Market Snapshot

| Indices | Week | YTD |

|---|

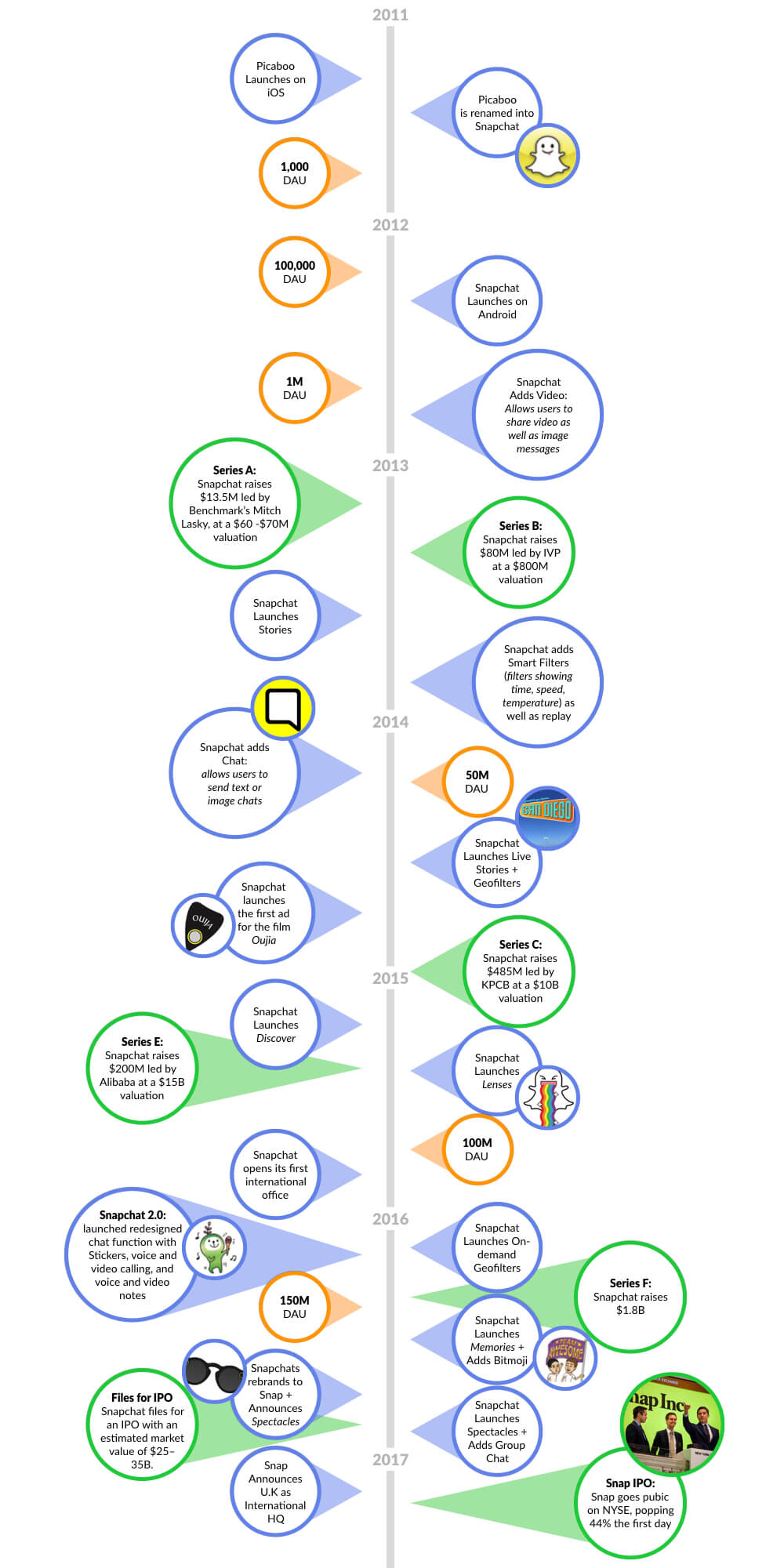

On Thursday, Snap’s IPO was greeted by eager investors, pricing above the range and popping 44%. As we’ve written in recent months, supply and demand was on the company’s side. A paltry 102 U.S. companies went public in 2016 — just 40 were venture-backed — which continued a broader IPO backlog that has been building for the past 15 years. (Disclosure: GSV owns shares in Snap).

But while Snap made its name leaving no fingerprints, it is creating a massive mark on the future of media. Old media is about sitting on your couch and watching a stationary box. Snap is media in motion. It’s built for digital natives that are mobile only and expect on-demand everything.

