Market Snapshot

| Indices | Week | YTD |

|---|

Who are you going to believe, me or your own eyes?

— Groucho Marx

If you didn’t see it with your own eyes, or hear it with your own ears, don’t invent it with your small mind and share it with your big mouth!

— Anonymous

Do you know, I always thought unicorns were fabulous monsters, too? I never saw one alive before!” Well, now that we have seen each other,” said the unicorn, “if you’ll believe in me, I’ll believe in you.

— Lewis Carroll

There is nothing like a good storm to give TV ratings a pop and Hurricane Florence hasn’t disappointed. There have been real-time images of massive flooding, on-the-scene reporters holding on to whatever they can grab to keep from being blown away, and nonstop updates on how far the “evil eye” of the storm came from obliterating the Carolinas.

While Florence has been a scary and serious natural disaster, the Weather Channel’s Mike Seidel decided to embellish the actual state of play with an acting performance that should win him an Emmy. As he was struggling to stay standing and not be swept away by the ferocious winds, several passersby strolled casually behind him, looking mildly curious to what the commotion was about with the guy in front of the camera.

The truth is, we’ve become conditioned to not believe what we see, hear, or read, because there often is an agenda attached to it. Forget about “fake news”, how about “fake facts”? Or even “real facts” with “fake conclusions”?

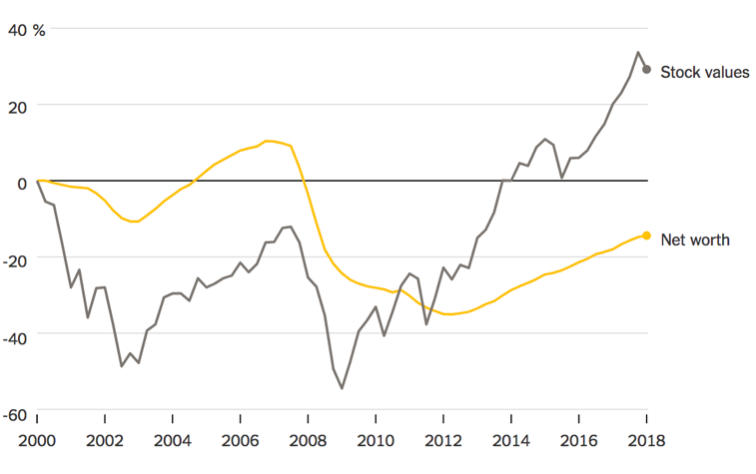

Ten years ago on September 15th, Lehman Brothers filed for bankruptcy, elevating the financial crisis to a full fledged Category 5 man-made disaster. (In the early ‘90s, I headed Growth Research at Lehman). Since the “Great Recession”, the stock market is up 60% and U.S. GDP is up 20%… so economists naturally say that we have “fully recovered” and things are better than ever.

The problem with that logic is that most people don’t own stocks and while the economy has grown, fewer and fewer people are participating in the future. Unemployment is down below crisis levels but that’s partly because more people have given up on looking for work. Home prices are still down 20% from 2007 and most people do own homes.

Stocks continue to rock based on soaring business and consumer confidence. But last week, when walking past the 9/11 Memorial seventeen years after Al Qaeda flew planes into the Twin Towers, there is still massive physical and psychological damage.

So, while it seems easy to clearly see the present… it isn’t. Seeing the future is obviously even harder. Creating the future is the hardest yet. But the benefits we’ve received from visionaries such as Steve Jobs and Elon Musk imposing their will to create our current realities is mind blowing.

