Market Snapshot

| Indices | Week | YTD |

|---|

(Ooo) What you want

(Ooo) Baby I got it

(Ooo) What you need

(Ooo) You know I got it

(Ooo) I’ll I’m askin’

(Ooo) Is a little respect when you get home

— Aretha Franklin (1942 – 2018)

Respect has been craved by people and institutions way before the “Queen of Soul” Aretha Franklin belted out her #1 hit fifty years ago. And the lack of receiving it has driven people to do crazy things since Cain killed Abel.

Elon Musk tweeting from his Tesla about having financing lined up to take TSLA private at $420 was definitely cray cray. But it was instigated by wanting to stick it to the short sellers who didn’t appreciate a genius at work. It’s ironic (or sinister?) that the supposed source of funds to buy out the public investors was Saudi Arabia’s Public Investment Fund, whose capital came indirectly from gas-guzzling cars.

Former CIA Director John Brennan wanted a little respect despite saying that President Trump had committed treason. But instead, he had his security clearance taken away. Even his compatriot James Clapper said over the weekend that former Director Brennan might have had a screw come loose.

It wasn’t that long ago that Turkey was supposed to take a major role on the World stage but last week, the country was teetering on the brink of chaos. Currency traders definitely disrespected what was going on in Turk-land with the Lira plummeting 20%. Fears were that Turkey could spark a Global contagion.

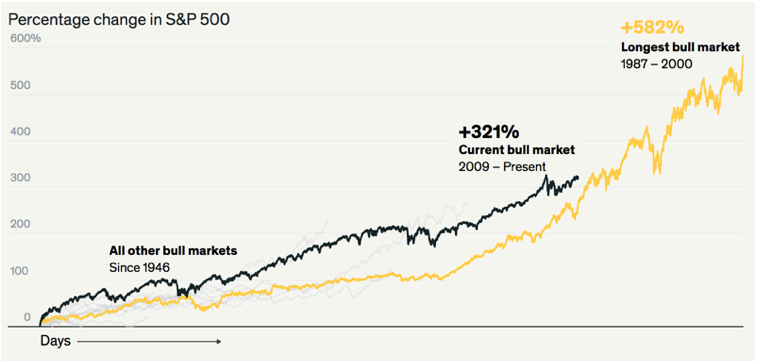

And how about R-E-S-P-E-C-T-I-N-G the strength of the U.S.A.? Despite employment at record highs, unemployment at record lows, an economy that is showing the fastest growth in thirty years, and a Stock Market that has had a nine year bull run advancing 321%, some people seem to be going crazy that things are going so well.

Respect should come from results, or as the legendary football coach Bill Parcells once said, “you are what your record says you are.”

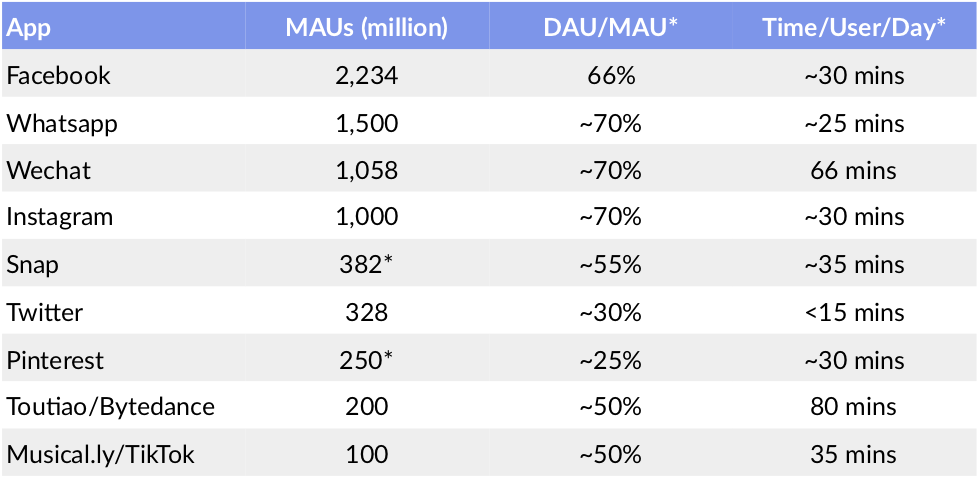

We respect the gigantic shift that’s taken place to mobile devices and the engagement people have with powerful social media apps, music, and games. All in all, time spent on mobile devices has gone up from 20 minutes in 2008 to over 3.5 hours today, with users spending an astronomical amount of time on social or immersive media platforms.

