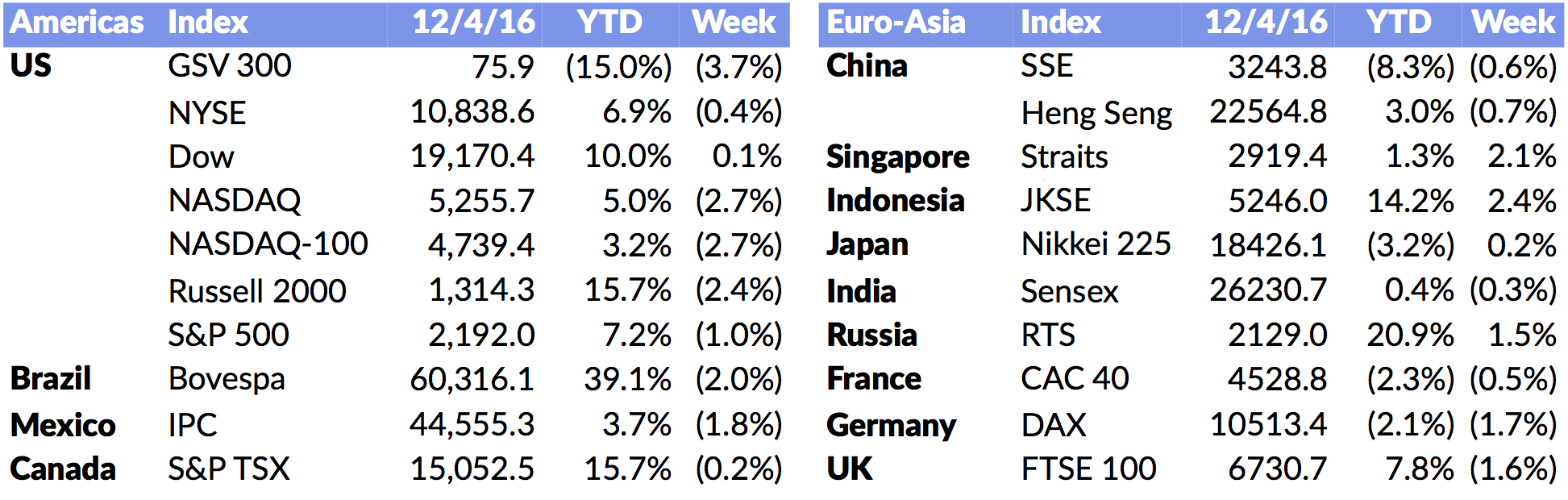

Market Snapshot

| Indices | Week | YTD |

|---|

On Black Friday last week, over 102 million Americans stampeded into retail stores across the country to take advantage of deep discounts on everything from diapers to drones and iPhones.

But impressive as this thundering herd may be, this year it was outnumbered for the first time by e-commerce shoppers, which clocked in at just over 103 million strong. Consumers spent $3.3 billion shopping online on Friday, a 22% year-over-year increase, and more than a third of these purchases were made on mobile devices.

