Market Snapshot

| Indices | Week | YTD |

|---|

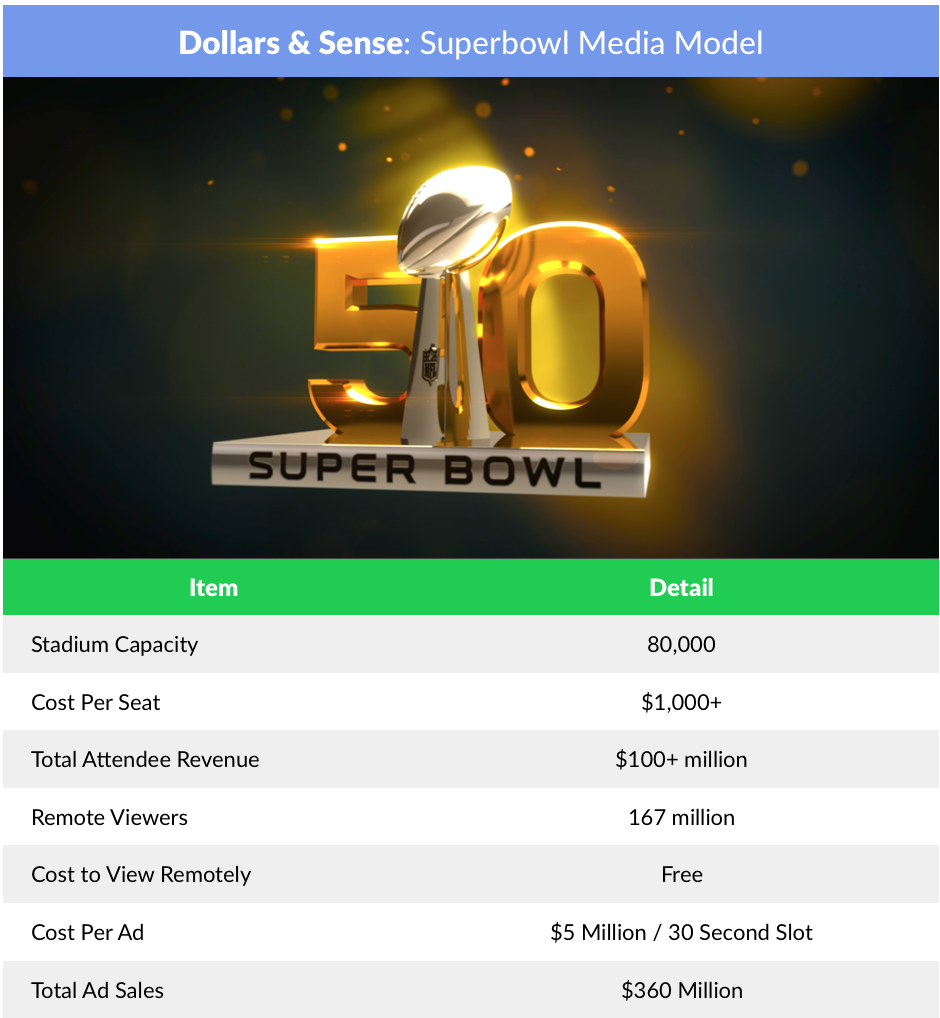

Super Bowl 50, which was played in Santa Clara, California on February 7, 2016, generated over $100 million in ticket sales and concessions. While impressive, that was nothing compared to the $350 million in advertising the Big Game generated for CBS at $5 million for a 30-second commercial.

Every year, only 80,000 or so fans are able to pay $1,000+ for a Super Bowl ticket and multiples of that for travel and lodging — not to mention having to be there at a certain date and time. But a billion people are able to watch the game for free in the comfort of their homes or neighborhood parties. With TiVo, the less social can record the whole event and watch it at their convenience.

But the fact is, TV not only creates broad access, but a better product for the people who attend the event. Mass distribution creates a virtuous circle by unlocking economics that attract better players, coaches and officials, with more riding on the game.

Applying the fundamentals of media models like the Super Bowl offers important insights into delivering quality education at scale. The Ivy League, like the Super Bowl, is expensive, exclusive, and most people cannot go. Less than one percent of college students attend Ivy League or other elite schools.

