Market Snapshot

| Indices | Week | YTD |

|---|

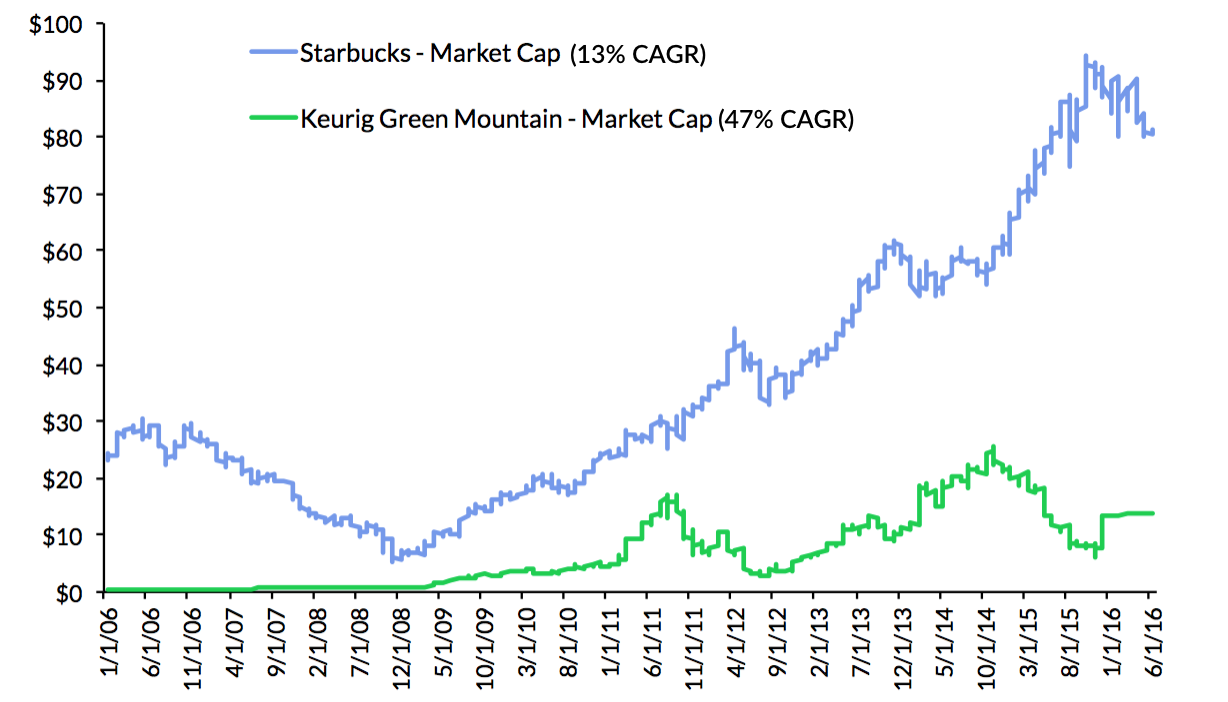

I was fortunate to be one of the first research analysts to identify Starbucks as a huge opportunity following its IPO in 1992, when its market cap was $200 million. Today its market cap is over $80 billion.

Lucky? Maybe a little. Art or science? Both. Let me tell you a story.

It was a Thursday afternoon after a long week on the road visiting companies. I was in Seattle with one meeting to go before I flew home. My friends told me about this coffee company — named after a Moby Dick character — that had a cult following. I almost cancelled my meeting on the way to the airport because I just wanted to get home and the company sounded ridiculous.

Maybe people in Seattle would embrace a coffee house as a great business, but I couldn’t imagine this concept traveling beyond the Puget Sound. But, Starbucks headquarters was just off Interstate 5 on the way to the airport and I figured, “Why not, I’ll make it quick.”

The minute I walked into the reception area, I knew something was going on there. The level of energy in the air was electric. When I sat down with CEO, Howard Shultz, he crystallized how Starbucks was going to become the most important coffee company in the World.

He talked about the importance of his employees and how he was creating a partnership with them. He was passionate about the quality of the product and the customer experience. He had a roadmap to become a universally respected consumer brand.

Starbucks CEO Howard Schultz

I was convinced. I left believing I had just met the next Ray Kroc — the man who turned McDonald’s into a billion-dollar hamburger business.