Source: Company Reports, GSV Asset Management

** Denotes DAU

***GSV estimates based on public disclosures

What’s also changed is the massive shift from living in a physical world to a digital one. Today, there is a new generation of digital businesses that leverage the power of the internet and globalization to scale the massive sizes. If you look at the largest transportation company in the world, Didi Chuxing, they own none of their vehicles. Airbnb, the world’s largest hospitality platform, creates none of its inventory. Dropbox, the world’s largest storage company, owns no warehouses. Facebook, the world’s largest media platform, owns none of its own content.

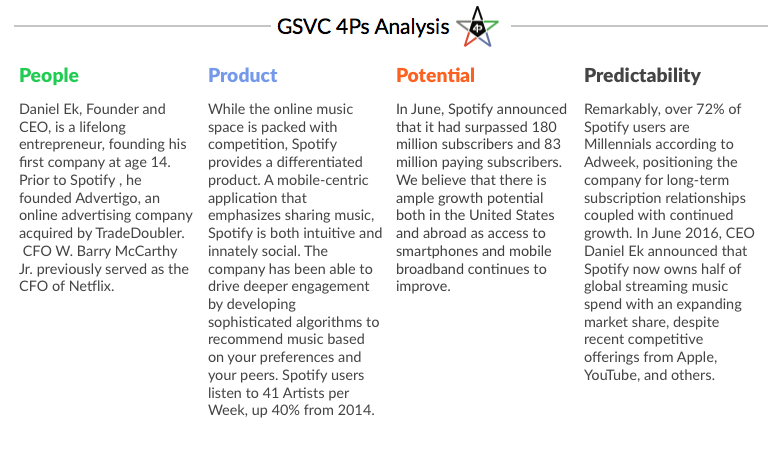

And there’s Spotify, the world’s largest music platform, which creates none of its content. Founded in 2006, Spotify is a “freemium” music streaming platform designed for mobile devices. Users can access a free, ad-supported experience, or pay a monthly subscription for Spotify’s premium offering.

Spotify pioneered the streaming music model and remains the premier brand in the category, with an expanding market share and a disproportionate following among Millennials. Remarkably, over 72% of Spotify users are Millennials according to Adweek, positioning the company for long-term subscription relationships coupled with continued growth.

This April, Spotify had a successful direct listing on the New York Stock Exchange is up approximately 43% to date from a reference price of $132 set by the NYSE in advance of the company’s direct listing.

