Market Snapshot

| Indices | Week | YTD |

|---|

We launched GSV Capital Corp. (GSVC or GSV Capital) in 2011 to provide public investors with access to the world’s leading VC-backed private companies. Driven by fundamental structural changes in the IPO market and in the characteristics of companies going public today, the opportunity that was historically available for investors to ride an emerging company’s value creation from small to medium to large at the time of its IPO has all but been abolished. Today, dramatic value creation is occurring in the private market with only a handful of investors able to participate.

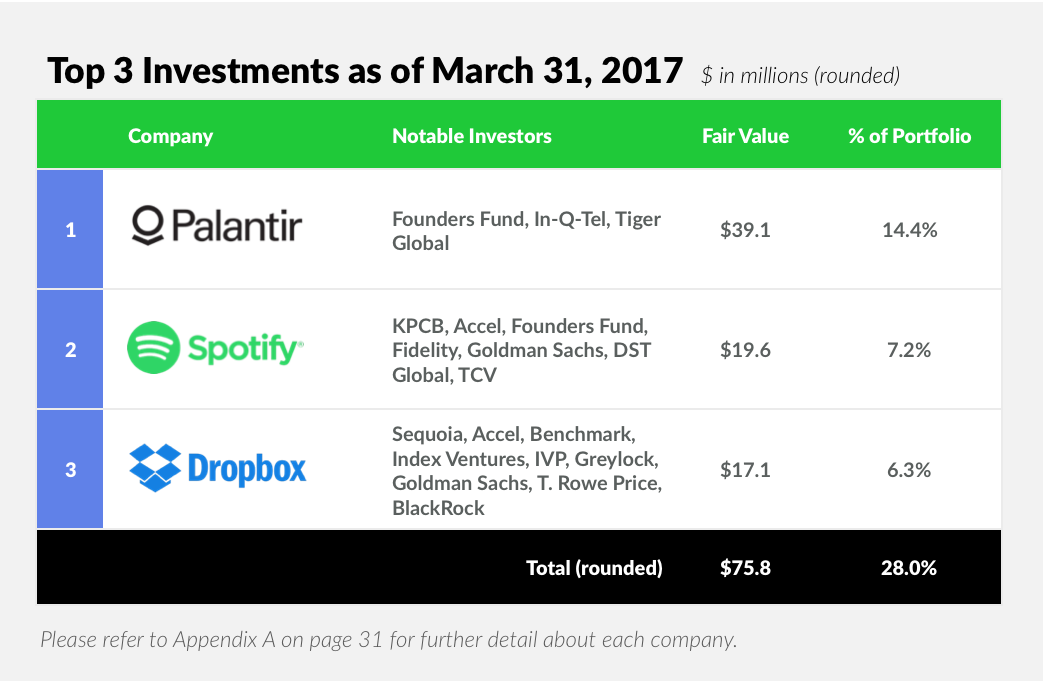

As a liquid, publicly traded stock, GSVC is a unique vehicle that enables public investors to access this attractive asset class, which has traditionally been limited to select venture capital firms and institutional investors. As of March 31, 2017, GSV Capital’s top three positions were Palantir, Spotify, and Dropbox, accounting for approximately 28% of the total portfolio at fair value, excluding treasuries. GSVC’s top 10 positions accounted for approximately 60% of the portfolio.

Our core thesis is that growth drives enterprise value, and accordingly, our focus remains on building a portfolio of the most dynamic, rapidly growing, late-stage private companies. With GSVC’s common stock trading at approximately 50% of NAV as we publish this letter, we continue to see a great risk-reward opportunity for our stockholders based on the strong momentum behind our top positions and an improving IPO environment that is showing signs of life.

We believe that the fundamentals that sparked the launch of GSV Capital are as prevalent today as they were in 2011, namely:

- There has been a 73% reduction in IPOs per year in the period from 2001 to 2016 (108), compared to the period from 1990 to 2000 (406), and the median time to IPO from initial VC investment has increased from three years in 2000 to approximately ten years today.

- At the same time, digital infrastructure created over the last 20 years, including 3.4 billion internet users and 2.6 billion smartphone users, has unlocked unprecedented opportunities to rapidly create and scale global businesses with outsized market values.

