Market Snapshot

| Indices | Week | YTD |

|---|

Humans have been able to predict solar eclipses for nearly 5,000 years, assigning a range of rosy and apocalyptic significance to the Sun’s disappearance from the Sky.

The Ancient Chinese revered solar eclipses and associated the event with the promise of health and success for the Emperor. In fact, two astrologers in the court of Emperor Chung K’ang were famously beheaded 2134 BCE for failing to predict the event. Ancient Greeks thought eclipses were a sign that the Gods were angry. In Vietnam, it was believed that a solar eclipse was caused by a giant frog devouring the Sun. Norse cultures blamed the wolves.

This week, as millions of Americans turned their gaze to the sun (some without the appropriate eye protection), we’ve assembled the top companies and innovators to watch in the resurgent area of space innovation.

It was widely reported that the Great American Eclipse cost employers nearly $700 million as people poured out of their workplaces to view the two and a half minute show. But what’s more amazing was the boom of economic activity spurred in cities across the “Zone of Totality.”

Hopkinsville, a small town of 32,000 in Kentucky, welcomed over half a million visitors in one day. All in all, the town experienced a $50 million eclipse boom. The state of Idaho anticipated up to 370,000 visitors during the eclipse — raking in an estimated $43 million in tourism revenue. Some people even Airbnb’d out plots of grass to pitch tents… starting at $100 per night.

While the eclipse boom has come and gone, we’re excited about a potential long boom in space innovation that is just getting started. Here are the companies, innovators, and investors to watch.

FIVE TO WATCH: TOP FUNDED SPACE COMPANIES

The global Space economy comprises approximately $323 billion in annual spending. Key components include launch and ground services, satellite manufacturing, satellite television and communications, government exploration, and military spending. Commercial Space products — including telecommunications, broadcasting, and Earth observation — is the largest sector, reaching $126 billion in 2016, according to the Space Foundation.

To date, global Space innovation has effectively existed as a closed platform built on funding from government agencies — headlined by NASA, which spends approximately $20 billion per year on a variety of initiatives. The net result is that a small ecosystem of multi-billion dollar aeroSpace companies has become a fixture, subsisting for decades on government contracts. Companies like Boeing, Lockheed Martin, and Airbus — together commanding more than $200 billion in market value — have provided a full range of services to get people, satellites, and supplies into Space.

New entrants to the Space innovation economy are unlocking economic opportunity and redefining the realms of possibility at a rapid pace. And they are serving notice to aerospace incumbents.

In 2015, investors poured a record $2.3 billion into Space startups, with SpaceX raising $1 billion and OneWeb and O3B Networks raising $500 million and $460 million, respectively. In 2016, funding fell back to earth, with 40 venture rounds representing $1.5 billion in funding, according to CB Insights.

1. OneWeb

Founded: 2012

Headquarters: London, UK

Total Funding: $1.7 billion

Investors: Airbus, Qualcomm, Virgin Group, Softbank, Intelsat, Totalplay, Hughes Network Systems

What They Do: OneWeb is deploying “constellations” of low-orbit micro-satellites — or “nanosats” — to provide global high-speed, low latency broadband access. The company’s goal is to put more than 2,600 satellites in orbit by 2019. It could be a blue print for bridging the digital divide that has left over half of the World’s population without Internet access. In December 2016, OneWeb completed a $1.2 billion financing led by SoftBank. It is using the proceeds to build the world’s first high volume satellite production facility in Florida. At scale, the factory will be able to produce 15 satellites per week at a fraction of current costs. Ultimately, the company aims to bring internet access across the entire world using their satellites by 2027.

2. SpaceX

Founded: 2002

Headquarters: Hawthorne, California

Total Funding: $1.5 billion

Investors: Founders Fund, Fidelity, DFJ, Capricorn Venture Partners, Google, Valor Equity Partners

What They Do: SpaceX was founded by Tesla CEO Elon Musk with the twin goals of creating technologies to reduce space transportation costs and enabling the colonization of planets like Mars. Until recently, the rule with rockets was that what goes up comes down in pieces. Accordingly, the cost of getting anything into orbit — from satellites to people and supplies — has routinely been upwards of $250 million per launch. It would be like having a commercial aviation industry where planes were flown once and then discarded. SpaceX has developed a class of reusable Falcon launch vehicles that reduce costs by nearly 10x. This April, SpaceX made history by launching and landing a pre-used rocket on the bullseye of a barge floating off the coast of Florida.

