Market Snapshot

| Indices | Week | YTD |

|---|

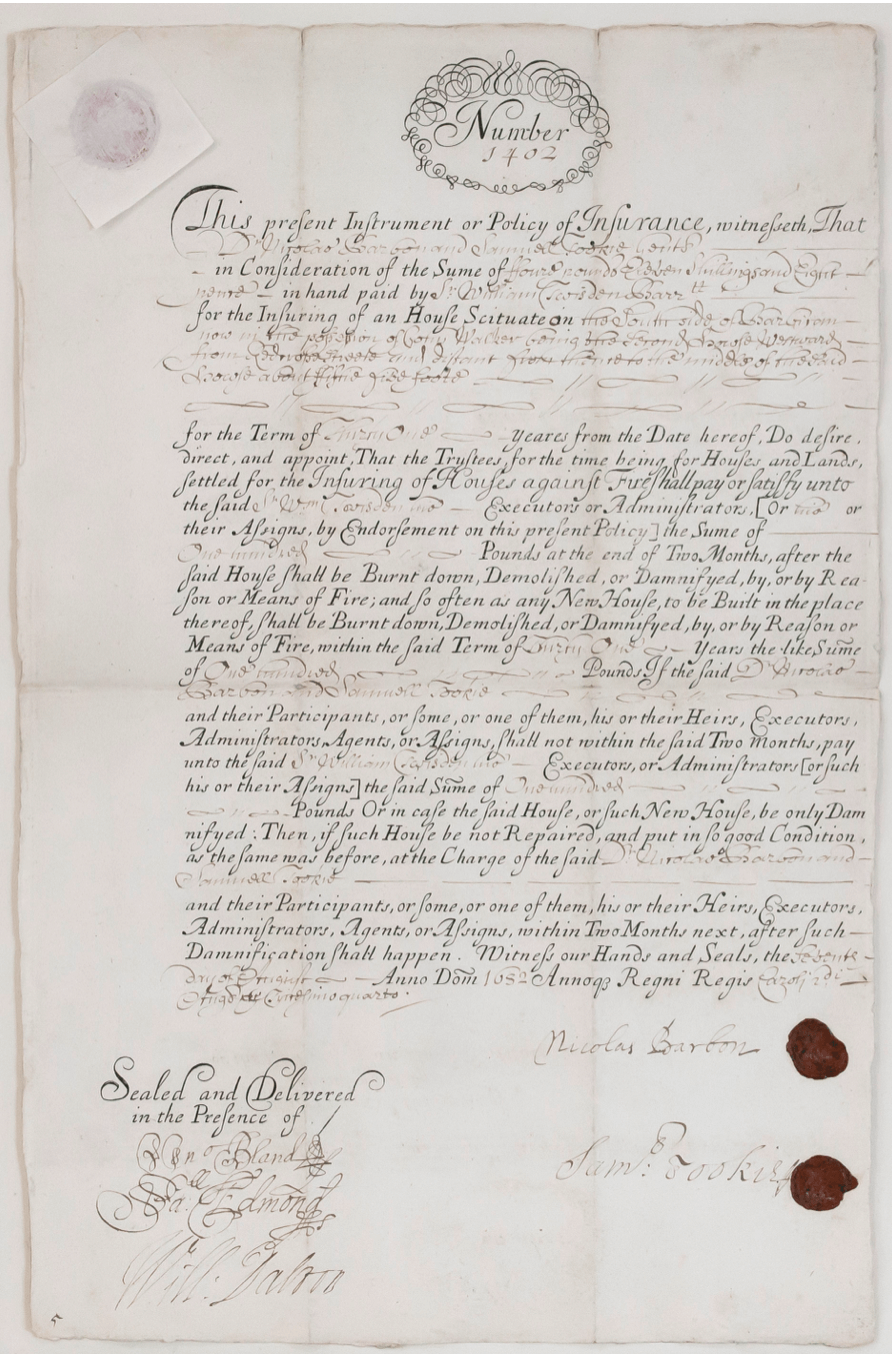

The first written insurance policy appeared in 1750 B.C. in ancient Babylonia on an obelisk recording the famous Code of Hammurabi. Debtors that offered lenders an extra sum did not have to repay their loans if an unforeseen catastrophe struck — think death, disability, fire, or flooding.