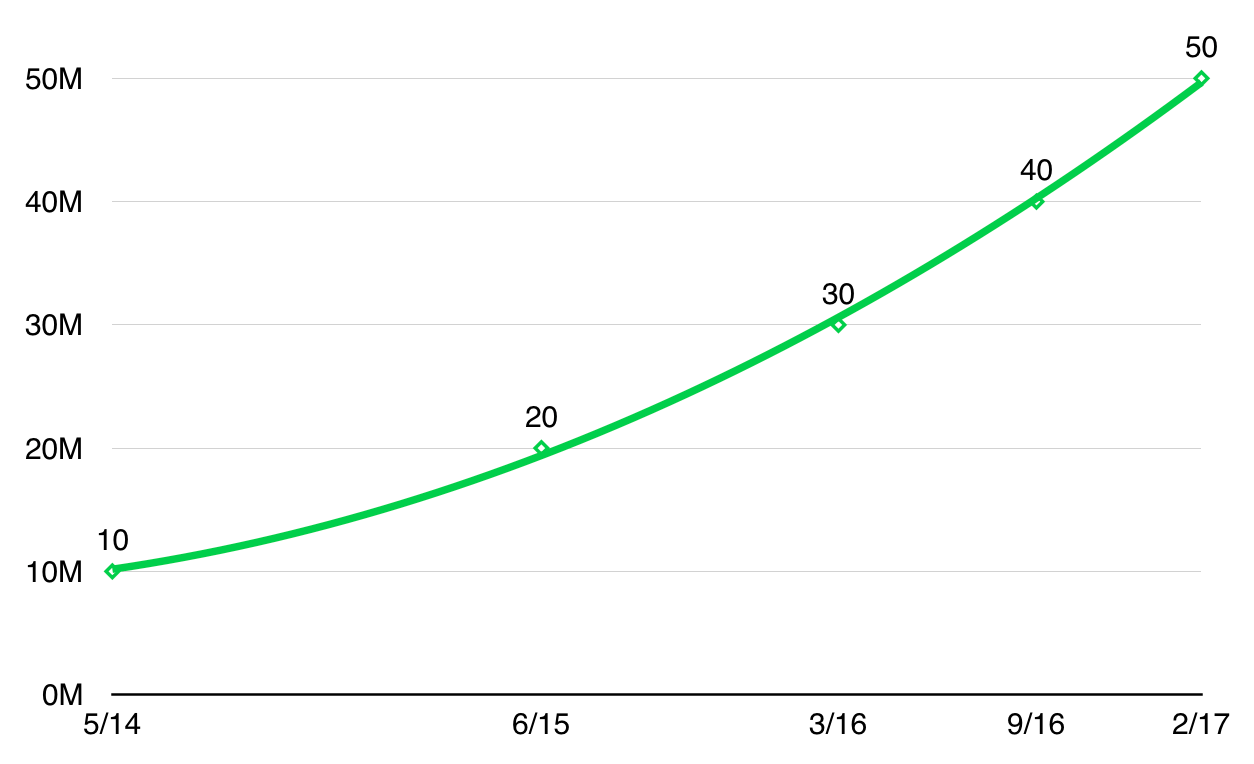

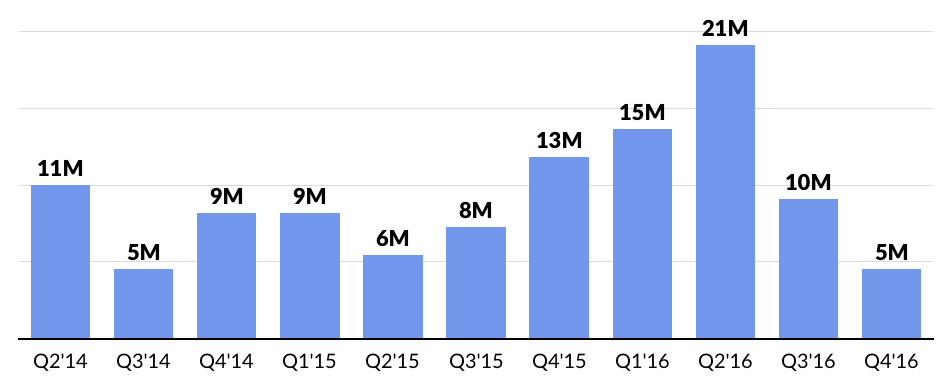

Snap incorporates everything from messaging to self-broadcasting to “Spectacles” and the engagement levels are unprecedented. Today, the company has well over 150 million daily users uploading 29,000 Snaps per second and watching a mind-blowing 10+ billion videos per day, up from just two billion in May 2015. Users spend nearly 30 minutes on the app per day and over 60% share new content every day.

We love companies that are addictive and don’t cause cancer.

USERS WATCH WELL OVER 10 BILLION VIDEOS ON SNAP PER DAY

THE FOUR “P’s”

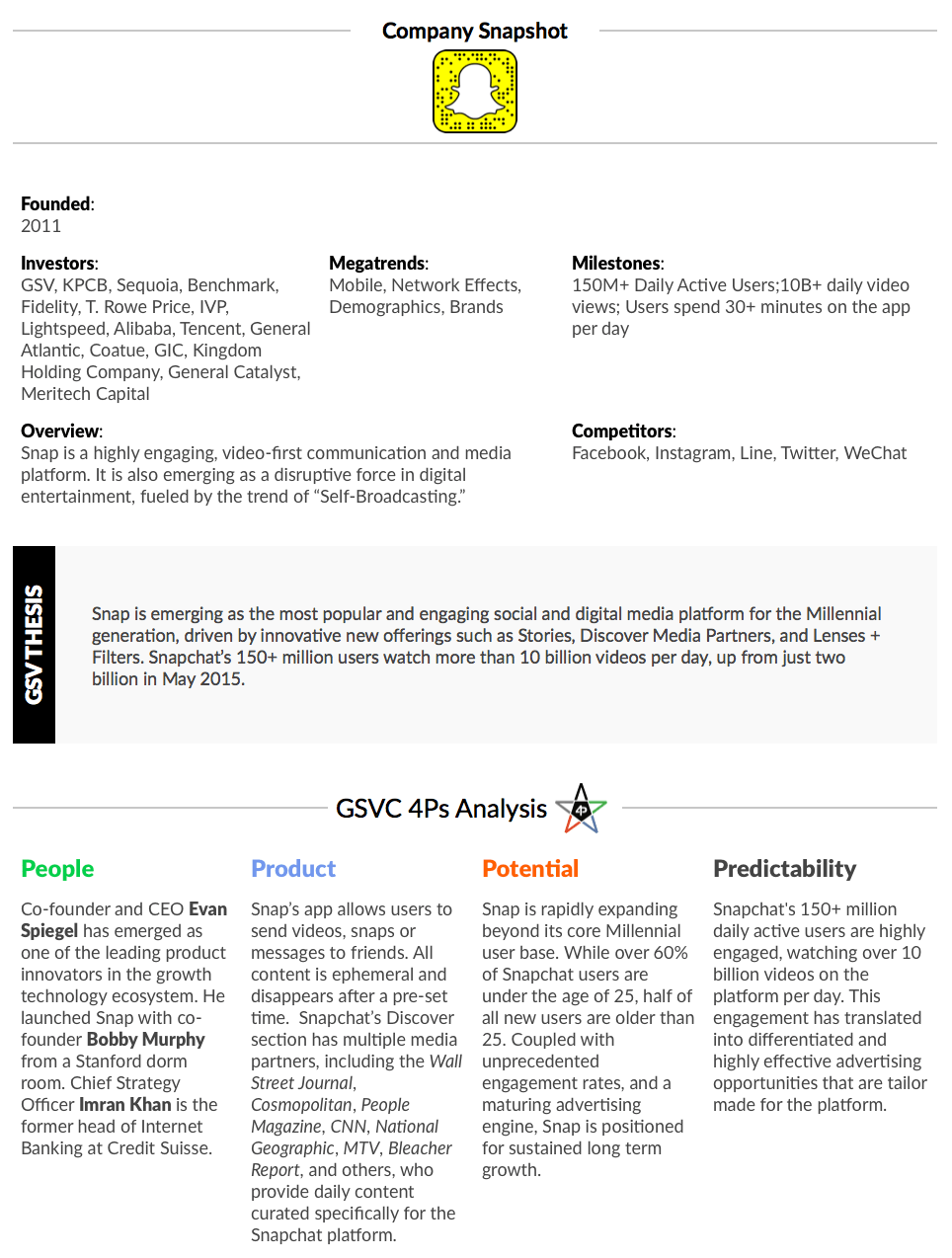

Founded in 2011, many were ready to write off Snap as it quickly ascended to the growing ranks of Unicorns. The conventional wisdom was that it would disappear as fast as a “Snap” — the company’s signature self-destructing message format.

