Market Snapshot

| Indices | Week | YTD |

|---|

Science Fiction allows you to picture a future which would otherwise be unimaginable today. Not coincidently, many of the great 21st century innovators and inventors have been science fiction devotees, and you can see it in modern devices that we take for granted.

The iPad and iPhone? Go back to the Starship Enterprise and check out the devices Scotty and Spock were using. The Apple Watch? Dick Tracy had one 70 years ago. Long ball hitter Marc Andreessen’s vision of the future was influenced by “KITT”, the computer car in Knight Rider. Jeff Bezos’ high school valedictorian speech paid homage to Star Trek and to, “boldly going where no man has gone before.” Today he has personally backed the rocket company Blue Origin in a “space race” with fellow billionaires Elon Musk (SpaceX) and Richard Branson (Virgin Galactic).

The 1997 cult-classic sci-fi film, GATTACA, was a box office flop as audiences failed to become enamored with a dystopian society that discriminated based on genetics. The movie raised eyebrows with its fake advertising for “genetically made to order” babies in the Washington Post. While GATTACA bombed, thousands of people responded to the ad, seeking to have their unborn children enhanced.

GATTACA’s Fake Ad For Designer Babies in the Washington Post

25828.png)

A lot has changed since GATTACA hit theaters. For context, it was released just three years after Netscape launched the modern Internet as we know it and one year before Google was born. What seemed like science fiction back then is rapidly becoming science reality. In fact, in 2011, NASA named GATTACA as the most plausible sci-fi film ever made, edging out Contact (1997), Metropolis (1927), and The Day the Earth Stood Still (1951).