Fast forward nearly two millennia to 1666, when the Great Fire of London nearly destroyed the city, incinerating over 13,000 homes and displacing 100,000 people. In the charred aftermath, an entrepreneurial physician and property investor named Nicholas Barbon conceived of an ingenious model to mitigate the risk of property damages to individuals from future fires — and perhaps make a little money in the process.

Individuals would pay a “premium” into a common fund — later called “The Insurance Office” — which would use the pooled resources to cover the cost of fire damage. While it held some cash, Barbon’s Insurance Office made real estate investments to grow the value of the fund. It also employed a private fire brigade to protect its members and and property investments.

Barbon’s enterprise was short-lived — sometimes the early bird gets the turd — but the Sun Fire Office, founded just after Barbon’s venture in 1710, still stands today. After a series of mergers, it is now known as Royal & Sun Alliance, or RSA Insurance Group, Britain’s largest insurance company.

STATE OF PLAY

Global insurance premiums surpassed an estimated $4.6 trillion in 2016, with the United States representing over $1.4 trillion of that figure. While it has grown in scale and sophistication, the core model and consumer experience has evolved very little since the time of Nicholas Barbon.

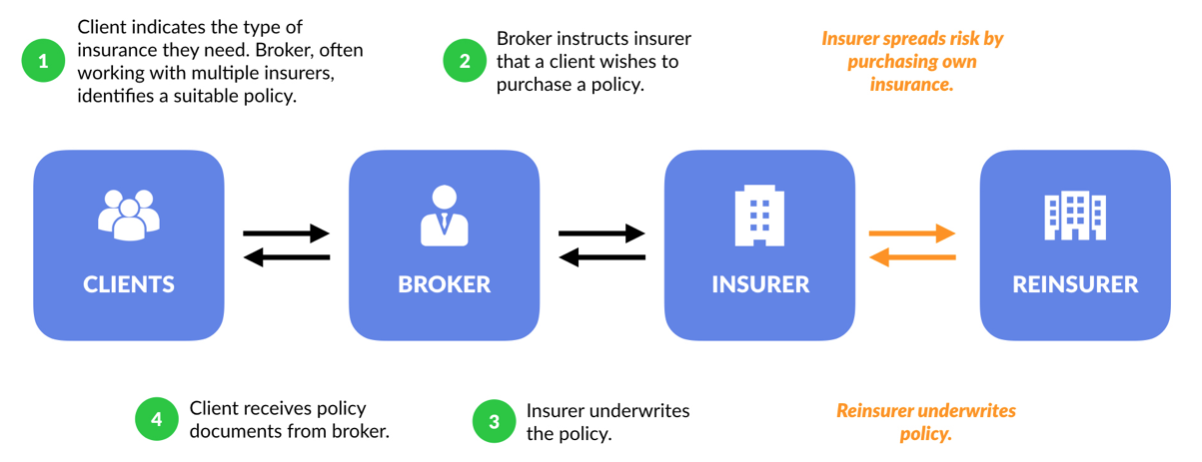

The traditional insurance industry is comprised of three main segments: brokers (distributors), which interact with clients; insurers, which perform operational tasks like underwriting and claims processing, and reinsurers, which insure the insurers.

The industry has been especially slow to modernize due to historically high barriers to entry — from regulatory burdens to product complexity. Insurance companies are personnel heavy, employing over two million people using legacy systems built around physical documents.

