Market Snapshot

| Indices | Week | YTD |

|---|

In 2004, Brian Chesky moved to Los Angeles to work as an industrial designer with a small firm. Three years later he quit, packed up his car, and drove to San Francisco to move in with a college friend who had also recently quit his job. The immediate challenge? “How the hell were we going to make rent?”

The new, jobless roommates noted that in two weeks the 2007 Industrial Design Society of America conference was being held in San Francisco and that hotel rooms would be scarce. So Chesky and his roommates found three air mattresses and turned their apartment into an “air bed and breakfast.”

Within days, Airbnb was a rudimentary website that booked three guests: a 35-year-old woman, a 30-year-old from India, and a 45-year-old father of five, each paying about $70 a night for several nights. That month’s rent problem was solved. But Chesky and his roommates were on to something bigger.

In early 2008, the Airbnb team began to accelerate their efforts, hiring engineers and focusing on the South by Southwest festival in Austin, Texas. Still, the company had nothing more than a rudimentary website: no online payments, no reviews, no bookings, no search function.

While hoping that business would pick up, Airbnb’s founders funded the company by opening up a slew of credit lines. They had so many credit cards that Brian Chesky once remarked in an interview with the Wall Street Journal: “You know those binders you put baseball cards in? We put credit cards in those.”

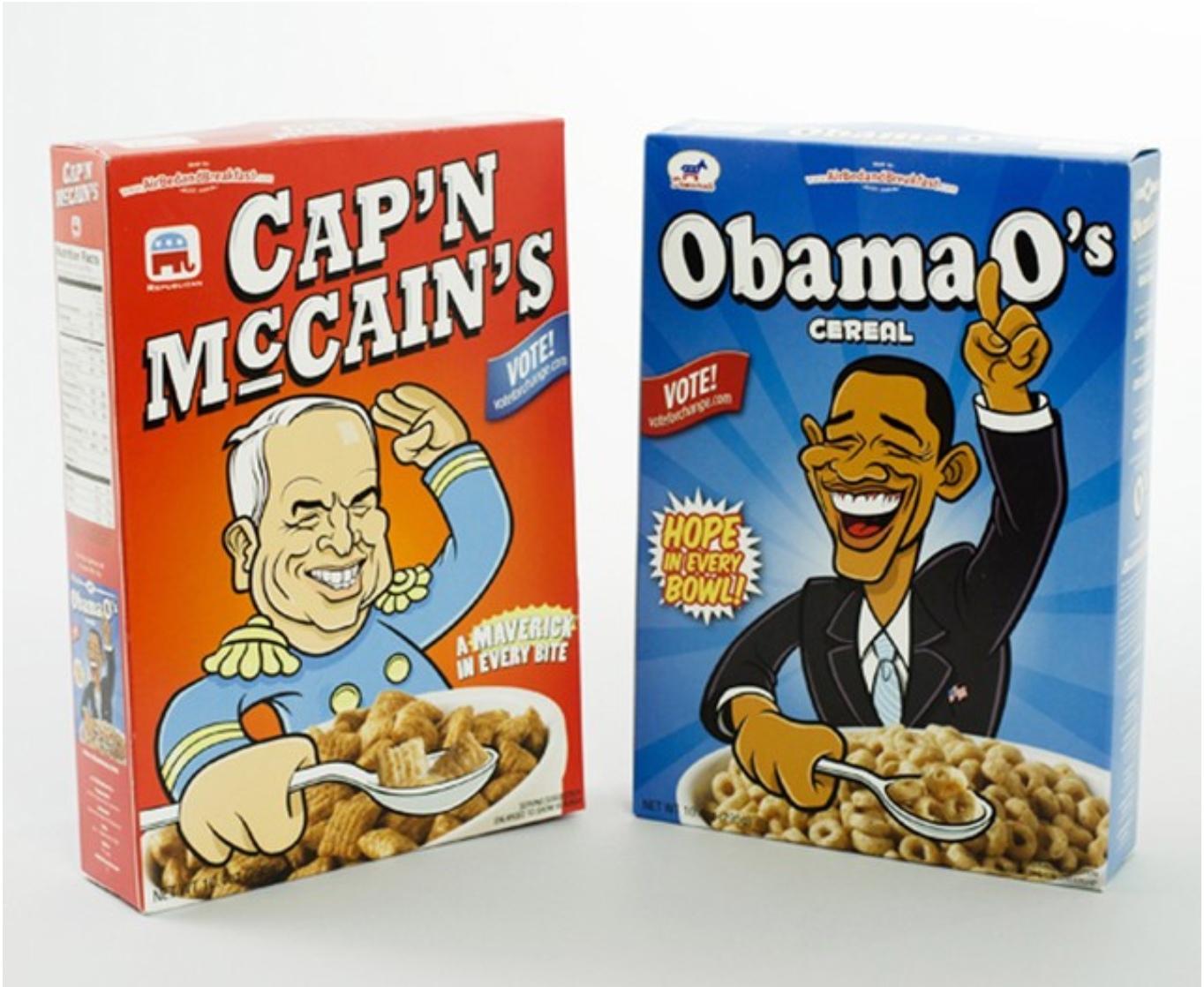

$40,000 deep in credit card debt, Airbnb’s founders needed to find a way to keep the company afloat. They did what any great entrepreneur would do and took a page out of Fred Wilson’s book to do “whatever it takes” to keep the company going. During the 2008 Presidential election, they sold thematic cereal boxes at campaign conventions (“Obama O’s” and “Cap’n McCains”) at $40 a box, selling more than $30,000 worth of themed cereal.

Airbnb’s break came in 2009 when the company was accepted by the business accelerator, Y-Combinator. Chesky and his co-founders secured $20,000 and three months to refine the Airbnb model. But more importantly, they had validation.

