Market Snapshot

| Indices | Week | YTD |

|---|

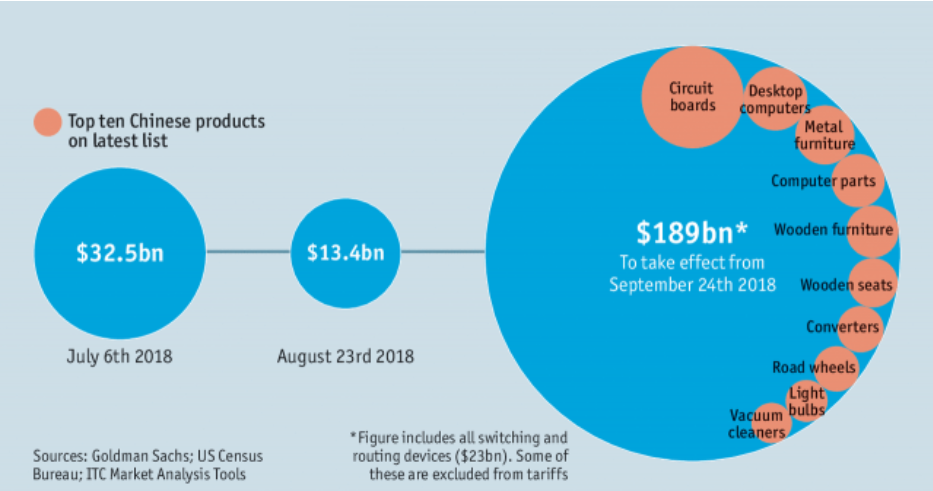

The “Trade War” between United States and China escalated last week with the U.S. imposing nearly $200 billion of new tariffs on the Middle Kingdom. China retaliated immediately, announcing another $60 billion of import taxes on U.S. goods.

Then something unexpected happened. Markets didn’t panic. Just like the “Whos of Whoville,” who continued to sing after the Grinch stole Christmas, stocks actually went up.

In fact, U.S. stocks hit all time highs this week, with the Dow up 2.2% and the S&P 500 up 0.8%. Chinese markets also rose. Until last week they had dropped like a rock in direct correlation to the Trump imposed tariffs. The Shanghai and Shenzhen Exchanges were both up approximately 3% last week versus being down 25% and 17% year-to-date, respectively.

EVERYBODY knows that free trade is a “win-win,” so what does the market know that economists from around the world don’t? It’s our suspicion that the “tit-for-tat” signals that a “peace pipe” is coming soon. This could result in a more level playing that benefits both the United States and China in the long run. To get a glimpse of how this mini-series ends, see the recent back and forth with Mexico, which will likely result in better trade agreements for both countries.

Speaking of peace pipes, pot and the broader cannabis industry has continued to be a smoking hot category. Newly public Tilray, a British Columbia-based cannabis provider, saw its stock increase 38% in September. The company now has a $16 billion market capitalization with $20 million of 2017 revenues. Cannabis competitor Canopy has a comparatively paltry $11 billion market capitalization.

Skipping the pipe all together, New Age Beverage offers a line of “non-psychotic” CBD-infused drinks. Its market capitalization has increased a probably-psychotic 284% since it listed on NASDAQ in 2017.

In the “definitely psychotic” category was Elon Musk smoking a blunt on a live podcast just before the SEC launched an investigation into his “beyond psychotic” tweet about Tesla going private.

While companies can grow in war and grow in peace, the biggest forward indicator for opportunity is demographics… it’s like a big, fat, slow curveball hanging over the plate for a growth investor.

Looking in the rearview mirror, the world’s economic engine for the last 100 years was the United States, Europe, Japan, and Canada.

In 2000, with just 9% of the global population, these countries contributed nearly 75% of global GDP. But over the last 15 years, GDP growth in these countries has been flat-to-negative. Today they contribute just 53% of Global GDP.

A key driver behind this change has been aging populations. Over 26% of these populations are over the age of 60 while just 16% are under the age of 15. In Japan last year, there are more adult diapers sold than baby diapers.

