the same token, it’s also “unsustainable” to pay people differently for doing the same job, biased by gender or race. It’s “unsustainable” for an organization to articulate one set of values but live by another.

Sustainability is an important topic that will increasingly define business strategies across sectors, with the title of “Chief Sustainability Officer” emerging rapidly into the “C Suite”.

It’s no longer a question of whether you “Grow” or are “Green” — you need to do both. The 56+ million Millennials in the workforce today expect something more from both the companies they work for and the businesses they buy from. Corporations that fail to embrace “sustainability” do so at their own peril.

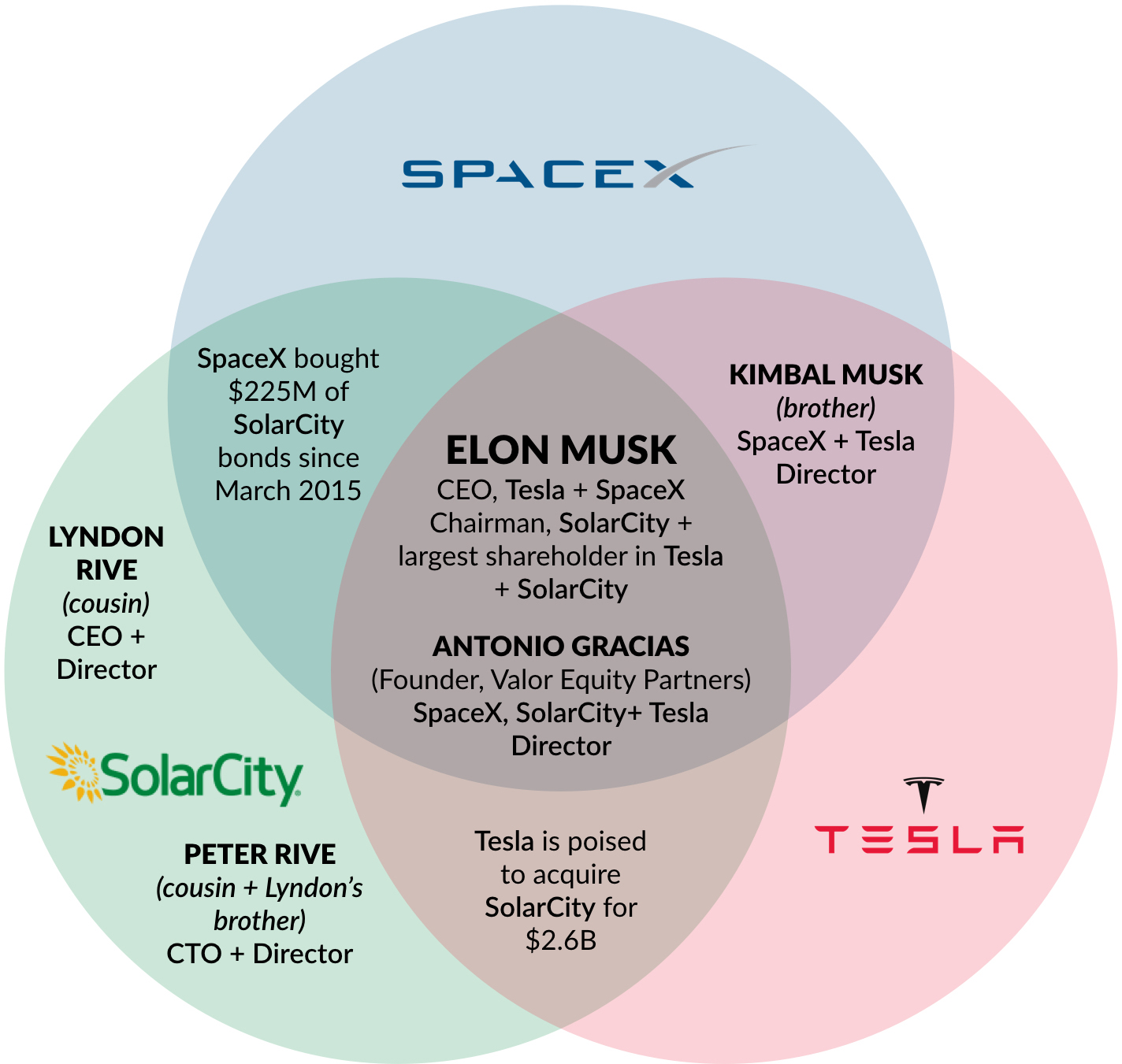

TESLA + SOLARCITY

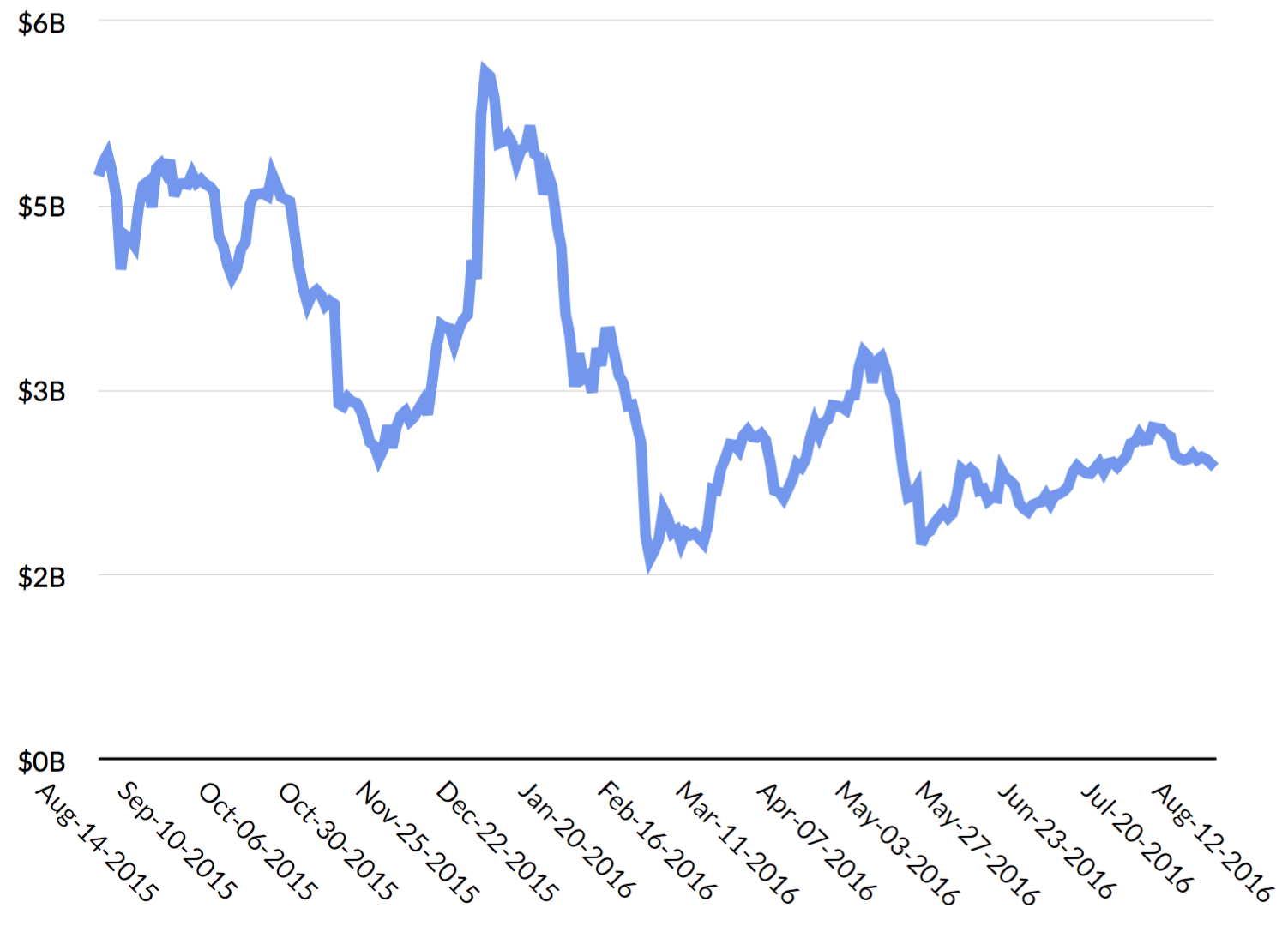

With Tesla’s impending $2.6 billion acquisition of SolarCity, “Sustainability” has taken center stage. Many have questioned whether Elon Musk is flying too close to the Sun. He’s the CEO of Tesla and serves as the Chairman of SolarCity, a full-service solar energy provider run by his cousins. Musk is the largest shareholder in both companies. As, SolarCity has faltered in recent months — it has lost nearly half of its market value year- to-date — many have suggested that the deal is a bailout in a flimsy disguise.

But context matters. Elon Musk has laid out a bold vision for a vertically integrated company that will accelerate the World’s adoption of renewable energy — from solar panels to home batteries and electric cars. Musk, more than anyone else, has given wings to the idea that we can achieve a sustainable future, powered by the sun.

To say that Tesla’s proposed takeover of SolarCity is unprecedented would be an understatement. The ties between the companies run deep. Beyond Musk’s potential conflicts as a major shareholder, CEO, and Chairman, there are overlapping directors and family ties. His cousins, Lyndon and Peter Rive, serve as SolarCity’s CEO and CTO, respectively. Musk’s brother is a Tesla director.

