Market Snapshot

| Indices | Week | YTD |

|---|

Desmond Tutu, a lion of the anti-apartheid movement in South Africa, once remarked that, “when the missionaries came to Africa, they had the Bible and we had the land. They said ‘Let us pray.’ We closed our eyes. When we opened them we had the Bible and they had the land.”

For generations, the cradle of civilization has been captive to colonial overreach. Economic development has been constrained by corruption and in some cases, chaos, resulting from arbitrarily defined borders and hastily-assembled export economies focused on commodities demanded by the developed world. But for those who’ve had their “eyes closed” over the last five years, a different narrative is taking shape across the African continent. It’s a story of renewal, growth, and innovation.

Consider Andela, which announced this week that it closed a $40 million Series C financing led by South Africa’s CRE Venture Capital — the largest venture round led by an African firm. Launched by 2U co-founder Jeremy Johnson in 2014, Andela identifies high-potential, motivated talent in Africa, molds them into world-class software developers, and pairs them with companies as remote team members. It now counts over 100 corporate partners — including Mastercard, Viacom, and others — and notable backers like GV (Google Ventures), Spark Capital, and the Chan Zuckerberg Initiative.

As the New York Times noted in its coverage the financing, Andela was launched with a founding team of six — three Africans, two Americans and a Canadian — and a first class of four students. It now employs over 800 people, and it expects to double its team over the next 12 months. While Andela is headquartered in New York, 90% of its workers are in Africa, including offices in Lagos, Nairobi, and Kampala, Uganda.

The Andela story distills the broader opportunity in Africa. It is capitalizing on the country’s undertapped talent. It is backed by local capital alongside bluechip global venture investors. And it is developing a learning and employment model that rethinks education systems that have been employed by western countries for centuries.

And it’s just the beginning.

DEMOGRAPHICS IS DESTINY

Looking in the rearview mirror, the economic engine for the last 100 years was the United States, Europe, Japan, and Canada. In 2000, with just 9% of the global population, these countries contributed over 50% of global GDP. But over the last 15 years, GDP growth has been flat-to-negative. Today the old guard contributes just 41% of Global GDP.

A key driver behind this change has been aging populations. Over 26% of these populations are over the age of 60 while just 15% are under the age of 15. In Japan last year, there were more adult diapers sold than baby diapers. These dynamics are not changing anytime soon. The average (weighted) fertility rate in Canada, the United States, Europe, and Japan is 1.6. At a fertility rate under two, you’re essentially dying.

Where is the growth and opportunity as we look ahead? One area to look is a group of countries we call the “VChIIPs” — Vietnam, China, India, Indonesia, and the Philippines. The VChIIPs are home to over 43% of the global population and command 28% of global GDP, growing at 6.7%. If you look at the demographics, they are the mirror opposite of the world’s developed countries. Just 11% the VChIIP population is older than 60, 24% is younger than 15, and the fertility rate is 2.3, driving organic growth.

Source: International Monetary Fund, World Bank, GSV Asset Management

*2017, as reported by the International Monetary Fund

But Africa is on deck. It claims five of the 10 fastest growing countries by population and three of the 10 fastest growing countries by GDP.

