Market Snapshot

| Indices | Week | YTD |

|---|

Content Is king, but promotion is queen.

— Author Unknown

Without promotion, something terrible happens. Nothing.

—P. T. BARNUM

In a world of selfies, with currency being how many followers you have on Twitter and “likes” you get on your Instagram post, my Midwestern roots cause me great discomfort with shameless self promotion. In the World I grew up, the Vikings Coach Bud Grant was revered for his modesty and avoidance of publicity. Coach Grant abhorred showboating and greeted behavior, such as a touchdown dance, with the instruction “act like you’ve been in the end zone before”. Recognition and reputation were created by what you did, not by telling them you were the greatest.

Alas, with our Global Silicon Valley Handbook hitting the bookstores March 7th, while I’d love for my friends to discover it on their own, I need to do what I grew up learning not to do… shamelessly self promote. “But it’s for a good cause” I could self-deceive, but actually the good cause is me. Or I could also say “think of all the amazing entrepreneurs we’re going to help” but really what we want to do is have a way for them to find us. As much as I’d like it to, the Global Silicon Valley Handbook isn’t going to cure cancer, stop poverty or make the environment greener… in fact, it’s being made out of paper which requires the chopping down of trees.

When all else fails, try the truth so here it is, please buy the Global Silicon Valley Handbook because you help me, Michael Moe. Thank you. 😉

—

A fun, yet factual guide to thrive not only in Silicon Valley, but in the emerging Global Silicon Valley… here is a preview of the Global Silicon Valley Handbook.

In 1849, pioneers from around the world came to California looking for gold, and what once was an empty landscape of natural beauty turned into a densely populated melting pot. A hundred and sixty something years later, the gold is long gone but the land of opportunity continues to BOOM. People still flock to California to chase a dream, but now one that is intermixed with microchips, apps, social networks, and most important: Silicon Valley.

At the heart of the tech revolution still in mid-swing, Silicon Valley is home to the superstars Apple, Google, and Facebook; the old-timers Intel and HP; and of course, the thousands of little guys still trying to make it: the startups. But Silicon Valley has quickly become more than a geographic spot on a map; it is a mind-set of innovation that has spread across the globe, and that’s what we at GSV stand for.

We’re delighted to share our vision of uniting a community of innovators who all hold a passion for changing the world for good.

One hundred years ago, Silicon Valley was filled with apricot and apple orchards with a twenty-year-old fledgling university called “The Farm.” Detroit was the innovation capital of the world with the young and ambitious migrating to the Motor City to seek fame and fortune. Automobiles were the disruptive technology, and Henry Ford was the Steve Jobs of his day.

Today, Detroit is bankrupt, and Silicon Valley has been the Mecca for entrepreneurs from around the world who believe that there is nothing more powerful than a big idea. Stanford University is Startup U, where people flock to pursue their dreams. Over the past fifty years, it’s been breathtaking to see how companies conceived on a napkin at Buck’s and started in garages between San Francisco and San Jose have transformed society and business.

Apple, Google, Facebook, Oracle, Cisco, eBay, Intuit, Intel, Tesla, Uber, Twitter, Lyft, Coursera, and Dropbox are but a few of the revolutionary companies that call Silicon Valley home. (Disclosure: GSV owns shares in Lyft, Coursera and Dropbox)

While the sixty miles between San Francisco and San Jose remain the epicenter for innovation, the spirit and entrepreneurial mind-set that made Silicon Valley such a magical place have gone viral and global. From Austin to Boston, to Chicago and São Paulo; from Shanghai to Mumbai to Dubai, there is something very powerful happening: a Global Silicon Valley is emerging. And it doesn’t have to rhyme with anything, either.

GSV created a formula for determining the top fifty markets in the Global Silicon Valley based on factors such as VC funding, startup activity, educational institutions, and business climate. We then researched each market to highlight key features and asked the local experts to understand what makes their city tick. We answer entrepreneur need-to-knows on how to be successful in bringing their concept to life. Who are the top angels? Which are the top incubators? What should be in the pitch? What shouldn’t be in the pitch? Where is the power breakfast spot? What is the dress code? And much, much more…

The Global Silicon Valley Handbook aspires to inspire the next Steve Jobs or Elon Musk to create the future they can imagine.

We are believers in how one person’s vision can change the world and that whatever the mind can conceive and believe, it can achieve.

That’s what this handbook is about and why it is the official guide to the Global Silicon Valley.

