Market Snapshot

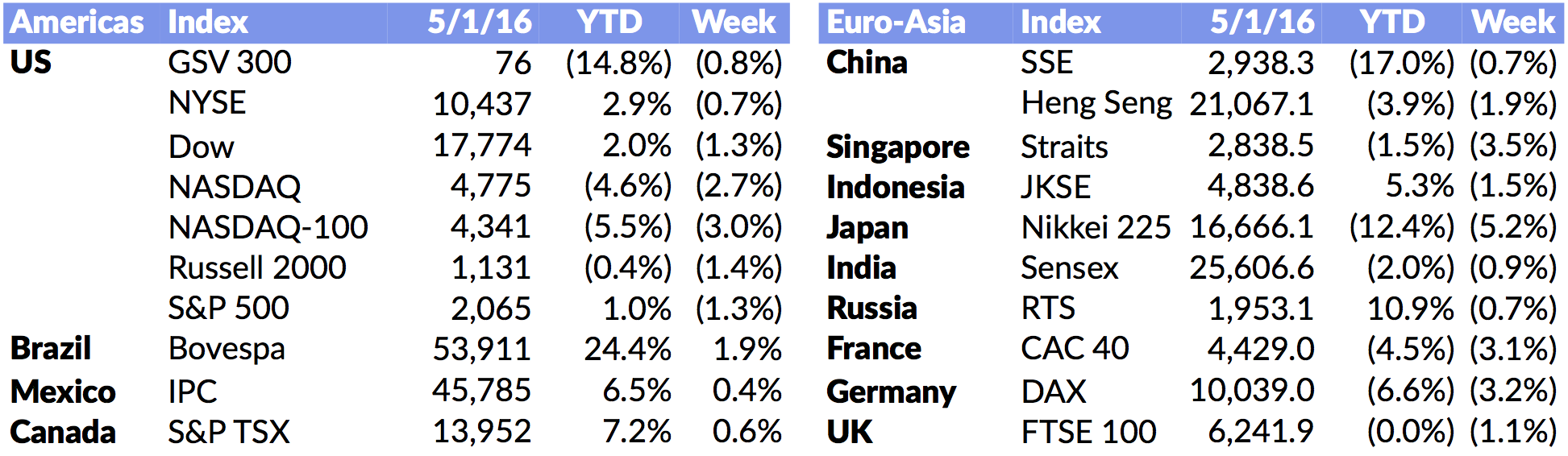

| Indices | Week | YTD |

|---|

Impossible is not a fact. It’s an opinion.

— Muhammad Ali

With Political Season in full swing, there are more “flip flops” in the air than a House of Pancakes. Candidates are trying to tap into the mood of the mob… and it’s not pretty. People are angry because opportunities feel few and far between, with the future not looking as bright as the past.

In the “Winner Take All Economy”, top entrepreneurs, executives, and enterprises garner a disproportionate amount of the spoils. CEOs make 303x their average employee. Professional baseball players earn an average of $4.2 million a year, whereas 50 years ago salaries were in line with median income. Consumers may say they want the choice between Coke and Pepsi, but with technology businesses, the winnings exponentially accrue to the top dog — from Google to Facebook, Amazon and Airbnb. (Disclosure: GSV owns shares in Alphabet, Facebook, and Amazon)

With the math of democracy being that 50.1% wins, the acts of the political circus have been about grabbing attention from the masses. Candidates are scrambling to change voters’ minds by selling their ability to better “stick it to the man”.

While there was plenty of competition for “mindshare”, last week we co-hosted the seventh annual ASU GSV Summit in San Diego, a gathering of leaders from across the global innovation economy with the mission of accelerating exponential ideas in education and talent. We welcomed over 3,500 entrepreneurs, educators, business leaders, policymakers, and investors, as well as 350 game-changing presenting companies.