We evaluate investment opportunities like Snap through a lens that combines key “Megatrends” with company-specific attributes — a systematic approach we call the “Four Ps”. And what we’ve concluded is that Snap is poised to reinvent the way we create, consume, and share media.

The first “P” is for “People” and it is the most important “P” by far. There is no shortage of interesting ideas, but it’s always the TEAM’s ability to execute against the opportunity that determines success or failure. Our experience is that “winners” find a way to win and attract other winners.

The Second “P” stands for “Product.” We want to support companies that are leaders in what they do, have a proprietary product or service, or better yet, a “one-of-a-kind” type of business. Said another way, a company needs to have a claim to fame. “Me too” enterprises are of no interest to us.

Technology, in general, and the Internet, in particular, are all about disproportionate gains to the leader in a category. We want to back businesses that not only survive, but thrive, during their corporate evolution.

The Third “P” is for “Potential” — how big can the company become? Determining total future market potential is a pillar of our research. Megatrends influence our analysis as they provide “tailwinds” to accelerate growth. Often, the companies with the most potential are where the biggest problems are —the bigger the problem, the bigger the opportunity.

The last “P” is for “Predictability” — how visible is the company’s growth and what kind of operating leverage does it get with scale? For most new enterprises, having any degree of confidence in the forecast is a challenge. But we are looking for business models that create predictability, whether it’s through recurring revenue or a clear articulation of operating metrics that drive the business.

PEOPLE

Snap CEO Evan Spiegel met co-founder Bobby Murphy at Stanford, where they eventually became roommates. Spiegel recalls in interviews that he would often ask Murphy for help with computer science projects. Murphy remembers being impressed with a line of shirts that Spiegel designed for their fraternity (Spiegel would later draw the iconic “ghost” icon).

Before working on Snapchat, Spiegel and Murphy collaborated on a Web product, Future Freshman, a guide for high school students applying to college. The product failed to gain any meaningful traction, however, and the founders went back to the drawing board.

In July 2011, they launched Snapchat — originally named “Picaboo” — inspired by a friend who lamented sending a photo in a text message that he would never be able to erase. By the end of the summer, it had only 127 users.

The turning point was a decision to take Snapchat from a clunky desktop computer program and instead focus entirely on building a mobile app. By the Spring of 2012, Snapchat had over 100,000 users and the app was going viral, particularly among young Millennials. On any given day, app activity spiked between 9:00AM and 3:00PM — in other words, among high school students.

A year later, Mark Zuckerberg reportedly approached Snap with a what seemed a like a preposterous $3 billion acquisition offer. Even more preposterous? Spiegel turned Zuck down, despite estimates from Forbes that he and co-founder Bobby Murphy were forgoing a $750 million windfall.

Today, with a successful IPO in the rearview mirror, the company is continuing to a assemble a core leadership team to grow into and beyond its valuation. Snap’s Chief Strategy Officer is Imran Khan, the former head of Internet Banking at Credit Suisse. Tom Conrad, the Vice President of Product is the former CTO of Pandora. CFO Andrew Vollero was a former executive at Mattel, and Timothy Sehn, Snap’s SVP of Engineering was formerly the Director of Software Development at Amazon.

Snap’s Board includes Chairman Michael Lynton (Former CEO & Chairman, Sony), Mitch Lasky (Partner, Benchmark), Joanna Coles (Chief Content Officer, Hearst Corporation), and A.G. Lafley (former CEO, P&G).

PRODUCT

A Camera Company?

Snap raised more than a few eyebrows in its prospectus when when it described itself as a “Camera Company.” The logic, according to Snap, is that the company believes that, “reinventing the camera represents our greatest opportunity to improve the way that people live and communicate.”

Unlike Facebook, Twitter, or Instagram, the first thing you see when you open Snap isn’t a massive feed of information. It’s a camera.

That’s on purpose, and it’s at the core of Snap’s strategy. The whole idea behind the app is to drive users to create content and share it — even if it’s just goofy videos. The push toward creating content as a vehicle to ultimately drive content consumption has paid off, with well over 10 billion videos viewed on the platform per day.