These dynamics are not changing anytime soon. The average (weighted) fertility rate in Canada, the United States, Europe, and Japan is 1.6. At a fertility rate under two, you’re essentially dying.

Where is the growth and opportunity as we look ahead? We call it the VChIIPs — Vietnam, China, India, Indonesia, and the Philippines.

These countries are home to over 41% of the global population and command 20% of global GDP, growing at 10.8%. If you look at the demographics, they are effectively the mirror opposite of what you see in the developed countries. Just 12% the VChIIP population is older than 60, 23% is younger than 15, and the fertility rate is 2.1, driving organic growth.

Source: The World Bank, GSV Asset Management

Surprisingly, conventional wisdom holds that the China growth story is yesterday’s news. But if you look at the Middle Kingdom’s profound technological innovations in recent years, coupled with a relentless pace of infrastructure investment, President Xi’s “Chinese Dream” is becoming a Chinese Reality. This growth story is just beginning.

A key catalyst is massive urbanization that is pervasive around the World but explosive in China. Take Shenzhen as an example.

In the 1970s, Shenzhen was a small fishing village. But in 1980, it became China’s first “Special Economic Zone,” which sparked breakneck growth for the next two decades. In less than a generation, Shenzhen has gone from being a backwater to the financial backbone of southern China. It is home to the Shenzhen Stock Exchange, as well as the headquarters of Ping An Insurance, Huawei, and Tencent. It has one of the busiest ports in the World.