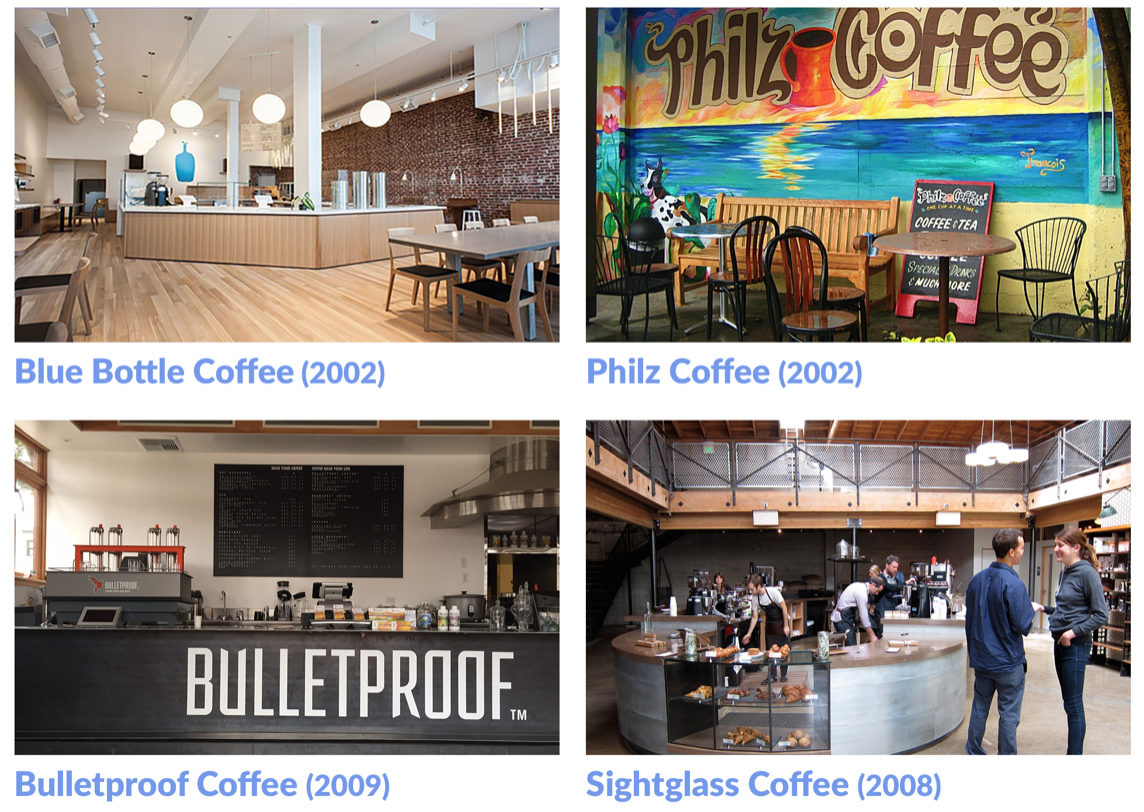

Today, a new wave of innovation is beginning to crest led by culinary and cultural upstarts seeking a piece of the $100 billion global coffee market. Businesses like Blue Bottle and Philz have raised $116 million and $30 million respectively by creating a highly curated consumer experience focused on carefully sourced and brewed coffee — combined with a rigorous emphasis on the aesthetic of their stores and take-home products.

The rise of Greek yogurt is instructive when considering the market opportunity for coffee newcomers.

Greek yogurt was an obscure 1% of U.S. yogurt sales in 2007. Then Chobani entered the scene, luring consumers away from sugary stalwarts like Dannon and Yoplait. Now Greek yogurt accounts for 40% of the $7.4 billion U.S. yogurt market, while the heavyweights are racing to catch up.

