Market Snapshot

| Indices | Week | YTD |

|---|

The telephone has too many shortcomings to be seriously considered as a means of communication.

— WESTERN UNION INTERNAL MEMO, 1876

In the last 12 months, remote controlled drones bought from retailers like Best Buy and Apple have grabbed headlines for turning up where they shouldn’t.

A drone operated by a high school teacher smashed into the stands of the U.S. Open in New York City last September. Police later learned that the operator was just looking for a sunset photo of the stadium before losing control. A few months before that, another drone dropped onto the White House lawn, causing a lockdown in the Capitol. The culprit this time? A scientist at the National Geospatial Intelligence Agency who flew a friend’s drone out of range… and into history.

In 2010, the Federal Aviation Authority (FAA) estimated that by 2020, there would be 15,000 consumer drones in the country. Today, that’s fewer than the number of drones sold per month. The Consumer Electronics Association (CEA) estimates that 700,000 drones were sold last year alone and 3 million units are due to ship to retailers in 2016. The FAA has some catching up to do. Reports of unmanned aerial vehicles (UAVs) interfering with regular air traffic have been running at over 100 per month, a number that will accelerate as millions of new drones take flight.

STATE OF PLAY

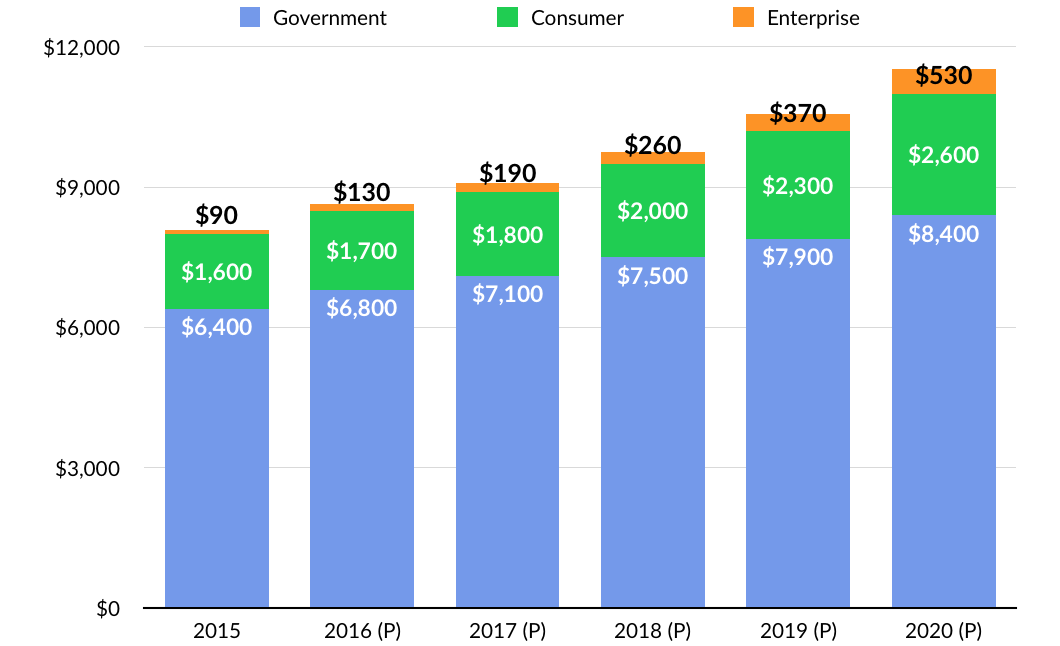

In the not so distant past, the market for drones, like tanks, was effectively limited to government purchases. The U.S. Department of Defense budget for fiscal year 2016 set aside $2.9 billion to acquire more than 50 new drones for combat and surveillance — accounting for nearly half of the $6.4 billion of projected global government spend on drones.

What changed? The same improvements that have transformed smartphones — low-cost, high-quality GPS units, accelerometers, and and advanced sensors — have have ushered in the age of the consumer drone.

Future historians may peg January 7, 2013, as the date that civilian drones went mainstream. That’s when DJI, a Chinese company, released the Phantom, which retailed for $679. A sleek, four-pronged helicopter that fit inside a backpack, you didn’t need to go to TOPGUN to fly it. The Phantom flew where you told it to fly. And capitalizing on the GoPro craze, you could strap a camera to it and record your flight.

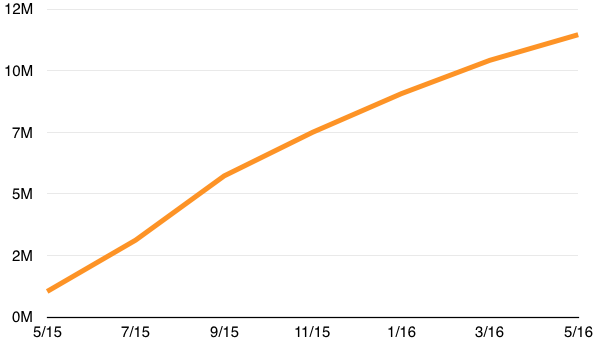

Today, the global drone market is estimated to be worth $8 billion, growing to over $11.5 billion by 2020. Consumer drone spending is projected to grow at a steady 10% CAGR for the next five years, from $1.6 billion today to $2.6 billion.

Looking forward, the most compelling category is just beginning to emerge. Commercial drone services were estimated to be less than $100 million in 2015. But the market is growing at a 43% CAGR — expected to top $500 million in 2020 — and will accelerate faster still as drone technology and regulations evolve.

