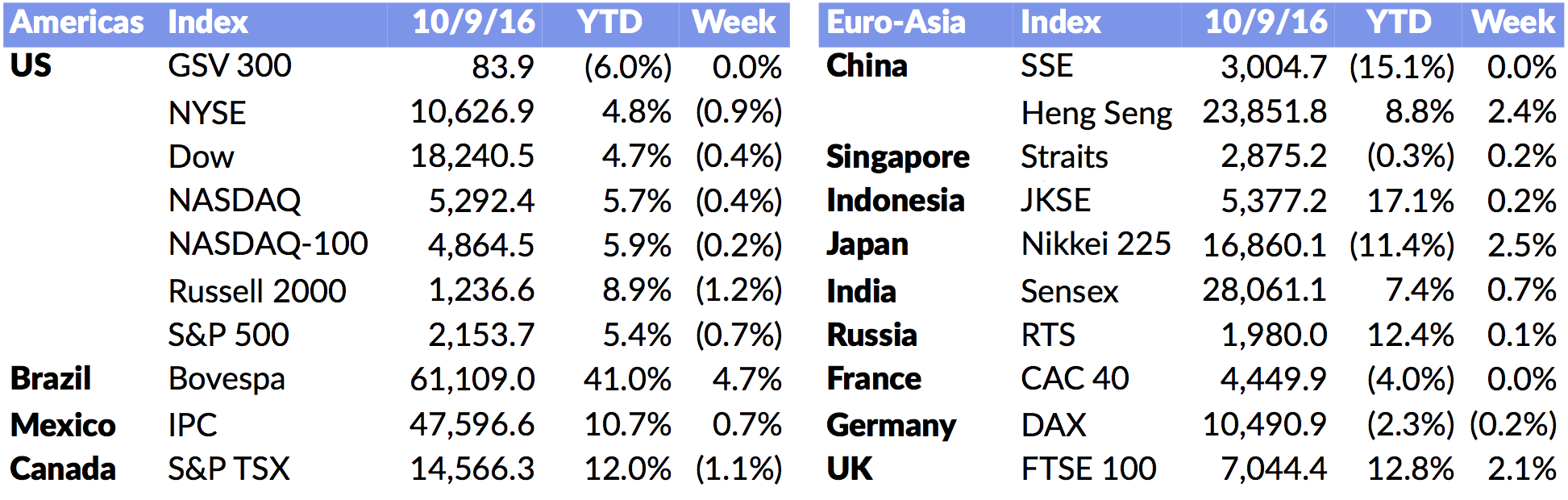

Market Snapshot

| Indices | Week | YTD |

|---|

Yes, risk-taking is inherently failure-prone. Otherwise, it would be called sure-thing-taking.

— Jim McMahon (Former Chicago Bears Quarterback, Super Bowl XX Champion)

You can only lose 1X your money and you can only lose once. But you can make 50X or 100X your money… so play for the big upside.