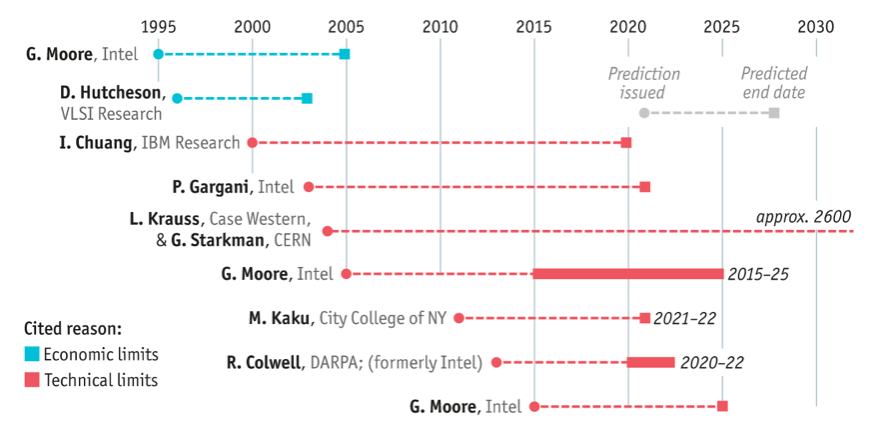

Perhaps nobody has willed their vision of the future and catalyzed more transformation than Gordon Moore, who in 1965 predicted that the number of transistors on an integrated circuit would double every two years. The effect of “Moore’s Law” is that computing power has doubled — or, costs have been halved — every two years for the past 50 years.

If the automobile industry would have had its own Moore’s Law, a Ford Taurus that cost $20,000 in 1990 would essentially be free and you’d throw it away after you drove it.

Interestingly, while Moore’s Law has been the foundation and catalyst for a global technology revolution, it is not a physical or natural law… it is a conjecture. In other words, the “Law” that has transformed computing and society was really more of a vision of what could become. It was a force of will. And the belief in Moore’s Law has enabled engineers and technologists to imagine a world where you could have a computer in your pocket, self-driving cars, and personalized medicine.

But we’re reaching the end of the curve. As Peter Lee, the Head of Microsoft’s New Experiences and Technologies organization (NExT), states, “There’s a law about Moore’s law… The number of people predicting the death of Moore’s law doubles every two years.”

According to the latest International Technology Roadmap for Semiconductors (ITRS) — a joint report from chip giants including Intel and Samsung — by 2021 chips will shrink to a point at which it is no longer economically viable to make them smaller. A North Star for the Global Silicon Valley, in other words, is beginning to flicker and fade.

Currently, the most advanced chips have transistors just 14 nanometers (nm) in diameter, which is thinner than the membrane of a cell wall. If Moore’s Law were to continue at its current clip, transistors would need to shrink to less than 5nm in diameter by 2020. That’s approximately 10 atoms across, or about as thin as the width of a DNA strand. At that scale, the laws of classical physics no longer suffice.

But where the door of classical physics is closing, the door of quantum physics is opening. So-called “Quantum Computing” throws out the assumptions and limitations of “Classical Computing” and is poised to define the next 50-year curve of global innovation.

