Market Snapshot

| Indices | Week | YTD |

|---|

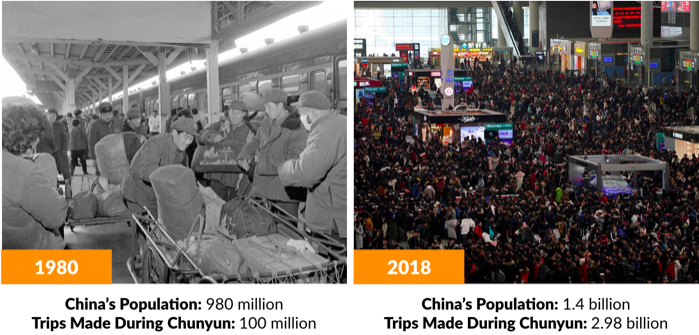

Last week kicked off one of the greatest mass migrations in human history. And it has nothing to do with the global refugee crisis.

Over the next 30 days, it is estimated that Chinese citizens and expats will complete nearly three billion trips by land, sea, and air on pilgrimages to their hometowns to ring in the Chinese New Year.

Chunyun — “The Spring Festival Travel Season” — is as good an opportunity as any to reflect on China’s staggering growth story. Thirty years ago, Chunyun comprised about 100 million travelers. This year, the Chinese Rail Authority is expecting over 390 million train travelers alone. That would be the equivalent of the entire U.S. population — and then some — piling onto Amtrak cars at Christmas time.

Surprisingly, conventional wisdom holds that the China growth story is yesterday’s news. But if you look at the Middle Kingdom’s profound technological innovations in recent years, coupled with a relentless pace of infrastructure investment, President Xi’s “Chinese Dream” is becoming a Chinese Reality. This growth story is just beginning.

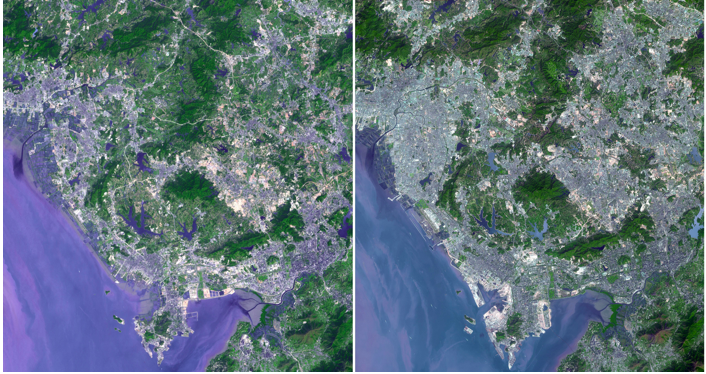

A key catalyst is massive urbanization that is pervasive around the World but explosive in China. Take Shenzhen as an example.

In the 1970s, Shenzhen was a small fishing village. But in 1980, it became China’s first “Special Economic Zone,” which sparked breakneck growth for the next two decades. In less than a generation, Shenzhen has gone from being a backwater to the financial backbone of southern China. It is home to the Shenzhen Stock Exchange, as well as the headquarters of Ping An Insurance, Huawei, and Tencent. It has one of the busiest ports in the World.

If you look at the United States, there are 10 cities with a population of one million or more. In China, there are 160. But more impressively, 35 Chinese cities have economies that are larger than entire countries, including the Philippines, Switzerland, the U.A.E. and Sweden.