- As blue chip private enterprises follow a longer timeline to liquidity, GSV Capital is a unique public investment vehicle targeting companies with significant growth and value creation potential.

- GSV Capital has demonstrated the ability to access shares in private companies backed by premier venture capital firms, including Benchmark, Kleiner Perkins, Andreessen Horowitz, IVP, NEA, and Sequoia. We believe a strong, well-networked investor base creates unfair advantages for emerging growth companies, including superior access to talent, counsel, and strategic partnership opportunities, as well as greater visibility into follow-on financings. We believe that shares in GSV Capital currently provide the “double play” opportunity of high underlying asset growth coupled with a significantly discounted price-to-shares versus NAV. Currently, as of the end of the first quarter of 2017, NAV was $8.83 and the share price was $4.57, approximately a 50% discount. Additionally, the year-over-year revenue growth of the portfolio exceeds 100% — a key driver of long term enterprise value. Moreover, an improving IPO environment is a positive signal as historically, leading portfolio positions with a runway to a public offering have been a positive catalyst for GSVC’s stock.

YEAR IN REVIEW

In 2016, we made important progress with respect to our goal of assembling a portfolio of the world’s most dynamic, VC-backed private companies — from new investments to portfolio construction and strengthening the GSV Capital platform.

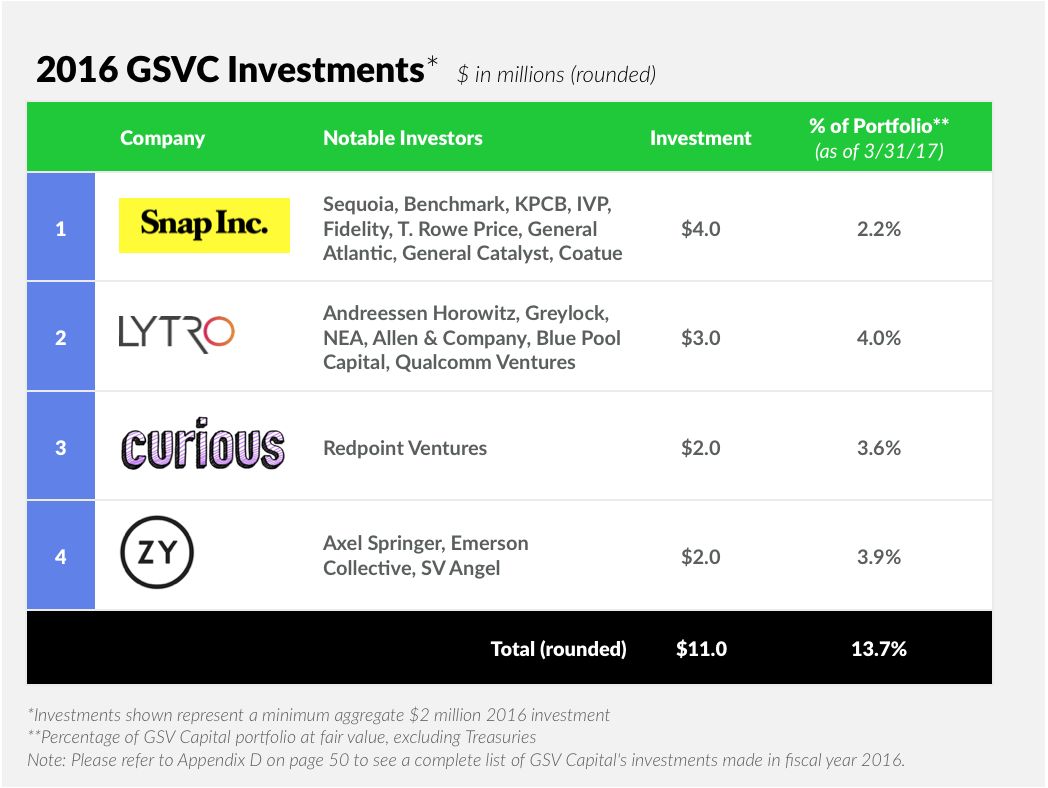

GSV Capital invested in the following companies in the year ended December 31, 2016:

- Snap ($4.0 million invested in FY 2016): Founded in 2011, Snap, the parent company of Snapchat, is emerging as one of the most engaging social and digital media platform for Millennials. Today, the company has well over 166 million daily users sending nearly 35,000 “Snaps” per second and watching 10+ billion videos per day, up from just two billion in May 2015. Users spend more than 30 minutes on the app per day and over 60% share new content every day. On March 2, 2017, Snap completed a $3.4 billion IPO, pricing above the range and currently trades at an approximately 23% premium to the IPO pricing. According to Nasdaq, this was the largest public offering for a U.S. technology company since Facebook listed in 2012. Notably, NBCUniversal invested $500 million in the IPO, which we believe signals an increasing focus on Snap as a distribution and growth engine for traditional media businesses.

