Market Snapshot

| Indices | Week | YTD |

|---|

This week, GSV Capital (GSVC) hosted its fourth annual Investor Day at GSVlabs, a global innovation platform located in the heart of Silicon Valley. It was a fitting backdrop for the leaders of GSV’s game-changing portfolio companies to share a window to the future of their businesses and the industries they are transforming. We welcomed over 700 attendees and 9 presenting company CEOs and executives. (Disclosure: GSV owns shares in GSVlabs)

While the media has taken to reporting on wounded Unicorns, and increasingly seems to view the optimism in Silicon Valley as a distorted reality field, what’s exciting to us is that innovation is accelerating. The vast majority of GSVC’s portfolio continue to exhibit extraordinary growth characteristics, with expected year-over-year revenue growth exceeding 100%. Some may quibble about appropriate values, but we’re very pleased with the value creation opportunity.

As a liquid, publicly traded stock, GSVC is a unique vehicle that enables public investors to access this asset class, which has increasingly been limited to select venture capital firms and institutional investors. We believe that growth drives enterprise value, and accordingly, our mission is to build a portfolio of the most dynamic, rapidly growing, late-stage private companies — the “Stars of Tomorrow”. (Click HERE to see my opening remarks on the state of play at GSVC, our strategy, and portfolio)

We believe that dramatic growth and value creation will increasingly occur in the private marketplace. But it’s not simply because “exponential businesses” are achieving scale more quickly than in years past. Investors used to have access to emerging, rapidly growing companies with big potential earlier in the life-cycle. Intel, for example, had a $53 million market capitalization at its IPO. Walmart had a $25 million market cap. Starbucks and Oracle had market caps of $220 million and $288 million, respectively.

Times have changed, and it’s a function of supply and demand.

SUPPLY & DEMAND

Over the last 20 years, the number of U.S. publicly traded companies has declined approximately 50%, from 7,300 in 1997 to 3,700 today.

One key factor is a dramatic decline in the supply of IPOs. From 1990 to 2000, there was an average of 406 IPOs in the United States per year. It dropped to 108 from 2001 to 2016. Central to the IPO decline is the fact that VC-backed private companies are staying private much longer. The time from initial Venture Capital investment to IPO has grown from a median of three years in 2000 to approximately ten years today.

But given the rapid value creation taking place, VCs have continued to invest despite a weak IPO market for much of the past fifteen years. Since 2001, VCs have invested in an average of 3,500 companies per year, including 4,799 companies in 2016, according to PwC’s Q1 2017 MoneyTree report.

We estimate that there are over 2,000 VC-backed private companies with a market value of $100 million or greater. This new combination of fundamentals puts some context around the recent rise of “Unicorns,” a herd that has grown from one in 2000 to 200 today.

Expanding corporate M&A activity is a parallel force that is compressing public markets. JPMorgan reports that global deal volume surpassed $3.9 trillion in 2016, tied for the third highest year on record. The top mark, which stands at $4.7 trillion, was set just a year earlier.