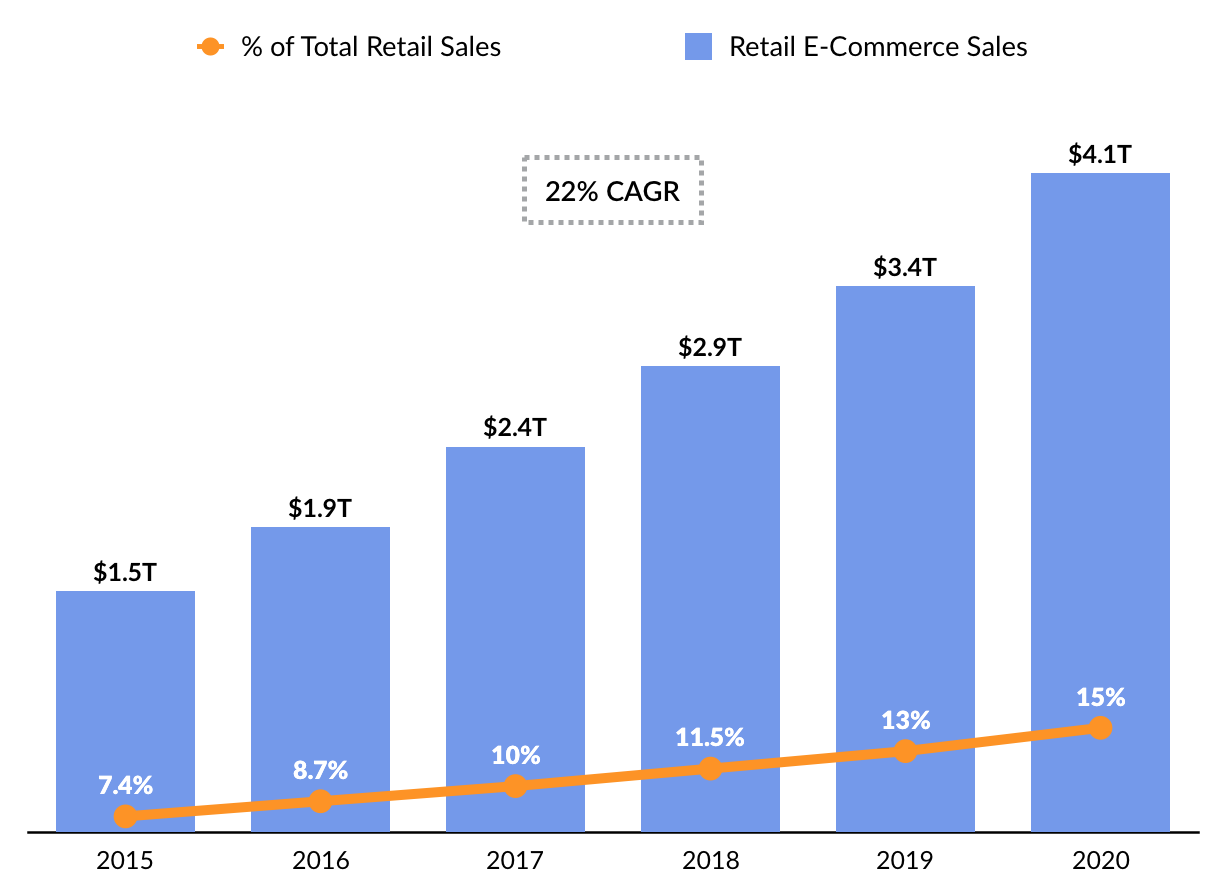

In one sense, this is a story about gravity. In 2016, e-commerce is projected to account for only 8.7% of global retail sales. The growth opportunity remains staggering and online sales numbers will continue to smash old records.