26896 (1)56280.jpg)

3. Virgin Galactic

Founded: 2004

Headquarters: New York, New York

Total Funding: $600+ million

Investors: Virgin Group, Aabar Investments (Abu Dhabi)

What They Do: Founded by Sir Richard Branson, Virgin Galactic plans to provide suborbital space flights to tourists through the development of viable commercial spacecraft. The company’s proprietary fleet of six-passenger “SpaceShipTwo” spacecraft will be released from planes flying 10 miles above Earth. Passengers will then be treated to a 60-mile voyage through space before returning home. The company aims to launch its first commercial flights in 2018 at a cost of $250,000 a seat.

4. Blue Origin

Founded: 2000

Headquarters: Kent, Washington

Total Funding: $500+ million

Investors: Jeff Bezos

What They Do: 18-year old Jeff Bezos declared in his high school valedictorian speech that the, “future of mankind is not on this planet.” In 2000, using a considerable war chest filled with the spoils of Amazon, he founded Blue Origin to turn his childhood dream into a reality. The company’s mission is to lower the cost of spaceflight, accelerate intergalactic exploration, and utilize the natural resources of the space system around us. In stealth mode for much of its existence, Blue Origin surprised the world in November 2015 by announcing that its New Shepard rocket successfully completed a controlled, upright landing after a brief visit above the Space line — a feat that had never been accomplished before. Bezos has personally funded the company to the tune of over $500 million and according to Bloomberg, he plans on selling $1 billion of Amazon stock annually to fund it going forward.

5. Kymeta

Founded: 2012

Headquarters: Redmond, Washington

Total Funding: $217.6 million

Investors: Bill Gates, Intelsat, Kresge Foundation, Lux Capital

What They Do: Kymeta develops next generation satellite antennas to unlock a global network of high-throughput bandwidth. Satellite-enabled communication networks offer over 5,000 times the capabilities of comparable terrestrial networks. The problem is that satellite networks are hard to reliably access due to technical challenges and cost constraints. Kymeta is bridging the gap.

16 TO WATCH: BILLIONAIRE SPACE CLUB

Much of the recent Space boom has been spurred by a billionaire’s club, led by Elon Musk, Jeff Bezos and Richard Branson. According to Bloomberg, 16 of the World’s richest 500 people have an investment in a Space enterprise. Together, this group has an estimated $512 billion at its disposal to satisfy its Sci-Fi fantasies.

FIVE TO WATCH: TOP SPACE INVESTORS

While many of the early space innovation headlines have centered on high-profile aerospace ventures from a billionaires club, VCs are also starting to bet big. DFJ’s Steve Jurvetson frames the unique opportunity in this way:

“Compared to other industries, I have never seen such an enormous margin for improvement. There’s this canonical thing about a startup needing to pitch a 10x improvement to be a worthwhile investment. You rarely see an entrepreneur pitch a 100x improvement. But in Space we’ve seen 1,000x, and really, we’ve seen 10,000x.”

Investors poured $2.3 billion and $1.5 billion into Space startups in 2015 and 2016, respectively. Notable financings in 2017 include SpaceX ($350 million), Rocket Lab ($75 million) and Kymeta ($73.6 million).