STATE OF PLAY

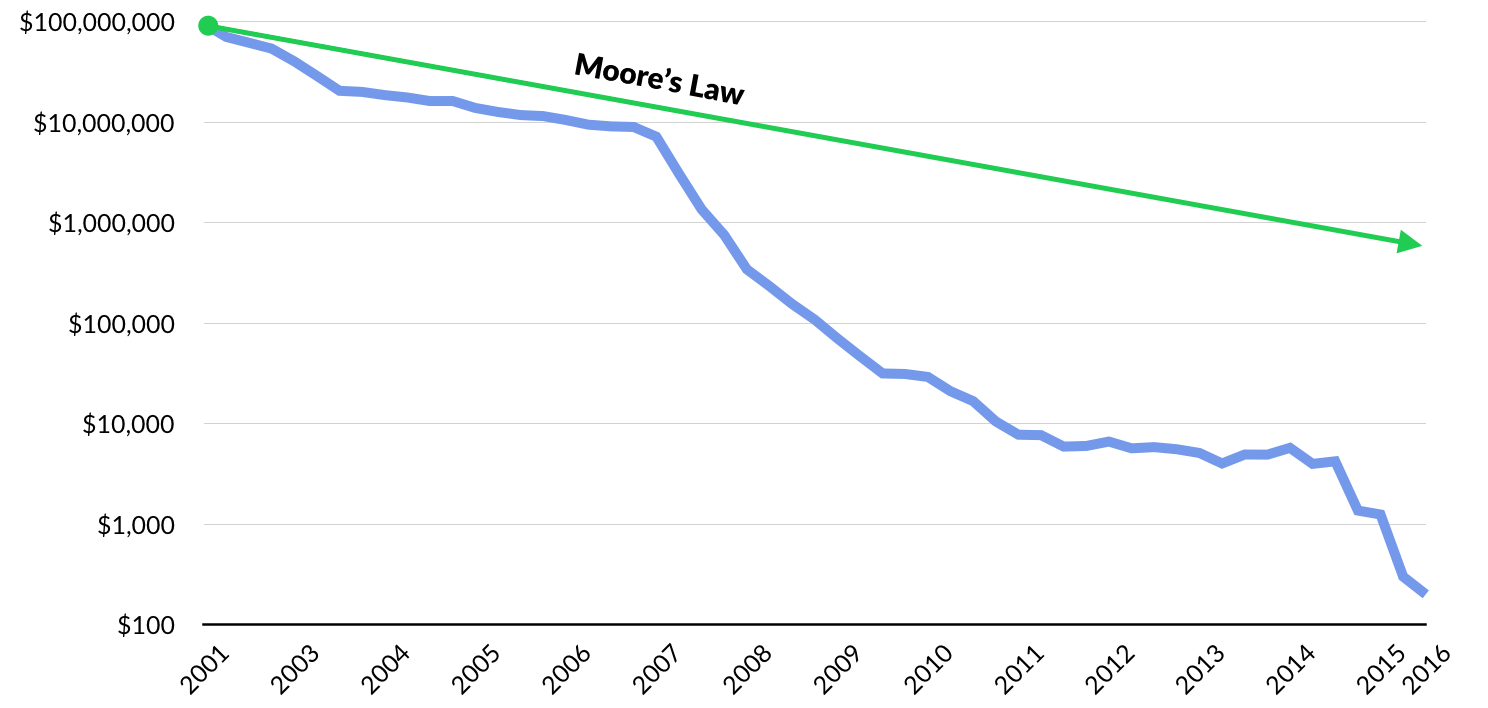

Interest in gene exploration dates back nearly 200 years to Gregor Mendel, the father of modern genetics. But it wasn’t until the mid 1980s that technology and Moore’s Law made it possible to use software to sequence the three billion plus genetic bases that make up the human body.

Unprecedented in terms of international collaboration and public-private partnerships, the Human Genome Project was launched in 1990 with the goal of mapping the entire human genome in what seemed like an unrealistic 15 years.

In April 2003, it was announced that the entire human genome had been mapped at a cost of $3.8 billion. Beyond scientific gains, the ROI was staggering. The Human Genome Project generated an economic impact of $796 billion from 1990 to 2010 alone.

Moore’s Law and the Megatrend of “Software Eating the World” are having a revolutionary impact on the cost for an individual to receive their own genetic map. In 2008, it cost $1 million dollars for a person to create a personalized gene map. By 2011, it was $100,000. In 2014, it cost $1,000 — less than a chest X-Ray — and today you can get a personal genetic report for less than $300.

Today, your mechanic knows more about your car than your doctor knows about your body. When you bring your car into the shop, the first step is usually to plug it into a computer that scans performance data and runs a battery of tests. Then (if it’s an honest mechanic), any specific issues are isolated and addressed with a targeted repair.

In a world where everyone can map their personal genome, healthcare gets a whole lot more personal, efficient, and effective.

GETTING PERSONAL: GENOMICS STARTUPS SURGE

Anne Wojcicki co-founded 23andMe in 2006, on the heels of the Human Genome Project, after a decade on Wall Street as a health care analyst convinced her that the way we treat illness and create new drugs is fundamentally broken.

A chance encounter with Markus Stoffel, a leading molecular biologist at ETH Zurich, left her convinced that the key to creating a new health and medicine paradigm was to aggregate the World’s genetic data and discern patterns to prevent and combat diseases like Parkinson’s and Alzheimer’s. Big Data meets Big Pharma.

23andMe launched with a mail-order test kit that generated a detailed genetic report for $1,000. A simple saliva sample produced insights across nearly 200 categories — including risk factors for inherited diseases like cystic fibrosis, genetic traits like lactose intolerance, and various details about your genealogical history. By 2012, 23andMe had driven the price down to $99.

In 2013, Uncle Sam dealt 23andMe a potential death blow. The Food and Drug Administration ordered the company to stop marketing its flagship tests, deeming them unregulated medical devices. Regulators argued that consumers could misinterpret this health data, which had not been clinically validated, and take action based on a “false positive” result.

While many would have wilted, Anne Wojcicki played offense. With its popular product sidelined, 23andMe partnered with pharmaceutical companies like Genentech and Pfizer, trading access to its DNA database in exchange for upfront payments and a cut of revenue from new drugs developed using it. At the same time, the company worked with the FDA to get an approved genetic test back on the market.