35 CHINESE CITIES HAVE ECONOMIES THAT ARE AS BIG AS A COUNTRY

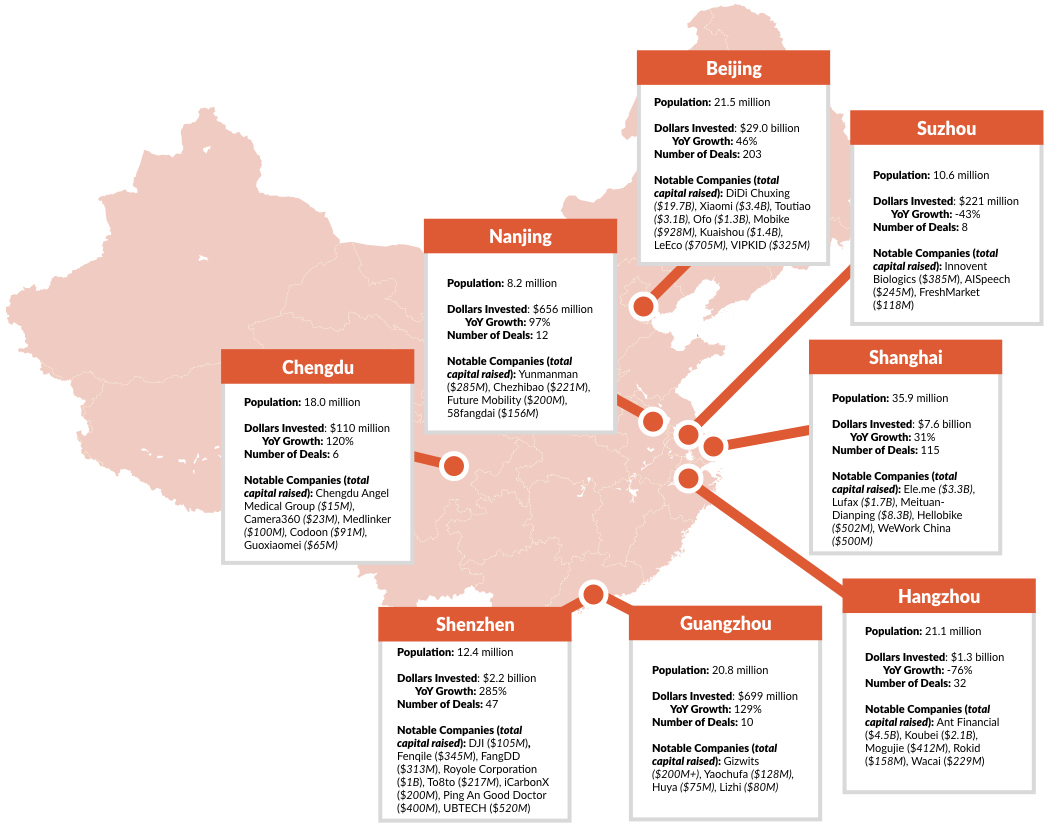

Importantly, Chinese urban behemoths are clusters of young people who are embracing technology, brands, and digital commerce. These are young people who are getting ready to change the World. Accordingly, we’re seeing innovation abound. Transformative businesses are being created. Venture investment activity is accelerating. In 2017, startups in Beijing and Shanghai raised more venture funding that startups in Silicon Valley.

4 KEY TRENDS TO WATCH

Our view is that while the country has unmistakable cons, you want to be long on China. While you can’t predict the short term ebbs and flows, China is a Mega-theme for the future. Today, the Middle Kingdom is positioning itself to be in the center of the Global Silicon Valley in four ways.

1. Imitator to Innovator

“Copycat” is rarely a term of endearment. But most great innovators have also been great imitators. Pablo Picasso once said, “Good artists copy, great artists steal.” It’s a lesson one of Silicon Valley’s great artists took to heart as he built a $650+ billion business. Steve Jobs created a culture at Apple that was built on “shamelessly stealing” great ideas, and then making them better than anyone could imagine.

This has played out in China on a massive scale. Beginning in the early 1990s, a boom in Global manufacturing outsourcing, sparked in part by access to cheap Chinese labor, became a driver of breakneck growth for the Middle Kingdom. It didn’t take long for local manufacturers and suppliers to realize that they could make more than component pieces. Phones and consumer electronics with names like “aPod” and “Nokla” flooded the market in the decade that followed.

The rise of the “Great Firewall of China” — a phase coined by Wired in 1997 to describe China’s widespread Internet censorship apparatus — created opportunities for copycats in the realm of software. The blocking or limitation of Western sites enabled Chinese entrepreneurs to carbon copy almost every blue-chip e-commerce and social media company that has emerged over the last twenty years.