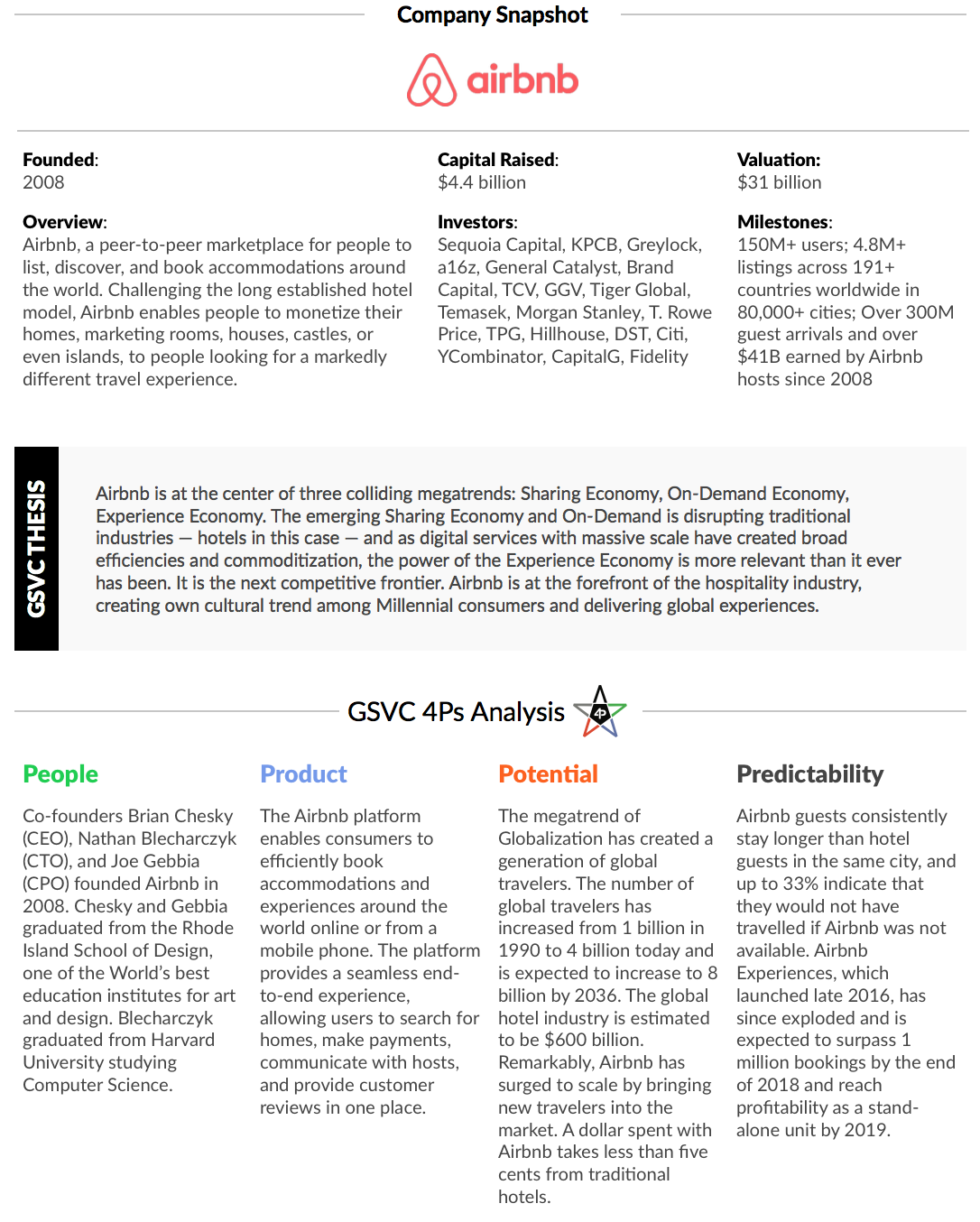

STATE OF PLAY

Founded in 2008, Airbnb has created an inventory of nearly five million rooms and a market value of $31 billion, surging past hotel industry stalwarts that have been operating for nearly 60 years. It has served over 150 million travelers in 80,000 cities across over 190 countries.

Airbnb’s rapid ascent was crystallized during the 2014 World Cup in Brazil. Of the 600,000 revelers who travelled to Brazil to support their team, one fifth, or 120,000 people, used Airbnb for their accommodations. Since then, the company has gone on to the support and provide accommodations for the 2017 Summer Olympics in Rio and the 2018 Winter Olympics in Pyeongchang.

Last August, Airbnb also provided accommodations for the once-in-a-lifetime total solar eclipse in the United States. More than 50,000 guests used Airbnb in order to witness the event, bringing hosts about $11 million in extra income. Nearly half of all hosts for the eclipse were first-timers on Airbnb.

Network Effects are at the core of Airbnb’s success. Travelers that enjoy the service often become hosts themselves. Airbnb’s consumers, in other words, are also the fuel of the company’s global growth engine. Today, there are more rooms on Airbnb’s platform (4.8 million) than the top six hotel chains — Marriott, Hilton, Accor, InterContinential, Wyndham, China Lodging (4.7 million) — by market value combined. More impressively, Airbnb, the World’s largest lodging company, doesn’t own any of its rooms.

Source: Yahoo Finance, Company Disclosures, Thomson Reuters, GSViQ

*Marriott International acquired Starwood Hotels for $13.6 billion in 2015.

The business model is simple and the growth opportunity is clear. Airbnb charges a 6-12% guest fee and a 3% host fee. We estimate the effective take rate to be in the 12-13% range, in line with projections from the Wall Street Journal.

Today, Airbnb is estimated to capture just over 3% of the $600 billion global lodging industry, in other words — implying a $80+ billion opportunity in just that segment.

What has driven Airbnb’s rise? It’s a fundamentally new form of travel that appeals to a broad audience. People stay in Airbnb rentals almost twice as long as traditional hotels. And guests also consistently indicate that they would not have even travelled at all had it not been for Airbnb.