- Lytro ($3.0 million invested in FY 2016): With its groundbreaking “Light Field” technology, Lytro is transforming the way digital content is created, from images to videos and, ultimately, virtual reality. Rather than capturing a flat, two-dimensional image through a standard camera, Lytro captures every ray of light in a frame. With this data, Lytro creates highly accurate three-dimensional models of entire environments. It makes the real world work much more like computer graphics, giving artists unprecedented design capability and flexibility while saving costs. To paraphrase Marc Andreessen, Lytro is software “eating” cameras and imaging. The company is backed by Andreessen Horowitz, Greylock, NEA, and Allen & Company.

- Curious ($2.0 million invested in FY 2016): Curious is a life-long learning platform that Forbes has described as the, “Netflix for learning.” With over 25,000 lessons on virtually any topic, Curious helps people master new skills — from how to play the banjo to business communication. Increasingly, Curious is showing traction with bite-sized “invisible” learning, whether it’s the one million people reading the Daily Curio, watching brief lessons, or completing brain teasers, all resulting in points added to their knowledge portfolio. The company’s learning engine is powered by leading cognitive science research, which demonstrates that people who stretch their brain for as little as 15 minutes per day are happier, healthier, and more productive. In addition to GSV Capital, Curious is backed by Redpoint Ventures.

- OZY Media ($2.0 million invested in FY 2016): Led by CEO Carlos Watson, a former CNN and MSNBC commentator, Ozy is a next generation multi-channel media business that delivers information about what’s new and next to more than 25 million people per month — an audience larger than the Economist, New Yorker, or Politico. Ozy is creating a powerful business model based on a three-legged stool — Digital News/Magazine Content, Events, and TV. In September 2016, OZY partnered with PBS to premiere a primetime program called “The Contenders – 16 for ’16,” an 8-part documentary series dissecting the most dramatic presidential campaigns in U.S. history. OZY is backed by leading German media company Axel Springer, as well as Emerson Collective and SV Angel.

Beyond new investments, we took several steps in 2016 to hone the GSV Capital portfolio around top positions and emerging names:

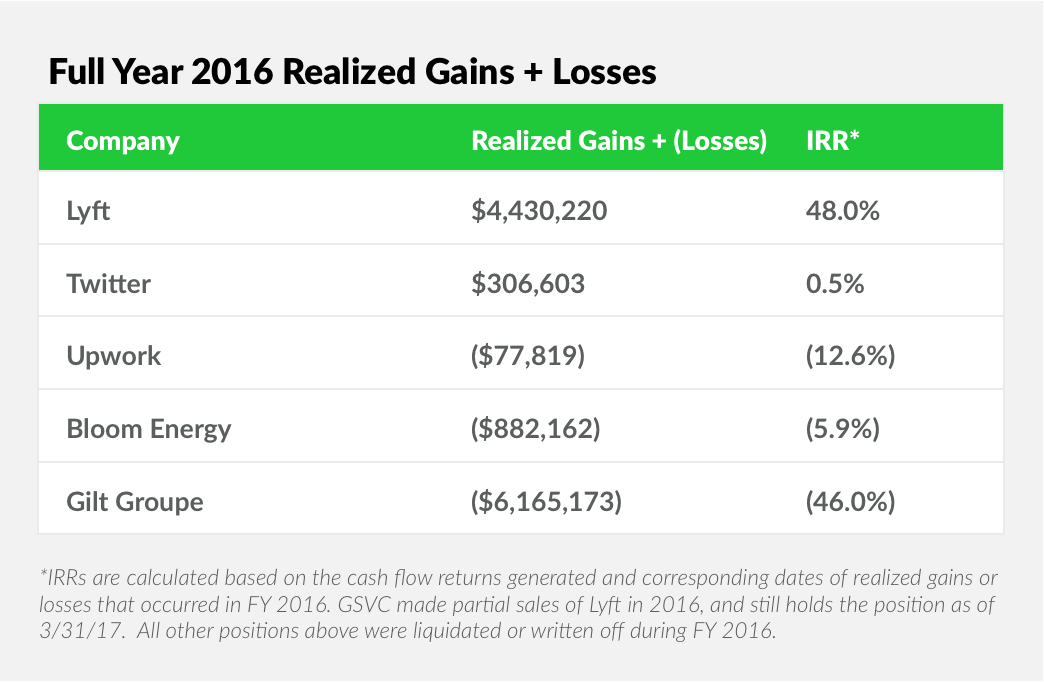

- GSV Capital sold shares in portfolio companies resulting in $2.4 million of net realized losses in the year ended December 31, 2016. Exits from Upwork, Bloom Energy, and Gilt Groupe — positions that had been substantially marked down prior to exit — generated the losses.

- We also sold shares in Lyft in 2016, resulting in a $4.4 million realized gain. While we were pleased to monetize a portion of our investment in a private transaction at an attractive return, GSV Capital continues to hold a $7.3 million position in the company at fair value as of March 31, 2017. We remain bullish on Lyft’s progress, momentum, and market opportunity.

