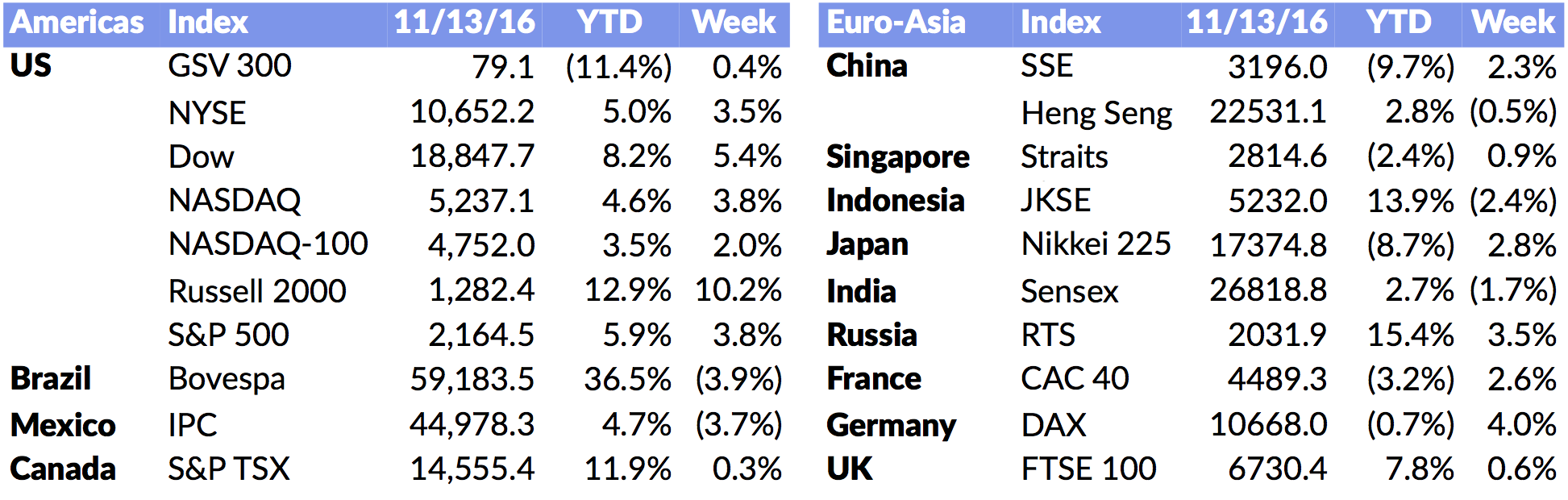

Market Snapshot

| Indices | Week | YTD |

|---|

New Zealand was greeted Monday morning with a 7.8 magnitude earthquake, sparking a tsunami with fifteen-foot waves. Fleeing residents in Christchurch were in a state of traumatized disbelief, having just seen their city reduced to rubble in an earthquake five years ago.

Shell-shocked doesn’t capture the feeling that many Americans, most pundits, and much of the World felt Tuesday evening in the wake of a 10.0 Richter Scale earthquake now known as President Elect Trump. Equities futures markets on every corner of Earth were in a free-fall as it became increasingly clear that the future President of the Free World was going to be the person best known for saying “You’re Fired” on a reality TV show.

Then, even more unexpected things happened. The first was that the Sun came up in the East Wednesday morning and the second was that stocks actually went up, not down, as the experts had proclaimed they would (not predicted — proclaimed). In fact, the Dow Jones, which was down nearly 1,000 points Tuesday evening, had its best week in five years, advancing 5.4%.

There were many lessons learned from this election but one that can be applied to investing is to believe what you see, not what you hear. The crowds that Donald Trump was getting everywhere he went suggested he was tapping into something powerful. The fact that despite shooting himself in the foot, the head, and the heart, he wouldn’t die — his poll numbers barely moved — said that people didn’t care about the bad stuff. They wanted change. If a stock has bad news and it doesn’t go down, it means that it is going up, and that’s what happened here.

Moreover, people interjected their own beliefs and bias as opposed to analyzing the data. The Real Clear Politics Poll, which aggregates all the polls, basically had Trump within the margin of error nationally and in all the battleground states on the eve of the election. Yet the experts couldn’t imagine a President Trump, so they were in shock when what the numbers were saying actually happened.

Logic suggested that Trump support would be understated in most polls because people didn’t want to get bludgeoned for saying they were voting for Trump… after all, Trump voters were uneducated, redneck, racist and misogynist. Look at what happened to Peter Thiel for being a visible Trump supporter. There was a movement to have him removed from the Facebook Board.

The pain, fright and anger that many Americans are feeling right now is very real and it will take real leadership to help our Country move forward. I’m optimistic that our brightest days are in front of us and that’s all up to we the people.

One of the first times I learned the lesson of believing what I saw, and doing the analysis versus what the pundits were saying, was with Starbucks Coffee nearly twenty five years ago.

I was fortunate to be one of the first research analysts to identify Starbucks as a huge opportunity following its IPO in 1992, when its market cap was $220 million. Today, its market cap is $79 billion.

Lucky? Maybe a little. Art or science? Both. Hard work? Absolutely. Let me tell you a story.

It was Thursday afternoon after a long week on the road visiting companies. I was in Seattle with one meeting to go before I flew home. My friends told me about this coffee company — named after a Moby Dick character — that had a cult following. I almost cancelled my meeting on the way to airport because I just wanted to get home and the company sounded ridiculous.

Maybe people in Seattle would embrace a coffee house as a great business, but I couldn’t imagine this concept traveling beyond the Puget Sound. But, Starbucks headquarters was just off Interstate 5 on the way to the airport and I figured, “Why not, I’ll make it quick.”

The minute I walked into the reception area, I knew something was going on there. The level of energy in the air was electric. I sat down with Howard Schultz and he crystallized how Starbucks was going to become the most important coffee company in the World. He talked about the importance of his employees, and how he was creating a partnership with them. He was passionate about the quality of the product and the customer experience. He was committed to constant innovation.