QUANTUM COMPUTING FUNDAMENTALS

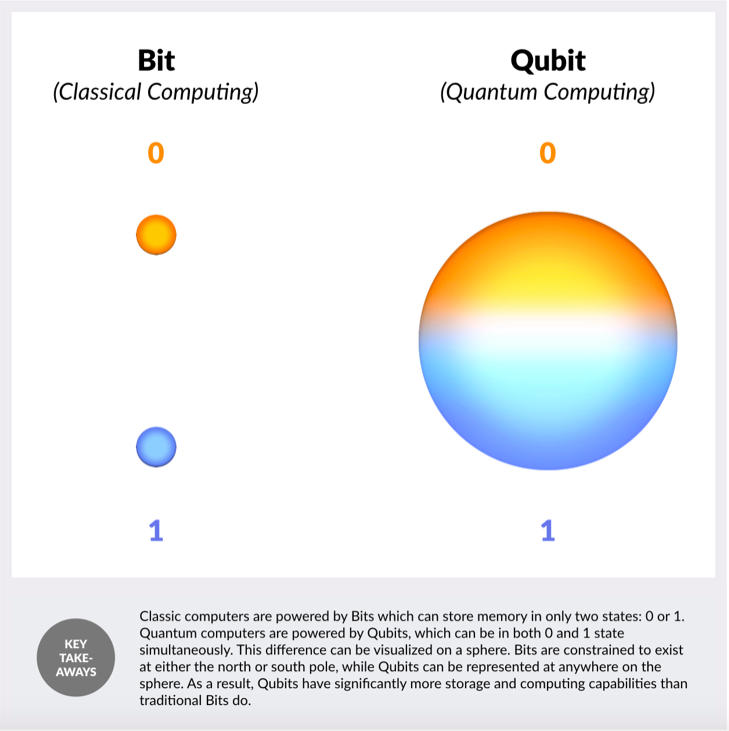

Classical computers encode information in “Bits” — the smallest unit into which all information is broken down. Each bit can take the value of a “1” or a “0.” These ones and zeroes, in turn, act as on/off switches that ultimately drive computer functions. And the computational power of a normal computer is dependent on the number of binary transistors — tiny power switches — that are contained within its microprocessor.

Quantum computers, on the other hand, are based on “Qubits,” which operate according to two key principles of quantum physics: “Superposition” and “Entanglement.” The punchline is that Qubits can be both a one and a zero, and that unlocks a multiple of computing power.

Superposition

In Quantum Physics — the realm of the very, very small — sub-atomic particles can exist in more than one state at the same time. While classical computers depend on Bits taking one of two values, 0 or 1, Qubits, their quantum analogues, can be arranged in “states” that are best thought of as some mixture of both 0 and 1.

Think of Bits and Qubits as spheres. Bits can only exist in two states at either of the two poles of the sphere. Qubits, under Superposition, can be represented as any point on the sphere. As a result, computers using qubits are able to store much more information using less energy and space than classical computers.

To understand the implications of the power of Superposition, imagine searching for a name in a phonebook. Classical computers will have to scan every name, line-by-line and page-by-page to find a person’s phone number. As a result, classic computers would have to conduct tens of thousands of searches to find one number. Quantum computers will scan the phonebook in its entirety at once and find the number in a single search.

Entanglement

Qubits, on their own, have an immense amount of power. But when they are linked together, in an unique property of Quantum physics called “Entanglement,” their power increases exponentially.

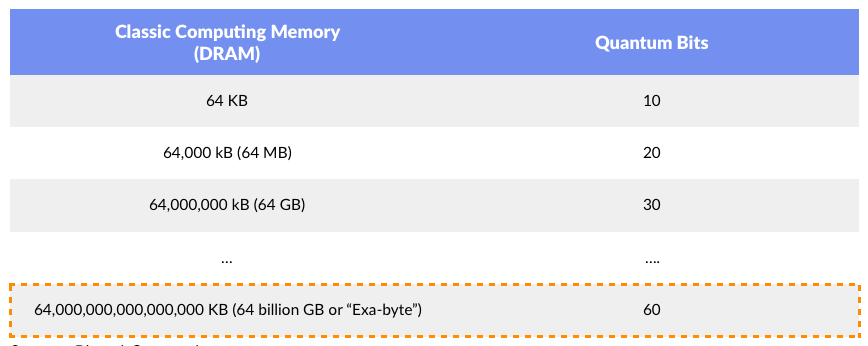

A standard computer depends on the complete isolation of one bit from the next to prevent a computation from going awry. For a quantum computer, the entangling of multiple qubits is paramount. Each Qubit that is linked to another doubles the total processing capabilities. The staggering opportunity for computing power versus traditional Bits becomes clear as you move past 10 Qubits.

According to Rigetti Computing — a quantum computing pioneer backed by Andreessen Horowitz — a quantum computer with 60 Qubits can perform calculations that even today’s most powerful computers cannot. Just how many unique numbers can 100 Qubits store? 1,267,650,600,228,229,401,496,703,205,375. A 300 Qubit computer can perform more computations simultaneously than there are known atoms in the universe. A whopping 1082 at once.