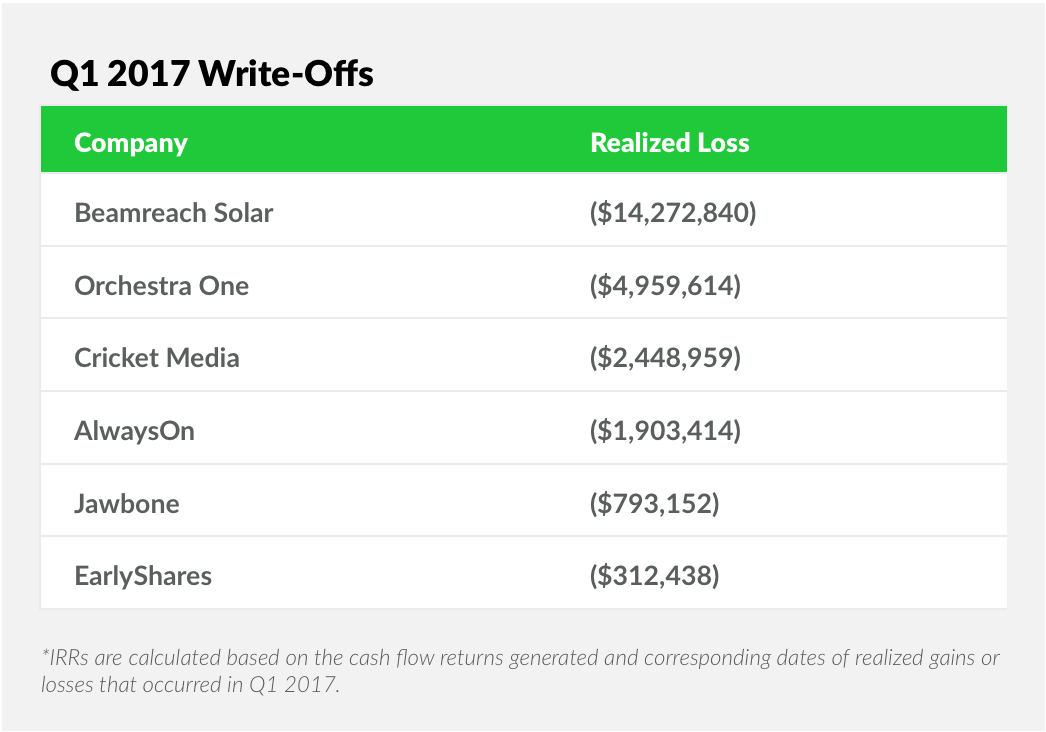

- At the end of 2016, we applied GSV Capital’s rigorous valuation process against an environment where it has been increasingly challenging to finance non-“Unicorn” companies. As PwC has indicated in its Q1 2017 MoneyTree report, despite high profile financings for Uber ($5.6 billion), Snap ($1.8 billion), and Slack ($200 million) in 2016, VC investments in “Expansion Stage” and “Later Stage” deals were down 12% and 35% respectively for the year. Recent examples of this dynamic in the GSV Capital portfolio include a near complete write-down of our investment in PayNearMe in the fourth quarter of 2016 and a write-off of our investment in Beamreach Solar in the first quarter of 2017. GSV Capital recorded additional write-offs in the first quarter of 2017 on several positions that had been written down substantially over previous quarters. Realized losses on write-offs in Q1 2017 totaled approximately $24.7 million. Moving forward, we will continue to monitor our positions as we aim to concentrate the GSV Capital portfolio around our top names. We have focused intently to clear out troubled investments, which is reflected by these write offs.

As part of the ongoing steps we are taking to strengthen the GSV Capital platform, in the first quarter of 2017, we announced the addition of two new members to the GSVC Board of Directors with significant investment and asset management experience.

- David Pottruck is the former CEO of Charles Schwab, which he guided from a $400 million value business to $45 billion. Today, David is the Chairman of Red Eagle Ventures and he is a 17-year board member at Intel. David is also the Chairman of Hightower Advisors, a $35 billion wealth management firm he helped launch in 2008. He officially joined the Board on May 31, 2017.

- Marc Mazur is the former CEO of Brevan Howard U.S. Asset Management. Before that, Marc was an executive at Goldman Sachs in its Fixed Income division for over a decade, and today he serves as a Senior Advisor to Brightwood Capital, a multi-fund asset manager with over $3 billion under management. Marc officially joined the Board on March 17, 2017.

While we were disappointed to record fourth quarter 2016 and first quarter 2017 write-downs, we are very encouraged by a distinct opportunity set that is materializing for GSV Capital. It starts with the portfolio, where average revenue growth was 110% in 2016 – the fourth consecutive year above 100%.

PORTFOLIO SNAPSHOT

Net assets totaled approximately $196 million, or $8.83 per share, as of March 31, 2017, versus approximately $192 million, or $8.66 per share at December 31, 2016. This compares to a NAV of $268.0 million, or $12.08 per share on December 31, 2015.

As of March 31, 2017, GSV Capital held positions in 39 portfolio companies with an aggregate fair value of $270.7 million. Our focus is on reducing the number of portfolio companies and increasing the size of core positions. GSV’s top 10 positions accounted for approximately 60% of the total portfolio at fair value, excluding treasuries as of March 31, 2017. Our three largest investments — Palantir, Spotify, and Dropbox – represented 28% of the portfolio.