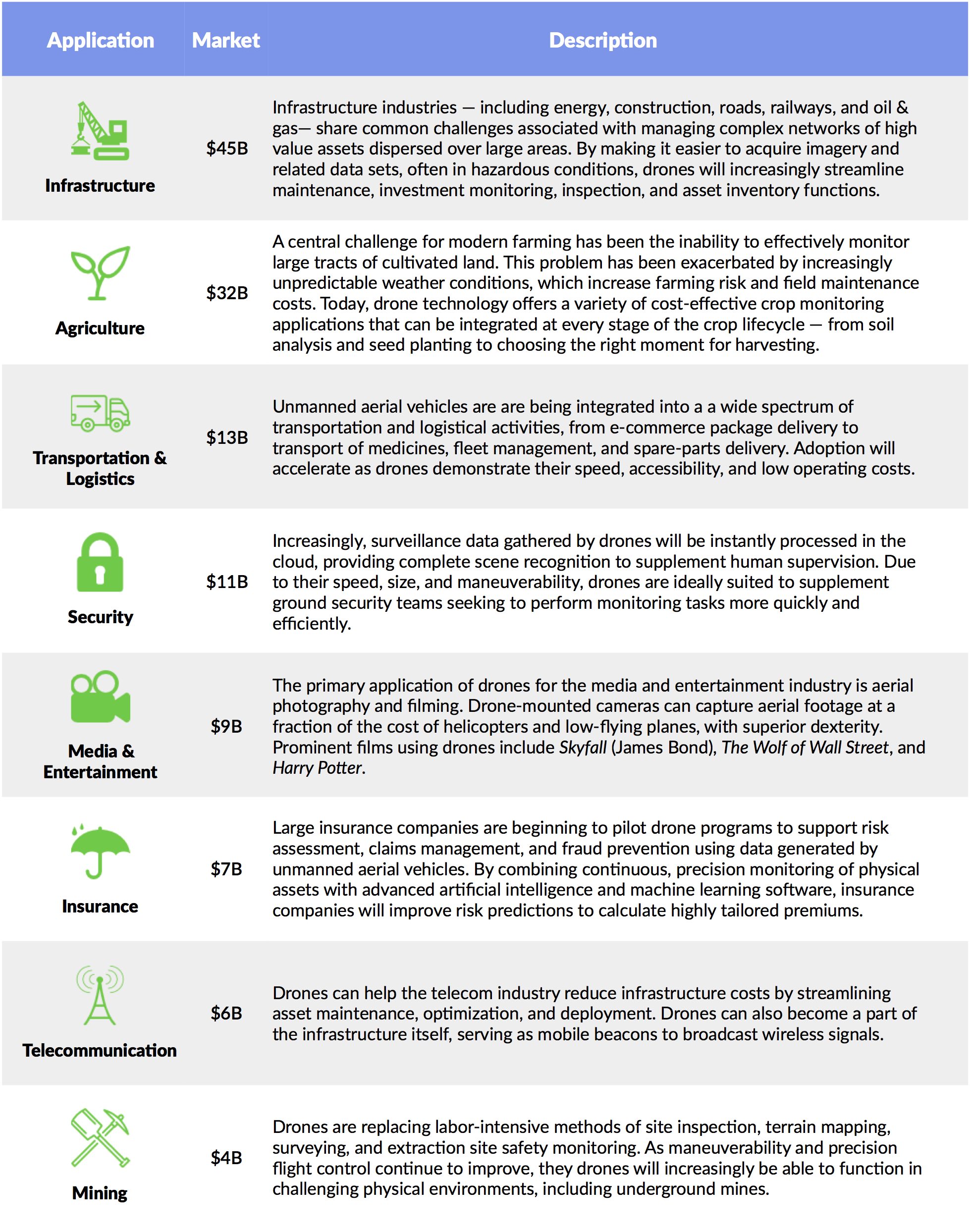

Fundamentally, drones create low-cost eyes from the sky, enabling real-time monitoring over wide distances. This capability is applicable across a wide range of industries that involve assets dispersed over large areas, including construction, energy, and agriculture. Low cost access to aerial images and rapid data gathering will benefit organizations gathering “intelligence”, from security to science.

While drones may not transform the world like the personal computer, their evolution will be similar. In the 1980s, when Apple launched the Macintosh and IBM released the PS/2, these devices rapidly evolved from premium consumer “nice to haves” to being business essentials. PwC recently estimated that that the near-term addressable market for drone-enabled business services is over $127 billion.

Last summer, in a proposal to the FAA, Amazon unveiled a vision for a network of superhighways crisscrossing the skies for drones to deliver packages. It contemplates three segmented bands of airspace. From the ground up to 200 feet would be reserved for hobbyists. From 200 feet to 400 feet would be for high-speed commercial drones operating autonomously. From 400 feet to 500 feet would be a no-fly zone to act as a buffer between manned and unmanned aircraft. (Disclosure: GSV owns shares in Amazon)

The idea isn’t farfetched. In 2015, Switzerland’s postal service began testing delivery drones in conjunction with California-based Matternet, which develops unmanned aerial vehicles and automated logistics networks. Germany’s DHL has been trialling its very own “parcelcopter” on the island of Juist in the North Sea since 2013.

Amazon’s proposal is unlikely to get off the ground any time soon because FAA rules require drones to remain within line of sight, either of an operator on the ground or in a chase plane in the sky. This defeats the purpose of automated delivery vehicles, and the rule has broader constraints for commercial drone applications.