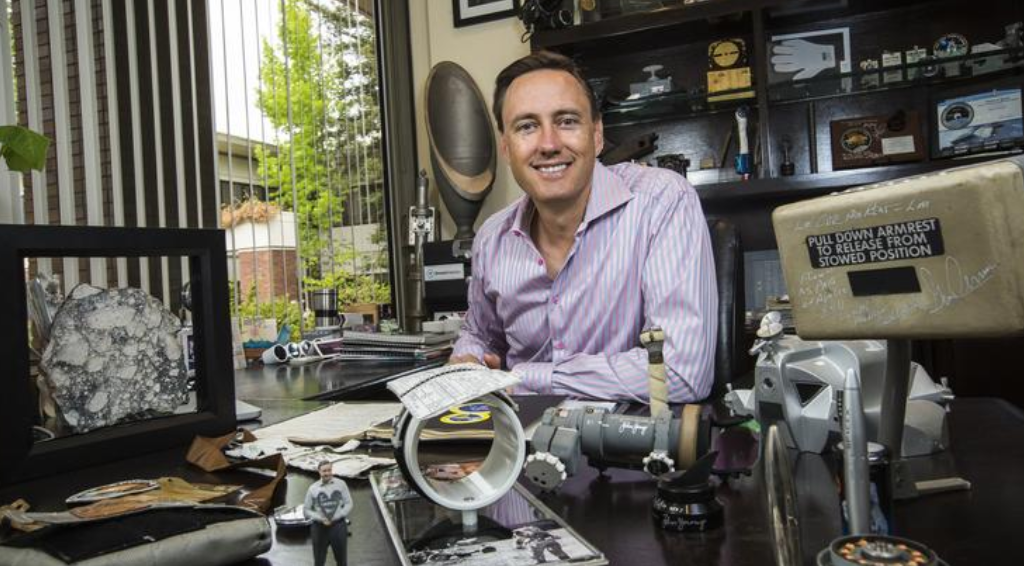

DFJ (Steve Jurvetson)

Notable Investments: SpaceX, Planet, Mapbox

Draper Fished Jurvetson (DFJ) has emerged as an early leader among VCs investing in Space enterprises, with Partner and Managing Director Steve Jurvetson at the helm. Jurvetson — the “J” in DFJ — read science fiction as a kid and dreamed of becoming an astronaut, even going to space camp at the Johnson Space Center in Texas. He lead an early investment in SpaceX, where he sits on the board of directors, and has also backed the satellite company Planet. Jurvetson’s office in Menlo Park has become something of a Space museum, displaying artifacts ranging from chunks of Mars to the door handle from NASA’s Apollo 11 Command Module.

Bessemer Venture Partners

Notable Investments: Rocket Lab, Skybox Imaging (now Terra Bella)

Bessemer was one of the earliest venture firms to invest in space startups. The firm led Skybox’s venture round in 2010 — back when Space technology was more science fiction than reality. In March 2015, Bessemer announced a Spacetech roadmap, formalizing their intent to have a hands-on role in developing the future of the Space economy. The firm intends to focus on companies developing “picks and shovels” for Space, including sensors, communications, data processing, rockets, propulsion, avionics and more.

Alphabet

Notable Investments: O3b Networks, SpaceX, Terra Bella. Orbital Insight, Moon Express

Alphabet began its foray into Space in 2008 with an investment in O3b Networks, a play to accelerate the availability of satellite-enabled global broadband internet. Since then, Alphabet has been actively investing in mapping and satellite startups through both Google and sidecar investment vehicles, CapitalG and Google Ventures (GV). The common thread is a desire to broaden access to the Internet, while improving its to data that can feed its many applications — from Search, to Google Maps, autonomous vehicles, and adjacent analytics.

Starburst Ventures

Starburst Ventures raised a $200 million debut fund in November 2016 to back early stage Space startups as extension of the Starburst Accelerator, which was founded in 2012. Starburst Ventures will aim to back 35 startups over the next three years according to CEO and founder Francois Choppard, a former aviator and Airbus engineer.

Space Angels Network

Notable Investments: Planet, Vector Space, Planetary Resources, World View Enterprises, Accion Systems, NanoRacks, XCOR Aerospace

The Space Angels Network is a group of angel investors who are exclusively focused on Space innovation. The group typically invests between $500K to $1 million into early stage Space startups and currently is comprised of over 200 accredited investors across 26 counties. Notable names in the Space Angels Network portfolio, which now comprises over 33 companies, include Planet, Vector Space, Planetary Resources, World View, and Accion Systems.

FIVE TO WATCH: ROCKET + SPACECRAFT COMPANIES

Elon Musk’s SpaceX and Jeff Bezos-backed Blue Origin are shattering the old Space cost paradigm by making rocket reusability a reality. Until recently, the rule with rockets was that what goes up comes down in pieces. Accordingly, the cost of getting anything into orbit — from satellites to people and supplies — has routinely been upwards of $250 million per launch. It would be like having a commercial aviation industry where planes were flown once and then discarded.