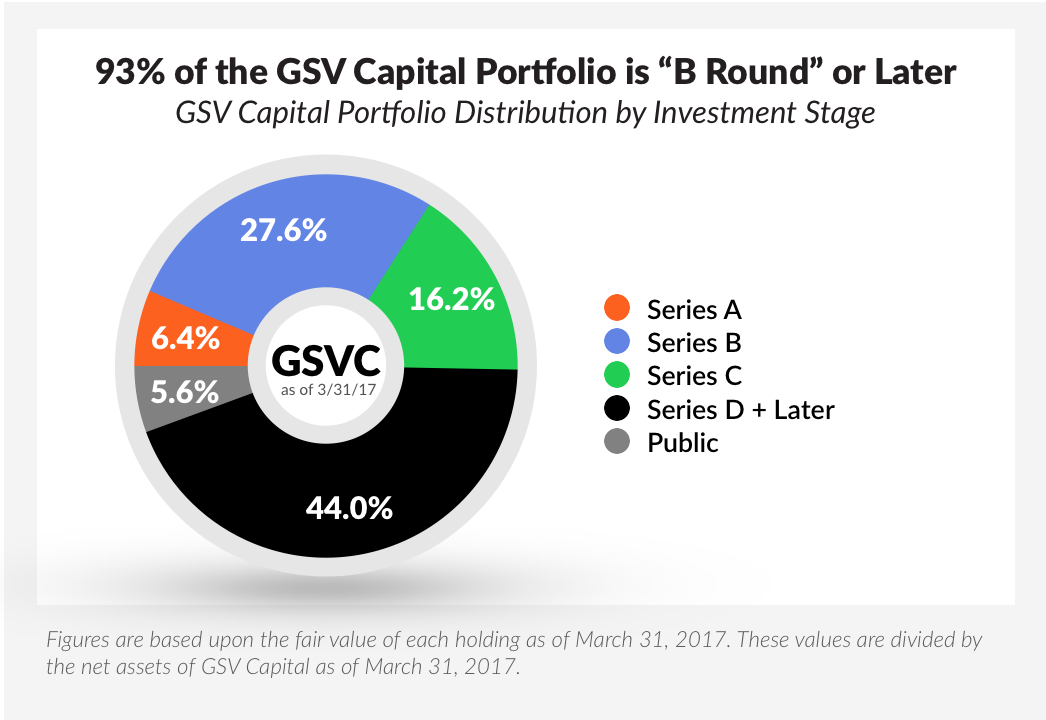

Over 93% of the GSV Capital portfolio is “B Round” or later as of March 31, 2017. We continue to see an enormous opportunity to invest in growth stage, VC-backed private companies — many of which would have been small cap IPOs in decades past.

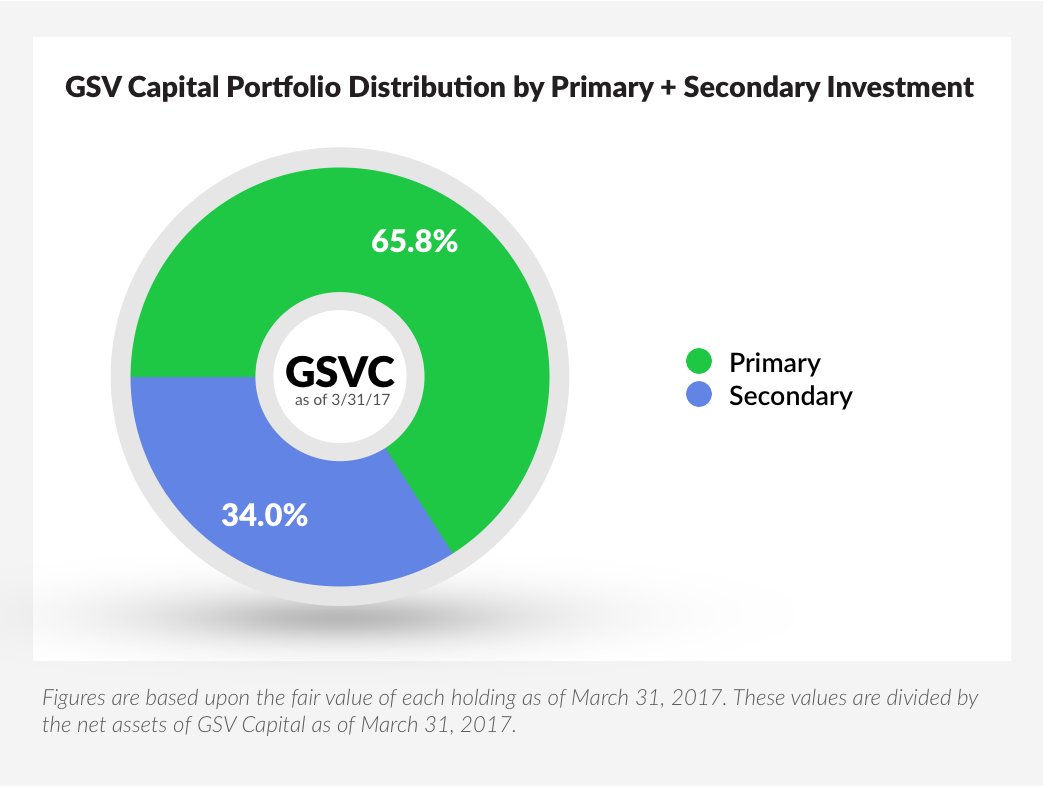

When GSV Capital was launched, we expected that the majority of our investments would be secondary transactions. And in fact, some of our portfolio’s most recognizable names — such as Facebook, Twitter, Dropbox, Spotify, and Palantir — were almost entirely secured through secondaries. But we have also found great opportunities to invest in primary rounds alongside premier institutional investors.

We are agnostic in terms of whether we invest in secondaries or primaries. Our goal is simply to invest in the top private companies in the world at a fair price. While primaries offer certain benefits, including formal information access, GSVC’s deep experience with secondaries creates advantages in terms of access, diligence, and timing.

