Market Snapshot

| Indices | Week | YTD |

|---|

Last week, GSV Capital (GSVC) hosted its third annual Investor Day at GSVlabs, a global innovation platform located in the heart of Silicon Valley. It was a fitting backdrop for the leaders of GSV’s game-changing portfolio companies to share a window to the future of their businesses and the industries they are transforming. We welcomed over 550 attendees and 15 presenting company CEOs. (Disclosure: GSV owns shares in GSVlabs)

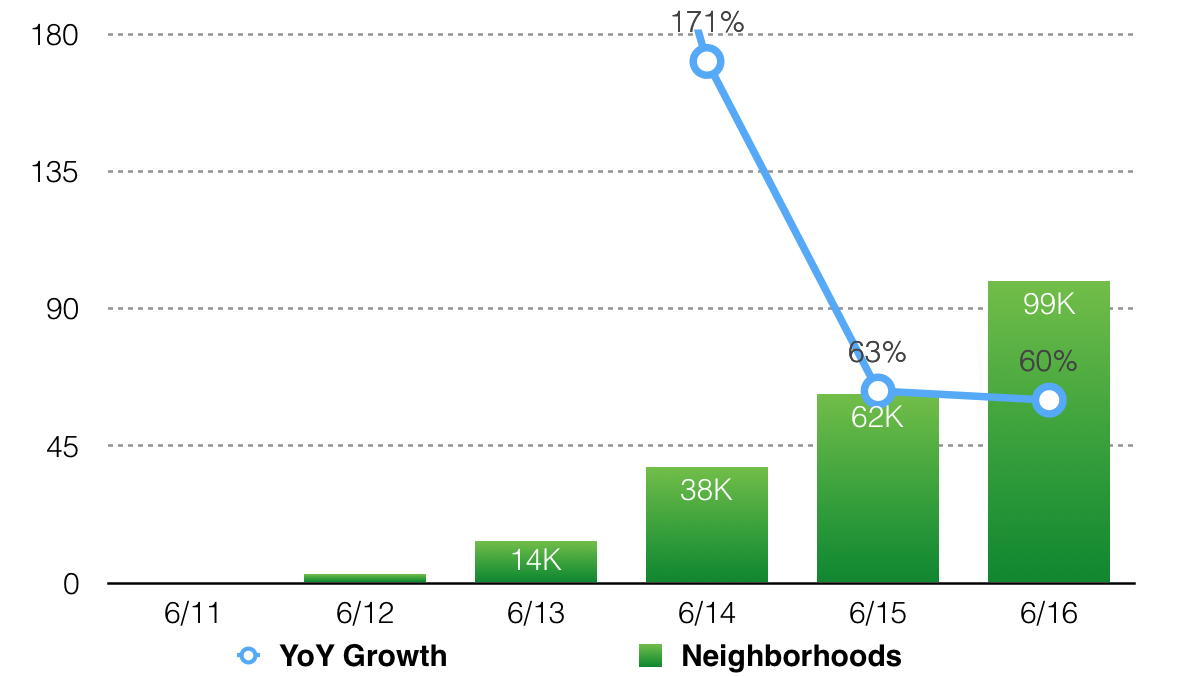

While the media has taken to reporting on wounded Unicorns, and increasingly seems to view the optimism in Silicon Valley as a distorted reality field, what’s exciting to us is that innovation is accelerating. The vast majority of GSVC’s portfolio continue to exhibit extraordinary growth characteristics, with expected year-over-year revenue growth exceeding 100%. Some may quibble about appropriate values, but we’re very pleased with the value creation opportunity.

As a liquid, publicly traded stock, GSVC is a unique vehicle that enables public investors to access this asset class, which has increasingly been limited to select venture capital firms and institutional investors. We believe that growth drives enterprise value, and accordingly, our mission is to build a portfolio of the most dynamic, rapidly growing, late-stage private companies — the “Stars of Tomorrow”. (Click HERE to see my opening remarks on the state of play at GSVC, our strategy, and portfolio)

For those who were unable to join us this year, we have curated a video library of 2016 Investor Day speakers, which are discussed below. We hope you enjoy their insights as much as we did.

A NEW XEROX PARC

In 1970, Xerox Corporation launched Xerox PARC in Palo Alto to develop captive innovation for the company. The charter for the initiative was to create “The Office of the Future”. Assembling a world-class team of experts in information technology and physical sciences, Xerox PARC was a catalyst for innovation — it yielded the original design for the personal computer (and famously inspired Steve Jobs to create the first Macintosh), the first Graphical User Interface, and even the computer mouse.