Source: Wall Street Journal, GSV Asset Management

Even SpaceX, where Musk also serves as the CEO, figures into the story. Since March 2015, SpaceX has purchased over $225 million of SolarCity bonds as the company has struggled to raise funds in the face of rising costs and elusive profitability.

SolarCity has seen its market value halved over the past 12 months, dropping from $4.7 billion to $2.4 billion. Analysts have increasingly sounded the alarm about the company’s stalling growth in rooftop solar panel installations, despite an extension of U.S. tax credits for solar projects beyond 2016.

Despite suggestions that Tesla is saving SolarCity by bolting it onto the automaker’s buoyant stock, Elon Musk has argued that the deal represents a critical opportunity for Tesla to create a one-stop clean energy shop, offering consumers solar panels, home battery storage and electric cars under a single trusted brand. To this end, he has outlined two core arguments for the acquisition.

ACCELERATING SUSTAINABLE SOLUTIONS

Musk’s first argument for the deal is that it will accelerate the emergence of a World powered by sustainable energy. As he recently observed on a conference call with analysts to discuss the deal, “It’s really all part of solving the sustainable energy problem… That’s why we are all doing this, to accelerate the advent of a sustainable energy world.”

While it might be impossible for anyone not named Jeff Bezos, Steve Jobs, or Elon Musk to make this type of broad argument for a major acquisition, his sense of urgency isn’t misplaced.

The International Energy Agency projects that global energy demand will grow 37% by 2040. This additional demand is equivalent to the total current annual consumption of the United States and European members of the OECD combined. China and India alone are expected to account for over half of the total increase.