Source: Airbnb, GSV Asset Management

THE POWER OF AIRBNB

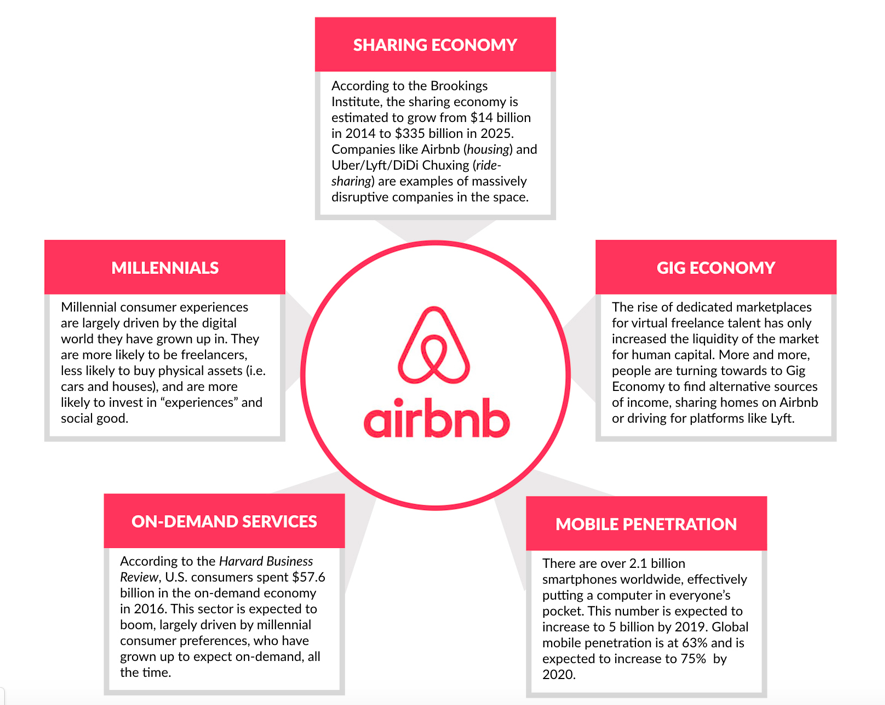

Airbnb is riding powerful tailwinds following the Big Bang, which created the forces that have changed — and continue to change — the world as we know it.

The Internet was commercialized by Netscape in 1994. Since then, the digital tracks have been laid with over 3.8 billion people on the internet today. 4.8 billion people in the World have a mobile phone. In comparison, only 4.2 billion people own a toothbrush.

The Fall of the Berlin Wall in 1989 has resulted in the surge in globalization. Airline travel has boomed, with the number of international travelers going from 1 billion in 1990 to 4 billion today. By 2036, there is expected to be 8 billion airline travelers.

There has been a massive shift from living in a physical world to a digital one. Today, there is a new generation of digital businesses that leverage the power of the internet and globalization to scale the massive sizes. If you look at the largest transportation company in the world, Didi Chuxing, they own none of their vehicles. Spotify, the world’s largest music platform, creates none of its content. Dropbox, the world’s largest storage company, owns no warehouses. Facebook, the world’s largest media platform, owns none of its own content.

And there’s Airbnb, the world’s largest hospitality platform, which owns none of its inventory. Since its creation in 2008, the company has strategically built out its platform and has positioned itself at the center of the megatrends of the Experience Economy, Demographics, and Brand.

All In On Experiences

In their 1999 book The Experience Economy, Joseph Pine and James Gilmore argue that the entire history of global economic progress can be summarized in the evolution of the birthday cake:

As a vestige of the agrarian economy, mothers made birthday cakes from scratch, mixing farm commodities (flour, sugar, butter, and eggs) that together cost mere dimes. As the goods-based industrial economy advanced, moms paid a dollar or two to Betty Crocker for premixed ingredients. Later, when the service economy took hold, busy parents ordered cakes from the bakery or grocery store, which, at $10 or $15, cost ten times as much as the packaged ingredients. Now, in the time-starved 1990s, parents neither make the birthday cake nor even throw the party. Instead, they spend $100 or more to “outsource” the entire event to… [a] business that stages a memorable event for the kids—and often throws in the cake for free.