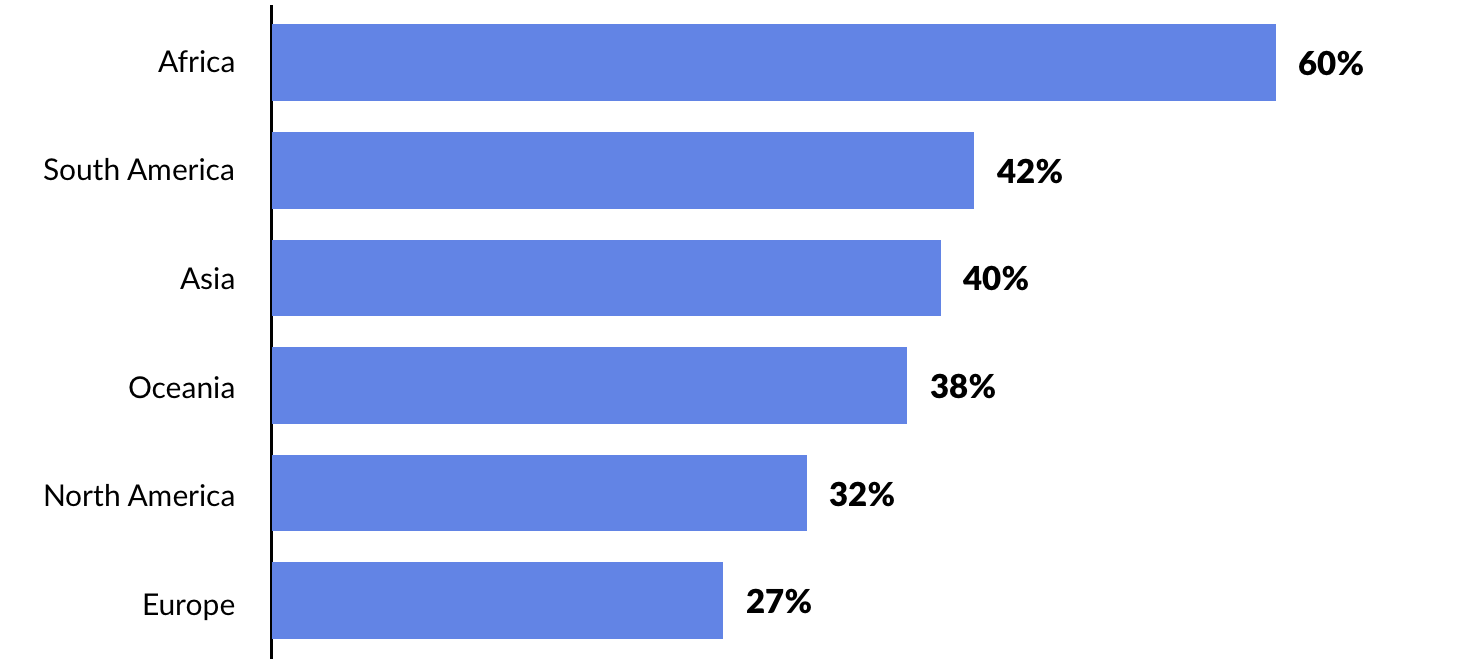

In world of stagnant or declining fertility rates, Africa’s remains high at 4.6, which is three times greater than the average developed country. In fact, the African continent is collectively home to the youngest population in the world. Over 60% of its inhabitants are under the age of 25 and 41% are under the age of 15. Less than 6% are over the age of 60.

As the World’s population is projected to reach 9.5 billion by 2050, approximately half of the growth in the next 35 years is expected to occur in Africa. In this period, Nigeria is projected to overtake the United States as the 3rd most populous country in the World. Over 400 million people will call a country one-tenth the size of the U.S. home.

Look for GDP growth to accelerate as the continent continues to develop fundamental infrastructure while broad segments of the continent’s 1.2 billion people claw their way to the middle class. Consumer spending power in Africa has risen from an estimated $470 billion in 2000 to over $1.1 trillion in 2016.