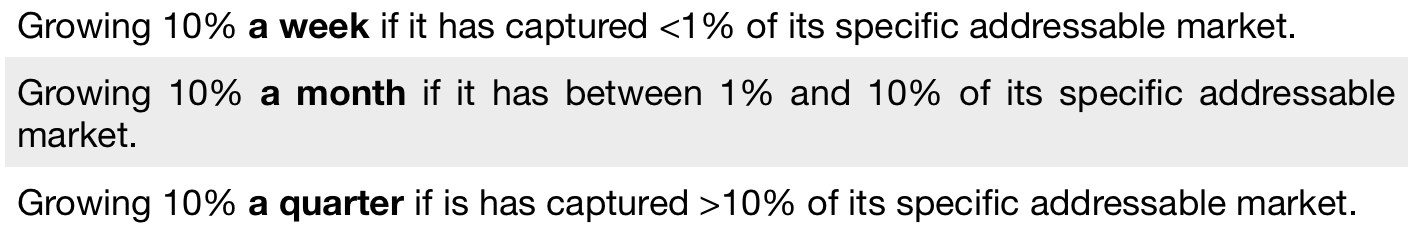

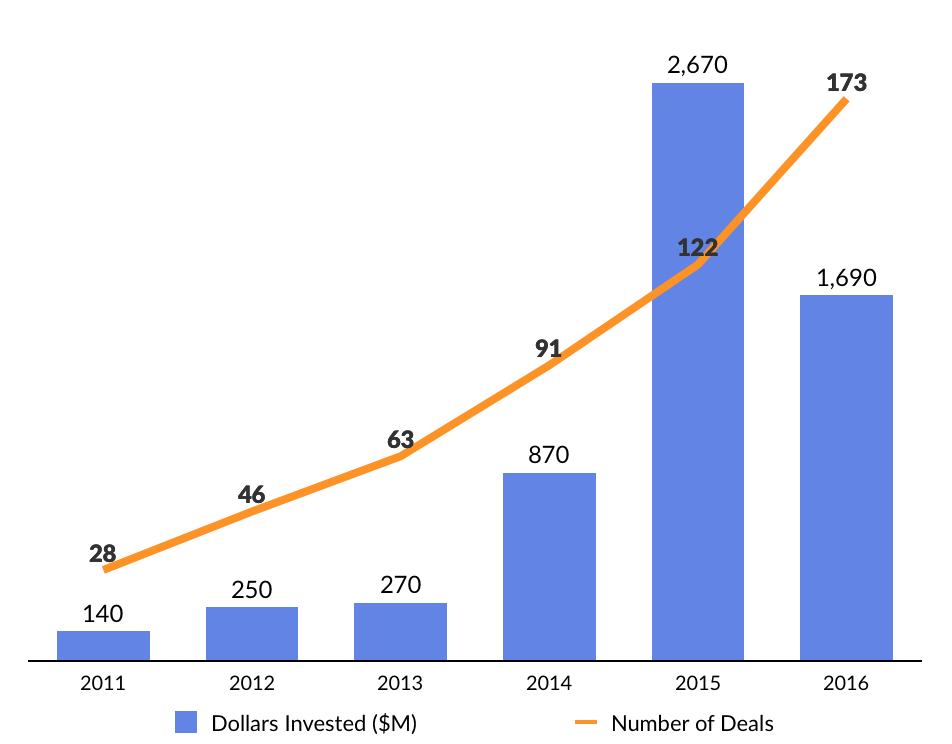

But consumers are increasingly seeking ease of use, transparent pricing, and on-demand services in all aspects of their lives— values that are contrary to the basic premise of insurance, which is to deny claims to make money. But entrepreneurs are rising to the challenge. CB Insights estimates that funding for for insurance technology companies rose from $870 million in 2014 to $2.7 billion in 2015, with Zenefits and Zhong An Insurance accounting for $1.4 billion on their own. VC activity “cooled off” to $1.7 billion in 2016.

In 2016, notable financings included health insurance platforms Oscar Health and Clover Health, which raised $400 million and $160 million rounds respectively. Auto insurance company Metromile raised $153 million.

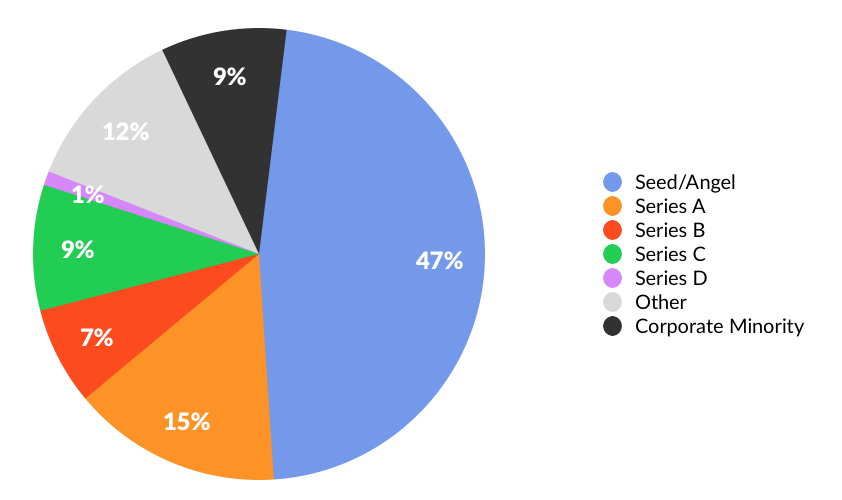

Today, a substantial majority of the deals in insurance tech are early stage, with over half of venture financings made in the Seed or Series A rounds. Accordingly, exits to date have been relatively few an far between.

