Market Snapshot

| Indices | Week | YTD |

|---|

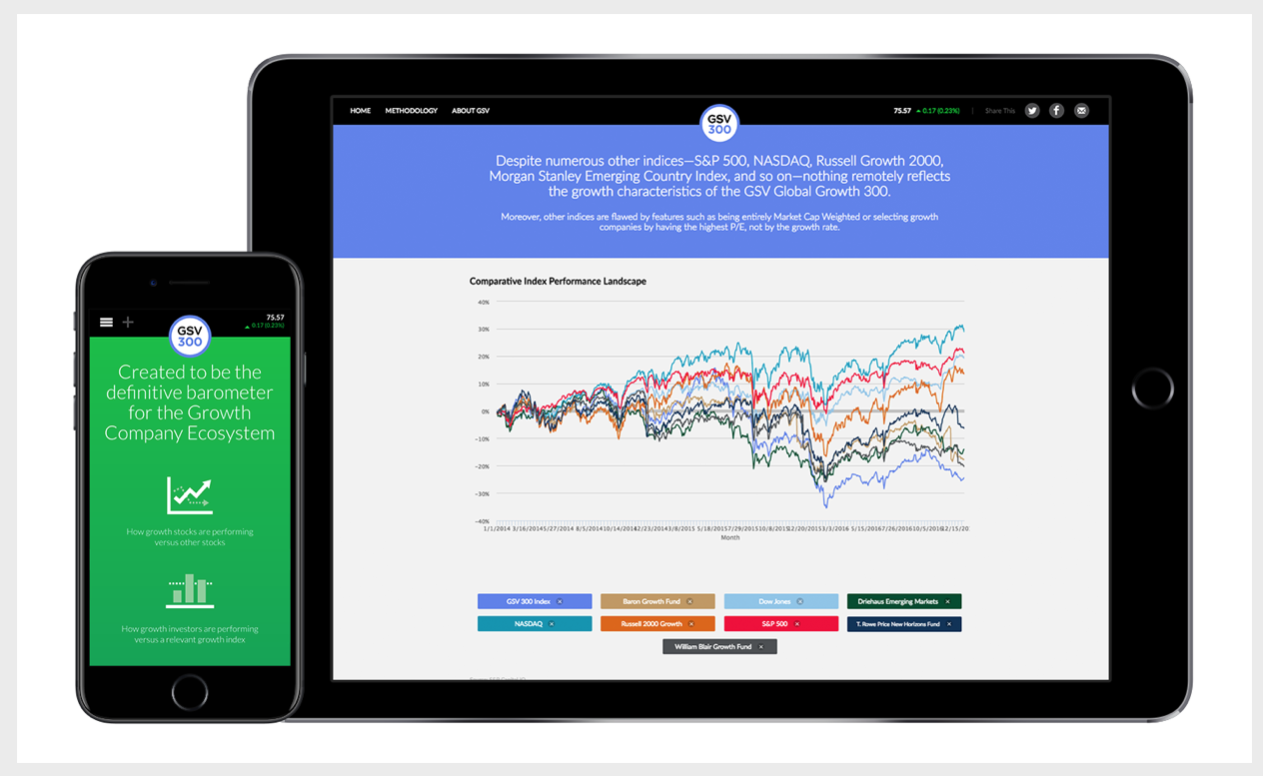

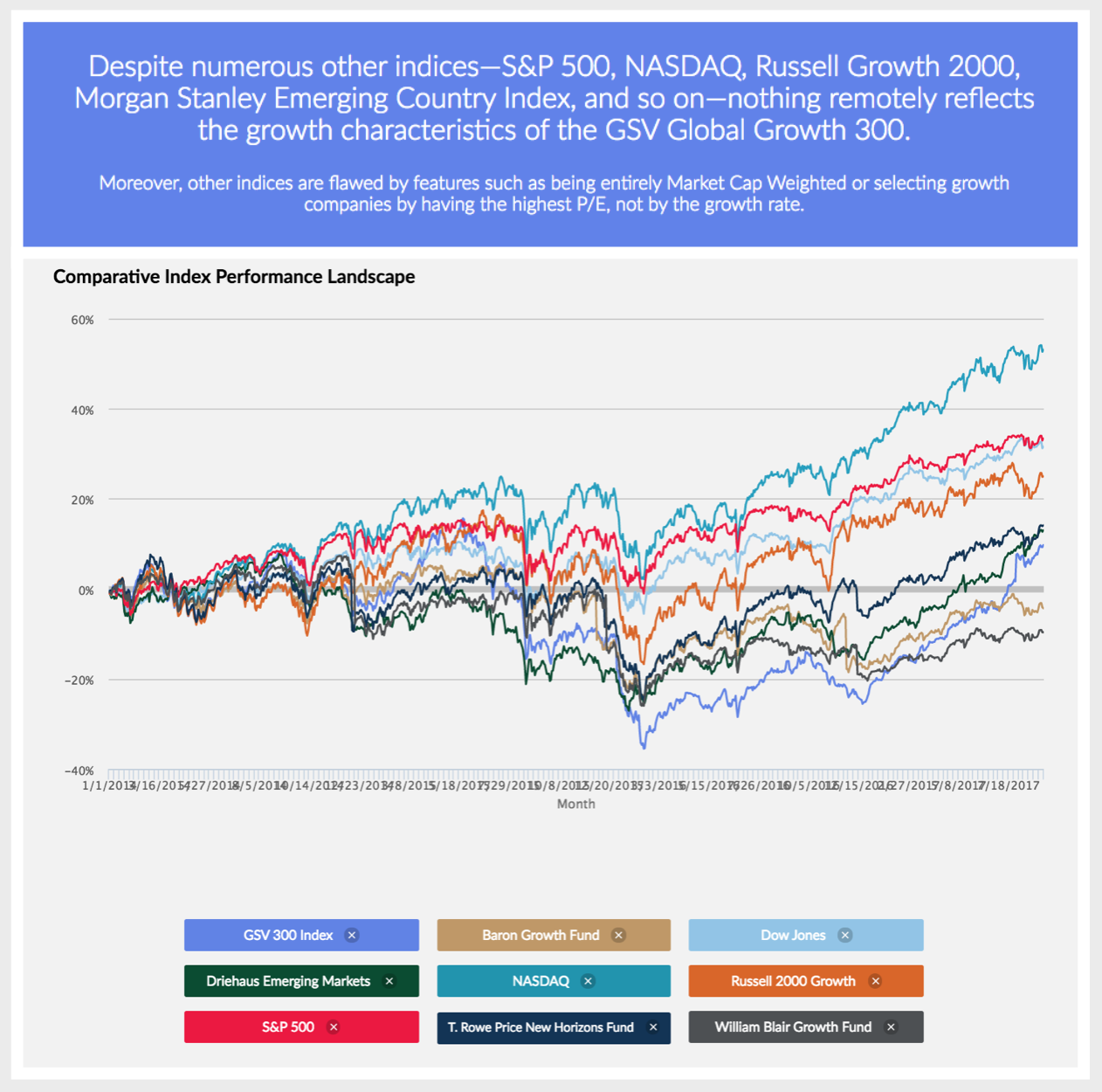

With President Trump huffing and puffing on the trade front, investors have been distracted from the positive momentum in growth companies over the past fifteen months. The GSV 300, which is made up of the 300 fastest growing companies in the world, is up 59% since January of 2017, versus the S&P 500, which has advanced a comparatively modest 14%.

As a direct consequence, the IPO market has shown more life than it has in years, with 44 IPOs to date (55% year-over-year increase) and $23 billion in proceeds (108% year-over-year increase).

But more importantly, leaders such as Dropbox and Spotify have decided to take advantage of the healthy growth environment. The Stock Market reflects the confidence investors have in the future, and the IPO market is an even more acute indicator. If investors are pessimistic, new issues shut down. If investors are optimistic, they treat IPOs like fresh oxygen that they can’t get enough of. DBX and SPOT have been the perfect shot in the arm to keep markets moving the right way. (Disclosure: GSV owns shares in Dropbox and Spotify)

Dropbox made its public debut on March 23rd, pricing above the range and popping 36%. Dropbox is the fastest Software-as-a-Service business to reach a $1 billion revenue run-rate according to IDC. 2017 revenues were $1.1 billion, up from $845 million in 2016 and $604 million in 2015 – a 35% CAGR for the period.

Dropbox counts over 500 million users across 180 countries, including 100 million new users added since the beginning of 2017. More than 400 billion files have been uploaded to the platform to date. The company is now up 43% since going public and raised a total of $969 million in its IPO, including the proceeds generated from selling additional shares this week.