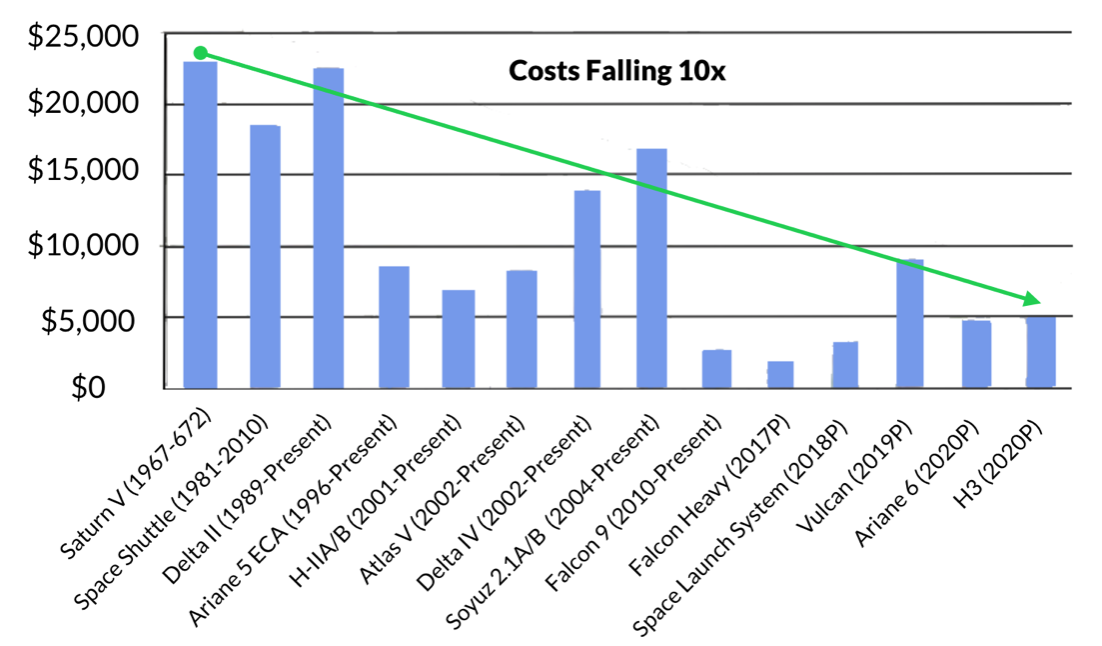

All told, Goldman Sachs estimates that improved rocket design and logistics have driven down launch costs 10x over the last decade — more than the entire previous history of Space exploration combined. The cost-to-LEO metric, which measures the cost to for one rocket to launch 1 kilogram of cargo into low Earth orbit, is used to gauge the differences between launch cost between rockets.

During the 1960s, Saturn V’s cost-to-LEO was between $20,000 to $25,000. Today, SpaceX’s Falcon 9’s cost-to-LEO is between $4,000 to $5,000. SpaceX hopes to bring the cost-to-LEO even further down to $1,700 with their new Falcon Heavy rocket, set to take off in late-2017.

SpaceX

Founded: 2002

Headquarters: Hawthorne, California

Total Funding: $1.5 billion

Investors: Founders Fund, Fidelity, DFJ, Capricorn Venture Partners, Google, Valor Equity Partners

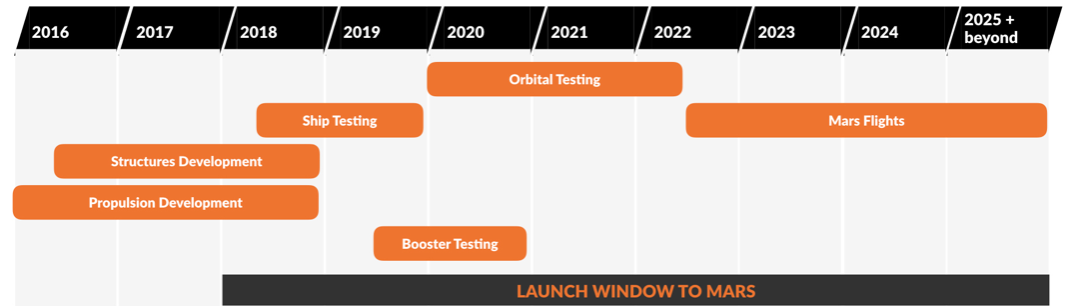

What They Do: Beyond transforming the space industry with reusable rockets that dramatically reduce cost (see SpaceX description above), Elon Musk has grabbed headlines with a commitment to colonize Mars in his lifetime. His goal is to have humans on the Red Plant by 2022. This isn’t PR fodder. SpaceX’s Interplanetary Transport System already lays out a framework to bring 100 people to Mars per trip in the early going. Musk’s ultimate vision is to have a Martian city of millions, seeded by tens of thousands of trips over the span of 40-100 years.