NASA, in collaboration with the FAA, is currently working with various universities and companies — including Google and Verizon — to design an air-traffic-control system for drones. It will have its own equivalent of roads, traffic lights, and “do not enter signs”. As regulation evolves, drone adoption will accelerate. (Disclosure: GSV owns shares in Alphabet)

Investment Activity

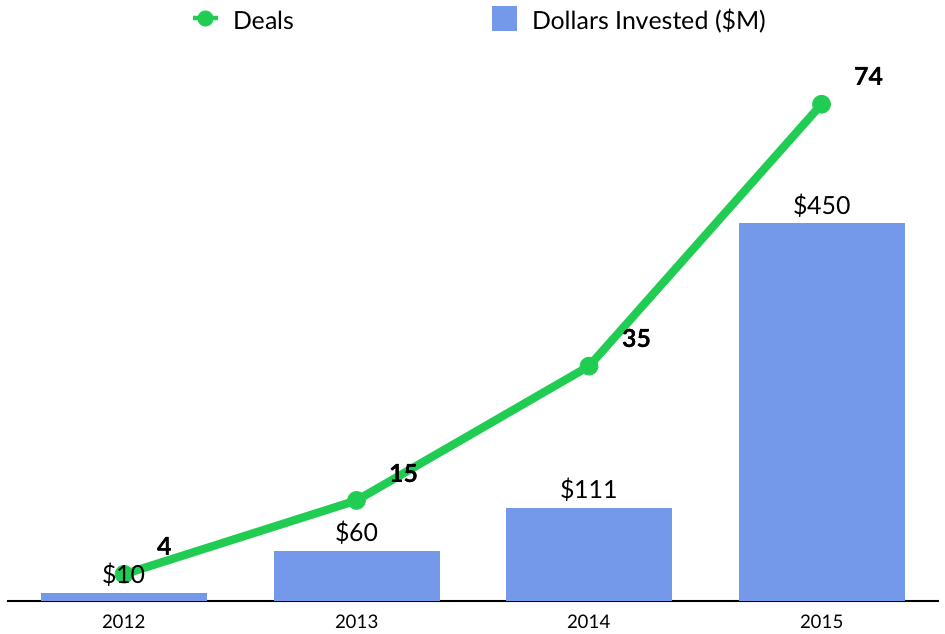

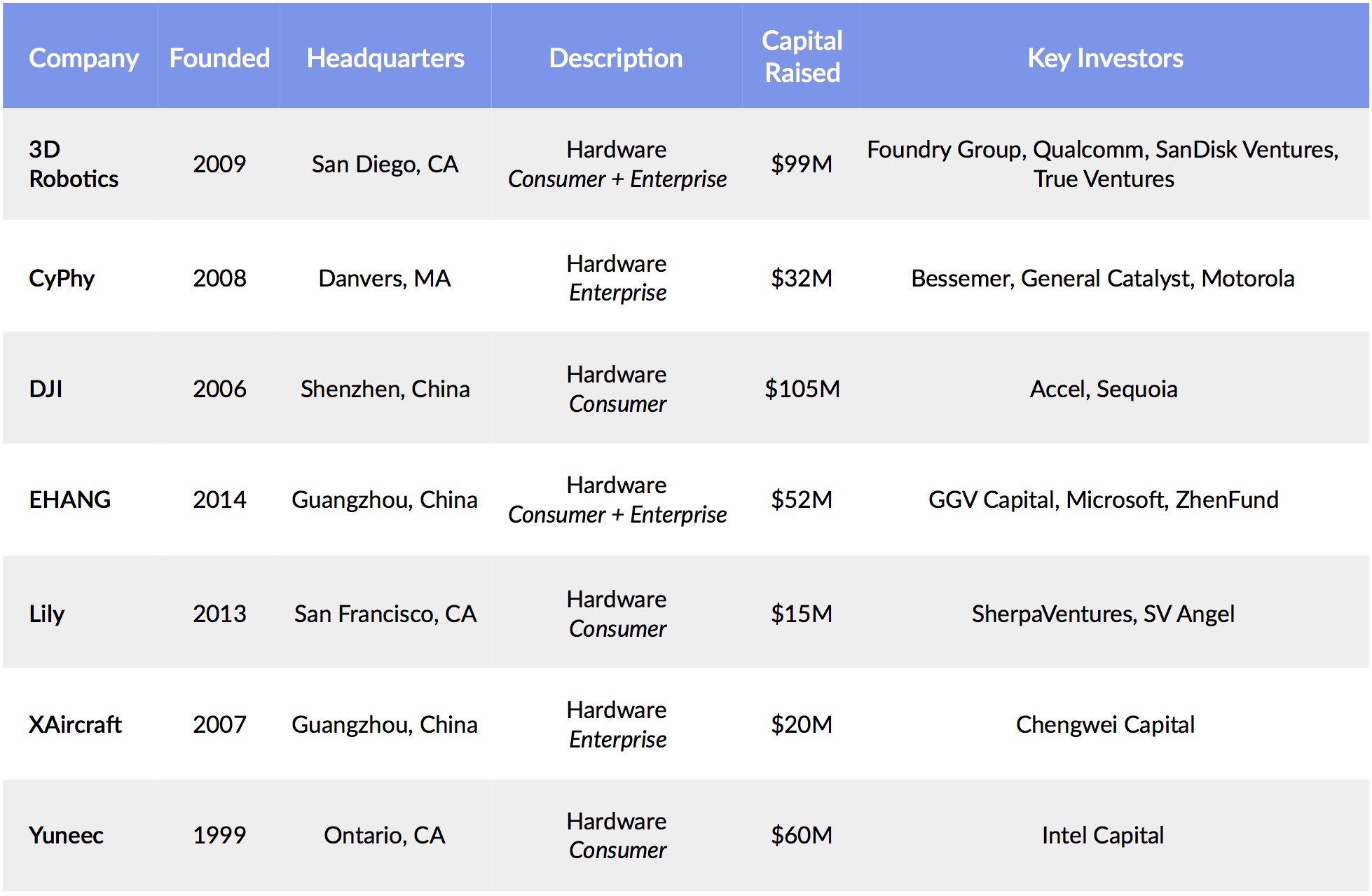

Drone startups raised over $450 million across 74 deals in 2015, up over 300% versus 2014 on a dollars basis and 111% on a deals basis. Investment hit an all-time high of $140 million in the third quarter. In total, there were 11 financings larger than $10 million for the year, compared to just eight in the previous three years combined. Companies raising over $50 million included Shenzhen, China-based consumer drone manufacturer DJI ($75 million), as well as California-based competitors YUNEEC ($60 million) and 3D Robotics ($50 million).

