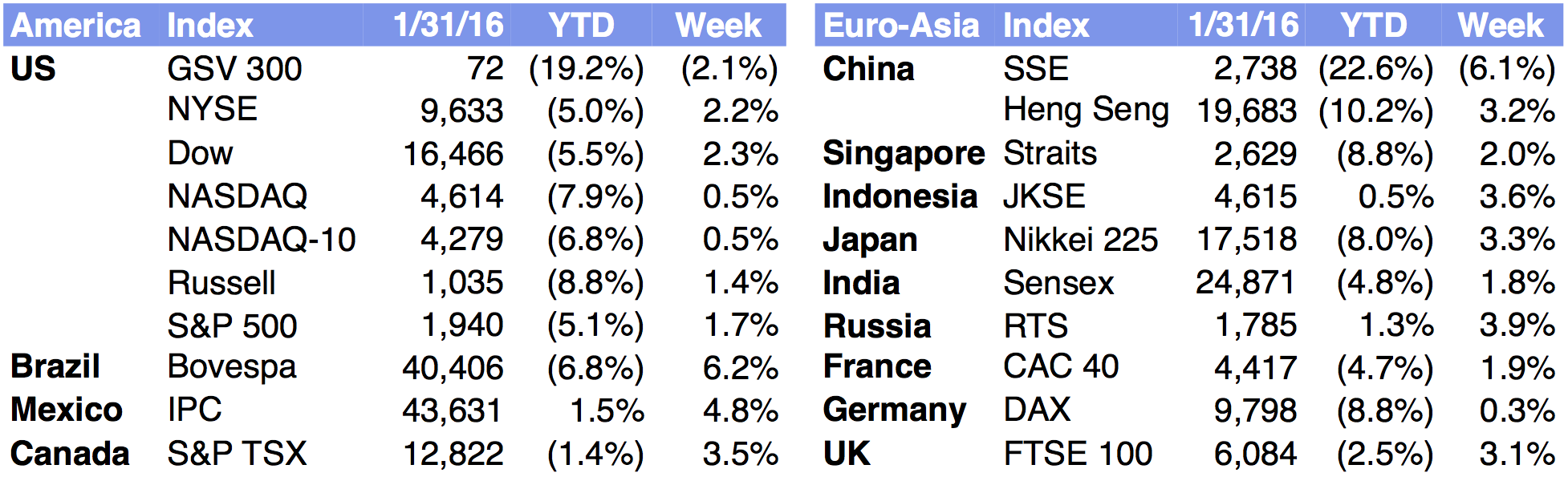

Market Snapshot

| Indices | Week | YTD |

|---|

GSV’s Pioneer Summit, an annual gathering of 1,200+ innovation leaders who are building the Global Silicon Valley and changing the world for good, is focused on game-changing entrepreneurs and ideas.

Among our featured speakers was Anne Wojcicki (@annewoj23), the Co-Founder and CEO of the revolutionary personalized genetics company, 23andMe. In a segment called “The Future of Health and the Human Genome”, moderated by Katy Steinmetz, the San Francisco Bureau Chief of Time Magazine, Anne shared her perspective on how 23andMe is ushering in an age of personalized, consumer medicine.