LEADERS & LAGGARDS

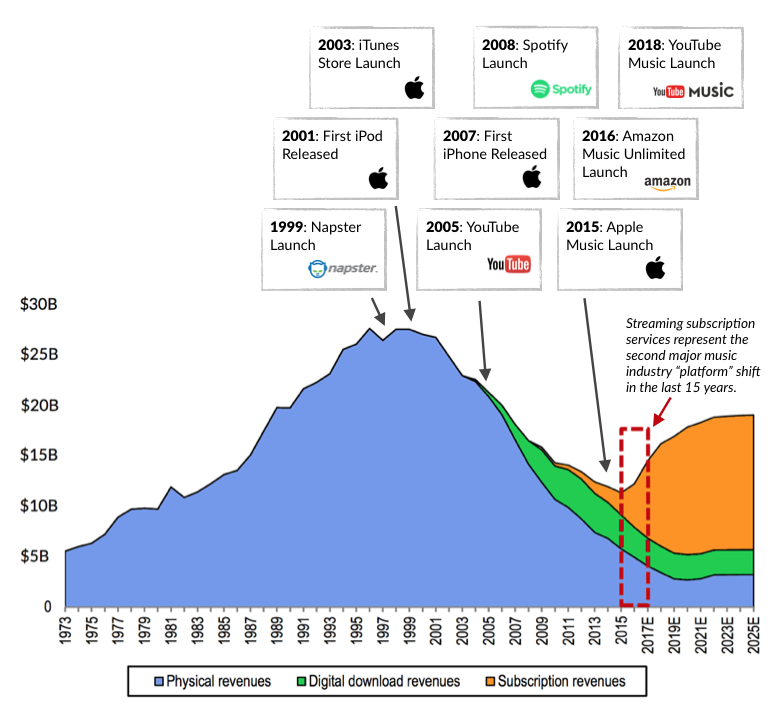

In 2001, Apple launched a marketing campaign for its new line of iBook computers with the slogan, “Rip, Mix, Burn.” The implication was that with the machine’s next generation optical drive, users could copy CD music albums onto their computer (“Rip”), assemble their own playlists (“Mix”), and then create new personalized CDs (“Burn”).

Record labels revolted. It was a blatant invitation to pirate music. When the first iPod was released shortly thereafter — a device that eliminated the need to “Burn” anything — Apple included a wry warning on the box: “Don’t steal music.”

Two years later, Apple launched the iTunes store. Combined with the iPod, it eliminated the need to copy or burn anything. It was the dawn of an age of digital music. When iTunes arrived in 2003, U.S. CD sales stood at $12 billion. Last year they were just $1.5 billion.

Digital music also meant personalized music as listeners were no longer beholden to purchasing an entire album — bad news for the bottom line of artists and labels. The burgeoning digital segment did little to offset the nosedive in physical album sales. But in recent years, the picture has gotten rosier for the music industry, which last year recorded its first twelve months of growth since 1998. Did we hit rock bottom? Maybe. But another innovation shift is catalyzing growth.

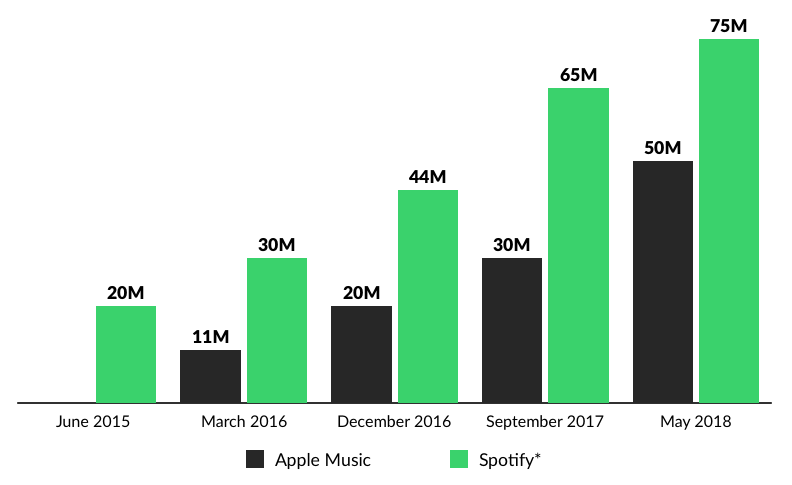

Streaming platforms like Spotify, Pandora, and Apple Music, which generate revenue from advertising and subscription fees, have effectively gone from a standing start in 2008 to generating $6.6 billion in 2017. Since its launch that year, Spotify has seen its user base grow from zero to over 180 million, with 83 million paying subscribers.

What’s remarkable is that the rise of streaming platforms marks the second major platform shift for music in the last 15 years. Today, streaming accounts for over 70% of digital music revenue, up from 60% a year ago and 42% in 2016. Downloading music is already going the way of the CD.

All in all, streaming services represent the second major “platform” shift in the music industry in the past 15 years. According to Goldman Sachs, music streaming will account for $34 billion of total revenues by 2030, collecting over 80% of the music industry’s projected revenue of $41 billion.

Apple’s iTunes disrupted the music industry by “unbundling” albums, enabling people to pick and choose songs to create their music portfolio. Combined with its highly popular iPod, Apple became a dominant force in music for the rest of the decade.

But in 2008, when Daniel Ek and Martin Lorentzon launched Spotify’s on-demand streaming service, a new disruptive force emerged. Instead of “owning” music, Spotify enabled people to access a massive catalog of music on demand through a superior user experience.