GETTING IN THE DOOR

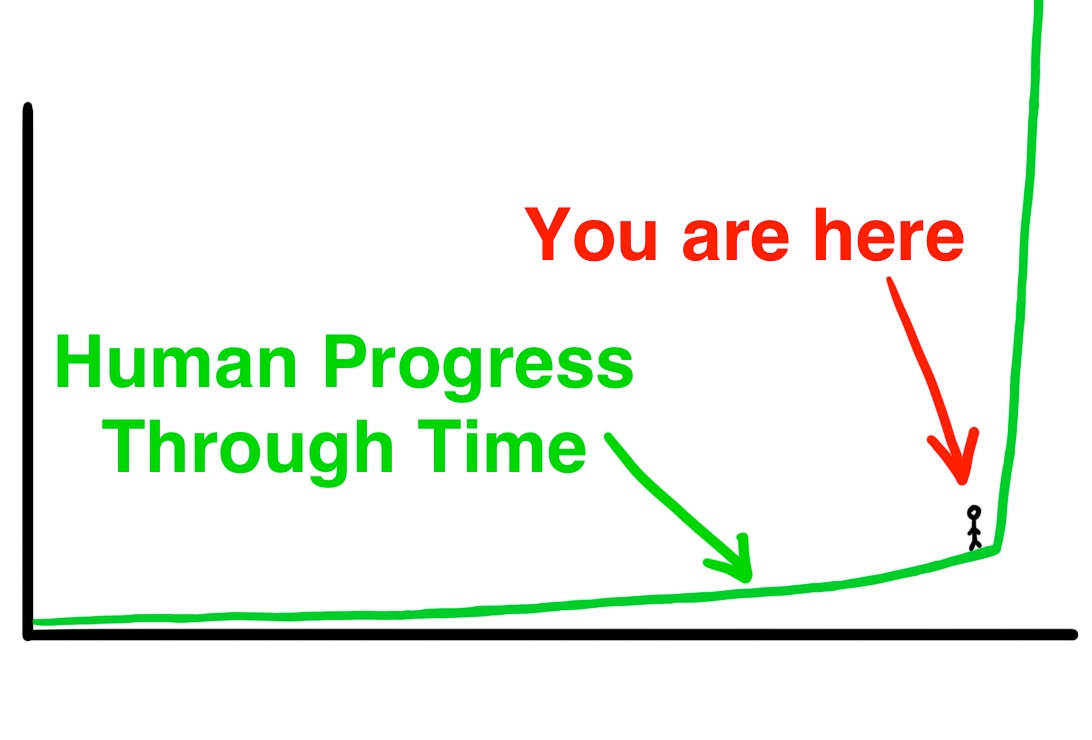

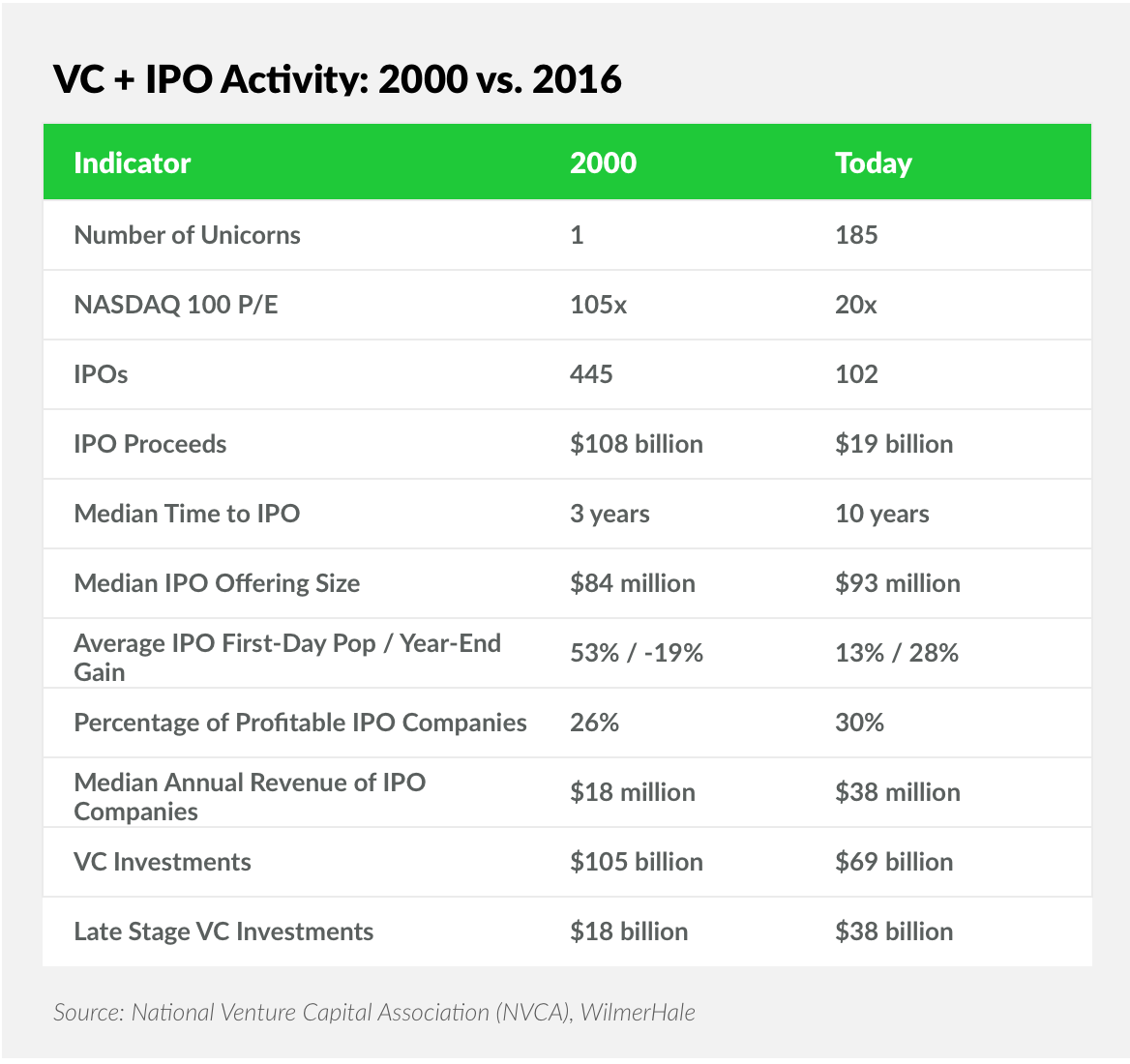

Before you launch the next great startup, take a step back and look at the big picture. Over the past 15 years, venture capital funding and initial public offerings have accelerated at an astounding rate. Just look at the evidence.

The dramatic increase in the number of large private companies is mainly a result of two key trends.

First, venture capitalist (VC)–backed private companies are staying private longer (a median of three years in 2000 versus ten years in 2015) Second, there are now over 3 billion people on the Internet with 2.6 billion smartphones, enabling entrepreneurs to go from an idea to a product that reaches billions of people at warp speed.