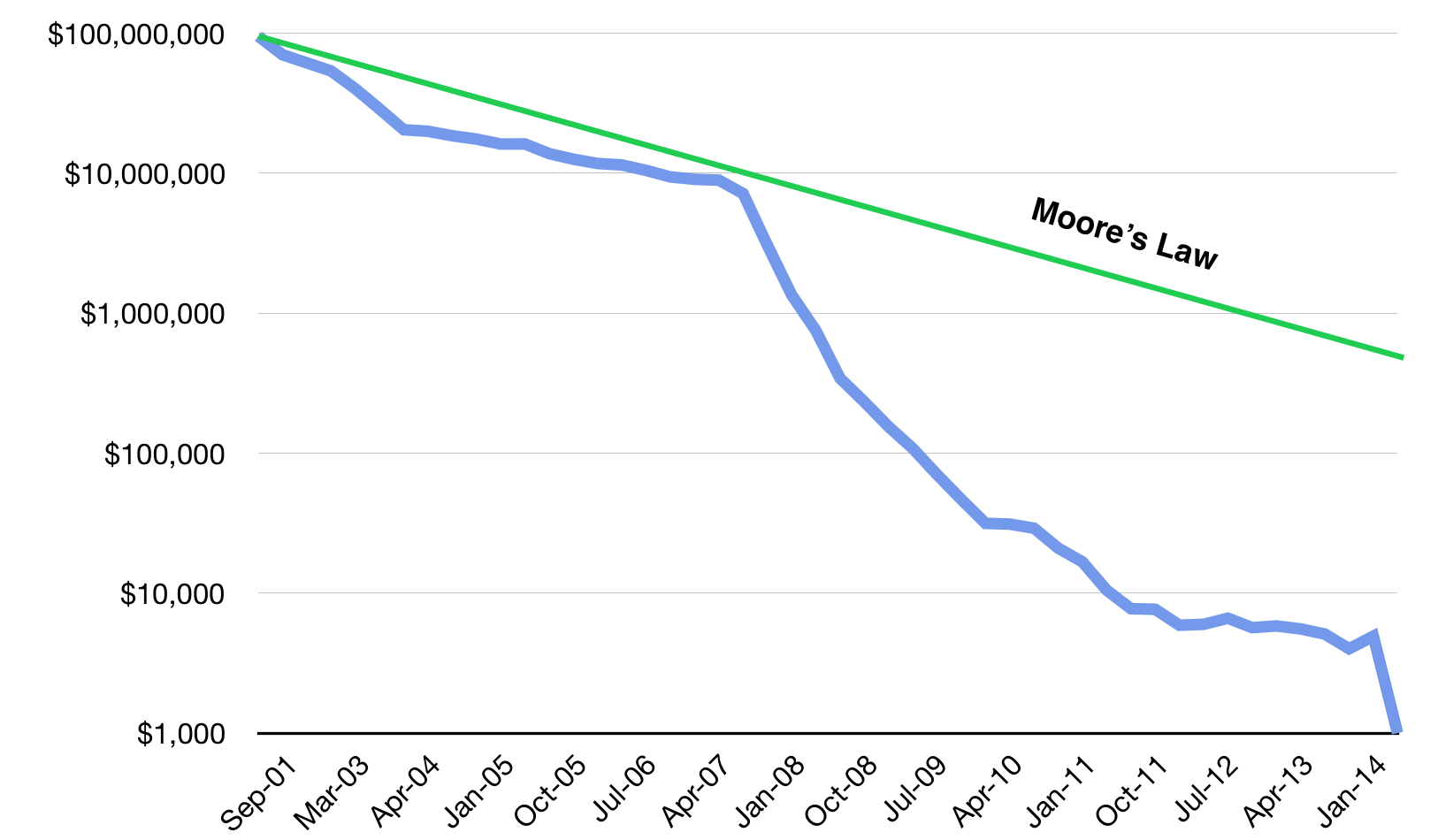

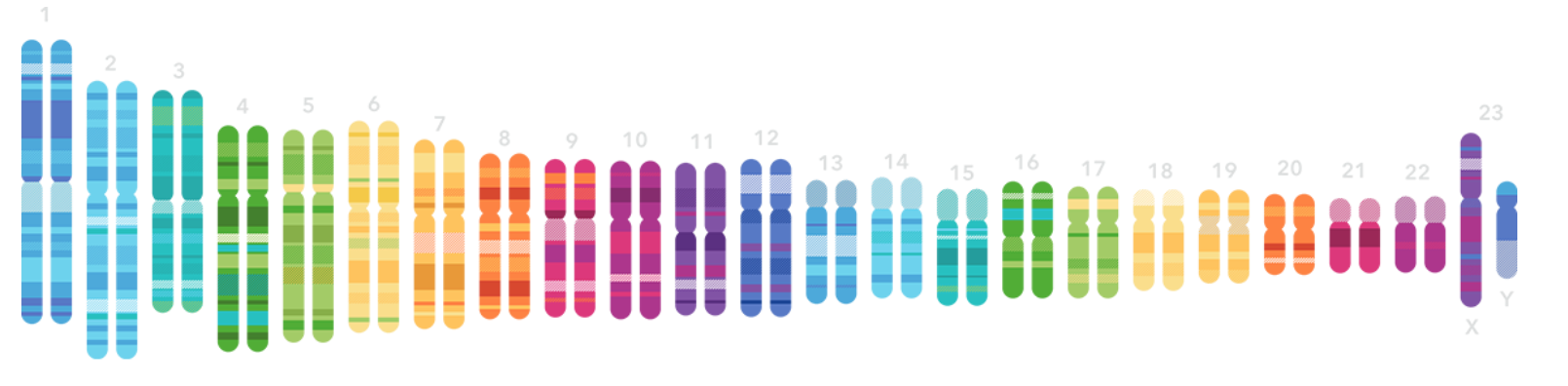

23andMe was founded in 2006, on the heels of the Human Genome Project (HGP) — perhaps the greatest accomplishment in exploration history with the most profound implications. Unlike the outward voyages of discovery by adventurers like Lewis and Clark, Columbus, or the Apollo astronauts, the HGP’s mission was inward, with the audacious goal to map the entire genetic blueprint of human beings. Interest in gene exploration dates back nearly 200 years to Gregor Mendel, the father of modern genetics. But it wasn’t until the mid 1980s that technology and Moore’s Law made it possible to use software to sequence the over three billion genetic bases that make up the human body.

Unprecedented in terms of international collaboration and public-private partnerships, the Human Genome Project was launched in 1990 with the goal of mapping the entire human genome in what seemed like an unrealistic 15 years.

In April 2003, it was announced that the entire human genome had been mapped at a cost of $3.8 billion. Beyond scientific gains, the ROI was staggering. The Human Genome Project generated an economic impact of $796 billion from 1990 to 2010 alone.

Moore’s Law and the Megatrend of “Software Eating the World” are having a revolutionary impact on the cost for an individual to receive their own genetic map. In 2008, it cost $1 million dollars for a person to create a personalized gene map. By 2011, it was $100,000. In 2014, it cost $1,000 — less than a chest X-Ray — and today you can get a personal genetic report for less than $200.

STATE OF PLAY

Anne Wojcicki co-founded 23andMe in 2006 after a decade on Wall Street as a health care analyst convinced her that the way we treat illness and create new drugs is fundamentally broken. Reflecting on the billions of dollars pharmaceutical companies pour into drug discovery in a recent Inc. interview, Anne remarked, “It just felt like there was this massive amount of waste.”

A chance encounter with Markus Stoffel, a leading molecular biologist at ETH Zurich, left her convinced that the key to creating a new health and medicine paradigm was to aggregate the World’s genetic data and discern patterns to prevent and combat diseases like Parkinson’s and Alzheimer’s. Big Data meets Big Pharma.