In 2015, CEO Daniel Ek revealed that more than 50% of Spotifiers are under the age of 27. Remarkably and impressively, given the young demographic, subscribers are faithful and the churn is tiny — 70% of the 2010 subscriber cohort still gladly pays the monthly subscription fee — college kids would rather have their electricity shut off than their Spotify account.

Not surprisingly, in 2015 Apple struck back with its own streaming service, Apple Music, on the heels of a $3 billion acquisition of the popular headphones-maker, Beats. Drawing on a 900 million-member iTunes user base, coupled with a massive marketing campaign, Apple Music has taken off well.

This year, Apple Music surpassed 50 million paying users, lagging behind Spotify’s 83 million paying users and Spotify’s 180 million total users. Spotify continues to distance itself at the top, remaining the clear leader in the on-demand music category. Today, Spotify’s market capitalization is $35 billion.

Source: Company Disclosures, GSV Estimates

**Denotes GSV Estimate

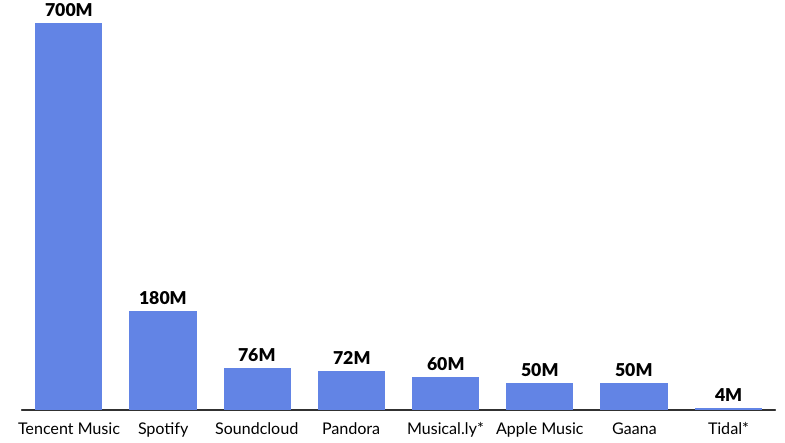

As with all emerging industries, China is poised to make a massive dent in streaming music in the coming years. Tencent Music Group is China’s largest music platform, clocking in with over 700 million monthly active users. The company operates popular music apps including QQ Music, Kuguo Music, and Kuwo Music. Tencent’s karaoke app WeSing has over 460 million registered users.

Source: Company Disclosures

Tencent Music is planning spin out of Tencent and IPO in the United States, seeking a valuation of $30 billion in its IPO. Tencent Music was last valued at $11.5 billion in December. According to The Information, Tencent Music is profitable, recording nearly $300 million in net income in 2017, primarily from the company’s non-subscription products including karaoke and live-streaming services.

Last December, Spotify and Tencent Music swapped a 10% stake in each others business. At the time, Tencent Music was valued at $11.5 billion. Accordingly, if Tencent Music’s IPO comes out to a $30 billion valuation, it would imply that the value of Spotify’s stake in Tencent Music would be more than double.

UNLABELING

Shuffling over to the record label industry, royalty negotiations with major record labels continues to be a chess game.

The music recording industry has been evolving into an oligopoly over time. Today, three major labels (Warner Brothers, Sony Music and Universal Music) own the industry, and exploit artists by collecting a large majority of the revenue.

Labels are agencies that work with musicians and help them with distribution, analytics, and brand partnerships, all while letting them keep rights over their recordings. The issue is that throughout the years, the labels have became greedy and have been taking bigger pieces of the pie.

Today, the big labels are pressured to increase the share to artists and to streaming platforms, as was evidenced last summer when Spotify and Apple Music “successfully” re-negotiated their streaming deals, lowering the payout to labels from about 55% to about 52%. A small step in the right direction.

This imbalance remains ripe for disruption. But what is the right split?

So far, the record label Oligopoly has been giving up inches, not feet. Royalties remain close to 70%, and they only hand over 10-20% to the artists. In other words, out of every $100 of sales, the artist gets $10-20, Spotify gets $30, and the record company gets $50-60.