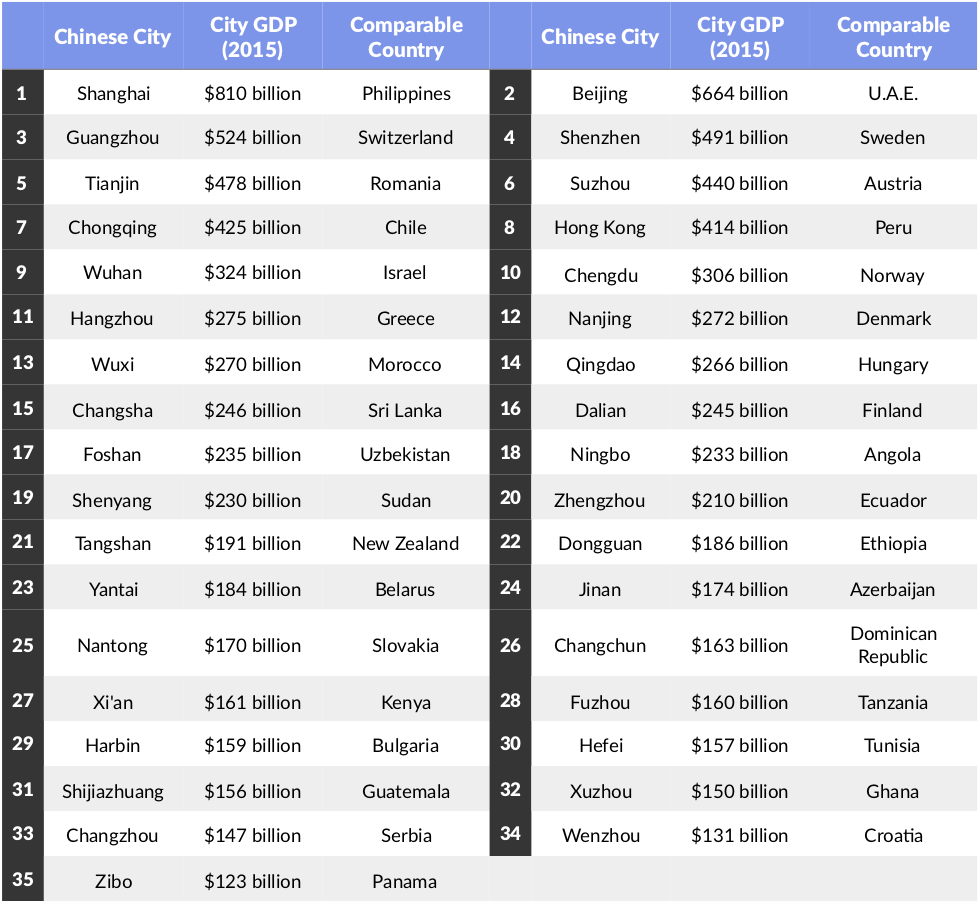

If you look at the United States, there are 10 cities with a population of one million or more. In China, there are 160. But more impressively, 35 Chinese cities have economies that are larger than entire countries, including the Philippines, Switzerland, the U.A.E. and Sweden.

Importantly, Chinese urban behemoths are clusters of young people who are embracing technology, brands, and digital commerce. These are young people who are getting ready to change the World. Accordingly, we’re seeing innovation abound. Transformative businesses are being created. Venture investment activity is accelerating. In 2017, startups in Beijing and Shanghai raised more venture funding that startups in Silicon Valley.

STATE OF PLAY

The VChIIPs are spawning a stable of game changing new businesses in their own right. China is intent on creating its own consumer brands, exporting them, and putting up roadblocks for foreign players. Alibaba (e-commerce), Tencent (digital media), Xiaomi (mobile devices), China Mobile (mobile), DJI (drones), Baidu (search & Internet services), and NetEase (gaming) — collectively valued at over $1.2 trillion — are just a few examples of what China has in store for the World. Today, China is home to the 7th and 8th largest public companies in the World — Alibaba and Tencent.

The VChIIPs are home to 95 Unicorns and seven “Ubercorns”— private companies valued at over $10 billion. Combined, Chinese Unicorns have a market value of over $324 billion.

Consumers

According to the Brookings Institute, the world is in the first inning of a demographic transformation that will result in the rise of a Global “Middle Class” numbering more than 5.2 billion people in the next decade, ascending predominantly from the low income populations of the world’s developing and emerging economies.

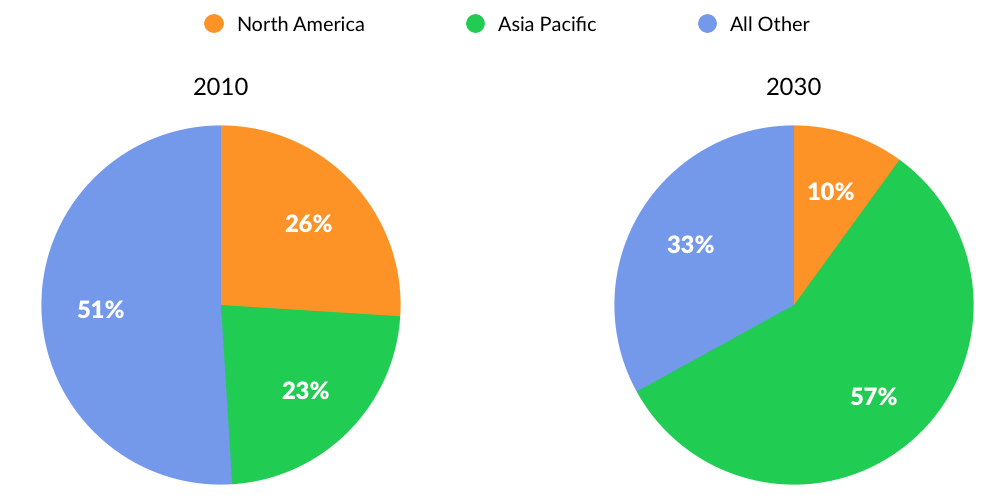

Defined as households that spend between $10 and $100 per day, the Middle Class is a cohort of CONSUMERS. The middle class is projected to spend $29 trillion more per year by 2030. Global middle class annual spending is expect to increase from $35 trillion today to $64 trillion by 2030 — an increase of over 80%.

The world has never witnessed income growth at this speed or magnitude. China and India, for example, are doubling their real per capita incomes at 10 times the pace England achieved during the Industrial Revolution and 200 times the scale.