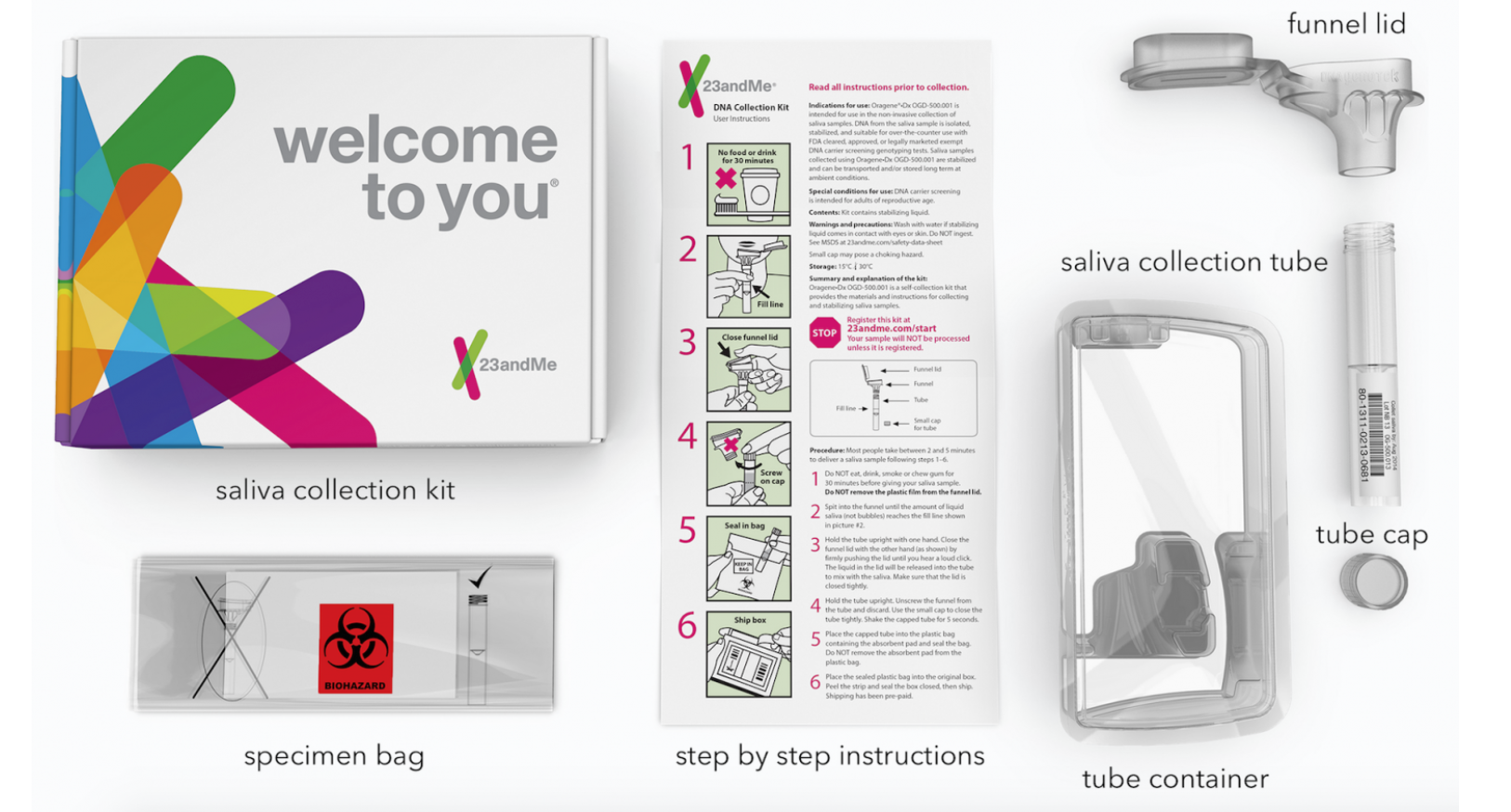

23andMe launched with a mail-order test kit that generated a detailed genetic report for $1,000. A simple saliva sample produced insights across nearly 200 categories — including risk factors for inherited diseases like cystic fibrosis, genetic traits like lactose intolerance, and various details about your genealogical history. By 2012, 23andMe had driven the price down to $99.

In 2013, Uncle Sam dealt 23andMe a potential death blow. The Food and Drug Administration ordered the company to stop marketing its flagship tests, deeming them unregulated medical devices. Regulators argued that consumers could misinterpret this health data, which had not been clinically validated, and take action based on a “false positive” result.

While many would have wilted, Anne Wojcicki played offense. Rule number one for startups is not to run out of money. With its popular product sidelined, 23andMe partnered with pharmaceutical companies like Genentech and Pfizer, trading access to its DNA database in exchange for upfront payments and a cut of revenue from new drugs developed using it. At the same time, it worked with the FDA to get an approved genetic test back on the market.

In late 2015, with the required Federal approvals in hand, 23andMe relaunched its genetic reporting service targeting four categories: ancestry, wellness, traits, and carrier status. With over one million customers and a $115 million Series E financing in October 2015 that valued the company at $1.1 billion, 23andMe is once again pushing the boundaries of personalized medicine.

THREE TRENDS TO WATCH

1. Personal, Predictive Medicine

The fact that everybody can and should have their own genetic profile has profound implications to the future of medicine and human life. This isn’t science fiction.

Instead of the normal reactive treatments patients receive under “modern medicine,” genetic mapping unlocks the potential for personalized prescriptions that could mean taking a new or modified drug, changing your diet or fitness routine, or any other combination of treatments that are tailored to your specific needs.