STATE OF PLAY

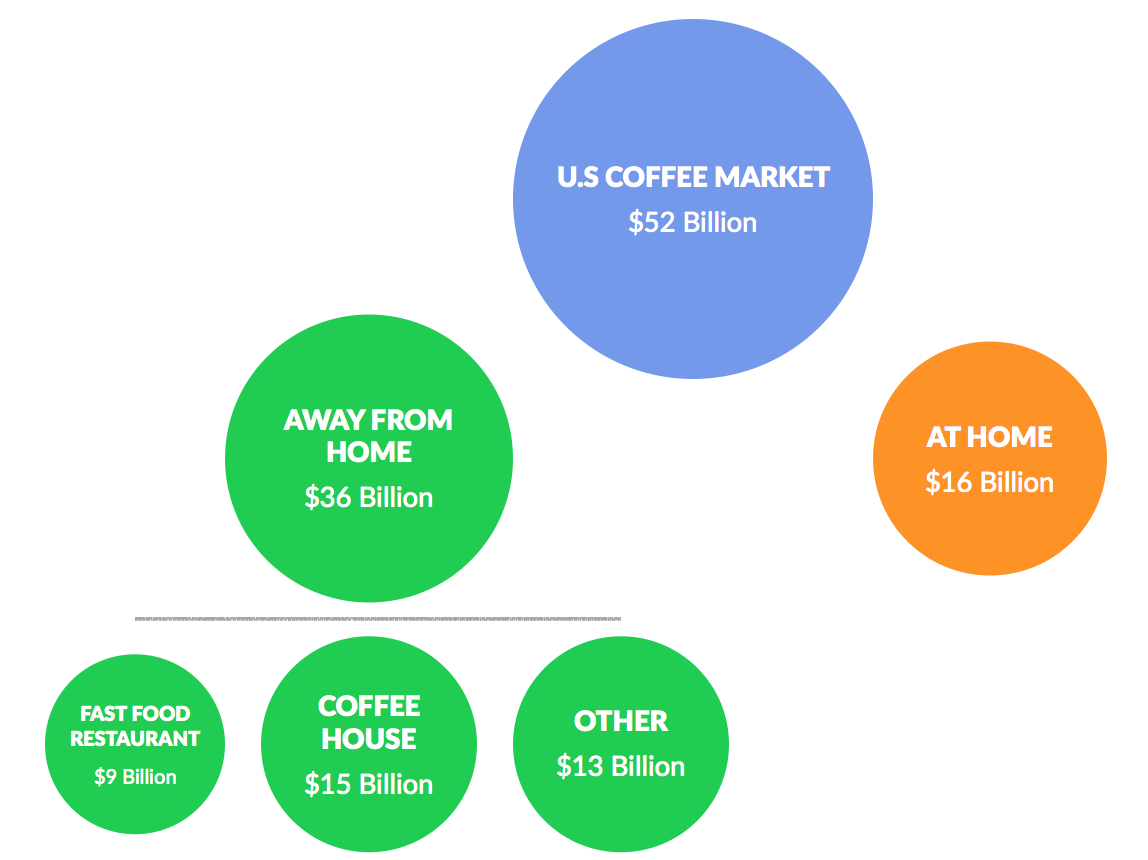

More American adults drink coffee on a given day than any other beverage — including soda, juice, tea, tap water, and bottled water.

