Market Snapshot

| Indices | Week | YTD |

|---|

This fall, the class of 2020 showed up on college campuses across the United States. They don’t know what a Walkman is and would be shocked to learn that people used to smoke in bars. They were three-years-old during 9/11 and have spent more than 80% of their lives in a country at war.

If you go back 18 years, the class of 2020 shares its birthday with Google, which was launched in 1998. Today, there are over four trillion searches per year. This group grew up in a world where information is free and at your fingertips. For me, the is opposite of the world I grew up in when information was expensive and water was free. But this is just the beginning of how different the class of 2020 is than the world I grew up in.

Think how much things have changed.

Just a year before Google’s launch, Steve Jobs returned to Apple for a second tour with the goal of putting a personal computer in every home. The launch of the iPhone in 2007 ultimately put a super computer in every pocket.

For the class of 2020, the smartphone is just a phone… they expect it to be “smart” as they do with other technology. And that’s just table stakes. They want to access everything on demand — from transportation, to food, retail products, and media.

If you think about entertainment, services like Netflix, Hulu, and YouTube enable you to access anything you want to watch, whenever and however you want to watch it. It’s no wonder that the Class of 2020 thinks that going to a movie theater at a set time to buy overpriced popcorn and soda is ridiculous.

Over the last decade, movie admissions in the United States and Canada peaked at 4.4 million in 2006 and 2007, dropping to 3.8 million in 2015. Nearly all of the major film studios — including Paramount, Sony, Universal, 20th Century Fox, and Warner Bros. reported losses in Q2 2016.

Not coincidentally, over 50% of the Class of 2020 thinks that online courses are as good or better than the classroom. It’s absurd to have go to a commodity Econ 101 class on Thursday morning at 8:00AM if you can access it on demand.

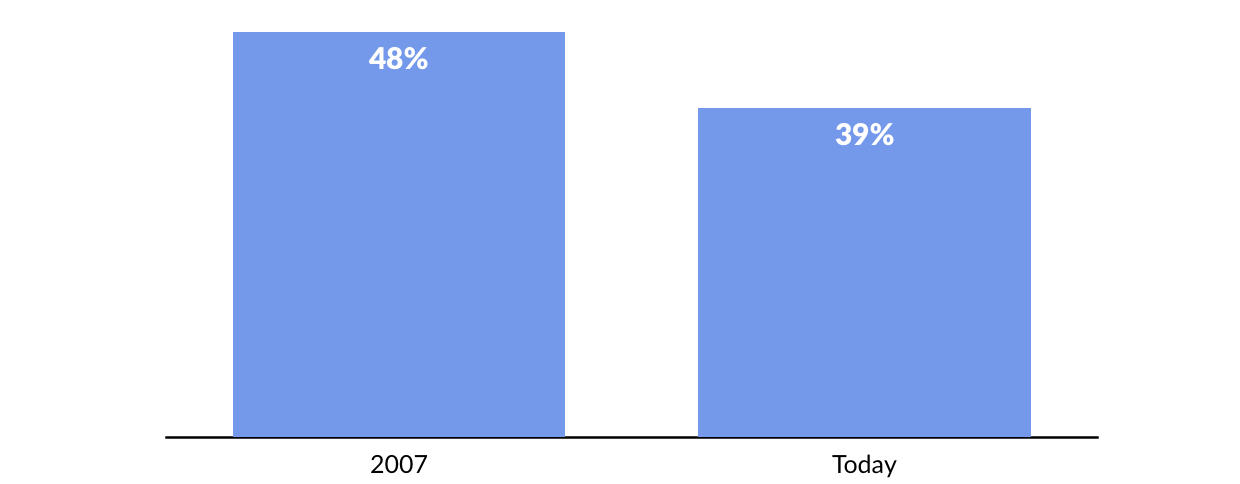

The class of 2020 loves technology but has no recollection of the Dotcom Bubble. They were three-years-old when it burst. But what’s etched in their memory forever is their family, or friends of their family, losing a home to foreclosure during the financial crisis of 2007. Not surprisingly, a decade later, Millennial home ownership is down nearly 20%. They also have no memory of the AOL Time Warner merger, the “worst merger of the century,” and think that the pending AT&T Time Warner merger is genius and conceptually gets you the most content for compelling value.