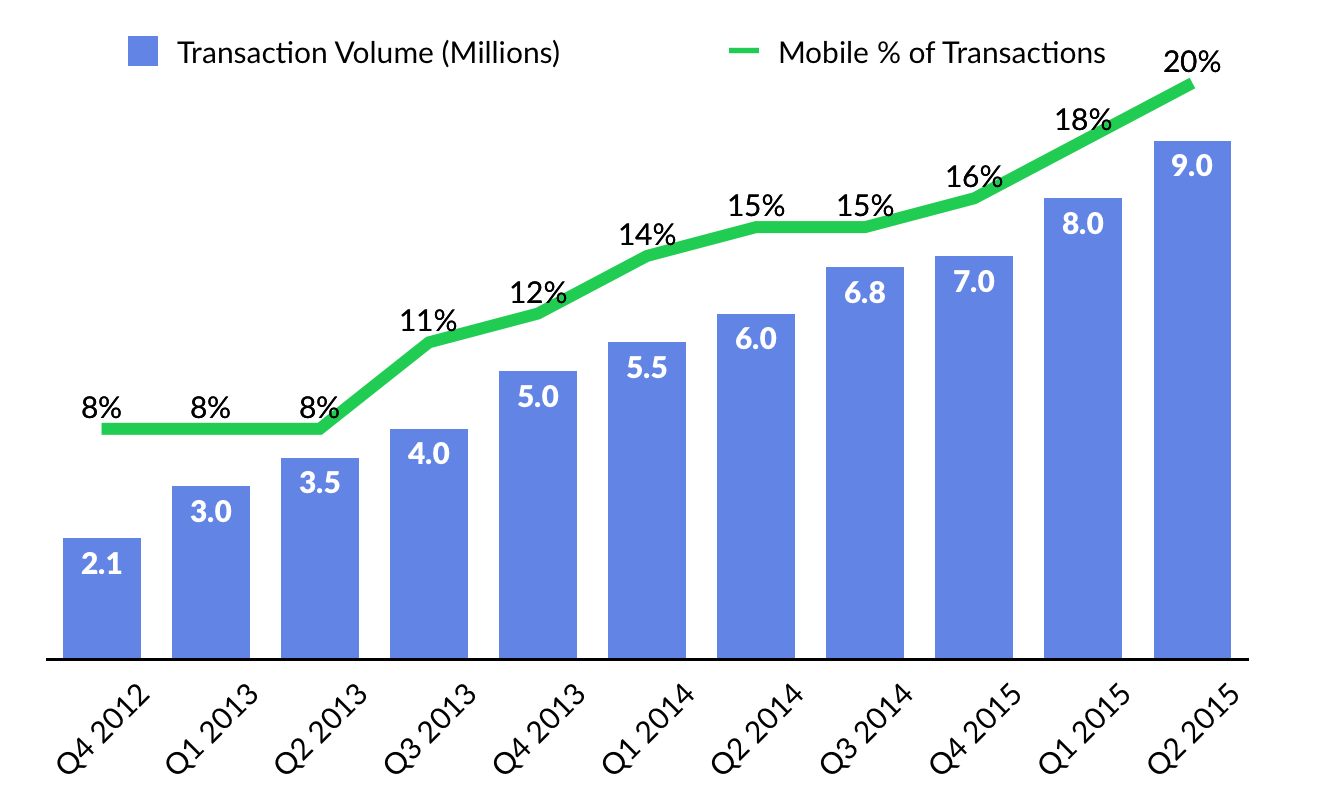

This week, Starbucks announced its quarterly earnings, narrowly beating analysts’ estimates. But buried among the ho-hum financial reporting was a remarkable development. Over 25% of the company’s U.S. transactions are now paid through the Starbucks app.

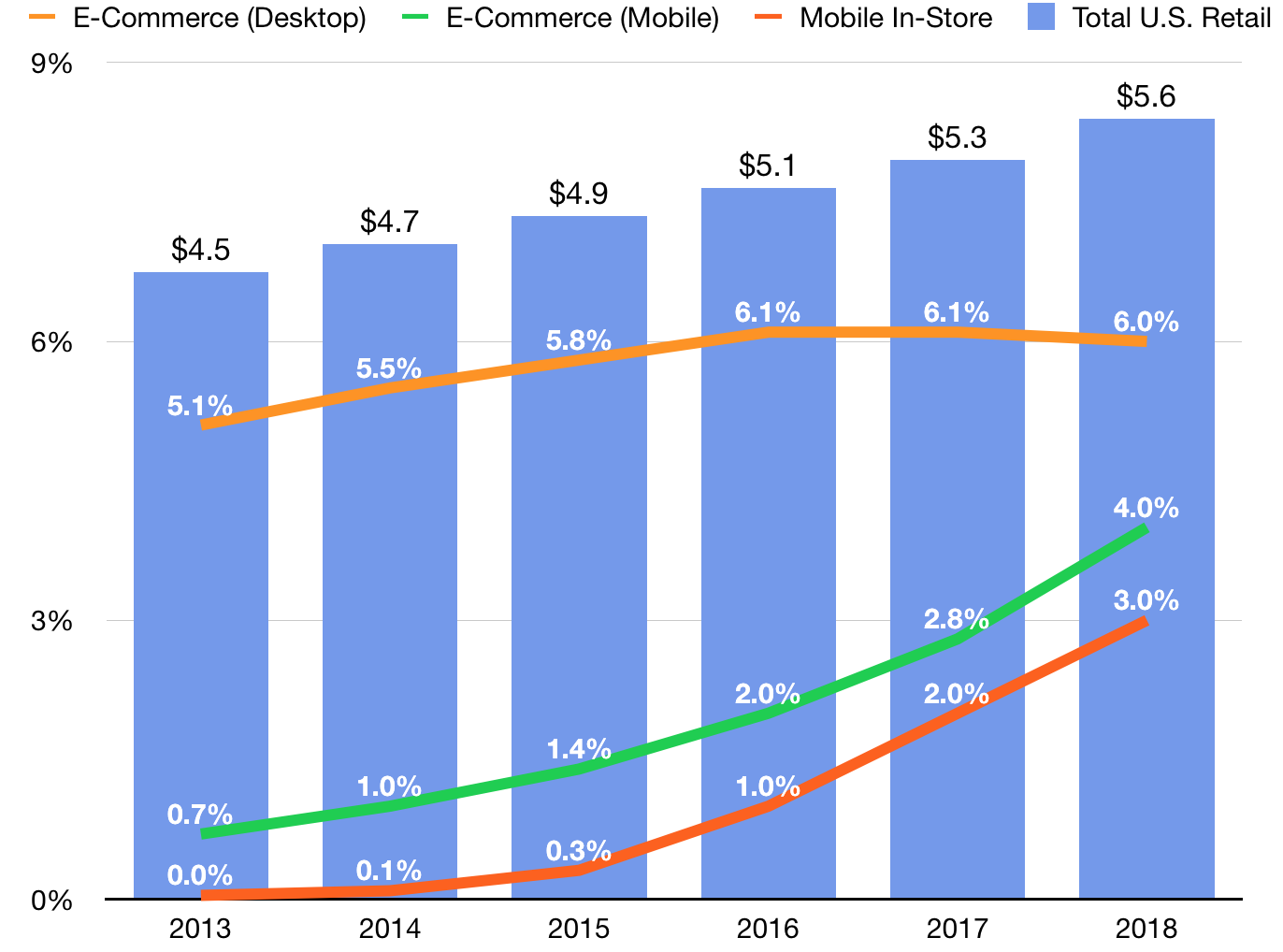

For context, of a projected $5+ trillion in 2016 U.S. retail spending, only 3% will come from mobile payments. And that’s despite a flurry of mobile wallet initiatives from major banks, online payment pioneers like PayPal, technology companies like Apple and Facebook, and countless startups.

