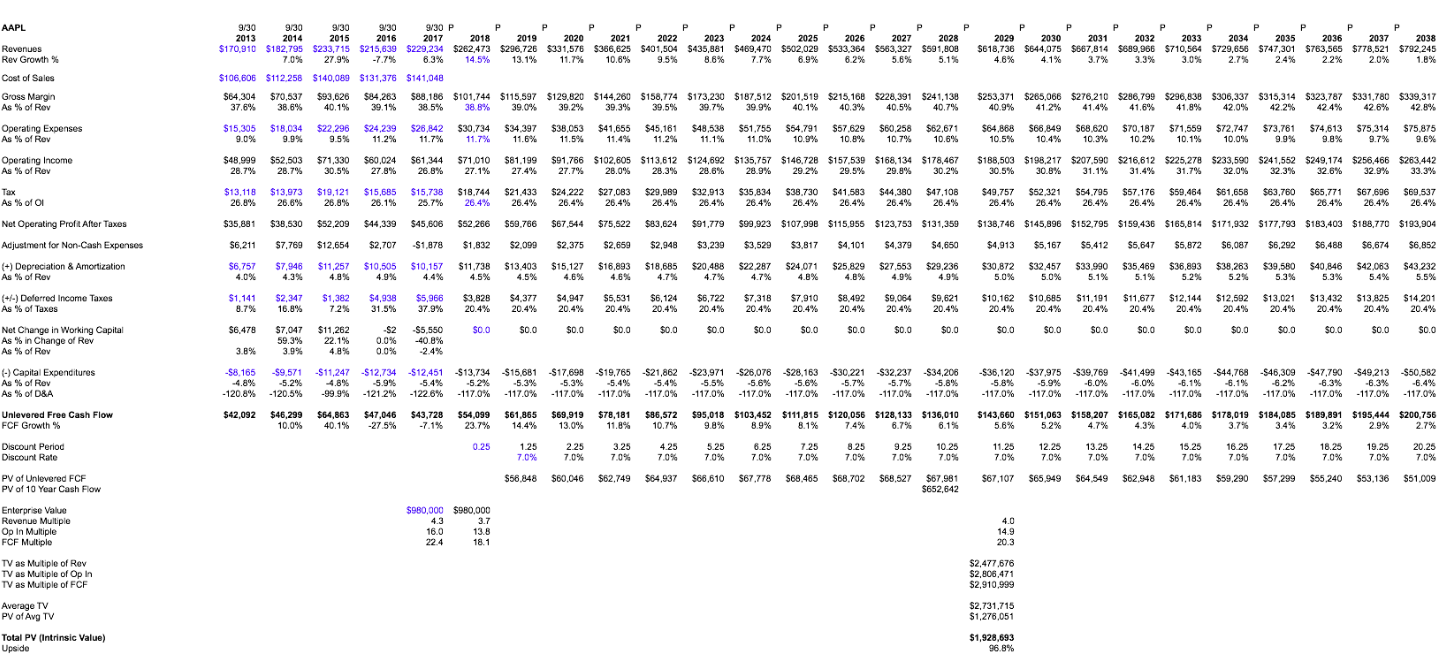

Market Snapshot

| Indices | Week | YTD |

|---|

On August 8, GSV Capital (NASDAQ: GSVC) announced its Second Quarter 2018 financial results. Please click here for GSVC’s official press release, which captures detail reflected in the update below.

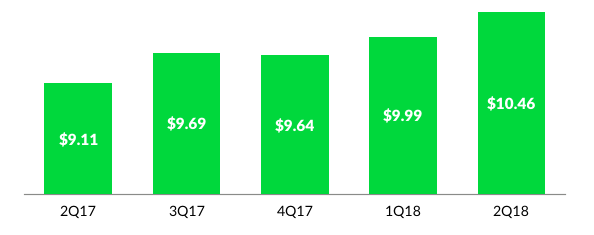

At the end of the second quarter, Net assets totaled approximately $217 million, or $10.46 per share. This is up from approximately $210 million, or $9.99 per share, at the end of the first quarter, and $202 million, or $9.11 per share at the same time last year.