The first quarter of 2016 marked several large deals to emerging drone startups, including Airware ($30 million), Skydio ($25 million), and Delair–Tech ($14.5 million). Despite these notable rounds, however, the quarterly financing total was the lowest for drone funding since the first quarter of 2015. Activity remained robust, however, with 21 deals in the first three months of 2016, the third quarter in a row in where activity eclipsed the 20-deal mark.

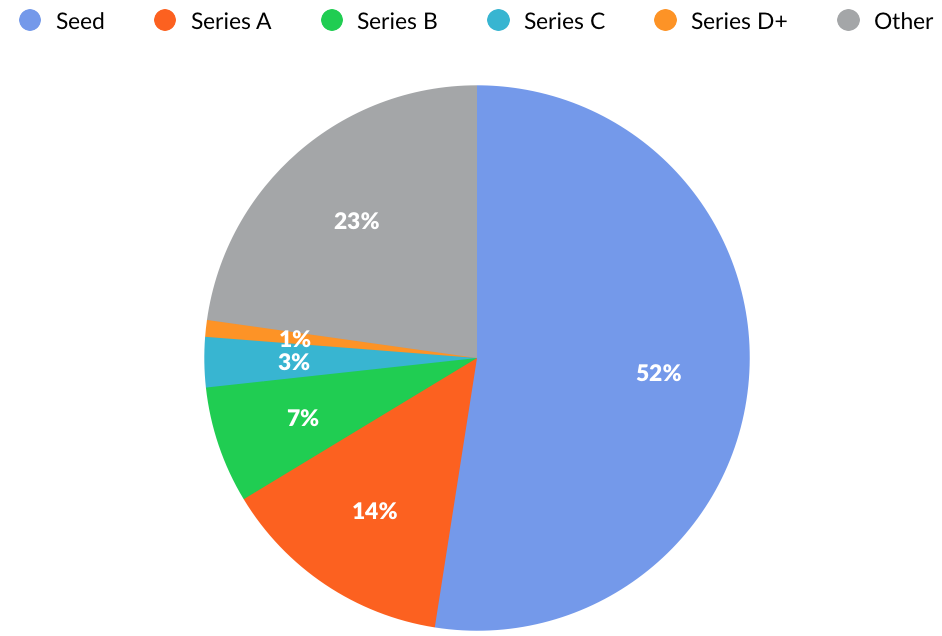

Despite the continued increase in funding levels and deals, it still is early days for the booming drone industry. Of all the deals completed in 2015, over 67% were in the A round or earlier. Series C and later rounds accounted for just 4% of deal activity.

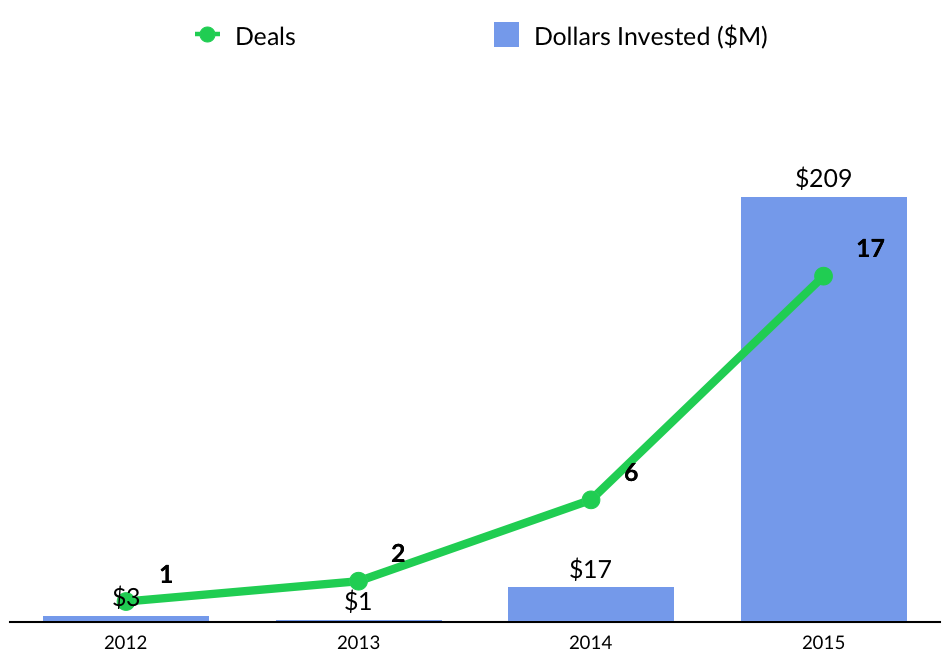

Beyond venture firms, corporate VCs, led by Intel and Qualcomm, have become increasingly active drone startup investors. In 2012, there was just one financing for a drone startup that involved a corporate VC. Last year, there were 17, totaling more than $209 million. That’s up from $17 million in 2014. Large deals involving corporates included rounds to Yuneec, 3D Robotics, and Skycatch ($22 million).