VENTURE INVESTMENT + STARTUP ACTIVITY

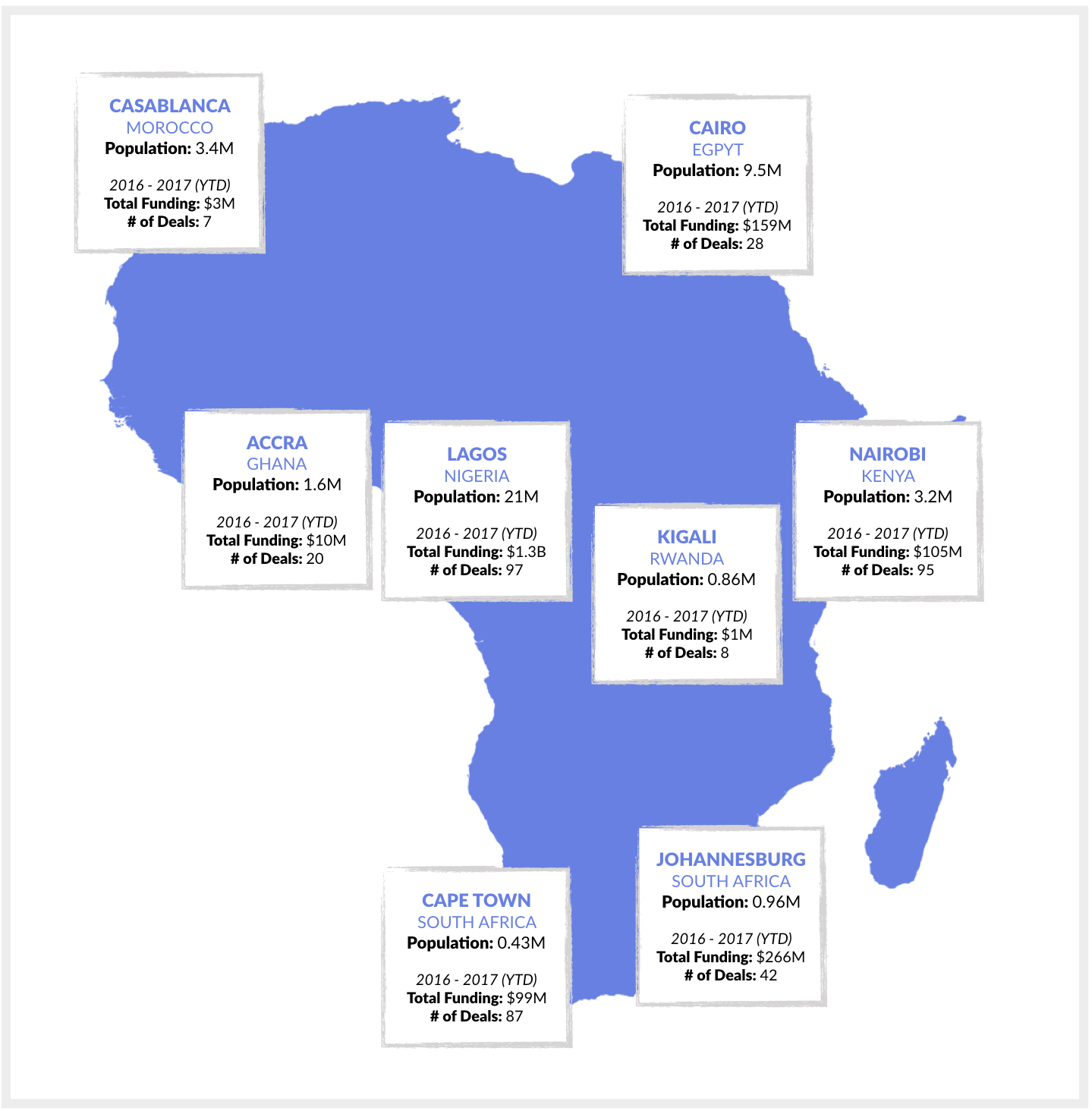

Startup activity and venture investment in Africa is has been primarily concentrated in Kenya (Nairobi), South Africa (Johannesburg + Capetown), and Nigeria (Lagos). Combined, these countries account for 3.2 of the 4.4 billion dollars invested in Africa over the past two years. But other major hubs of innovation are emerging.

The government of Rwanda, for example, has actively invested to position Kigali as a regional tech hub. The country has built fiber-optic cable networks to bring broadband access across the country and through its $100 million venture fund, aims to produce 100 technology companies valued over $50 million by 2030.