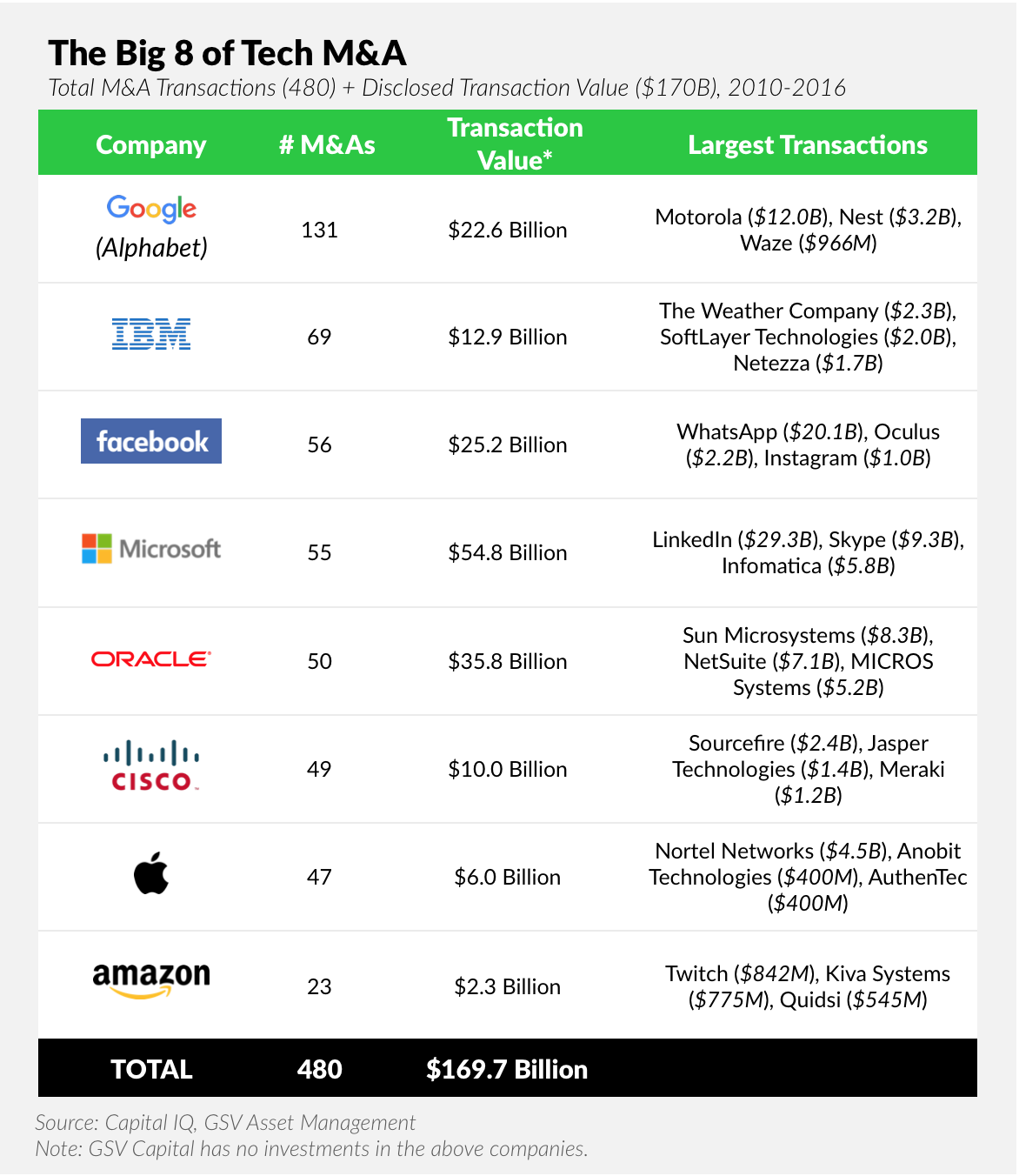

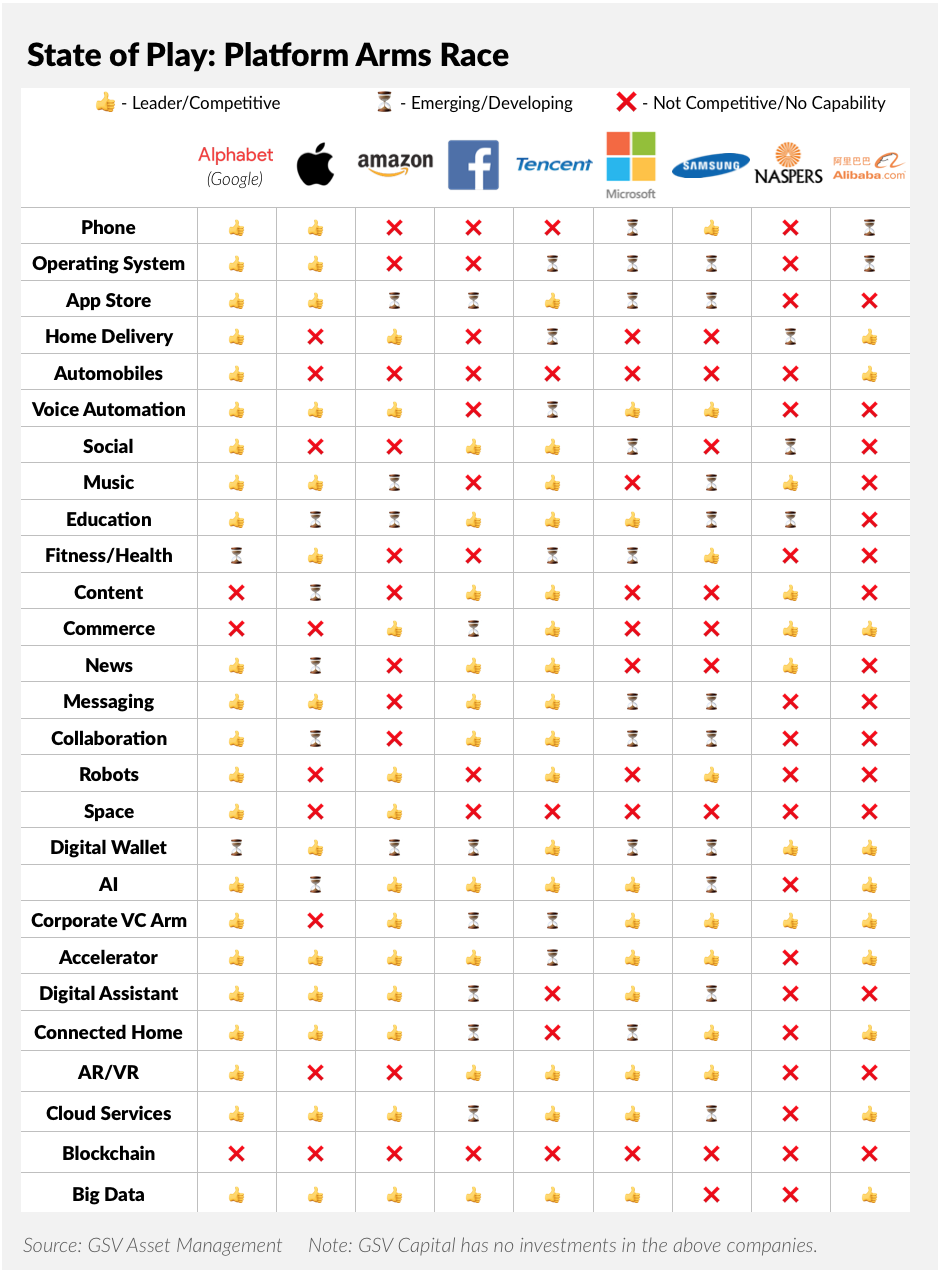

Today, U.S. corporate cash reserves have reached approximately $2.2 trillion and M&A focus is increasingly turning towards emerging technologies and disruptive business models. Leading technology companies, in particular, have continued to “roll up” the industry. Technology is all about disproportionate gains to the leader in a category, with “platforms” evolving rapidly, filling in category and product maps. From 2010 to 2016, the “Big 8” — Alphabet (Google), IBM, Facebook, Microsoft, Oracle, Cisco, Apple, and Amazon — completed approximately 480 acquisitions worth nearly $170 billion.

Ultimately, like a society that is dying faster than new babies are born, we believe that public markets will continue to shrink and won’t reverse until it becomes more attractive to be a public company. As a consequence, interest in private company investments — particularly in emerging leaders backed by top VCs — will continue to intensify.