In late 2015, with the required Federal approvals in hand, 23andMe relaunched its genetic reporting service targeting four categories: ancestry, wellness, traits, and carrier status. Today, the company has over one million customers. Backed by NEA, Google Ventures, Fidelity, Genentech, and Illumina, 23andMe recently raised an additional $200 million this Fall and is valued at $1.5 billion.

Today, over half of 23andMe customers learn something from their test results that is “medically meaningful” — from a disease risk to a dietary trait. Understanding risks and health conditions enables people to take preventative measures, and as tests continue to improve, health and wellness service providers will be better equipped to help people avoid or stave off risk.

Innovative startups and eager investors are springing up in 23andMe’s wake.

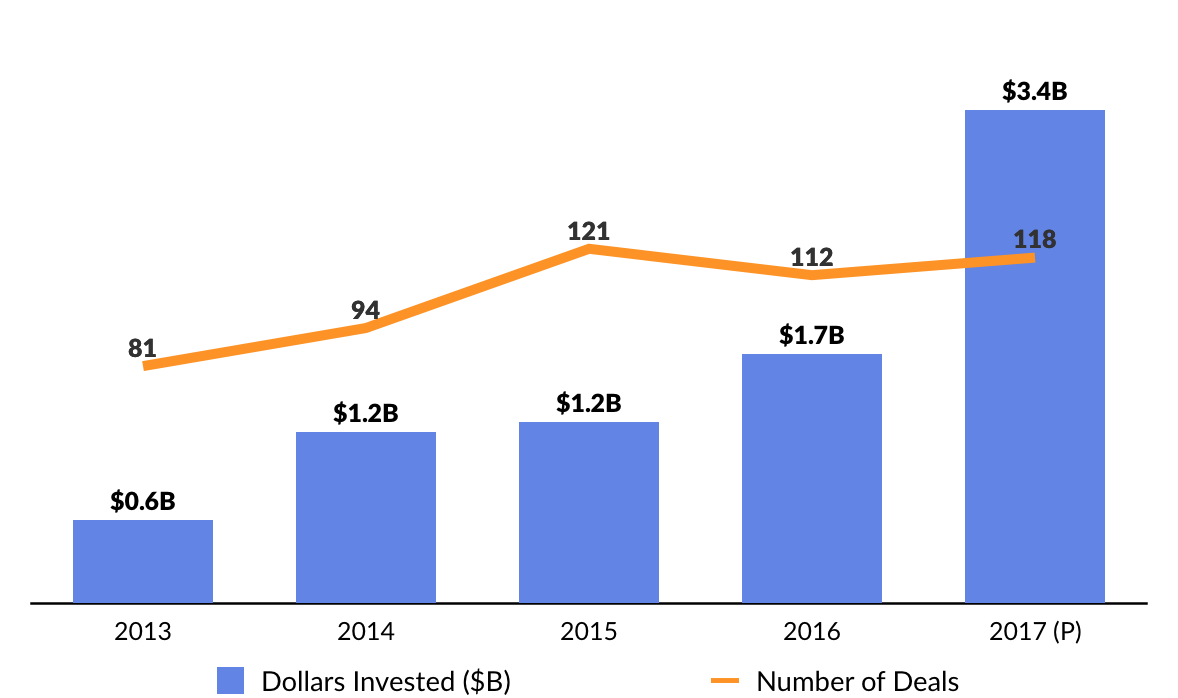

2017 Financing Activity

It has been a banner year for genomics startups, which have raised approximately $1.9 billion in the first half of 2017 — more than all of 2016.

Notable financings went to the blood-testing startup Grail (blood testing for early cancer detection), an Illumina (DNA sequencing and diagnostics) spinout that raised a staggering $1 billion (Series A and B), and Guardant Health (genomic cancer testing), which completed $360 million Series E capital raise. In sum, CB Insights predicts that 2017 funding for genomics startups will surpass $3 billion, or double 2016.