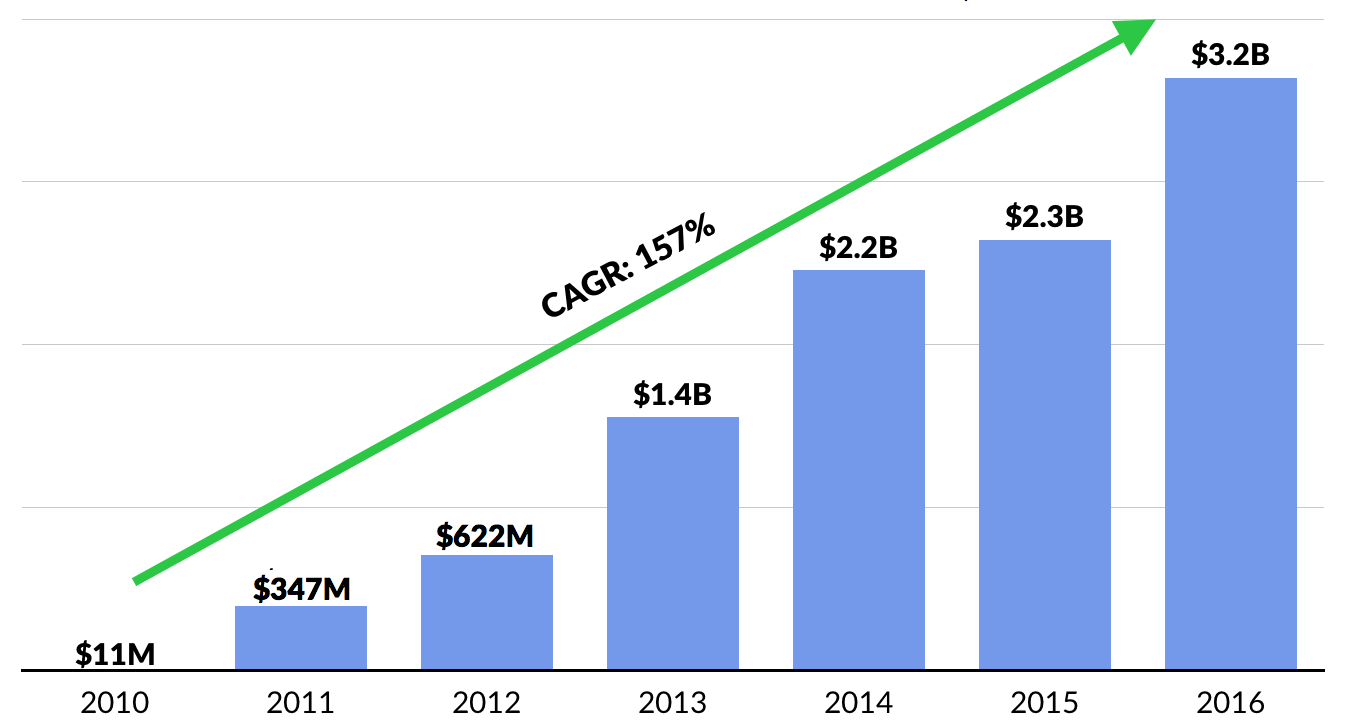

Venture investment into African startups has been rapidly increasing as entrepreneurs launch viable businesses targeting a defined growth opportunity. In 2010, only $11 million was invested into Africa startups. It ballooned to $3.2 billion in 2016.

2016’s massive year was largely due to Jumia Group’s (formerly Africa Internet Group) massive financings. Jumia — Africa’s first Unicorn — was founded in 2012 in Lagos, Nigeria, and its footprint today spans 23 African countries. The company operates a portfolio of e-commerce businesses, offering everything from consumer products, to travel services, homes, groceries, jobs, and more. The company has raised over $500 million from investors including Goldman Sachs, Rocket Internet, AXA Group, MTN, and Orange.