What makes the Summit so impactful is the unusual “cocktail” of participants we convene, with the common ingredient being a commitment to giving everybody an equal opportunity to participate in the future. Increasingly, as exponential ideas that are transforming other industries are applied to education — think Tesla’s impact on the automobile industry or Airbnb upending travel and hospitality — this goal is more reachable than ever. (Click HERE to watch my opening remarks at the ASU GSV Summit, which lay out a vision for applying exponential ideas to education.) (Disclosure: GSV owns shares in Tesla)

This year’s cocktail of keynote speakers included Bill Gates, Dr. Condoleezza Rice, Khan Academy Founder Sal Khan, Grammy award winning musician and actor Common, retired Four-Star General Stanley McChrystal, and many others.

We all go to conferences where there are some good speakers and intellectually stimulating conversation. But when you leave, it‚Äôs over. This is why the ASU GSV Summit has so much momentum. People come here because things happen here.¬ÝConnections are made. Capital is raised. Ideas are¬Ýbrought to life. People come here to make things happen.

OPPORTUNITY GAP

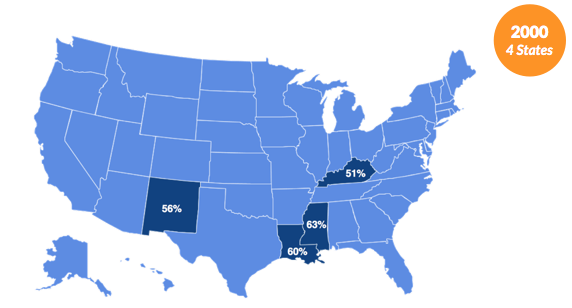

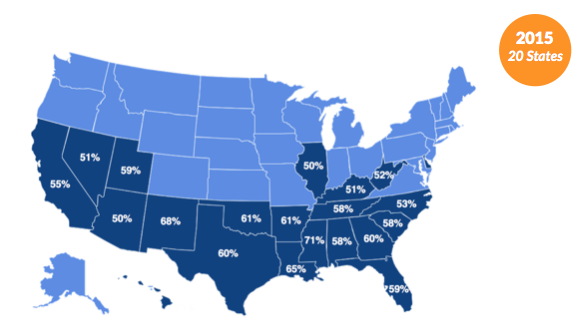

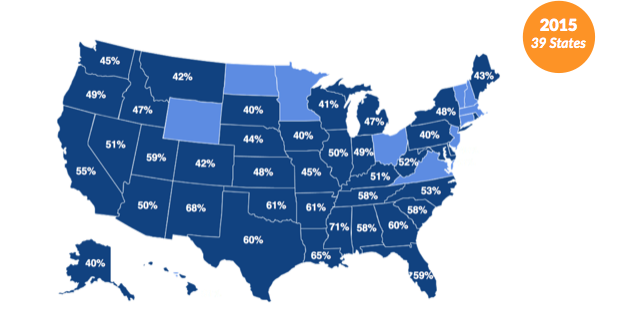

America’s population of students from low-income families is exploding. In 2000, there were four states where 50% of the total student population was low income. That’s a sobering number in its own right in a developed country like the United States. Today, it’s 20 states, approaching half of the country’s entire student population. If you count the states where 40% of students are from low income families, it jumps up to 39.

States where Students from Low-Income Families Exceed 40% of the Total Student Population

Source: The Atlantic, Southern Education Foundation, New York Times, GSV Asset Management

Play it forward and students from low income families are five times more likely to drop out of high school and eight times more likely to go to prison. In fact, according to research from the Bill & Melinda Gates Foundation and the National Education Association, over 80% of the U.S. prison population is comprised of high school dropouts.