Given that investing in secondary shares can be more challenging for many investors, we believe it presents an opportunity for GSVC to secure better pricing, which can help drive superior returns. Accordingly, we expect to have an increasing percentage of the portfolio originate from secondary transactions.

Investment Themes

Megatrends are powerful technological, economic, and social forces that develop from a groundswell (early adoption), move into the mainstream (mass market), and ultimately drive broad changes to societies, industries, and entire economies (mature market). Change unlocks opportunities for entrepreneurs, and we believe that a disproportionate number of transformational businesses are created where megatrends converge with growth sectors of the economy.

GSV Capital has developed five core investment themes that are focused on these areas of convergence to identify the “Stars of Tomorrow”… the fastest-growing, most dynamic companies in the world.

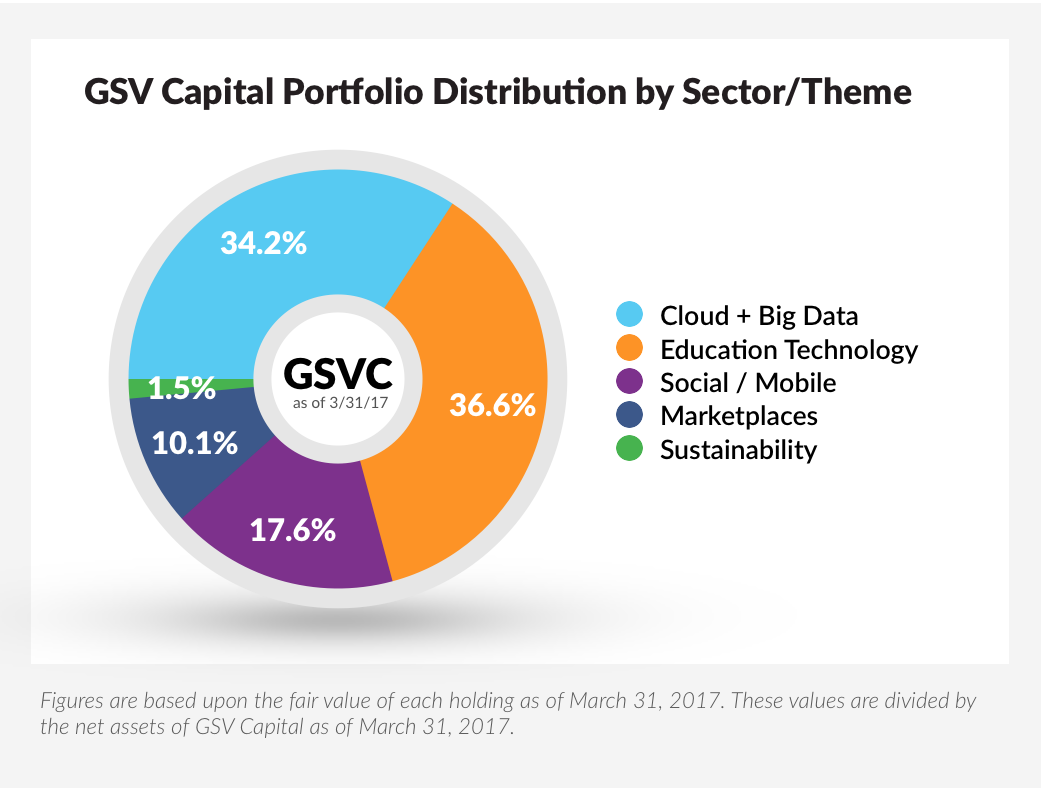

1. Education Technology (36.6% of Portfolio Fair Value as of 3/31/17):

- Summary: In a Knowledge Economy and Global Marketplace, education is the critical difference-maker for individuals, companies, and ultimately, countries. As rapid advances in Artificial Intelligence and Robotics accelerate the pace of automation across industries, the education imperative is growing more acute. Researchers from the University of Oxford have projected that 47% of American jobs are at “high risk” of being automated in the next 20 years and McKinsey estimates that 12 million U.S. “middle skill” jobs will be eliminated by 2025. In a world with smart machines, you can no longer fill up your “knowledge tank” until age 25 and cruise through life. To participate in the future, people will need to refill their knowledge tanks continuously. The flip-side of technology disruption is that ubiquitous internet connectivity, smartphones, and powerful big data applications enable highly effective, rapid scale education platforms to attract millions of students in a short period of time — what we call “Weapons of Mass Instruction.”