It’s vintage Howard Schultz. Many people thought Starbucks was crazy for putting free Wifi in their stores in 2008. Today, we increasingly expect high speed connectivity everywhere we go.

In the same way, Starbucks is now a window to the future of consumer financial technology, or FinTech. Launched in 2011, the Starbucks app is generating six million transactions per month. And with $1.9 billion in prepaid deposits, it’s larger than many banks.

Why has Starbucks been so successful with mobile payments, and what does it tell us about how technology will transform the long-stagnant financial industry? First, Starbucks has created a superior user experience that makes it substantially more efficient to order a cup of coffee. It speeds up the checkout process and enables customers to order ahead.

Secondly, the payment process is effectively invisible — it’s just part of the app. The same is true of wildly popular ride-sharing apps like Uber and Lyft. Beyond making it dramatically easier to find a ride, these platforms have eliminated the need to hand a driver money, swipe a credit card, or even open a digital wallet like Apple Pay. The payment just “happens.”

Finally, Starbucks is a brand people love and trust. And customers are rewarded for loyalty with perks and incentives in the app every time they make a purchase.

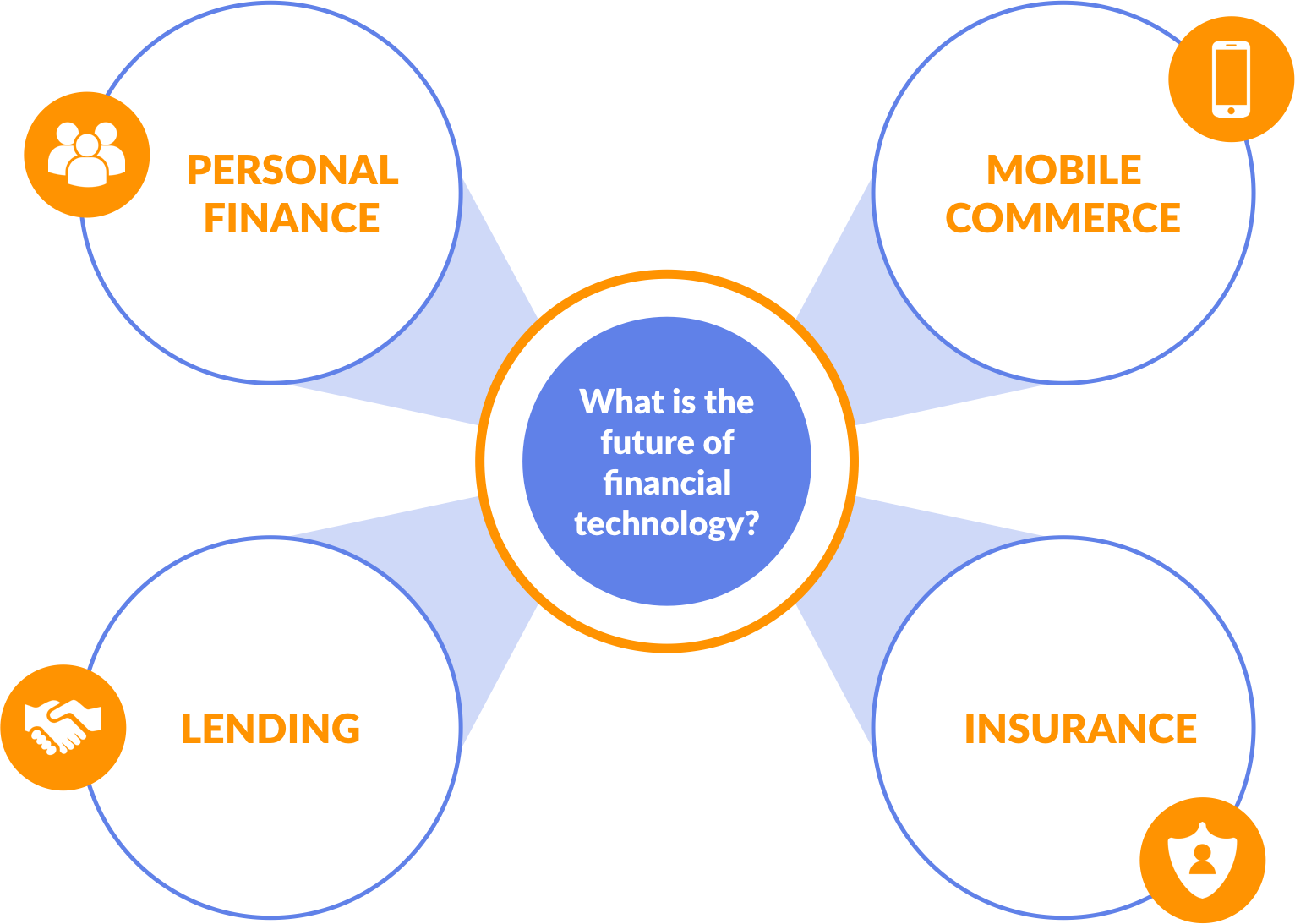

Looking ahead, we see four key areas at the frontier of consumer FinTech innovation: Personal Finance, Mobile Commerce, Lending, and Insurance. Innovation leaders in each category are drawing on many of the fundamentals that have propelled the success of the Starbucks app to upend an industry that Goldman Sachs estimates is worth over $4.7 trillion.