The first key impact is prevention. Today, over half of 23andMe customers learn something from their test results that is “medically meaningful” — from a disease risk to a dietary trait. Understanding risks and health conditions enables people to take preventative measures, and as tests continue to improve, health and wellness service providers will be better equipped to help people avoid or stave off risk.

The second key impact is personalized medicine. Big Pharma companies are eager to purchase 23andMe data because it unlocks insights about how various drugs and treatments impact people across a variety of genetic profiles. As pharmaceutical R&D increasingly integrates massive genetic datasets, it will enable the development of tailored drugs that are more effective for sub-populations, or that minimize the risks of adverse reactions.

A benign example is Benadryl, which makes some children sleepy and others hyperactive. In the future, parents will be able to pick the Benadryl “flavor” that doesn’t make their kids bounce off the wall.

23andMe is attacking this opportunity head on, recently announcing the addition of former Genentech research chief Richard Scheller, who will lead an in-house research TEAM focused on the discovery and development of new therapeutics. Look out Big Pharma.

2. The Age of Consumer Health

Beyond the tangible implications for prevention and personalized medicine, 23andMe’s genetic testing services are ushering in a much broader paradigm shift. As Anne Wojcicki observed at the Pioneer Summit, “What I’m most excited about is this consumer-health revolution. Consumers are standing up and saying they want to take control.”

The rise of fitness trackers like Fitbit underscore a massive public interest in taking ownership of health and wellness, instead of navigating an arcane healthcare system with opaque processes, elusive personal records, and ambiguous outcomes. 23andMe takes this concept a step further by allowing consumers to determine game-changing insights about their medical profile without going to a doctor or specialist.

The net result will be increasingly consumer-directed healthcare, with service providers becoming more accountable to empowered patients who demand timely, preventative, and personalized treatment.