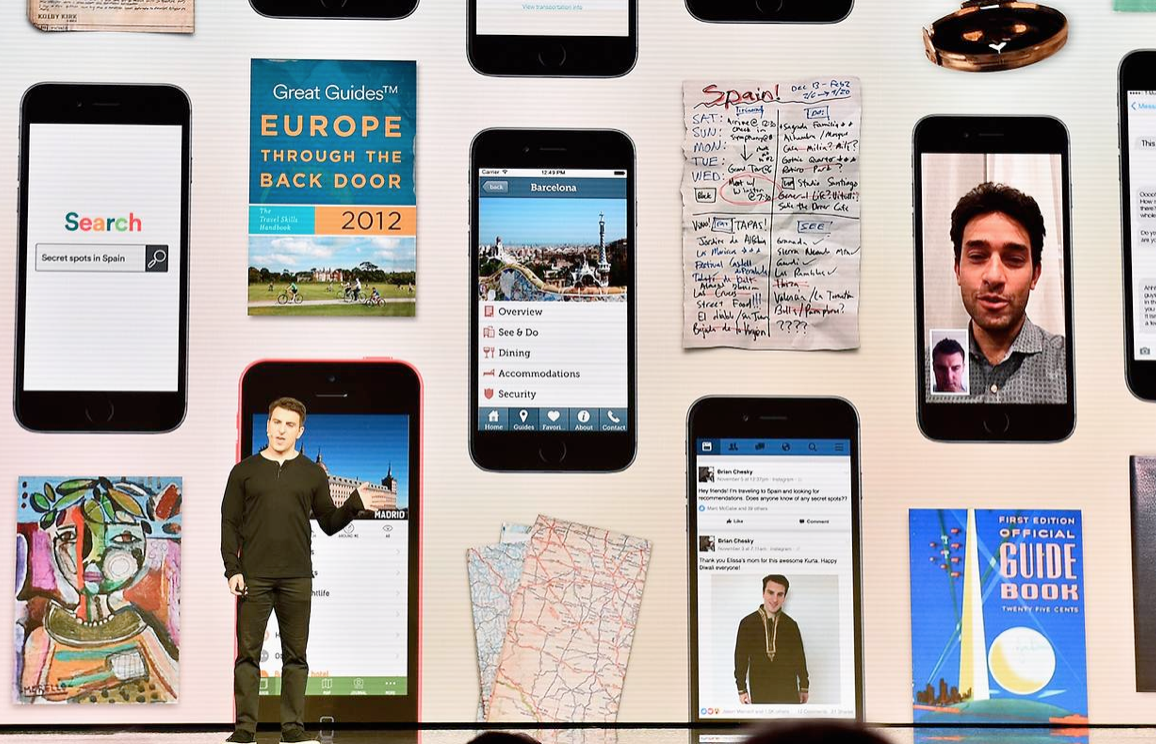

But lost in the lead-up to Black Friday was an announcement from Airbnb a week earlier that highlights a new frontier in the World of commerce. CEO Brian Chesky unveiled a service called “Trips,” which will offer much more than a place to sleep. It’s a collection of over 500 private tours and tailored activities — from art classes to workouts and nightlife — available through the network. Airbnb is not content to be a room broker. It’s going all in on experience.

The rise of Amazon, which accounted for over 30% of spending on Black Friday through “Cyber Monday”, has been about scale and efficiency. According to PiperJaffray, the company now has a warehouse or delivery station within 20 miles of 44% of the U.S. population. That’s up from 38% in 2015 and 26% in 2014.

Today, Amazon Prime counts over 54 million members in the United States, reaching nearly half of U.S. households. Prime members spend 1.8x the average consumer. This year, Amazon held it’s second annual “Prime Day” — which includes a variety of deals for members — generating an estimated $600 million of incremental revenue.

For participants in this market — old and new — growth is fundamentally driven by logistics, not an expansion of products, offerings, or experiences. That’s where experience comes in — and why Airbnb’s announcement is a window to the future.

If you look at the world of physical stores, many compete on service — the customer experience — not just efficiency. For every Best Buy, there is an Apple store. For every Target, there’s a Nordstrom.

The next wave of digital commerce will bring a renewed focus on combining efficiency with a superior personal experience.

STATE OF PLAY

Retail e-commerce sales are projected to reach $1.9 trillion in 2016, accounting for 8.7% of total retail spending worldwide. It is projected to grow to $4.1 trillion by 2020, eclipsing 15% of total spending.

China’s e-commerce market surpassed the United States in 2013 and today, Alibaba handles more transactions than Amazon and eBay combined. In 2016, Alibaba topped its Singles’ Day record (annual online shopping event), netting $17.8 billion in 24 hours. The average cost per order was $27 and 82% of were completed on smartphones. In 2016, mobile commerce will account for over half of online purchases in China, or $506 billion — up from $180 billion in 2014.

Surging e-commerce, particularly in the United States, has come at the expense of traditional brick and mortar retails. In 2006, a year before the first iPhone was released, Best Buy, JCPenney, Kohl’s, Macy’s, Nordstrom, Sears, Target, and Walmart had a combined market value of $400 billion. Today, they’re worth $315 billion. If you back out Walmart, which managed to grow a modest 2% over this period, the average decline in value was -53%.

*Peak Market Value 2006

Contrast this with Amazon, which has grown 1,910% over the same period. What’s remarkable is that at $17.5 billion, Amazon was a huge market cap company in 2006. It has still been a twenty-bagger since then. That’s the amazing thing about the Internet. Disproportionate gains go to the leader in a category. It’s winner-take-all.

Another recent accelerant for e-commerce has been the rise of same-day delivery apps.

In the dot-com bust, on-demand delivery services like Kozmo, Urbanfetch, and Webvan weren’t just high-profile failures. They became a symbol of the excess that fueled the crash. At its peak (or valley, depending on your perspective), Kozmo was charging $2 per delivery while hemorrhaging money on courier and warehouse expenses (in 1999, Kozmo reported $3.5 million of revenue on $29 million of expenses).

But something funny happened in 2013. Companies promising instant gratification from same-day delivery services roared back to life, raising over $8.5 billion through 2015, backed by heavy-hitters like Sequoia, Greylock, Accel and Khosla Ventures.

