Market Snapshot

| Indices | Week | YTD |

|---|

This week, IBM announced a partnership with Andela as part of its Big Data University initiative, which aims to train one million data scientists around the World in the next 10 years.

What’s fascinating is that Andela — launched by 2U Co-Founder Jeremy Johnson in 2014 — combines an unlikely source of talent with a new model of education. The company identifies high-potential, motivated talent in Africa, molds them into world-class software developers, and pairs them with companies as remote team members through freelance talent platforms like Upwork. (Disclosure: GSV owns shares in 2U and Upwork)

Andela’s model unlocks a virtuous circle. By targeting highly relevant skills in an untapped market, it can produce affordable, reliable technology talent to support the core operations of major corporations — an area of desperate need.

Revenue generated by corporate partnerships, in turn, enables Andela to pay students while they learn, and ultimately place them into full-time jobs when they complete the four-year program. The entire model is enabled by new technology fundamentals that empower people to connect and collaborate from any corner of the earth.

THE 100-YEAR GAP

Andela is an outlier in the heavily fragmented global Education and Talent industry, which has dramatically lagged key sectors of the World economy in producing game-changing ideas and scalable businesses. It is creating a technology-enabled platform that will be propelled by network effects. And it is providing a blueprint for the developing World — which has chronically lagged the developed world in education attainment and outcomes — to leapfrog into the 21st century.