More than two-thirds of corporate investments over the past five quarters were at the seed or Series A stages. While deal activity has dipped in early 2016 — there was just one financing the first quarter — we expect sustained longterm interest in the category from a variety of corporate VCs representing a wide range of industries.

PIONEERS: KEY COMPANIES AND PEOPLE

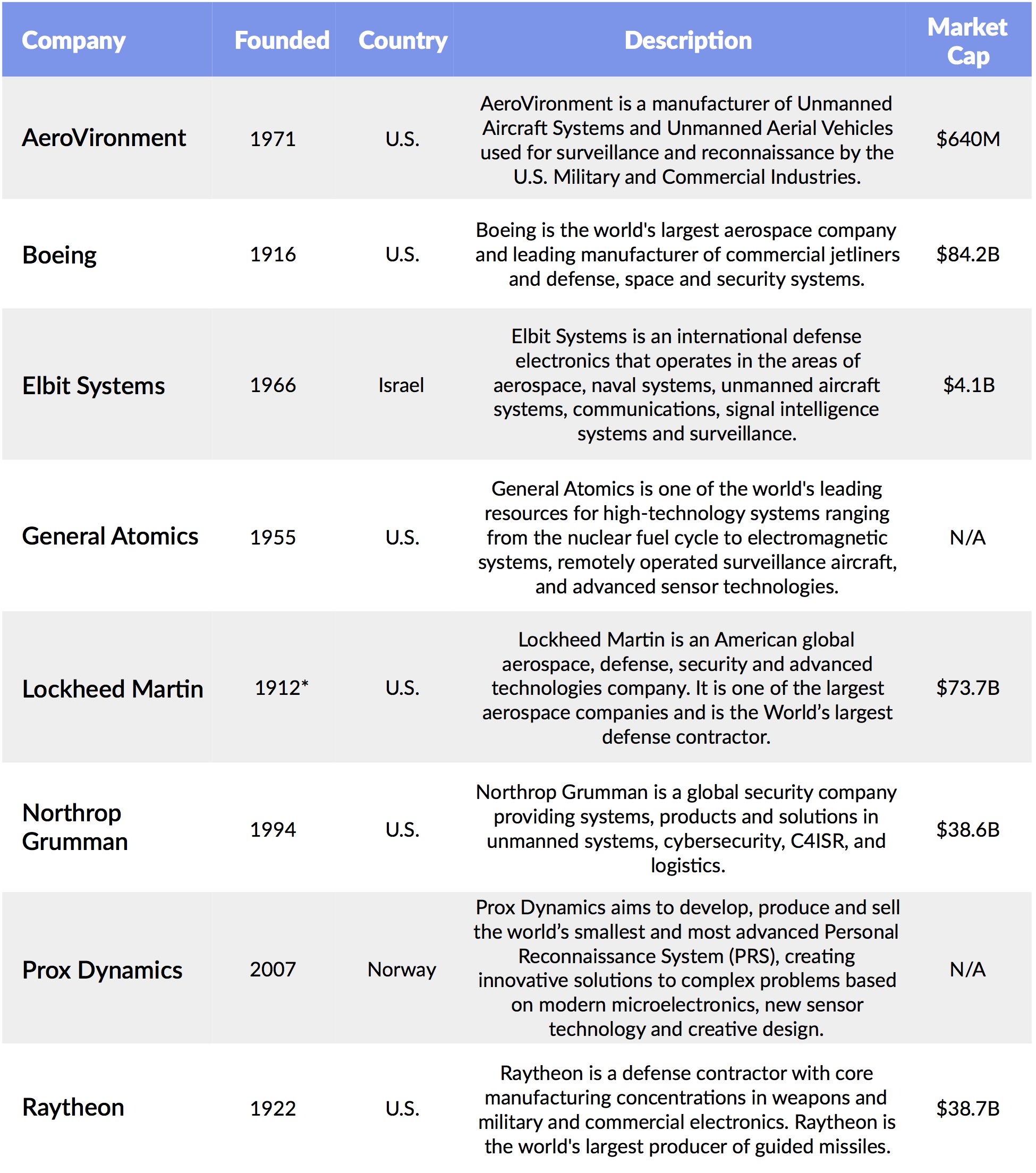

Defense

The U.S. military has experimented with remotely piloted airplanes since World War I, when the Army developed the “Kettering Bug”, a biplane equipped with a gyroscope. Never used in combat, the contraption was designed to haul 180 pounds of ordinance and dive-bomb close-range targets.