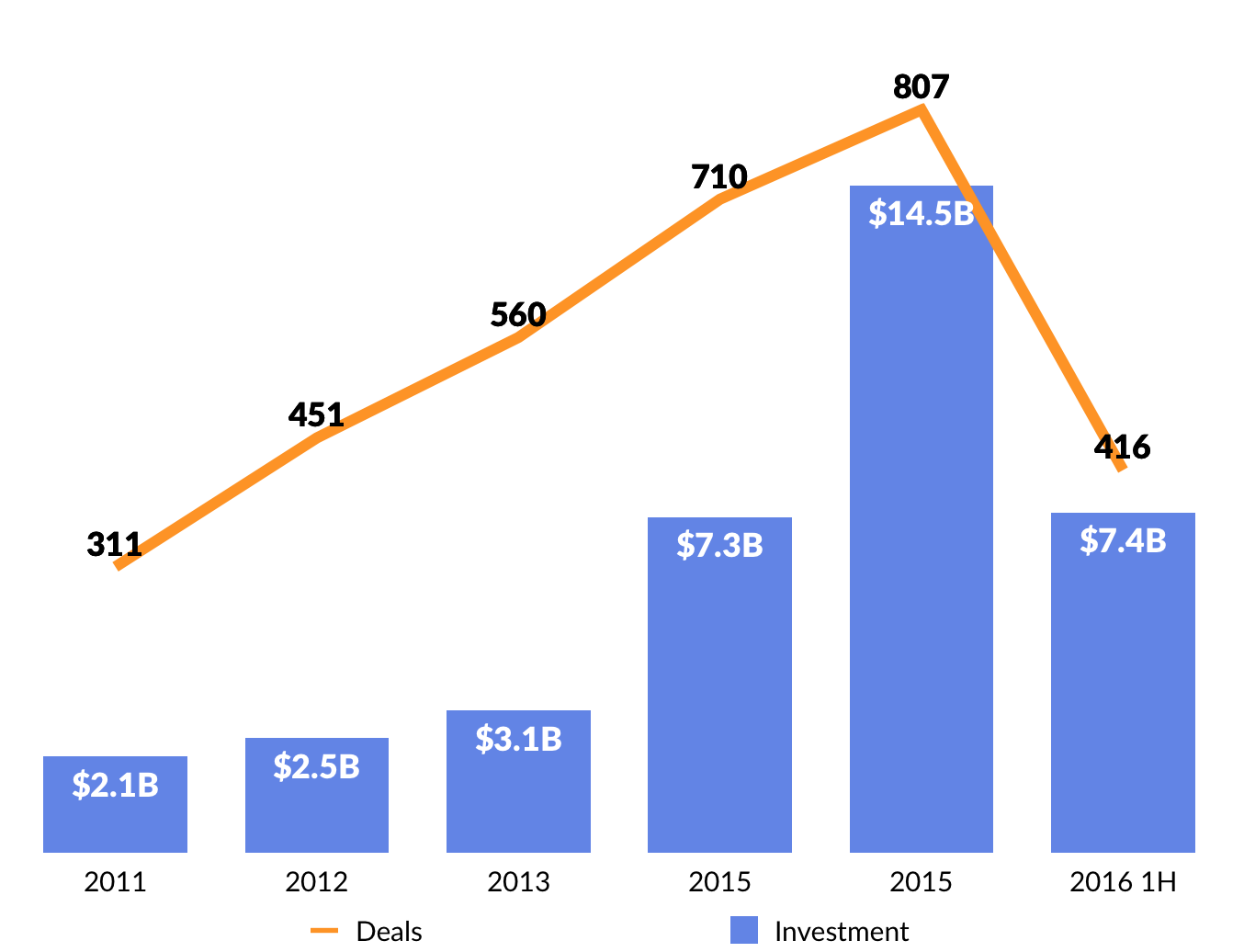

Through the first half of 2016, there were 416 VC-backed FinTech deals worth a combined $7.4 billion according to CB Insights, a trajectory in line with $14.5 billion invested in 2015. Given the deeply entrenched stakeholders involved in finance — from big banks to insurance companies — corporate VC activity is accelerating. It accounted for an estimated 23% of deals in 2015 and jumped to 32% in the second quarter of 2016.

Notable 2016 financings include Chinese marketplace lenders Lufax ($1.2 billion) and Weidai ($153 million), insurance platforms Oscar ($400 million) and Clover Health ($160 million), and consumer financial services companies Betterment ($100 million) and Affirm ($100 million). Two leading global payment platforms — China’s Ant Financial (Alipay, a spinout from Alibaba) and India’s Paytm — raised $4.5 billion and $300 million respectively. Ant Financial was valued at $60 billion and Paytm was valued at $5 billion.

MOBILE COMMERCE

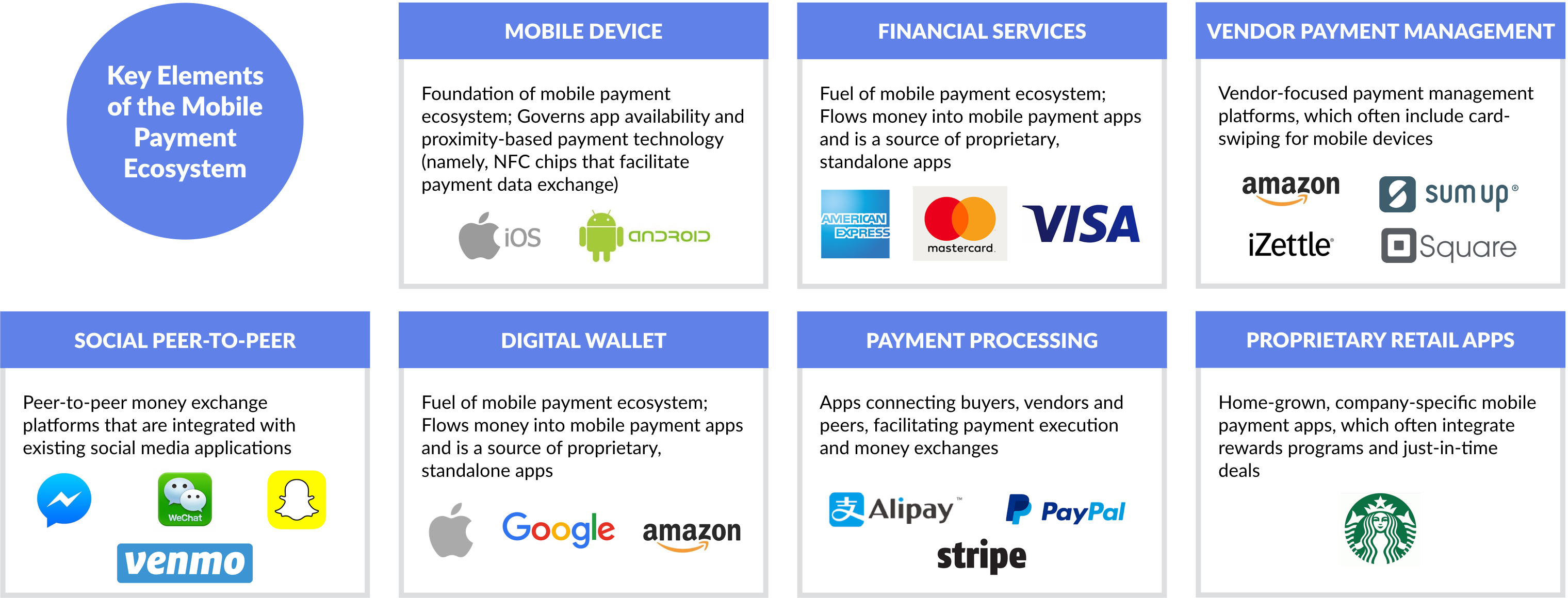

Mobile payment technology emerged as the next frontier for financial innovation as global cellphone adoption became ubiquitous.