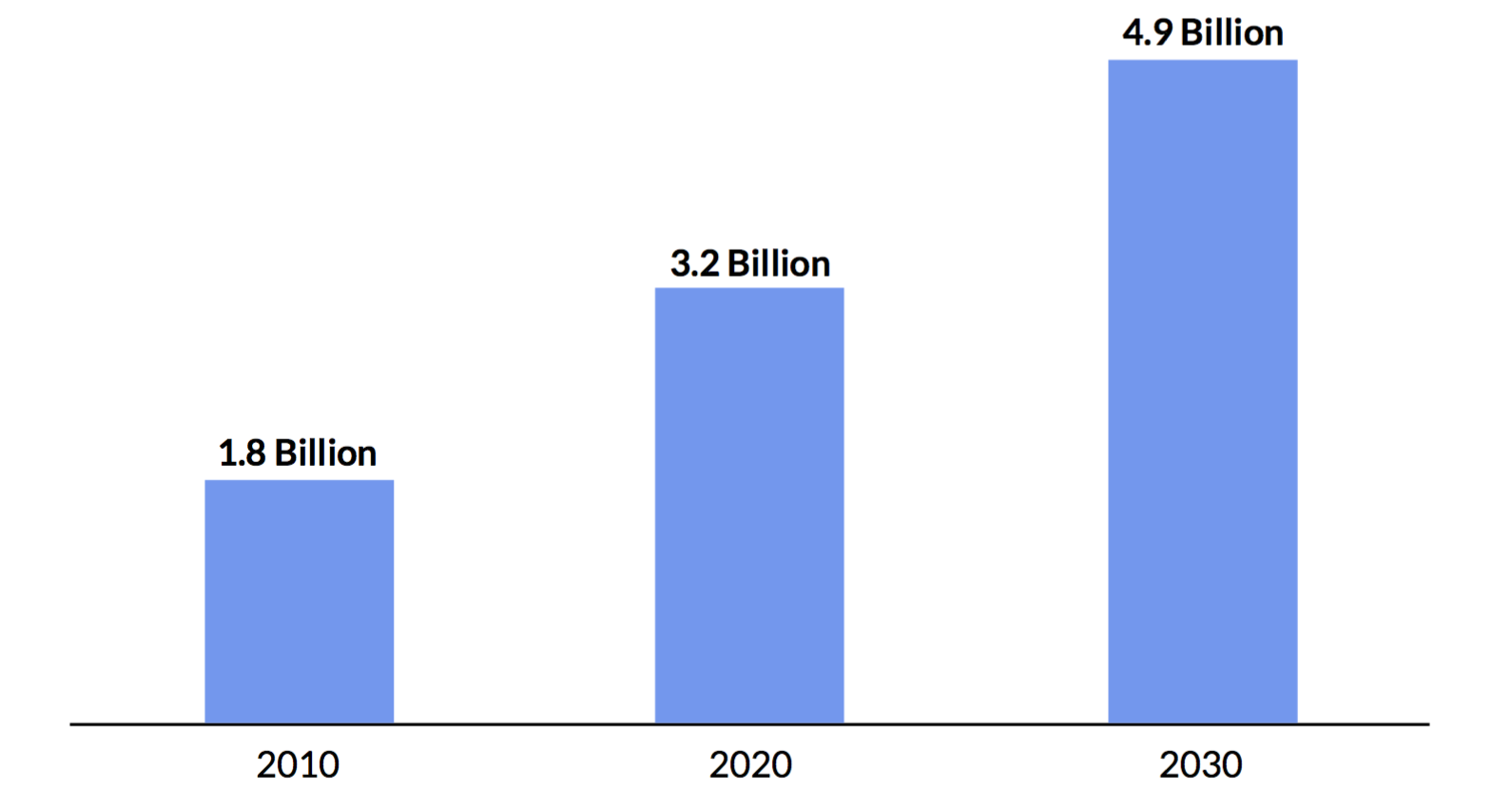

While global population growth will naturally drive demand, demographic changes are accelerating it. According to the Organization for Economic Cooperation and Development (OECD), the world is in the first inning of a demographic transformation that will result in the rise of a Global “Middle Class” numbering more than 4.9 billion people, ascending predominantly from the low income populations of the world’s developing and emerging economies. Defined as households that spend between $10 and $100 per day, the Middle Class is a cohort of CONSUMERS.

The world has never witnessed income growth at this speed or magnitude. China and India, for example, are doubling their real per capita incomes at 10 times the pace England achieved during the Industrial Revolution and 200 times the scale.

And the American way of life — house(s), car(s), comforts — have become the world’s gold standard for quality of life. William Faulkner, who served as a cultural ambassador for the State Department during the Cold War, remarked that if we simply gave people a used car and a TV, they would understand the benefits of the American model.

Unfortunately, the Earth cannot sustain carbon copies of America. Today, we are already using 1.5 planets worth of resources to meet global consumption demands (it takes 1.5 years to replenish the resources we consume in a year). We will need another half of a planet to simply sustain the next generation.

But this assumes that the new global Middle Class will follow the consumption patterns of their low-income parents. I wouldn’t bet on that.

According to a recent study by the University of Michigan, for example, if India, China and Indonesia were to use air conditioners at the same rate as the United States (they are on pace to do so), energy consumption in those countries would be 50x levels in the United States.

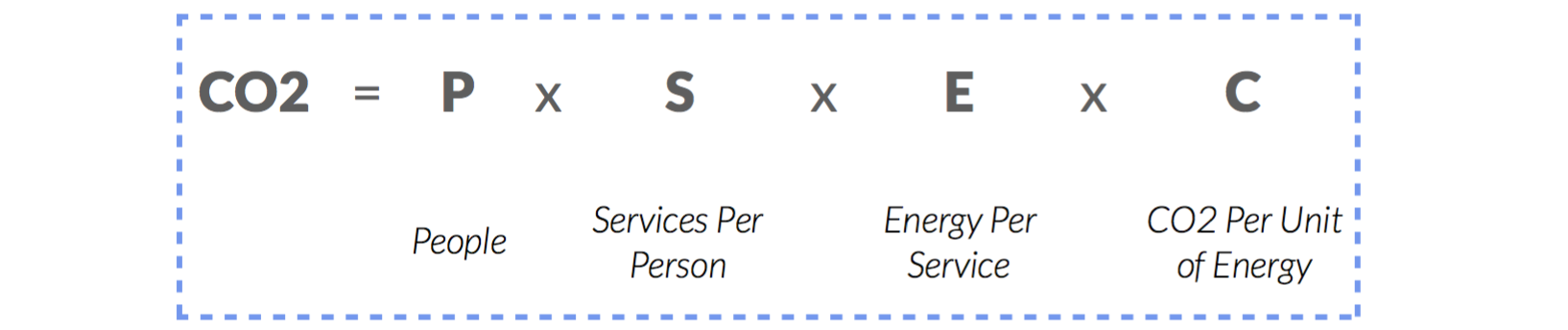

Beyond resource constraints, the implied CO2 emissions of meeting this demand by burning fossil fuels is untenable. Bill Gates lays out these constraints in a succinct equation:

Beyond resource constraints, the implied CO2 emissions of meeting this demand by burning fossil fuels is untenable. Bill Gates lays out these constraints in a succinct equation:

Curbing population growth (“P”) and meaningfully limiting the goods and services consumed per person (“S”) is a losing proposition. Limiting the energy required to produce goods and services (“E”) and the C02 per unit of energy produced (“C”) is the only viable path forward.

It is up to Tesla shareholders to evaluate if the deal will meaningfully reduce the “E” and “C” in the Gates Climate Equation — and whether this justifies the deal in the first place.

“DISTRIBUTED” RENEWABLE ENERGY PLATFORM

In his master plan for Tesla, Elon Musk outlines a second key reason for the transaction. His vision for Tesla, which extends far beyond cars, is to create an integrated solar-roof- with-battery product that empowers the individual as their own “utility”.

In the current system, there is little opportunity or incentive to improve efficiency or conserve energy. Our electricity grid is predominantly fed by utilities that make more money by adding power plants and customers because rates are based on capital expenditures.

Like mobile phones before the rise of the smartphone, the electricity grid is “dumb”. Effectively, the grid can only distribute power from a central location, making it prone to massive outages. It cannot efficiently adapt to fluctuations in customer demand, instead keeping massive amounts of reserve power online, leading to tremendous energy waste.

The ability to generate and store power off the grid enables the creation of a “smart” system. Increasingly, “Apps” and connected devices will empower consumers and businesses to optimize energy use. A “distributed” system that increasingly relies on the energy creation and storage capacity of individual homes and small businesses represents a true paradigm shift. It would enable a more nimble, fundamentally resilient energy network built on renewables.

SolarCity’s DemandLogic platform, for example, enables businesses in markets where energy rates fluctuate during the day to draw down stored solar energy during times of peak demand and cost. They can toggle back to grid power during the morning and evening when energy demand and rates fall. As more utilities and regulators adopt dynamic pricing, consumer offerings that combine storage and off-grid energy production will thrive.