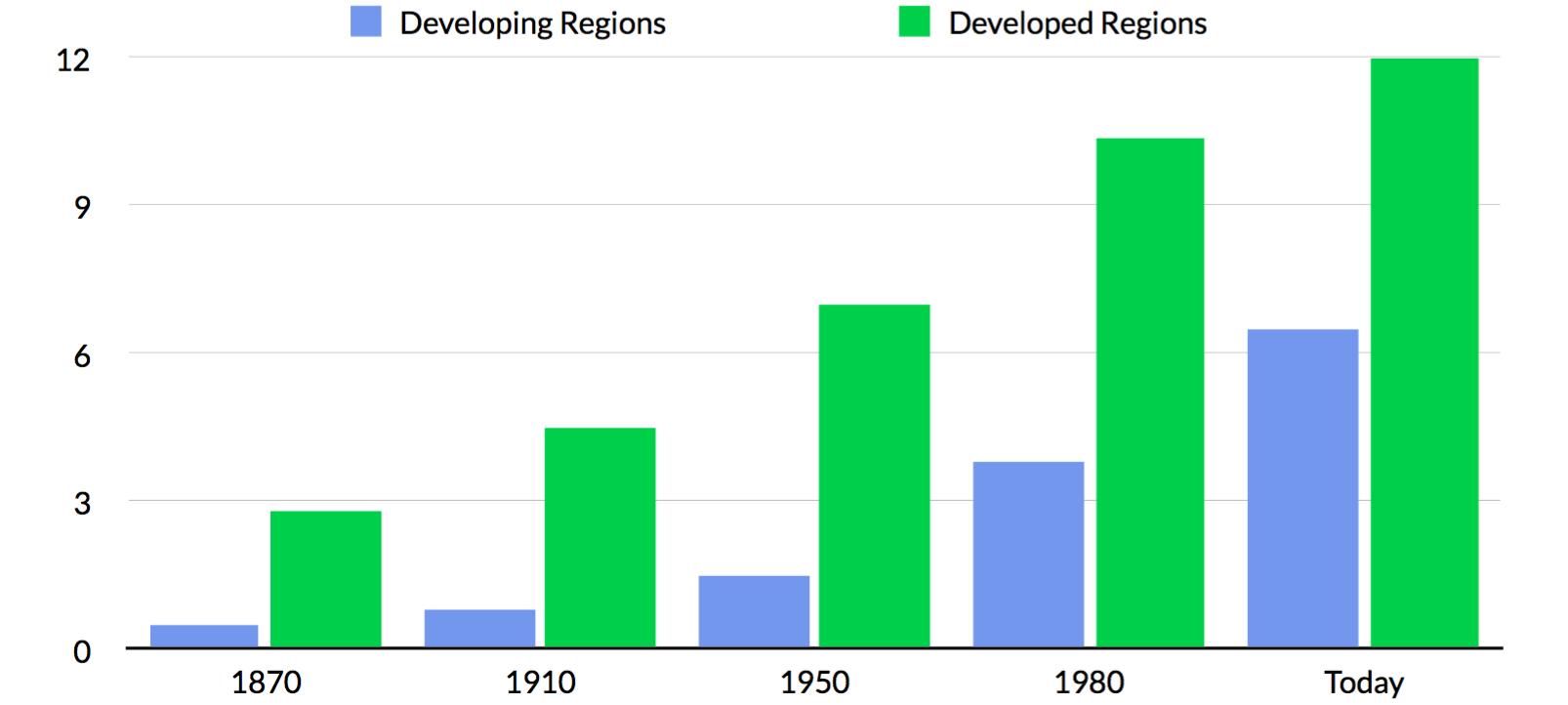

According to research from the Brookings Institution, the developing world is about 100 years behind developed countries in educational attainment and achievement. You might think these gaps would have tightened significantly with the technological advancements and increased connectivity of the Internet Age.

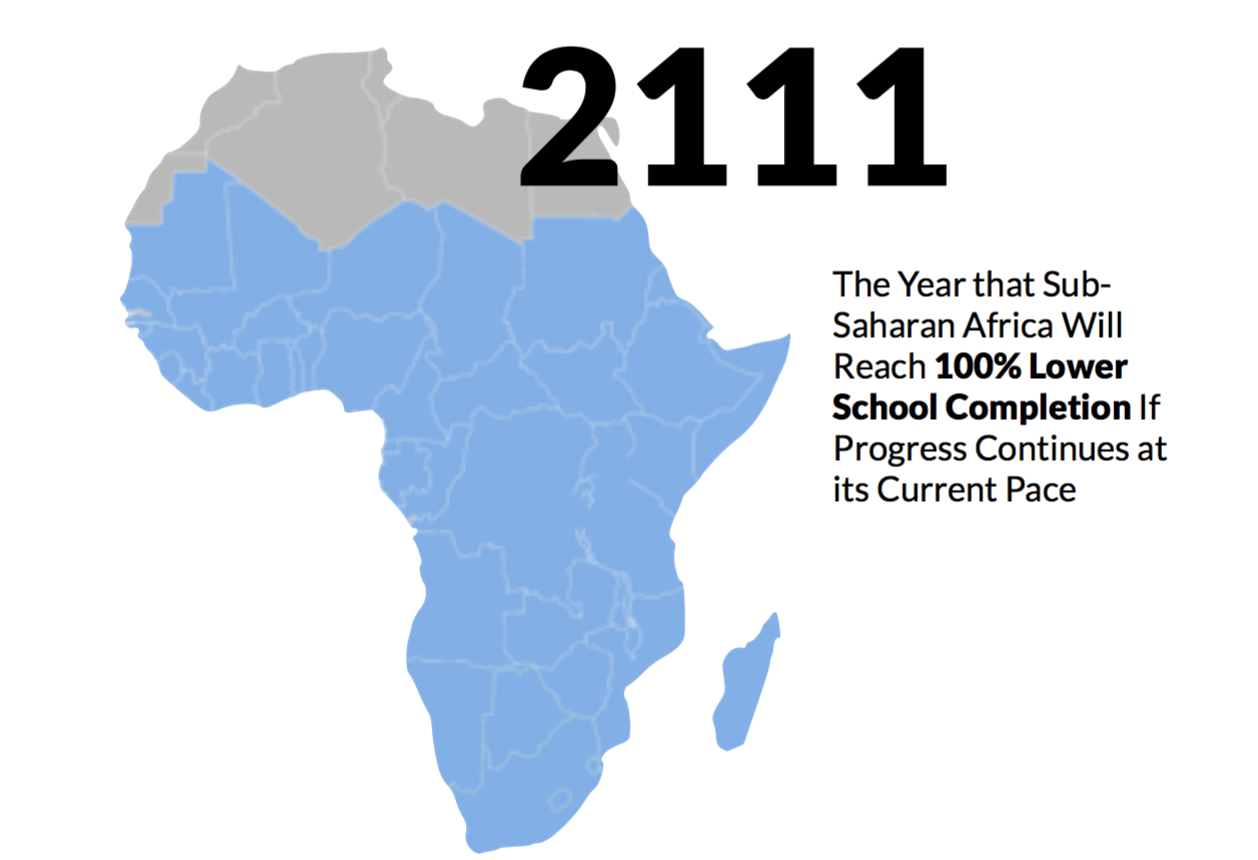

But educational models have remained effectively unchanged for over a century — which has resulted in linear progress against one of the great challenges in our time. At current rates, for example, sub-Saharan Africa will have implemented complete lower-secondary education — a cornerstone of first World education standards — 95 years from today.