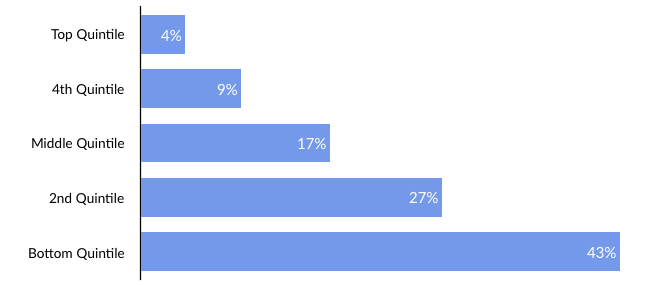

The net result is that today, if you are born poor in the United States, you are likely to stay poor. For the first time in our country’s history, there is no social mobility. Over 70% of people born at the bottom of the income ladder never make it to the middle rung. We have effectively evolved from a meritocracy to an aristocracy.

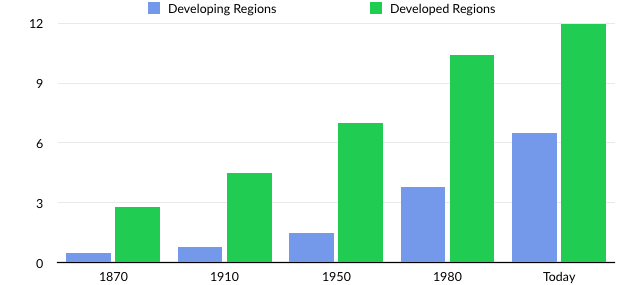

The widening U.S. opportunity gap is matched by a broader global gap. According to research from the Brookings Institution, the developing World is about 100 years behind developed countries in educational achievement. You might think these gaps would have tightened significantly with the technological advancements and increased connectivity of the Internet Age.

But educational models have remained effectively unchanged for over a century — which has resulted in linear progress against one of the great challenges in our time. At current rates, for example, sub-Saharan Africa will have implemented complete lower-secondary education — a cornerstone of first World education standards — 95 years from today.

MIND THE GAP

The ASU GSV Summit is all about “Minding the Gap”. As our 2016 Lifetime Achievement award winners Mitch and Freada Kapor have observed, talent is equally distributed by zip code but opportunity is not. The common thread of all the programming is accelerating exponential ideas that support our mission to give everyone an equal opportunity to participate in the future.

Bill Gates anchored the Summit’s keynote speaker group by reflecting on the “new majority” of students in the U.S. education system and how best to serve them. He positioned his philanthropic priorities around developing effective personalized learning solutions, building evidence of what works, and adopting proven education technologies.

Watch Remarks from Bill Gates HERE

Bill Gates is Interviewed by Deborah Quazzo, Founder and Managing Partner, GSV Advisors

Former U.S. Secretary of State Condoleezza Rice argued that education must be the fundamental American priority. She remarked that it is not only a “national security problem”, but, “It’s a civil right — it’s got to the be right of every child in this country.”

Watch Remarks from Condoleezza Rice HERE

Former Secretary of State Condoleezza Rice is Interviewed by 2U CEO Chip Paucek

Visionary Arizona State University President Michael Crow announced the launch of the ASU Draper GSV Accelerator, a platform to accelerate exponential ideas, entrepreneurs, and ventures in education and talent. Dr. Crow remarked, “We’re creating a way to take new ideas from companies in the edtech space, and walk them through the process of prototyping their tools our testbed of students and faculty.”

Watch Remarks From Arizona State University Michael Crow HERE

The Grammy Award-winning artist Common, a tireless advocate for mentoring and education programs for disadvantaged youth in his native city of Chicago, discussed the the three core pillars of his philanthropic organization, The Common Ground Foundation: Character Development, Creative Expression, and Healthy Living.

Watch Remarks from Common HERE

Khan Academy founder Sal Khan reflected on creating global access to high quality education at scale on a panel with Hyatt CEO Mark Hoplamazian and CNN anchor-turned education policy advocate Campbell Brown.