Source: Yahoo Finance, Wall Street Journal, GSV Asset Management

* Denotes estimate

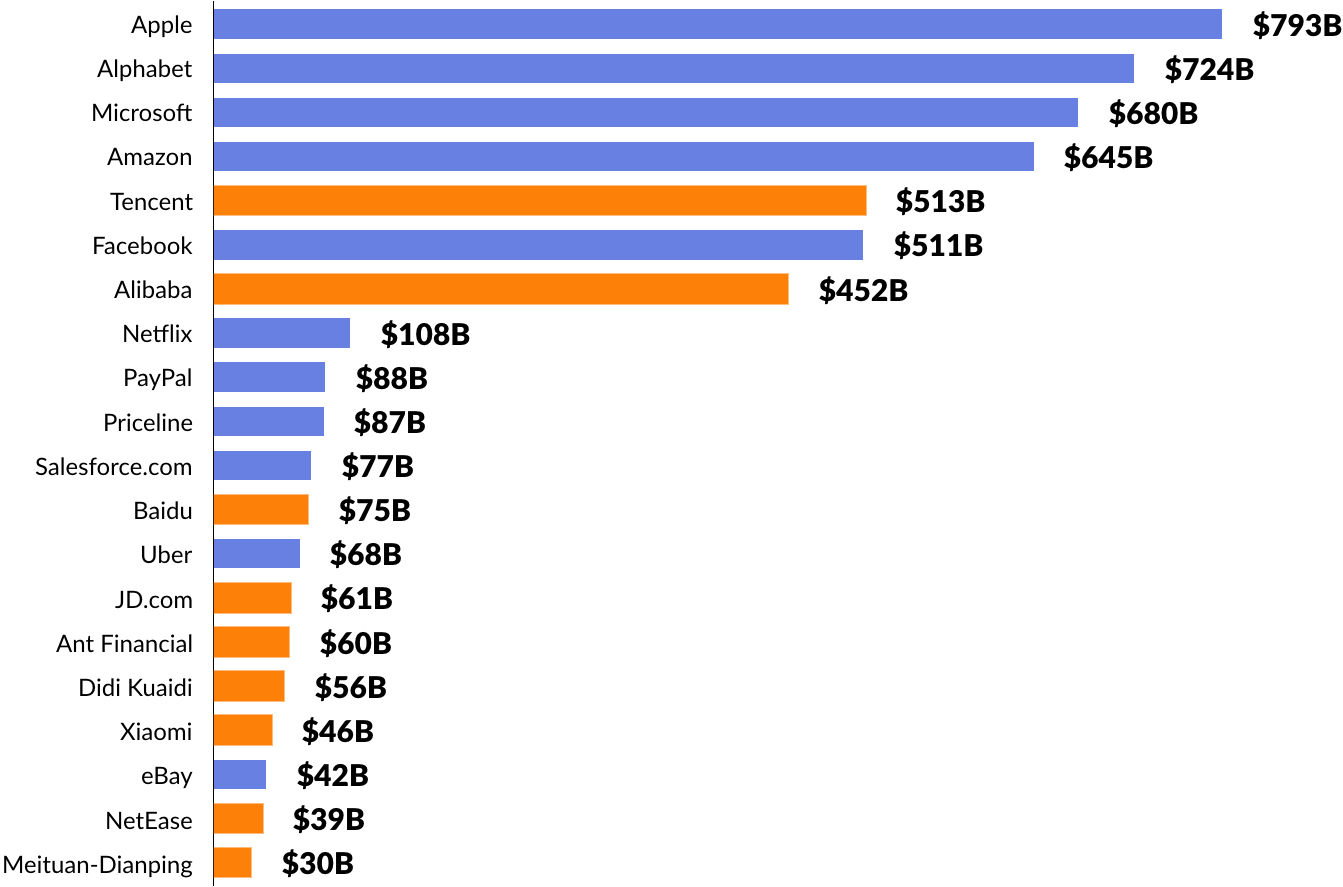

But the imitator has become the innovator. China is intent on creating its own consumer brands, exporting them, and putting up roadblocks for foreign players. Alibaba (e-commerce), Tencent (digital media), Xiaomi (mobile devices), China Mobile (mobile), DJI (drones), and Baidu (search & Internet services), NetEase (gaming) — collectively valued at over $1.2 trillion — are just a few examples of what China has in store for the World.

Today, China is home to the 5th and 7th largest public companies in the World — Alibaba and Tencent. It has produced nine of the top 20 global Internet companies by market value. Incredibly, none of these companies are even 20-years-old.

Dynamic companies born and raised in China are hitting the global stage to actively compete against tech leaders in the United States. And startups are following suit. Today, Chinese entrepreneurs are developing sector-defining technologies and business models.

China, for example, is by far the global leader in creating and using facial recognition technology. Megvii’s Face++, the World’s largest facial recognition platform, is currently used by more than 300,000 developers in 150 countries to determine identities for everything from consumer payment apps to government-issued IDs.

Last year, using a vast camera network coupled with facial recognition technology powered by Megvii Face++, Chinese authorities were able to locate a BBC reporter in less than seven minutes.

Taking a page out of The Matrix, Chinese police are donning facial-recognition glasses to detect and apprehend any known criminals who are traveling during the holidays.

2. One Belt, One Road

In Chinese philosophy, the concept of “yin” and “yang” describes how seemingly opposite or contrary forces may actually be complementary, interconnected, and interdependent.