$52 Billion U.S. Coffee Market

Source: Specialty Coffee Association of America, GSV Asset Management

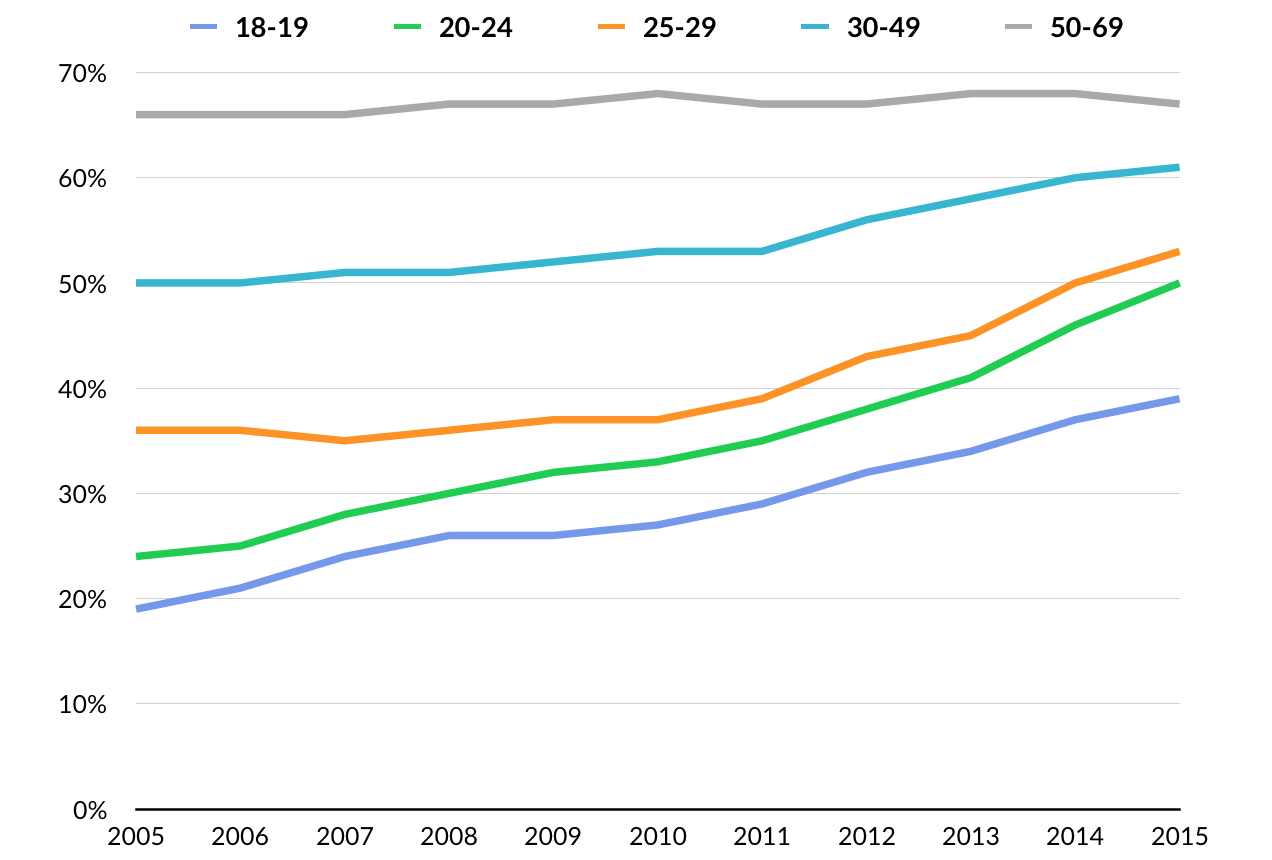

According to the National Coffee Association, Americans drank two cups of coffee per day in 2015, the continuation of a steady rebound in coffee consumption from historical lows in the 1990s. Two key drivers are behind this trend. First, young people are drinking more coffee than ever before.

*Trailing Five-Year Average

A second key driver for increasing coffee consumption is a growing appetite for “specialty coffee”. According to the Specialty Coffee Association of America, one of every two cups of coffee consumed in the U.S. is considered specialty, and according to the National Coffee Association, specialty coffee consumption rose threefold between 2000 and 2015. Over 34% of adult coffee drinkers report drinking specialty coffee daily, up from 24% in 2010.

The estimated $28 billion U.S. speciality coffee market represents a broad spectrum of coffee varieties sourced from a range of regions. The common threads are high quality beans, nuanced flavor profiles, and greater attention to sustainable, eco-friendly supply chains. Served primarily in coffee houses, the rise of the speciality market is at the core of what Pulitzer Prize winning food critic Jonathan Gold described in 2008 as the emerging “Third Wave” of American coffee.