In the span of 2014 to 2015 alone, Berlin-based Delivery Hero raised over $1.2 billion across an alphabet soup of financings. China’s Ele.me, a popular restaurant delivery platform, secured a $980 million investment from Tencent and others (followed by a $1.25 billion strategic investment from Alibaba in April, 2016).

Others crossing the $100 million investment threshold include Instacart ($275 million), Deliveroo ($475 million), and Postmates ($278 million). As private financings surged, Benchmark-backed GrubHub recorded a successful IPO in 2014 and is valued at over $3 billion today.

While the new crop of business may sound eerily familiar, the fundamentals are very different than the dot-com days. In 2000, there were only 370 million people on the Internet (roughly 5% of the world’s population), smartphones were a fantasy, and applications off of a platform had not been invented.

Today, digital infrastructure is in place, with three billion people on the Internet, over 2.6 billion smartphones in the hands of Digital Natives, and 226 billion apps having been downloaded from Apple and Alphabet (Google). Goods, services, and delivery teams can be more efficiently networked and coordinated. And the customer experience is vastly superior in a paradigm of on-demand, transparent commerce.

The renaissance of same-day delivery in recent years has been focused on applying powerful new technology and business models to create efficiencies for customers. But it’s still a market where you win on scale and efficiency. It could be winner-take-all or winner-take-most, and leaders like Amazon and GrubHub loom large.

The next frontier will be creating a superior experience, which means we’ll have to think differently about e-commerce altogether.