An “Experience” — a memorable event intentionally created for a consumer — is a distinct economic offering that has become more valuable as goods and services are commoditized.

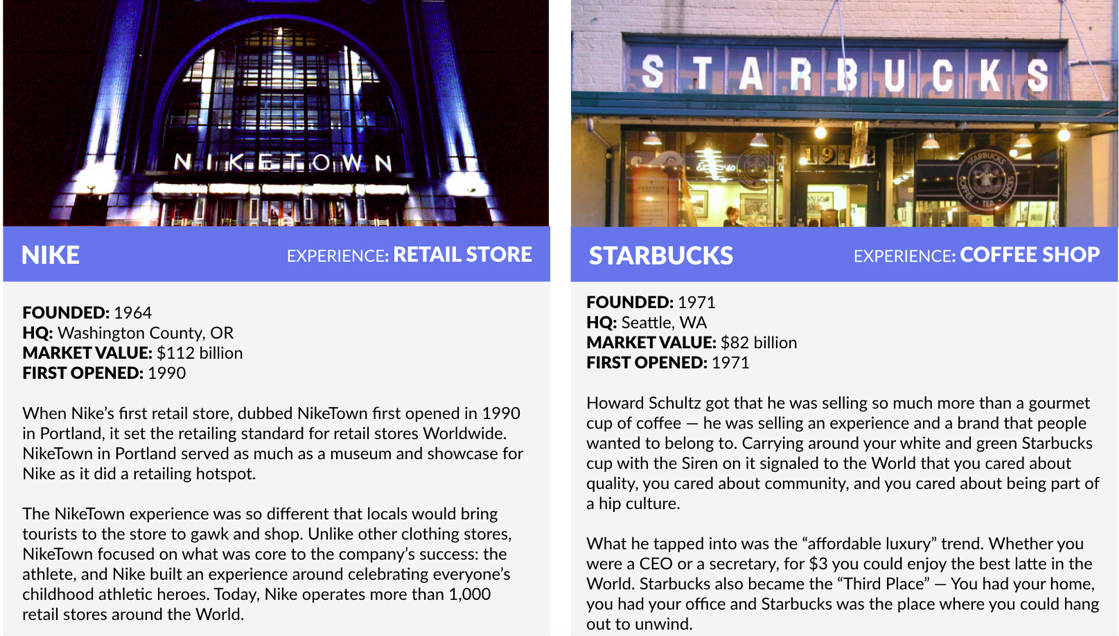

Pine and Gilmore published their book in 1999, five years after Marc Andreessen co-founded Netscape, creating the Internet as we know it. Over the next decades, the Internet, and later smartphones, have transformed the way services are designed and delivered, from retail (e.g. Amazon to transportation, (e.g. Lyft) to communication (e.g. Facebook). (Disclosure: GSV owns shares in Lyft)