But while the idea of using a smartphone to quickly and securely pay for things sounds appealing, mobile commerce has yet to make a dent in the United States. According to Bain & Company, mobile payments — for e-commerce and in-store purchases — represents an estimated 3% of total U.S. retail sales.

Mobile commerce will surge over the next five years. Euromonitor estimates that global mobile commerce will amount to $972 billion by the end of this year. By 2021, it will reach $3 trillion. Much of this growth will be driven by expanding mobile e-commerce, which is a function of desktop e-commerce moving to smartphones. China and India are catalyzing this transformation.

China’s e-commerce market surpassed the United States in 2013 and today, Alibaba handles more transactions than Amazon and eBay combined. This week, Alibaba topped its Singles’ Day record (annual online shopping event), netting $17.8 billion in 24 hours. The average cost per order was $27 and 82% of were completed on smartphones. In 2016, mobile commerce will account for over half of online purchases in China, or $506 billion — up from $180 billion in 2014.

Key Trends

As smartphones become increasingly ubiquitous, the opportunity to create the killer payment app or “digital wallet” has proven irresistible to banks, credit card companies, and technology leaders — from Apple to Alphabet (Google), Amazon, Facebook, Tencent, and Alibaba.

In practice, mobile commerce requires a nuanced set of relationships between merchants, banks, credit card companies, payment processors, mobile operators, and mobile device makers. As expected, many are trying to master this complex ecosystem through scale.

On a 2015 quarterly earnings call, Apple CEO Tim claimed that 2015 would be the “year of Apple Pay” — the company’s integrated digital wallet. There was reason for optimism. Apple is the second largest global smartphone maker and they have over 800 million credit cards on file through iTunes. Time to connect the dots, starting with in-store purchases, where the bulk of retail spending occurs.

Through the first half of 2016, Apple Pay represented 75% of U.S. “contactless” mobile payments in the United States. But they are the master of a tiny market. eMarketer estimates that through the end of the year, just 19% of Americans will have used their smartphones to pay at the point of sale.

Why? Not every checkout counter is equipped to talk to an iPhone. For some it’s still easier to pull out a credit card. Citi entered the mix this week with the launch of Citi Pay.

PayPal, a pioneer in online payment processing, is projects that it will complete $100 billion in mobile payment volume over the next 12 months. It has been buoyed by its acquisition of Venmo, a popular peer-to-peer payment platform that has processed nearly $15 billion year-to-date and is growing 130% per year. The app launched in 2012.

In October, 19 banks, including Wells Fargo, Bank of America, Citi, Capital One, and JPMorgan, partnered to form Zelle, a money-transfer service designed to compete with Venmo and its peers. Importantly, it will enable consumers to access funds at no cost (Venmo and others typically pass on bank deposit/integration fees to their customers). The battle continues.

Alibaba spinout, Alipay (Ant Financial Services) might be best positioned to dominate the future of mobile commerce. Alipay counts over 450 million users, a group larger than the entire population of the United States, and it’s going global. In September alone, Alipay added over 80,000 retailers in 70 countries, including 10 international airports, from Munich to Tokyo.

Credit Suisse estimates that 58% of China’s online payment transactions go through Alipay. A $4.5 billion financing in April 2016 valued the company $60 billion. Look for similar growth in India where Paytm, the country’s leading mobile payments platform, already counts over 130 million users making at least one purchase per month. As you might have guessed, it is backed by Alibaba and Alipay.

What’s Next

Peer-to-Peer payment services like Venmo, which allow people to easily exchange money, will increase the velocity of mobile payments. Acquired by PayPal in 2014, Venmo is on track to process $20 billion in 2016.

Venmo launched as a free service in 2009, enabling people to link their debit and credit card accounts to the app and send money to their contacts. Venmo is now turning its attention to retailers, enabling merchants to accept payments from its network of engaged users who transact 3-4 times per week on average.