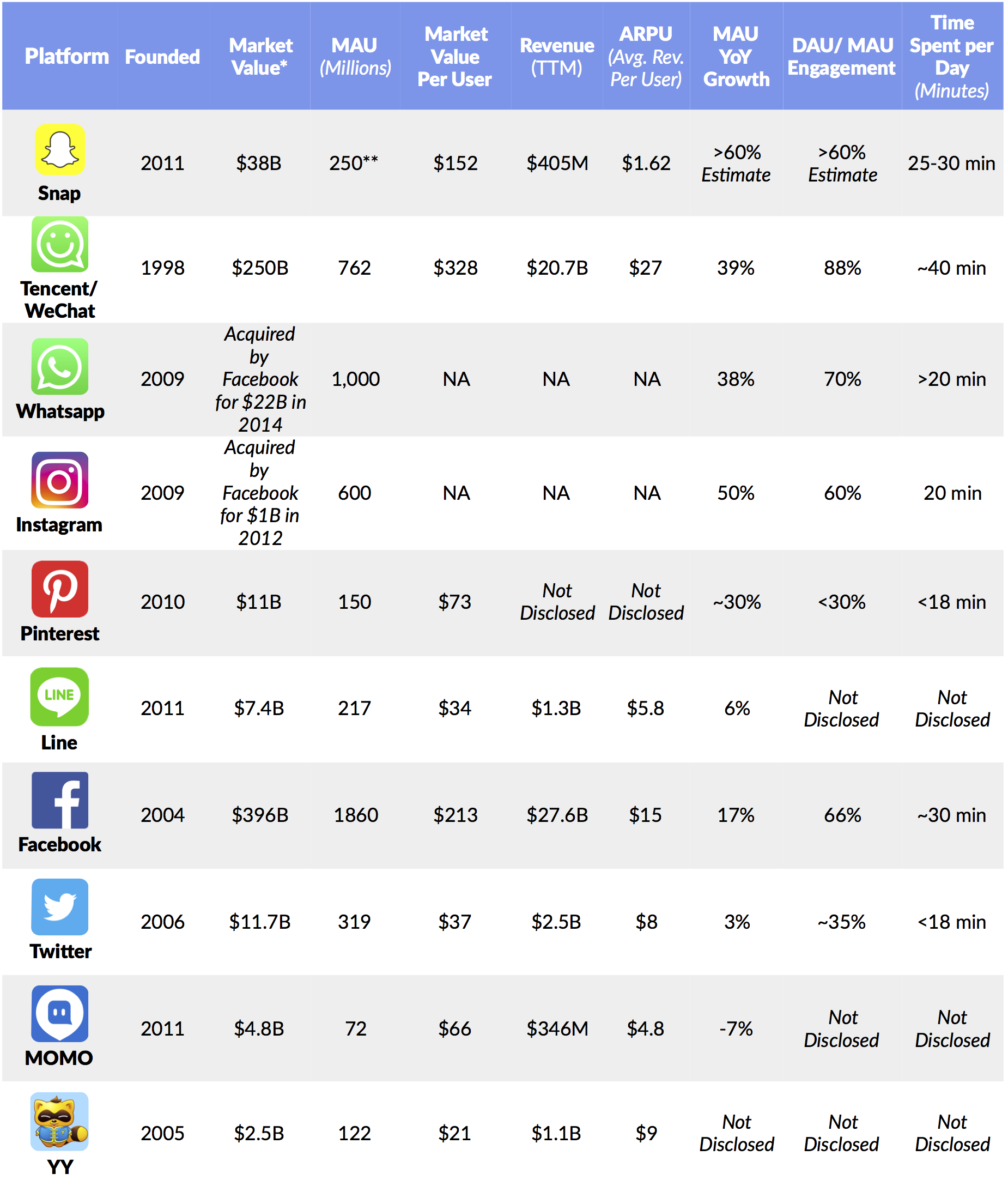

Users, Engagement, and Growth Dynamics by Social Media Platform

Source: Yahoo Finance, Company Announcements, GSV Asset Management

*Market Values as of March 5, 2017

**Reported by Fortune and Re/code

The number one, two, and three fundamental of a successful platform is engagement. Snap creates deep engagement with a platform that is built on on four core pillars:

- Private Messaging: At the center of the Snap platform is its signature private photo messaging interface, “Snapchat,” where messages are automatically deleted after they are read by the recipient. For the first-time user, Snapchat doesn’t look or feel like a normal form of communication. Open the app, and you’re greeted with a full-screen viewfinder that looks a lot like your phone’s regular camera app. This is where committed users upload and send over 29,000 snaps per second, annotating them with emojis or doodles, or applying one of Snapchat’s constantly changing collection of “filters.”

- Stories: Swiping right gets you to “Stories”. These are short video clips that run in a series and disappear, typically within 24 hours. You, your friends, and people you follow, can share stories.

- Discover: Swipe right again and you’ll find Snapchat’s “Discover” channels. Each channel is produced by established media brands such as CNN, ESPN, the Wall Street Journal, Vice, and BuzzFeed, and they offer engaging short-form content optimized for the Snapchat platform.

- Memories: Swipe up on your camera screen and you can see your Memories, a collection of old Snaps that you’ve saved and care share again. Introduced in July 2016, Memories reflects Snapchat’s growing status as the default camera for its users.

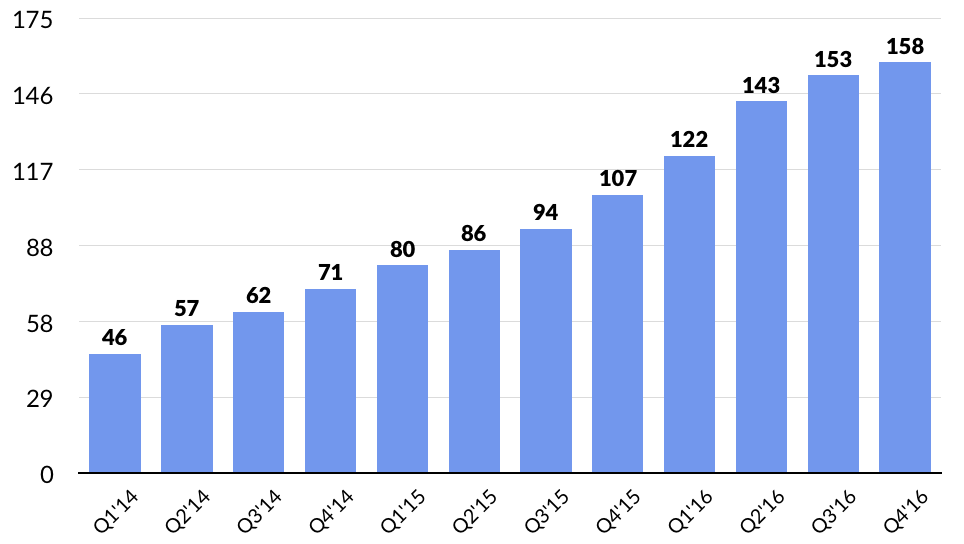

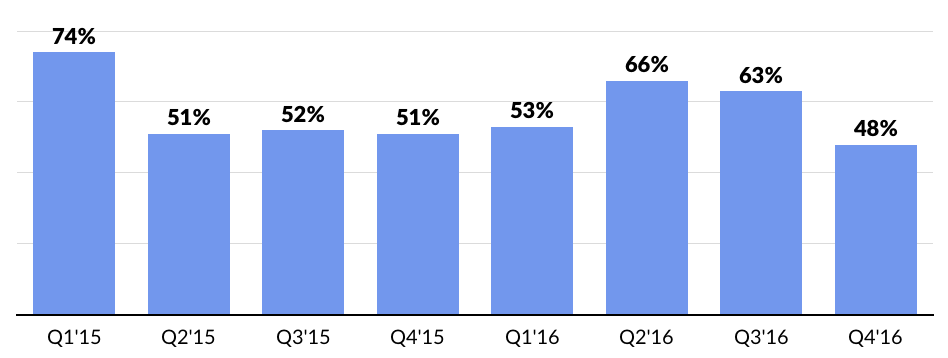

Snap’s user growth has maintained a strong clip, with the only concern being the most recent quarter, where Daily Active Users (DAUs) decelerated to “only” 48%.