Color Genomics, which closed a $52 million Series C financing in August led by General Catalyst, sells kits that lets people find out if they are at risk for certain hereditary cancers and genetic disorders. Then it connects them with genetic counselors to analyze the test results and discuss prevention, monitoring, and treatment options. Notable investors include Khosla Ventures, Formation 8, CRV, and Emerson Collective.

This Fall, Color Genomics announced a new kit that tests for heard health, signaling the company’s desire to expand their product testing line beyond hereditary cancers. As CEO Othman Laraki observed in a recent interview with Recode, “We have a torrent of data in our bodies… and today, we make use of almost none of it.” That’s changing, fast.

The field of genomics has captured the attention of a broad range of investors, including venture capitalists, accelerators, corporate investors, and healthcare focused funds.

In recent years, there has been a notable surge in interest from corporate/strategic investors, with pharmaceutical company Illumina leading the charge. Since 2013, Illumina backed 14+ startups — including 23andMe (personal genetic tests) and Human Longevity (genetic data & research platform) — through a variety of vehicles, including its parent company, its venture arm (Illumina Ventures), and its accelerator (Illumina Accelerator).

This year, Illumina spun out Grail, a San Francisco-based startup that is using Illumina’s sequencing technology to build blood-based screens for early cancer detection. The company raised a $1.2 billion Series B this year from ARCH Venture Partners and Johnson & Johnson. Previous investors include Bill Gates, Jeff Bezos and Sutter Hill Ventures.

THE FUTURE IS NOW: BIOENGINEERING

A key frontier in genomics is creating personalized treatments that align with an individual’s unique genetic profile. Today, scientists are demonstrating the ability to enlist genes themselves in the treatment of various diseases. Here, the story is all about “CRISPR.”

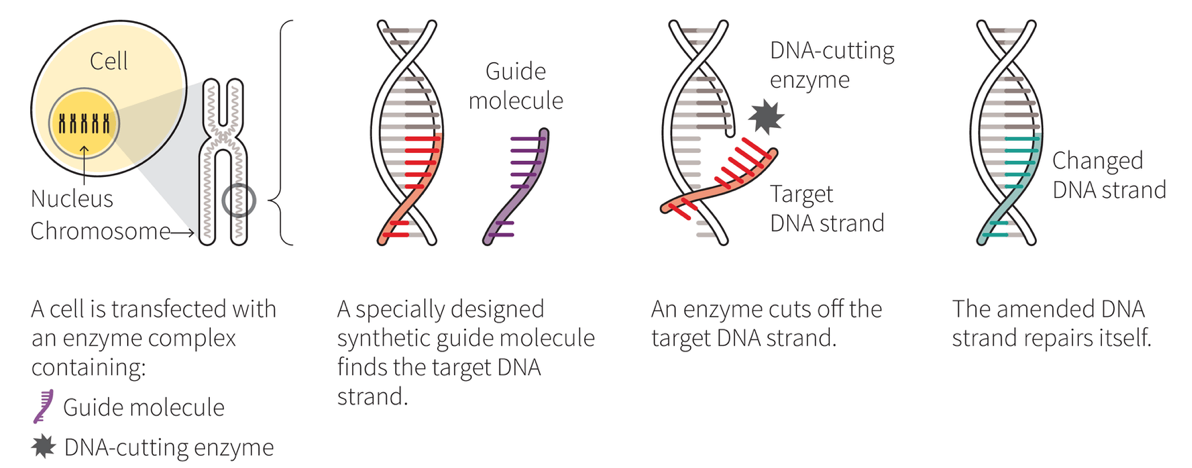

CRISPR — which stands for Clustered Regularly Interspaced Short Palindromic Repeats — is a series of naturally-occurring gene segments that act as an immunity system set up in the genetic code of our cells. When combined with an enzyme called Cas9, which acts as a type of genetic scissors, the CRISPR-Cas9 system is able to target, snip out and replace undesirable genetic code in our cells.