TIME TO ENJOY

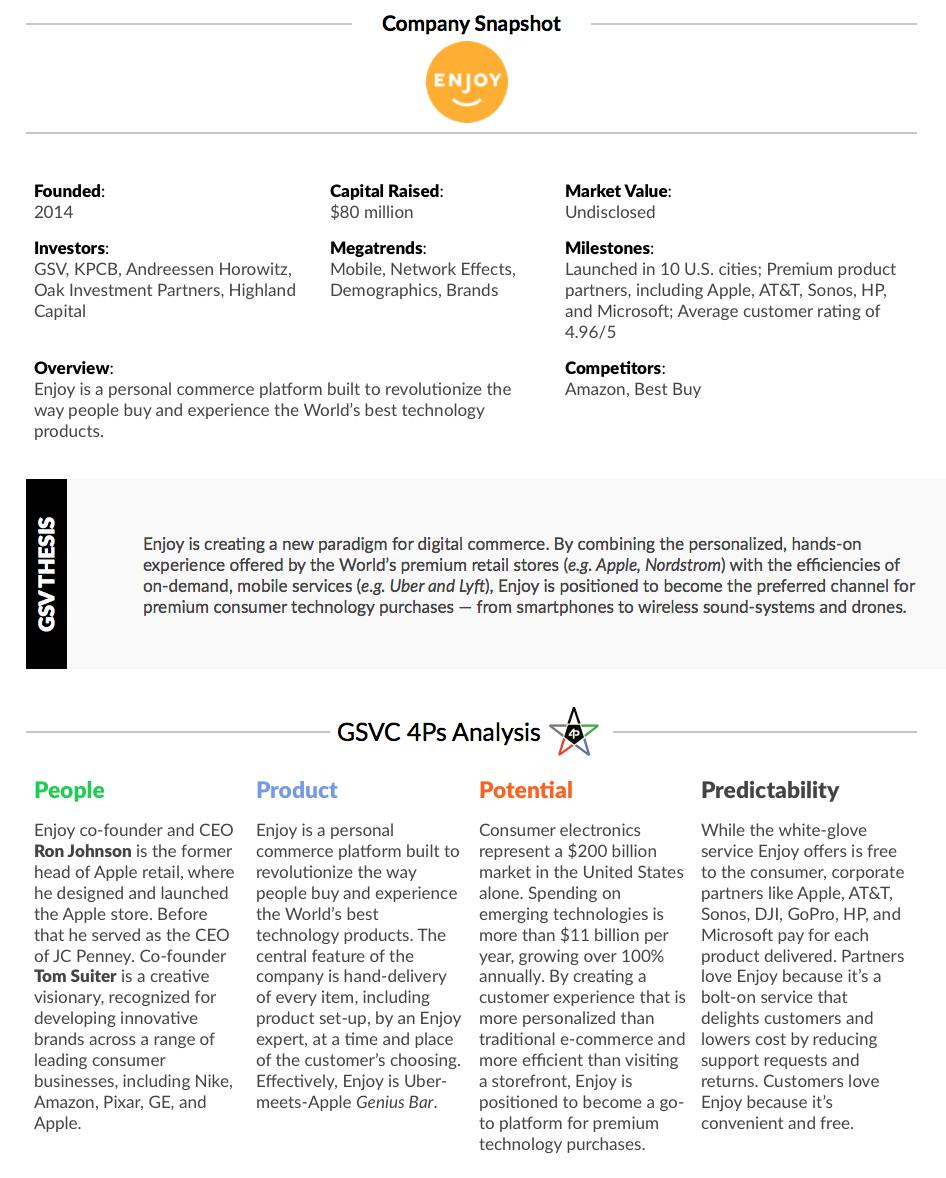

Enjoy, co-founded by former Apple retail head Ron Johnson, is at the forefront of this trend. It’s a personal commerce platform built to revolutionize the way people buy and experience the World’s best technology products — from smartphones to wireless sound-systems and drones. The central feature of the company is hand-delivery of every item within 2-3 hours, including product set-up by an Enjoy expert. Effectively, Enjoy is Uber-meets-Apple Genius Bar. (Disclosure: GSV owns share in Enjoy)

The magic is in the experience Enjoy delivers. Efficient, on-demand delivery is table stakes. Enjoy experts meet customers at a time and place of their choosing, arriving early 97% of the time. Delivery is free and the product prices are the same or less than Amazon, Best Buy, or the Apple store.

How does it work? Enjoy doesn’t build stores. It hires great people. Enjoy can deploy a team of highly trained, engaging product experts a lot less expensively than building a physical storefront. Effectively, it works off the same margins as a physical store, but with a different model.

While the white-glove service Enjoy offers is free to the consumer, corporate partners like Apple, AT&T, Sonos, DJI, GoPro, HP, and Microsoft pay for each product delivered. Partners love Enjoy because it’s a bolt-on service that delights customers and lowers cost by reducing support requests and returns. Customers love Enjoy because it’s convenient and free.

One of the biggest challenges for most e-commerce platforms, particularly newcomers, is that acquiring customers is prohibitively expensive. Enjoy is thinking differently about this paradigm as well. It works directly with manufacturers to integrate its “hand delivery with expert help” service as an option at the point of sale (e.g. you can select Enjoy when purchasing an iPhone through AT&T).

WATCH REMARKS FROM ENJOY CO-FOUNDERS RON JOHNSON + TOM SUITER HERE

Ron Johnson (Right) and Tom Suiter (Left) Discuss the Future of Digital Commerce Reimagined at GSV Capital’s 2016 Investor Day

Enjoy believes that after delivering a delightful experience to customers, it will be able to invite them back to to purchase additional products over time. To date, the company has an average customer rating of 4.96/5.

In this respect, Enjoy is taking a page out of Amazon’s playbook from the 1990s. Amazon used to run e-commerce websites for brands like Target — a strategy that helped the company build scale before blossoming into its own brand.