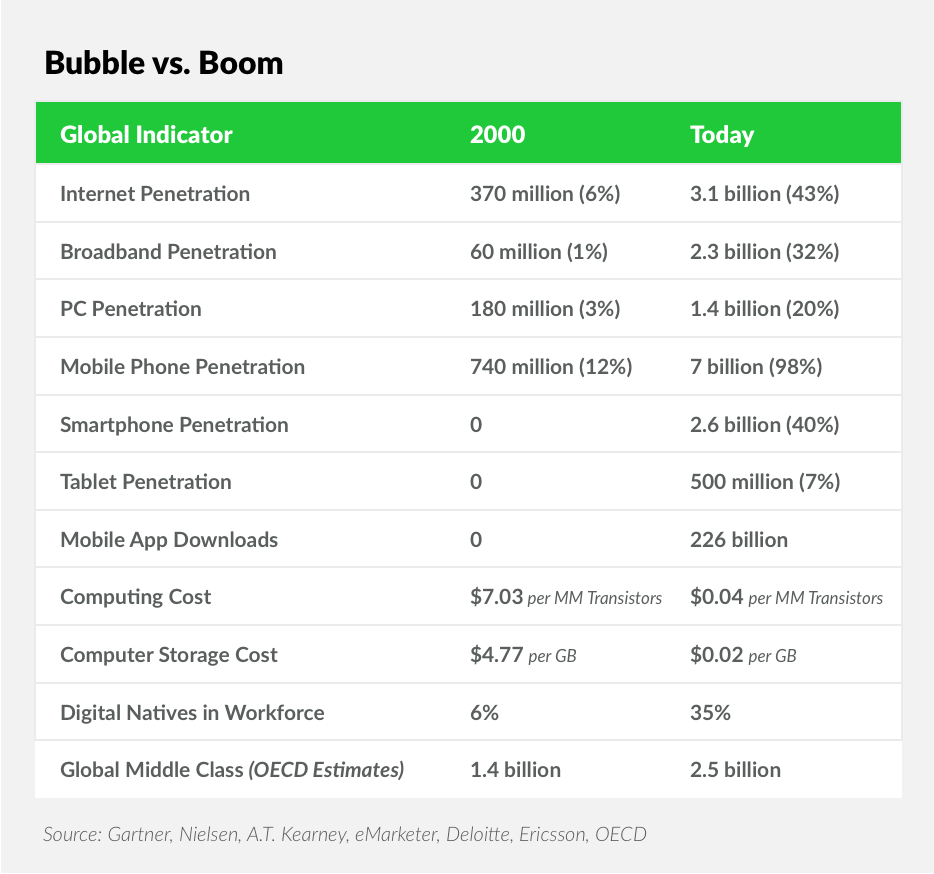

We are riding powerful tailwinds that are rapidly transforming the world as we know it. In 2000, there were only 370 million people on the Internet (roughly 6% of the world population), no one had heard of a smartphone yet, broadband was a fantasy, and mobile applications off a platform had not been invented Today, the “digital tracks” have been laid and 140 billion apps have been downloaded from Apple and Google.

Moreover, in the Internet Bubble of 2000, the ten largest Internet companies were valued off a figment of one’s imagination. Now, they are mainly valued on future cash flows discounted back to today. Apple, with a $640 billion market value, has $200 billion of sales and $190 billion in cash.

However, as those who have seen Benchmark Capital’s VC Bill Gurley’s tweetstorm know, valuations for private companies are reaching sky-high levels. On the one hand, the value of every Unicorn put together is less than the market capitalization of Facebook, and lower valuations means less VC money being spent. On the other hand, many Unicorns are reaching huge valuations with little profit to show for it, meaning a market correction may be in order. As Gurley argues, this means there could be a shift in venture capital from focusing on growth to focusing on the path to profitability.

HOW VENTURE CAPITAL WORKS

Venture capitalists (VCs) are people, too — most of them anyway. And as such, while insanely ambitious, competitive, and hopefully intelligent, just like anyone else, they aren’t looking for more work to do.

A blind business plan hurled over the e-mail transom has as much chance of being read as an e-mail starting out with “Dear Sir or Madam.” A top VC might receive 500 to 1,000 e-mails a day, so cluttering up the inbox without an edge is only making you the enemy of the assistant whose job it is to delete e-mails. You might think you have the best idea since Travis hitched a ride on Uber, but without a warm introduction from a trusted person in their network, your idea will die an anonymous death.

LinkedIn can be a start to finding out who you are “linked” to, helping you build a path toward your VC target. Unfortunately, many people are LinkedIn whores and send and accept LinkedIn invitations from people they barely know. Affinity groups are a good way to get your foot in the door. Going to the same college or high school as the targeted VC is super helpful. VCs will be courteous to somebody who comes from their hometown (they don’t want to be called the rich jerk who forgot where he came from) or from their alma mater.

Networking through past business affiliations of the VC is one of the best ways to get a meeting. If a VC worked with someone who can attest to your brilliance or your startup’s potential, you now have provided the VC the trusted shortcut to finding the next big thing.

Don’t send a business plan. That takes too much time to read and is often impossible to understand without an interpreter.

A short deck describing how your idea is going to transform the world is what will get their attention. Include the 4P description of your business — who are the people, what is the product, what is the potential, and what is the predictability on execution. Once you’ve got the meeting, the pitch is all about precision and passion — don’t speak in vague generalities or like a professor. No VC wants to understand how to build the clock — they want to know what time it is.

The beginning of the pitch basically sets the stage for success or to be sent packing. The first two minutes are about getting the VC engaged and establishing credibility. Recognizing that they reject 99.9% of the investment opportunities presented to them, you need to create the impression that what you have is revolutionary and that you are Marc Benioff’s better-looking clone.

Next you need to explain the market opportunity that you are going after. What is the TAM (Total Addressable Market)? What are the megatrends that your idea benefits from? Who are the competitors?

Now it’s time to explain your plan for world domination. What is your go-to market strategy? How does this disrupt the status quo? What kind of people and partners do you need to execute against your opportunity?

Finally, explain the financial model. What are the key metrics that will drive value and how are you focused on achieving success? List the key milestones that will provide confirmation that you are on the right track to take over the industry.

After going through your presentation, don’t overstay your welcome. Make sure you give the impression that you are tight on time and you are on your way to your next meeting, whether you are or you aren’t. Back to VCs are people, too — they want something that others want or can’t have.