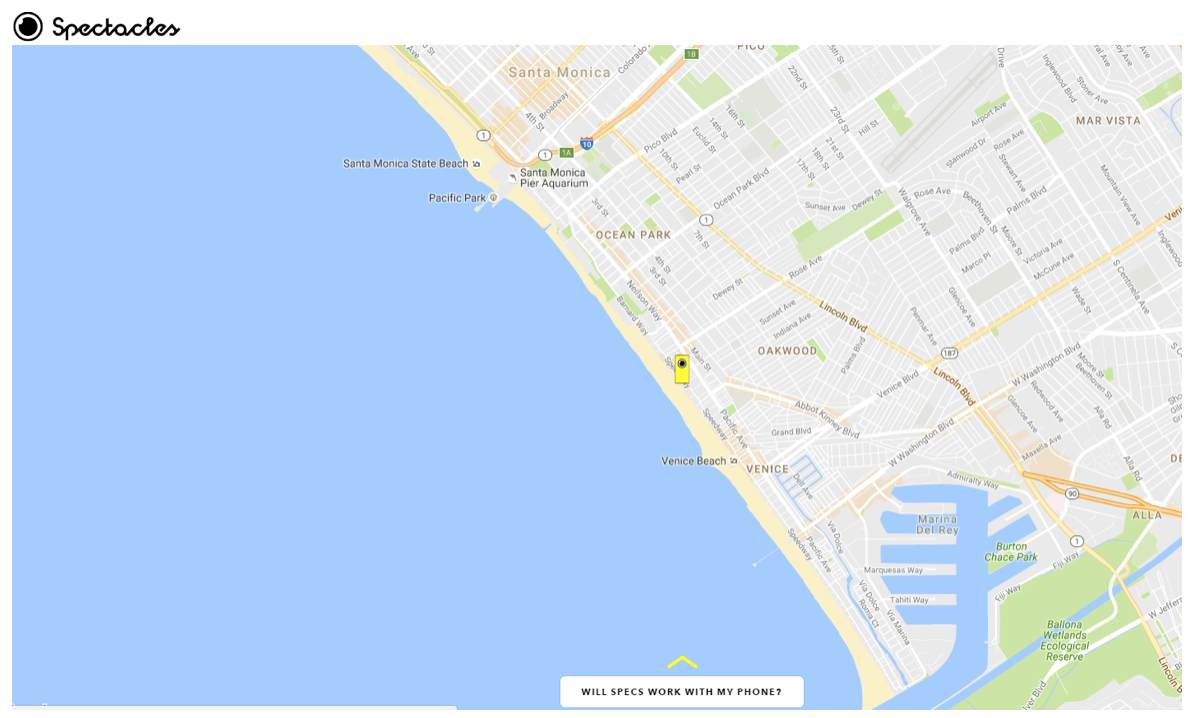

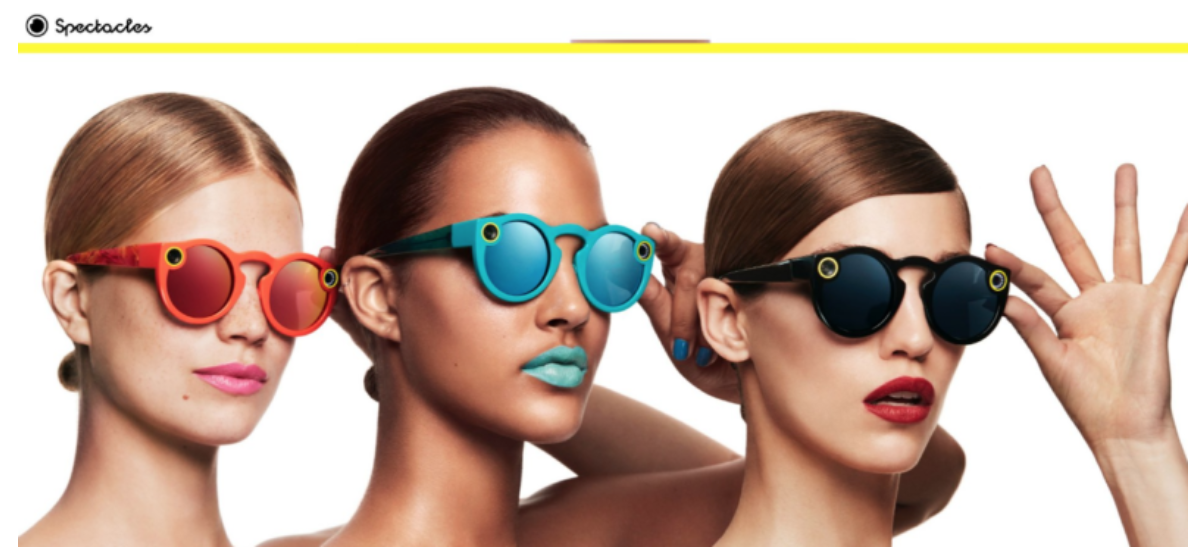

Peer-to-Peer payments will be further propelled by the rise of messaging apps integrating similar payment functionality, including Snapchat (Snapcash), Facebook Messenger, Tencent (Weixin + WeChat), and Line. Forbes estimates that Tencent’s WeChat alone will process over $556 billion in transactions in 2016 alone. (Disclosure: GSV owns shares in Snap)

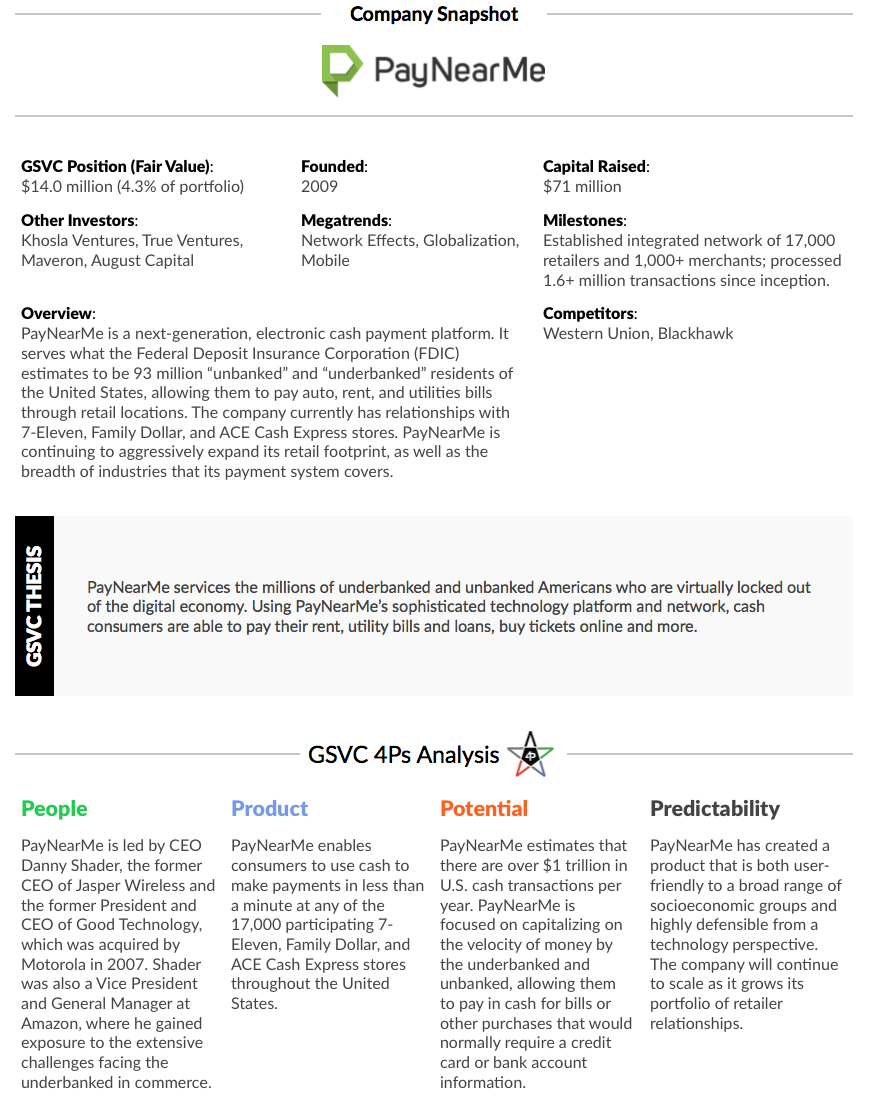

Despite mass connectivity and smartphone access, the The Federal Deposit Insurance Corporation (FDIC) estimates that there are 93 million “unbanked” and “underbanked” residents of the United States. The World Bank estimates that it is over two billion globally.

PayNearMe is addressing this challenge with a next-generation, payment platform that enables people use cash to pay auto, rent, and utilities bills through 17,000 U.S. retail locations. Bill payments that would typically require a credit or debit card can be made in cash, with receipts, processing, and confirmation tracked through a mobile device. (Disclosure: GSV owns shares in PayNearMe)

We anticipate that activity to serve global unbanked populations will accelerate as key players in the mobile payments ecosystem turn their attention to this potentially open-ended opportunity.

PERSONAL FINANCE

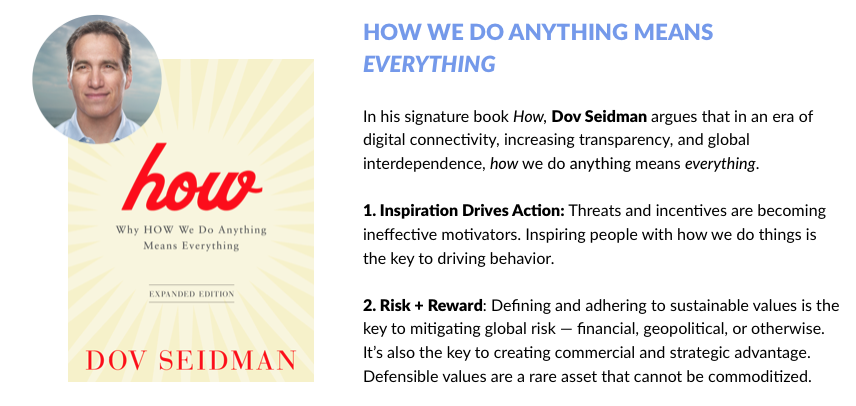

In his signature book How, Dov Seidman argues that in an era of digital connectivity, increasing transparency, and global interdependence, how we do anything means everything.