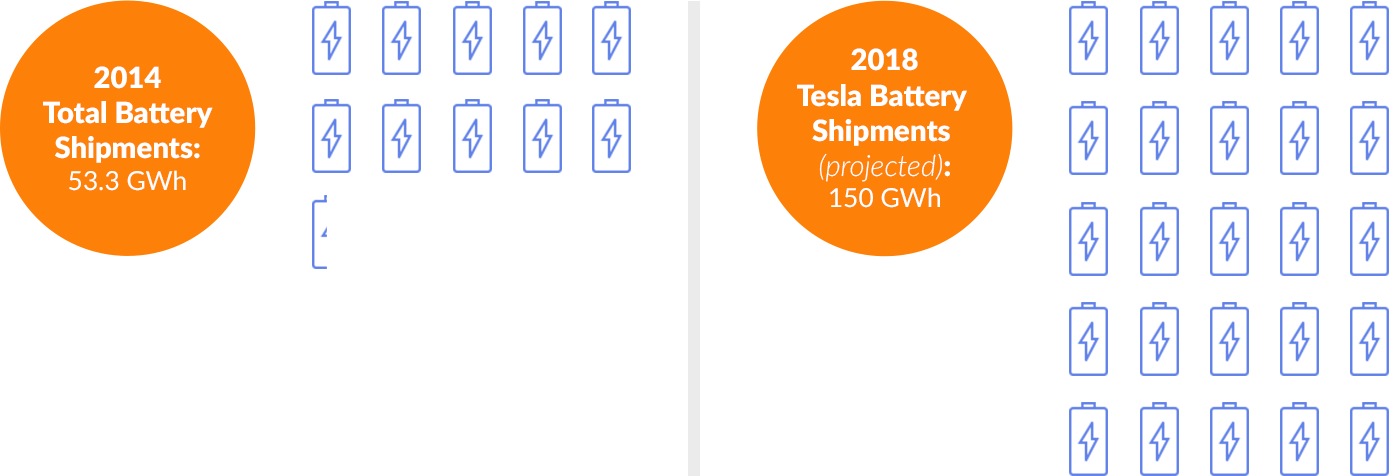

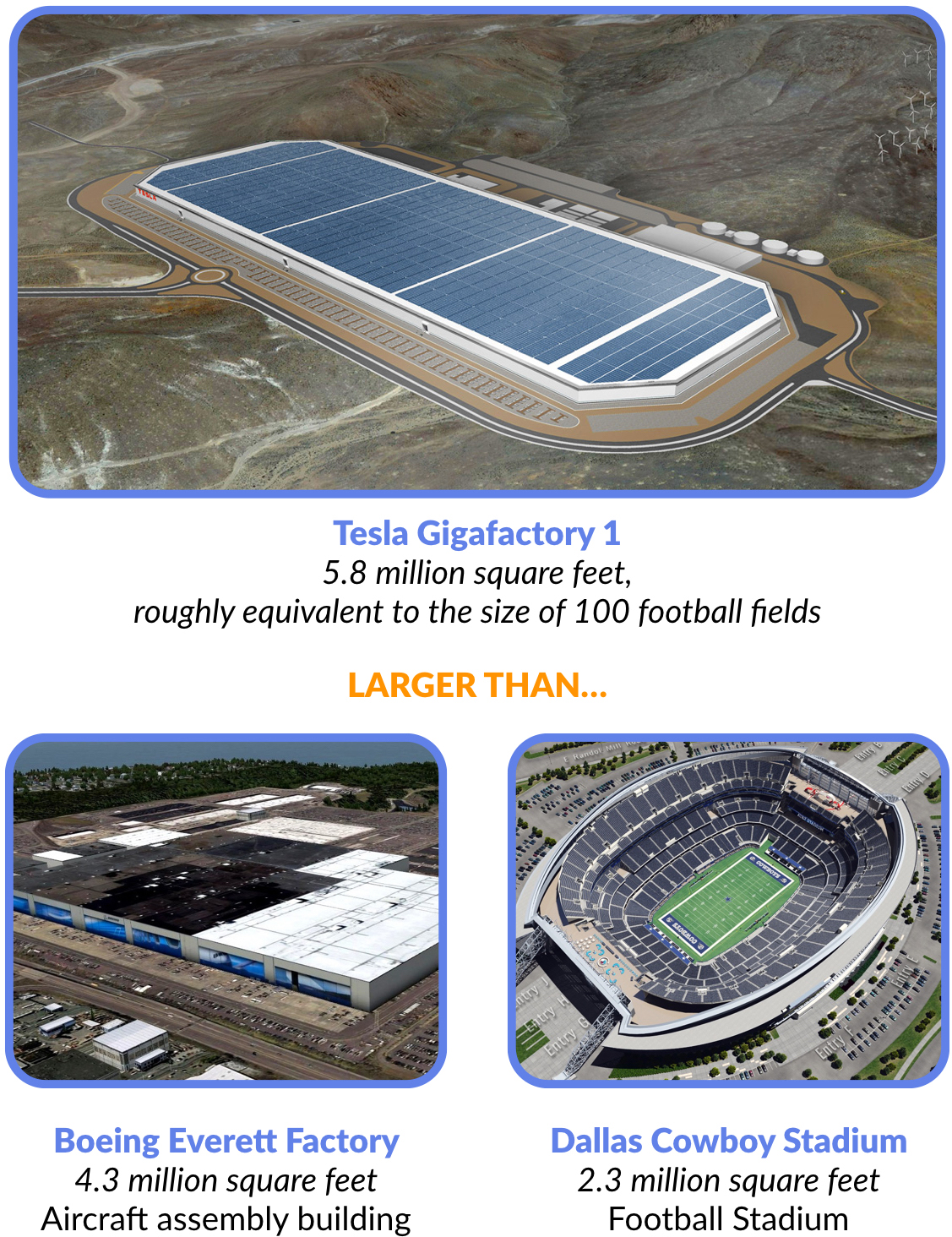

In theory, SolarCity’s solar panel and energy management capability aligns directly with Tesla’s $5 billion investment in its massive Nevada Gigafactory, which is projected to produce 150 GWH of lithium ion batteries by 2018. For context, the entire global production of lithium ion batteries in 2014 was 53.3 GWH. The batteries will not only power the cars Tesla produces, but they will also be packaged and sold for home energy storage.

As a preview of things to come, in 2015, SolarCity announced that it would incorporate the new Tesla battery into its enterprise and retail offerings. It was a first step towards providing a turnkey solution for customers to create an “off the grid” power system that stores energy generated by SolarCity solar panels, using stored electricity to reduce peak demand and to provide backup power during grid outages.