As I’ve emphasized to varying degrees on previous earnings calls, we are focused on three core areas to drive GSV Capital performance and investor returns.

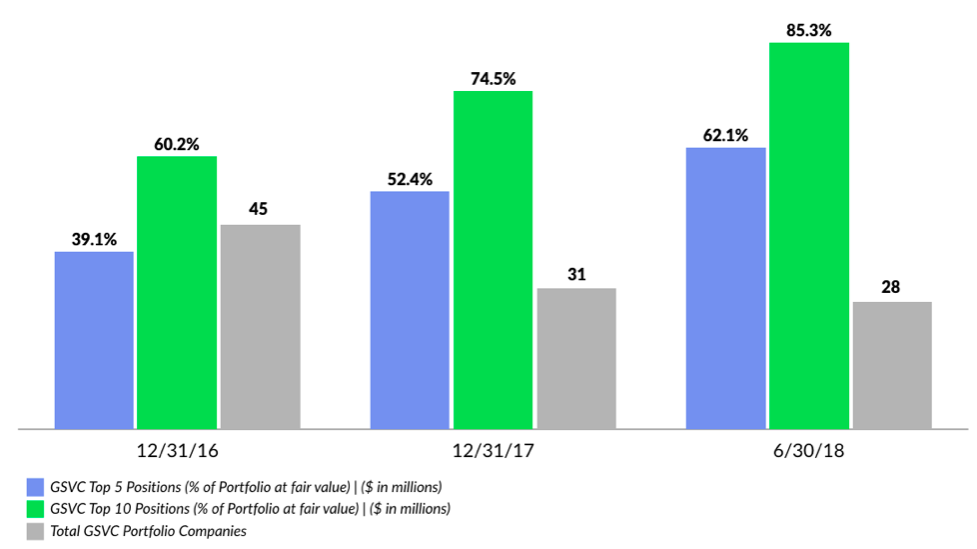

First, we continue to increase the size per position and reduce the number of companies in our investment portfolio.

- At the end of the Second Quarter, GSV Capital had positions in 28 portfolio companies, compared to 38 a year ago.

- Our top five positions account for approximately 62% of the portfolio at fair value, excluding treasuries. For context, that’s about the same weighting as GSV Capital’s top 10 positions at the same time last year, which accounted for just 63% of the portfolio.

- To put the evolution of the GSV Capital portfolio into perspective, the combined fair value of our top five positions as of June 30, 2018 was $134 million. That’s almost equal to GSV Capital’s total market capitalization, which is approximately $151 million today. We believe this dynamic emphasizes a significant risk-reward opportunity for investors as our stock currently trades at a discount of about 32% to NAV.

With recent public listings from Spotify and Dropbox – two of our top three positions – a second key area of focus is selectively adding new names to the portfolio. As a general rule, given the size of our portfolio, we are targeting $10 to $15 million positions in premier late stage growth companies with a line of sight to an IPO or significant liquidity event. At the same time, we will opportunistically make follow-on investments where we can underwrite equally compelling returns. (Disclosure: GSV owns shares in Spotify and Dropbox)

- As of June 30, 2018, GSV Capital had approximately $93.5 million of cash consisting of proceeds from the issuance of $40 million in Convertible Senior Notes due in 2023 during the first quarter 2018, as well as proceeds generated by the monetization of various portfolio positions from the fourth quarter of 2017 through the second quarter of 2018. We also had $65 million in marketable securities, $25.5 million of which is subject to sales restrictions.

- We intend to use approximately $50 million of our cash on hand to repurchase or pay at maturity GSV Capital’s $50 million of outstanding 5.25% Convertible Senior Notes, which mature on September 15, 2018.

- Beyond that, we are actively sourcing and evaluating investment opportunities in top VC-backed companies that demonstrate strong operating fundamentals. We are targeting businesses that have crossed the chasm of initial business risk and have the opportunity to generate scaled valuation growth before a potential IPO or strategic exit. To frame the opportunity, CB Insights identifies 355 IPO pipeline companies today, a group that has raised over $104 billion in aggregate and more than $75 billion since 2015.