The harder you are to get now, the more they will want you.

We just solved all your dating problems, too.

For more, check out The Global Silicon Valley Handbook published by Grand Central Released on March 7, 2017.

Available on Amazon, Barnes & Noble, iBooks.

FEATURES IN THE GSV HANDBOOK

A fun, yet factual guide to thrive not only in Silicon Valley, but in the emerging Global Silicon Valley… here is a preview of the other features in the Global Silicon Valley Handbook.

Silicon Valley Speak

“Work-Life Balance” — Legends have been told about this mysterious concept, but the millions of 20- to 30-year-old college graduates in the Valley consider it a myth.

“MVP” — Minimally Viable Product, a product with just enough features to show early adopters its potential, providing a feedback loop to guide future improvement.

Local Tips + Facts

Start holding your drink in your left hand (Networking Tip): Having to switch hands when being introduced to someone makes you appear clumsy, and wiping your hand on your pants and offering a cold handshake is never a good first impression.

Don’t wear anything that’s not tight (Clothing Tip in Paris): Wear tight jeans, tight hoodies, tight shirts, tight belts, but not tight fanny packs. Don’t wear fanny packs. No yoga pants either.

Don’t be too friendly (Dos + Don’ts in Boston): Smiling all the time and asking questions isn’t the Boston way. Bostonians would help a blind man cross the street, but wouldn’t want to be friends with him afterward.

Local Fact in Stockholm: Once known almost exclusively as the birthplace of ABBA, Stockholm and Sweden are now responsible for Skype, Spotify, and the two most addicting games around: Candy Crush Saga and Minecraft. (Disclosure: GSV owns shares in Spotify)

Other Tidbits

Android (Acquisitions from Heaven): Purchased by Google in 2005 for $50 million, Android is now the dominant mobile OS, installed on over 1.4 billion mobile devices and in almost every country.

Myspace (Acquisitions from Hell): Acquired by NewsCorp for $520 million in 2005, the once white-hot social network was unloaded for $35 million in 2011.

Entrepreneur Test: You’re not an entrepreneur if… You get a speeding ticket and you don’t pitch your startup to the officer.

History of Silicon Valley: In Jan 1971, Don Hoefler brands phrase “Silicon Valley” in a series of articles in the paper “Electronic News” inspired by friend Ralph Vaerst, a central California entrepreneur. Today, Silicon Valley is global— no longer referring to a small geographic area, but rather a powerful mindset and worldwide phenomenon.

ACCLAIM FOR THE GLOBAL SILICON VALLEY HANDBOOK

—

Despite the third week of the Trump Presidency feeling like the third year with all the news and noise, stocks continued to hit record highs. NASDAQ advanced 1.2% last week and is now up 6.5% YTD, the Dow added 1% and the S&P 500 0.8%. Bond yields fell fractionally to 2.4%.

What’s Mr. Market like in DJT that organizations such as the New York Times and CNN don’t care for? There is no question that a pro-business policy which reduces taxes and over-the-top regulations is a welcome relief and a boom for stocks… in fact, economic optimism is at a twelve year high.

But when all is said and done, part of the reason stocks are going higher is that earnings are increasing…finally. Last year, the S&P 500 was up nearly 10% but earnings were flat. So far, the earnings coming out from companies like NVIDIA (+117%), Zillow (+34%) and Coherent (+160%) have been a positive catalyst for stocks.

We believe we are in a good environment for growth investors with the P/E on many great names being modest and fundamentals being strong. Accordingly, we are BULLISH.

TIDBITS

- Ant Financial, valued at $60B, is raising $3B in venture debt for global M&A spree

- Argo AI raised $1B from Ford exclusively; this is Ford’s largest investment in self-driving technology; Argo AI was founded by two top engineers from Google and Uber

- CarTrade raised $55M from Temasek; CarTrade is India’s car listing service, with 15 million customers per month and 200,000 cars auctioned per year

- Evident.io raised $22M from GV; Evident.io offers security services for public cloud infrastructure provider Amazon Web Services (AWS), and currently serves 200 customers, including Adobe, Airbnb, Capital One, The Honest Company, HBO, Starbucks, and Sony

- Holberton School raised $2.3M from Reach Capital and Jerry Murdock, co-founder of Insight Venture Partners; Holberton offers select students (students are selected by algorithms) a hands-on, project-based education (for software engineers and programmers) that is reportedly faster than traditional coursework

- Klarna acquired BillPay, the PayPal of Germany, for $75M from Wonga