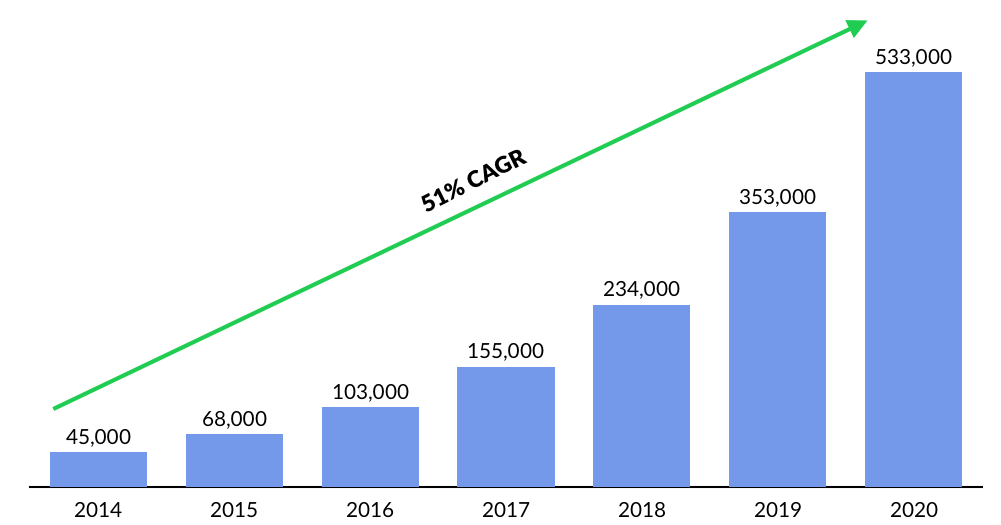

The Air Force activated its first operational squadron of unmanned aerial vehicles in 1995, which completed intelligence missions in Kosovo. By 2005, military personnel were logging 40,000 flight hours per year operating UAVs. Last year, flight hours hit over 368,000, according to the Pentagon, with some drone pilots flying upwards of 900 hours. Fighter pilots, by contrast, typically max out at 300 hours per year. All told, over 20,000 military and civilian personnel are currently assigned to the RPA program, representing roughly 5% of the Air Force’s total capability.

*Founded in the 1995 merger of Lockheed Corporation (est. 1912) and Martin Marietta (est. 1961)

The expansive use of drones by the United States military has touched off a race among other countries, with the United Kingdom, Israel, China, India, and Pakistan all acquiring fleets of varying sizes. This expanding market has enabled participants beyond the U.S. stalwarts, including Israel’s Elbit Systems, which has emerged as the largest military drone manufacturer in the World. Today, Israel and the United States account for more than 80% of all military drone exports worldwide.

Hardware: Consumer & Enterprise

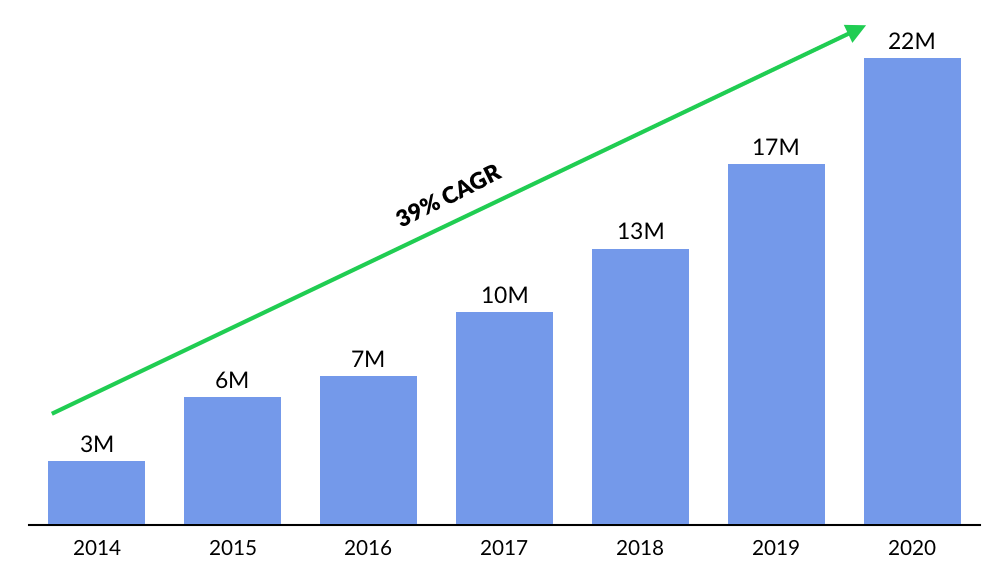

The consumer market for drones has been spurred by improving technology fundamentals that reduce component costs while enabling the creation of intuitive, mobile centric designs. Consumer drone shipments worldwide will top 7.3 million in 2016, and are projected to surpass 22 million by 2020 — a 39% CAGR since 2014.

As drone technology matures, a variety of Drone manufacturers are emerging to meet nuanced demand across the consumer to commercial continuum. As of last year, however, China-based DJI owned and estimated 70% of the market for both consumer and commercial drones, with over $1 billion in revenue. An early market entrant, DJI drones have been widely adopted for their reliability, ease of use, and integrated photography and video capture capabilities.

Platforms: Data, Analytics + Services

A leading company in the emerging market for integrated drone data, analytics, and intelligence platforms is Skycatch. Based in San Francisco, the company’s drones and software enable data capture and 3D terrain rendering in real time.

Skycatch drones are operated via “Commander”, an app that allows users to easily select the area they’d like to survey before analyzing the collected data. So far, Skycatch’s products have been put to use not only on industrial sites, but also in managing disaster relief, including the aftermath of the recent 7.8 magnitude earthquake in Nepal.

Source: Crunchbase, GSV Asset Management

Agribotix is a drone and software developer that employs data analysis to help farmers achieve greater crop yields. Its cloud-based FarmLens application — sold either a la carte or with a long-range agricultural quadcopter — scans and processes aerial crop images to highlight and predict plant decay. FarmLens has already processed drone-derived data from 34 countries and 40 crop types around the world.

WHAT’S NEXT

Essential Human Services

The first company to start making drone deliveries at a commercial, high-volume scale won’t be Amazon or DHL, but a startup sending medical supplies to remote hospitals in Rwanda to save lives.