GSV CAPITAL TAILWINDS

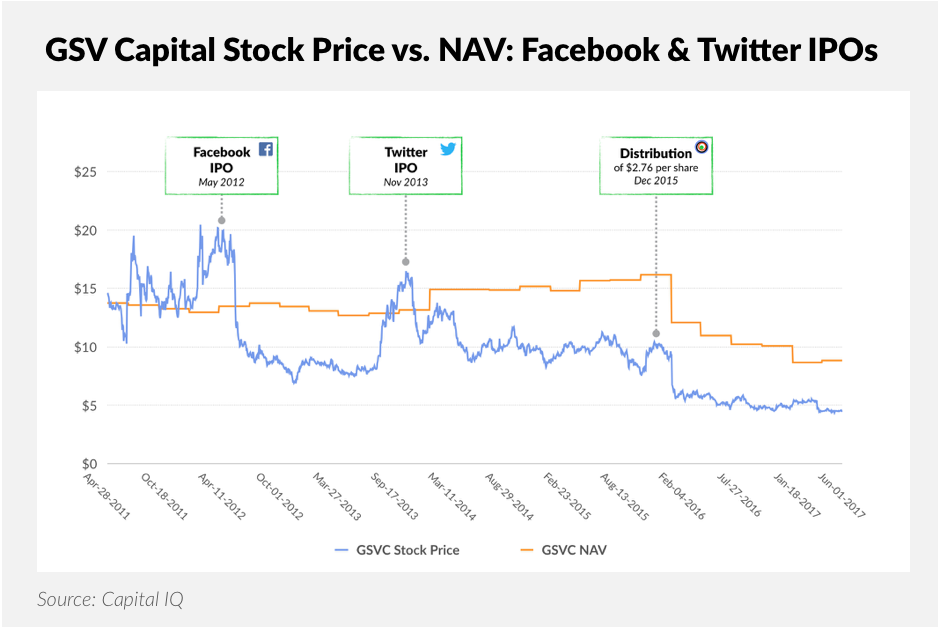

Historically, leading portfolio positions with a runway to IPO have been a positive catalyst for our stock. In fact, GSV Capital traded at a premium to NAV in advance of high profile IPOs from Facebook and Twitter.

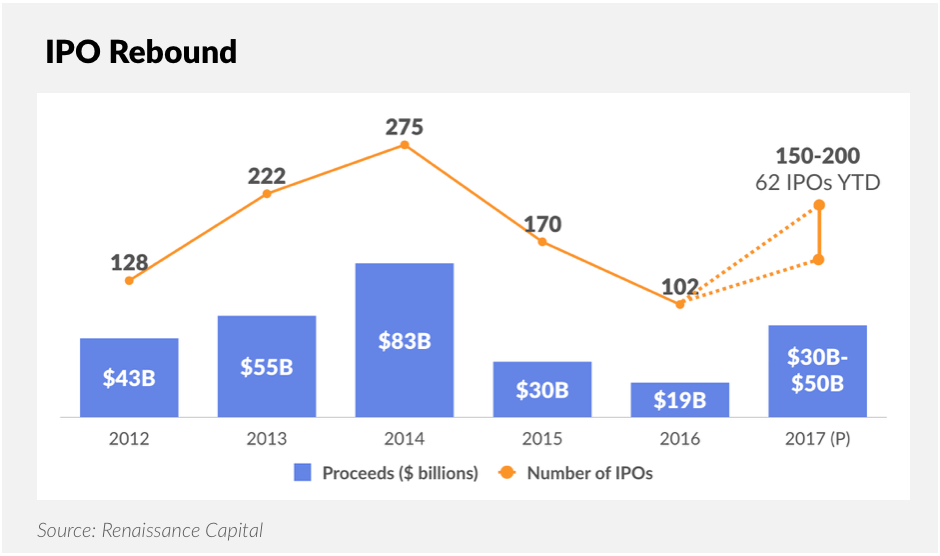

We are encouraged by a 2017 IPO market that continues to signal investor demand for premier VC-backed growth companies. According to Renaissance Capital, just 102 U.S. companies went public in 2016 and only 40 were venture-backed. In fact, IPO proceeds from venture-backed companies dropped 90% from 2014 to 2016.

Through June 2, 2017, Renaissance Capital reports that there were 62 U.S. IPOs, representing an 82% increase over the same period last year. IPO proceeds through June 2, 2017, have surpassed $17.2 billion, which compares to $18.8 billion for the entire year in 2016.