The most well-funded African startups typically fall into three categories: Internet Infrastructure, Mobile Payments, and Online Marketplaces. But other companies such as Zipline (drone delivery of key medical products) and Andela (technology talent development) are broadening the aperture.

South Africa based Naspers, one of the largest digital consumer platforms (commerce & entertainment) in the world with a $100+ billion market value, has played an enormous role in investing and supporting startups in Africa and around the world. Notable investments include Tencent (it owns 30%), Flipkart, Delivery Hero, Foodpanda, FarmLogs, and more.

WHAT’S NEXT: LEAPFROGGING THE WORLD

Africa missed the PC revolution, but it is “leapfrogging” into the smartphone age. Today, there are over 290 million smartphone users across the continent, a number that is projected to grow to 900+ million by 2021.

According to The Economist and the GSMA, an international trade body, for every 10% increase in phone penetration in poor countries, productivity improves by more than four percentage points. A doubling in mobile-data usage increases annual growth in GDP per person by half a percentage point.

But the ability to leapfrog to new technologies, business models, and ideas creates compounding returns. Mobile phones, for example, have enabled African countries with limited banking and payment infrastructure to become leaders in mobile payments. Over 43% of Kenya’s GDP flows through M-Pesa, a telecom-based payment platform. It has been a true pioneer in the mobile payments industry and set the stage for other emerging services, such as Paytm (India), AliPay + Ant Financial (China), GoPay (Indonesia), and Venmo (United States).

While it is unrealistic to expect that African countries will leapfrog their way to advanced economies, the lack of infrastructure across the continent leads to massive opportunities for innovation without the constraints of developed countries. Paradoxically, this often creates a window to the future.

Today in Rwanda, Zipline is using drones to to deliver blood from Rwandan blood banks to rural areas for emergency transfusions. Right now, the country struggles to get blood to remote clinics that might not have a reliable way to store it, and can’t predict in advance which blood types they’ll need. Furthermore, 75% Rwanda’s roads are unpaved and often unusable during the rain season, making them impassable to the vehicles that are deployed to make emergency medical deliveries.

Working with UPS and vaccine distributor Gavi, Zipline’s goal is to have 15 autonomous aircraft deployed daily, making 150 deliveries to 21 medical stations throughout the Western half of Rwanda. With the addition of a second hub, the company believes that they can service the entire population of 11 million people.

In the United States, an analogous service would almost be unheard of due to FAA regulations — not to mention potential FDA restrictions. For context, it took Amazon three years before it was fully approved to conduct its first drone delivery in December 2016… and that was in the United Kingdom.

Andela is another prime example of the leapfrog effect.