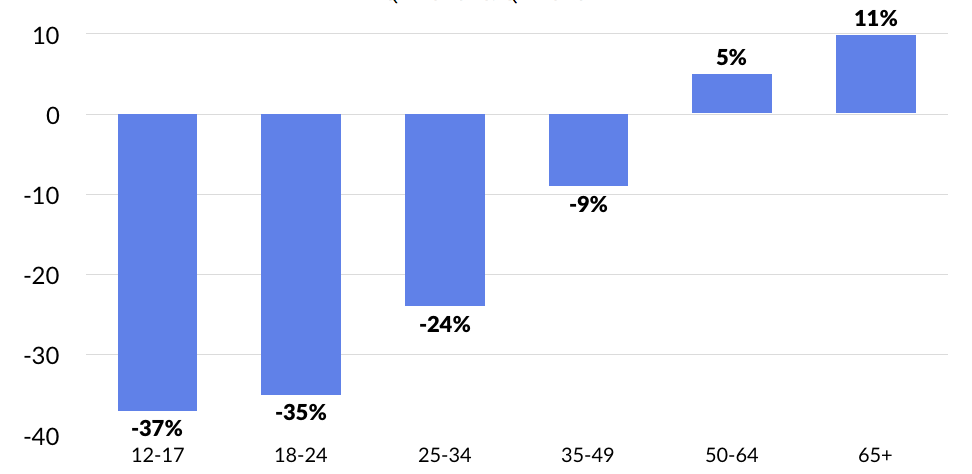

Part of Snap’s recent DAU slowdown is a direct result of the launch of Instagram “Stories.” After a long list of failed attempts to copy Snap, Instagram and Facebook have finally found something that works. The results have been impressive — Instagram now has over 150 million users engaging with Stories on a daily basis. Additionally, Instagram has surpassed 400 million daily active users, growing at approximately 50%+ year-over-year.

While the slowdown in DAU is worth monitoring, to date, Snap has only been focused on developed countries in North America and Western Europe. Essentially 3/4th of its user base comes from countries that make up 12% of the World’s population.

Compare that to Facebook, which has only 25% of its user base in North America and Europe. The rest is in developing and emerging countries. This represents a massive expansion opportunity for Snap, but local bandwidth will be a gating factor in the near term. Snap is a video-centric app that requires strong internet connections to function.

It’s also worth noting that Snap has seen its user growth slow down in the past. But it has consistently managed to release new tools and features to reignite growth and engagement. Prior to the release of Snap Stories, user growth was slowing down. In early 2015, user growth was also decelerating, but it kicked back into gear with the enhancement of video viewing tools and the launch of interactive “Lenses.”

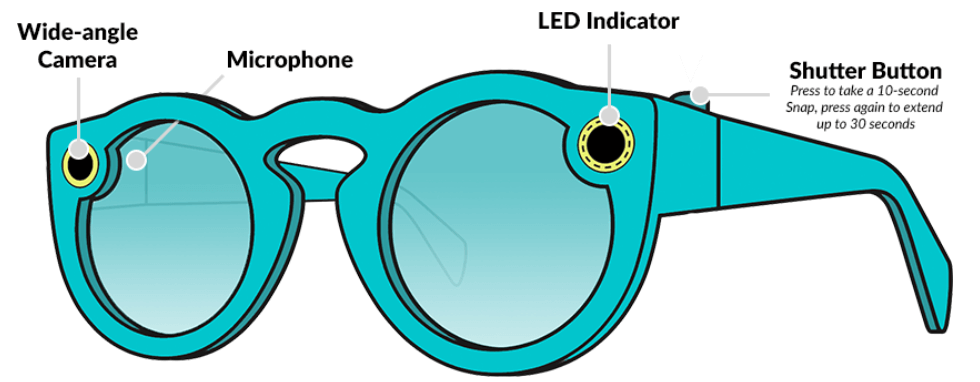

In September 2016, Snap announced the launch of Spectacles, a set of connected sunglasses that record 10-second videos and sync seamlessly with the company’s flagship app, Snapchat, making it easy to create Memories.

What’s special about Spectacles is that they capture video from a human perspective — and they’re cool (unlike their predecessor, Google Glass). The camera lens is designed to mimic the way the human eye sees the World. When a user views a Memory afterwards it makes them feel like they are reliving the experience.

The product roll-out has been marketing gold. Without advanced warning, Snap dropped unmanned vending machines, or “Snapbots” — into random locations across the United States, from Venice Beach to New York City. The machines, which sporadically appeared on a map on the company’s website, were greeted immediately by throngs of would-be buyers. While the glasses retail for $130, they sold for as much as $2,500 on eBay. Today, Spectacles can be bought online on Snap’s website.

With the launch of Spectacles as their first hardware product, Snap is demonstrating that it is truly committed to reinventing the camera. The product has not yet generated significant revenue or scale, but the opportunity for future hardware releases is tantalizing given a network of 150+ million loyal followers. If just 4% of Snap’s user base bought a pair over the next year, that could result in approximately $1 billion of incremental revenue.

According to the New York Times, Snap is rumored to be working on a drone to follow users and take overhead videos and photographs. Stay tuned.