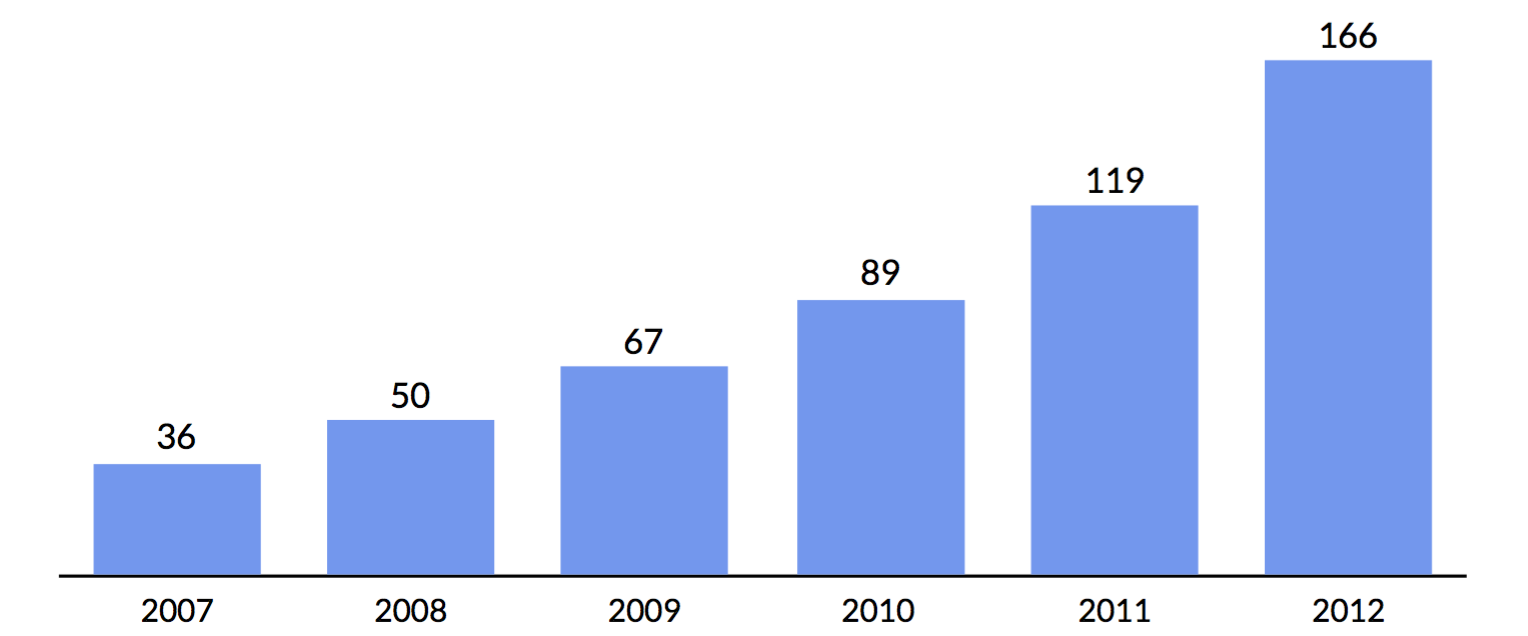

In India, the number of private universities doubled from 2007 to 2012 in response to massive demand for higher education and a growing knowledge economy. But linear growth through brick-and-mortar models has been no match for demographics. According to research from the Parthenon Group, India is on track to have 40 million more college-uneducated adults in 2020 than today.