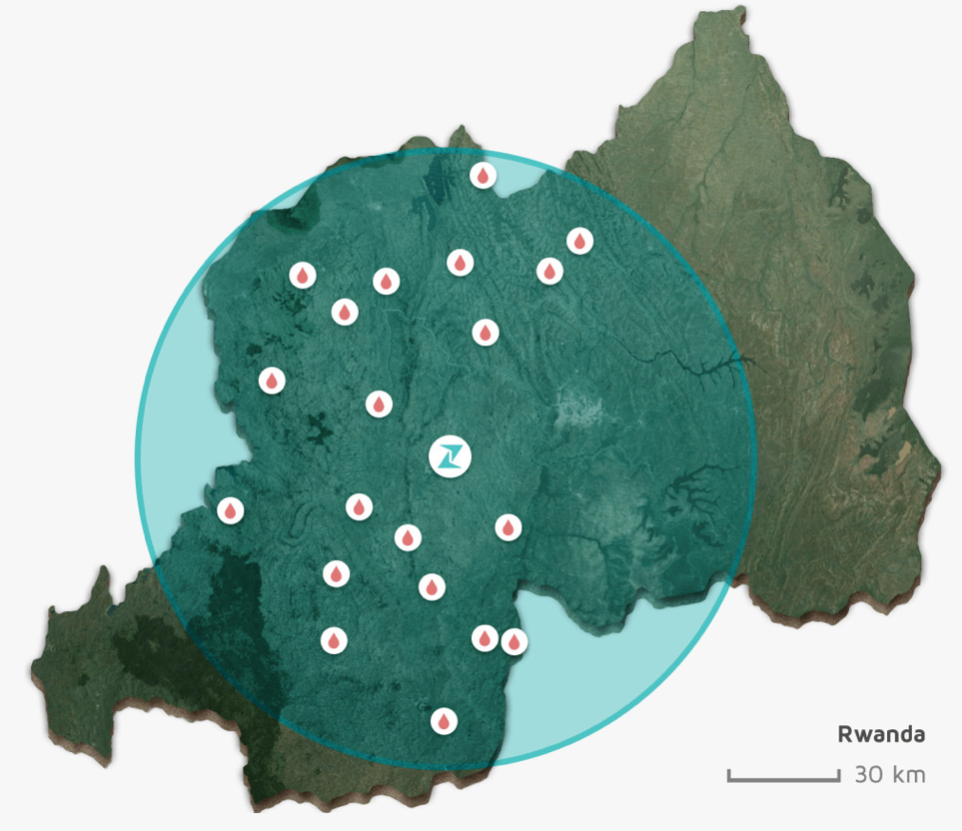

In July, San Francisco-based Zipline plans to begin using its new drones to deliver blood from Rwandan blood banks to rural areas for emergency transfusions. Right now, the country struggles to get blood to remote clinics that might not have a reliable way to store it, and can’t predict in advance which blood types they’ll need. Furthermore, 75% Rwanda’s roads are unpaved and often unusable during the rain season, making them impassable to the vehicles that are deployed to make emergency medical deliveries.

That’s why drone deliveries make all the sense to CEO Keller Rinaudo, who believes that his company can match the cost of a ground delivery, while also reliably making deliveries in less time.

Later this year, Zipline plans to deploy a fleet of drones in Rwanda to deliver medical supplies. Working with UPS and vaccine distributor Gavi, Zipline’s goal is to have 15 autonomous aircraft deployed daily, making 150 deliveries to 21 medical stations throughout the Western half of Rwanda. With the addition of a second hub, the company believes that they can service the entire population of 11 million people.

Insurance

A growing group of the largest U.S. insurance companies are turning to drones to help conduct inspections for underwriting and claims adjusting. Farmer’s CIO Ron Guerrier recently remarked that his company is evaluating how it can use drones to inspect brush clean-up in areas prone to wildfire. Allstate is similarly testing the use of drones to help with property claims after natural disasters such as hurricanes.

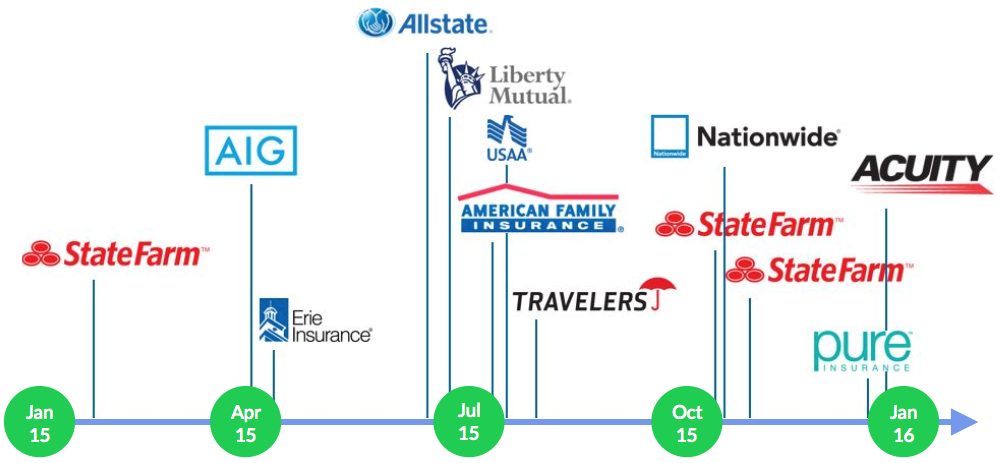

The testing and research of drones by insurers is evidenced by the boom of FAA drone exemptions — allowances to use drones in various settings — that were granted to insurers in 2015, including AIG, Liberty Mutual, Allstate, and State Farm.

MAJOR INSURERS ARE BEGINNING TO ADOPT DRONES

Recent FAA Drone Exemptions by Insures

Transportation

At this year’s CES, EHang announced that it was in advanced development stages for a helicopter drone with the ability to carry human passengers. It will be 100% battery powered, fully autonomous, and capable of carrying one passenger up to 10 miles. While obviously not ready for commercial primetime, the range will increase dramatically with technology fundamentals that continue to improve at rapid rates.