Source: Company Disclosure, GSV Asset Management

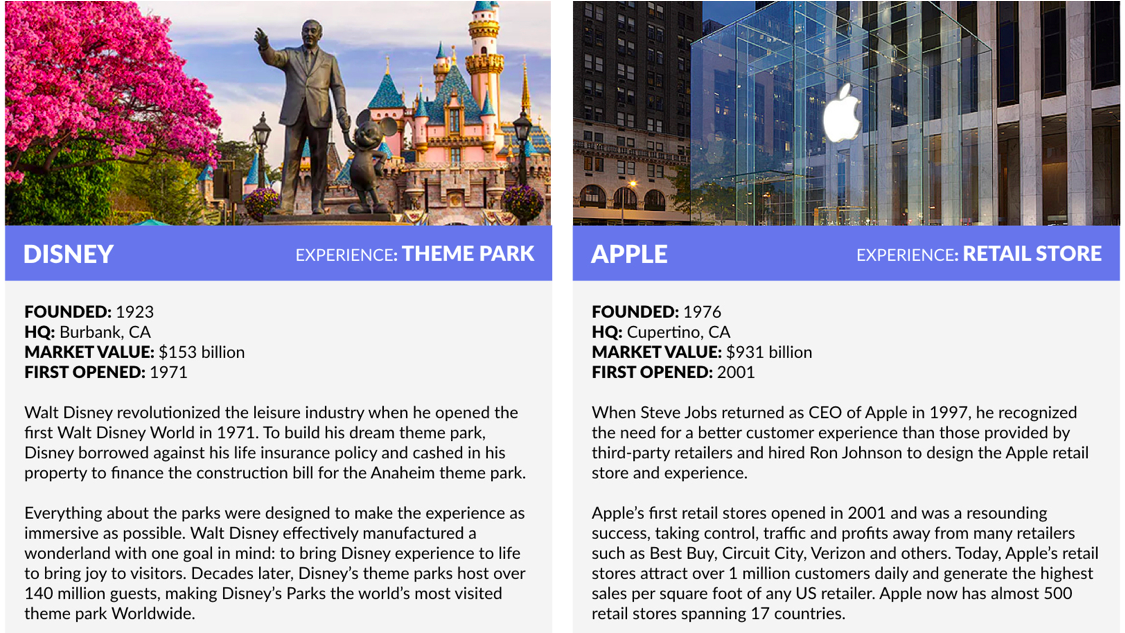

As digital services with massive scale have created broad efficiencies and commoditization, the power of the Experience Economy is more relevant than it has ever been. It is the next competitive frontier.

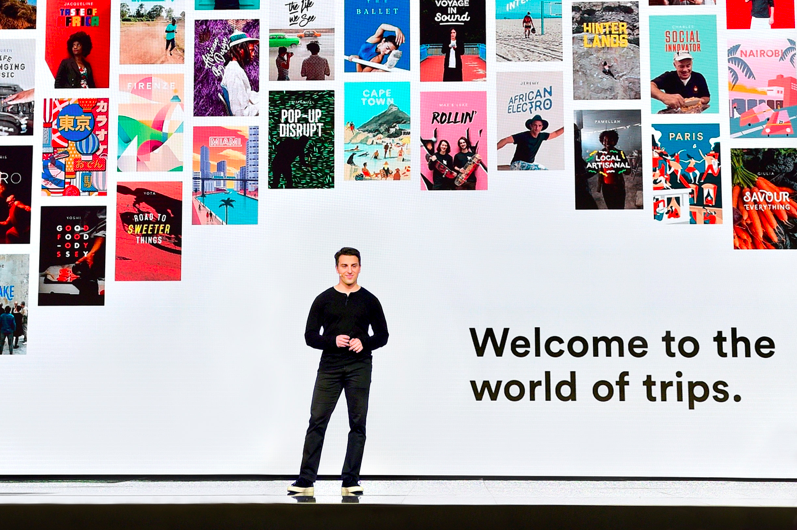

From inception, Airbnb was focused on offering travelers an opportunity to experience a special home in their destinations, with heavy emphasis on creating a product that users were delighted to use. In 2016, Airbnb CEO Brian Chesky unveiled a service called “Experiences,” which offers much more than a place to sleep. The company’s first product launch since its initial product, Airbnb Experiences is a collection of private tours and tailored activities — from wine tasting in California to kimono making in Tokyo and guided meditation in Paris — available through the network.

Airbnb is not content to be a room broker. It’s going all in on experiences. And today, the platform offers more than 5,000 experiences in 60+ cities worldwide. A year after announcing the product, weekly Experience bookings were up over 2,000% and the number of active Experiences was up 500%.

By launching Experiences, Airbnb was able to diversify its revenue sources amid regulatory pressures the company faces in cities, which they’ve encounter in effectively every market they’ve entered. Property and rental laws simply were not written for the sharing economy, and legislators have scrambled to respond coherently. Critics, particularly in San Francisco, complain that Airbnb’s popularity has lead to decreasing inventory of rental units and increased prices. The logic is dubious at best. But the broader point is that fighting Airbnb and the sharing economy is like fighting gravity.