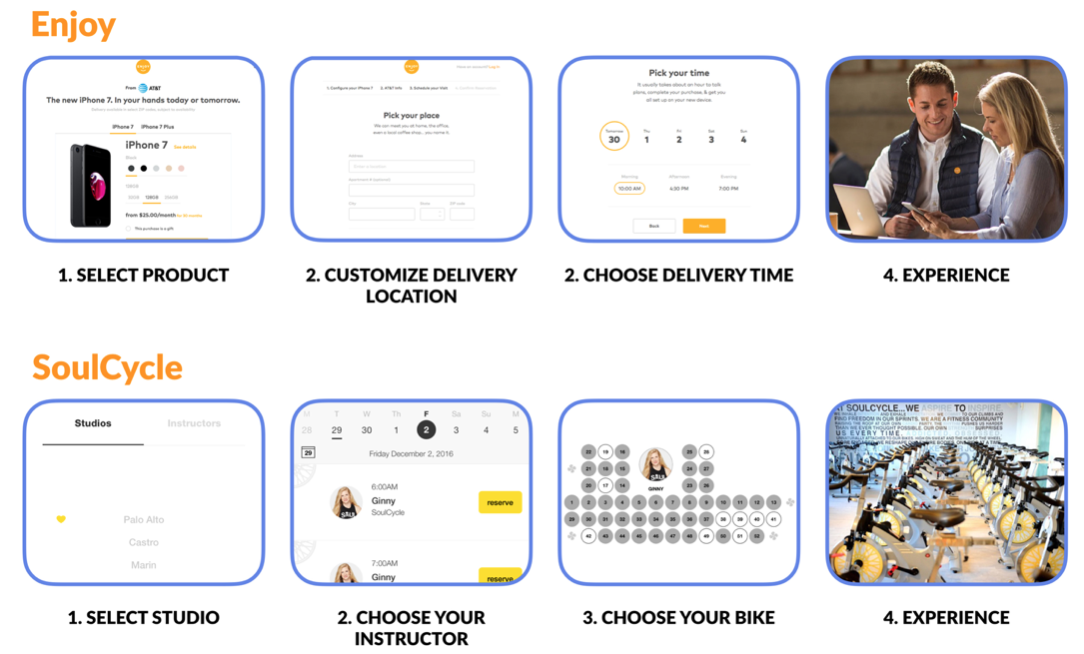

Ultimately, Enjoy is part of a trend that transcends the delivery market. It is focused on creating a delightful experience for people that make digital purchases. In this respect, popular, emerging consumer businesses like SoulCycle are kindred spirits.

There is nothing about what SoulCycle does that can be patented. The casual observer might even mistake it for a “spinning class.” But when you study SoulCycle, you realize that its monster success derives from doing a hundred little things better than anybody else.

First, SoulCycle is a digital commerce platform. You go on your phone. You pick your class, your bike, your instructor, and your session time. Mobile payments are fully integrated.

And then you show up and have a delightful experience. The bikes are specially designed for SoulCycle to develop your “core.” The program emphasizes every muscle in your body, so that after 45 minutes, you’re wiped. The instructors are trained to be both inspirational and aspirational. The music is perfectly choreographed. Despite the heavy sweat, SoulCycle studios sparkle and smell fresh. And there is plenty of cool SoulCycle swag, so you can proudly display that you’re a member of the tribe.

Like Enjoy, SoulCycle starts digitally, and ends with an experience you love. We see a new generation of businesses emerging that are creating advantages through experience.

Tesla

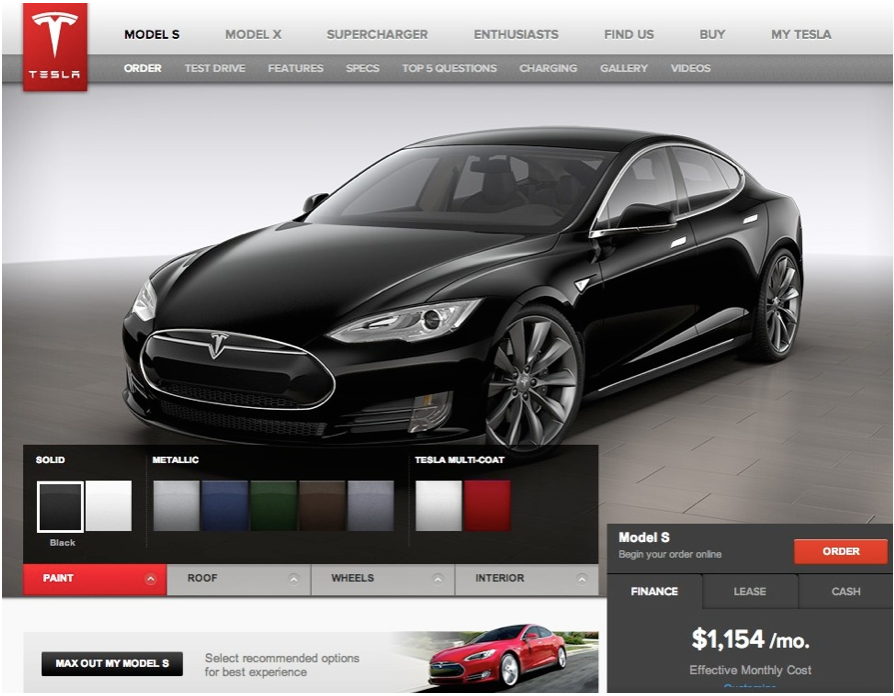

Founded: 2003

Market Value: $31 billion

Why it Matters: As the company rightly notes on its website, “Ordering your Tesla is just like any buying experience on the Internet. Simply choose your options, enter your contact information, and indicate your preferred delivery timing.” Goodbye car dealerships and awkward, high-pressure sales experiences.