Watch Remarks from Khan Academy CEO Sal Khan HERE

Sal Khan with Hyatt CEO Mark Hoplamazian and Former CNN Anchor Campbell Brown

Chegg CEO Dan Rosensweig explored the new fundamentals driving broad scale disruption across the higher education system. (Disclosure: GSV owns shares in Chegg)

Watch Remarks from Chegg CEO Dan Rosensweig HERE

Retired Four-Star General Stanley McChrystal shared a vision for a nation transformed by an ethic of “service”, and discussed the lessons he learned transforming U.S. counter-terrorism strategy to confront new enemies and new challenges.

Watch Remarks from General Stanley McChrystal HERE

Retired Four Star General Stanley McChrystal Shares a Vision for a Nation Transformed by Service

Source: GSV

—

The first bad Apple in 13 years sank tech stocks last week, with NASDAQ falling 2.7%, the S&P 500 dropping 1.3% and the GSV 300 down 0.8%. For the first time since 2003, Apple reported lower revenues, with iPhone sales falling for the first time ever. Since the Market bottom in February, the S&P 500has risen 14% and oil is up approximately 40%.¬Ý(Disclosure: GSV owns shares in Apple)

With first quarter earnings mainly reported, the good news is that they’ve slightly beaten expectations. The bad news is that earnings have fallen 5.5% year over year. The other bad news is that U.S. Economy reported sluggish growth of just 0.5% for the first quarter. The silver lining (in the short term) is that the Fed is less likely to raise rates.

There were three IPOs last week, all pricing in range, with an average return of +0.4%. PayMed was the star, rising 61%. Four Biotech IPOs are on deck this week