In November 2016, a group of Chinese scientists were the first to use CRISPR technology to genetically edit cells in patients to fight off a form of lung cancer. The World is waiting to see the results, but the China’s first-to-the-clinic victory as sparked a genomic arms race. As the leading cancer immunotherapy expert Dr. Carl June observed in an interview with Fortune, “I think this is going to trigger Sputnik 2.0.”

The CRISPR technology, though a massive breakthrough in the field of genetic engineering, is still an imperfect system. When Cas9 cuts genes at the wrong locations, it can actually cause cancer. Despite the difficulties, Editas, a publicly-traded genome editing shop, has proposed running a CRISPR trial to treat genes causing blindness in humans. Stanford University has similar plans to use CRISPR to repair genes causing sickle cell anemia.

As part of a $250 million study, another group of U.S. scientists will use CRISPR to treat lung cancer. Funded by Sean Parker’s new cancer institute, this study will take place at the University of Pennsylvania. It has been approved by the NIH (National Institute of Health) and is awaiting FDA approval.

This October, MIT scientists announced the development of a more precise version of CRISPR, dubbed CRIPSR 2.0. Researchers modified CRISPR so that the editing tool would target and modify a single DNA base, allowing for more efficient modifications. If the CRISPR-Cas9 system is akin to editing genes with a pair of scissors, CRISPR 2.0 is more like editing with a pencil.

We expect to see a wave of emerging startups focused on bioengineering as pioneering labs break through the initial regulatory hurdles.

Other startups are exploring methods of gene editing without using CRISPR. Homology Medicines, for example, aims to treat genetic diseases using viruses capable of efficiently repairing human genes.

While the company’s striking claims have raised a few eyebrows and skeptics, the feat is not impossible. In 1998, it was demonstrated that if a virus could successfully deliver a very similar or homologous DNA strand to a gene, the new DNA strand could be swapped in when a cell divides.

Today, Homology Medicines claims to have developed a line of viruses that can successfully edit as many as 50% of cells in a test tube, an unprecedented feat. Since its founding in 2015, Homology Medicines has raised $127 million from investors including Temasek, ARCH Venture Partners, and Fidelity.

WHAT’S NEXT: REGENERATIVE MEDICINE

In 1665, Robert Hooke looked at thinly sliced piece of cork under a microscope and remarked that the magnified cork looked strongly similar to the small rooms or “cellula” which monks inhabited. What Hooke really observed under the microscope were the dead cell walls of a cork plant. And from that blossomed the field of cell theory and the study of cells, the basic building blocks of our bodies.

It was later discovered that some cells — stem cells — had the unique ability to produce other cells. Stem cells became known as the cellular “putty” from which all tissues of the body could be made. While its debated who truly “discovered” stem cells, since the 1980s, researchers have dreamed of using these unique cells to grow new or repair damaged organs.

Stem Cells hold an enormous potential to promote human longevity and the pace of innovation in this field is accelerating. In the past decade, two Nobel Prizes have been awarded to scientists working on stem cells. In 2010, a person with a spinal cord injury became the first individual to receive stem cell medical treatment. In 2012, it was discovered that stem cells showed promise to cure human blindness, and in 2014, researchers in Japan began clinical trials in human patients.