Blue Origin

Founded: 2000

Headquarters: Kent, Washington

Total Funding: $500+ million

Investors: Jeff Bezos

What They Do: The company’s mission is to lower the cost of spaceflight, accelerate intergalactic exploration, and utilize the natural resources of the space system around us. In stealth mode for much of its existence, Blue Origin surprised the world in November 2015 by announcing that its New Shepard rocket successfully completed a controlled, upright landing after a brief visit above the Space line — a feat that had never been accomplished before.

Rocket Lab

Founded: 2006

Headquarters: Los Angeles, California

Total Funding: $75 million

Investors: Bessemer Venture Partners, Data Collective, Promus Ventures, Khosla Ventures

What They Do: Rocket Lab is democratizing access to Space by dramatically lowering small satellite launch costs with a vehicle designed specifically for low earth orbit deployments. The company currently counts NASA, Moon Express, and Spire as customers and aims to launch over 50 times per year at full operation. Rocket Lab successfully launched their first orbital-class rocket in May 2017 continues to refine their infrastructure for commercial scale.

Vector

Founded: 2016

Headquarters: Tuscon, Arizona

Total Funding: $27.8 million

Investors: Sequoia Capital, Lightspeed Venture Partners, Shasta Ventures, NASA, DARPA

What They Do: Vector, founded by early SpaceX employees, designs and flies low-cost, rapid-launch rockets. It plans on achieving cost-efficiency by launching more than 100 rockets per year. The Vector-R “micro-rocket” aims to lower to cost of launches to $3 million, or twenty times cheaper than SpaceX. The company successfully launched a prototype of the Vector-R this month.

Bagaveev Corporation

Founded: 2013

Headquarters: San Mateo, California

Total Funding: $1 million +

Investors: Y Combinator, Data Collective, Boost VC

What They Do: Bagaveev is developing a platform to create and launch 3-D printed rockets that are capable of delivering small satellites into Earth’s orbit. The company aims to make rockets ubiquitous by massively simplifying the manufacturing and launch process. Bagaveev tested its first rocket six months after the company was founded but is is still in the early stages of development.

FIVE TO WATCH: SATELLITE COMPANIES

Over the past decade we have become increasingly dependent on satellites to complete a variety of daily activities, from communication to commuting. Smartphones and tablets used by billions of people are powered by processors that rely on satellite-enabled position, navigation, and timing (PNT) functionality. Apps like Google Maps, or Uber and Lyft wouldn’t work without PNT. (Disclosure: GSV owns shares in Lyft.)

According to the Space Foundation, 262 satellites were launched in 2015. By contrast, between 2000 and 2010, only 108 satellites were launched per year on average. Two key factors are driving this trend. First, there has been a proliferation of companies providing satellite launch and management services that make it more efficient and affordable for to place satellites into orbit. Secondly, the miniaturization of satellites, enabled by smaller, lower cost advanced components, as driven down costs and reduced launch constraints.

Kymeta

Founded: 2012

Headquarters: Redmond, Washington

Total Funding: $217.6 million

Investors: Bill Gates, Intelsat, Kresge Foundation, Lux Capital

What They Do: Kymeta develops next generation satellite antennas to unlock a global network of high-throughput bandwidth. Satellite-enabled communication networks offer over 5,000 times the capabilities of comparable terrestrial networks. The problem is that satellite networks are hard to reliably access due to technical challenges and cost constraints. Kymeta is bridging the gap.

