Market Snapshot

| Indices | Week | YTD |

|---|

On May 8, GSV Capital (NASDAQ: GSVC) announced its First Quarter 2018 financial results. Please click here for GSVC’s official press release, which captures detail reflected in the update below.

At the end of the first quarter, Net assets totaled approximately $211 million, or $9.99 per share. This is up from approximately $205 million, or $9.64 per share, at 2017 year end, and $196 million, or $8.83 per share at the same time last year. Successful IPOs from Dropbox and Spotify headlined strong first quarter momentum in the GSV Capital portfolio. (Disclosure: GSV owns shares in Dropbox and Spotify)

At the same time, we have continued to execute key initiatives to systematically enhance shareholder value.

- In 2017, GSV Capital’s Board authorized a $10 million discretionary open-market share repurchase program through November 6, 2018. To date, we have repurchased approximately $6.2 million in shares of common stock under the program, including $1.2 million in the first quarter of 2018. We are pleased to announce today that our Board has authorized a $5 million expansion of the program to an aggregate of $15 million, which leaves $8.8 million for repurchases under the program.

- A second noteworthy initiative announced on March 23 was the pricing of $40 million in aggregate principal amount of 4.75% Convertible Senior Notes due in 2023. We are thrilled to have the support of a group of world-class institutional investors and believe this instrument will create value in a few specific ways:

- First, we intend to use the proceeds, as well additional cash on hand, to repurchase or pay at maturity GSV Capital’s $50 million of outstanding 5.25% Convertible Senior Notes, which mature on September 15, 2018. The new instrument, in other words, is effectively a $40 million extension at a 50 basis point discount. As of March 31, 2018, GSV Capital’s cash position was approximately $90 million.

- By extension, the new instrument will create broader capacity for GSV Capital to make new portfolio investments in premier VC-backed technology companies with a line of site to an IPO or significant liquidity event. To frame the opportunity, CB Insights identifies 355 IPO pipeline companies today. This group has raised over $104 billion in aggregate and more than $75 billion since 2015.

- The new note will also enable us to opportunistically make follow on investments in portfolio companies that continue to demonstrate strong growth fundamentals.

- A third initiative is the implementation of comprehensive adjustments to GSV Capital’s advisory fee structure. On February 5, 2018, we announced that GSV Asset Management would forfeit $5 million of its previously accrued, but unearned incentive fee, which resulted in the addition of approximately 24 cents per share of NAV in the first quarter.

- Finally, we continue to focus on prudent opportunities to reduce expenses. In the first quarter, for example, we lowered the operating costs incurred under GSV Capital’s administration agreement by 20% versus the same period last year.

On March 23, Dropbox, completed a successful IPO, trading up 40% for the day as investors embraced the fastest SaaS business to reach a $1 billion revenue run rate.

Today, the company trades at approximately $31, a gain of 48% from its listing price. As of March 31, 2018, GSV Capital held 874,990 shares of Dropbox at a fair value of $24 million, or approximately $27 per share. The Wall Street Journal reports that the median analyst price target for the company is currently $34, with a high of $40.

As we have communicated in the past, our intention is to monetize public positions at a time that will maximize shareholder value within 18 months of a portfolio company going public, or 12 months after any relevant lock-up has expired. We remain very bullish on the outlook for Dropbox.

In its S-1, Dropbox reported 2017 revenues of $1.1 billion, up from $604 million in 2015 – a 35% CAGR for the period. Gross Margins nearly doubled over that span, improving from 33% to 67%.

We believe that Dropbox is creating long term competitive advantages in the enterprise by unlocking powerful and disruptive network effects.

Dropbox reported more 11 million paying customers at the time of its filing, including 300,000 businesses and over half of the Fortune 500. Remarkably, over 90% of the company’s revenue originates from self-service channels – individuals who purchase a subscription through the app or website. Employees, in other words, want to use the technology they use at home.

Today, Dropbox has over 500 million users across 180 countries, including 100 million new users added since the beginning of 2017.

A second key development in the portfolio was Spotify’s successful direct listing on the New York Stock Exchange on April 3. As expected, the company opted to forgo a traditional IPO, which means there was no formal share offering, underwriters, or lock-up period for current investors.