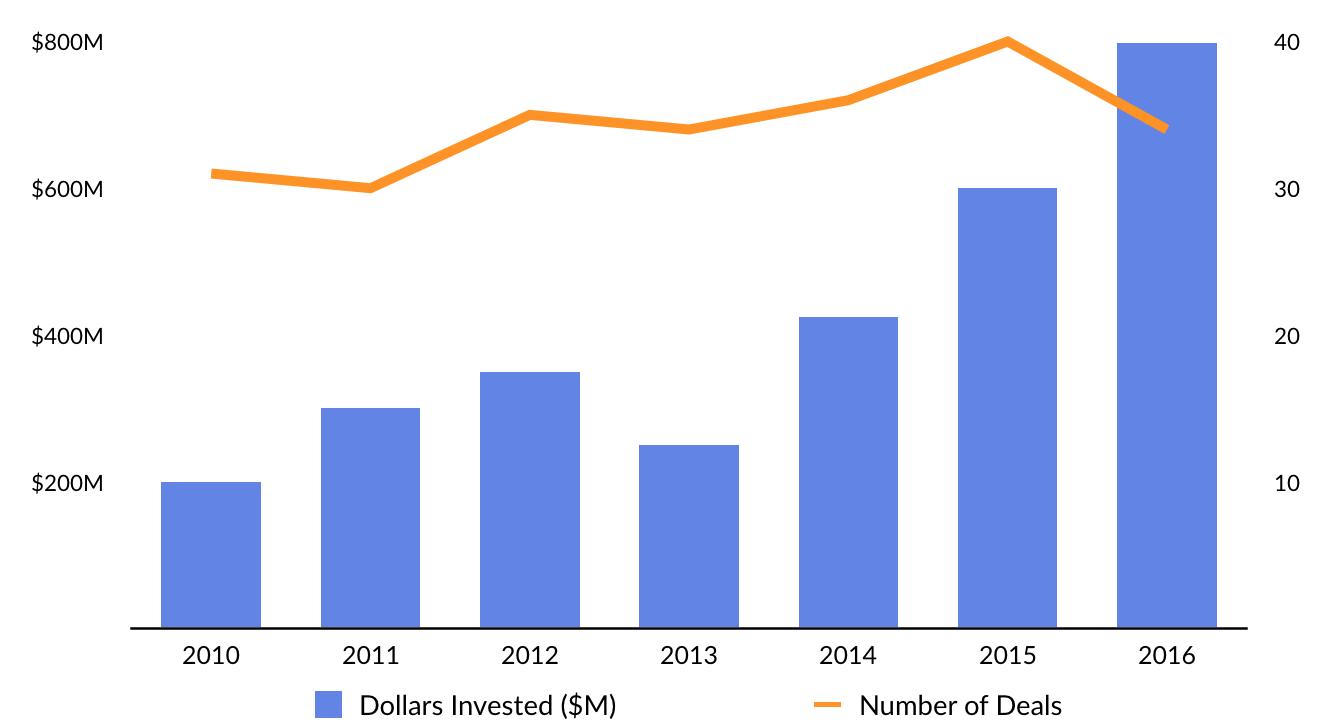

The private sector is taking notice. Venture funding into regenerative medicine startups has increased from less than $300 million in 2011 to over $800 million in 2016.

Notable startups include San Diego-based Samumed, which has raised over $300 million and is reportedly valued at $12 billion. The company offers the promise of regenerating hair, skin, bones, and joints, by stimulating the production of specially targeted stem cells.

UNITY Biotechnology takes a different approach to reverse aging by eliminating senescent cells, which are cells that have permanently stopped dividing. Our bodies use cellular senescence as an “emergency brake” to stop cells from dividing to prevent the proliferation of tumors. But these senescent cells accumulate in our bodies with age, secreting inflammatory chemicals that harm nearby cells.

As a result, these cells result in common “old age” diseases including osteoarthritis, atherosclerosis, eye diseases, and kidney diseases. By eliminating these senescent cells, UNITY aims to prevent the development of fatal and debilitating diseases. The company has raised $154 million since its founding in 2009 from investors including Venrock, Founders Fund, Vulcan Capital, Jeff Bezos, Fidelity, and the Mayo Clinic.

In December 2016, pharmaceutical giant Bayer and Versant Ventures partnered to launch BlueRock Therapeutics, a stem cell therapy company, committing a combined $225 million into the effort. The company develops stem cells that can be used to develop organs that are suitable for transplants.