Source: GSV Asset Management

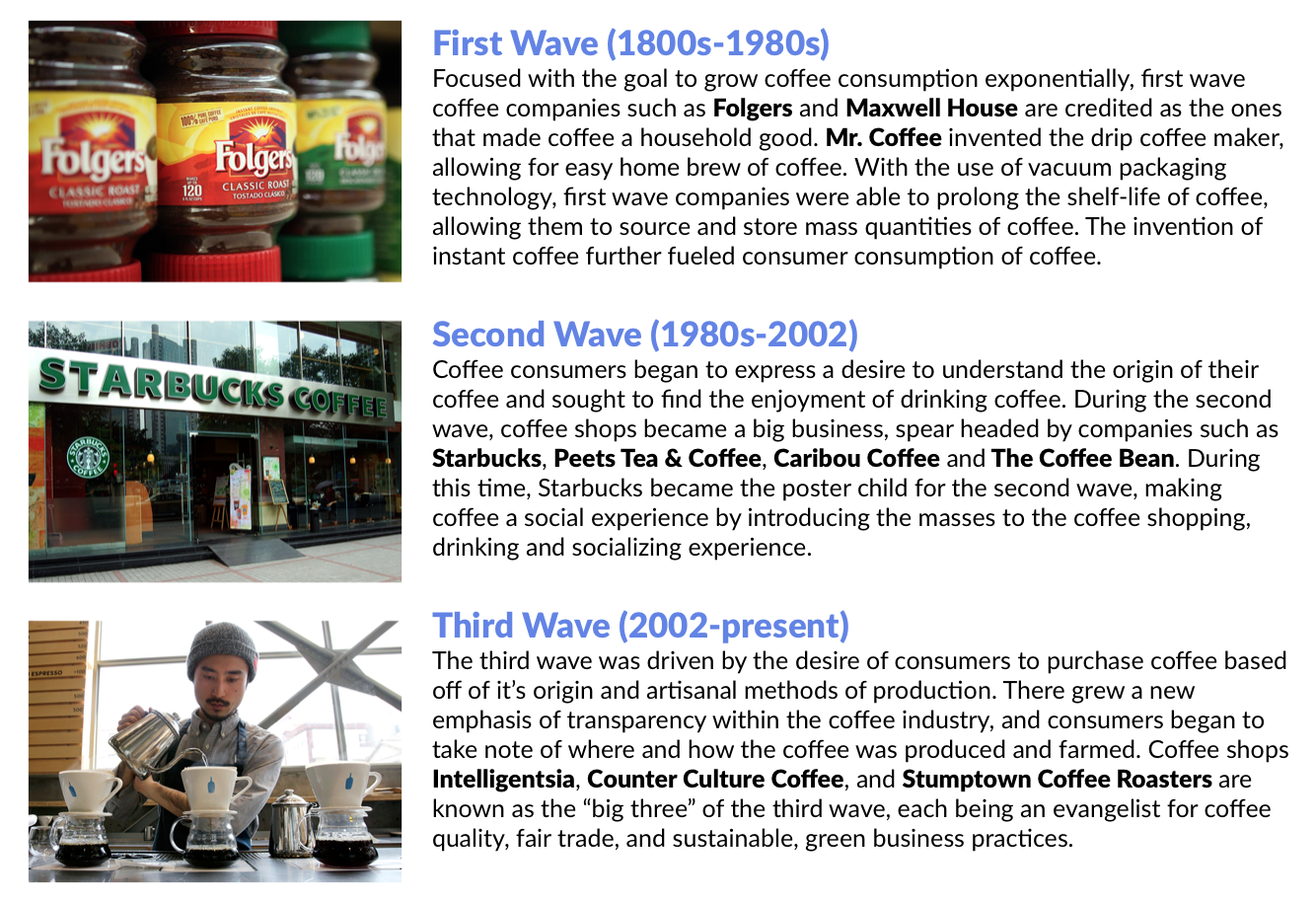

FIRST WAVE

In the “First Wave”, coffee consumption accelerated as brands like Folgers and Maxwell House made coffee a household good with a variety of “instant” and easy-to-brew products. Capitalizing on improving vacuum packaging technology, First Wave companies were able to prolong the shelf-life of coffee, allowing them to source, store, and ship products in mass quantities.

The launch of the Mr. Coffee drip coffeemaker in 1972 accelerated this trend, enabling high-quality and user-friendly home brewing. Prior to this machine, coffee was primarily made in a percolator, which often gave it a bitter and burned flavor. Baseball legend Joe DiMaggio became a spokesman in 1973, and by 1974, Mr. Coffee had sold over one million units.

SECOND WAVE

Howard Schultz grew up as an immigrant’s son in the projects of Brooklyn, New

York, where his father was an oft-unemployed janitor. Schultz went to college only because he secured a football scholarship to Northern Michigan University. After college, he moved out to Seattle, where he was a household appliance salesperson.