— Vinod Khosla

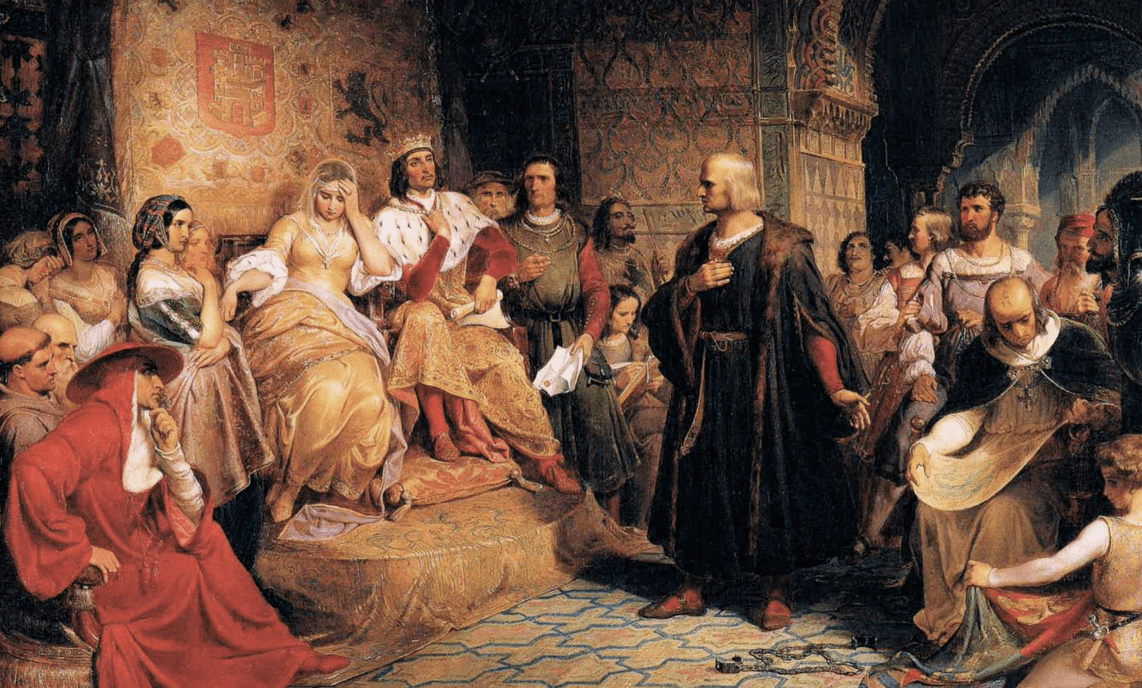

Some may think that startups are a new phenomenon, but in fact, they’re as old as time. A young Italian entrepreneur named Christopher Columbus had this harebrained idea that it could be faster and easier to reach China and India by heading West across the Atlantic versus the land and ocean routes that were being used going East.

Columbus first pitched his idea to King John II of Portugal in 1485, who was intrigued by the notion as Constantinople had fallen to the Ottoman Empire, making land travel to the Silk Road perilous. Travel by boat around Africa’s Cape of Good Hope was thought to be almost impossible.

Despite the appeal, King John’s advisors voted the deal down saying the assumptions were insane.

Columbus went down Santiago Road (the inspiration behind Sand Hill Road ☺ ) to see venture capitalist Queen Isabella of Spain. She thought Columbus had a “big idea” but wasn’t sold on the execution and ultimately passed due to an unfavorable “risk – reward ” calculation.

Like any good entrepreneur, Columbus didn’t take the first “no” as a final answer and went back to King John II of Portugal in 1488. As luck would have it, Columbus lost his first mover’s advantage to Bartolomeu Dias who had made it around the Cape of Good Hope of Africa, so King John sent Columbus packing for the second time.

Source: The Daily Telegraph, Smithsonian Magazine, Wikipedia, GSV Asset Management

Seeking less sophisticated capital sources, Columbus went to family offices in Genoa and Venice. The “dumb money” wanted to know why the “smart money” didn’t bite and ultimately passed as well.

Having struck out on his own, Columbus hired his brother Bartholomew as his banker and told him to find the money. Bartholomew pulled a Ryan Lochte and claimed he was robbed by pirates en route to pitch King Henry VII of England and King Charles VIII of France on his brother’s idea. He arrived in disarray and was soundly turned down by the King.

Convinced that his “distorted reality field” was correct, Christopher Columbus went back to King Ferdinand and Queen Isabella of Spain to once again give them an opportunity to back his “game changing” idea.

The King and Queen of Spain entertained Columbus and his idea and hosted him as an “entrepreneur in residence” for several years before sending him home without the money.

Finally, as Columbus was dejectedly riding out of town on a mule, the King and Queen VC sent for him to come back to the castle to do a deal (this makes Reid Hoffman’s 25 VC rejections with LinkedIn before scoring look like Kindergarten).

The Term Sheet Columbus and the King and Queen signed looked like Venture Capital Economics in reverse. The Deal they struck was that Columbus would receive 10% of revenue from New Lands in perpetuity, AND he was granted the option to buy a 13% interest in any subsequent commercial venture arising from territory discovered.