THE AGE OF EXPONENTIAL IDEAS

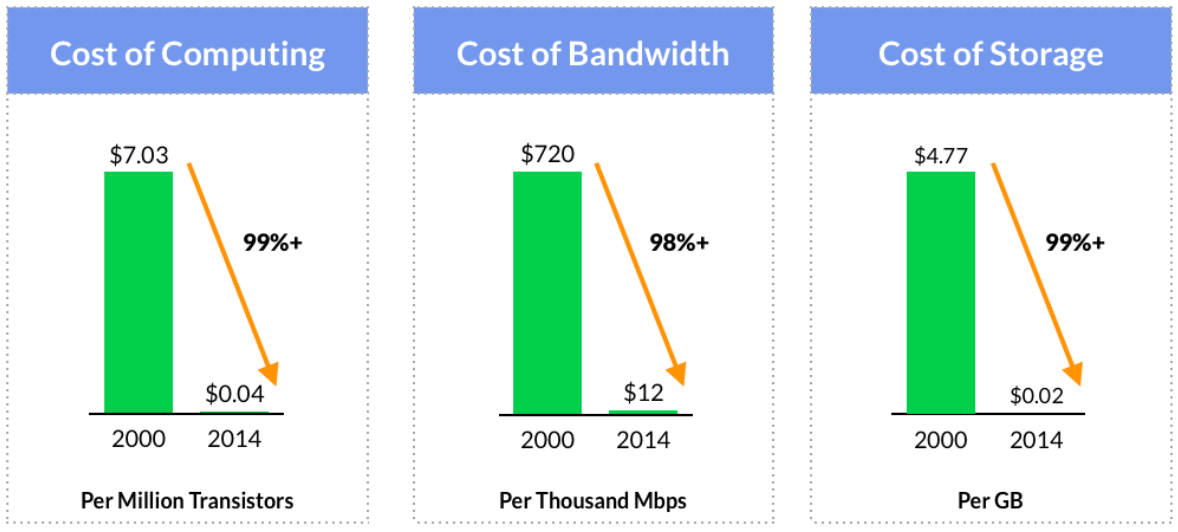

In 1965, Gordon Moore predicted that the number of transistors on an integrated circuit would double every two years. The effect of “Moore’s Law” is that computing power has doubled (or, costs have been halved) every two years for the past 50 years. If the automobile industry would have had its own Moore’s Law, a Ford Taurus that cost $20,000 in 1990 would essentially be free and you’d throw it away after you drove it.

Interestingly, while Moore’s Law has been the foundation and catalyst behind the Technology Revolution, it’s not a physical or natural law… it was a conjecture. In other words, the “Law” that has transformed computing and society was really more of a vision of what could become. It was a force of will. Nonetheless, the belief in Moore’s Law allowed engineers and technologists to imagine a World where you could have a computer in your pocket, self-driving cars, and personalized medicine.

So, in effect, Moore’s Law has become like gravity… inevitable. It ushered in an Internet Age that has evolved in three phases.

The first phase was the creation of the digital infrastructure upon which new businesses could be built. This was roughly 1995 to 2001, and the leaders were Netscape, AOL, and Cisco.

The second phase of the Internet Age was to build products off of the Internet Platform. Amazon, eBay, Google (Alphabet), Apple, Salesforce, and Facebook were all pioneers of this era. (Disclosure: GSV owns shares in Amazon, Alphabet, Apple, and Facebook)