Today, the company trades at approximately $157 per share following a 40-to-1 stock split announced before the listing. As of March 31, 2018, GSV Capital held 235,360 shares of Spotify at a fair value of $31 million, or approximately $132 per share.

Last week, a slew of leading investment banks initiated coverage of Spotify and issued price targets. Goldman Sachs, JP Morgan, Evercore, and Morgan Stanley all pegged the company at $190 per share. Bank of America Merrill Lynch came in at $195 and UBS set a price target of $200. The Wall Street Journal reports that Spotify’s median analyst price target is currently $180, with a high of $210.

We believe that Spotify continues to demonstrate significant upside potential based on strong operating fundamentals and growth initiatives. In its first earnings report last Wednesday, the company announced revenue and user growth that was in line with forecasts. As of first quarter end, Spotify reported over 75 million subscribers and 170 million users overall. By contrast, Apple Music reported just 40 million users on April 11.

Beyond the headline numbers, two key metrics stood out:

- First, the average monthly premium churn rate hit a record low, falling below 5% for the first time.

- Second, Gross Margin reached 25%, which surpassed Spotify’s most recent estimates. For context, Netflix operates with approximately 35% Gross Margin and we believe Spotify’s continued improvement in this area will be a catalyst for the stock.

In a third key development for the portfolio, GSVlabs announced on April 9th that it completed a Series B financing of approximately $7 million at a $25 million pre-money valuation. The round was led by outside investors. As of March 31, 2018, GSV Capital’s valuation for the company implied an enterprise value of approximately $18 million. (Disclosure: GSV owns shares in GSVlabs)

We’re also excited to report that in conjunction with the financing, GSVlabs announced the hiring of new CEO Nikhil Sinha to lead the platform’s global expansion.

Nikhil brings a unique blend of experience spanning venture capital, as well as executive roles in both the corporate and academic sectors. He’s an accomplished VC, he co-founded and successfully exited two technology companies, and more recently, he launched a major university in India. Nikhil is the Director Emeritus of the U.S.-India Business Council and a member of the Advisory Board of the Annenberg School for Communication at the University of Pennsylvania.

A final key portfolio development subsequent to first quarter end was the acquisition of General Assembly for $413 million by the European human resources and staffing firm Adecco. We are thrilled for the General Assembly team and believe Adecco, which serves over 100,000 businesses, can help meaningfully accelerate its expansion into the enterprise. (Disclosure: GSV owns shares in General Assembly)

GSV Capital initiated its position in General Assembly in 2014 and we believe the acquisition price aligns with our current valuation for the company. As of March 31, 2018, we held General Assembly at a fair value of $9.6 million against a cost basis of $6 million, which represents a return of approximately 60%.

The acquisition was announced on April 16 during the 9th annual ASU GSV Summit, which attracted over 4,000 attendees from 40 countries, as well as 450 presenting companies. Notable keynotes included former U.S. and Mexican presidents George W. Bush and Vicente Fox, Angela Duckworth who authored the bestseller Grit, education activists Matthew McConaughey and John Legend, and many others.

The New York Times has described the Summit as a “must attend” event for investors in the education and talent sector and we believe it creates key advantages for GSV Capital. Not only is the Summit an engine for unique deal flow, it is a platform to promote and connect major portfolio companies like General Assembly, Course Hero, and Coursera. Please click HERE to access a video library from the event. (Disclosure: GSV owns shares in Course Hero and Coursera)