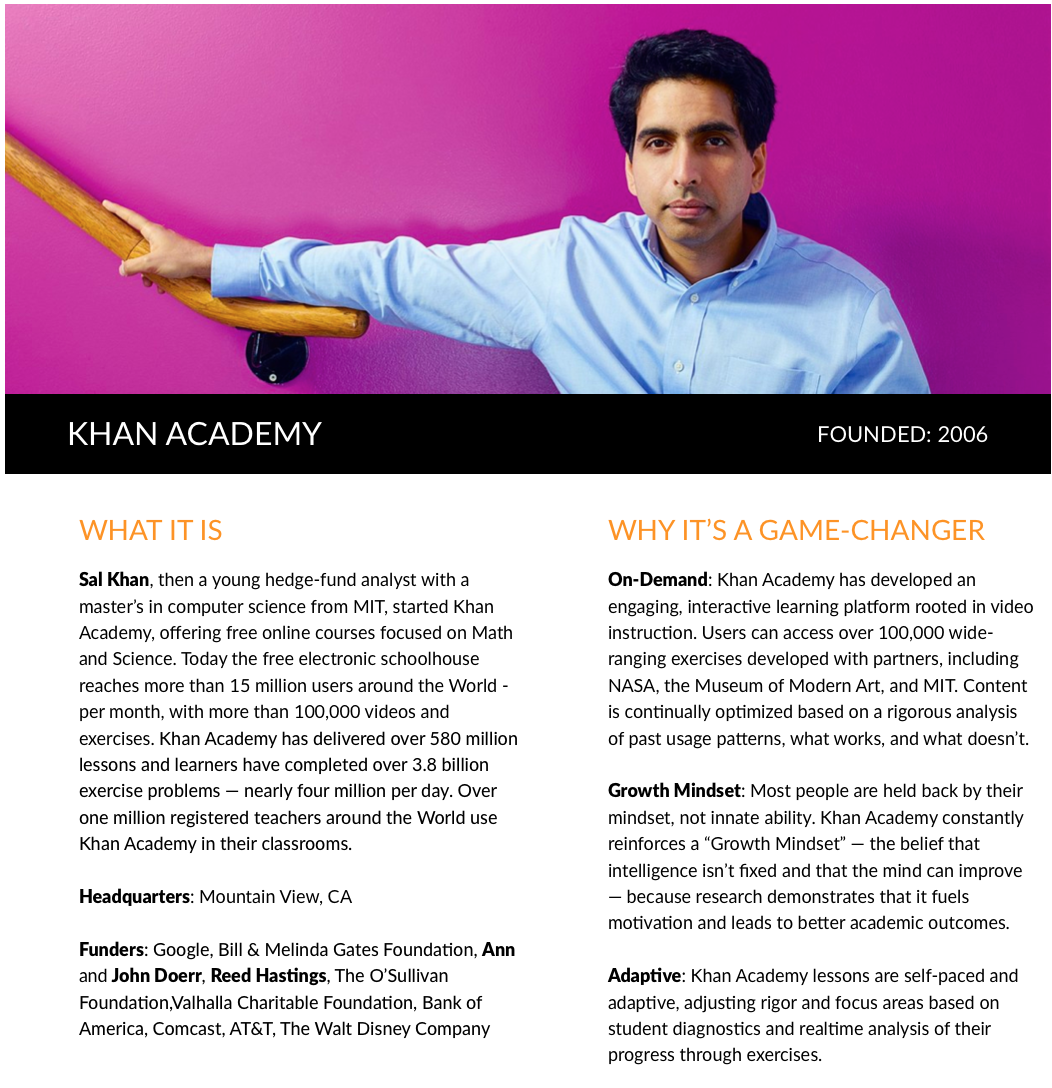

But the emergence of digital education platforms, catalyzed by pioneers like Khan Academy in 2006, has demonstrated that it is possible to make high quality, effective online learning available anytime, anywhere, and free. We can democratize access to the best programs and professors.

Broken Model

Higher education has evolved very little since the 11th century when the University of Bologna, the world’s oldest university, was founded in 1088. While there are many causes for this inertia, teaching has been fundamentally constrained by technology. Until recently, a student needed to be in a lecture hall to have access to university instruction.