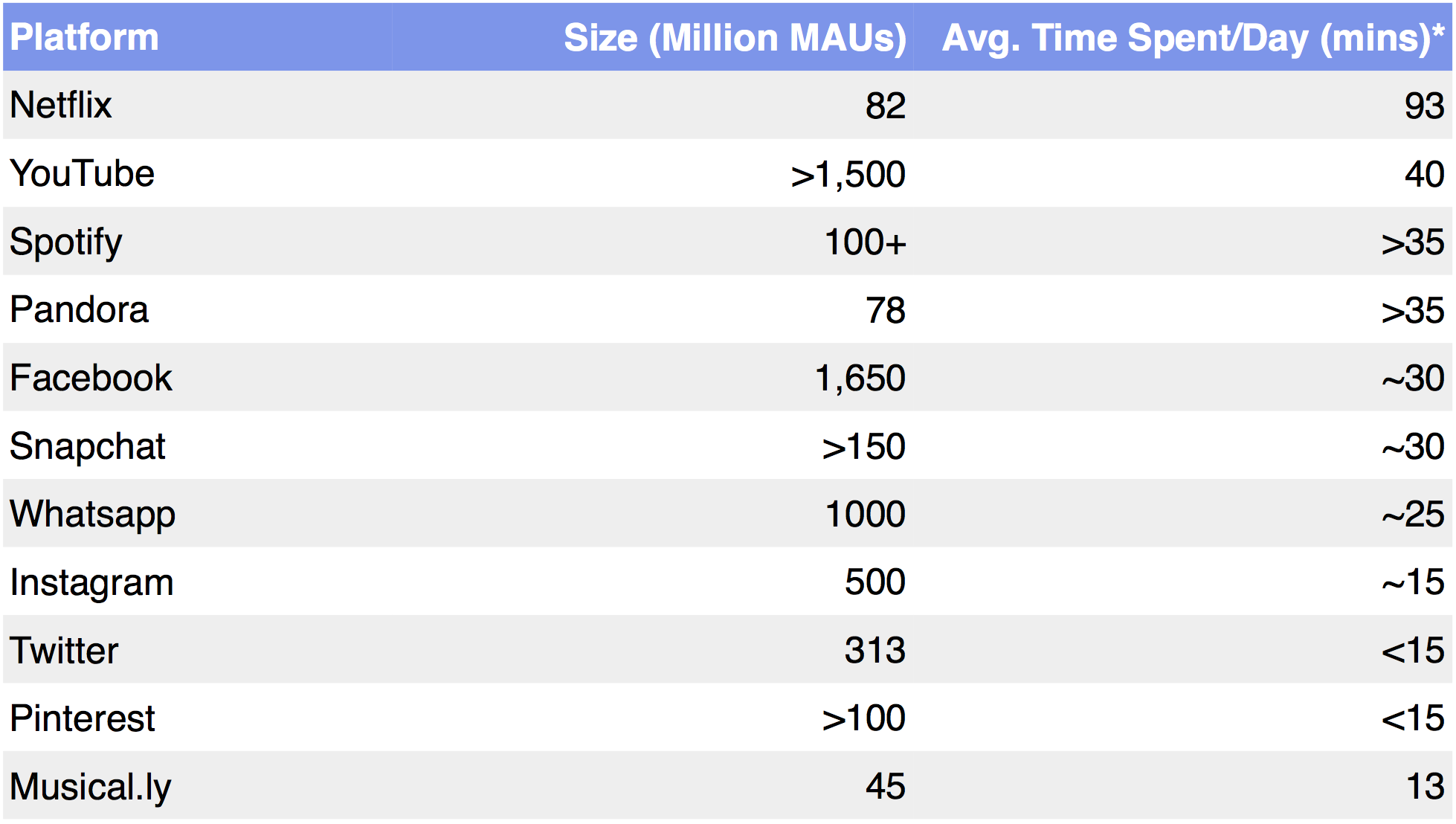

Columbus discovering North America instead of finding a faster path to Asia was the first “pivot” of modern venture capital… to be followed by many others. Facebook began as “FaceMash”, with the user picking which face was “hotter”. Twitter began as “Odeo”, a personal podcast service. YouTube was first a video dating site. Pinterest was “Tote”, which alerted users when their favorite stores had sales. Instagram was originally Foursquare-meets-“Mafia Wars”.

71154.jpg)

—

Stocks sagged last week with the NASDAQ off 0.4%, the S&P 500 down 0.7% and the GSV 300 flat. While job growth in September was 156K, more or less in line with expectations, this perversely concerned investors that rate hikes might be happening sooner than was conventional wisdom.

“Innovations” in Techland were basically the big guys doing something their kin were already doing. Facebook announced “Marketplace,” which was their answer to eBay and Craigslist. Google announced “Assistant” which was its non-gendered initiative to join the virtual assistant game already in session with Apple‘s “Siri”, Microsoft‘s “Contana” and Amazon‘s “Alexa”.

Twitter stock was as volatile as Tweets from Donald Trump with its stock falling as fast following leaks that nobody accepted Salesforce interest in getting married. TWTR dropped 20% on Thursday. It was also leaked that Snap (the artist formerly known as Snapchat) was ramping up to go Public by next March.

Elon Musk continues to dazzle or puzzle depending on your perspective, with Tesla reporting it produced nearly 25K cars last quarter one week after he announced he’d like to colonize Mars within ten years. Investors still worry that he’s already on Mars with his Solar City acquisition and remain leery with TSLA shares down 3.5% for the week.

We continue to be optimistic about the outlook for growth stocks. While earnings growth overall is expected to be down for the sixth quarter in a row for the S&P 500, leading growth companies such as Facebook and Alphabet continue to deliver strong results. Moreover, with the IPO Market heating up, we expect a number of attractive fresh faces to be available to public investors soon.