PREDICTABILITY

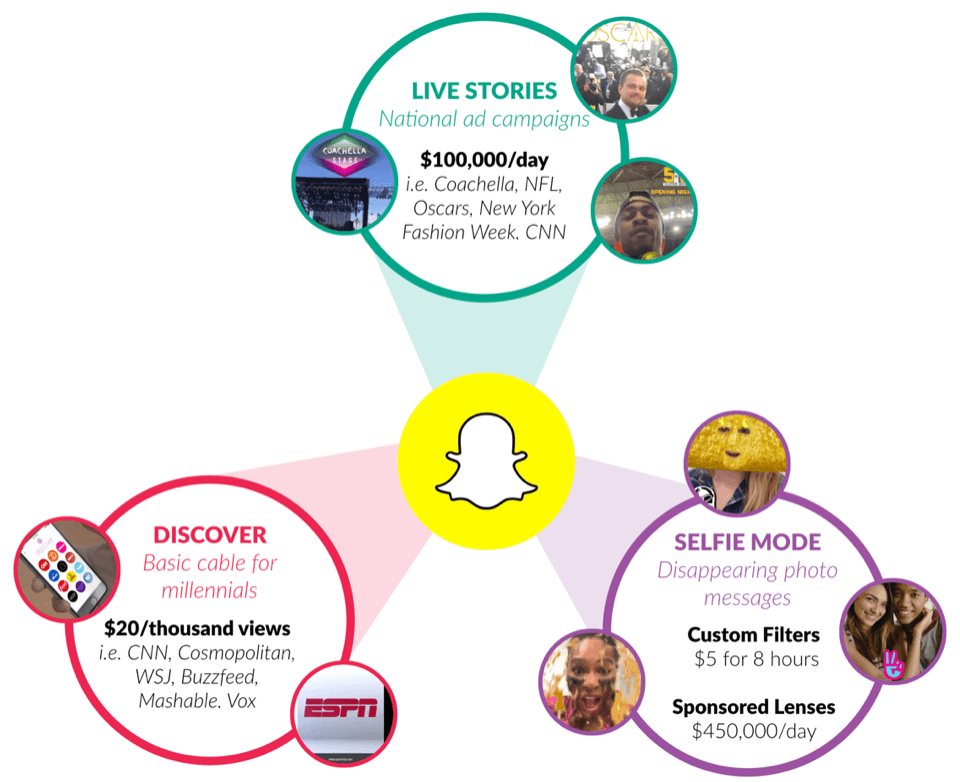

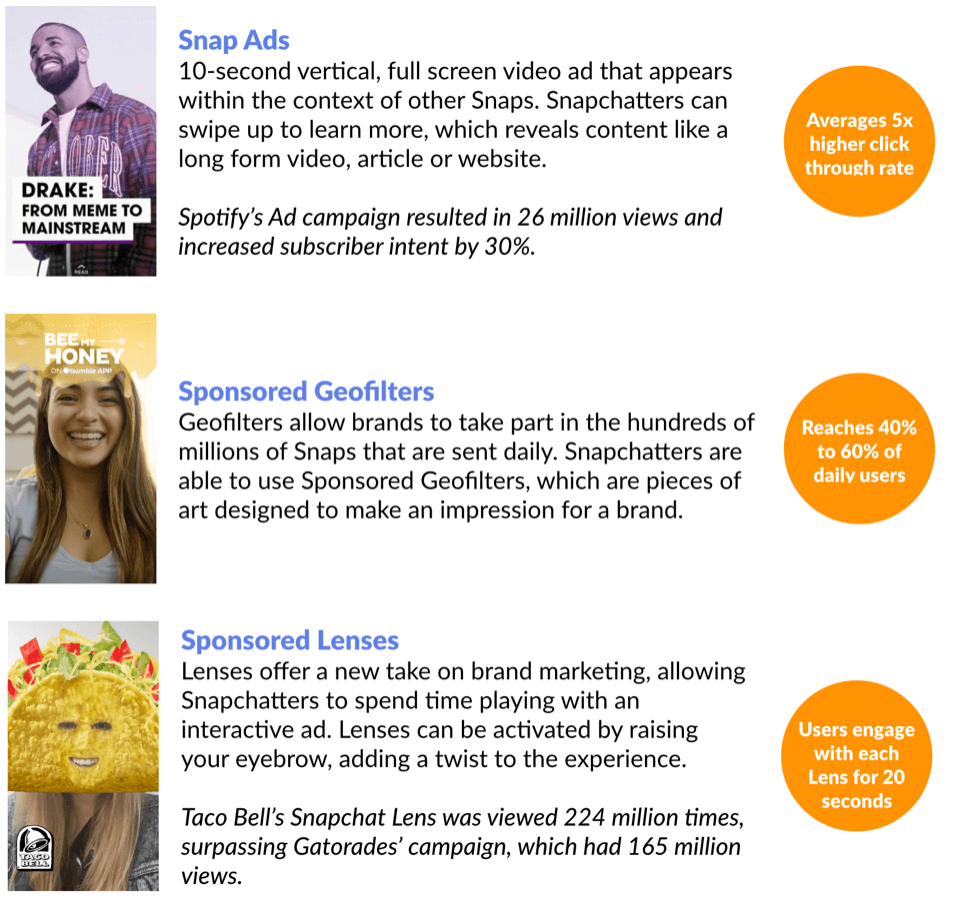

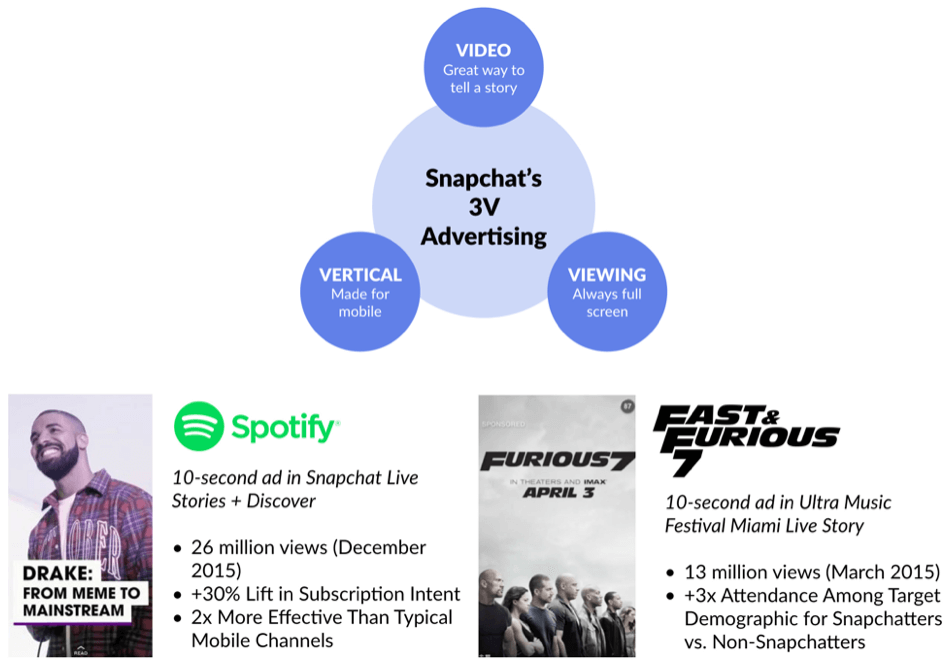

The best growth companies have high predictability and gain operating leverage as they continue to achieve economies of scale. This is often a major challenge for young, fast-growing businesses. Snap’s growth, and increasingly its predictability, has been fueled by the creation of differentiated, highly effective advertising channels that map to its core areas of user engagement.