The artist — the creator of the product — should be capturing the lion’s share of the revenue. For argument’s sake, let’s say that is up to $50 of every $100 generated. Spotify, as the distribution platform, should be getting $30, and the labels, who provide limited value-added services to the artists, should capture $20.

Additionally, artists are increasingly finding alternative ways to promote themselves and record labels will have to lower their rates to stay competitive.

New York-based UnitedMasters is giving artists an alternative to record labels, offering a broad set of services ranging from data analytics and insights to merchandise support and marketing. And importantly, all of that comes at much better economics compared to major labels.

UnitedMasters raised a $70 million Series A round led by Alphabet, and with participation from Andreessen Horowitz and Floodgate. The magnitude of the funding for a Series A investment is eyeopening, but even more impressive is the direct involvement of Larry Page, who led Alphabet’s investment and Ben Horowitz, who led Andreessen’s investment and joined UnitedMasters’ board. In describing UnitedMasters’ potential as a platform, Horowritz wrote in his blog:

“…What if there were a platform that instantly enabled musical artists to market themselves globally as effectively as the top technology companies market to their customers?… Such a platform would free musicians from dependencies on the old model while increasing their income tenfold. It would create unprecedented intimacy between artists and fans, while making artists truly independent.”

Paris-based Believe Digital is the leading distributor of digital music in Europe for independent artists and labels. Early success examples include Novo Amor who has over 100 million streams on Spotify, or FKJ who topped the iTunes electro charts in 10 countries. Last year, Believe Digital was expected to generate $250 million in revenue, and we believe that number will continue to grow at a fast clip.

Lastly, and certainly, Spotify itself is poised to disrupt the labels in the near term, acting as an all-in-one platform — distribution, data analytics, and owning the content.

MUSIC & LYRICS

Listeners continue to be highly interested in learning or following the words behind their favorite songs. Currently the monthly audience accessing lyrics sites currently surpasses 2 billion people. AZLyrics.com, one of the most popular Lyrics search engines, has over 200 million monthly unique users.

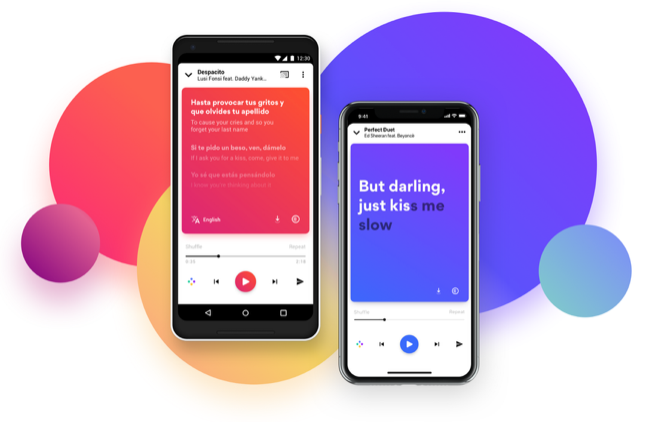

Italian startup Musixmatch is one of the leading platform for lyric search and owns the largest song lyrics databased. The platform has over 70 million users, over 30 million monthly active users, and over 14 million lyrics that are translated to more than 60 languages. Musixmatch not only attracts users to their app and website, but also powers lyrics on major streaming platforms such as Apple Music and others. Furthermore, the company integrates artificial intelligence and natural language processing into its product to allow users to easily search for songs by entering and speaking song words or phrases.

For digital platforms, a key product development feature for streaming platforms is the integration of lyrics into the platform and allowing users to search for songs using lyrics.

Amazon Music, despite being the third largest streaming music company, is the leader amongst its peers in lyric integration. Amazon Music allows listeners to view lyrics as songs play and allows listeners to search for songs with lyrics or by simply asking Alexa by saying “play the song that goes…”. Apple Music and Google Music are following suit, offering similar product offerings to their listeners that Amazon does.

But for Spotify, which currently offers minimal lyric support and voice search capabilities, lyrics will be a huge opportunity for the Swedish streaming company to capitalize upon to drive increased engagement on its platform.