The Tesla ordering process begins in a virtual “Design Studio” where buyers customize the appearance of their future car and select various options. Price changes are transparent. Once the order is confirmed, a Tesla “Experience Specialist” follows up to answer any lingering questions you may have, as well as to discuss financing options, trading in your old car, installing charging equipment, and delivery day logistics.

SoulCycle

Founded: 2006

Market Value: Undisclosed ($150+ million estimated annual revenue)

Why it Matters: There is nothing about what SoulCycle does that can be patented. The casual observer might even mistake it for a “spinning class.” But when you study SoulCycle, you realize that its monster success derives from doing a hundred little things better than anybody else.

The bikes are specially designed for SoulCycle to develop your “core.” The program emphasizes every muscle in your body, so that after 45 minutes, you’re wiped. The instructors are trained to be both inspirational and aspirational. The music is perfectly choreographed. Despite the heavy sweat, SoulCycle studios sparkle and smell fresh. And there is plenty of cool SoulCycle swag, so you can proudly display that you’re a member of the tribe.

SoulCycle, which has been preparing for an IPO since a 2015 announcement, saw its revenue hit $112 million in 2014, up from $36 million in 2012, according to its IPO filing.

Uber & Lyft

Founded: Uber (2009), Lyft (2012)

Market Value: Uber ($68 billion), Lyft ($5.5 billion)

Why it Matters: Here’s how the old taxi model works. You stand on the edge of the street, put your hand up in the air while competing with other would-be riders, and pray for a car to swerve to a stop in front of you. Taxi drivers, meanwhile, troll around blindly for fares, relying on dead reckoning and luck to find passengers. The ride doesn’t usually go much better. For starters, the customer is never right. Try suggesting a preferred route. And safety isn’t exactly first.

Ride-sharing platforms like Uber and Lyft are the polar opposite. They create a variety of efficiencies while empowering the customer. Your ride appears where you want it, when you want it. You don’t need physical money — or even a credit card for that matter — to pay your driver. It’s all in the app.