Increasingly, global technology leaders such as Alphabet (Google), Alibaba and Baidu have demonstrated a growing interest in insurance technology, partnering with both emerging startups and industry behemoths alike to embed their platforms across various services.

Alphabet’s Google Ventures (GV), for example, recently invested in Sequoia-backed Lemonade, a technology enabled property and casualty insurance company with transparent, fixed pricing and streamlined customer service. It has also backed benefits and insurance management startups Gusto and Collective Health. Google Capital has invested approximately $33 million into the data-driven health insurance platform, Clover Health.

Chinese behemoth Alibaba invested in ZhongAn Insurance, China’s first exclusively online product insurance company. Its affiliate, Ant Financial, is the company’s largest shareholder. ZhongAn Insurance generates the bulk of its revenue through a return-delivery insurance product for buyers on TaoBao.com, Alibaba’s online marketplace.

Global insurer Allianz recently partnered with Chinese Internet search giant Baidu and investment group Hillhouse Capital to establish a digital insurance company in China. This joint venture will digitize travel, e-commerce, and internet finance insurance in the short term, targeting verticals such as healthcare, lifestyle, and automobiles in the future.

KEY VERTICALS

The obvious area for innovation, with the fewest barriers to entry, has been replacing the individual brokers with transparent, efficient marketplaces that apply the design principles of successful e-commerce platforms. Companies like CoverHound, Cover, FinanceFox, PolicyBazaar, and PolicyGenius have all gained strong traction and blue chip backing.

But we are also seeing innovation in specific segments of the insurance industry , which is both disrupting the stalwart incumbents and creating services where there used to be none.

Healthcare

To say that Americans don’t like health insurance companies would be more than a mild understatement. A 2015 survey by the American Consumer Satisfaction Index that asked consumers to rank their satisfaction with companies across 43 industries found that health insurers placed in the bottom five — ahead of only Internet service providers, cable companies, the U.S. Postal Service and fixed-line telephone services. Even banks received higher marks.

Companies like Clover Health, which reportedly raising $120 million at a $1+ billion valuation, are changing the paradigm by using data and mobile technology to reduce costs, improve outcomes, and deliver a superior customer experience. Backed by Sequoia and First Round Capital, Clover’s initial goal is upend the Medicare health insurance market, which is dominated by sprawling incumbents like UnitedHealth and Cigna, which have a combined market value over $150 billion.

To do this, Clover collects a range of patient data like lab test results, radiology results, and routine checkup absenteeism to get an overall profile of a person’s health and risk profile. It then uses software models to automatically identify issues — like patients not regularly taking a prescription — and intervenes early with nurse practitioners and social workers that are equipped for home visits.

As Clover co-founder Kris Gale observed in an interview with TechCrunch, “If we know something is on a 30-day refill and we haven’t seen a claim in 35 days, we know they aren’t taking it regularly. We can reach out and intervene. This is info that’s available to us because we’re the payer… The doctor doesn’t know if they’re getting that filled unless they’re asking them regularly. That’s part of the data advantage.”

The net result is lower costs for both Clover and its customers, not to mention better health outcomes. In 2015, for example, seniors using Clover Health had 50% fewer hospital admissions and 34% fewer hospital readmissions than the average group of Medicare patients in the New Jersey areas it serves.

Next generation insurance providers include Oscar, Zoom+, and Beam Dental. In February 2016, Oscar, completed a $400 million financing led by Fidelity Investments, which valued the company at $2.7 billion. Last year Oscar secured a key hire, naming Alan Warren — a former Alphabet executive overseeing the Google Docs and Google Drive product lines — as its Chief Technology Officer.

A second key segment of related companies is purely focused on the buying, selling and management of health insurance. These include Zenefits, Collective Health, Stride Health, GetInsured, SimplyInsured, Gravie, and Picwell.