The VChIIPs are where the action is. According to the Brookings Institution, the Asia-Pacific region accounts for roughly 23% of global middle class consumption today. By 2030, it will be nearly 60%. This shift will create profound opportunities and challenges.

Expanding populations with discretionary income is creating a remarkable opportunity for multinational corporations and homegrown startups. This trend will drive new product development and marketing dynamics for a generation.

India has had its own proliferation of consumer brands including Flipkart, Ola, InMobi, and PayTM — without the onerous state protections of its neighbor in the Middle Kingdom.

Last month, Walmart completed its $16 billion acquisition of Flipkart and the American retailer intends to use the Flipkart investment to transform Walmart’s position as a consumer brand in India. One week after Walmart announced its acquisition, Paytm — India’s largest digital payments company — announced a strategic investment from Berkshire Hathway. This investment follows a $1.4 billion fundraise from SoftBank that Paytm completed last May.

Finally, among the remaining VChIIPs, Indonesia — home to Tokopedia (Digital Marketplace, $1+ billion market value), and Go-Jek (Transportation & Logistics, $5 billion market value) — is on deck.

Indonesia’s Go-Jek, particularly, crystallizes the dynamic opportunities emerging from the VChIIPs.

Ride sharing, in most parts of the World, involves getting into someone’s car. But in a few countries, ride sharing is done on motorbikes. Thailand, Vietnam, India, and Indonesia have significantly more motorbikes than cars on the streets. The reason is simple — most of the population cannot afford a car. In Indonesia, approximately 80% of urban transportation is done on motorbikes, with an estimated 80 million motorbikes sold annually.

Founded in 2010 with only twenty motorbike drivers, Go-Jek’s fleet today now exceeds 1 million drivers. Go-Jek, which launched as a motorbike peer-to-peer ride sharing service, has quickly risen in popularity despite the entrance of heavy hitters like Uber in the region. The company is applying technology in a way that makes sense for the nuanced Indonesian market and offers more than 18 app-based on-demand services. Services offered include Go-Send, Go-Box, Go-Mart, Go-Tix, Go-Med, Go-Pulsa, Go-Pay, Go-Bills, Go-Points, Go-Massage, Go-Glam, Go-Auto, Go-Food, Go-Clean to name a few.

Sustainability

William Faulkner, who served as a cultural ambassador for the State Department during the Cold War, remarked that if we simply gave people a used car and a TV, they would understand the benefits of the American model.

Unfortunately, under the current model, the Earth cannot sustain transition of VChIIPs into carbon copies of America. Today, we are already using 1.5 planets worth of resources to meet global consumption demands (it takes 1.5 years to replenish the resources we consume in a year). We will need another half of a planet to simply sustain the next generation.

According to a recent study by the University of Michigan, for example, if India, China and Indonesia were to use air conditioners at the same rate as the United States (they are on pace to do so), energy consumption in those countries would be 50x levels in the United States.

The International Energy Agency projects that global energy demand will grow 37% by 2040. This additional demand is equivalent to the total current annual consumption of the United States and European members of the OECD combined. China and India alone are expected to account for over half of the total increase.