This week, all eyes — and ears — were on Spotify as the Stockholm-based music streaming platform made its anticipated public debut via a direct listing. The company priced well above the price of most recent private transactions, and is now a $26.5 billion market cap company.

As of December 31, 2017, Spotify counted over 159 million monthly active users. It also had 71 million paying subscribers, a 46% increase over the previous year. Apple, by contrast, reported on March 12 that it had 38 million subscribers for its paid music streaming service, which it launched in 2015.

On a relative basis, the U.S. IPO market rebounded in 2017 as 153 companies listed – a 50% increase over 2016. There were 64 VC-backed IPOs in 2017 versus 40 in 2016 according to Renaissance Capital and our research affiliate, GSViQ.

Set against the backdrop of an IPO backlog that has been building for the last 15 years, however, we believe that there could be plenty of rebound yet to come. According to data from the National Venture Capital Association, from 1990 to 2000, there was an average of 406 IPOs in the United States per year. From 2001 to 2016, it dropped to 108.

GSV 300

Beyond IPOs, when it comes to tracking the state of play in the global growth economy, an old saying rings true: “If you can’t measure it, you can’t manage it.”

So in 2015, GSV launched the GSV 300 Index, which we believe is the best representation of what is truly going on with growth companies, their valuations, and performance. It is an index of 300 of the World’s fastest growing companies, selected systematically based on key fundamentals, including revenue and earnings growth, geography, valuation metrics, and market capitalization.

The most relevant index for Institutional Investors to date has been the S&P 500, which is a good proxy for broad Market dynamics. But with a 5% long term growth rate, it hardly reflects conditions or performance for fast growing companies.

The fact that the S&P 500 is solely a market cap weighted index is problematic in that a $100 Billion Market Cap Company has 100x the impact on the Index as a $1 Billion Market Cap Company… not realistic in that a portfolio manager who viewed two portfolio companies as being equally attractive would have 100x more of that company in their portfolio.

The most well-known index, the Dow Jones Industrial Average (DJIA), is created with an even more bizarre rationale in that it is weighted by share price. So in other words, if one stock was $30 per share and another was $300 per share, the $300 stock would have 10x the influence on the DJIA as the $30 stock.

The GSV 300, an index of the World’s 300 fastest growing public companies and a barometer for the broader Global growth economy, is up 2.5%.

The GSV 300, by contrast, is constructed using a systematic three-step process, which is summarized below: Screening, Ranking + Scoring, and Index Weightage. For a full description of the GSV 300 construction methodology, please click HERE.

GSV 300 Snapshot

The average market capitalization of GSV 300 constituent companies is $13.6 billion, with a median of $3.2 billion. The 10 largest companies account for 25% of the index. By comparison, the top five companies in the 2,500-company NASDAQ Composite — Apple, Microsoft, Amazon, Facebook, and Alphabet (Google) — account for approximately 30% of the index alone.