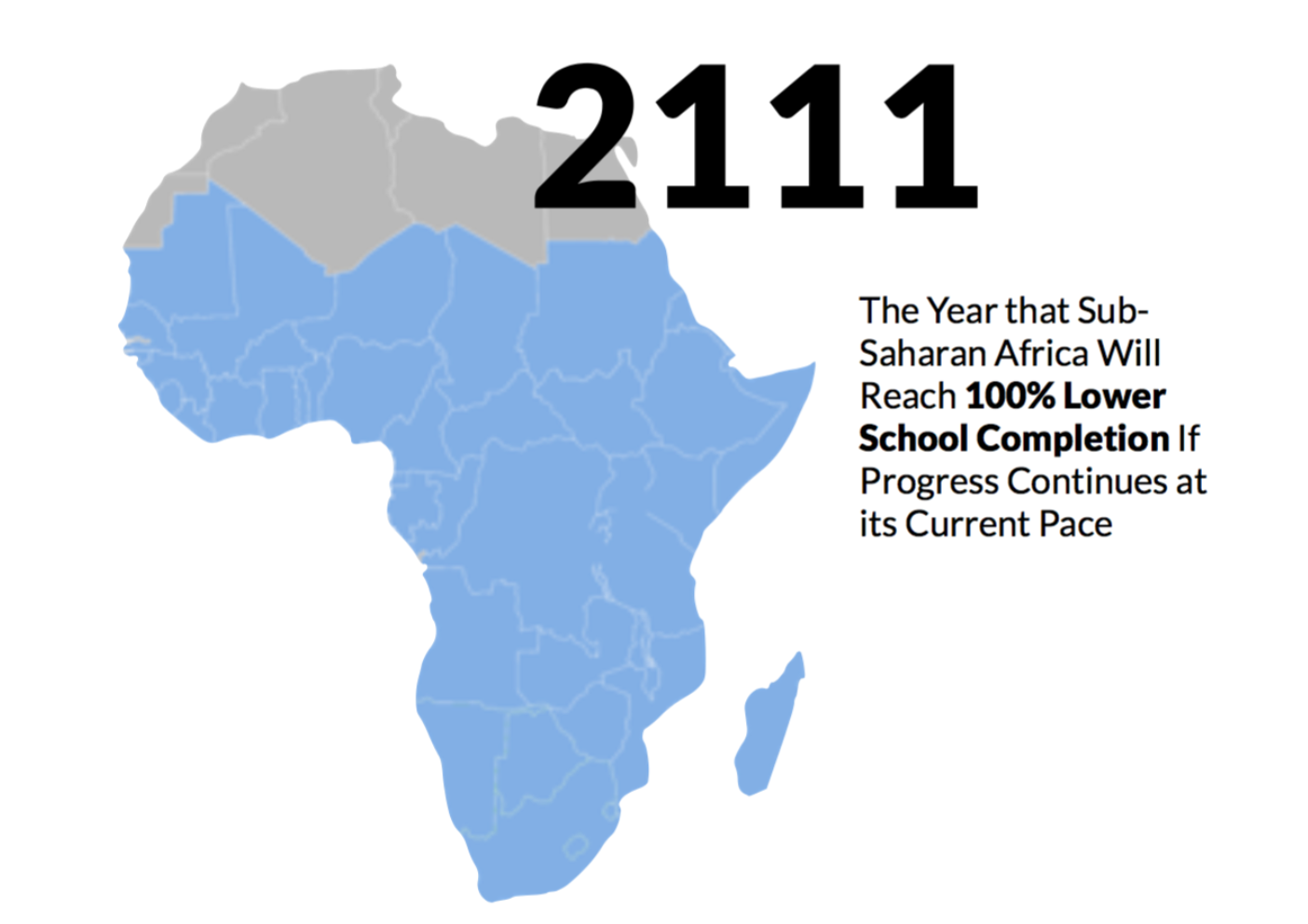

According to research from the Brookings Institution, the developing world is about 100 years behind developed countries in educational attainment and achievement.

You might think these gaps would have tightened significantly with the technological advancements and increased connectivity of the Internet Age. But educational models have remained effectively unchanged for over a century — which has resulted in linear progress against one of the great challenges in our time.

At current rates, for example, sub-Saharan Africa will have implemented complete lower-secondary education — a cornerstone of first World education standards — 95 years from today.

Andela is capitalizing on the untapped talent pool and fragmented education infrastructure and combines an unlikely source of talent with a new model of education. The company identifies high-potential, motivated talent in Africa, molds them into world-class software developers, and pairs them with companies as remote team members. With an acceptance rate of 1%, Andela is one of the most selective training programs in the world — more exclusive than the likes of Harvard and Princeton.

Similarly, Nairobi-based Moringa School has created a career accelerator focused on transforming higher education in Africa, starting with computer science. Serving customers ranging from universities to tech hubs and governments, Moringa has built a platform of high-quality content and instruction. Like Andela, it isn’t constrained by traditional assumptions of what “education” should look like.