- Next Up: NETwork Effects Businesses — education and talent platforms connecting people (supply side), learning opportunities, and employment (demand side)

2. Cloud + Big Data (34.2% of Portfolio Fair Value as of 3/31/17)

- Summary: According to the MIT Technology Review, by 2020, 1.7 megabytes of new information will be created every second for every human being on the planet. To put that in perspective, in 1969, we sent astronauts to the moon and back using computers with only 2 kilobytes (0.002 megabytes) of memory. At the same time, organizations are struggling to make use of abundant new sources of information. EMC projects that less than 5% of target-rich data is analyzed today, let alone used. Powerful software analytics and connected devices are creating massive opportunities for innovative companies that are attacking a global Big Data and Business Analytics market that is forecasted by IDC to surpass $200 billion by 2020.

- Next Up: Artificial Intelligence, Machine Learning, Cloud Robotics, Blockchain

3. Social Mobile (17.6% of Portfolio Fair Value as of 3/31/17):

- Summary: In 2008, the average American spent 2.7 hours per day on digital media. Today we spend 3.1 hours per day on smartphones alone — more time than we used to spend on desktops, laptops, mobile, and other connected devices combined. Over 87% of Millennials sleep with their smartphones and 97% U.S. high school and college students would rather lose every other possession before giving up their smartphone. Snapchat now reaches 45% of U.S. 18-34-year olds, which is 9x greater than the top 15 TV networks combined. Social everything — entertainment, communication, collaboration, shopping, education, and healthcare — is the future and it is going to be done anytime, anywhere on mobile devices.

- Next Up: Digital Doctors, Connected Homes, Digital Assistants/Personal “Operating Systems”

4. Marketplaces (10.1% of Portfolio Fair Value as of 3/31/17):

- Summary: The foundation of modern economics is Adam Smith’s “invisible hand.” As people make economic decisions in their own self-interest, it ultimately brings economic benefits to others. But the rise of modern information technology and ubiquitous mobile computing has made the invisible hand a lot more collaborative. Every year, millions of travelers who would have typically checked into a hotel are instead using Airbnb’s marketplace to rent unused houses, apartments, and bedrooms for a better price — and a more unique experience. Billions more are saving time and money by ditching taxis for rides with services like Uber, Lyft, Didi, Go-Jek, and Ola. The Internet is exceptionally suited to aggregate supply and demand within an industry, and smartphones amplify the tremendous network effects that can be created.

- Next Up: Experience Economy

5. Sustainability (1.5% of Portfolio Fair Value as of 3/31/17):

- Summary: The good news is that the world’s middle class will more than double to five billion over the next 15 years. The bad news is that the strain this will put on the environment will be extreme, with wealthier people traveling more, consuming more, and using more electricity for everything — from air conditioning to lighting larger homes. Sustainability is not just green technology — it is water and wellness. There is no longer a debate between being “green” or “growing” — both are important. Water is even more precious, with California’s drought being a living example of how vital access to “blue gold” is for everything. Despite the prolonged slump in oil prices, Moore’s Law has taken effect with numerous sustainable technologies being able to compete on cost with dirty fossil fuels.

- Next Up: “Mind, Body, Soul” — brands and value propositions at the intersection of sustainability, health & wellness, and mindfulness

Rigorous, Systematic NAV Process

We calculate NAV on a quarterly basis using a rigorous process that values every security in the portfolio. Key factors that drive the valuation process for each security include:

- Recent institutional trades in the security where we have visibility on pricing

- Institutional marks on positions (e.g., security is held by a mutual fund with public marks)

- Valuations driven by new rounds of financing

- Company performance

GSV Capital’s Board of Directors (the Board) also employs an outside independent valuation firm, Andersen Tax, to perform an appraisal of the portfolio and its corresponding NAV each quarter. The Board reviews the fair value as recommended by the investment team of GSV Asset Management, as well as the fair value as determined by Andersen Tax and, based on its review, determines the fair value of our investment portfolio.

Click HERE to read the full letter.