There were 20 VC-backed IPOs in the first quarter of 2017, which generated more than $4.6 billion of proceeds. VC-backed IPOs generated just $3.5 billion for the entire year in 2016.

Beyond the broader market activity, we were pleased to see a variety of publications issue 2017 IPO predictions between November 2016 and February 2017 that included top names in GSV Capital’s portfolio.

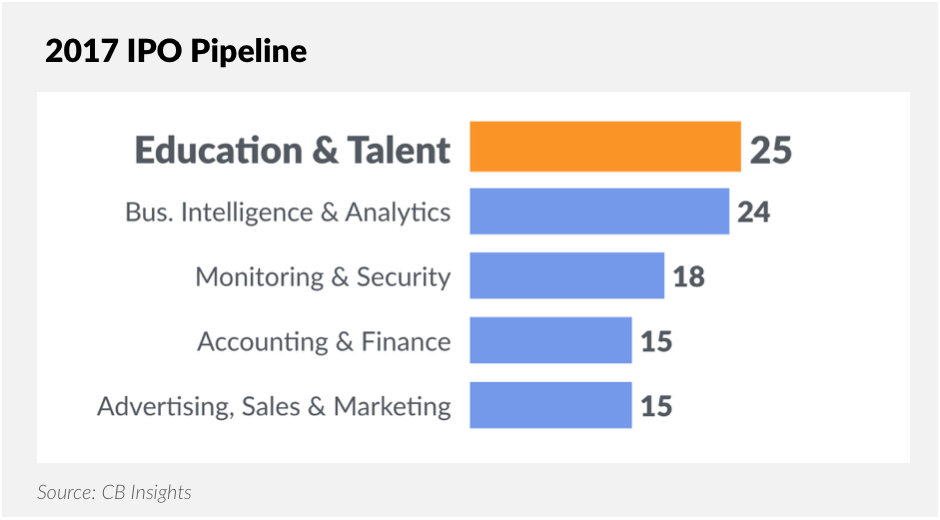

Interestingly, in its “2017 Tech IPO Pipeline,” published in December 2016, CB Insights identified “Education & Training” and “HR & Workforce Management” as the top combined category for 2017 IPO candidates. We believe this aligns closely with GSV Capital’s top investment theme, Education Technology, which represented 36.6% of Portfolio Fair Value as of March 31, 2017.

EXPONENTIAL IDEAS: 2017 INVESTOR DAY SPEAKERS + PANELS

For those who were unable to join us this year, we have curated a video library of 2017 Investor Day speakers, which are discussed below. We hope you enjoy their insights as much as we did.

Coursera

Coursera is the leading global education platform, serving over 26 million users with more than 2,000 courses from premier university partners, including Stanford, Yale, Princeton, the University of Pennsylvania, Peking University, the Moscow Institute of Physics & Technology, and Hebrew University. This Wednesday, Coursera announced their $64 million Series D led by GSV with participation from New Enterprise Associates (NEA), Kleiner Perkins Caufield Byers (KPCB), The Lampert Foundation and Learn Capital. (Disclosure: GSV owns shares in Coursera)

Coursera is capitalizing on the convergence of increasing global education demand with new technology fundamentals that enable people to learn anytime, anywhere. The twin forces of globalization and automation are making career obsolescence a new reality. You can no longer fill up your knowledge tank until age 25 and drive off through life. Effective workers will be refilling their “knowledge tank” continuously. In this new paradigm, education technology platforms like Coursera will be like air — invisible, ubiquitous, and life-sustaining. Living will be learning.

WATCH REMARKS FROM COURSERA CEO RICK LEVIN HERE

CEO Rick Levin, the former President of Yale University, discussed the company’s massive ascent from 2012, dubbed the “Year of the MOOC” to today, five years later, to reach 26 million students, across 2,000 courses and 180 specializations across the World.