According to Bloomberg, customers can prepay $5,000 for a nine-year lease on a 10 kilowatt-hour system. Customers can also buy the entire system for $7,000.

Tesla and Solar City are projecting to cut about $150 million in costs through the transaction in the first full year after the deal closes. They expect customers to benefit through lower hardware and installation costs, and they plan to use Tesla’s 190 stores to expand SolarCity’s reach. Ultimately, the devil is in the details and Tesla will need to demonstrate why acquiring Solar City is more effective than an expanded strategic partnership.

Battery Challenge

In recent years, the accelerating adoption of solar energy has intensified a central challenge: how to use the sun’s energy when it isn’t shining. The technology to generate renewable energy has leapt far ahead of the capacity to store and deploy it. An exponential breakthrough in battery capacity and cost would bulldoze limitations to adopting renewable energy on a massive scale.

Compared with breakthrough technologies like the computer processor, batteries have progressed remarkably slowly. Moore’s Law gives us twice the amount of transistors every two years, but Bloomberg estimates that battery performance is improving at no more than 7% per year.

The first battery was invented in 1800 by Alessandro Volta, and in 1859, Gaston Planté invented the lead-acid battery, which is now ubiquitous in gasoline-powered cars. It took until 1991 for Sony to produce the first commercial lithium-ion battery and little has changed since.

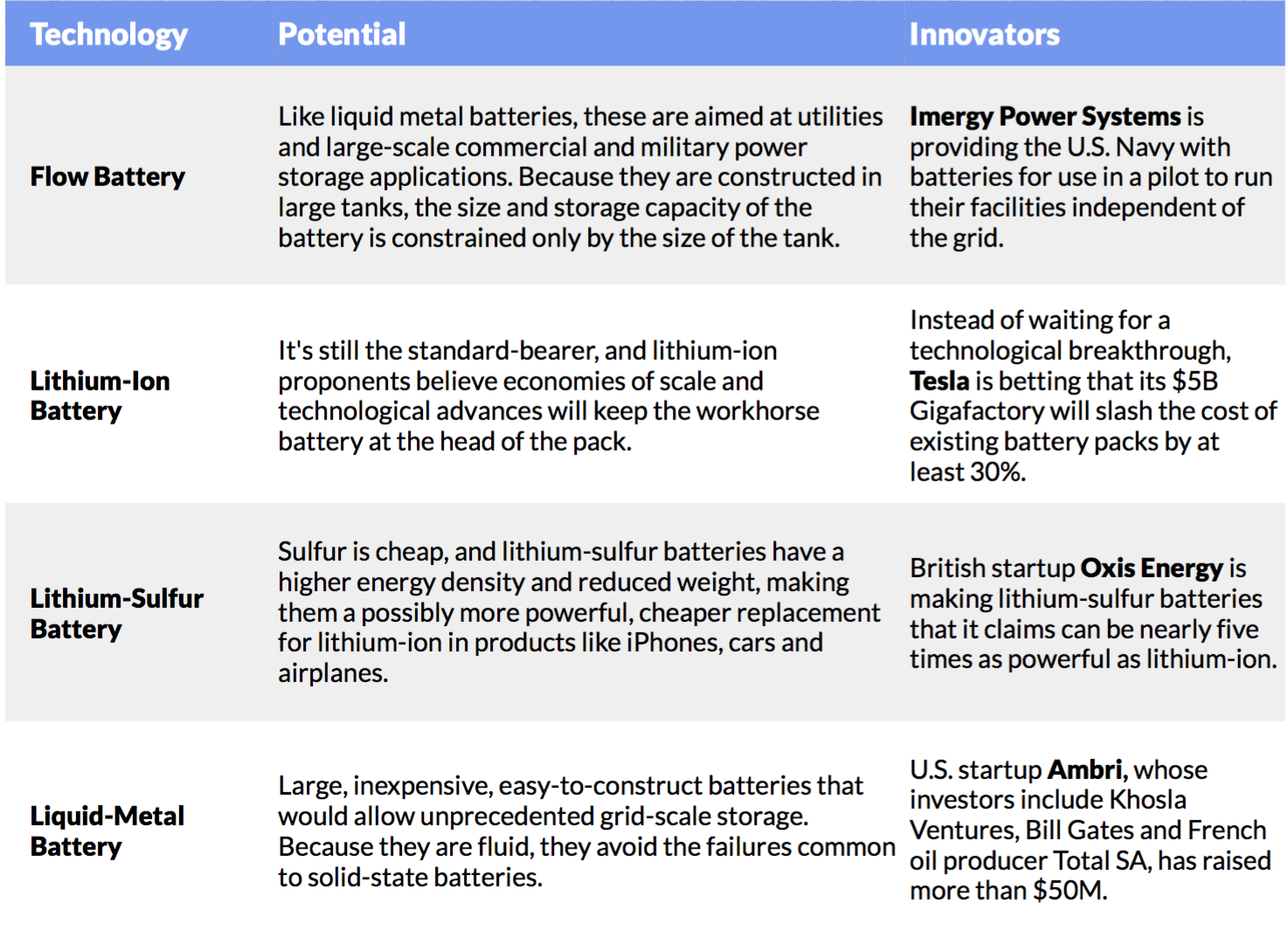

While a variety of researchers and entrepreneurs are ramping up efforts to produce alternative technologies, Tesla is is doubling down on its bid to produce on lithium-ion batteries through economies of scale.