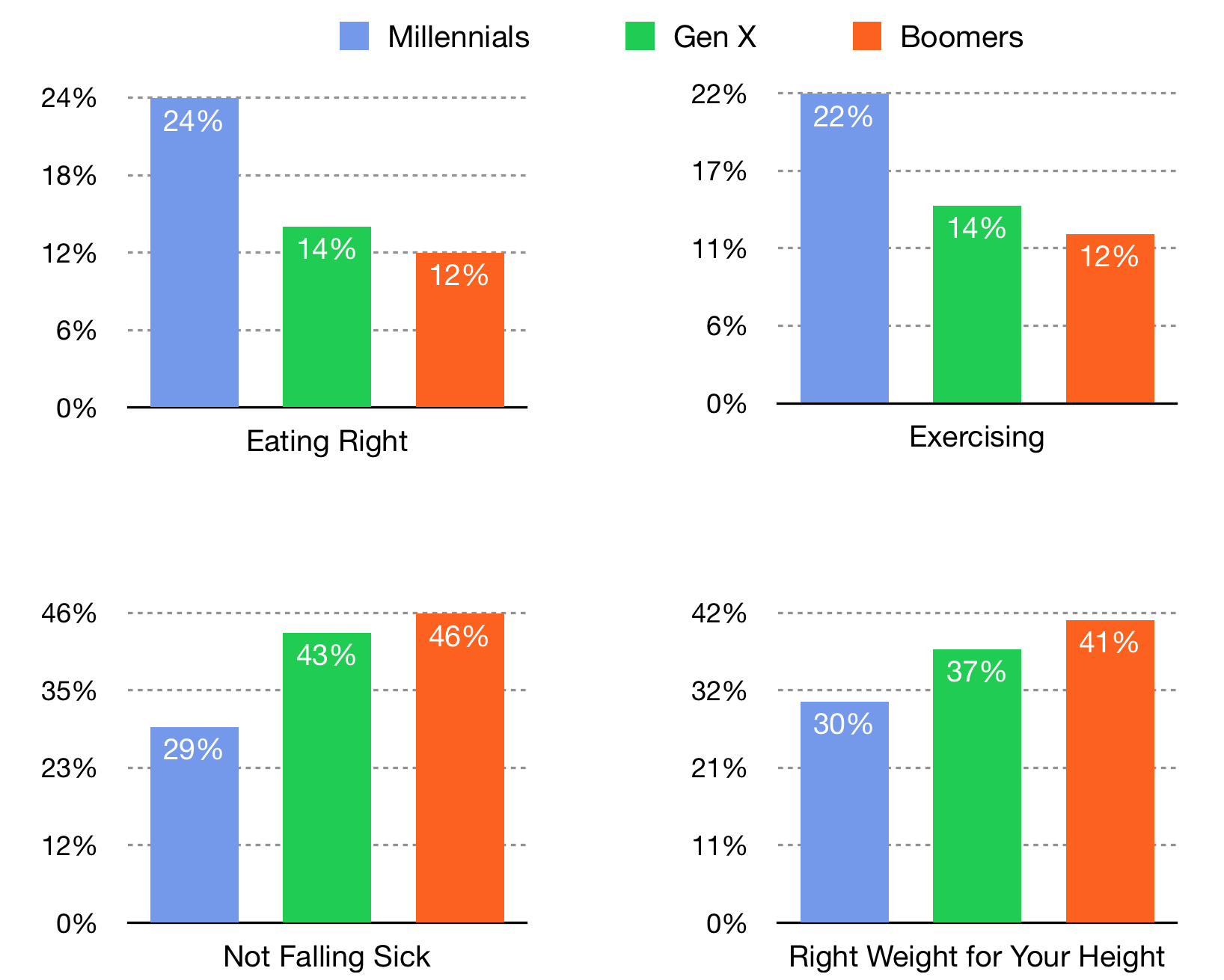

This trend is consistent with a generational shift we are seeing in the very definition of a “healthy” life.

For Millennials, “healthy” doesn’t just mean “not sick.” It means a daily commitment to eating right and exercising. This mindset stands in stark contrast with that of prior generations, who care less about lifestyle and more about simply avoiding bad health outcomes.

Source: Brookings Institution, Goldman Sachs, Nielsen

3. Big Data, Smart Medicine

23andMe has assembled the World’s largest database of genetics and phenotypic data, which the company will begin aggressively mining as part of its recently-announced in-house therapeutics research strategy.