SILICON VALLEY TACKLES HARD TECH

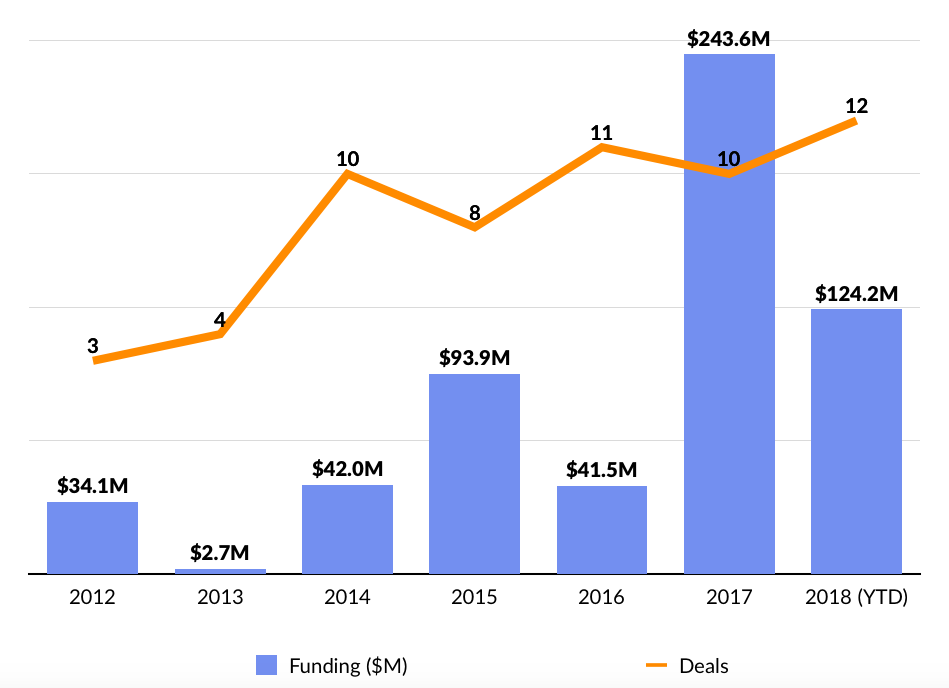

As quantum computing moves from concept to reality, Silicon Valley is taking notice. Since 2012, there has been $580 million of venture investment across 58 deals to quantum computing startups. The early trend line remains bumpy but financing activity is poised to accelerate.

2017 was a banner year for quantum computing startups, which saw $243 million of funding deployed. To date, there has been $124 million of venturing funding towards quantum computing startups. Notable companies that raised rounds since 2017 include Rigetti Computing ($50M Series C; $40M Series B), D-Wave Systems ($50M), 1QBit ($35M Series B), and Silicon Quantum Computing ($65.8).

Much of the innovation and investment activity has focused on three core areas: 1) Full-stack Quantum Computing (developing + deploying quantum computers), 2) Software + Implementation Tools, and 3) Cybersecurity + Novel Technology.

D-Wave Systems was the first private company to focus heavily on quantum computing and is the first company in the world to sell quantum computers. Since its founding in 1999, D-Wave has solidified its spot as an early leader in the category and currently counts companies like Alphabet, Lockheed Martin, Volkswagen and NASA as customers.

According to researchers from Google and NASA, D-Wave’s computers are more than 100 million times faster than the best classic computers. Released in January 2017, the company’s latest computer, D-Wave 2000Q, is powered by a chip with 2048 qubits. “What a D-Wave does in a second would take a conventional computer 10,000 years to do,” Hartmut Nevan, director of engineering at Google, observed at the time. D-Wave has raised over $205 million from a syndicate of investors, including Fidelity, Goldman Sachs, DFJ, and In-Q-Tel.

Rigetti Computing is another early leader developing a “full-stack” quantum computing system — from proprietary integrated circuit hardware to software, and everything in between. Launched in 2013 by Founder and CEO Chad Rigetti, a physics PhD who led pioneering work on quantum hardware at Yale and IBM, Rigetti Computing is a Y Combinator alum that has raised $120 million for investors including Andreessen Horowitz, Bloomberg Beta, and Data Collective.