Source: Visual Capitalist, Tesla Disclosures, GSV Asset Management

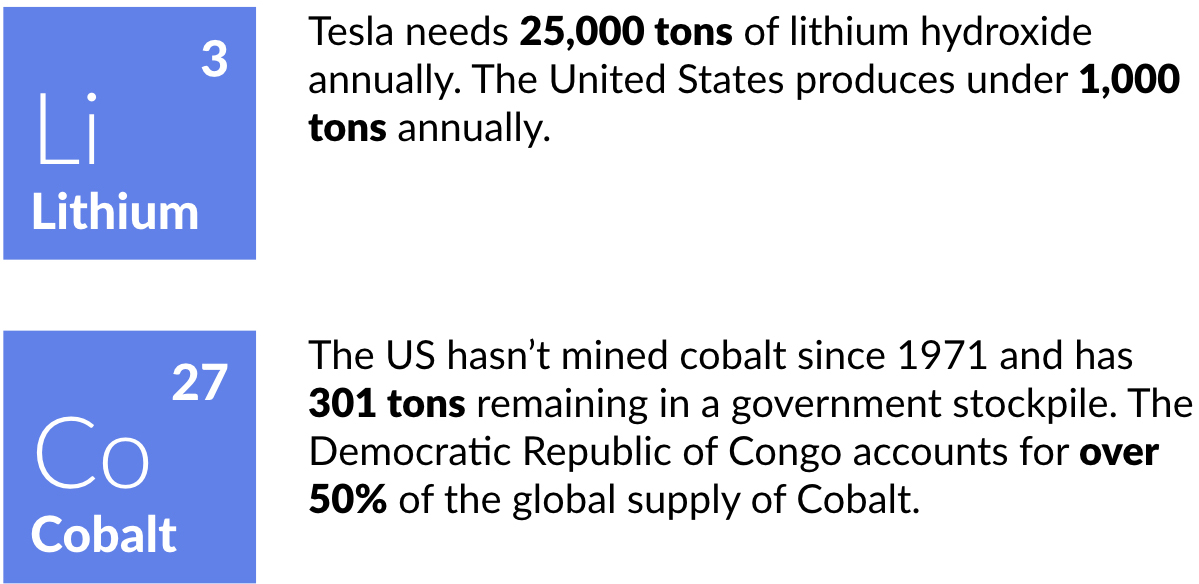

RUSH FOR RAW MATERIALS

Tesla Will Need to Create Global Supply Chain for the Extraordinary Amount of Natural Resources Its Batteries Will Consume

BROADER TAKEAWAYS

Belief in the Electrification of Transportation

The anticipated approval of Tesla’s acquisition of SolarCity (as well as the resilience of its stock) despite murky details underscores a massive belief in the electrification of transportation.

Why does Tesla trade at 23x P/E of General Motors?

Because a Tesla now gives you the ability to drive 270 miles and you can recharge your car in the time it takes to grab lunch. If Teslas only went 40 miles, the company would be dead in the water. Add in the fact that Teslas are effectively computers on wheels (with hands- free mode they drive themselves) and stylish to boot, and you have a game-changing product.

General Motors, in contrast, spends over $7.2 billion per year on R&D, and the net result has been the Cadillac ELR, which will take you 35 miles on a charge.