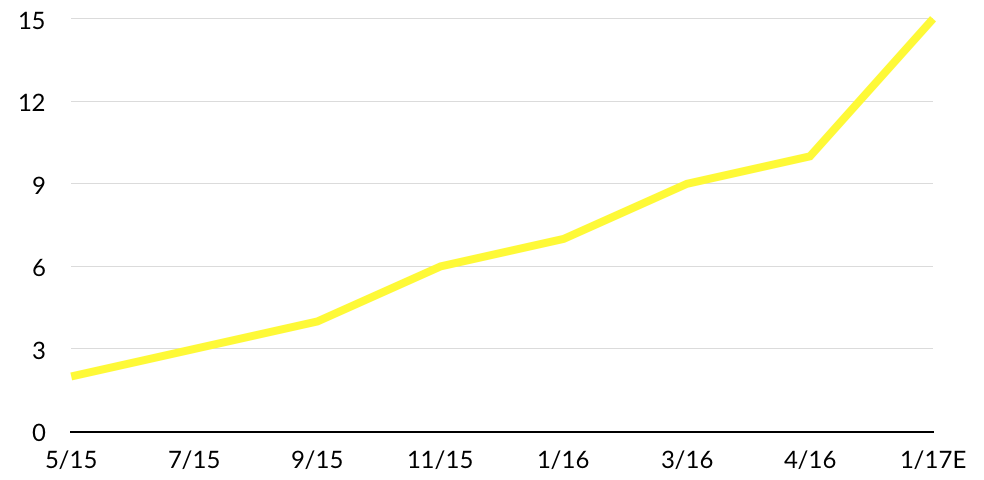

In just 24 months since beginning to monetize, Snap has managed to grow to $405 million in annual revenue, growing at +408% in Q4 2016. On a per user basis (ARPU), Snap generated $2.71 for 2016.

But that’s just a beginning. The upside looks open-ended when comparing Snap to Facebook, which generates about $62.23 per monthly active user in North America, or about $94.33 when adjusted to daily active users (DAU). Snap, with essentially all of its DAU ARPU generated in North America today, going from the current $5.64 to about $30 ARPU in North America would imply approximately $3.5 billion in annual revenue from that geography alone. We believe this can be quickly achieved, especially if DAU growth continues to be strong.

A proxy for Snap’s impressive level of engagement is that the company’s CPM — cost per thousand clicks — has been way above comparable social media platforms. In some cases, CPM rates that the company charges advertisers has been in the $40-60 level, which is competitive with TV advertisements, according to Adweek. Facebook, by contrast, has CPMs in the $6.00 range, and most other social media sites have CPMs of around $2.00.

Snap worked with MediaSciences to study the effectiveness of its various advertising vehicles. The results showed that Snap ads generated 2.0x the visual attention compared to ads on Facebook, 1.5x compared to Instagram, and 1.3x more than on YouTube.

On last year’s Cinco de Mayo holiday, for example, Taco Bell’s sponsored “Lens” was viewed more than 224 million times by Snapchat users, surpassing Gatorade’s Super Bowl campaign which was viewed 165 million times a few months earlier. The average user engaged with Taco Bell’s lens for 20+ seconds before sharing it with friends.

Snap announced the launch of “Snapchat Partners”, its long-anticipated advertising API, which will hook up more than 20 tech-minded companies. The API is expected to expand advertising on the platform dramatically.

Snap advertisements is sold by third parties, divided into two core groups: “Ads Partners” and “Creative Partners”. The first group develops software for Snap advertisers, enabling buying, optimizing and analyzing of campaigns. Ads Partners includes 4C, Amobee, VaynerMedia, Brand Networks, SocialCode, TubeMogul, Adaptly, and Unified. The Creative Partners represent a mix of players with expertise in social content and experience with Snapchat’s vertical-video format. (Disclosure: GSV owns shares in 4C)

POTENTIAL

Looking ahead, we think there are strong fundamentals in place to support Snap’s continued strong revenue growth. We estimate that with persistent DAU expansion, coupled with high engagement rates, the company could achieve ~$1.4 billion in revenue in 2017, over $3 billion in 2018, and ~$6 billion in 2019.

When looking at the speed of Snap’s monetization, it is remarkable that they’ve reached over $400 million in revenue by year five (or in just 5 quarters of real revenue generation). Facebook at its fifth year had just under $300 million in revenue, and Twitter had just over $100 million of revenue.

Source: Company reports and Analyst Estimates for 2017

*Snap’s 2017 Valuation is at IPO price, and the 2017 revenue estimates are from GSV Asset Management

From Showtime to Snaptime

“Kids, turn off the TV!”

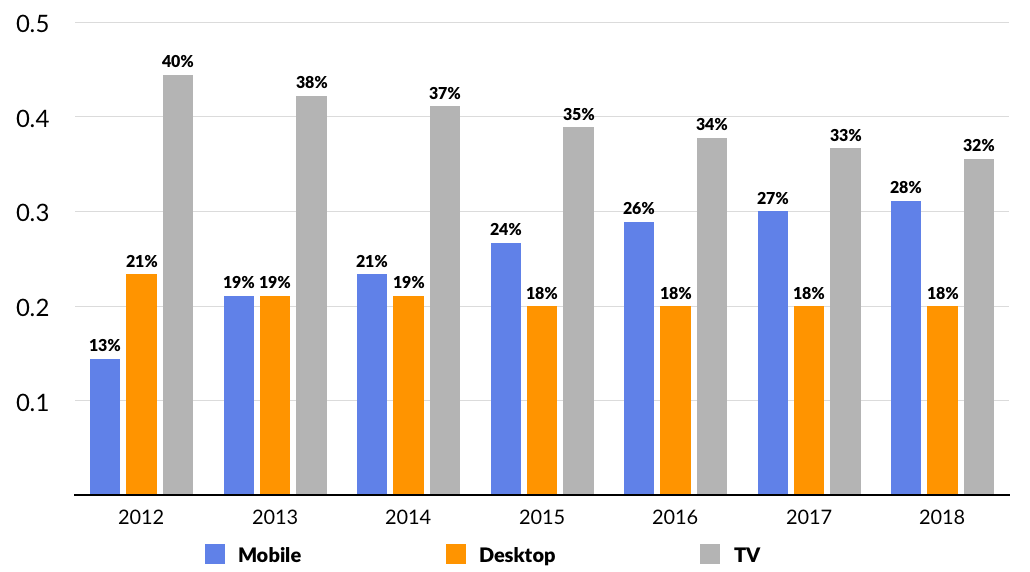

You may not hear this as much from parents in 2017. Kids, teens, and millennials are all ditching the TV in greater numbers as self-broadcasting emerges as a key megatrend in media. Here’s how it works:

“Channel 1” — Snapchat: Watch Stories from your friends to see what they were up to in the past 24 hours. Then catch up on sports highlights on the ESPN channel in Discover. Finally, check out the latest from your favorite celebrities — looks like Rihanna had an epic Christmas party at her house in Barbados…

“Channel 2” — Facebook: Watch a few Live videos from your friends last night. That puppy video your cousin shared? It already has half a million likes. Then catch up on trending news.