Across the Pacific in Singapore, CXA, which raised $25 million in February from EDBI and Facebook co-founder Eduardo Saverin’s B Capital Group, is pushing the corporate value proposition a step further. CXA enables employees to select a mix of insurance and wellness benefits that align to their needs and preferences. Rather than offering one-size-fits-all insurance plans, CXA aggregates a wide range of providers on its platform — from insurers to gyms and yoga studios.

Automobile Insurance

We all know that like a good neighbor, State Farm is there and that we can save 15% on our car insurance in 15 minutes through GEICO. Combined, State Farm and GEICO wrote nearly $60 billion worth of auto insurance in 2015.

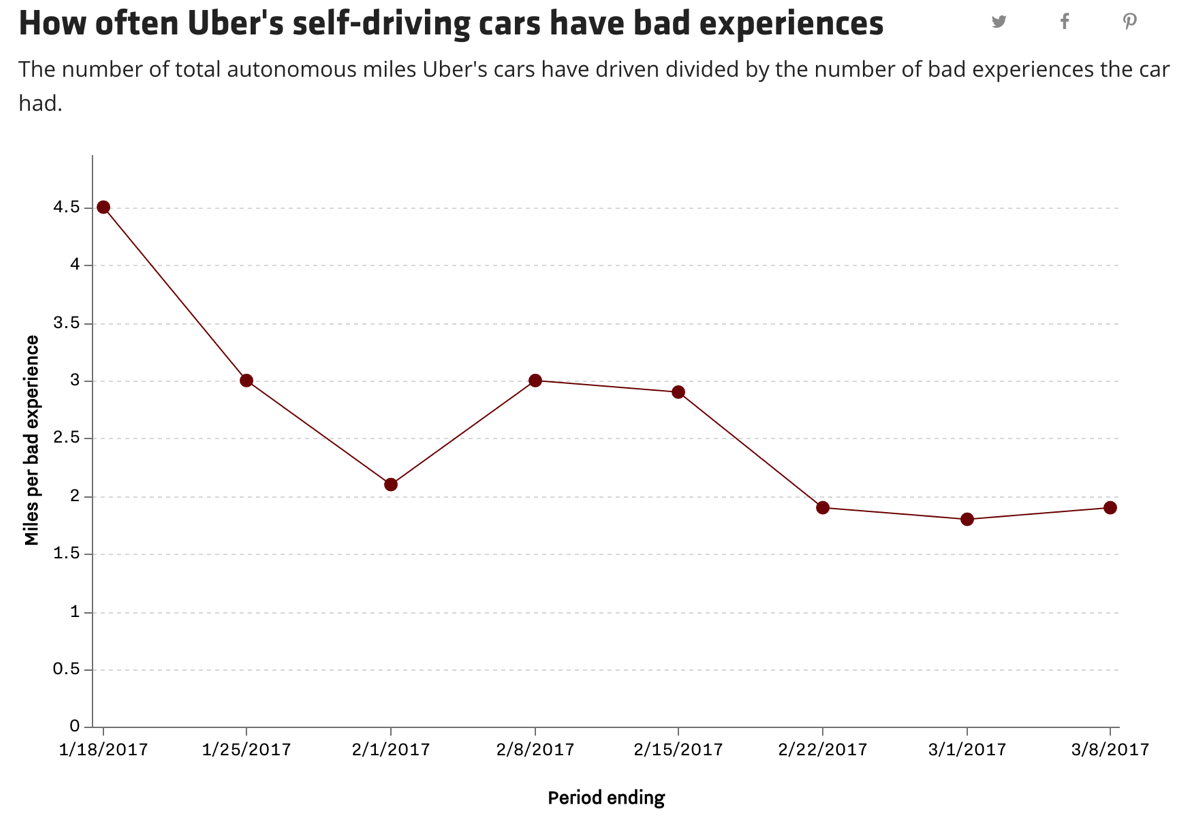

However, KPMG estimates that the automobile industry has the potential to shrink 60% within the next 25 years, as vehicles get safer and result in fewer car accidents and fatalities. The rise of on-demand car services such as Lyft and the adoption of autonomous vehicles will also reduce the need for auto insurance as we buy fewer cars. (Disclosure: GSV owns shares in Lyft)

In a survey done by Goldman Sachs, only 15% of millennials — the largest generation in U.S. history — feel that is it extremely important to own a car. In fact, people aged 75+ have surpassed 18-24 year olds in annual car purchases. And the number of young people with a driver’s license has steadily decreased. In 1983, 92% of 20- to 24-year-olds had driver’s licenses. Today it is just 77%. Look younger, and the shift is even more pronounced. In 1983, 46% of 16-year-olds had licenses. Today it is 24%.