According to the OECD, for example, the Global Middle Class has increased over 80% since 2000 — from 1.4 billion to 2.5 billion today. While more people than ever now have the opportunity for a comfortable life, today, half of the world still lives on less than $2.50 a day or less. Over 22,000 children die per day from starvation, 2,000 die daily from lack of access to clean water, and 1.6 billion people — a quarter of the World’s population — lacks access to electricity.

Disruptive new technologies like the Internet and smartphones have democratized access to information and created broad new arenas for entrepreneurship. In fact, there are over 2.3 billion smartphones in the world today, effectively placing a computer in everyone’s pocket. But technology also means that nearly 50% of jobs are at risk of automation in the next 20 years.

The power of interconnected forces drives the global growth economy.

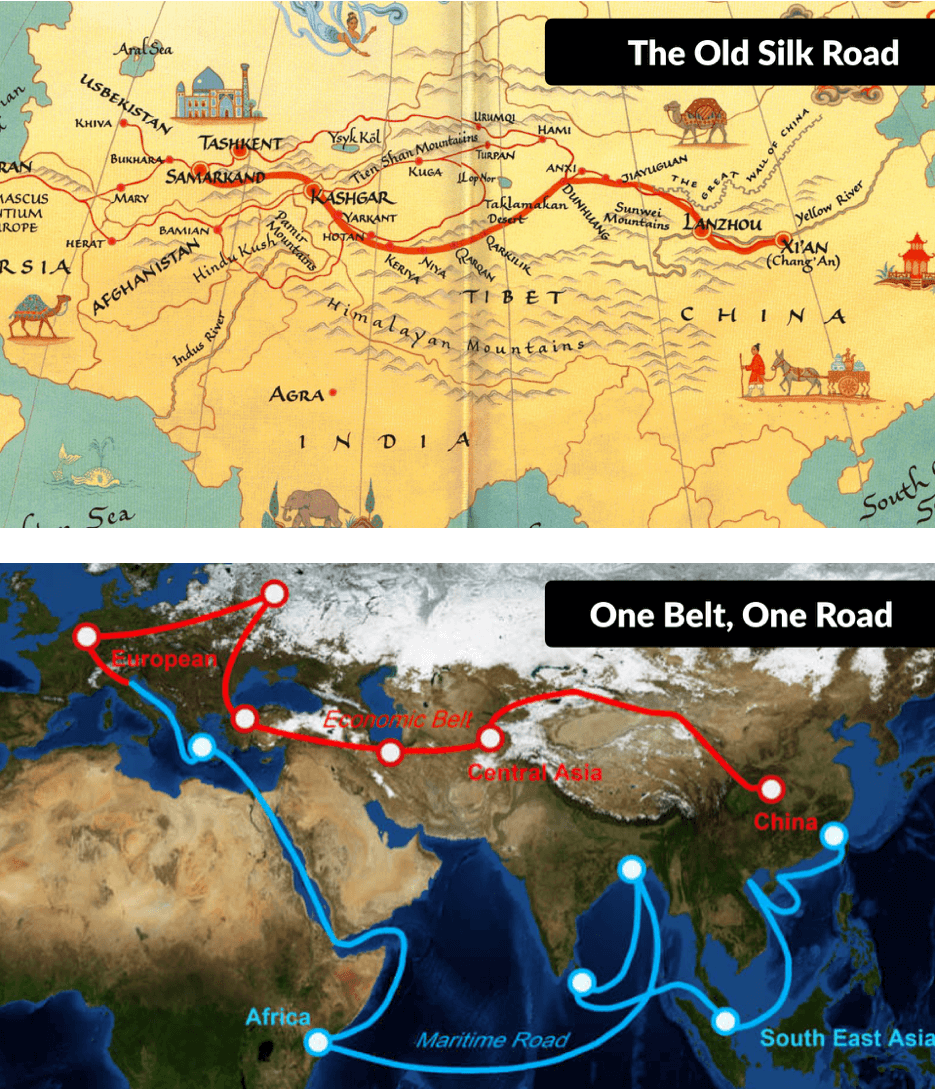

The historic Silk Road which connected Central Asia, India and China was as much about an exchange an ideas than of physical goods. The trade route was catalyst for cultural development across China, India, Persia, Europe, and the the African continent. It catapulted China to economic and geo political dominance. President Xi’s “One Belt, One Road Initiative” aims to create the modern Silk Road, focused on creating connectivity and cooperation between Eurasia and China.

The ambitious project underlines China’s ambitions to become a center of gravity for the global economy. Unveiled in 2013, the One Belt, One Road initiative will span more than 68 countries, encompassing 4.4 billon people and upwards of 40% of the Worlds GDP. It will cost approximately $5 trillion dollars to execute the vision.