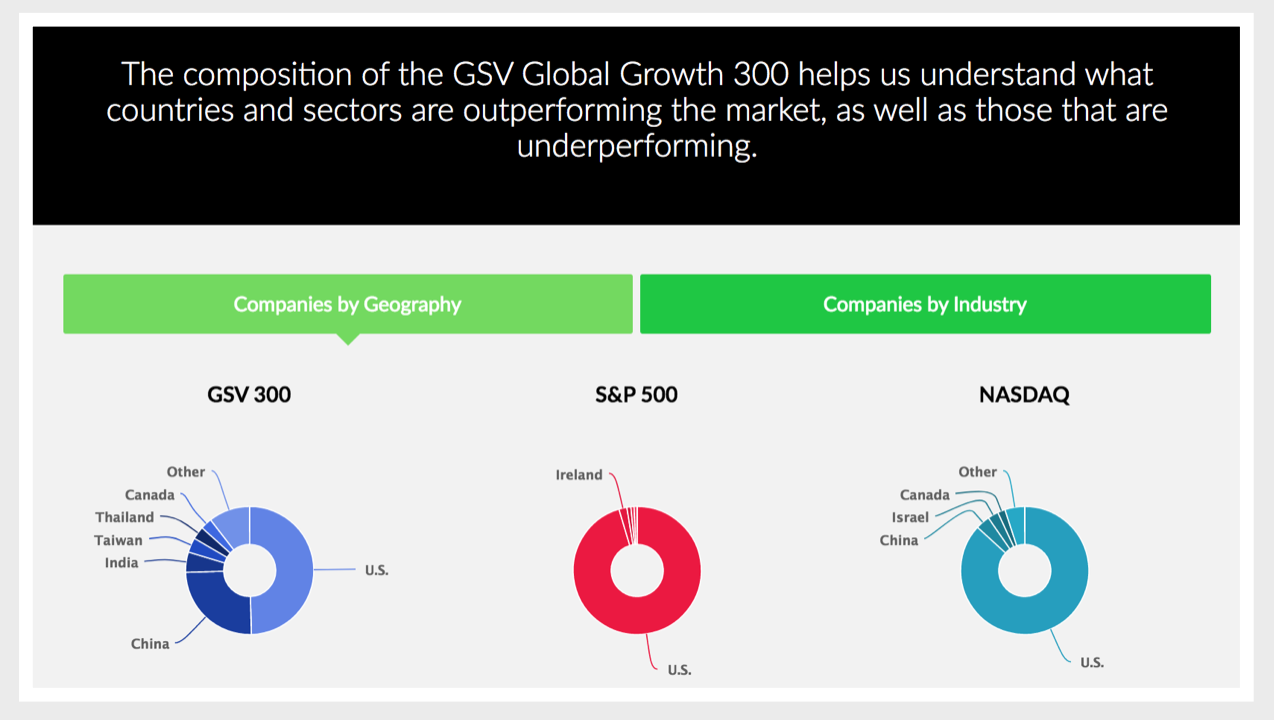

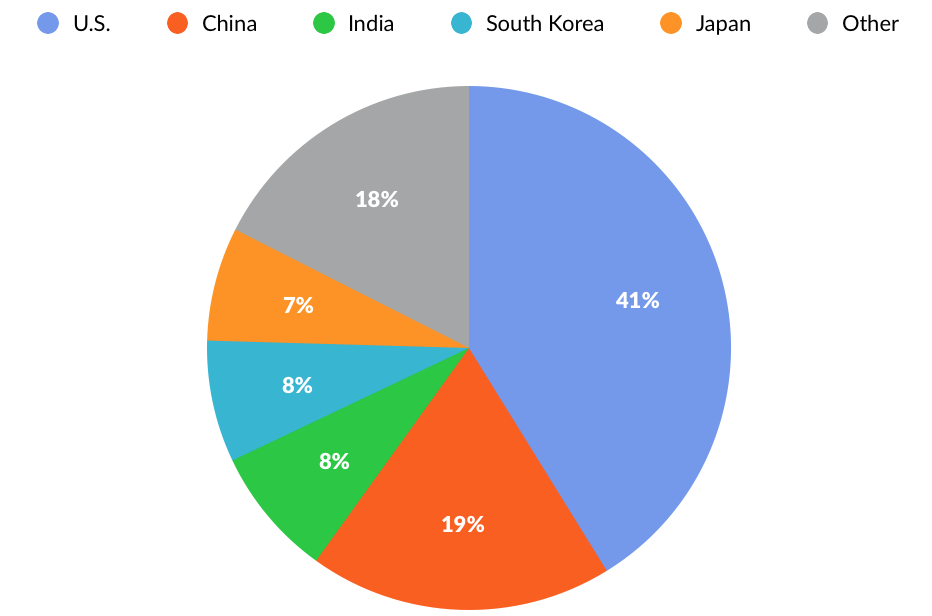

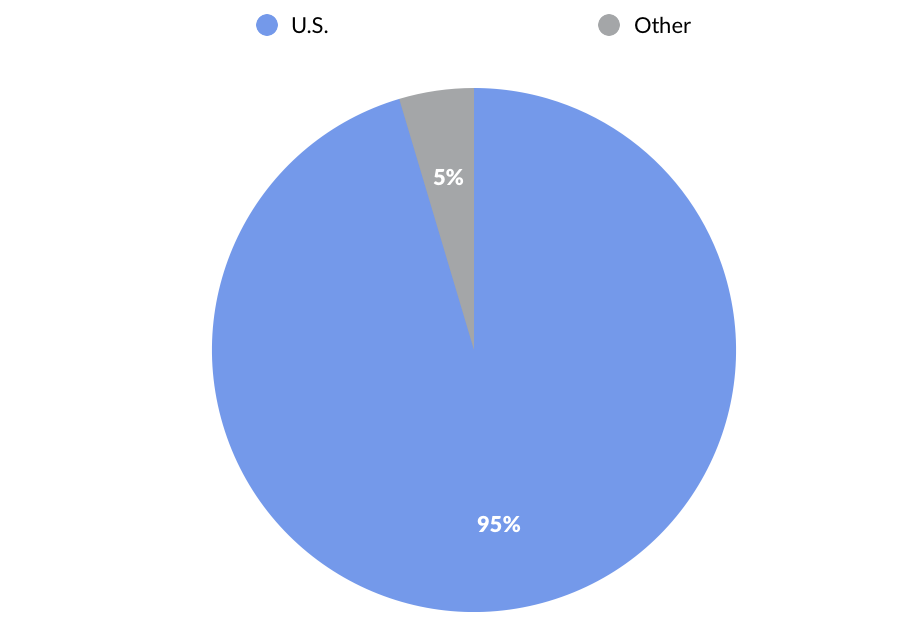

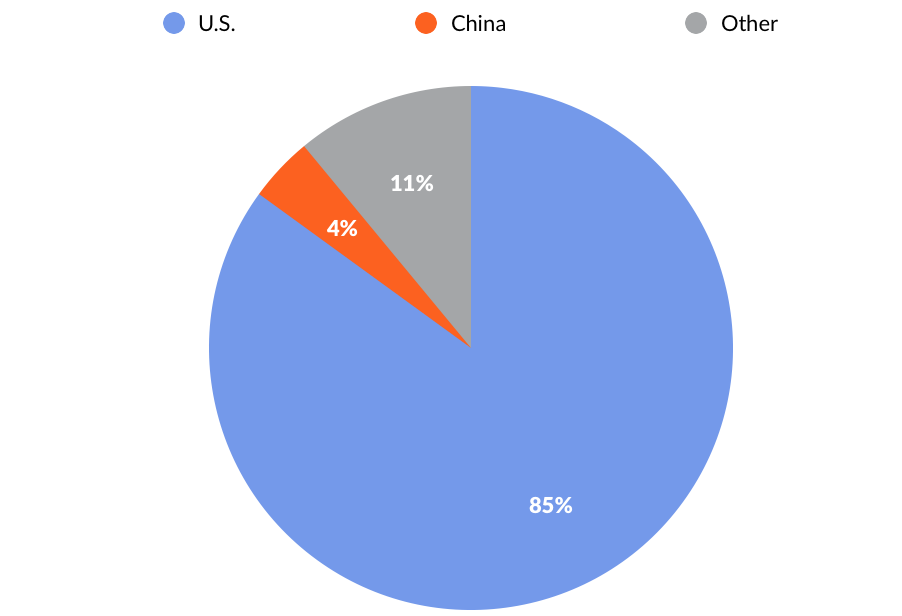

Looking at the GSV 300 by geography, 41% of the index weightage comes from U.S. companies. China is the second-largest geography at 19%, followed by India and South Korea at 8% apiece. Japan rounds out the top five, contributing 7% to the index. By contrast, 95% of the S&P 500 and 85% of NASDAQ are represented by U.S. companies.

Performance & Valuation

In the first quarter, the GSV 300 was up 4%, with U.S. companies rising 9% and Chinese companies gaining 3%. Segmented by GSV investment theme, “Social Mobile” companies rose 3%, “Cloud + Big Data” companies surged 15%, and “Marketplaces” and “Education Technology” were both up 3%. “Sustainability” companies declined by 1%.

While we are certainly rooting for strong performance, our objective in launching the GSV 300 was to create a scorecard that reflects what is actually going on in the World of growth stocks.

The T. Rowe Price New Horizons Fund, for example, has pursued a strategy of investing in small, high-growth companies since 1961. While it is actively managed, Peter Lynch observed in Beating the Street that the fund is, “as close as you’ll get to a barometer of what is happening to emerging growth stocks.”

Since small companies are expected to grow at a faster rate than large companies, they usually sell at a higher P/E than larger companies. Logic might suggest, therefore, that the P/E of the New Horizons Fund would be higher than that of the S&P 500 at all times.

This isn’t always the case, and at times when it isn’t, the New Horizons Fund can be a smoke signal for an undervalued or overheated growth economy. Over the last 50 years, for example, the New Horizons P/E has risen to double that of the S&P 500 only four times.