Tours are a $2.5 trillion industry — five times larger tan the advertising industry — according to CEO Brian Chesky. The company is placing a strategic bet on Experiences, expecting that revenue from the new product will eventually eclipse proceeds from the home-sharing business. According to Reuters, Airbnb Experiences is on track to surpass 1 million guest bookings by the end of 2018 and is expected to be profitable by the end of 2019. Earlier this year, the company announced that it would be investing $5 million into expanding the Experiences product, aiming to reach to 200 U.S. cities by the end of this year.

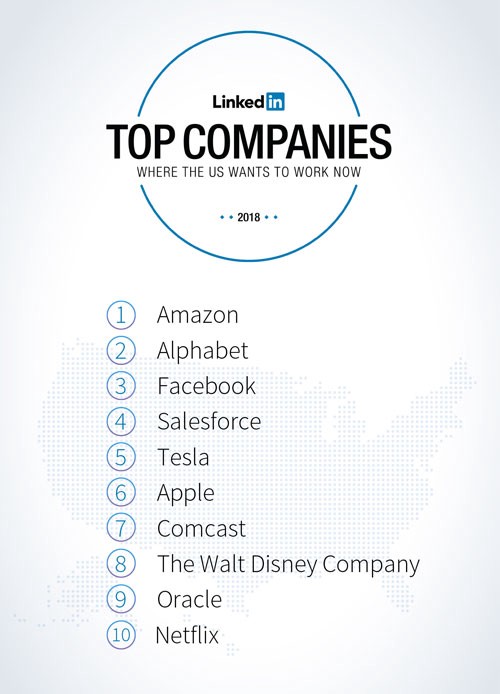

A Community-First Brand

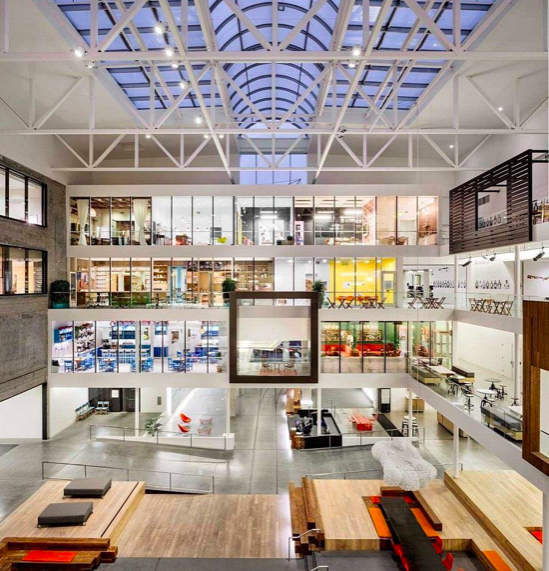

For the past twenty years, Fortune has published its annual list of the Top 100 Best Companies to Work For. From all of these studies, it is clear that the best companies to work for are focused on three criteria: 1) Meritocracy; 2) Mission Driven; 3) Investing in Employees. In fact, the number of hours companies dedicate to training and developing employees has increased from 35 hours to more than 58 hours today.

Employees at the Top 100 Best Companies are 20x more likely to state their company is innovative and are 15% more likely to want to come to work. Customer are 11% more likely to rate services as “Excellent”. And the Top 100 Best Companies outperform the Russell 3000 by over 2x. Simply put, the Top 100 Best Companies have happier employees, customers, and shareholders. Fortune’s 100 Best Companies to Work For are simply the Best Companies, period.

In 2016, Airbnb dethroned Google as Glassdoor’s Best Place to Work. The company’s employees were ecstatic over Airbnb’s benefits, which included a travel stipend, a free meal plan, lucrative compensation, a healthy company culture and values, and high quality senior management — including a CEO who had a 98% approval rating.

While the company has since fallen in ranking on Glassdoor’s list, it’s clear that the Brian Chesky is focused on creating a company that employees are proud to and strive to work for. In March 2017, Chesky announced that he would be taking on the role as Head of Community at Airbnb, showing his commitment towards developing a brand that customers, shareholders and employees were excited about.