This week, Rigetti announced Quantum Cloud Services (QCS), an Amazon Web Services analog for quantum cloud services. QCS offers a combination of a cloud-based classical computer, Rigetti’s quantum development platform Forest, and access to Rigetti’s quantum backend services. Through QCS, developers will able to more quickly write, test and deploy algorithms. Earlier this year, Rigetti announced their plan to build and deploy 128-qubit quantum computing chips — creating, by far, the world’s most powerful computer.

BIG TECH GOES QUANTUM

Large technology companies, including Alphabet, Intel, IBM and others have become increasingly focused on understanding quantum computing.

Alphabet, IBM, Intel and Rigetti Computing are locked in a race to produce and commercialize the world’ most powerful and useful quantum systems. This year, Alphabet announced their 72-qubit quantum system, which bests the power of IBM’s 50-qubit quantum processor.

A few large tech companies are focusing their efforts on quantum computing by partnering with leading academic institutions and research centers. Intel, whose microchip innovations led to the Silicon Valley we see today, committed $50 million towards quantum computing research in The Netherlands at QuTech in 2015.

Microsoft has created Station Q, a consortium of the world’s leading computer scientists, mathematicians, and physicists — all dedicated to building an universal quantum computer. As part of this initiative, Microsoft launched QuArC (Quantum Architectures and Computation Group) to focus on developing the enabling software to power quantum systems.

Other companies such as Lockheed Martin and Google have turned to partnering with startups, particularly D-Wave, to understand and accelerate the development of commercial quantum computing applications. Google is D-Wave’s largest partner and the company has access to the latest technology and updates coming out of the startup for up to seven years. Google currently operates a quantum computer from D-Wave in NASA’s Quantum Artificial Intelligence Lab (QuAIL), where it is exploring applications in areas such as search, pattern recognition, logistics and management, and Space.

WHAT’S NEXT

Just as Moore’s Law unlocked a wave of innovation across multiple industries, quantum computing is fundamentally an enabling technology.

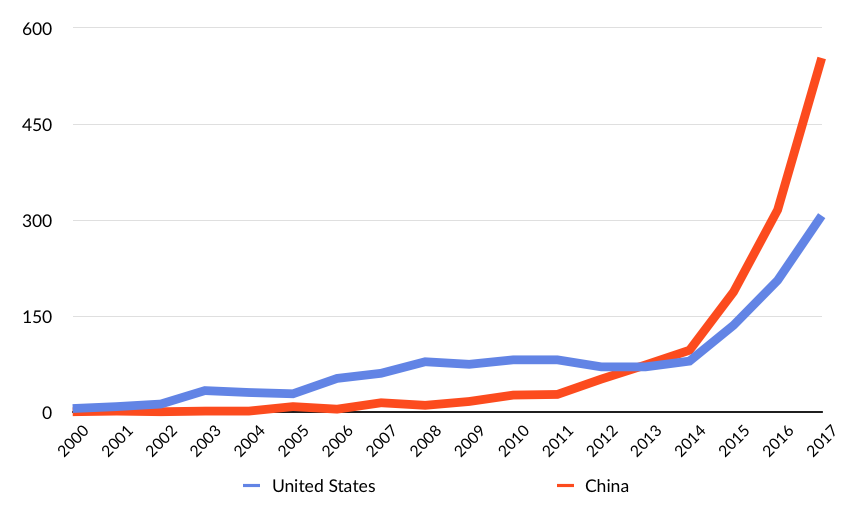

China is an emerging star in the East and is building itself to be a powerhouse in quantum computing. Today, The Middle Kingdom and the United States are locked in an arms race to develop quantum computers and determine who will own the next generation of computing. In 2017, China issued nearly double the number of patents when compared to the U.S. in quantum technologies.

Overall investment in quantum computing by the Chinese government is unknown, but the government is building a $10 billion National Laboratory for Quantum Information Sciences in Hefei, Anhui Province, which is slated to open in 2020.

Already, there have been a crop of startups utilizing quantum computing technology in the fields of big data, artificial intelligence, and biology, to name a few. As more commercially viable quantum computers begin to hit the market, we expect to see the technology applied more broadly.