Source: The Atlantic, GSV Asset Management

This basic limitation has resulted in three fundamental supply-side challenges that have increased cost, limited access to quality, and created inefficiencies for consumers:

- High Cost: The constraint of physical proximity creates high fixed and marginal costs that are passed on to consumers. Colleges and Universities employ armies of professors and administrators while maintaining lecture halls and laboratories. Adding new students requires more buildings and instructors. The net result is that U.S. student debt, which recently surged past $1.3 trillion, has grown at a 14 percent CAGR since 2005 and now exceeds credit card debt.

- Quality Constraint: Obtaining a quality college education is dependent on access to a school that employs top teaching talent and offers compelling courses. People that lack that the financial resources or the physical proximity to attend a high-quality school have limited recourse.

- Inefficient: The old university model is set up for 18- to 22-year-olds who can afford to drop out of life for two years or more to secure a credential. Additionally, the bundles of services offered by schools – from dormitories to football teams and marching bands – are basically irrelevant to a huge portion of the audience that desperately needs education to find a sustainable career.

This model is no longer viable in a global knowledge economy that demands a broad, highly educated workforce. Of the projected 55 million new job openings that will be created in the United States over the next decade, 65 percent will require a postsecondary credential. Yet only 34 percent of Americans have a degree, a number that dips substantially for students of color — 16 percent of African Americans and 14 percent of Latinos.

Globally, the higher education shortfall is equally pronounced. According to a 2015 study by the global employment agency, Manpower Group, skills shortages prevented 38 percent of employers from filling critical vacancies across the world —the highest reported rate since 2007.

The rise of digital technologies that are rapidly redefining industries and automating jobs is making the challenge more acute. Researchers at Oxford University estimate that over 47 percent of job functions are at risk of being replaced by technology within the next 20 years. Nine out of ten workers today are in occupations that existed 100 years ago.

Increasingly, people will no longer be able to fill up their “knowledge tanks” until age 25 and cruise through life. Effective workers will need to refill their knowledge tanks continuously to maintain the skills required to participate the global knowledge economy. But it will not be feasible to drop out of life and take on massive amounts of debt to stay educated.

Rise of the MOOCs

The idea of Massive Open Online Courses (MOOCs) was hatched on YouTube in 2011 by Stanford Professor, Sebastian Thrun, who essentially dared would-be students to take his Artificial Intelligence class online for free. The quid pro quo was that participants would be graded as if they were actually Stanford students in his class

Provocateur Thrun was bona fide — not only being a star faculty member on essentially the Yankees of higher education but also being a leader of the Google (Alphabet) team that was developing driverless cars and Google Glass. Surprising to everybody, perhaps, but Thrun, 160,000 students rapidly signed up for the “Stanford Challenge” and a movement was born.