- Importantly, we are agnostic in terms of whether we invest in secondary or primary shares. Our goal is simply to invest in the top growth companies in the world at a fair price. While primaries offer certain benefits, including broader information rights, our deep experience with secondaries creates unique advantages and opportunities in terms of access, diligence, timing, and pricing. Some of our portfolio’s most recognizable names, including Dropbox, Spotify, and Palantir, were secured almost entirely through secondary shares.

Our third and final key area of focus is continuing to take proactive steps to enhance shareholder value:

- In 2017, GSV Capital’s Board authorized a $10 million discretionary open-market Share Repurchase Program through November 6, 2018. In May, the Board authorized a $5 million expansion of the program to an aggregate of $15 million. To date, we have repurchased approximately $10 million in shares of common stock under the program, including $2.2 million in the second quarter of 2018 and an additional $1.6 million subsequent to quarter end.

- The Share Repurchase Program complements the shareholder-centric adjustments we have made to our fee structure in recent months. Later in the call, Allison Green will discuss a few additional steps we are taking on this front. We have also continued to reduce the operating expenses incurred under GSV Capital’s administration agreement, which declined about 12% year-over-year in the second quarter.

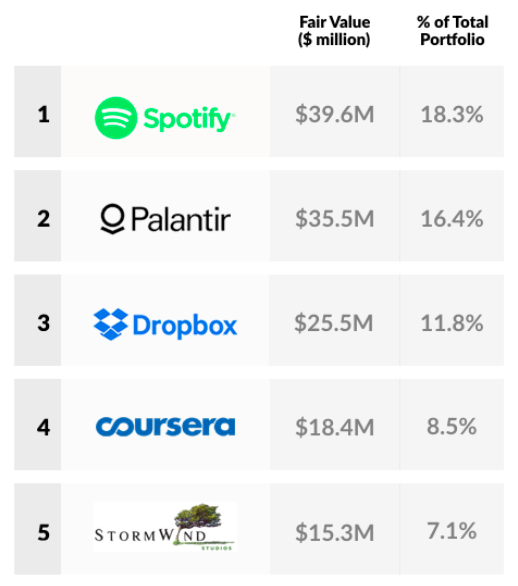

GSV’s top five positions as of June 30, 2018 were Spotify, Palantir, Dropbox, Coursera, and Stormwind, comprising 62% of the portfolio at value, excluding treasuries. Our top 10 positions accounted for over 85% of the portfolio. (Disclosure: GSV owns shares in Palantir, Coursera and Stormwind)

Segmented by investment theme, the top allocations were to Education Technology as well as Cloud and Big Data companies – which each comprised approximately 30% of the portfolio at fair value, excluding treasuries. Social Mobile was the next largest category, representing 22% of the portfolio.

Our largest position, Spotify, went public on April 3 and is up approximately 35% to date from a reference price of $132 set by the New York Stock Exchange in advance of the company’s direct listing.

As of June 30, 2018, GSV Capital carried Spotify at a fair value of $39.6 million. This translates to approximately 18% of the portfolio at fair value, excluding treasuries.

Our valuation reflects Spotify’s closing share price as of June 30, 2018, which was $168.24 per share. The company’s shares closed at approximately $189 and CNN Money reports that Spotify’s median analyst 12-month price target is $205.

As we have communicated in the past, our intention is to monetize public positions at a time that will maximize shareholder value within 18 months of a portfolio company going public, or 12 months after any relevant lock-up has expired. There are no restrictions on GSV Capital’s Spotify holdings.

On July 26, Spotify reported strong second quarter results, reinforcing our conviction in the company’s near-term upside potential:

- Spotify has reached 180 million Monthly Active Users and 83 million paying subscribers, up 30% and 40% year-over-year respectively.

- Revenue was up 26% year-over-year in the second quarter, which jumps to 34% after adjusting for the negative impact from changes in foreign exchange rates.

- Gross Margin improved to 26%, which was at the high end of Spotify’s guidance. For context, Netflix operates with approximately 35% Gross Margin and we believe Spotify’s continued improvement in this area will be a catalyst for the stock.