Founded in 2012, GSVlabs accelerates startups and connects corporations to exponential technologies, business models, and entrepreneurs. We believe it has the potential to be a next generation Xerox PARC.

At the core of GSVlabs is a community of game-changing entrepreneurs focused on key verticals, including Big Data, Sustainability, Education Technology (EdTech), Entertainment, and Mobile. GSVlabs is home to over 170 startups, which raised $200 million in 2015.

WATCH A PANEL DISCUSSION ON THE GSVLABS INNOVATION PLATFORM HERE

GSVlabs CMO Diane Flynn Discusses the Power of an Innovation Platform with Marlon Evans (CEO, GSVlabs), Lisa Hammitt (Vice President, IBM Cloud Portfolio), and Neville Taraporewalla (President, Brand Capital — $2 Billion Venture Capital Arm of the Times of India) — Pictured Left to Right

As the access point to a startup ecosystem, major corporations like AT&T, Intel, IBM, Intuit, the Times of India, and JetBlue choose to partner with GSVlabs in order to launch new initiatives, identify talent, attack new markets, and propel new business models. GSVlabs creates value through this virtuous circle, attracting and accelerating promising entrepreneurs, while providing targeted innovation services for forward-thinking corporations. (Click HERE for the recently-published GSVlabs white paper on the future of corporate innovation).

Beyond serving as the perfect setting for this year’s Investor Day, GSVlabs is a key asset our shareholders — it is 70%+ owned by GSV Capital. GSVlabs sits at the intersection of proven models — co-working platforms like WeWork ($16 billion valuation), which generate recurring revenue from startups, and accelerators like Y-Combinator, which capture equity in potentially game-changing businesses (Y-Combinator alumni include Dropbox and Airbnb, valued at $10 billion and $26 billion, respectively). (Disclosure: GSV owns shares in Dropbox)

In May 2016, GSVlabs announced a partnership with the $2 billion venture capital arm of the Times of India to launch two centers in India — one in Bangalore and one in Delhi (Gurgaon). We envision GSVlabs expanding to the top innovation centers around the World.

EXPONENTIAL IDEAS: 2016 INVESTOR DAY SPEAKERS

PayNearMe

PayNearMe is a next-generation, electronic cash payment platform. It serves what the Federal Deposit Insurance Corporation (FDIC) estimates to be 93 million “unbanked” and “underbanked” residents of the United States, allowing them to pay auto, rent, and utilities bills through retail locations. The company currently has relationships with 7-Eleven, Family Dollar, and ACE Cash Express stores, creating a footprint of over 17,000 locations across the country. (Disclosure: GSV owns shares in PayNearMe)

WATCH REMARKS FROM PAYNEARME CEO DANNY SHADER HERE

Danny Shader Outlines How PayNearMe is Serving a Market of over 93 Million “Underbanked” Americans

Source: GSV Asset Management

CEO Danny Shader discussed how PayNearMe is continuing to aggressively expand its retail footprint, as well as the breadth of industries that its payment system covers, tapping into over $1 trillion in U.S. cash transactions that occur per year.

Enjoy

Enjoy is a personal commerce platform built to revolutionize the way people buy and enjoy the world’s best technology products. The central feature of the company is hand-delivery of every item, including product set-up, by an Enjoy product expert, at a time and place of the customer’s choosing. (Disclosure: GSV owns shares in Enjoy)

WATCH REMARKS FROM ENJOY CO-FOUNDERS RON JOHNSON + TOM SUITER HERE

Ron Johnson (Right) and Tom Suiter (Left) Share a Vision for Commerce Reimagined

Co-founders Ron Johnson (Former Head of Apple Retail + CEO of J.C. Penney) and Tom Suiter (Former Apple Creative Director) discussed how Enjoy is creating and scaling a novel retail experience that customers love. It is effectively Lyft-meets-Apple Genius Bar. (Disclosure: GSV owns shares shares in Lyft)

Lytro

Lytro is a pioneering Light Field Imaging platform that is redefining the way images are captured and created. CEO Jason Rosenthal discussed how the company’s technology platform will have a transformative impact across a broad range of applications — from virtual reality to photography and filmmaking. Effectively, Lytro has the opportunity to improve any imaging device with a lens and sensor. (Disclosure: GSV owns shares in Lytro)

WATCH REMARKS FROM LYTRO CEO JASON ROSENTHAL HERE

Jason Rosenthal Discusses the Future of Imaging and Augmented/Virtual Reality

DogVacay

DogVacay is a peer-to-peer marketplace connecting pet owners with individuals providing boarding and daycare services. By combining the efficiencies of a transparent, two-sided marketplace, with a focus on curating a network of high-quality pet caregivers, DogVacay is emerging as a disruptive force in the $60+ billion U.S. pet services market. COO Deborah Sharkey discussed how DogVacay building a vibrant marketplace — and more importantly, a brand — that pet owners trust. (Disclosure: GSV owns shares in DogVacay)