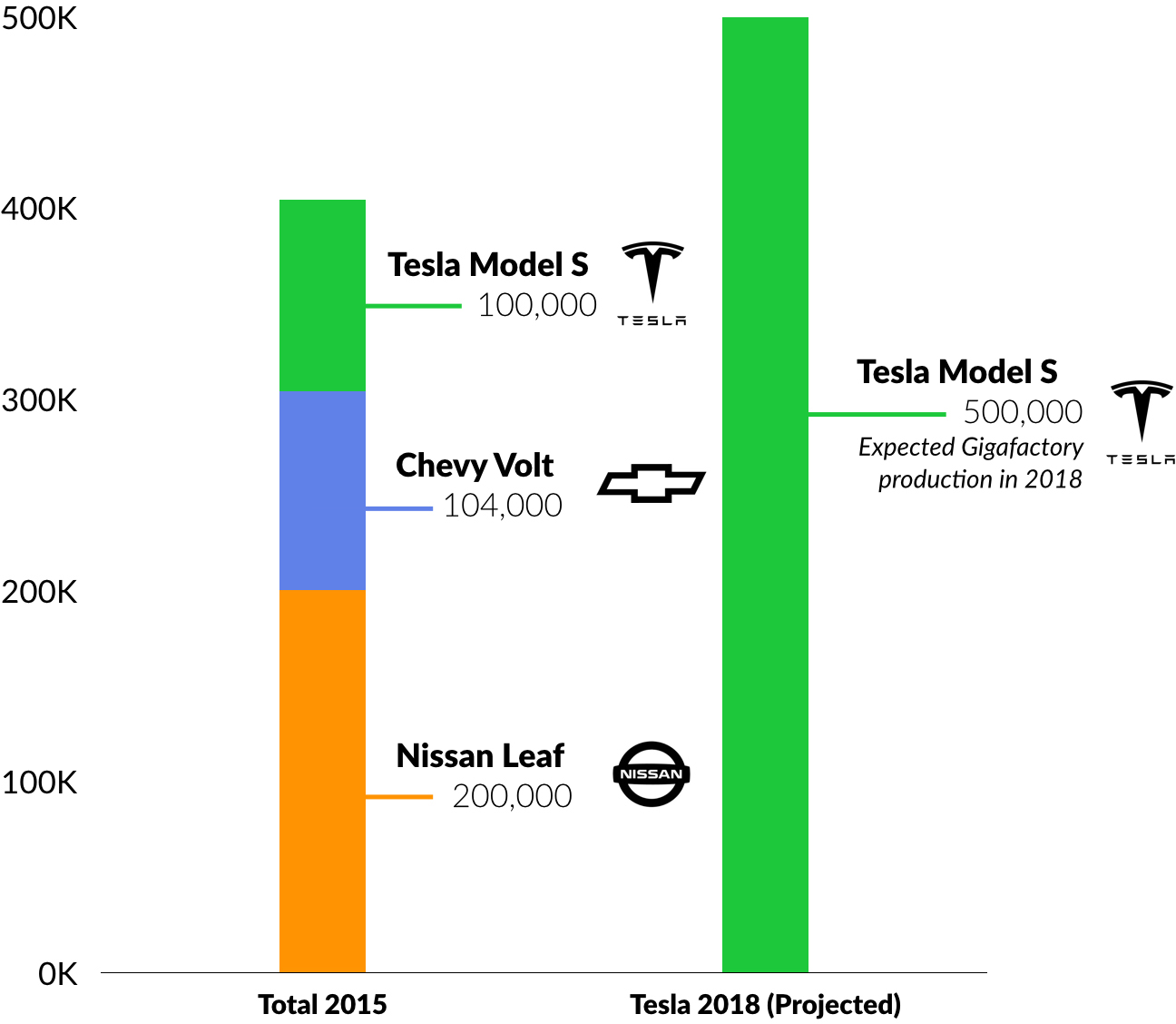

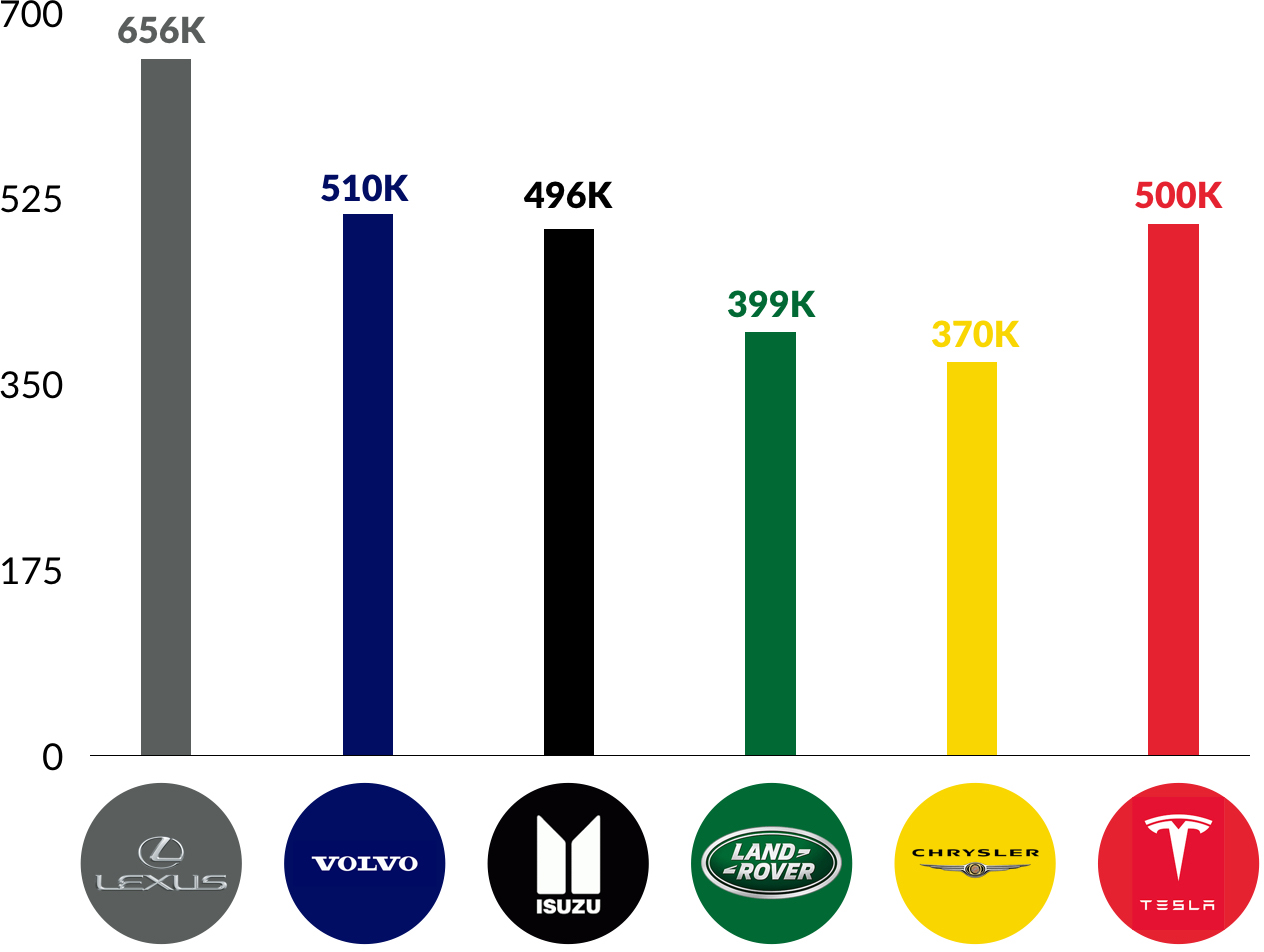

Tesla aims to sell 500,000 cars in 2018. If it hits the mark, it will be a major milestone for the electric vehicle (EV) market. To put that number in perspective, the total sales (all- time) for the three most popular EV models (Leaf, Volt, Model S) add up to an estimated 404,000 cars as of December 2015.

Tesla is still a relatively small auto manufacturer, but if it meets its stated production goal of 500,000 vehicles in 2018, it will be comparable with brands like Chrysler, Land Rover, Isuzu, Volvo, and Lexus.

“Clean”, “Distributed” Energy at “Grid Parity” = Massive Opportunity

Distributed, renewable, baseload (not intermittent) power at grid parity is a revolution waiting to happen. To put this opportunity in perspective, consider that the entire e- commerce industry is Global e-commerce sales are projected to reach $2 trillion in 2016, rising to $3.6 trillion over the next three years. The International Energy Agency estimates that for the World to meet global energy demand for the two decades from 2015 to 2035, it will require investment of at least $48 trillion