“Channel 3” — Instagram: Check out David Beckham pouring a can of Guinness into the Christmas beef stew. And watch Shakira singing a preview of her new song. Then catch up on your other friends who are not on Snapchat yet.

“Channel 4” — Musical.ly: Watch your friend lip-syncing to Sia’s new song…

“Channel 5” (if you have time) — Twitter: Watch some live sports coverage. Check in on what the The Donald has to say.

We are entering a phase where self-broadcasting platforms are poised to deliver a death-blow to traditional television. A key catalyst has been rapidly improving Internet connectivity, allowing for the high-quality display of live broadcasting. Another has been the continued evolution of smartphones to devices with large, high-definition screens. Watching video on your phone is no longer tough on the eye. And recording yourself is simple — just tap Snapchat, and it’s “Action!”

To illustrate the power and magnitude of this trend, consider that over 70% of ESPN’s Millennial audience consumes ESPN content from the Discover channel on Snapchat. Only a small fraction actually watch the content on ESPN, the “TV channel.” Similar shifts are happening on other media platforms. People Magazine, Cosmopolitan, National Geographic, MTV, Refinery 29, Vice Media — all are seeing strong user engagement through the Snapchat Discover platform.

Additionally, Disney recently announced that it will create a new post-episode program for its hit show, The Bachelor. The new production will be streamed on Snapchat as a Story, available for 24 hours following each episode. That’s just the first of several upcoming Disney-ABC Snapchat series. Look for more to follow in 2017.

It’s no wonder NBCUniversal invested $500 million in the Snap IPO. NBCUniversal’s partnership with Snap builds on their strategy to drive digital growth for their businesses, and is a very strong signal that media focus and money is shifting towards Snap.

The future is now.

Marketing Validation

Over the past 12 months, Snap has locked in 10 partnerships with independent firms to measure the effectiveness of its advertising channels. Findings from a recent research initiative with Oracle’s data cloud division show that the company’s marketing tools can boost in-store sales — including 92 percent of ads for consumer packaged goods from deodorant to breakfast cereals. As Snap generates transparent metrics around the effectiveness of its marketing engine, it will continue to lock in high profile, lucrative advertising deals.

AR/VR

The rise of consumer Augmented and Virtual Reality (AR/VR) aligns directly Snap’s long term engagement strategy. Applying interactive “Lenses” to photos has already proven to be wildly popular — AR/VR enables the expansion of this capability.

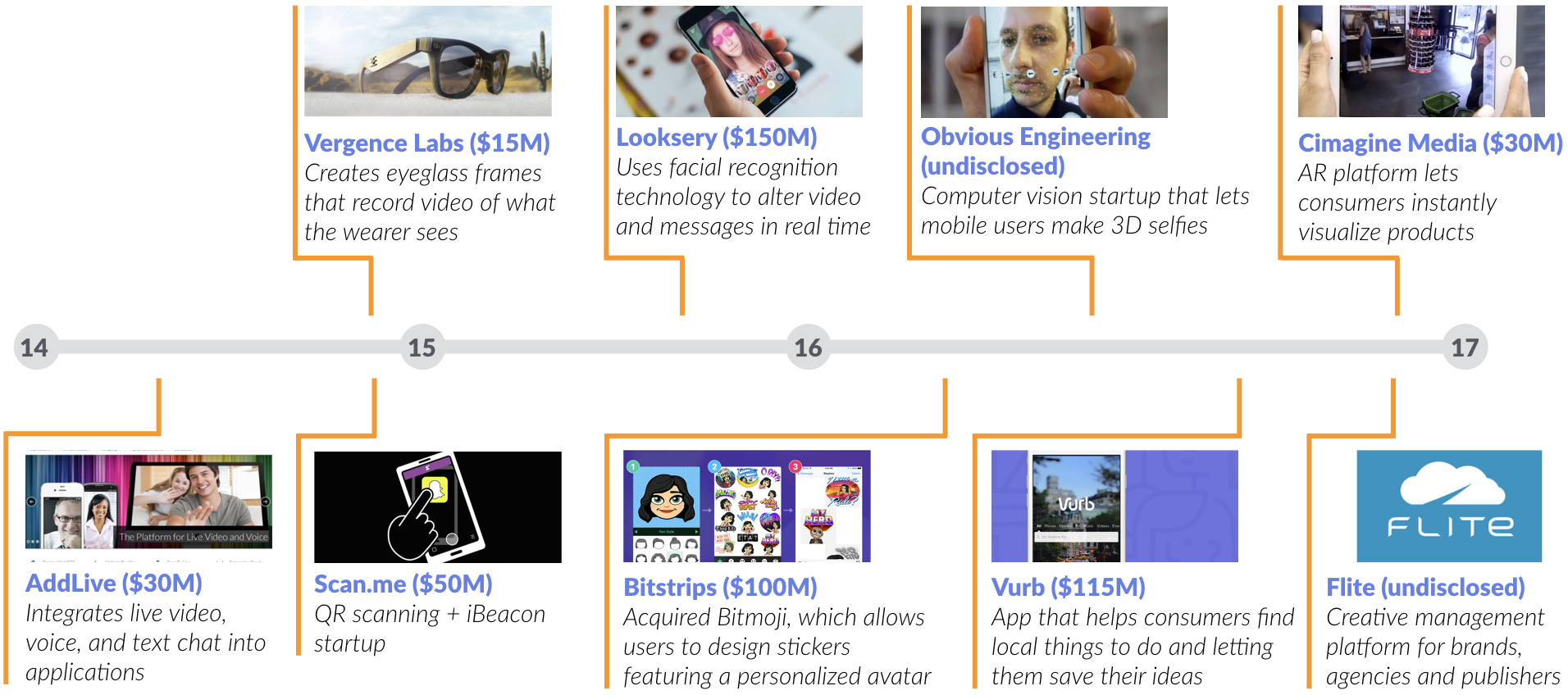

Snap has acquired Vengeance Labs (creates eyeglass frames that record videos of what the wearer sees) and Seene/Obvious Engineering (computer vision startups that let’s mobile users take 3D “selfies”. The company has also been on a hiring spree, adding hardware executives from GoPro, Google Glass, Nokia, HoloLens, and Qualcomm.