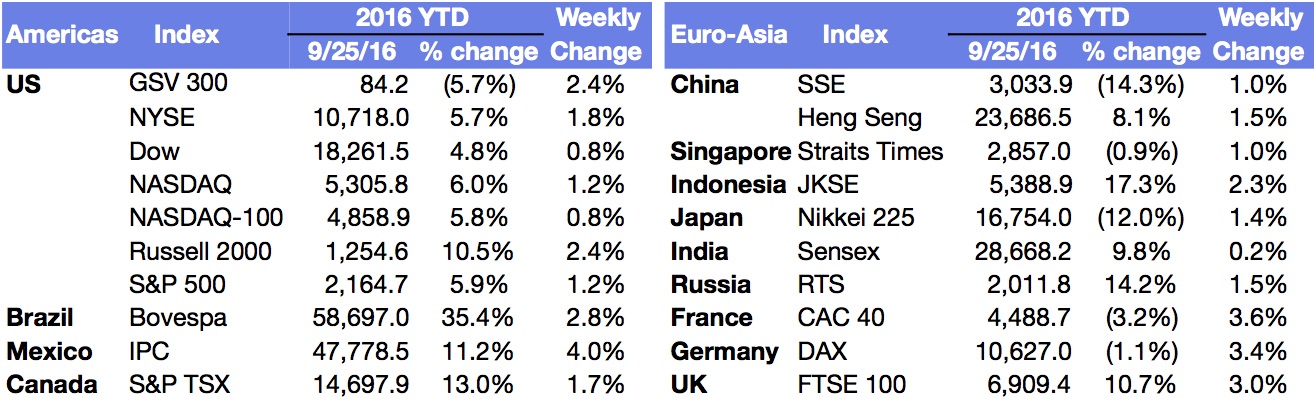

Market Snapshot

| Indices | Week | YTD |

|---|

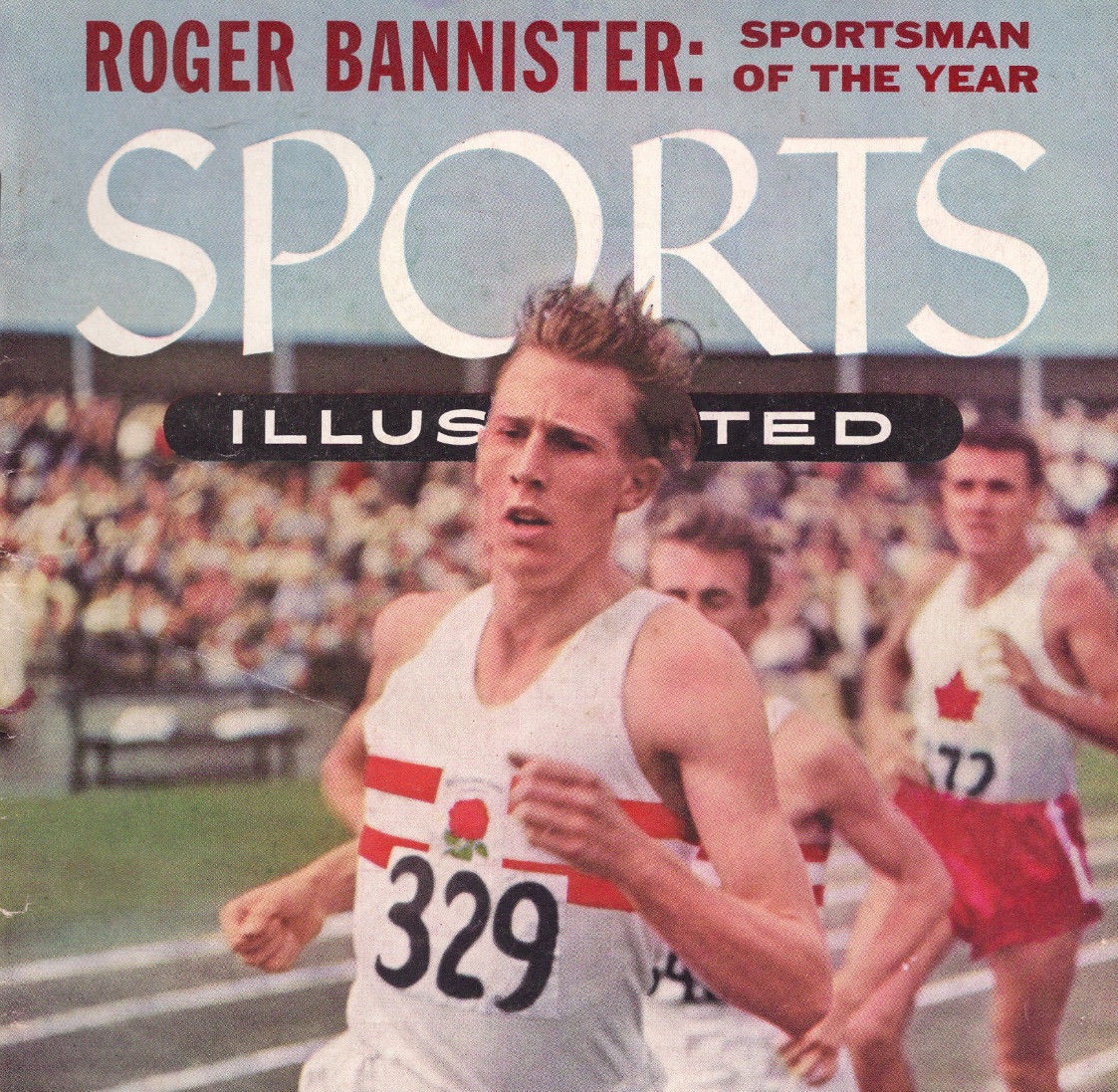

Doctors and Scientists said that breaking the Four-Minute Mile was impossible and one would die in the attempt. Thus when I got up from the track after collapsing at the finish line, I figured I was dead.

— Roger Bannister (May 6, 1954)

On a rainy, cool evening in 1954, Roger Bannister, a lanky British medical student, ran a mile in 3:59, shattering experts’ views that a sub four-minute mile was beyond human capability. The previous record of 4:01 had stood for decades, and despite advancements in training and thousands of attempts, nobody had come close to running a mile in under four minutes. The best part of the story, however, isn’t that Bannister cracked the barrier, but that just 46 days after he did, another runner, John Landy, beat Bannister’s time. Within a few years, dozens of runners had notched sub four-minute miles. Today, the record stands at 3:43 and even high school runners have routinely beat the once impossible four-minute mark.

The distance didn’t change. The mindset did.

In this spirit, GSV hosted the second annual Pioneer Summit at GSVlabs in Silicon Valley last week. The Summit’s mission is to accelerate transformative ideas by bringing together visionary founders, investors, and leaders who revel in “defying gravity” and changing the world for good. This year we welcomed over 1,700 attendees and 125+ companies that have raised more than $5 billion.

Click HERE to watch my opening remarks at the Pioneer Summit, which explores the five key “Gravitational Shifts” defining the emerging Global Silicon Valley)

Exponential Ideas: 2016 GSV Pioneer Summit Speakers

The focus of the 2016 Pioneer Summit was on “Industries of the Future.” Key themes included Exponential Machines, Human Renaissance, Commerce Reimagined, a Sustainable World, and Moonshot Startups. The common thread is game-changing entrepreneurs who are defying gravity.