EHang was launched just two years ago as an Indiegogo project, and was able to secure $850,000 in just a month. It launched its initial product in November 2014, and its Ghost Drone won the CES 2015 Top Pick Award. To date, EHang has raised $52 million from GGV, Zhen Fund, and GP Capital.

Drones + VR

Today, drone pilots typically use a high definition screen on a smartphone or tablet to guide a drone through the air. Integrating Virtual Reality into the user experience has the potential to amplify the impact of realtime imagery captured by mounted cameras. The CloudlightFPV app, for example, enables VR One headset owners to see the world through a drone’s perspective by simply turning one’s head any direction.

The implications of the intersection of these two technologies are broad. Beyond an intriguing new immersive experience, the combination of drones and virtual reality has wide applicability across a variety of commercial functions. Students will be able to hover over and experience the Great Wall of China live from inside a classroom. Construction companies will be able to safely monitor projects in granular detail when needed. Emergency workers will be able to assess dangerous sites in real time while reducing their exposure to danger.

The list goes on. As we continue to seek out the most dynamic growth companies in the world — the Stars of Tomorrow — we will be tracking the rise of drones.

—

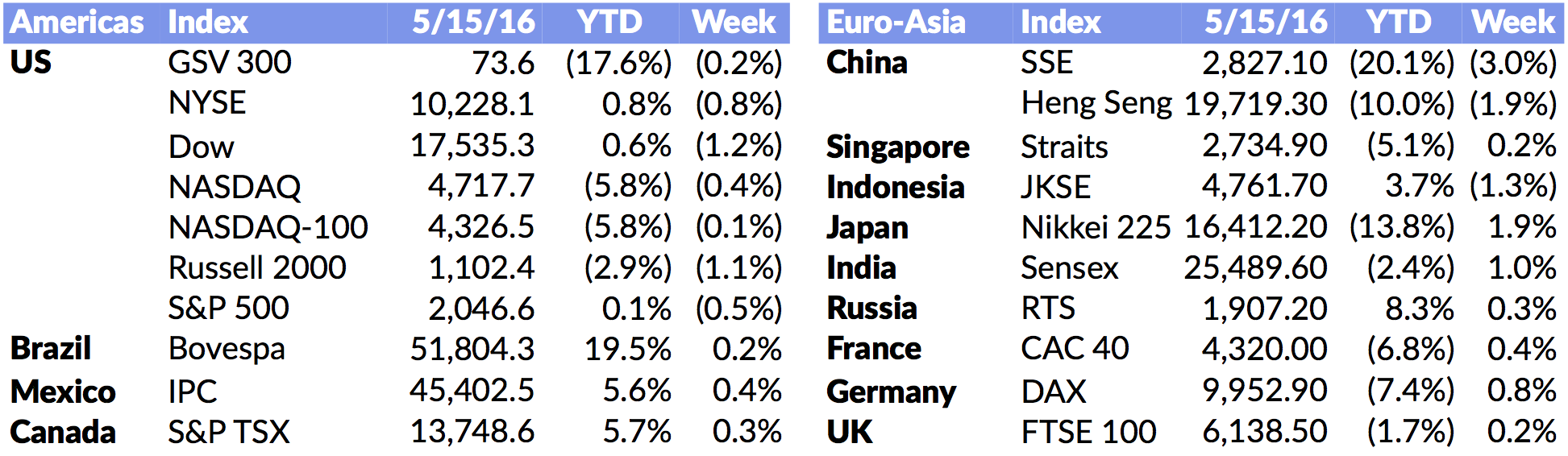

Despite stronger than expected retail data for the month of April, which was up 3% year-over-year, U.S. indices declined again last week — the S&P 500 (down 0.5%) for the third week in a row and NASDAQ (down 0.4%) for the fourth week in a row. The GSV 300 index was off 0.2%.

China’s April exports and imports data was below expectations, showing weaker demand at home and abroad. April exports were down 1.8% and imports were down 10.9% year-over-year. The Shanghai Composite finished the week down 3.0% and is now down 20.1% year-to-date.

On the positive side, IPOs are showing signs of life again, with four new companies going public last week. Most impressively, Acacia Communication, which develops high-speed interconnect modules for cloud infrastructure, priced its IPO in-range and popped +35% on Friday. Acacia now has a $1.1 billion market cap, trading at a 4x P/S and an 18x trailing P/E. Acacia’s first quarter revenue growth was +79%, and EPS growth was +193%. Goldman Sachs led the deal. Four IPOs are on deck this week.

Additionally, China Online Education (COE) filed for a U.S. IPO, with Morgan Stanley acting as its lead banker. Backed by Sequoia, SCC Venture, and Shunwei, COE is China’s largest online English education platform. In the first quarter, COE had 71,000 active students (+122% year-over-year), 26,400 paying students (+100% year-over-year), and 4,700 available teachers (+124% year-over-year). China Online Education’s trailing revenue is $31 million, which grew by +215% in the first quarter.

On the venture side, Apple invested $1 billion in China’s ride-sharing giant Didi, which now processes 11 million rides per day. Hyperloop One, famously architected by Elon Musk, raised $80 million from Zhen Fund, 8VC, Khosla Ventures, and others. Poland-based peer-to-peer learning platform Brainly received a $15 million investment from Naspers. FreshGrade, which connects teachers, students and parents and operates in 70 countries, received $12 million in new capital from Accel, Relay Capital and Reach Capital. (Disclosure: GSV owns shares in Naspers).

The ongoing market volatility, especially in growth stocks, creates buying opportunities for long-term investors. We remain BULLISH on the fundamentals for the best growth companies.