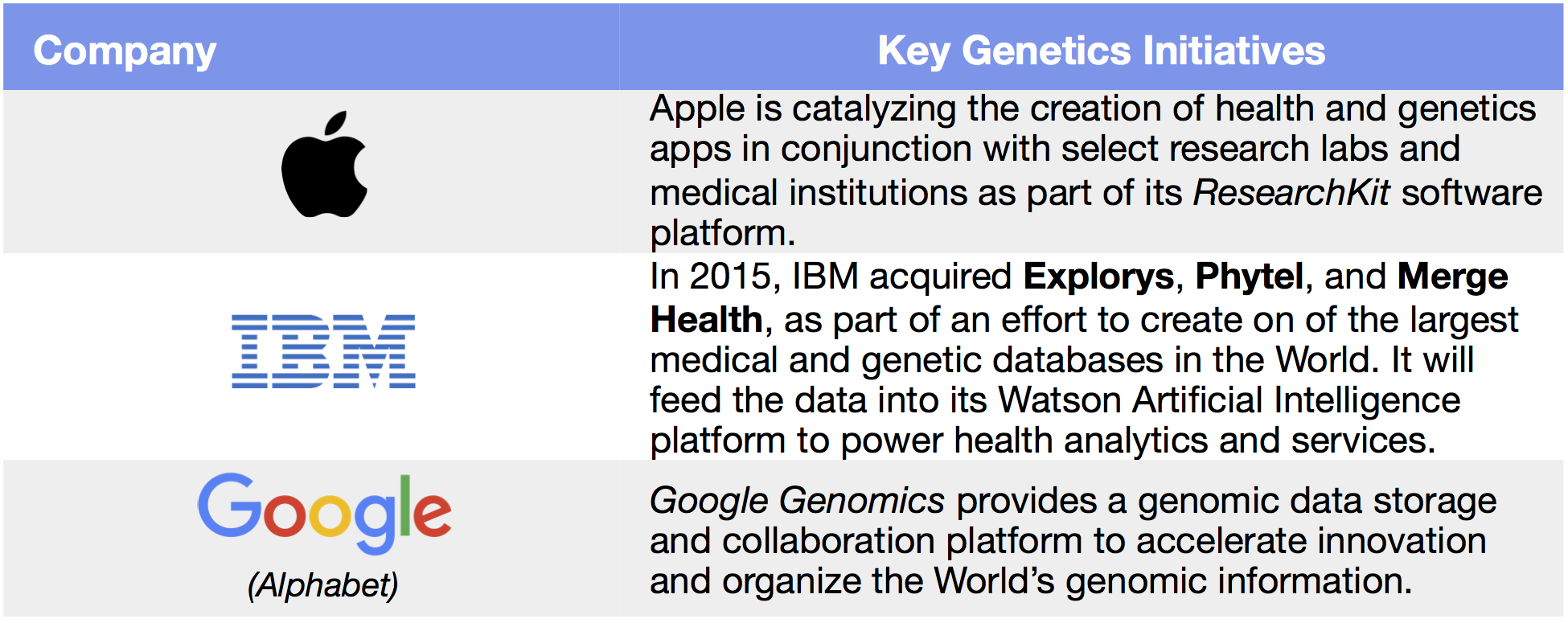

In recent years, leading technology companies have also turned their attention to genetics, using Big Data to make healthcare smarter. IBM, for example, has been on a healthcare and genetics buying spree. In 2015 it acquired Explorys, a company spun out of the Cleveland Clinic with access to the anonymized health records of over 50 million people, and Phytel, which has access to population health management data. Big Blue could be sitting on one of the largest, most comprehensive health and genetic databases in the World.