No speaker better embodied this mindset than our closing keynote, Nikesh Arora. The former President of Softbank and Chief Business Officer of Google mused about a future where shopping malls laid to waste by mobile commerce become homes for self-driving cars, maintained by fleets of robots…and much more.

2016 GLOBAL SILICON VALLEY HALL OF FAME

Central to the Pioneer Summit — and the GSV community more broadly — is celebrating the leaders who have inspired generations of innovators and dreamers. That’s why we launched the Global Silicon Valley Hall of Fame at the inaugural Pioneer Summit in 2015, honoring Bill Campbell, Larry Sonsini, Diane Greene, Dick Kramlich, and Mike Homer (posthumously).

This year, we inducted our second class of GSV Hall of Famers — Gordy Davidson, Carol Bartz, Ken Coleman, and Andy Grove (posthumously) — a unique group of pioneers who have created, led, and advised some of the most important technology companies in the World. Their vision and impact is remarkable. Just listen to their peers, a group of luminaries from the Global Silicon Valley: Click HERE to watch the 2016 GSV Hall of Frame tribute video.

Before there was a Sheryl Sandberg or Susan Wojcicki, there was Carol Bartz. Carol served at the helm of two high-profile tech companies, Autodesk and Yahoo!, in addition to serving on the boards of numerous corporations, including Cisco. Carol turned Autodesk into the company that it is today. During her time as the CEO, annual revenue rose from $300 million to $1.5 billion.

Carol began her corporate career at 3M where she flourished amidst gender discrimination in a male-dominated workplace. After four years, Carol left 3M and rose to Silicon Valley stardom, first at Digital Equipment Corp, then at Sun Microsystems. Soon Autodesk came knocking and Carol began her 14-year tenure as CEO, transforming the company into the profitable, software leader it is today. After Autodesk, Carol was given the daunting task of taking over internet giant Yahoo! from its founder Jerry Yang in 2009. She served as CEO of Yahoo! until 2011. Carol is married to Bill Marr, a former executive at Data General and Sun Microsystems. They have three children: Bill, Meredith, and Layne.