OneWeb

Founded: 2012

Headquarters: London, UK

Total Funding: $1.7 billion

Investors: Airbus, Qualcomm, Virgin Group, Softbank, Intelsat, Totalplay, Hughes Network Systems

What They Do: OneWeb is deploying “constellations” of low-orbit micro-satellites — or “nanosats” — to provide global high-speed, low latency broadband access. The company’s goal is to put more than 2,600 satellites in orbit by 2019. It could be a blue print for bridging the digital divide that has left over half of the World’s population without Internet access. In December 2016, OneWeb completed a $1.2 billion financing led by SoftBank. It is using the proceeds to build the world’s first high volume satellite production facility in Florida. At scale, the factory will be able to produce 15 satellites per week at a fraction of current costs. Ultimately, the company aims to bring internet access across the entire world using their satellites by 2027.

O3b Networks

Founded: 2007

Headquarters: The Hague, Netherlands

Total Funding: $1.8 billion (acquired by SES in 2016)

Investors: Allen & Company, Google, HSBC, North Bridge, SES

What They Do: Launched by OneWeb Founder, Greg Wyler, O3b (which stands for “Other 3 billion”) is developing a satellite-enabled network to bring fiber-speed internet connectivity to billions of people. At full deployment, the company’s satellite constellation could make affordable, ubiquitous Internet connectivity a reality for over 70% of the world’s population.

Spaceflight Industries

Founded: 1999

Headquarters: Seattle, Washington

Total Funding: $53.5 million

Investors: Vulcan Capital, RRE Ventures, Mithril Capital Management

What They Do: Spaceflight Industries is making it more efficient and affordable for companies to place satellites into orbit. The company offers a comprehensive suite of launch and mission management capabilities to allow a broader range of companies to deploy space and satellite-enabled services.

Accion Systems

Founded: 2014

Headquarters: Boston, Massachusetts

Total Funding: $9.5 million

Investors: Founders Fund, Founders Collective, U.S. Department of Defense, Slow Ventures, RRE Ventures, Shasta Ventures

What They Do: Using technology designed at MIT, Accion Systems is developing a groundbreaking miniature propulsion system for small satellites. While so-called “nanosats” can be deployed into low orbit at a dramatically reduced cost compared to traditional satellites, they have limited flexibility once deployed due to the lack of propulsion systems, which have traditionally been too bulky to attach. Accion is changing this dynamic with propulsion systems the size of a penny that generate thrust by accelerating charged particles at very high speeds.

FIVE TO WATCH: IMAGING + ANALYSIS COMPANIES

As James Crawford, the founder and CEO of satellite imaging startup Orbital Insight has observed, “In the old days, when satellites were like mainframes, incredibly expensive, if you managed to get an image, you probably spent $10,000 on them.” New satellite technology fundamentals, coupled with declining costs for computing power and data storage, have changed the paradigm.

Lower-cost satellites can now be deployed to capture enormous quantities of imaging data that can be applied across a wide range of business functions. Weather services, for example, can utilize sensors on Nanosats to gather more timely information, to the benefit of farmers, transportation and logistics businesses, and rescue workers. Government agencies can analyze imagery to monitor deforestation and environmental impact over time. The list goes on.

Orbital Insights

Founded: 2013

Headquarters: Mountain View, California

Total Funding: $50 million

Investors: Sequoia Capital, GV, In-Q-Tel, Lux Capital, Bloomberg Beta

What They Do: Orbital Insights analyzes satellite data to provide actionable intelligence and insights. By analyzing millions of satellites images, the company provides knowledge on macro socio-economic trends that otherwise go unnoticed. For example, the company conducted a historical analysis on cars in the parking lots of Ross Stores. It successfully forecasted the retailer’s better-than-expected quarterly performance. Already, more than 70 hedge funds and governmental agencies rely on Orbital Insight’s algorithms to monitor economic trends. The applications for satellite data will continue expand rapidly across industries as technology and services mature.

MapBox

Founded: Washington, D.C.

Headquarters: 2010

Total Funding: $63.2 million

Investors: DFJ, Knight Foundation, Thrive Capital, Promus Ventures, Foundry Group

What They Do: Data from Space will continue to diffuse into broader industries and data-platform Mapbox is one of the companies leading the charge by offering the building blocks to enhance satellite maps using data. Mapbox counts companies like Foursquare, Pinterest, The Weather Channel and Uber as customers and reaches over 300 million people monthly through the apps it powers. The company entered the autonomous car market with Mapbox Drive in 2016. Through Drive, Mapbox will provide car companies the software to enhance autonomous driving capabilities by integrating navigation data with real-world driving conditions derived from satellite observations.