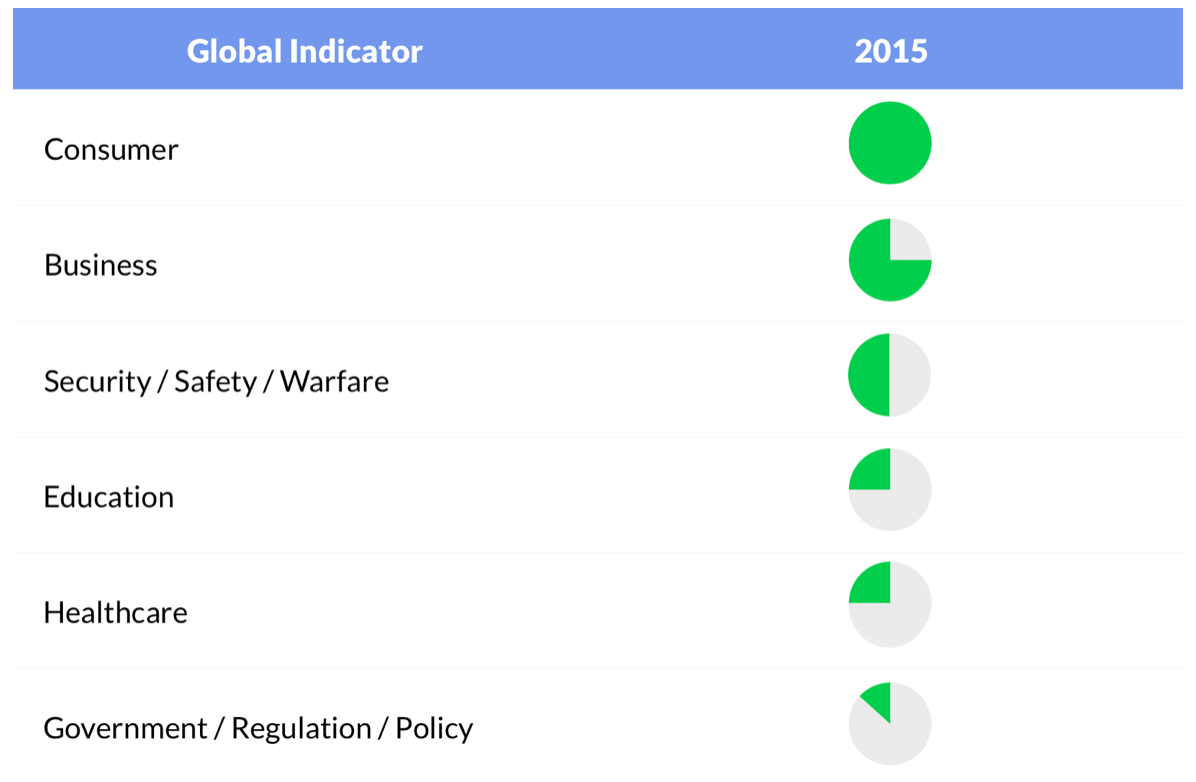

The third phase, which is now upon us, is the transformation of crucial segments of society and the economy, such as Government, Healthcare, and Education. Each sector is beginning to utilize Internet capabilities and digital models more effectively to evolve for public good.

The same dynamics that have paved the way for disruptive global businesses to launch at lightening speeds — from Uber, which is upending the transportation industry, to Airbnb, which is redefining the hotel industry — are now propelling a new generation of education and talent companies.

“Weapons of Mass Instruction” — rapidly growing, scaled models with disruptive technology — are using the Digital Tracks that have been laid over the past 15 years to reach and impact massive audiences.