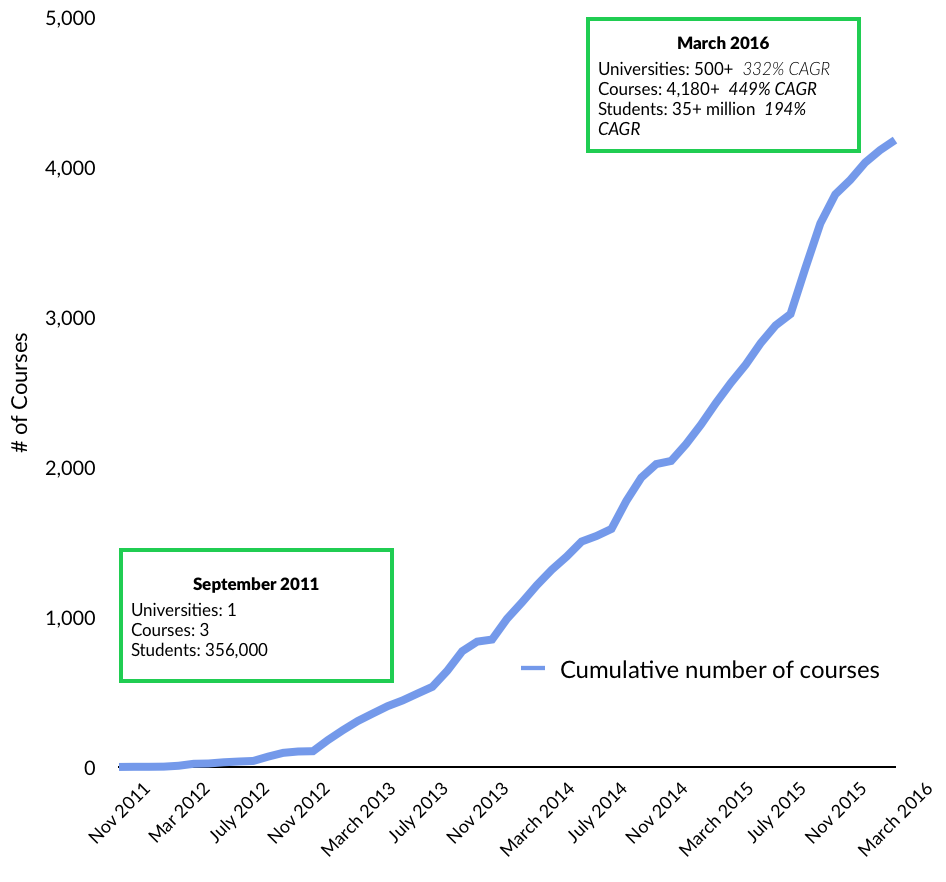

Not wishing to miss out on a second California Gold Rush, alliances quickly formed amongst nascent MOOC providers — the “Big Three” being Thrun’s Udacity, Daphne Koller and Andrew Ng’s Coursera, and Harvard and MIT’s not-for-profit EdX — and academic institutions from around the World. Millions of people were signing up for MOOC classes for free and by the Spring of 2013, it had become conventional wisdom that MOOC’s were going to disrupt higher education in a major way. Then something predictable happened — the Empire fought back. (Disclosure: GSV owns shares in Coursera)

At first, it was subtle slaps with prominent professors voicing their disappointment that their online experience just wasn’t what they thought it could be. Next, the chorus started to highlight the low completion rates — often less than 10% — of the MOOC courses (failing to acknowledge the remarkably low completion rates and graduation rates for physical classes at most universities despite students paying tens of thousands of dollars).

Then, under the guise of protecting students, faculty and institutions, the economic model of providing courses for “free” was routinely roasted as absurd and certainly not sustainable. Alas, conventional wisdom now regarded MOOCs as a Roman Candle, and the Empire largely viewed them as a temporary threat averted.

While much of the hype faded, MOOCs have continued to expand rapidly as supply induces demand. Today, over 35 million students are taking nearly 4,200 courses on MOOC platforms, up from effectively zero at the end of 2011.

As supply and demand for MOOCs has grown, business models have evolved. The largest platforms have zeroed in on low-cost credentialing, charging students as little as $50 to verify their mastery of skills taught by an individual course or sequence of courses. Coursera (Specializations), EdX (XSeries + ASU Global Freshmen Academy), and Udacity (Nanodegrees) have all launched and refined variations of the model.

MOOC Model Matures

Coursera has emerged from the MOOC phenomenon as a game-changing education platform. Co-founded by Stanford computer science professors Daphne Koller (President) and Andrew Ng (Chairman — Ng also serves as the Chief Scientist for Baidu, China’s leading search engine), Coursera has gone from idea in 2012 to serving over 18 million students with 1,800 courses from 140 university partners — including Stanford, Yale, Princeton, the University of Pennsylvania, Peking University, the Moscow Institute of Physics & Technology, and Hebrew University.

In March 2014, Coursera added Rick Levin, former President of Yale University, as CEO. Rick was instrumental in launching Yale’s visionary foray into online education, first in partnership with Stanford and Oxford, and later with Open Yale Courses. In addition to his academic career, he also serves on President Obama’s Council of Advisors for Science and Technology, and is a trustee of the Hewlett Foundation, and a director of American Express.

Coursera added six million new users in 2015 alone and continues to be propelled by powerful network effects. A bigger audience means that Coursera can more easily curate premier education content from universities and employers, which in turn attracts more students from broader markets. Over 75% of Coursera users are now outside the United States.