Enjoy

Enjoy is a personal commerce platform built to revolutionize the way people buy and enjoy the world’s best technology products. The central feature of the company is hand-delivery of every item, including product set-up, by an Enjoy product expert, at a time and place of the customer’s choosing. CEO Ron Johnson talked about how Enjoy has scaled and built a novel on-demand service that brings customers an experience that they love. (Disclosure: GSV owns shares in Enjoy)

WATCH REMARKS FROM ENJOY CEO RON JOHNSON HERE

Chegg

Chegg is a hub for students to learn more, spend less, and find meaningful college and career opportunities. Just as Facebook uses data to optimize communication and collaboration through a “Social Graph,” Chegg’s “Student Graph” uses data to network students with learning resources and potential employers. (Disclosure: GSV owns shares in Chegg)

WATCH REMARKS FROM CHEGG CEO DAN ROSENSWEIG HERE

CEO Dan Rosensweig discussed how Chegg is transforming the way millions of students learn by connecting them to the people and tools needed to succeed from high school to college and the workforce.

Lytro

Lytro’s pioneering Light Field Imaging platform is redefining the way images are captured and created across a broad range of applications — from traditional filmmaking to Augmented and Virtual Reality. Combining a pioneering technology with an attractive Software-as-a-Service (SaaS) business model, we see Lytro as software “eating” cameras and imaging. (Disclosure: GSV owns shares in Lytro)

VP of Engineering Tim Milliron discussed how the company’s technology platform will have a transformative impact across a broad range of applications — from virtual reality to photography and filmmaking.

WATCH REMARKS FROM LYTRO VP OF ENGINEERING TIM MILLIRON HERE

Aspiration

Aspiration is creating a digital investment firm focused on providing transparency and trust with the goal of becoming one of the leading brands for millennials and other investors looking for a fresh alternative to traditional wealth managers. Aspiration provides even entry-level investors access to research and analysis on top of a unique fee structure based on what the investor believes to be fair. Aspiration aims to become the premier brand for investors seeking a more open, transparent, fair and customer-centric investment platform. (Disclosure: GSV owns shares in Aspiration)

WATCH REMARKS FROM ASPIRATION CEO ANDREI CHERNY HERE

CEO Andrei Cherny talked about his desire to build Aspiration into the leading and largest digital investment management company in the world, serving a generation of socially conscious millennials and other investors.

Silicon Valley Data Science

Silicon Valley Data Science (SVDS) is a big data and data science consulting company that specializes in agile and business-focused solutions. The team’s experience in building products, engineering systems and strategic consulting has led the company to develop a distinctive methodology that blends the best of agile product development and iterative consulting techniques. SVDS works with clients to iterate towards big data applications that create meaningful business impact. (Disclosure: GSV owns shares in SVDS)

WATCH REMARKS FROM SVDS CTO JOHN AKRED HERE

CTO John Akred discussed Silicon Valley Data Science’s business that helps companies unlock the potential of their data by bringing in SVDS’s teams who are talented, know how to meet business needs with technology, and balance data science and engineering.

Spotify, Dropbox, Lyft, Snap

GSV Asset Management Co-founder and Partner Luben Pampoulov gave an update on some of GSV Capital’s larger investments including Spotify, Dropbox, Lyft and Snap, and discussed the fundamentals, competition and near-term drivers of each company. (Disclosure: GSV owns shares in Spotify, Dropbox, Lyft and Snap)

WATCH REMARKS FROM GSV PARTNER LUBEN PAMPOULOV HERE

GSVlabs: Rethinking Corporate Innovation

As the access point to a startup ecosystem, major corporations like AT&T, Intel, IBM, Intuit, Cisco, the Times of India, and JetBlue choose to partner with GSVlabs in order to launch new initiatives, identify talent, attack new markets, and propel new business models. GSVlabs creates value through this virtuous circle, attracting and accelerating promising entrepreneurs, while providing targeted innovation services for forward-thinking corporations.

WATCH A PANEL ON CORPORATE INNOVATION HERE

Li Jiang, VP at GSV Asset Management, discussed the power of an innovation platform with Bonny Simi (President, JetBlue Technology Ventures), Neville Taraporewalla (President, Brand Capital – $2B VC arm of the Times of India), and Kate O’Keeffe (Managing Director, Cisco HyperInnovation Living Labs).