Education

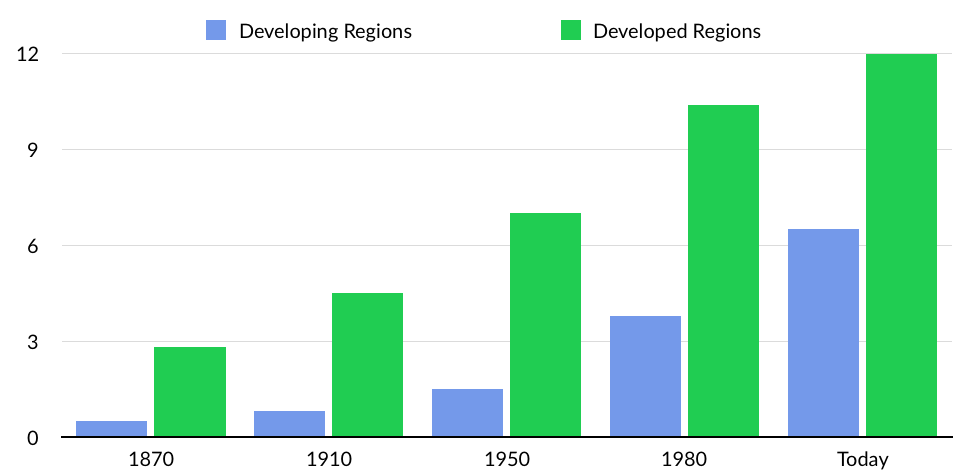

According to research from the Brookings Institution, the developing World is about 100 years behind developed countries in educational achievement. You might think these gaps would have tightened significantly with the technological advancements and increased connectivity of the Internet Age.

But educational models have remained effectively unchanged for over a century — which has resulted in linear progress.

In India, for example, the number of private universities doubled from 2007 to 2012 in response to massive demand for higher education and a growing knowledge economy. But linear growth through brick-and-mortar models has been no match for demographics. According to research from the Parthenon Group, India is on track to have 40 million more college-uneducated adults in 2020 than today.

The same dynamics that have paved the way for disruptive global businesses to launch at lightening speeds — from Uber, which is upending the transportation industry, to Airbnb, which is redefining the hotel industry — are now propelling a new generation of education and talent companies the will help the VChIIPs bridge the gap.

Founded by CEO Cindy Mi, language learning platform VIPKID is the first female-led and founded Unicorn in Global Education Technology. Founded in 2013, today VIPKID has over 60,000 teachers delivering lessons to over 500,000 students.

VIPKID is one of the fastest growing companies in the world, going from zero dollars in revenue in 2014 to a forecasted $750 million in annual revenue run-rate this year, according to CEO Cindy Mi. This April, VIPKID raised $500 million from Sequoia Capital China, Tencent, Matrix Partners ,and Coatue at a $3 billion valuation.

Liulishuo, which operates an AI-powered language learning application is another emerging star in the East. Founded in 2012, the Shanghai-based company has over 45 million registered users on its English learning platform. The company has raised $129 million from investors including IDG, GGV, Cherubic Ventures, and Hearst Ventures. The company filed to go public and is expecting to raised approximately $72 million in its IPO.

In India, BYJU’S is the country’s largest education technology company. Founded in 2008 and headquartered in Bangalore, BYJU’s operates a platform of online classes in India for students in grades 4 through 12. The company counts over seven million learners who spend 57 minutes daily on the platform on average. BYJU’S has raised $244 million to date from investors including Tencent, Sequoia Capital India, IFC, Times Internet, Chan Zuckerberg Ventures, and Lightspeed Venture Partners.

WHAT’S NEXT: CRADLE OF GROWTH

Desmond Tutu, a lion of the anti-apartheid movement in South Africa, once remarked that, “when the missionaries came to Africa, they had the Bible and we had the land. They said ‘Let us pray.’ We closed our eyes. When we opened them we had the Bible and they had the land.”

For generations, the cradle of civilization has been captive to colonial overreach. Economic development has been constrained by corruption and in some cases, chaos, resulting from arbitrarily defined borders and hastily-assembled export economies focused on commodities demanded by the developed world. But for those who’ve had their “eyes closed” over the last five years, a different narrative is taking shape across the African continent. It’s a story of renewal, growth, and innovation.

Today, the continent claims seven of the 10 fastest growing countries by population and four of the 10 fastest growing countries by GDP.