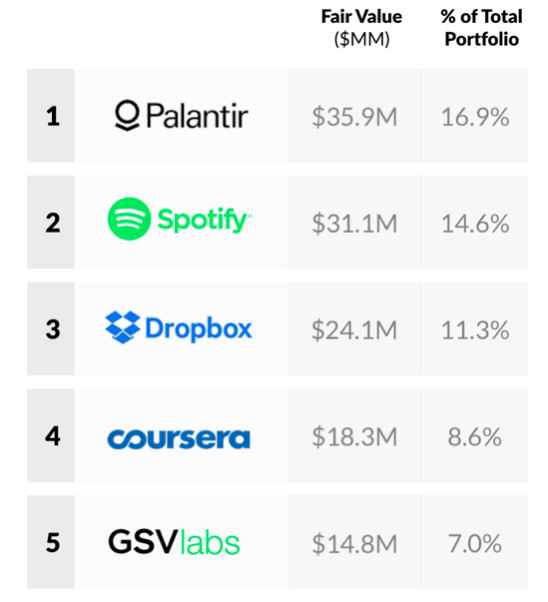

Turning to a broader review of the portfolio, GSV Capital’s top five positions as of March 31, 2018 were Palantir, Spotify, Dropbox, Coursera, and GSVlabs. These positions account for approximately 59% of the total portfolio at fair value, excluding treasuries. Our top 10 positions account for 83% of the portfolio. (Disclosure: GSV owns shares in Palantir)

By comparison, as of March 31, 2017, GSV Capital’s top five positions accounted for just 39% of the portfolio at fair value, excluding treasuries. The top 10 positions accounted for 60%.

This reflects our continued strategy of increasing the size per position in our investment portfolio. As a result of this objective, as of March 31, 2018, there were 29 companies in our portfolio, compared with 39 a year earlier.

Looking ahead we believe that the GSV Capital portfolio is well positioned against a strong environment for leading venture-backed companies.

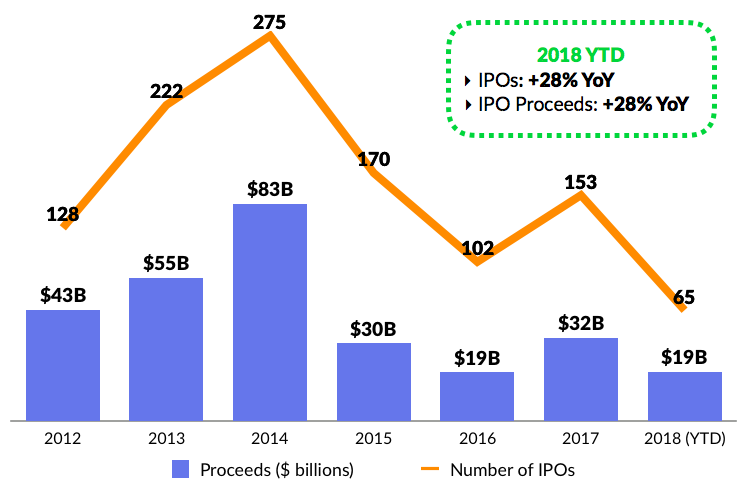

There have been 65 U.S. IPOs in 2018 according to Renaissance Capital and our research affiliate, GSViQ, a 28% increase over the same period last year. To date, 19% of companies have priced above range and 61% have priced in range, which is consistent with a healthy IPO market.

Total IPO proceeds stand at $19.3 billion to date, a 28% year over year increase. To illustrate what a meaningful change this represents, IPO proceeds for the entire year in 2016 were only $18.8 billion.

The strong IPO market has been matched by robust VC investment activity to date. According to KPMG’s Q1 Venture Pulse report, VCs invested a record $28.2 billion in U.S. companies across nearly 1,700 deals in the first quarter of 2018 as global investments topped $49 billion.

We believe these trends bode well for top GSV Capital names, including Palantir and Lyft, which continue to be popular IPO candidates. (Disclosure: GSV owns shares in Lyft)

On March 14, Lyft announced that it received a $200 million investment from the global auto parts manufacturer Magna, an extension of the Alphabet-led Series H financing announced in October 2017. Lyft is now valued at $11.7 billion.

According to reports from Bloomberg, Lyft entered 2018 controlling approximately one third of the U.S. ridesharing market, up more than 60% year over year, and we believe it’s gained more ground to date. The company reportedly generated well over $1 billion in net revenue in 2017 – the amount of money it captures after paying drivers – more than doubling 2016 performance. As of March 31, 2018, Lyft was GSV Capital’s 7th largest position at a fair value of $12.2 million.

GSV Capital’s annual investor day is scheduled for Wednesday, May 30th, from 1:00pm to 5:00pm PT at GSVlabs in Silicon Valley. The event will feature presentations from portfolio company CEOs and we will share our perspective on the key trends driving the global growth economy. Please register to attend HERE. It will also be live streamed, which you can access from our website as well.