Fundamentally, there are three ways to drive human action. You can coerce, incentivize, or inspire. Coercion and incentives rely on external rewards (carrots) and punishments (sticks). In the hyper-connected World pioneered by Millennials, a generation of digital natives, the limitations of carrots and sticks are quickly becoming clear. Rules and directives cannot not keep pace with technology innovation — a challenge that China will continue to grapple with as it seeks to limit the ability of social networks to amplify political unrest.

On the other end of the spectrum, the “Return on Incentives” is declining as increasing access to information enables people to find better “deals” elsewhere — from the products they buy to the jobs they pursue and the cities they live in. It is getting harder to buy loyalty, and the World of finance is finally taking notice.

Key Trends

In a far-reaching study by PR powerhouse Edelman, consumers reported that when quality and price are a wash in competing products, a company’s “social purpose” is the most important factor in selecting a brand. Nearly 44% of people are even willing to pay a premium for the products of companies that support a “good cause.” Among Millennials, over 89% indicate that they actively aim to make purchases from companies that are committed to solving societal issues, from pollution to poverty.

Companies like Aspiration are creating a new breed of financial services firms that are born of these new fundamentals. Co-Founded by CEO Andrei Cherny (a former Clinton White House aide and the youngest White House speechwriter in American history) and Joe Sanberg (a former Managing Director at Tiger Global Management and a founding investor in Blue Apron), Aspiration offers banking and investment services based on trust. (Disclosure: GSV owns shares in Aspiration)

The key characteristic of the Aspiration model is that customers choose what fees to pay. They don’t make a cent from bank accounts or the mutual funds the offer beyond what customers are willing to pay. The bet is that if they deliver outstanding service, customers will compensate them. Since launching in the fall of 2014, Aspiration has over 20,000 customers with an average age of 33.

SoFi, which launched in 2011 with an emphasis on more friendly and transparent student loans, is branching out into a range of financial services. It remains squarely focused on creative customer engagement as a competitive advantage, providing everything from career counseling, to wine tastings and home-buying workshops.

In 2016 to date, SoFi has lent out $5.5 billion, up from the $5.2 billion it originated all of last year, and the $1.3 billion it did in 2014. The company has now issued loans to over 175,000 customers.

What’s Next

The frontier of personal finance is harnessing powerful new technologies to provide a range of automated services that are both engaging and value added.

Chatbots — programs designed to conduct an intelligent conversation with human users — are becoming increasingly effective with the application of new Artificial Intelligence principles. Using Machine Learning, Chatbots are increasingly able to observe and learn from patterns of communication, escalate critical issues to customer service representatives, and anticipate questions and problems.

Source: GSV Asset Management

Financial services behemoths are beginning to deploy chatbots to better manage customer relationships. MasterCard, for example, is launching its own banking bot in partnership with AI company Kasisto, which users can contact through Facebook Messenger. The bot will enable users to review their accounts, monitor spending levels, and access financial literacy resources in real time.

The application of Artificial Intelligence to investment management itself will further transform the financial services industry. Business Insider estimates that “Robo-Advisors” will manage $8 trillion in assets globally by 2020.

LENDING

In Shakespeare’s Hamlet, Polonius famously warns his son Laertes to, “Neither a borrower nor a lender be.” In recent years, markets have seemingly signaled to consumers, “Neither a saver nor a borrower be.”

How did we arrive at this strange paradox? Typically, when it’s bad to be a borrower, it’s because interest rates are high — which should mean that it’s a good time to be saver. But a prolonged period of record-low interest rates following the global financial crisis has left savers starving for returns.

A different logic has prevailed for individual borrowers. As faltering banks pulled back on consumer lending to lick their wounds, would-be borrowers were left with few sources of credit outside of credit cards — a lifeline with double digit interest rates that tend to remain high through economic cycles. The net result is that while savers have never had a worse deal, for most individual borrowers, credit is scarce and costly.

Key Trends

These fundamentals have sparked the rise of a new breed of “marketplace” lenders that are challenging established banks by offering consumer loans at more competitive rates, financed by individuals seeking to put their savings to work or Wall Street institutions looking lend money.

Pioneers like Prosper and Lending Club harnessed the same models that propelled the rise of the “sharing economy.” Like Uber and Lyft with cars, and Airbnb with homes, these companies created marketplaces for a commodity they do not provide themselves — in this case, money. (Disclosure: GSV owns shares in Lyft)

Rates are lower because marketplace lenders don’t share the massive overhead of a traditional banking operation. Instead of a bank intermediating between savers and borrowers, the two parties are able to connect directly. The platforms do the credit-scoring and earn a profit from arrangement fees, not from the spread between lending and deposit rates.