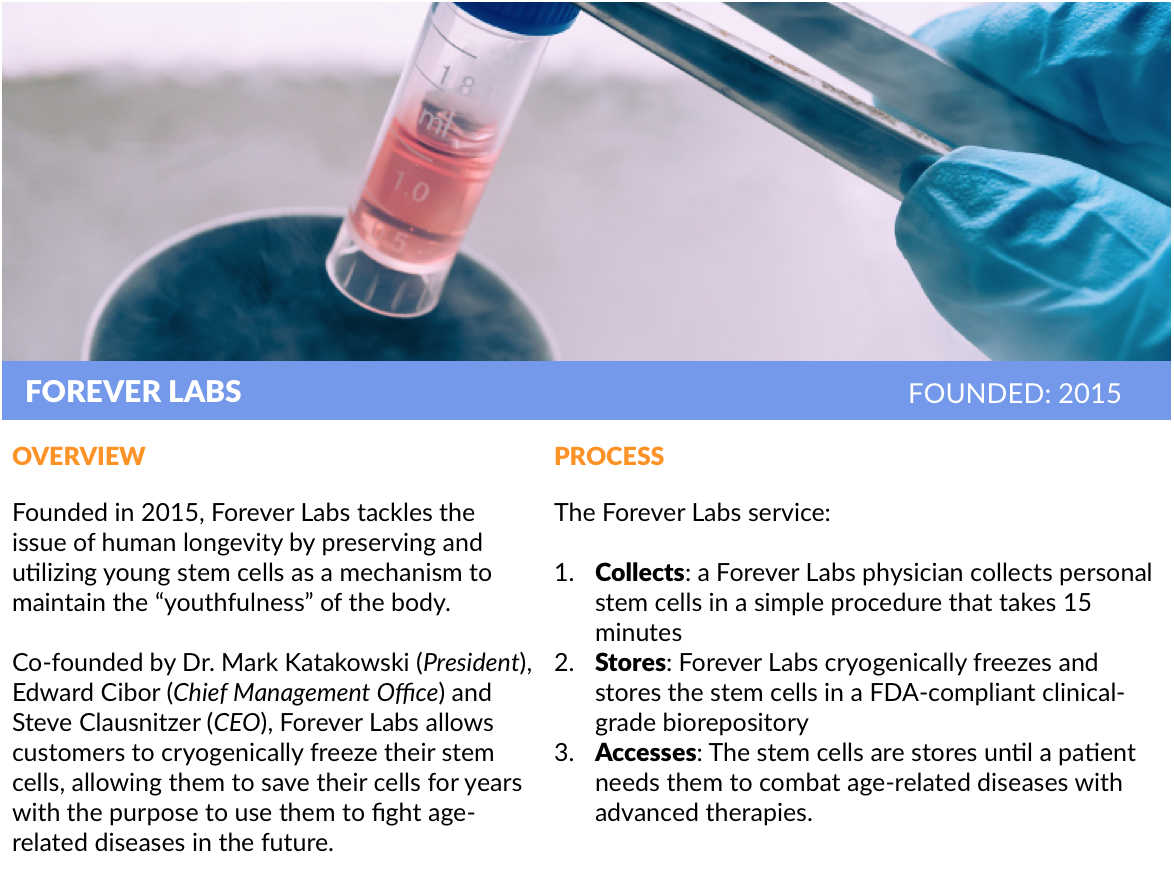

Other startups, like Y Combinator alumnus Forever Labs, are attacking the issue of human longevity by preserving and enhancing young stem cells so they can be used in therapeutic applications at a later date. It’s a call option on a potential “fountain of youth” as material treatments are developed in the coming years.

Forever Labs’ President Dr. Mark Katakowski spent the last 15 years studying stem cells and found that, like regular cells, they lose their function as they age. Better to store them now. He co-founded the company with Steve Clausnitzer (CEO) and Edward Cibor (Chief Management Officer) to build a stem cell storage company that allows people to capitalize on the opportunity while they’re still young.