INFLECTION POINT

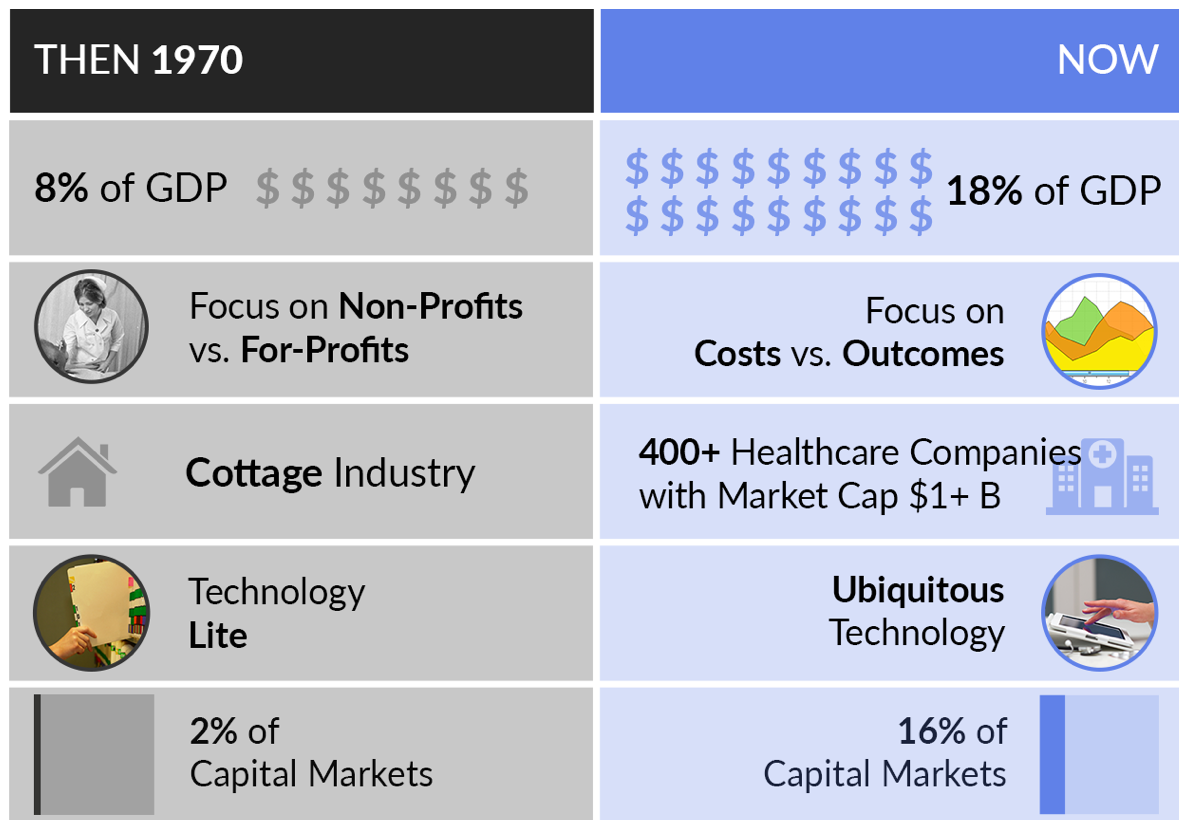

Today, the Education and Talent market has reached an inflection point with strong parallels to the evolution of the Healthcare sector in the 1970s.

In 1970, Healthcare was a huge market — 8% of U.S. GDP — but a highly fragmented cottage industry, characterized by limited technology and uneven service. Skeptics questioned whether investors could make money in the sector and critics debated whether they should. From an investor’s standpoint, the sector was almost non-existent, with Healthcare companies representing less than 3% of capital markets.

Today, Healthcare is a much larger market, at over 18% of GDP, or $3 trillion. Spurred by significant capital investments, Healthcare has emerged as a sophisticated, technologically-advanced sector that represents over 16% of U.S. capital markets. The industry has rapidly consolidated and is global. In 1970 there were just four companies with a $1 billion or greater market value… today there are over 400 companies that surpass this marker.