We will continue to closely track the Spotify’s performance as we seek to exit the position at a time that will maximize returns for GSV Capital shareholders.

On a similar note, Dropbox, our third largest position, is set to report earnings on August 9. As of June 30, 2018, GSV Capital carried Dropbox at a fair value of $25.5 million, which represents approximately 12% of the portfolio, excluding treasuries.

Our current valuation reflects Dropbox’s closing share price as of June 30, 2018, which was $32.42 per share, discounted modestly for a lockup period that expires on September 19. The company’s shares closed at approximately $31 and CNN Money reports that Dropbox’s median analyst 12-month price target is $35.

On August 9, the company announced that second quarter revenue was up 27% year-over-year and that paying customers had surpassed 11.9 million, up 20% versus the same period in 2017. Average revenue per paying user stood at approximately $116.7, compared to $111 a year earlier.

Beyond Dropbox and Spotify, we’re pleased to report noteworthy developments from Lyft, Coursera, and DreamBox Learning.

- On June 27, Lyft completed a $600 million financing led by Fidelity that valued the company at $15.1 billion. The round builds on the Lyft’s strong momentum in 2018, headlined by a March 12 announcement that the company completed its 20th consecutive quarter with year-over-year revenue growth above 100 percent. On July 2, Lyft announced that it acquired Motivate, the largest bikeshare operator in North America, as part of its plan to provide a broader range of last mile transportation services. The company has also indicated that it will launch an electric scooter service in the near future. (Disclosure: GSV owns shares in Lyft)

- Coursera, our fourth-largest position, announced in July that it was partnering with the University of Pennsylvania to launch its first accredited online Ivy League degree. The company will offer a Master’s program in Computer and Information Technology at a price point of $26,000, a disruptive value proposition that checks in at less than a third of the price of UPenn’s on-campus program. Today Coursera reaches over 33 million learners with 2,700 courses from 150 premier global universities. It also serves over 1,000 enterprise customers, targeting a fragmented $300 billion global corporate learning market. With developments like the UPenn online degree, we believe Coursera is continuing to position itself as the world’s leading learning platform.

- Finally, DreamBox Learning announced on July 31 that it received a $130 million investment from TPG that will enable GSV Capital to monetize its position in the company. We established our position in the company in 2011, and based on the terms of the deal, we expect this exit to generate approximately $5.7 million in proceeds. This would translate to a net realized gain of $3.4 million for GSV Capital and an IRR of approximately 19%. (Disclosure: GSV owns shares in DreamBox Learning)

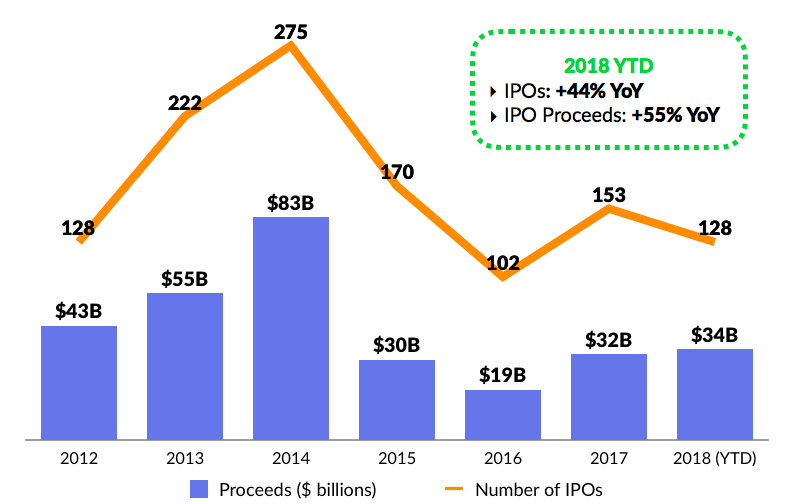

Looking ahead, we believe that GSV Capital is well positioned to deliver long-term shareholder value. We are executing against a disciplined growth investment strategy with strong tailwinds. We believe the fundamentals of the portfolio are strong. And the IPO environment continues to show signs of strength, which has historically been a catalyst our stock.