Ken Coleman has long been a trailblazer in the Valley. Despite working in an industry notorious for being dominated by white male executives, Ken has held some of the most senior positions in Silicon Valley. He was notably the Executive Vice President of Sales, Service and Marketing of Silicon Graphics (where he hired Ben Horowitz as an intern), and is perhaps the most influential major African American leader in Silicon Valley.

Ken is Chairman of Saama Technologies, one of the largest pure-play analytics solutions and services companies in the Data Analytics market. He is currently a special advisor at Andreessen Horowitz, mentoring founders into CEOs and advising talented individuals on opportunities in Silicon Valley. He is also an advisor at Pinterest. In addition, he is a board member of CSAA Insurance, Entertainment Partners, and Procura.

Ken is noted by many in the Silicon Valley community not only as an important mentor to many leading CEOs and executives, but also a philanthropist, giving his time, knowledge and resources to people who have the most significant needs in the community.

Gordy Davidson is one of the most trusted advisors in Silicon Valley. His client list reads like a history of Silicon Valley: Apple, Cisco, Oracle, Intuit, Electronic Arts, Macromedia, Facebook.

He has worked on over 50 public offerings and has represented boards of directors, audit committees and executives in numerous special investigations. He has also acted as lead counsel on over 100 mergers and acquisitions valued at more than $75 billion in the aggregate, including WhatsApp’s $19 billion sale to Facebook in 2012.

Gordy has spoken on current issues in IPOs at the Securities Regulation Institute and on corporate governance issues at the Stanford Directors College. He has lectured on venture capital investments at the Stanford Law School, the Stanford Business School and the Haas Business School. He has taught courses on deals and mergers & acquisitions at Stanford Law School, and chaired the Practicing Law Institute programs on private placements and mergers & acquisitions of high technology companies. Gordy has also served on the boards of directors of non-profit organizations, including BayBio, Children’s Health Council and Pacific Community Ventures.

It is hard to describe the profound impact that Andy Grove had on the world, other than to say that Silicon Valley would probably not exist today without Andy’s leadership at Intel, which enabled almost everything built on its computing platform.

Andy, a co-founder and later CEO of Intel, was the visionary behind their shift from memory to processor chips, the slogan “Intel Inside,” and Intel’s dramatic growth. During his time as CEO, Intel’s market capitalization skyrocketed from $4 billion to $197 billion.

Andy overcame tremendous hardship to become the legend that he will always be remembered to be. He was born in Hungary where he survived a Fascist dictatorship, German occupation, the Nazi “Final Solution,” and a repressive communist regime. Andy escaped Hungary when he was 20 and eventually came to America.

He began as a busboy, but eventually earned both a Bachelor’s degree and PhD in chemical engineering from City College of New York and University of California, Berkeley, respectively. After earning his PhD, Andy worked for Fairchild Semiconductors where he met fellow Intel co-founders Robert Noyce and Gordon Moore.

After ending his tenure as CEO on Intel in 1998, Andy continued to be a pivotal figure in The Valley as chairman of Intel’s board until 2004, a lecturer at Stanford University, and through his philanthropy with UCSF, International Rescue Committee, and more. His untimely passing this April sent shockwaves throughout the Valley. He was a legend, a mentor, and a friend to generations of technologists and innovators.

—

The Fed’s “steady as she goes” policy comforted equity investors last week with NASDAQ and the S&P 500 both rising 1.2% to all time highs. Additionally, the hyper-growth GSV 300 advanced 2.4%. What pleased investors about the Fed’s actions even more than doing nothing now were indications that 2017 was likely to see only a couple of rate hikes.

Much maligned TWITTER rose 21% on reports that Salesforce and Alphabet had a hankering to own the social network. Apple and Adobe also had good weeks rising approximately 4% and 8%, respectively. Apple is on the go primarily due to strong demand for the iPhone 7 despite critics chirping that it looked like a flop. Adobe rose for old fashioned reasons—it reported 39% EPS growth for the quarter trouncing analyst estimates.

What made our hearts beat a little faster was the significantly positive action in the IPO market last week with eight new issues and strong performance. As we noted with the Twilio IPO, we viewed that as a starting gun going off for IPO’s. Last week, we had the ad network Trade Desk debut opening up 67%, cosmetic maker e.l.f. Beauty up 56%, and cloud tools provider Apptio opening with a 41% day. Should be a busy fall.

We look at the action of growth stocks as confirming our BULLISH thesis which the positive activity in IPO’s is strong evidence of. Moreover, fundamentals for growth companies are generally stellar and compare favorably to non-growth businesses and bonds. Accordingly, we remain BULLISH.