In an interview with Fortune, Chesky stated:

The reason why is I love Steve Jobs and Walt Disney; they are some of the great CEOs of the 20th and 21st century. What made them great was they were obsessed with the product. And, one day I was thinking, what’s our product? Our product is not the website, it’s not the app–it’s the community, the people. CEOs are often chief product officers. But for me to say I’m a chief product officer when my product is a community, I really should be thinking of myself as head of this community.

Not surprisingly, Walt Disney and Steve Jobs were the earliest pioneers of the Experience Economy and were highly focused on building an experience and brand that left an impression with customers.

Happy customers are at the core of Airbnb’s platform driving the network effects that have propelled the company to grow exponentially. Travelers that are happy with the Airbnb experience often become hosts themselves, resulting in a dynamic cycle of growth that feeds upon itself.

The company’s focus on expanding it’s “Community First” brand was clear when Brian Chesky announced this February the company’s aspiration to be a 21st Century Company — one that operates in the interests of all its stakeholders, including hosts, guests and communities.

The company announced the expansion of its Superhost program, which recognizes and gives over 20 benefits to the most loved Airbnb hosts. The company is also launching its guest appreciation program, Superguests, which provides benefits towards the companies best customers.

Demographic Shifts

Airbnb is at the center of major demographic shifts which have changed the way customers demand and acquire products and experiences.

The sharing economy means that in 60 seconds you can be an entrepreneur. You can monetize your home and your car on your schedule, at a price you believe is reasonable. For a sharing economy company to work, there needs to be the potential for a sizable marketplace to utilize slack resources that people previously hadn’t valued effectively. And there needs to be an existing set of competitors that are ripe for disruption because they provide a sub-par value proposition.

The Sharing Economy is part of a broader evolution to a Free Agent Economy. The workforce of the United States is increasingly operating outside of the traditional corporate structure, a trend that Daniel Pink forecasted in his 2001 book Free Agent Nation. People have gone from having one job in the 1990s to having 15 lifetime careers, with one career being part of the gig economy. Today, 82% of today’s millennials aspire to be flexible workers. Already, 60% of workers are flexible workers in China, and in the U.S. it is 40%. Through Airbnb, individuals are able to monetize their passions by curating, designing and running Experiences that capture the flavor of their local community.

All in all, the rise of flexible work and the gig economy is largely attributed to the massive demographic shift from the rise of the Millennial Generation. This generation differs greatly from prior generations and has resulted in a class of consumers with expectations and preferences driven by the digital world the generation grew up in.

73% of Millennials are willing to spend more on a product if it comes from a sustainable brand and are more likely to invest in “experiences” as opposed to assets. In fact, Millennial homeownership is at an all time low at 39%, which is significantly down from 48% in 2007. As an offshoot of that, Millennials are less likely to own cars — and prefer to take part on the ridesharing industry — and last year more cars were sold to people over the age of 75 than 18-25 year olds.

Airbnb has positioned itself at the center of what consumers, especially Millennials, desire from a company. It offers mobile-friendly, on-demand travel booking experience with transparent pricing and a brand centered around providing good for the World. The platform’s evolution towards offering Experiences allows consumers to monetize their hobbies and local flavor to create a dynamic global community of World learners.

WHAT’S NEXT

What started out as three air mattresses in a San Francisco apartment has today grown to become a phenomenon in global travel. In ten years, Airbnb has grown to be a company worth over $30 billion, logging 300 million guest check in and generating $41 billion of revenue for Airbnb hosts. Airbnb’s platform today has 4.8 million homes across 80,000 cities in over 190 countries.

Amazon has gone from your book store to be your everything store — a one-stop shop for shopping. Airbnb has ambitions to become a one-stop shop for travel and Brian Chesky even teased the possibility of an Airbnb airline.

As the company turns to the next ten years, Chesky presented his ambitious Roadmap to scale Airbnb’s platform to cater to 1 billion annual guests by 2028. New property types, Airbnb Collections (for specific travelers like business or family travelers), and community recognition (Superhosts + Superguests) are the key elements in the Roadmap to create an Airbnb for everyone.