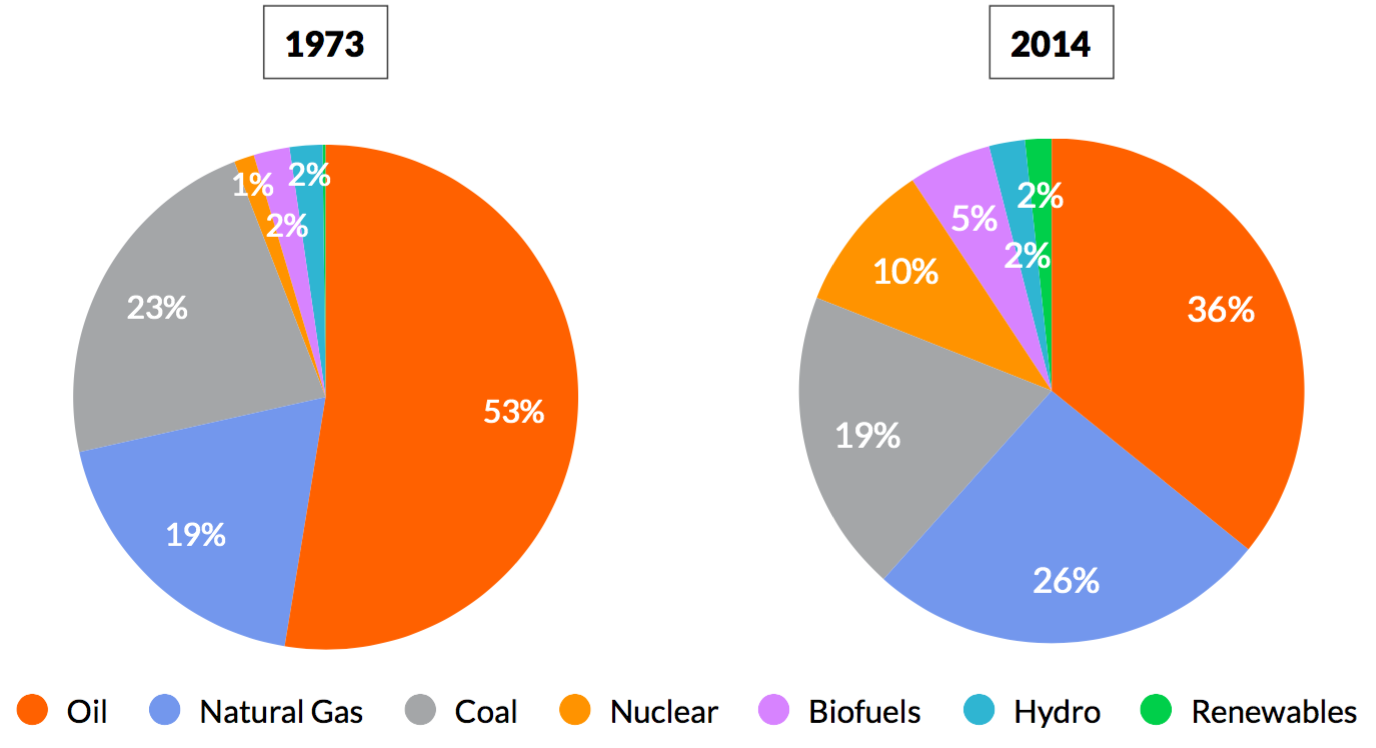

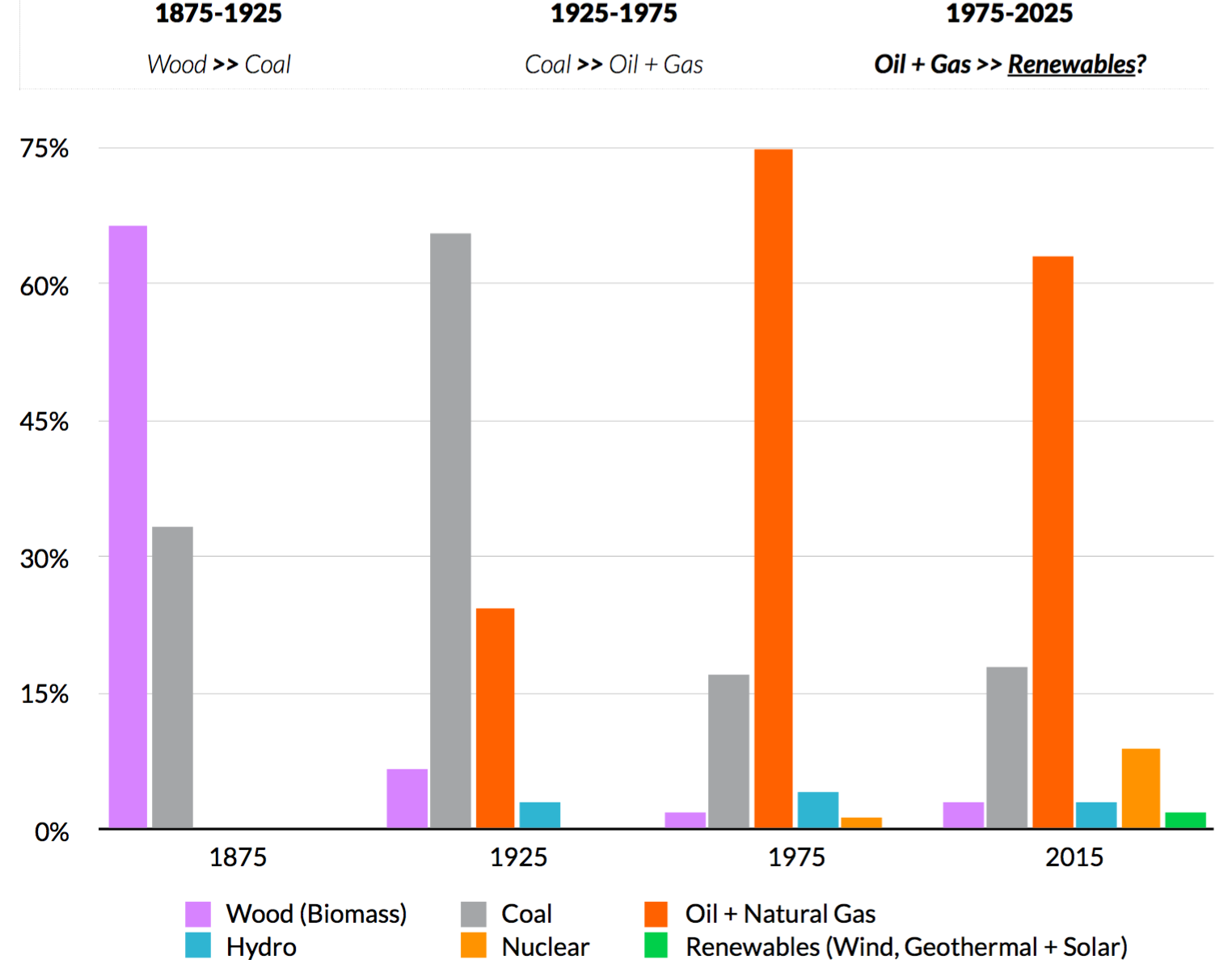

The shift to a sustainable energy future may be upon us.

The United States, for example, has seen two complete energy generation shifts, each lasting roughly 50 years. The first major shift was from wood to coal. From 1875 to 1925, wood dropped from 66% of U.S. energy consumption to under 7%.

Source: EIA Annual Energy Review, Dr. Stefan Heck (4/1 Presentation: Driving Growth with Big Ideas — Private Capital and Global Innovation)

From 1925 to 1975, a similar transition occurred. This time, coal dropped from 66% of energy consumption to 17%. At the same time, oil and gas soared to over 75%. While they have dropped moderately to 60% of energy consumption over the last 40 years, the fundamentals are in place for an accelerated decline led by a rise in viable renewable energy alternatives. Companies like Tesla and SolarCity are at the vanguard.

—

The “Big Three” — the Dow, S&P 500, and NASDAQ — all reached new all-time highs last week, albeit with modest gains. NASDAQ and the Dow both inched up 0.2%, while the S&P 500 was just barely above being flat.

Solar stocks, which are visible members of the Sustainability family, had a tough week, epitomized by SunPower’s 28% decline. Weak industrial demand caused both SunPower and SolarCity to reduce their outlook and expectations. In the long term, we are BULLISH on solar as a sustainable power source because when the Sun runs out of energy, we have bigger problems to worry about.

Despite broad skepticism about the Middle Kingdom, Chinese Internet leaders Alibaba and JD.com reported monster numbers. Alibaba’s revenue accelerated to 59% growth and JD.com delivered 42% revenue growth for the quarter. Alibaba’s and JD.com’s stocks responded in kind, moving up 16% and 13%, respectively.

In other tech news, Nvidia put up 24% revenue growth and 700% EPS growth. Twilio reported its first quarter as a public company and blew out its numbers, achieving 70% revenue growth. Its stock moving up 28%.

Interestingly, Big Box retailers Macy’s, Kohl’s, Nordstrom, and JC Penny reported mixed- to-ugly results, but their stocks surged 16%, 14%, 18%, and 12%, respectively.

We continue to see the action in stocks as being very BULLISH for the best growth companies, which is confirmed by strong fundamentals. Accordingly, we remain optimistic as long term growth investors.