Despite their scale, growth, and emerging business models, a chorus of MOOC naysayers continue to question how an education business can be profitable if its basic offering is “free”. Obviously, this analysis is unencumbered by observations of models such as Google, Facebook, Spotify, and Dropbox, which are all “free”. We see numerous ways MOOCs will be able to monetize their large, engaged, and growing networks. You just have to think differently. (Disclosure: GSV owns shares in Alphabet, Facebook, Spotify, Dropbox)

Coursera’s growth has been driven by a rapidly expanding value proposition, from increased course inventory to design enhancements emphasizing an improved mobile experience for iOS, Android, and Amazon devices. Coursera even announced a partnership with JetBlue whereby passengers can access courses on the airline’s in-flight entertainment system. (Disclosure: GSV owns shares in Amazon)

Source: TheNextWeb

A key milestone for Coursera has been the launch of highly popular learning sequences called “Specializations” — groupings of related courses that enable students to gain deep expertise in a given field of study.

Today, Coursera offers 120 Specializations, ranging from Business Foundations (developed with the of the University of Pennsylvania Wharton School) to Data Science (developed with Johns Hopkins University). Between April 2014 and February 2015, Johns Hopkins awarded over 71,000 verified certificates for Coursera Data Science courses, despite an on-campus enrollment of just 21,000. In fact, the certificate is so popular that the joint Coursera-Johns Hopkins offering is the second result on a generic Google search for “Data Science”. (Disclosure: GSV owns shares in Alphabet)

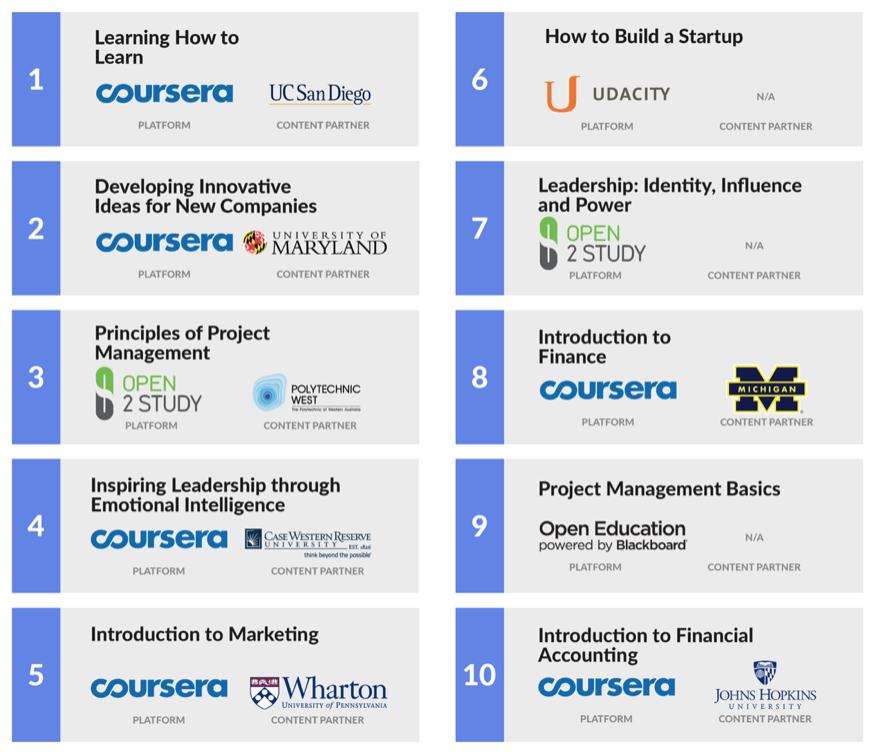

Coursera’s revenue flywheel began to spin with the launch of fee-based certification for course completion for as little as $50. The introduction of Specializations, have added further momentum, commanding higher price points as students certify the completion of multiple courses focused on high-demand skills. Top MOOC Courses

Beyond credential monetization, Coursera has launched an enterprise strategy targeting an estimated $325 billion in annual corporate training spending. Early customers include Yahoo, MasterCard, and GE, who use the platform to provide low-cost, high-quality professional development and new hire on-boarding.