Howard came up with the idea for what Starbucks would become on a trip to Europe,

where he witnessed the connective power of the local coffee bar. Today, Starbucks has taken the power of “local” and made it global, with over 23,000 stores in 63 countries and a market value of over $80 billion.

*Keurig Green Mountain was acquired in March 2016 for $13.9 billion by a group of investors led by JAB Holding Company

Starbucks is the poster child for coffee’s Second Wave because it created a scalable retail experience based on consistently serving high-quality coffee in a magnetic setting.

What Starbucks tapped into was the “affordable luxury” trend. Whether your were a CEO or a secretary, for $3 you could enjoy the best latte in the World. Starbucks also became the “Third Place” — You had your home, you had your office and Starbucks was the place where you could hang out to unwind, read the newspaper or mingle with people in the community.

Howard Schultz got that he was selling so much more than a gourmet cup of coffee — he was selling an experience and a brand that people wanted to belong to. Carrying around your white and green Starbucks cup with the Siren on it signaled to the World that you cared about quality, you cared about community, and you cared about being part of a hip culture.

Starbucks brought customers its own music label. In 2002, It offered Wi-Fi in cafés before most people knew what Wi-Fi was. No surprise, the average Starbucks customer began showing up 20x a month, which effectively created a recurring revenue model for a restaurant — unheard of.

Perhaps more importantly, Starbucks demonstrated how to build a powerful relationship with employees in the service economy. It was the first “fast food” restaurant to provide health care benefits to even part time workers. It offered stock options. Starbucks showed that it was not only the right thing to do but the smart thing to do, as employee turnover dropped by 70% and the program paid for itself… with incredibly happy and loyal workers.

Starbucks figured out that if they treated their employee “partners” great, they would in turn treat the customers great and everybody would be happier and better off. Starbucks aspired to a higher mission than selling coffee and truly had a goal to make the World a better place. But it could only get there by earning a great return on investment.

The recent college education program it launched in conjunction with Arizona State University is just the next smart initiative focused on creating a better relationship with its people… and the program is already proving that it will pay for itself.

Source: Company Disclosures, New York Times, Yahoo Finance, GSV Asset Management

Single Serve

Another key development appearing later in the Second Wave was the rise of single-serve brewing systems, which began appearing in kitchens and offices in the 1990s. In the United States, the trend took off when Green Mountain purchased Keurig, launching the market leading “K-Cup” coffee pod in 1998.

Over the past decade, the $8 billion single-serve industry has grown from 2% to almost 10% of the global coffee market. In 2015 U.S. consumers bought $3.1 billion worth of coffee pods — versus $132 million in 2008. In comparison, last year Americans bought $6 billion worth of traditional roasted coffee, and about $2.5 billion in instant coffee.

The success of single-serve owes in part to the rise of retail chains like Starbucks, which accustomed consumers to the idea of ordering a single cup of coffee, chosen from a wide variety of beans. Incidentally, Starbucks, which is in the midst of a five-year partnership with Green Mountain, has emerged as a major player in the field, claiming about 15% of the single-serve market with its branded K-Cups.

Keurig Green Mountain has faltered over the past two years as it has failed to innovate beyond its initially popular K-Cup machines. Consumers have met recent product releases with a collective shrug. Despite this, the company was purchased by Joh. A. Benckiser GmbH (JAB) in late 2015 for $13.9 billion.

At the same time, Nestlé’s Nespresso, which accounts for 6% of the company’s $100 billion in revenue, is surging. The leader in the global coffee pod market with 26% market share, Nespresso has developed a line of wildly popular single serve espresso machines, positioning itself as a premiere, high-end coffee brand. It has taken aim at the U.S. market with the launch of VertuoLine, which brews traditional coffee and competes directly with Keurig Green Mountain.

Source: Nespresso

THIRD WAVE

The next generation artisanal coffee shops such as Blue Bottle Coffee and Philz have been enabled by the coffee culture Starbucks established around the World. Coffee needs to be great, but it also needs to tell an authentic story.

The 18- to 34-year-olds who are driving coffee’s Third Wave are picking products and brands based on their origins, processes, methods, and design. Coffee is a lifestyle. Not surprisingly, the coffee shop has replaced the garage as the place where businesses are created and started. In fact, you’re beginning to see artisanal coffee shops adjacent to or embedded in start-up spaces.