Spire

Founded: 2012

Headquarters: San Francisco, California

Total Funding: $66.5 million

Investors: Bessemer Venture Partners, Lemnos Labs, Mitsui, Promus Ventures, RRE Ventures, Shasta Ventures

What They Do: Founded in 2012, Spire is on a mission to eradicate the “data dead zones” that exist across the Earth’s oceans. More than 50 nautical miles from any coastline, connections to the modern World are effectively severed. Tracking systems for ships leave mariners and the cargo they transport vulnerable, while letting illegal activity go unchecked. You can track a UPS truck to a city block, but cargo ships carrying millions of dollars worth of goods remain elusive. The company is also analyzing environmental patterns to predict the weather and currently produces more than 100,000 weather models daily. If done with high fidelity, Spire’s weather predictions could save businesses billions of dollars.

Planet

Founded: 2010

Headquarters: San Francisco, California

Total Funding: $183 million

Investors: Founders Fund, Data Collective, AME Cloud Ventures, Felicis Ventures, First Round, IFC, O’Reilly AlphaTech Ventures, Lux Capital, DFJ, Capricorn

What They Do: With nearly 150 “Dove” nanosats in Space, Planet has the largest fleet of Earth imaging satellites in the market — among private companies and government agencies alike. In February 2017 alone, Planet launched 88 satellites into orbit at once, enabling it to photograph every square mile of Earth’s land mass daily — a total of 57 million square miles, up from roughly 19 million square miles pre-launch. This year, Planet acquired Alphabet’s satellite imagery subsidiary Terra Bella (a company that Alphabet purchased in 2014 for $500 million). With this acquisition, Planet will be able to scan the world in medium resolution to detect macro changes, while using Terra Bella’s high-resolution satellites to pinpoint and track specific developments on a finer scale.

Descartes Labs

Founded: 2014

Headquarters: Santa Fe, New Mexico

Total Funding: $38.3 million

Investors: Data Collective, Correlation Ventures, TenOneTen Ventures, Crosslink Capital, March Capital Partners

What They Do: By analyzing mass quantities of satellite data, Descartes Labs aims to be the planet’s “fitness tracker” by monitoring everything that changes on the Earth’s surface — from deforestation to transportation trends. On a daily basis, the company’s artificial intelligence processes five terabytes of data, analyzing each image, pixel by pixel, to determine trends and differences. The company is already able to predict the yield of cornfields with 99% accuracy and it hopes to deploy its technology to anticipate a broad range of Global macro trends.

FIVE TO WATCH: “MOONSHOT” SPACE COMPANIES

Elon Musk has grabbed headlines with a commitment to colonize Mars in his lifetime. His goal is to have humans on the Red Plant by 2022. Musk even recently enlisted the services of Jose Fernandez — the acclaimed costume designer for superhero movie franchises including Batman and Captain America — to design “stylish and heroic” Spacesuits for the company’s astronauts. Beyond interplanetary colonization, as entrepreneurs continue to apply new ideas and technologies to Space, we expect a drumbeat of game-changing “moonshot” businesses to emerge.

Astroscale

Founded: 2013

Headquarters: Singapore, Singapore

Total Funding: $67.7 million

Investors: JAFCO, OSG Corporation, ANA Holdings, Innovation Network Corporation of Japan