As Levin remarked in a 2015 interview with the Wall Street Journal, “This is a natural evolution. We’ve found over the last year that there is tremendous demand for job relevant skills.”

To further this strategy, in 2015, Coursera announced the creation of the Global Skills Initiative (GSI), a program to build deeper relationships between industry and education. BNY Mellon, Cisco, Microsoft, Qualcomm, Splunk, and UBS, have all provided funding and content expertise to produce online courses in fields like data science, computer programming, and finance, aligning to consistent areas of corporate skills demand.

In a similar spirit, Coursera has been adopted by governments (e.g. Trinidad and Tobago), foundations (e.g. Carlos Slim Foundation in Mexico), and other organizations (e.g. U.S. Department of Commerce, 500 Startups) to make courses and certificates available to their constituents.

Looking Ahead

The twin consumer and corporate strategies have created a blueprint for Coursera to build a scaled, global education platform with a variety of complimentary revenue streams. Importantly, as Coursera continues to expand, the credentials it offers are gaining broader acceptance in the job market, a trend we call “Knowledge-as-a-Currency” (KNAAC).

The old ticket to ride was a degree. The new ticket to ride is going to be a Personal Knowledge Portfolio that incorporates content, courses, and experiences, which were curated over time. Platforms like Coursera are making this concept a reality.

Beyond Coursera, Arizona State University, under the leadership of its visionary President, Michael Crow, is building on the MOOC model to broadly expand access to higher education.

Launched in 2015, the institution’s groundbreaking Global Freshman Academy is like a money-back guarantee in reverse. It enables any student to complete entry-level courses using the EdX platform at no cost, making them “official” for $200 per credit — only when they pass.

The initiative was borne out of EdPlus, ASU’s innovation engine, which is positioning the institution as a global change agent. It is committed to developing unconventional, technology-enabled education models that reduce cost while improving quality and access.

We look forward to convening key leaders from across the global innovation economy at the 7th Annual ASU GSV Summit (April 18-20) in San Diego with the goal of accelerating the transformation of the sector and improving educational outcomes through exponential ideas.

We expect over 3,000 attendees, including a wide range of entrepreneurs, investors, foundation leaders, educators, policymakers, and CEOs of leading global companies. Keynote speakers include Bill Gates, Former U.S. Secretary of State Condoleezza Rice, General Stanley McChrystal, Khan Academy Founder Sal Khan, business strategy visionary Jim Collins, and many more.

Additionally, please click HERE to download 2020 Vision: A History of the Future, GSV’s aspirational vision for how to address society’s greatest challenge — ensuring that everyone has an equal opportunity to participate in the future. With over 100 company case studies, leader profiles, and market data, 2020 Vision offers comprehensive analysis and insights into the state of human capital and education innovation.

—

Janet Yellin and Co. left rates where they were, which was good enough to lift stocks for the fifth week in a row. The thirty-member Dow Club led the way, rising 2.2% for the week, followed by the S&P 500’s 1.3% gain. NASDAQ was next with a 1% advance, and the GSV 300 was up 0.6%. More than not doing anything — which was expected — the Fed also said they were likely to only have two raises in 2016. The 10-Year Note yield fell 11 basis points and the dollar fell against rival currencies.

Determining the micro impact of macro news continues to be challenging, with Trump plowing his way to the Republican nomination; Oil doing a Lazarus, moving over $40; Brazil’s former rock star President Lula joining the government to avoid prosecution; and Russia doing an exit stage left out of Syria. Truly news of the weird.

On the corporate front, Adobe continues to exhibit momentum, with its third quarter in a row of accelerated growth. Revenue in the first quarter grew 25% and EPS grew at 50%. Tesla also had a great week, rising 11% with excitement over the Model X and Model 3. (Disclosure: GSV owns shares in Tesla)

Stocks have been on fire over the past six weeks, which was a somewhat predictable reaction to the extreme pessimism at the beginning of the year. Moving ahead, earnings and revenue growth will drive leaders higher and we continue to be BULLISH on Alphabet (Google), Facebook, Amazon, Tesla and TWITTER, to name a few. (Disclosure: GSV owns shares in Alphabet, Facebook, Amazon, Tesla, and Twitter)