A related dynamic is the “megatrend” of urbanization. Today, the United Nations estimates that four billion people, or 54% of the World’s population, live in cities. In the next 15 years, the Economist projects that urbanization will increase average city density by 30%. By 2050, the ranks of urban dwellers will swell by 2.5 billion to nearly two-thirds of global population.

This means that in the future, when people do own cars, they probably be underutilized. But today, auto insurance companies offer plans that care comparatively expensive for low-milage drivers on a per mile basis. It is estimated that 65% of drivers overpay to subsidize high mileage drivers.

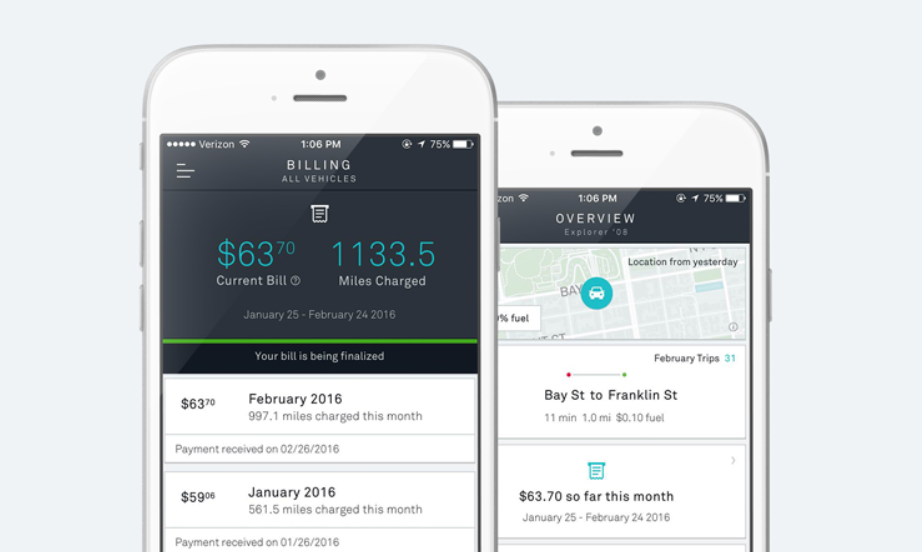

As consumer habits change, new auto insurance companies are emerging to address rapidly evolving consumer habits. Metromile, for example, is delivering pay-per-mile auto insurance. It tracks the vehicle usage though Metromile Pulse, a product that plugs into the diagnostic port of a vehicle to track the number of miles driven, displaying real-time updates through a mobile app. Drivers are billed per-mile and low-mileage customers can save $500 on average annually.

The Metromile Pulse app is a snapshot of how next generation insurance companies designed for digital natives are creating competitive advantages. Pricing is transparent and consumers can track what they’re spending as they spend it. They can also monitor their car’s health and keep track of where it’s parked. Metromile is insurance, and then some. The company has raised over $200 million from investors such as NEA, Index Ventures, and First Round, as well as insurance giants such as Canada’s Intact Financial and China Pacific Insurance. Metromile is currently available for drivers in California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington and will be expanding to other states with their recent financing.

Auto insurance startups are increasingly partnering with ride-sharing and self-driving car companies to provide new forms of coverage.

Metromile, for example partnered with Uber in 2015 to provide an insurance coverage for drivers when they are not carrying a passenger. Root offers discounts to Tesla drivers who use Tesla’s Autopilot technology based off of Federal data that demonstrates that Tesla’s technology results in lower crash rates. Expect to see more partnerships between ride sharing and pay-as-you-go insurance platforms as both platforms evolve.

Personal Insurance

We are seeing a proliferation of various consumer insurance products and platforms that a mobile-centric experience with transparent pricing and on-demand characteristics.