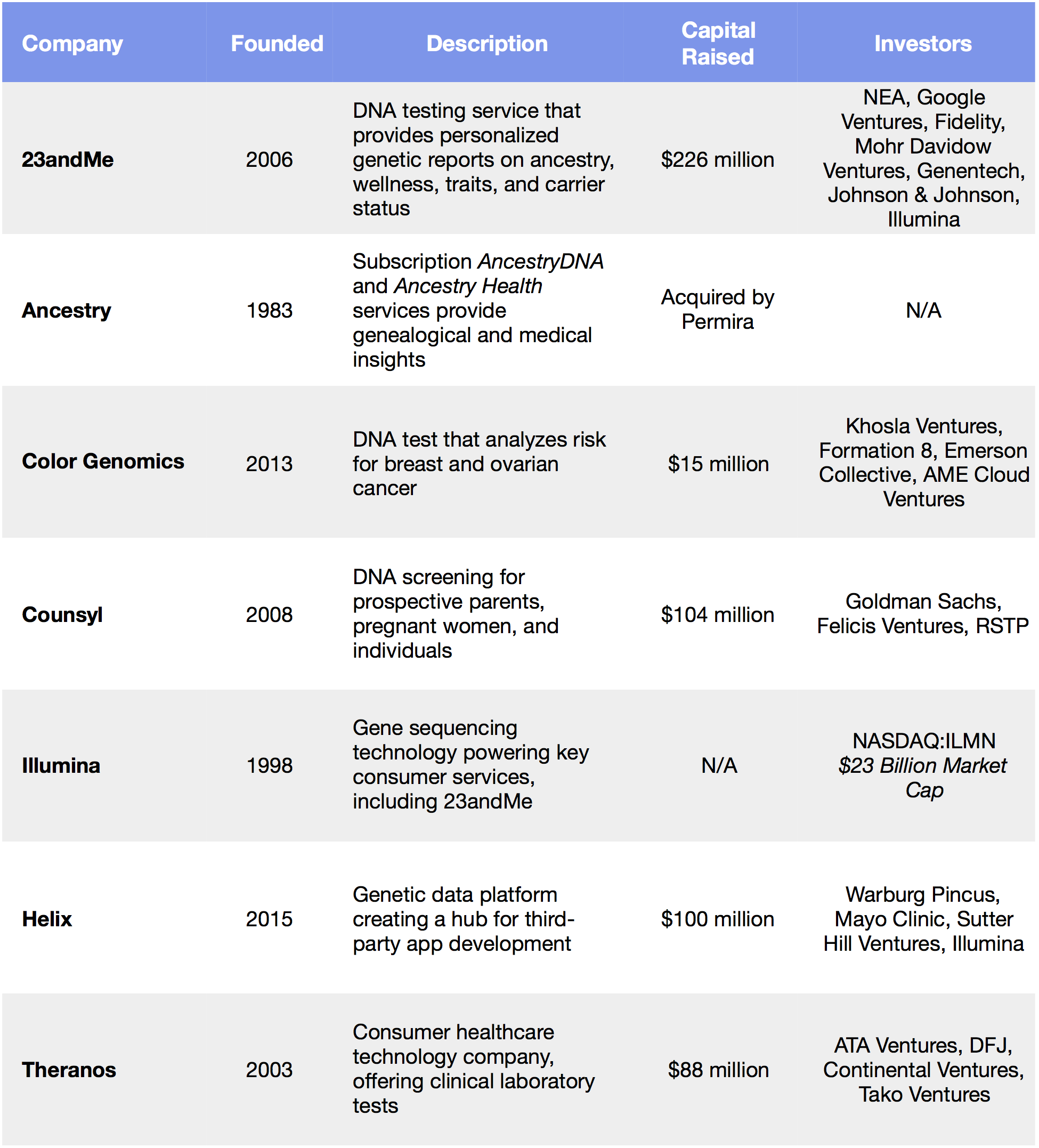

Source: MIT Technology Review, Fusion, GSV Asset Management

Apple is collaborating with U.S. researchers to catalyze the creation of apps that will collect and apply user DNA to provide health insights and medical services. The apps will be based on Apple’s ResearchKit software platform, which launched in 2015. Alphabet (Google) launched Google Genomics for researchers to store and share genomic data, with the aim to accelerate key research breakthroughs and organize the World’s genomic data. (Disclosure: GSV owns shares in Apple and Alphabet)

WHAT’S NEXT

In her closing remarks, Anne observed that as Silicon Valley turns its attention to health, wellness, and medicine, the pace of innovation will continue to accelerate. Part of the interest has been driven by economic opportunity. The healthcare and pharmaceutical industries in many ways resemble the early days of the Internet. The Market has been dominated by large incumbents and inefficient services and opportunity for innovative technology-enabled solutions abounds.

But more importantly, Silicon Valley has always been about solving BIG problems. As entrepreneurs and engineers have grown up, health matters more. And caring for parents in their later years brings many of these challenges into sharper focus. We’re excited to track companies like 23andMe as they invent the future of health and personalized medicine.

—

Stocks finished January better than they started, with the Dow rising 2.3% for the week, the S&P 500 advancing 1.7%, and NASDAQ gaining 0.5%. Even with solid gains over the past two weeks, January was brutal, with the S&P 500 down 5.1%, NASDAQ off 7.9%, and the GSV 300 falling 19.2%. Oil prices bounced from the bottom last week and the 10-Year Note yield finished at 1.92%.

The Fed decided to do nothing in its monthly meeting. Anemic GDP growth of 0.7% for the 4th Quarter and an extremely shaky Market were undoubtedly reasons for the inaction.

Facebook continued to be a monster with 4th Quarter sales up over 50%, fueled by momentum in mobile. For the week, Facebook rose nearly 15% and now has a market cap of $319 billion. Another positive last week was the continued resurgence of Microsoft, which beat analyst views, sending the stock up over 5%. Microsoft has gone from your desktop operating system to your cloud service provider. (Disclosure: GSV owns shares in Facebook)

Speaking of cloud services, on the not-so-sunny side of earnings results, Amazon missed analyst estimates, putting the brakes on what had been an acceleration story. Apple also disappointed investors, despite reporting nearly $20 billion of earnings, which was a new profit record. eBay reported mixed results, which prompted a 12% decline in its stock. (Disclosure: GSV owns shares in Amazon and Apple)

There is no question that we are in an environment that is fraught with anxiousness. The slightest hint of bad news is treated like a catastrophe. While it takes a strong stomach to be proactive, history has shown that it is times like these that provide long term investors with the greatest opportunities. We are focusing on fundamentals and look at the Market volatility as our friend.