WATCH REMARKS FROM DOGVACAY COO DEBORAH SHARKEY HERE

Deborah Sharkey Discusses the Evolution of the DogVacay Peer-to-Peer Marketplace

Curious

Curious helps people learn anything, from how to play the banjo to basic business skills. Described by Forbes as the “Netflix for learning,” the Curious platform offers “all you can eat” access to over 20,000 high quality digital lessons on virtually any topic through a subscription model. (Disclosure: GSV owns shares in Curious)

WATCH REMARKS FROM CURIOUS CEO JUSTIN KITCH HERE

Justin Kitch Discusses How Curious Can Become a Netflix for Lifelong Learners with GSV Partner Matt Hanson (Right)

CEO Justin Kitch discussed the cognitive science research that is powering Curious, which demonstrates that learning doesn’t just make you smarter — it makes you happier, healthier, and more productive. Emphasizing engaging, short-form content, Curious creates entertaining, on-demand educational experiences for the lifelong learner. It focuses on eight core content areas — Mind/Body, Relationships, Humanities, STEM, Aesthetic, Music, Play, and Work — to help users build their “Curious Quotient”, or CQ.

JAMF

JAMF is rethinking enterprise mobility, streamlining the way commercial, education, and government organizations adopt and optimize the Apple platform. CEO Dean Hager shared a perspective on the emerging opportunities and challenges that come with integrating mobile devices into everything we do. (Disclosure: GSV owns shares in JAMF)

WATCH REMARKS FROM JAMF CEO DEAN HAGER HERE

Dean Hager Discusses JAMF’s Role in the Future of Enterprise Mobility

Source: GSV Asset Management

OZY

OZY is a digital media platform focused on going beyond news to what’s next. It has attracted an active audience of more than 20 million people — surpassing Politico, the Economist, and the New Yorker — by delivering timely, stylish, and insightful content every day. CEO Carlos Watson discussed the evolution of transformative new media platforms, and what’s next for OZY. (Disclosure: GSV owns shares in OZY)

WATCH REMARKS FROM OZY CEO CARLOS WATSON HERE

Carlos Watson Invites the Audience to Discover a Media Platform for the “Change Generation”

Coursera

Coursera is an education platform that partners with top universities and organizations worldwide, offering free and paid courses for anyone to take. It is capitalizing on the convergence of increasing global education demand with new technology fundamentals that enable people to learn anytime, anywhere.(Disclosure: GSV owns shares in Coursera)

The twin forces of globalization and automation are making career obsolescence a new reality. You can no longer fill up your knowledge tank until age 25 and drive off through life. Effective workers will be refilling their “knowledge tank” continuously. In this new paradigm, education technology platforms like Coursera will be like air — invisible, ubiquitous, and life-sustaining. Living will be learning.

WATCH REMARKS FROM COURSERA CEO RICK LEVIN HERE

GSV Partner Mark Flynn (Left) Explores What’s Next for Coursera with Rick Levin (Right)

CEO Rick Levin, the former President of Yale University, discussed the company’s rapid ascent — it now serves more than 18 million students with 1,800+ courses from 140 university partners. He also previewed what’s next for Coursera as it moves beyond credential monetization, including disruptive, low-cost full MBA and computer science degree programs launched in conjunction with the University of Illinois.

Coursera has also launched an enterprise strategy targeting an estimated $325 billion in annual corporate training spending. Early customers include Yahoo, MasterCard, and GE, who use the platform to provide low-cost, high-quality professional development and new hire on-boarding.

GLOBAL SILICON VALLEY

Beyond the leaders of our portfolio companies, we featured two discussions on key trends that are shaping the Global Silicon Valley.

Sustainability

The good news is that the world’s middle class will more than double to five billion over the next 15 years. The bad news is that the strain this will put on the environment will be extreme, with wealthier people traveling more, consuming more, and using more electricity for everything — from air conditioning to lighting larger homes. Sustainability is not just green technology — it is water and wellness.

There is no longer a debate between being “green” or “growing” — both are important. Water is even more precious, with California’s drought being a living example of how vital access to “blue gold” is for everything. Despite the prolonged slump in oil prices, Moore’s Law has taken effect with numerous sustainable technologies being able to compete on cost with dirty fossil fuels.