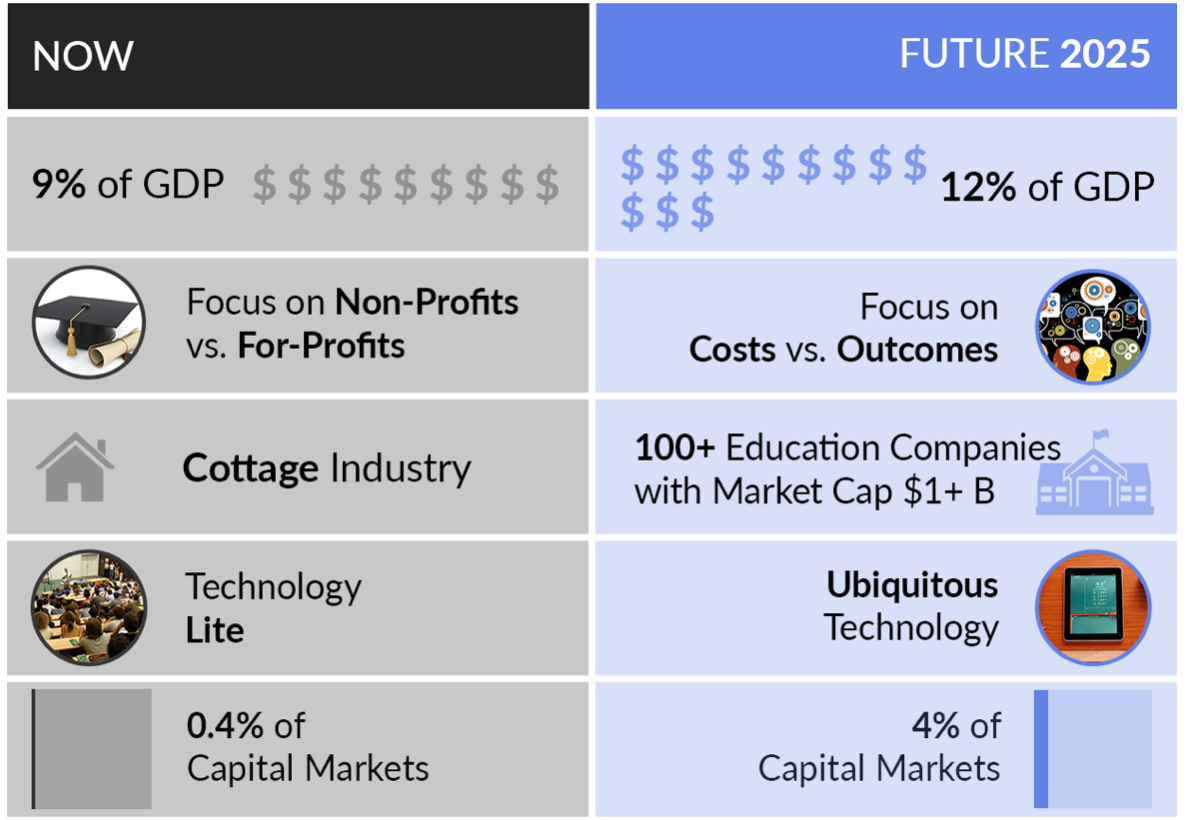

Today, Education is a large industry at 9% of U.S. GDP, second only to Healthcare, and larger than Defense and Social Security combined. Skeptics question whether investors can make money in the sector and critics debate whether they should. While education is large in terms of overall money spent, it is a widely fragmented cottage industry, with very few large individual companies.

A major difference between Healthcare and Education is that if 50% of the patients died that entered a hospital, they would close the hospital. In Education, if 50% of kids drop out of a high school — to become the “living dead” — they bring in the next class. While the Education Industry has made important technology improvements over the past five years, when compared to what’s transpired in almost every other industry, it has much ground to gain.

As with Healthcare in the 1970s, talent is pouring into the industry, and there is more to come. Increased depth of professional management will catalyze solutions to massive problems and create large, scaled enterprises.

Looking at capital markets, while Education represents 9% of GDP, it is just 0.4% of the U.S. Stock Market. There are only 11 Education companies with a market value of $1 billion or greater.

We believe the convergence that will take place between money spent in Education as a percent of GDP and proportional representation in the public markets will translate into the 12% of GDP and 4% of capital markets over the next 10 years. This represents a mind-blowing trillion dollar opportunity.

We look forward to convening key leaders from across the global innovation economy at the 7th Annual ASU GSV Summit (April 18-20) in San Diego to accelerate the transformation of the sector and to improve educational outcomes through exponential ideas.

We expect over 3,000 attendees, including a wide range of entrepreneurs, investors, foundation leaders, educators, policymakers, and CEOs of leading global companies. Keynote speakers include Bill Gates, Former U.S. Secretary of State Condoleezza Rice, General Stanley McChrystal, Khan Academy Founder Sal Khan, business strategy visionary Jim Collins, and many more.

Additionally, please click HERE to download 2020 Vision: A History of the Future, GSV’s aspirational vision for how to address society’s greatest challenge — ensuring that everyone has an equal opportunity to participate in the future. With over 100 company case studies, leader profiles, and market data, 2020 Vision offers comprehensive analysis and insights into the state of human capital and education innovation.

—

Stocks rallied upwards for the third week in a row, with NASDAQ advancing 2.8%, the S&P 500 up 2.7%, and the GSV 300 rising 5.0%. Small cap stocks, in particular, did well with the Russell 2000 up 4.3% for the week. The 10-Year Note yield was up 11 bips to 1.7%.

Employment numbers were excellent, with 214,000 jobs created in February, far better than analyst estimates. On the flip side, the IBD/TIPP Optimism Index fell in March, hitting its lowest level since last November.

IDC projected that smartphone sales will slow in 2016 materially, with iPhone shipments expected to be basically flat and Android phone shipments rising over 7%. Part of this slowing down is an inevitably maturing market, accentuated by China, the World’s leading smartphone buyer.

Stocks have an uncanny knack for doing the opposite of what people expect. With pessimism reaching extremes early this year, stocks have quietly climbed the “Wall of Worry.” We continue to be optimistic on the outlook for our favorite growth stocks and will add to our positions and be opportunistically involved with the Market.