Philz Coffee has been a pioneer of the Third Wave, becoming synonymous with carefully crafted cups of coffee served in an environment people love.

Philz founder Faisal “Phil” Jaber opened San Francisco’s Gateway Liquor & Deli on the corner of 24th Street and Folsom in the city’s Mission District in 1976. With a signature fedora and thick mustache, he quickly became a neighborhood fixture, selling everything from cigarettes, to whiskey, and eggs.

But Phil’s passion was coffee. In his spare time, he experimented with beans and created his own speciality blends.

Before converting his store into the now iconic coffee shop, however, Phil studied the market. As he recalled in a 2014 interview, “I visited over 1,100 coffee shops and five-star restaurants to figure out why people went there, what they were looking for, how the employees interacted with the patrons. It wasn’t to see how they made coffee. I wanted to know how they were building a culture around it.”

Today, Philz has opened 34 locations in the Bay Area, Los Angeles, and Washington DC. The business is led by Phil’s son, Jacob Jabber, who is committed to scaling the business without sacrificing its core asset — an authentic experience based on a cup of coffee made with love.

The recent rise of SoulCycle is instructive for the brand and experience Philz is creating. SoulCycle transcends fitness — it’s about being part of a community where you strengthen your mind, body, and soul. The casual observer might mistake it for a “spinning class.” But when you study SoulCycle, you realize that its monster success derives from doing a hundred little things better than anybody else.

The bikes are specially designed for SoulCycle to develop your “core.” The program emphasizes every muscle in your body, so that after 45 minutes, you’re wiped. The instructors are trained to be both inspirational and aspirational. The music is perfectly choreographed. Despite the heavy sweat, SoulCycle studios sparkle and smell fresh. And there is plenty of cool SoulCycle swag, so you can proudly display that you’re a member of the tribe.

We’re betting that brands like Philz can become to Starbucks what SoulCycle is to the fitness industry. Starbucks is a $80 billion company. Capturing just 2% of that market is a multi-billion dollar opportunity.

Source: Wired, Fast Company, Crunchbase, GSV Asset Management

WHAT TO WATCH

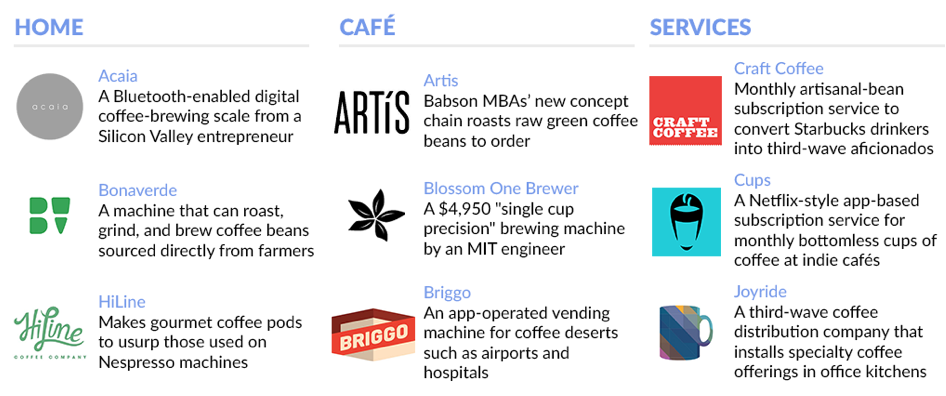

As entrepreneurs continue to pour into coffee, expect the Third Wave to gain more momentum. Already, a variety of new models are beginning to emerge, offering products and services targeting the home, offices, and cafes.

Subscription

As Third Wave coffee purveyors increasingly address demand for high quality coffee at home, expect a continued proliferation of subscription services. In 2014, Blue Bottle announced the acquisition of Tonx to pave the way for the launch of its service, Blue Bottle at Home. The company is delivering its expertly sourced, single origin beans to doorsteps just 24 hours after roasting.

Blue Bottle at Home costs roughly $20 a month, while other boutique coffee roasters, including Chicago’s Intelligentsia and Portland’s Stumptown, offer tiered plans that can be adjusted to ship weekly or monthly.