GSV Shared-X Chairman John Denniston, a leading authority on green-tech investing and a former Investment Partner at Kleiner Perkins, discussed the state of play in global sustainability, including the 10 megatrends that are driving the industry.

WATCH REMARKS FROM GSV SHARED-X CHAIRMAN JOHN DENNISTON HERE

John Denniston Discusses the State of Play in Global Sustainability

India Rising

GSV stands for “Global Silicon Valley”, reflecting our belief that Silicon Valley is no longer just a physical place. It is a mindset that has gone global and viral. No longer are the most innovative ideas limited to the corridor between San Francisco and San Jose. They have spread to Austin and Boston; from Chicago to Sao Paulo; from Mumbai to Shanghai to Dubai.

In this spirit, we were pleased to welcome Satyan Gajwani, the Managing Director of Times Internet — the digital arm of India’s largest media company, the Times Group — as a guest speaker. For context, the Times Group publishes the Times of India, the most widely circulated English-language newspaper in the world, as well as the Economic Times, the second most widely read business publication behind the Wall Street Journal. It also commands a broad range of TV, radio, internet, and publishing assets.

WATCH REMARKS FROM TIMES INTERNET MANAGING DIRECTOR SATYAN GAJWANI HERE

Satyan Gajwani (Left) Reflects on the Rise of Digital Media in India and Creating a Bridge to Silicon Valley with GSV CEO & Co-Founder, Michael Moe (Right)

Satyan shared his perspective on the state of play for digital media in India, and the role that Times Internet is playing in reshaping the future. He also discussed his company’s strategy to invest in, acquire, and partner with emerging technology platforms that can compliment core Times Internet offerings, including recently announced deals with Uber, Coursera, and Airbnb. (Disclosure: GSV owns shares in Coursera)

—

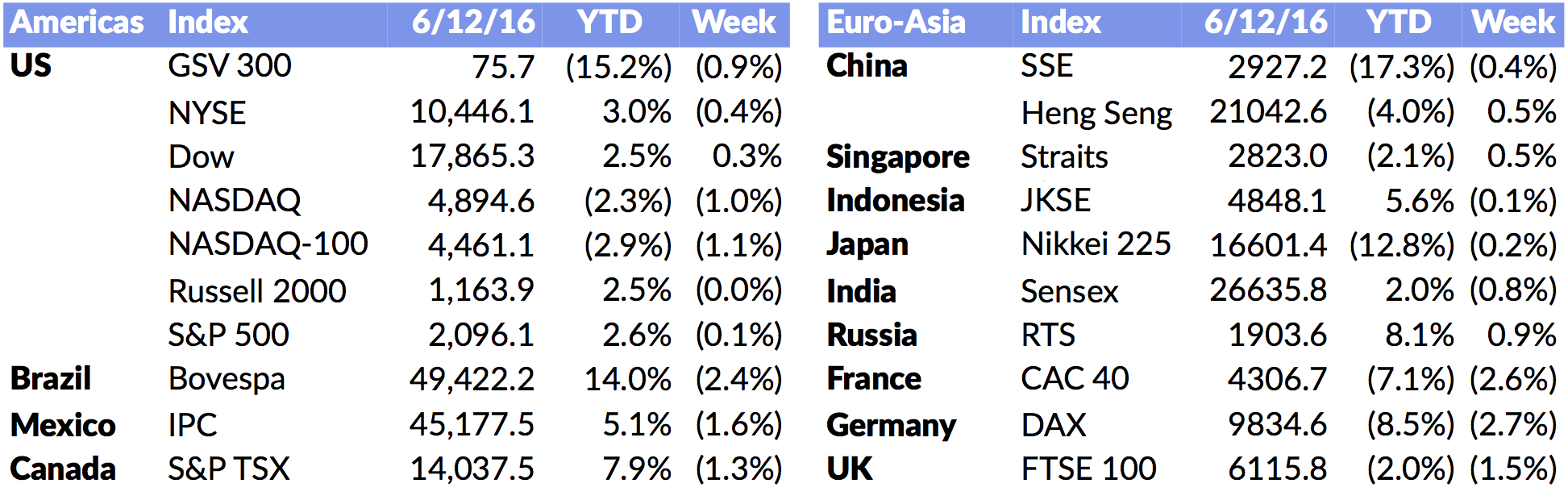

For the week, stocks were mixed with the fear of the day being Brexit. The Dow was up 0.3%, the S&P 500 was down 0.1%, and NASDAQ fell 1.0%. The GSV 300 was off 0.9% for the week.

While we remain in a directionless market, growth fundamentals for many of our favorite names remain strong. Currently, we look to keep our positions in leading growth companies.