Flagship projects in the One Belt, One Road initiative include the $62 billion China–Pakistan Economic Corridor, which will create a series of roads and railways to link China to the Pakistani coast, a high-speed railway that connects Singapore and China, and a vast network of gas pipelines across Central Asia. Other projects are drawing in countries across Europe, Africa, Oceania, and even the Arctic.

3. Silk Road to Silicon Valley

According to the Wall Street Journal, in 2017, over 3,400 venture capital and private equity funds in China raised $240+ billion. That number is more than double the amount raised in 2015 and is 10x more than 2006. Zero2IPO, a global consultancy, estimates that 12,000 investment firms in China manage $1.3 trillion, an increase from 8,000 firms managing $750 billion in 2015.

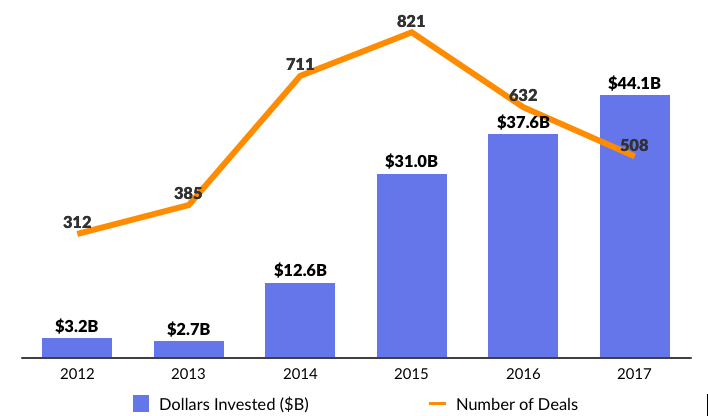

Global venture funding for Chinese startups has been steadily increasing in recent years. rising from $3.2 billion in 2012 to $44.1 billion in 2017.

Source: PitchBook

China is home to 60 Unicorns and six “Ubercorns”— private companies valued at over $10 billion. Combined, Chinese Unicorns have a market value of over $278 billion and they have raised over $63 billion from syndicates of leading global investors.

Beyond venture investments, the Chinese government is fostering an innovation ecosystem across China by accelerating investments in R&D, building hundreds of science and technology parks, universities, and government research institutions across the country.

In 1950, Stanford University created one of the first “high tech parks” in the World, which had a lot to do with the eventual rise of Silicon Valley. In the late 1990s, China took note and began to construct its own network of university science parks, notably the Tsinghua University Science Park (TusPark).

Over the past 20 years, TusPark has produced more than 600 startups and 14 listed corporations — producing over $58 billion in revenue and representing $15 billion of market value. These numbers will accelerate dramatically over the next decade. Today, TusPark operates in over 30 locations across China and Hong Kong, providing incubator services, market access, and connectivity to capital.

4. Pay For Knowledge

Knowledge is power — in more sense than one. In a knowledge-based economy and global marketplace, intellectual capital is the difference-maker for individuals, companies, and ultimately countries.

And you can understand a country by looking at how its people spend their money. Census data shows that families in Asia broadly and China specifically invest a disproportionate amount in the education of their children versus families in the United States.

For example, American families spend 33% of their income on housing. Chinese families spend 10%. On the flip side, American families spend 2% of their income on Education. Chinese families spend 15% of their income on education — nearly 8x more than American families.

A recent headline in the Jack Ma-owned South China Morning Post drives this point home. It described “China’s Myopia Epidemic,” indicating that Chinese students are studying so hard that by the time they enter Universities, 90% are near-sighted.

This year at the 19th Party Congress, President Xi gave a 3.5 hour opening speech to Chinese government officials. What’s more striking is the fact that he spent approximately 25% of the speech talking about the importance of prioritizing educational excellence in China.

Between 2013 and 2017, China spent $450 billion to enable every child in the country to access at least nine years of education for free. During this period, the country built 12,000 new schools — a staggering 6.5 new schools per day. China has also recruited 1.3 million new teachers in the past five years. By comparison, there are only 3.2 million total teachers in the United States.

But, in a recurring theme across almost every major initiative the country undertakes, China is not simply winning with scale. It is winning with innovation.

Consider the phenomenon of “pay for knowledge.” According to a recent study conducted by Chinese education company Guokr.com and media platform NetEase, 75% of surveyed users stated that they were willing to pay for information and knowledge from people they trust and respect. This has led to the rise of companies like iGet, which offers curated information from celebrity experts in the form of podcasts — for a fee.

Forget Bitcoin. In China, the next big currency is knowledge.