Also etched across the collective memory of the Class of 2020 is parents losing jobs they had for an entire career — and pensions along with it. Not surprisingly, the Department of Labor estimates that the latest crop of graduating Millennials will have over 15 lifetime careers — up from four in 2010. While a number of factors are driving this dynamic, including accelerating digital disruption and globalization, a simple aversion to career commitment has a lot to do with it.

Increasingly, many of these lifetime careers will be a part of the emerging “Gig Economy.” Anyone can become an entrepreneur in 60 seconds by monetizing their home, their car, or even their spare cash, by selling services through digital Peer-to-Peer Marketplaces like Uber, Lyft, and Airbnb. Currently, the Financial Times estimates that over 20% of Americans are employed as freelancers, up from 6% in 1989. The freelance marketplace Upwork pegs the number at 54 million part time workers in the United States. (Disclosure: GSV owns shares in Lyft and Upwork).

Interestingly, as ride-sharing platforms have surged — Uber raced past two billion rides delivered in 2016 — the demand for car ownership among Millennials has plummeted. According to Bloomberg industry research, last year, more automobiles were sold to people aged 75 and older than 18-24-year-olds.

The precarious new dynamics in the auto industry drive home the disruptive and deeply intertwined elements of the Class of 2020. Powerful, ubiquitous mobile devices enable on-demand services and Peer-to-Peer Marketplaces. Broad demand for these services, in turn, has created widespread part-time work opportunities for a generation that is increasingly unlikely to commit to a single career. And sharing platforms have further reduced the need and desire to purchase physical assets, like houses or cars.

Understanding the Class of 2020, and the profound impact this generation is having on the World, is about thinking outside boundaries and connecting dots.