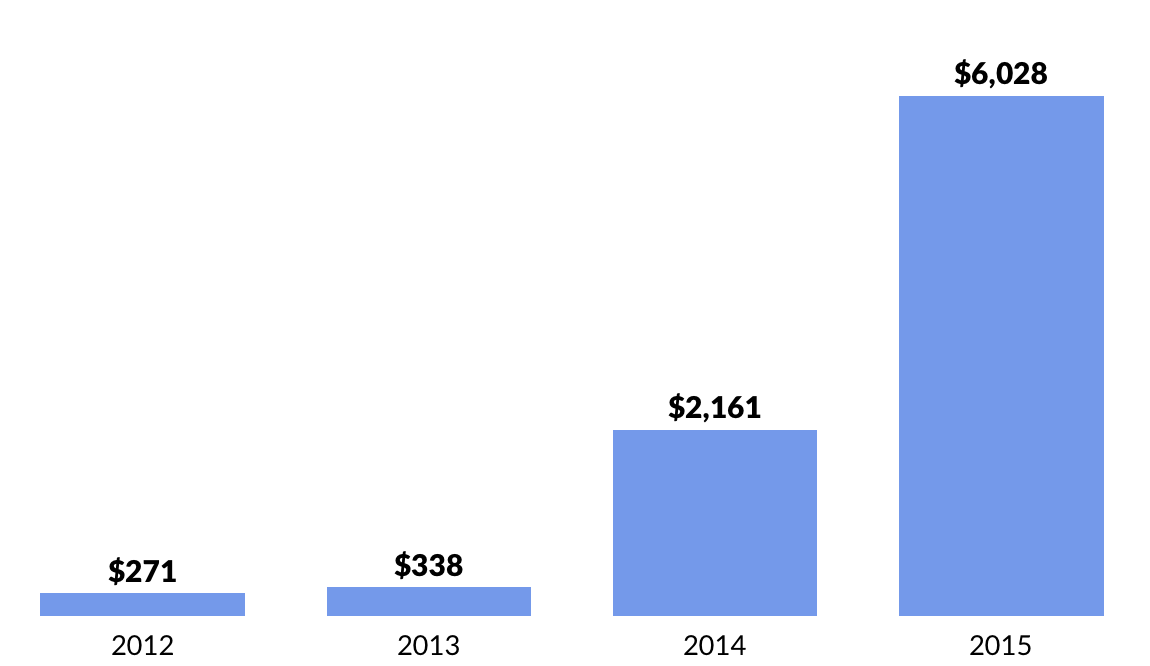

Given two fundamental shifts — efficiency and customer experience — it is no wonder that we are seeing a major industry transformation unfold rapidly before of our eyes. We estimate that ride-sharing has grown from $500 million in 2012 to over $45 billion in 2016 — a 208% Compound Annual Growth Rate (CAGR).

Warby Parker

Founded: 2010

Market Value: $1.2 billion

Why it Matters: On one level, Warby Parker is following a tried and true playbook. They’ve taken a relatively expensive product — glasses, in this case — cut out the middle men (distributors and licensors), and sold it directly to consumers online at a discount to traditional retailers. For $95, you can get a cool pair of glasses, including prescription lenses and shipping. And for every pair purchased, Warby Parker donates a pair to someone in need.

The company sold over one million pairs of glasses in just four years while holding off a slew of copycats because it is creating powerful technology-based lifestyle brand. The buying process includes recommendations based on face shape and style preferences. And then Warby sends you five frames to test out in a stylish box reminiscent of Apple’s packaging. And if you still need help deciding, you can post a picture of yourself using #warbyhometryon and the company will give you feedback.

Warby Parker has built on its popular digital experience with the launch of 12 strategically placed storefronts to reinforce its brand. It plans to have 20 by the end of 2016. It is also investing in new technology to make shopping for frames in stores and online easier, including enabling customers conduct eye exams using their smartphones.

Starbucks

Founded: 1971 (acquired by investor group led by Howard Schultz in 1987)

Market Value: $83 billion

Why it Matters: In November, Starbucks announced its quarterly earnings, narrowly beating analysts’ estimates. But buried among the ho-hum financial reporting was a remarkable development. Over 25% of the company’s U.S. transactions are now paid through the Starbucks app.

Launched in 2011, the Starbucks app is generating six million transactions per month. And with $1.9 billion in prepaid deposits, it’s larger than many banks. Why has it been so successful? Not only does it make the check-out process more efficient and enjoyable, but it reinforces a brand that people love, offering perks and rewards with every purchase.

Snap (Snapchat)

Founded: 2011

Market Value: $18 billion

Why it Matters: In September, Snap announced that it would begin selling Spectacles, a set of connected sunglasses that record 10-second videos and sync seamlessly with the company’s flagship app, Snapchat.

The product roll-out has been marketing gold. Without advanced warning, Snap has dropped unmanned vending machines, or “Snapbots” — into random locations, from Venice Beach to New York City. The machines, which sporadically appear in a map on the company’s website, are followed immediately by throngs of would-be buyers. While the glasses retail for $130, they already sell for as much as $2,500 on eBay.

While Snap may not be in the hardware business in the long run, the company has reminded the World of retail how powerful it can be to create a truly distinct customer experience — not to mention the potential for robot vending machines that are likely shattering records for sales-per-square foot.

—

The Trump rally finally hit the pause button last week, with the S&P 500 falling 1%, NASDAQ dropping 2.7%, and the GSV 300 down 3.7%. The 30-company Dow advanced 0.1% last week, reaching another new record high. Bond yields continued their ascension, with the 10-Year Note yield now at 2.4% Oil prices surged over 10%, with the OPEC cartel agreeing to limit production for the first time in nearly 10 years.

The stocks that are doing the best have low P/E multiples — which makes sense in that as interest rates rise, it makes the future earnings of higher P/E stocks less valuable. What doesn’t make sense is that the growth characteristics of many higher P/E stocks are vastly superior, and P/E multiples aren’t high vis-à-vis growth.

The economy continues to show some good signs, with unemployment falling to 4.6% and strong manufacturing numbers. The bad news is that main reason unemployment is so low is because an increasing number of people have stopped looking for work.

There were no IPOs last week but five are expected to price this week. Ola, the Uber competitor in India, did a “down round” but still received a $3 billion valuation.

We remain optimistic on the Innovation Economy and the outlook for growth companies. Accordingly, we are BULLISH.