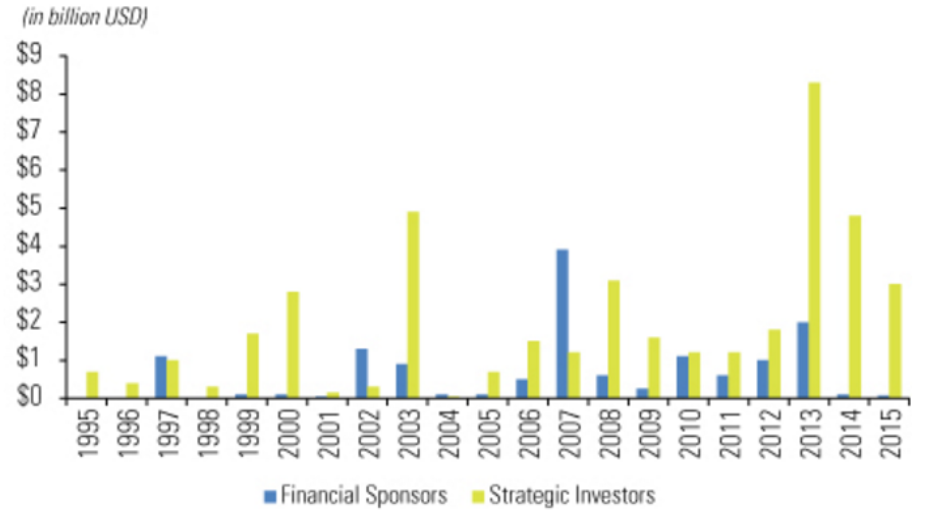

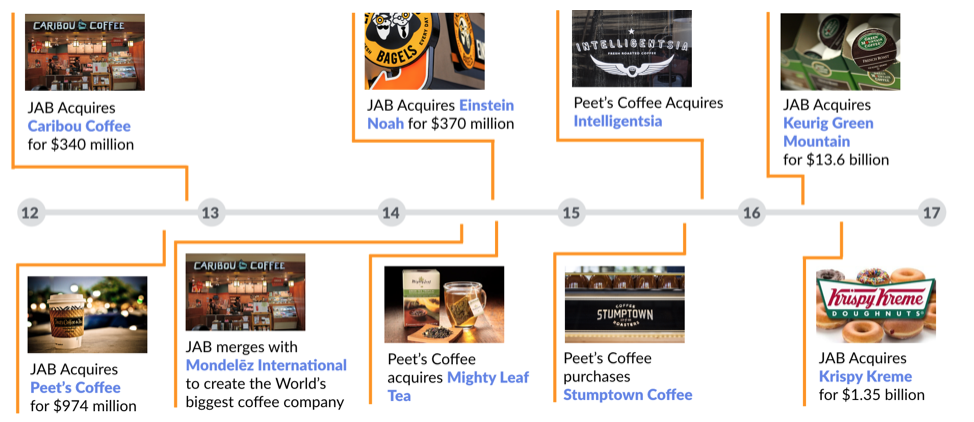

Caffeinated M&A

According to Dealogic, since the beginning of 2015, there have been 50 coffee or coffee-related mergers and acquisitions worth an aggregate $3 billion worldwide. Strategic buyers have represented 97% of the dollar value of the deals in 2015, with an emphasis on adding scale to the higher margins associated with specialty coffee.

Joh. A. Benckiser GmbH (JAB), particularly, has been on a buying spree. The company purchased California-based Peet’s Coffee & Tea and Minnesota-based Caribou Coffee in 2012, and D.E. Master Blenders 1753, which had been spun off from Sara Lee Corp., in 2013. In July 2015, JAB acquired Danish retail coffee shop chain Baresso Coffee, later capping the year with the purchase of Keurig Green Mountain for $13.9 billion.

Blue Bottle has acquired three coffee startups over the past two years, including Tonx (Monthly Personalized Coffee Subscription Service), Handsome Coffee Roasters (Coffee Roaster + Retail Store), and Perfect Coffee (Subscription Service for Freshly-Ground Coffee). Look for Third Wave M&A to accelerate as the battle for the future of coffee heats up.