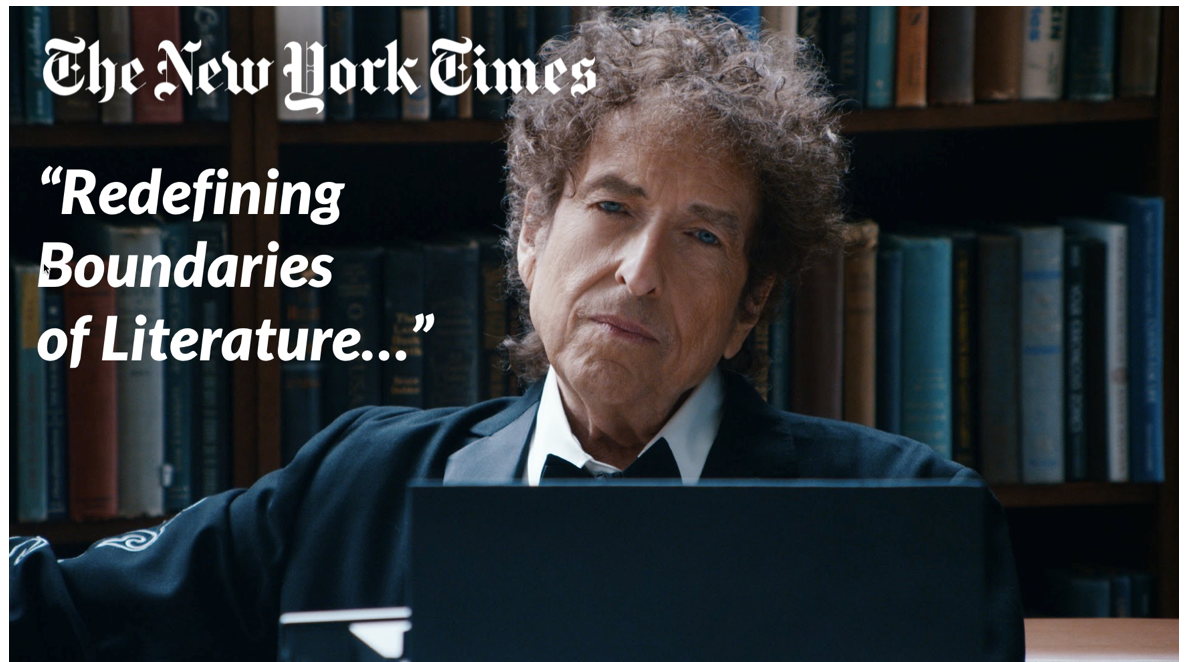

It is fitting that the most recent Nobel Prize for Literature was awarded to Bob Dylan. Now in the company of T.S. Eliot, Samuel Beckett, and Gabriel García Márquez, Dylan is the first musician to win the award. The Swedish Academy decided to think differently (It’s about time — even the Oxford Book of American Poetry included his song “Desolation Row,” in its 2006 edition, and Cambridge University Press released “The Cambridge Companion to Bob Dylan” in 2009.)

Dylan once observed that, “Some people feel the rain… others just get wet.” He has also said that, “Colleges are like old-age homes, except for the fact that more people die in colleges,” which may be of particular interest to the Class of 2020.

Source: New York Times, GSV Asset Management

At GSV Capital, we’re focused on “seeing the rain” when it comes to understanding the the profound global transformations that are taking place — particularly embodied in the Class of 2020.

GSV’s research and investment process is structured to accomplish the identification of large, open-ended growth opportunities, as well as individual companies that possess the critical elements necessary to capture meaningful market share in these opportunities

Our top-down perspective focuses on the intersection of Megatrends (technological, economic, and social forces that disrupt the status quo) across growth sectors of the economy to identify game-changing businesses with innovative technologies and

services. GSV’s bottom-up analysis is centered on the Four Ps — People, Product, Potential, and Predictability — an objective framework to assess a company’s potential to

realize sustained long-term growth resulting from market Megatrends.

The convergence of Megatrends and growth sectors is how we develop investment themes focused on identifying the “Stars of Tomorrow”… the fastest-growing, most dynamic companies in the world. We have identified five themes that we believe are the most fertile for investments in companies with the greatest potential.

1. CLOUD + BIG DATA: Over 90% of the world’s data has been created in the last two years. According to the MIT Technology Review, by 2020, 1.7 megabytes of new information will be created every second for every human being on the planet. To put that in perspective, in 1969, we sent astronauts to the moon and back using computers with only 2 kilobytes (0.002 megabytes) of memory.

At the same time, organizations are struggling to make use of abundant new sources of information. EMC projects that less than 5% of target-rich data is analyzed today, let alone used. Powerful software analytics are creating massive opportunities for innovative companies that are attacking a global Big Data services market that surpassed $125 billion in 2015.

2. EDUCATION TECHNOLOGY: In a Knowledge Economy and Global Marketplace, education makes the difference in terms of how well an individual does, how well a company does, and for that matter, how well a country does. The Internet, combined with ubiquitous smartphones, democratizes education access by lowering cost, and now, improving quality. We are starting to see the rise of what we call “Weapons of Mass Instruction” — rapidly scaling education companies attracting millions of students in a short period of time.