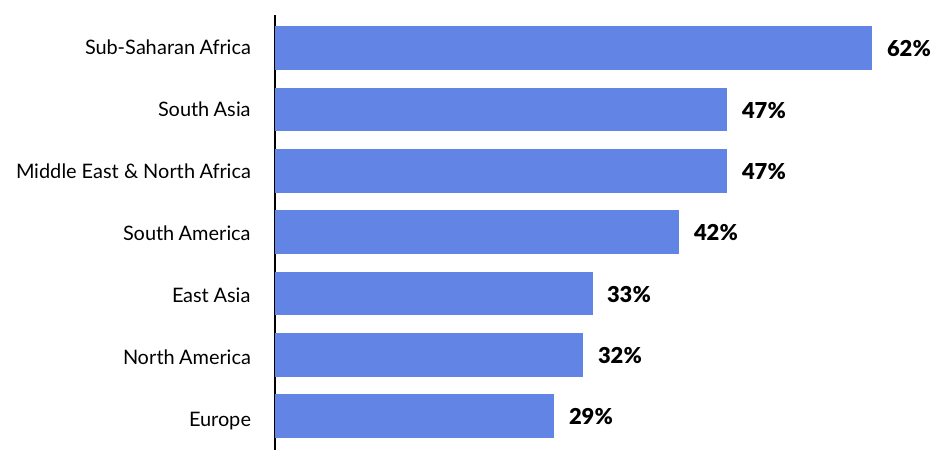

In world of stagnant or declining fertility rates, Sub-Saharan Africa’s remains high at 4.8, which is three times greater than the average developed country. In fact, the region is collectively home to the youngest population in the world. 62% of its inhabitants are under the age of 25 and 42% are under the age of 15. Less than 5% are over the age of 60.

As the World’s population is projected to reach 9.5 billion by 2050, approximately half of the growth in the next 35 years is expected to occur in Africa. In this period, Nigeria is projected to overtake the United States as the 3rd most populous country in the World. Over 400 million people will call a country one-tenth the size of the U.S. home.

Look for GDP growth to accelerate as the continent continues to develop fundamental infrastructure while broad segments of the continent’s 1.2 billion people claw their way to the middle class. Consumer spending power in Africa has risen from an estimated $470 billion in 2000 to over $1.1 trillion in 2016.

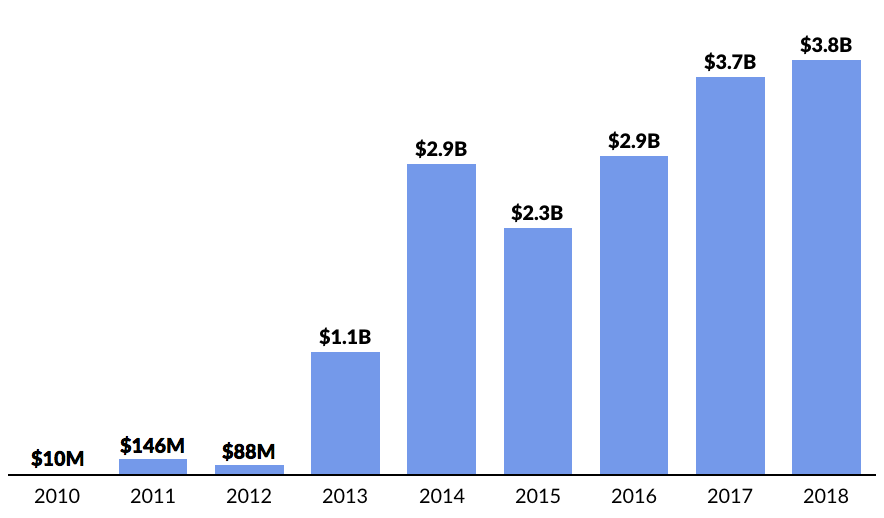

Venture investment into African startups has been rapidly increasing as entrepreneurs launch viable businesses targeting a defined growth opportunity. In 2010, only $11 million was invested into Africa startups. It ballooned to $3.2 billion in 2016.

South Africa based Naspers, one of the largest digital consumer platforms (commerce & entertainment) in the world with nearly a $100 billion market value, has played an enormous role in investing and supporting startups in Africa and around the world. Notable investments include Tencent (it owns 30%), Flipkart, Delivery Hero, Foodpanda, FarmLogs, and more.