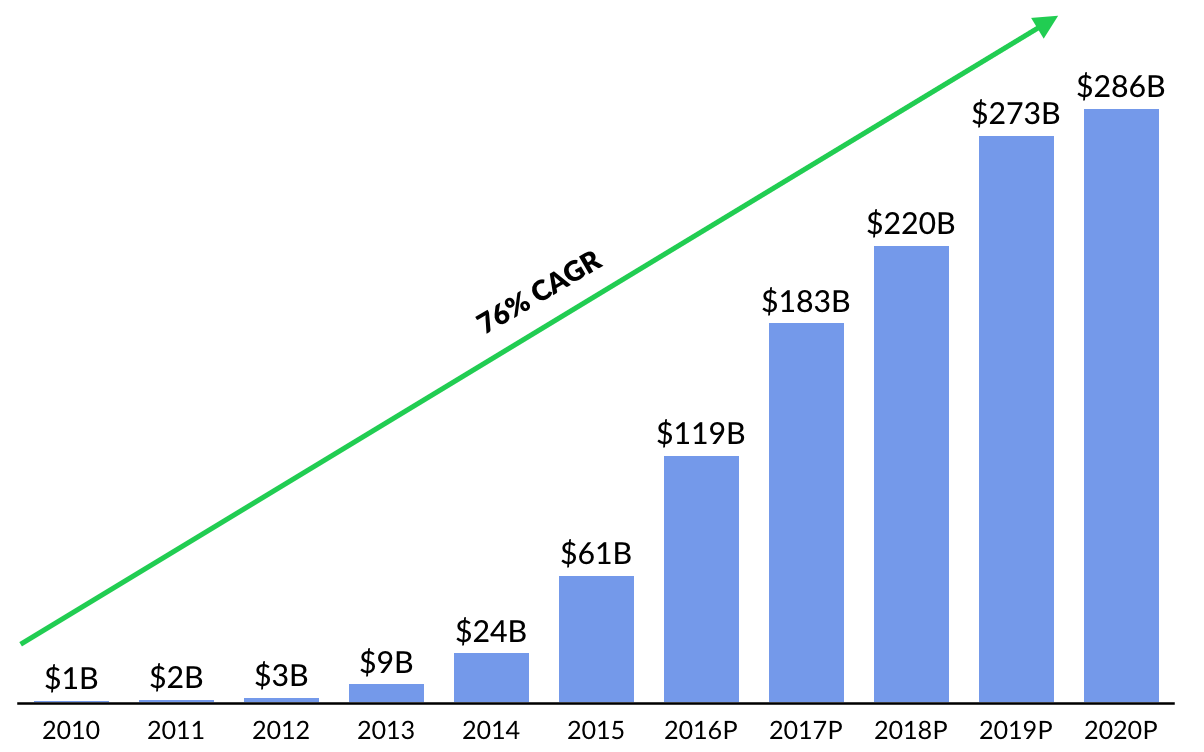

Though still dwarfed by the $3 trillion of consumer debt outstanding in America alone, the Morgan Stanley estimates that the Marketplace lending sector is on track to surpass $286 billion by 2020, representing a 76% Compound Annual Growth Rate (CAGR) since 2010.

To date, marketplace lenders have primarily focused on unsecured consumer credit, with roughly 80% of loans used to consolidate debt, and small business loans. But attention is quickly turning to the $1.2 trillion student loan market, auto loans and mortgages.

What’s Next

Next generation lenders have struggled in recent months — particularly Lending Club, whose CEO Renauld Laplanche resigned in May 2016 following reports of improprieties in the company’s lending processes. Adding to the negative perception is an increasing anxiety that underwriting has been too lax, with marketplace lending pools primed for default should broader market conditions worsen. Briefly valued at $10 billion following its 2014 IPO, the company has languished and now has a market cap of $2.4 billion.

The episode underscores the central challenge — and opportunity — for marketplace lenders. Freed from the costs of brick-and-mortar branches and federal regulations requiring that they reserve money against their loans, marketplace lenders have been able to grow quickly and with fewer expenses.

Institutional investors like hedge funds, insurance companies and pension funds initially clamored to buy large pools of these loans, which offered an attractive returns at a time of record low interest rates. But as institutional interest has waned, Marketplace lenders have not been able to fall back on reserves of capital that are the foundations of banks and insurance companies.

Moving forward, the leading marketplace lenders will continue to diversify their services. SoFi, for example, which has raised $1.4 billion from a syndicate of leading investors including IVP and Softbank, has moved from student loans to investment products and value-added services. Some marketplace lenders may capitalize on their brand equity and proprietary underwriting processes to evolve into banks with permanent capital bases. The “Peer-to-Peer” aspect of these services — individuals buying loans from other individuals — will continue to recede.

INSURANCE

The first written insurance policy appeared in 1750 B.C. in ancient Babylonia on an obelisk recording the famous Code of Hammurabi. Debtors that offered lenders an extra sum did not have to repay their loans if an unforeseen catastrophe struck — think death, disability, fire, or flooding.

Global insurance premiums reached $4.6 trillion in 2015 with the United States representing at $1.4 trillion — of that figure. While it has grown in scale and sophistication, the consumer experience has evolved very little.

The industry has been especially slow to modernize due to historically high barriers to entry — from regulatory burdens to product complexity. But consumers are increasingly seeking ease of use, transparent pricing, and on-demand services in all aspects of their lives— values that are contrary to the basic premise of insurance, which is to deny claims to make money. But entrepreneurs are rising to the challenge. CB Insights estimates that funding for for insurance technology companies rose from $740 million in 2014 to $2.7 billion last year.

Key Trends

The traditional insurance industry is comprised of three main segments: brokers (distributors), which interact with clients; insurers, which perform operational tasks like underwriting and claims processing, and reinsurers, which insure the insurers.

The obvious area for innovation, with the fewest barriers to entry, has been replacing the individual brokers with transparent, efficient marketplaces that apply the design principles of successful e-commerce platforms. Companies like CoverHound, Cover, FinanceFox, PolicyBazaar, and PolicyGenius have all gained strong traction and blue chip backing.

A second key group of companies is taking the industry head on, raising larger war chests to create next-generation, regulated insurance companies for Digital Natives. Clover Health and Oscar, which have raised $295 million and $728 million respectively, have focused on healthcare as it is ripe for applying superior technology, data, and customer service to more effectively price premiums, reduce costs, and deliver services.

A final category of companies has found traction with specialized services. Metromile, for example, is delivering pay-per-mile auto insurance. Trov enables consumers to insure individual possessions. Simplesurance provides a platform for point-of-sale insurance sales for e-commerce platforms. It is focused on technology products like smartphones.

What’s Next

Moving forward, insurance startups will continue to partner with established providers to provide a regulatory halo for their services. But as newcomers establish their own brands, they will seek to create their own regulated vehicles to cut out the middleman. We’re beginning to see this dynamic play out with companies like Metromile.

We also expect to see a proliferation of new insurance models. Sequoia backed Lemonade for example, is charging a fixed fee to customers that join insurance “pools.” If the pool is unable to pay for the claims of its members, the Lemonade will pay the excess from reinsurance and capital reserves. If the pool is “profitable”, funds are donated to a social cause members care about. In this model, there’s no incentive to withhold payouts. The times they are a-changin.

—

Contrary to conventional wisdom, stocks surged last week on news that the 45th President of the United States would be Donald Trump. The Dow had its best week in five years and advanced 5.4%, with the S&P 500 and NASDAQ both rising 3.8%. Investors liked the proposed $1 trillion in infrastructure spending and tax cuts.

Despite significant upward moves in traditional sectors like defense, banks and basic materials, big tech mainly didn’t join the Trump Rally. Amazon, Microsoft, Apple, Alphabet (Google), and Facebook all finished the week lower. Bucking the negative tech action, Nvidia reported a blow out quarter, with its EPS rising 91% and its stock jumping 30% for the week.

Priceline also reported a strong quarter, with EPS up 23% and its stock rising over 8%. As a paired trade, Priceline competitor Trip Advisor reported less-than-stellar numbers, with its shares sinking 20%.

We remain BULLISH on the outlook for Growth Stocks. We see an environment of strong fundamentals, modest valuations, and low interest rates — all good characteristics for strong performance.