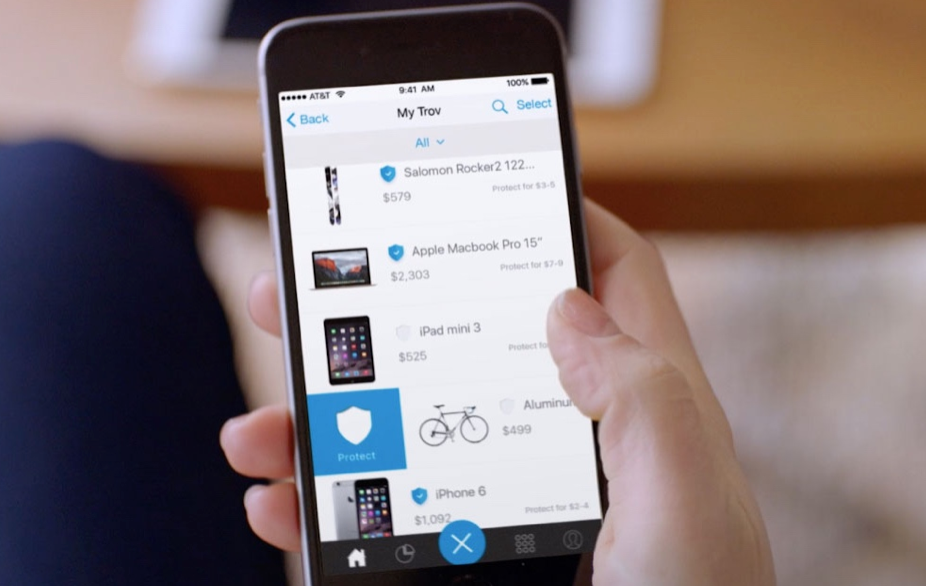

Founded in 2012, Trov, for example, enables consumers to buy insurance for specific products and possessions. Users can items products ranging from instruments to smartphones and surfboards. All they need to do is input the “make and model” into the Trov platform. It then gathers the data necessary to generate a quote to insure the product. Users can then turn protection “on” and “off” whenever they choose through a single swipe on Trov’s mobile app.

Since its launch, Trov has insured over $10 billion worth of goods and the platform has over 1 million items added. It partners with large insurance companies — Suncorp in Australia and Axa in the UK — to provide coverage, sharing the premiums. Trov gets the underwriting infrastructure, and the insurance companies get a new channel to access customers and put their balance sheets to work.

Trov has raised $46 million and currently operates only in the U.K. and Australia. The company plans to expand to the United States in 2017, followed by Europe and Asia.

What’s Next

Partnerships + M&A

Moving forward, insurance startups will continue to partner with established providers to provide a regulatory halo for their services. But as newcomers establish their own brands, they will seek to create their own regulated vehicles to cut out the middleman. We’re beginning to see this dynamic play out with companies like Metromile.

Metromile, which raised its Series D in September 2016, plans to use some of its $192 million round to acquire an insurance carrier called Mosaic Insurance. Mosaic Insurance will handle the underwriting of the insurance policies itself to streamline the process of providing insurance to drivers.

Peer-to-Peer

We also expect to see a proliferation of new insurance models. Peer-to-peer insurance models, using a sharing economy approach, invites users to form small groups of policyholders who will pay into a pool to use for small claims.

Sequoia backed Lemonade for example, is charging a fixed fee to customers that join insurance “pools.” If the pool is unable to pay for the claims of its members, then Lemonade will pay the excess from reinsurance and capital reserves. If the pool is “profitable”, funds are donated to a social cause members care about. In this model, there’s no incentive to withhold payouts.

Peer-to-peer insurance models have gone global as well. Berlin-based Friendsurance allows small groups of users to pool together into one car insurance policy. At the end of each year, policy holders using the platform receive a cash-back bonus if they did not file a claim.

IoT + Drones

With the proliferation of Internet-of-Things (IoT) devices, insurance companies are able to have an additional pulse check on insured items. For example, home insurance companies are encouraging consumers to use connected devices to keep their properties safe. American Family Insurance (AFI) partnered with IoT startup Ring, which creates a video home security doorbell, to improve home safety.

Additionally, connected wearables like the Apple Watch or Fitbit give insurers the ability to monitor health activity in real time, offering discounts for a healthy lifestyle. John Hancock was one of the first to use wearable devices to track customers and incentivized them to stay fit by giving away free Fitbits and by offering entertainment and travel rewards.