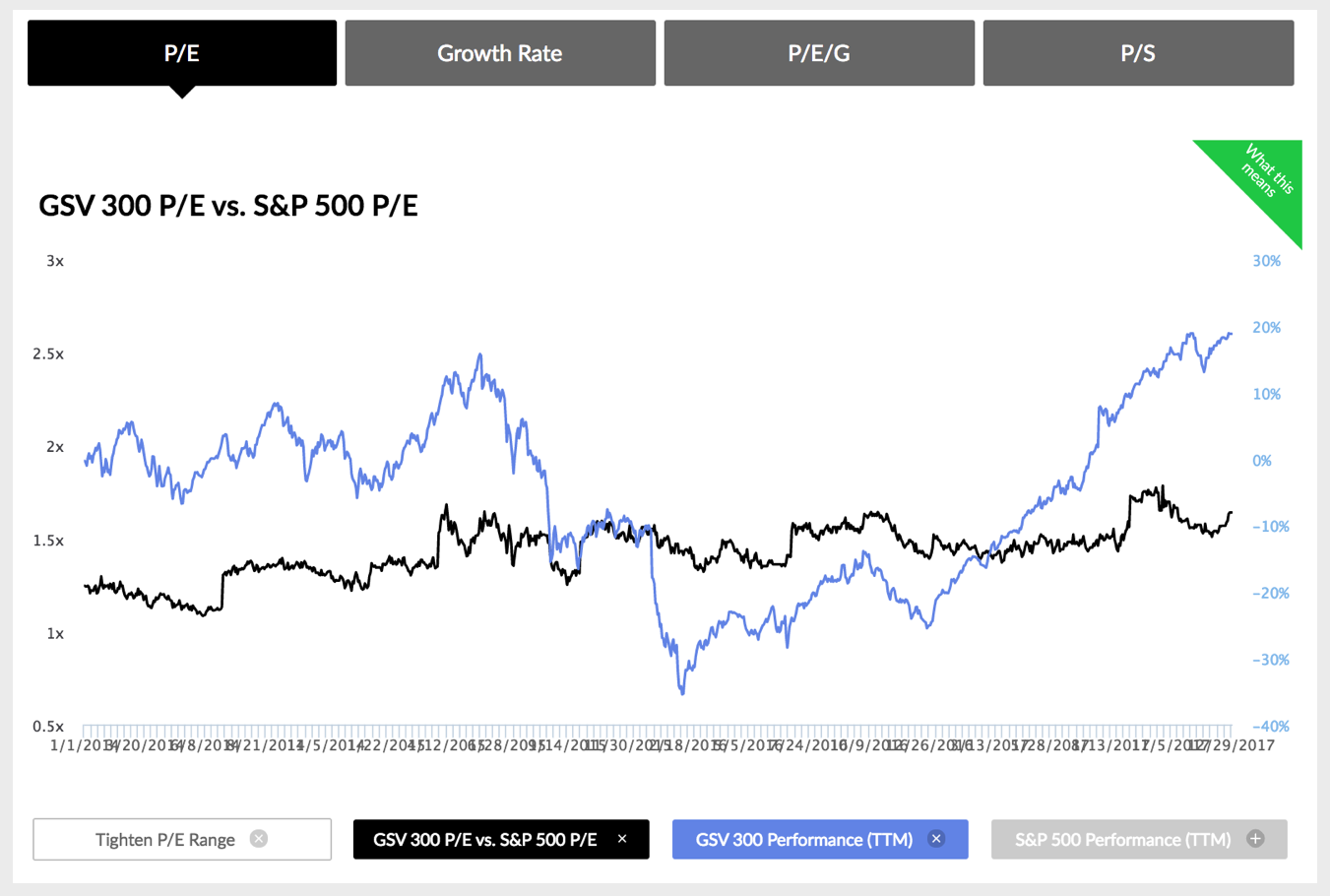

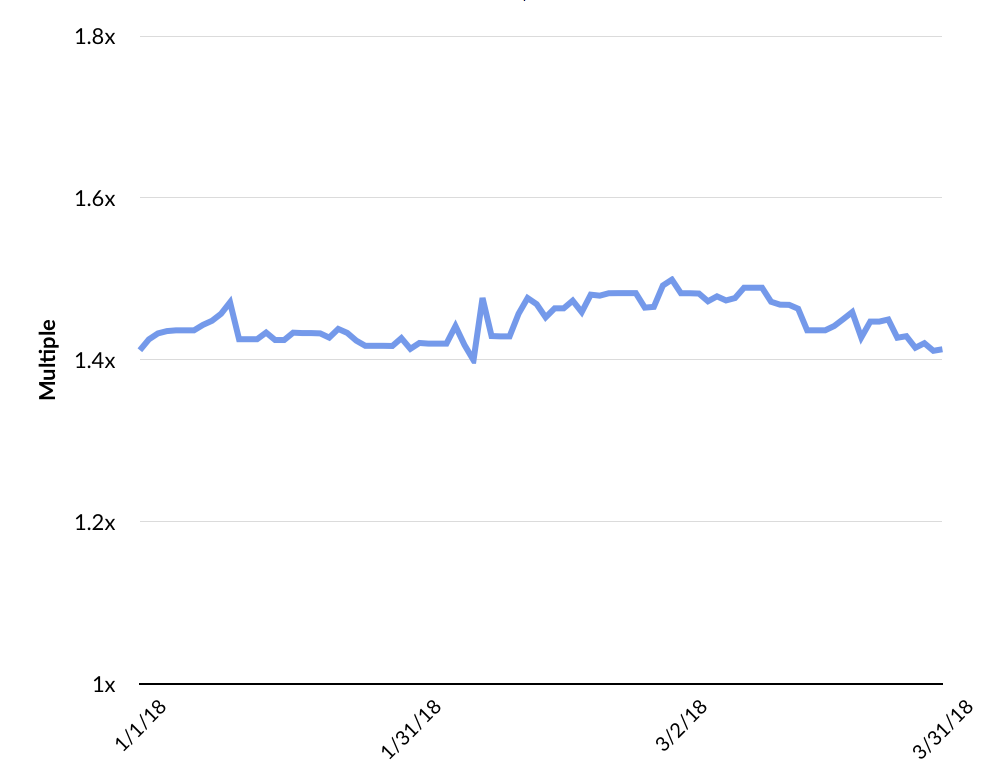

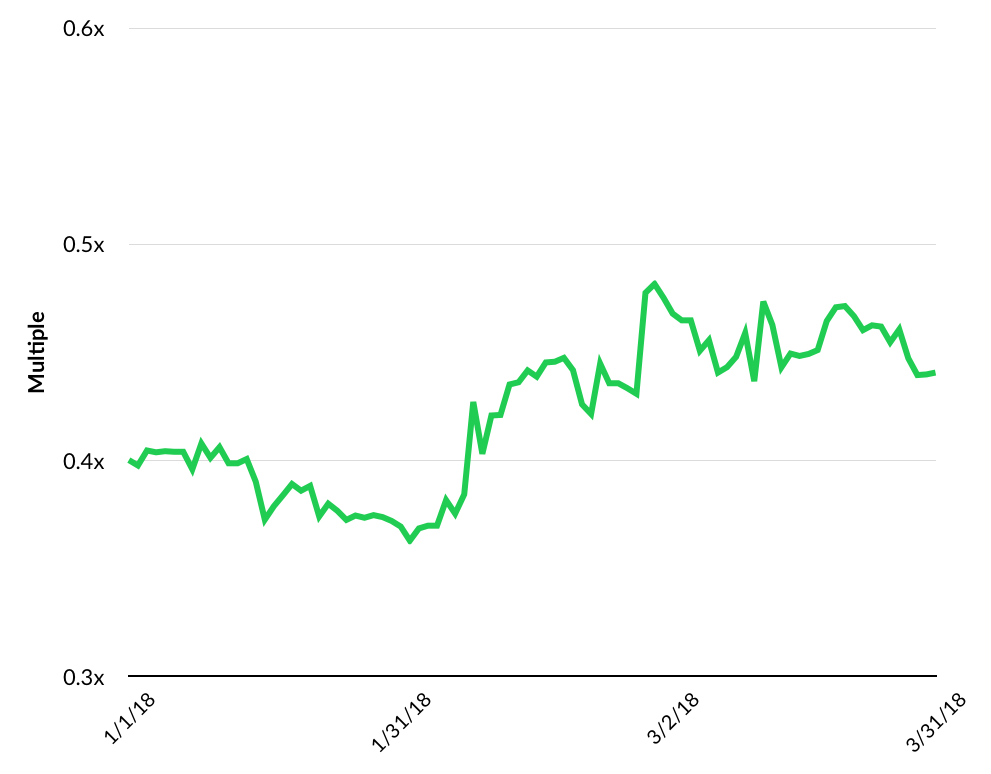

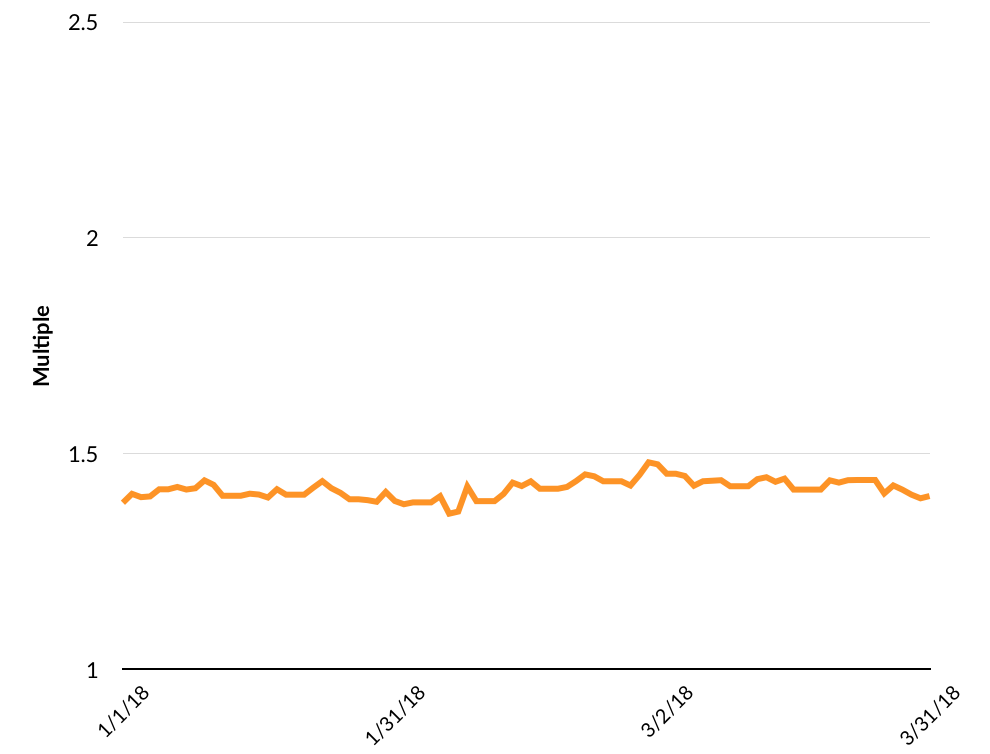

Currently, the GSV 300 has a P/E (forward) of 24.2x, or 1.4x greater than the S&P 500. Our thesis is that at over 2x, it’s a warning signal for growth stocks, and at under 1.2x, it’s a buying opportunity. We’ll monitor this trend, as well as the relationships of other key valuation metrics, to determine patterns over time.

Additional Q1 2018 IPOs of Note

Beyond Dropbox and Spotify, Other notable technology IPOs in the first quarter of 2018 include cybersecurity provider Zscaler, which popped 107% and is up 75% since its IPO. Founded in 2008, the company has raised $128 million from investors including TPG, Lightspeed Venture Partners, and CapitalG and was last privately valued at $1 billion in 2015.

China’s Netflix equivalent iQiyi made its public debut last week and performed -14% on its first day. The Baidu-spinoff was founded in 2010 and raised $1.9 billion from Sequoia, Baidu, Hillhouse, Xiaomi, and IDG. The company is now down 11% since its IPO and has a market capitalization of $11.3 billion.

Earlier this year, China’s Lufax announced its plans to go public in Hong Kong at a $60 billion valuation. Founded in 2011, Lufax is one of China’s largest wealth management platforms and is owned by Ping An Insurance Group. Other notable technology IPOs in the horizon include transaction management company DocuSign and cloud subscription software provider Zuora. Utah-based education and talent technology platform Pluralsight also filed to go public. The company has raised $193 million from investors including GSV Acceleration, Insight Venture Partners, and Felicis Ventures.