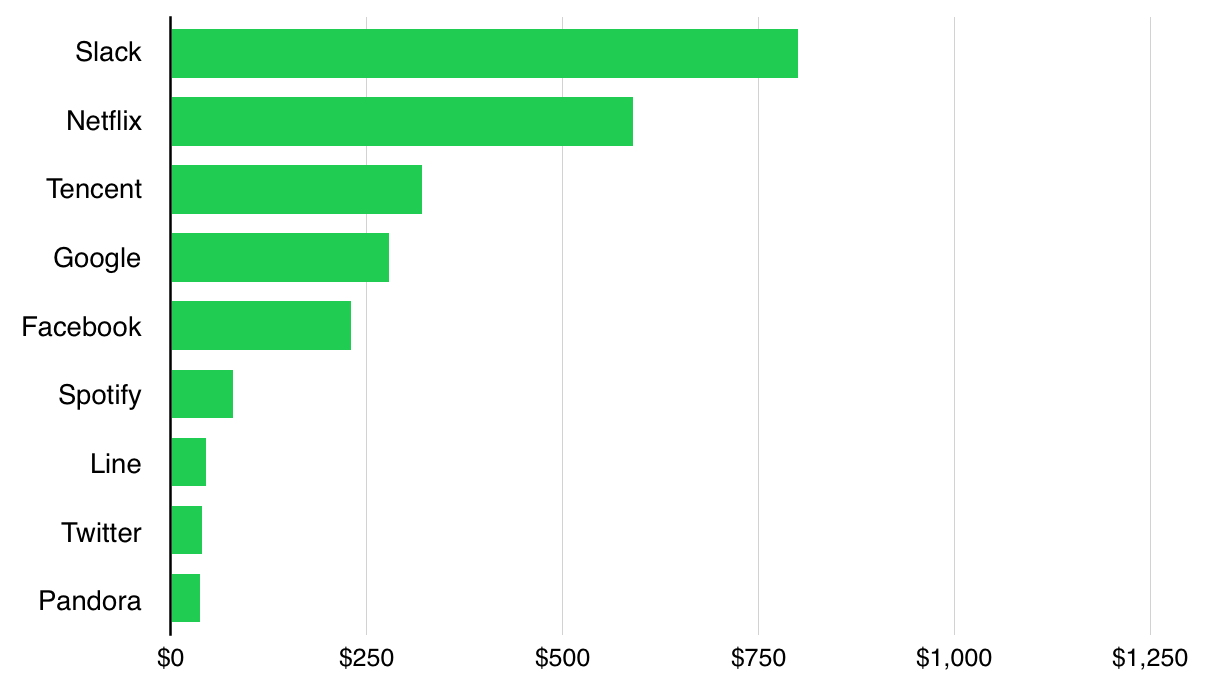

3. SOCIAL-MOBILE: In 2008, the average American spent 2.7 hours per day on digital media. In 2015, we spent 2.8 hours per day on smartphones alone — more time than we used to spend on desktops, laptops, mobile, and other connected devices combined. Over 87% of Millennials sleep with their smartphones and 97% U.S. high school and college students would rather lose every other possession before giving up their smartphone.

Facebook-owned WhatsApp processes a mind-bending 60 billion messages per day while Snapchat (Snap) users upload 9,000 photos per second. Social everything — communication, collaboration, photography, music, shopping, education, and healthcare — is the future and it is going to be done anytime, anywhere on mobile devices. (Disclosure: GSV owns shares in Snap).

4. MARKETPLACES: The foundation of modern economics is Adam Smith’s “invisible hand.” As people make economic decisions in their own self-interest, it ultimately brings economic benefits to others. But the rise of modern information technology and ubiquitous mobile computing has made the invisible hand a lot more collaborative.

On any given night, roughly one million travelers who would have typically checked into a hotel are instead using Airbnb’s marketplace to rent unused houses, apartments, and bedrooms for a better price — and a more unique experience. Millions more are saving time and money by ditching taxis for rides with services like Uber and Lyft. The Internet is exceptionally suited to aggregate supply and demand within an industry, and smartphones amplify the tremendous network effects that can be created. (Disclosure: GSV owns shares in Lyft)

5. SUSTAINABILITY: The good news is that the world’s middle class will more than double to five billion over the next 15 years. The bad news is that the strain this will put on the environment will be extreme, with wealthier people traveling more, consuming more, and using more electricity for everything — from air conditioning to lighting larger homes. Sustainability is not just green technology — it is water and wellness. There is no longer a debate between being “green” or “growing” — both are important.