A growing group of the large insurance companies is turning to drones to help conduct inspections for underwriting and claims adjusting. Farmer’s CIO Ron Guerrier recently remarked that his company is evaluating how it can use drones to inspect brush clean-up in areas prone to wildfire. Allstate is similarly testing the use of drones to help with property claims after natural disasters such as hurricanes.

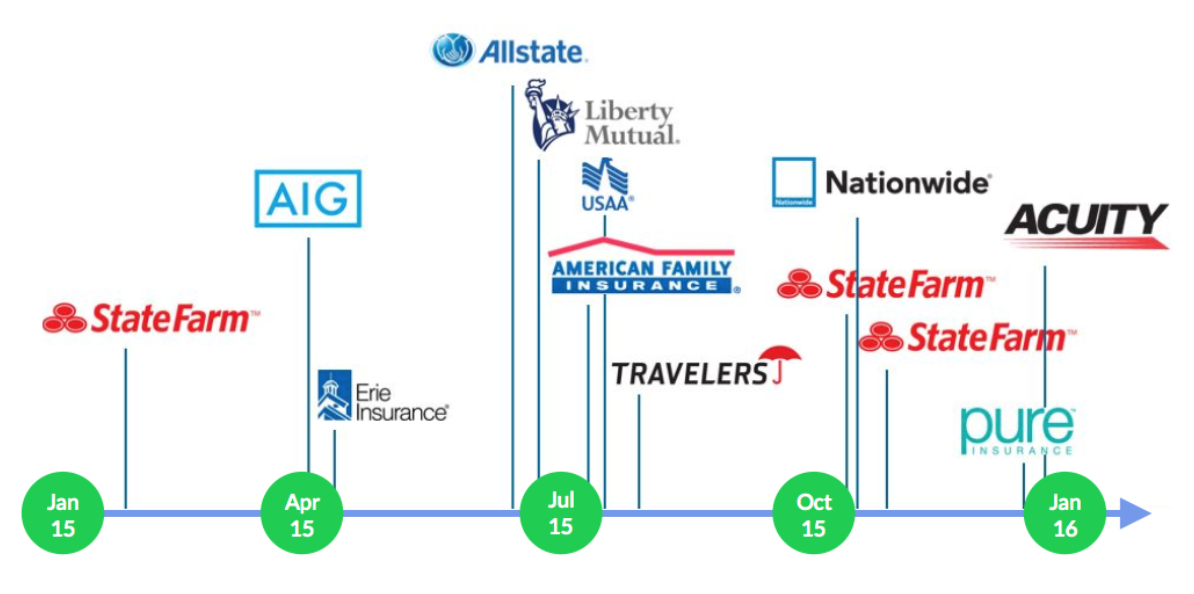

The testing and research of drones by insurers is evidenced by the boom of FAA drone exemptions — allowances to use drones in various settings — that were granted to insurers in 2015, including AIG, Liberty Mutual, Allstate, and State Farm.

Blockchain

While the future of Bitcoin is uncertain — it could be the Facebook or the MySpace of so-called “cryptocurrencies” — the underlying technology powering it, “Blockchain,” is here to stay. Effectively a decentralized, open-source public ledger for the exchange of information, blockchain has the potential to transform any industry that relies on middlemen and “honest brokers” for critical functions — from finance to supply chain management to academic credentialing and healthcare.

Healthcare institutions suffer from an endemic inability to securely and efficiently share information, despite the profound opportunity to benefit consumers. A central challenge has been the absence of a shared communication network that both meets the needs of all parties without compromising patient information security. The net result has been a tangled network of redundant, error-prone records.

Blockchain technology has the potential to enable better data collaboration between providers, patients, and insurance companies, which would translate into higher probabilities of accurate diagnoses, increased likelihood of effective treatments, and reduced costs for all parties.

Gem, for example, recently launched the Gem Health Network in partnership with Philips. It’s an Ethereum-enabled blockchain network streamlining data movement and integration from patient records, wellness apps, insurance claims management, clinical and trials.

In 2016, the government of Estonia announced that it would begin securing over a million healthcare records using blockchain in partnership with Guardtime and Oracle. It was the first national health system to adopt the technology.