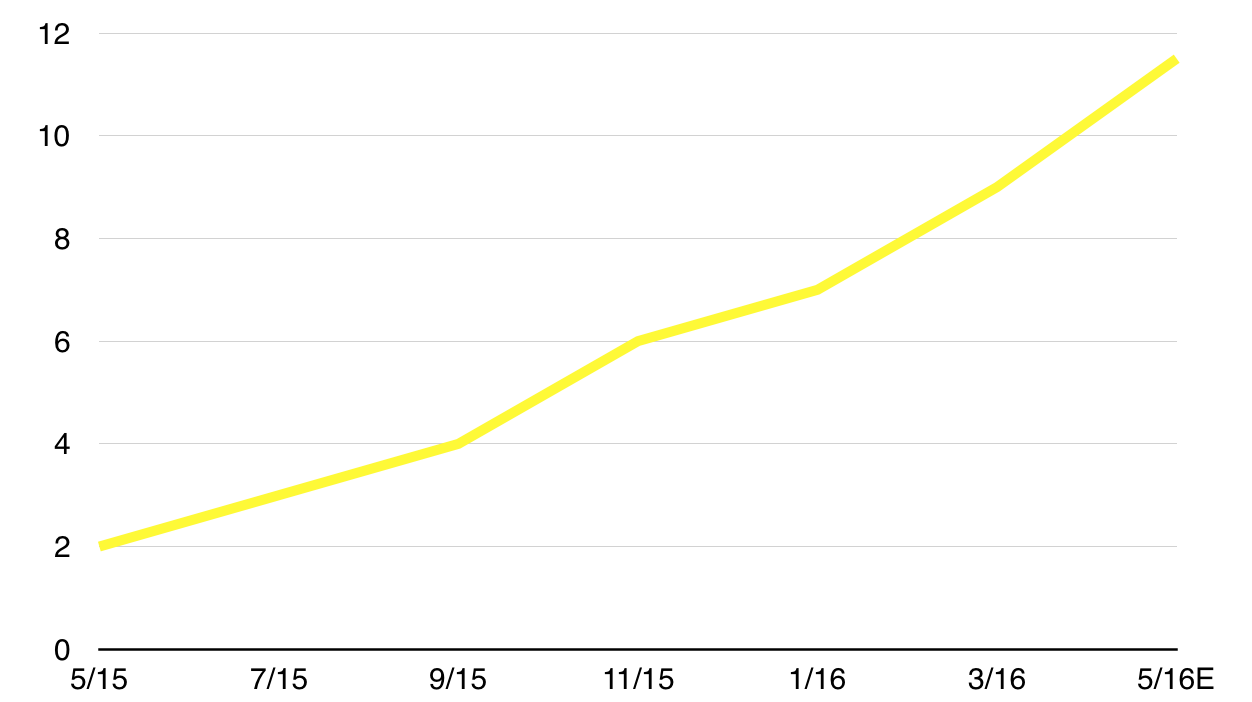

On the private financing side, Ant Financial raised $4.5 billion at a $60 billion valuation from CIC, China Construction Bank, China Post Group, Primavera Capital, and China Development Bank. Ant Financial operates Alipay and has over 450 million annual active users.

Aquion Energy, a leader in next generation ion battery technology, raised $33 million from existing investors, including Advanced Technology Ventures, Bright Capital, Foundation Capital, KPCB and Bill Gates.¬ÝDrivy raised $35 million from Cathay Innovation, Nokia Growth, and Index Ventures. The Paris-based peer-to-peer car renal platform has booked 1.4 million rental days and has 850,000 users.

Baidu Video raised $155 million from Shanghai New Culture Media, Tianshen Yule, Softbank, Asia and Redpoint Ventures. The Baidu spin-off has over 300 million monthly viewers.

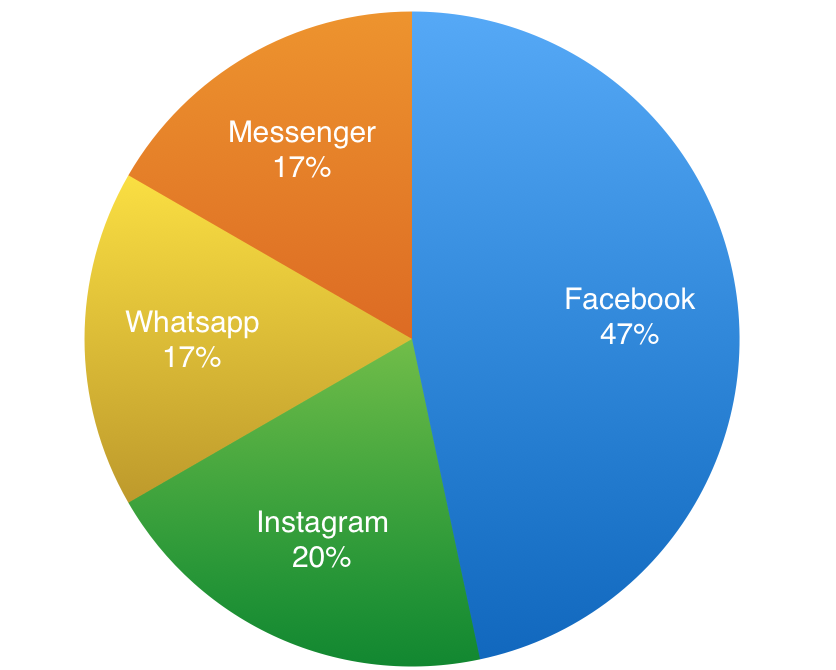

Also of interest in the growth world, Snapchat announced that its users view over 10 billion videos per day. Facebook announced that its Daily Active Users spent 50 minutes per day across Facebook, Instagram, and Facebook Messenger (our guess for split is: 28-14-8). (Disclosure: GSV owns shares in Facebook)

Spotify bought photo aggregator CrowdAlbum to build better marketing tools for artists. Dropbox announced “Project Infinite”, which will enable users to seamlessly access all of their Dropbox files from their desktop, regardless of how much space they have available on their hard drives. (Disclosure: GSV owns shares in Spotify and Dropbox)

We continue to see an attractive Market for growth investors. While the average public company is experiencing negative growth, the best growth companies we focus on are growing earnings at 25%+ yet sell at moderate valuations. Favorites include Facebook, Alphabet, Twitter, and Amazon. (Disclosure: GSV owns shares in Facebook, Alphabet, Twitter, and Amazon)¬Ý