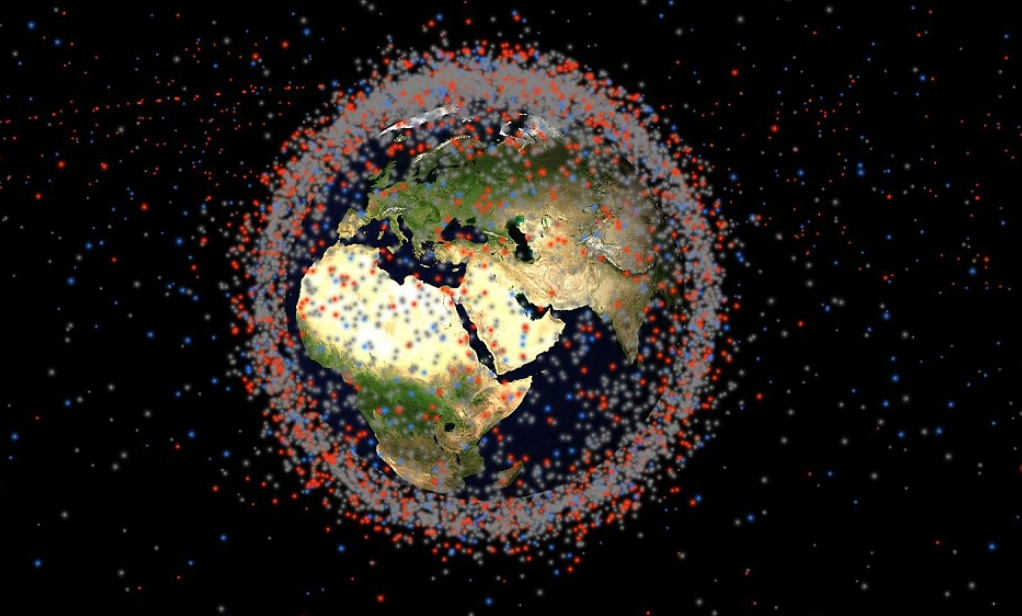

What They Do: Over the past fifty years, low Earth orbit has been littered with Space debris. The United States Air Force tracks up to 23,000 pieces of “junk” that are large enough to be detected from the ground. With increasing Space activity, the risk of dangerous collisions with satellites and manned aircraft is increasing. Moving at rates upwards of 17,000 miles per hour, even the tiniest pieces of debris are deadly projectiles.

Mitsunobu Okada, the founder of Astroscale, aims to solve this problem with a service that is designed to intercept and remove debris from low Earth orbit. Astroscale does this by using a glue-like adhesive that will stick to debris and drag it out of orbit, burning up upon re-entry to Earth.

Planetary Resources

Founded: 2010

Headquarters: Redmond, Washington

Total Funding: $50.2 million

Investors: James Cameron, Eric Schmidt, Larry Page, Tencent, ZhenFund, Grishin Robotics

What They Do: Asteroids are an existential threat to Earth, but they are also rich in precious metals. Goldman Sachs estimates that the value of platinum on an asteroid the size of a football field to be between $25-50 billion. The next “gold rush,” in other words, might be in the sky. To this end, Planetary Resources is developing the capability to mine resources from asteroids. Asteroids are also rich in water, which could be converted into rocket fuel to refill rockets on long-haul Space journeys.

World View Enterprises

Founded: 2013

Headquarters: Tuscon, Arizona

Total Funding: $15.3 million

Investors: Norwest Venture Partners, Canaan Partners

What They Do: World View Enterprises is a space tourism company that takes individuals on sub-orbital journeys using high-altitude balloons. These balloons take voyagers 100,000 feet (nearly 20 miles) up and allow passengers to view Earth from the cosmos. The company envisions that its flights will last five to six hours once commercialized and will initially cost upwards of $75,000 per person. The company is also developing a vehicle which it intends to send into the stratosphere for scientific research.

NovaWurks

Founded: 2011

Headquarters: Los Alamitos, California

Total Funding: Undisclosed

Investors: N/A

What They Do: NovaWurks is developing a modular spacecraft that has the ability to conform to the capability requirements of any payload. In 2013, the company received a contract worth up to $46.2 million from DARPA to apply its technologies toward the agency’s Phoenix project, which is focused on lower cost, more flexible Space systems.

Made in Space

Founded: 2010

Headquarters: Mountain View, California

Total Funding: N/A

Investors: N/A

What They Do: Made in Space develops 3-D printers for use in microgravity. Their printer, the Zero-G Printer, was the first manufacturing device deployed in Space. By bringing manufacturing capabilities to Space, Made in Space could significantly reduce the cost of long-haul and deep Space missions by reducing the need for redundant parts to be carried or resupplied from Earth. Additionally, the company recently revealed a project dubbed Archinaut, a robot-operated factory for Space.

A special thanks to this week’s contributors: Lindsey Yee, Lawrence Williams, Mike Hwang, Nadir Bagaveyev and others.